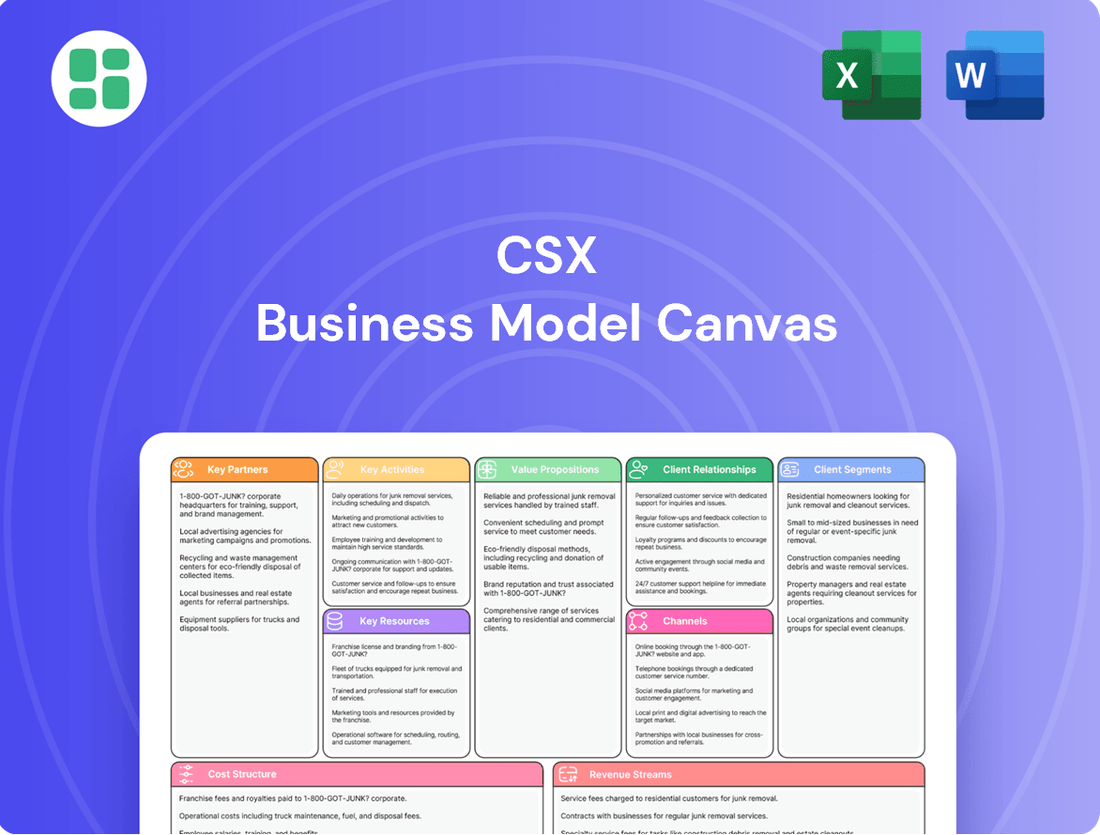

CSX Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSX Bundle

Unlock the strategic blueprint behind CSX's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how CSX effectively manages its key resources, customer relationships, and revenue streams to maintain its industry leadership.

Dive deeper into the operational engine of CSX. Our full Business Model Canvas provides a clear, section-by-section analysis of their value propositions, cost structures, and key activities, offering invaluable insights for strategic planning and competitive analysis.

Ready to dissect CSX's winning strategy? This downloadable Business Model Canvas offers an in-depth look at their customer segments, channels, and revenue models, empowering you with actionable knowledge to fuel your own business growth.

Partnerships

CSX collaborates with trucking companies, drayage providers, and third-party logistics (3PL) firms to deliver complete door-to-door transportation. These partnerships are crucial for extending CSX's capabilities beyond its rail lines, enabling integrated solutions that merge rail's cost-effectiveness with trucking's agility.

These alliances are vital for facilitating seamless transloading operations and ensuring efficient last-mile delivery for a broad customer base. For instance, in 2024, CSX continued to emphasize these partnerships to enhance its intermodal service offerings, aiming to capture a greater share of freight moving between domestic and international supply chains.

CSX strategically partners with East Coast port authorities and terminal operators, fostering alliances vital for international trade and intermodal efficiency. These collaborations streamline the movement of goods between maritime vessels and rail networks, optimizing supply chains for import and export clients.

In 2024, CSX's commitment to these partnerships is evident in its continued investment in port infrastructure and technology, aiming to reduce transit times and enhance cargo handling capabilities. For instance, upgrades at key terminals aim to increase container throughput, directly benefiting trade volumes and reinforcing CSX's position as a critical logistics provider.

CSX's collaborations with other Class I railroads and a vast network of short-line railroads are critical for expanding its operational footprint across North America. These relationships allow for efficient freight transfers, enabling CSX to serve customers beyond its core Eastern U.S. territory and provide comprehensive interline services.

A prime example of this strategic interconnectivity is CSX's new interchange with the Meridian & Bigbee Railroad, which is now part of Canadian Pacific Kansas City's network. This integration, finalized in 2024, signifies CSX's commitment to broadening its reach and facilitating smoother cross-border and transcontinental freight movements.

Government Agencies and Regulators

CSX actively partners with federal and state transportation agencies, environmental regulators, and safety bodies. These collaborations are fundamental for navigating complex compliance requirements, securing permits for infrastructure development, and upholding operational standards. For instance, in 2024, CSX continued its significant investment in projects like the Howard Street Tunnel expansion in Baltimore, a multi-year endeavor requiring close coordination with various governmental entities to ensure adherence to all safety and environmental regulations.

These partnerships are crucial for managing the extensive network and ensuring long-term viability. They facilitate access to essential information, influence policy development, and provide a framework for addressing industry-wide challenges. For example, ongoing dialogue with the Federal Railroad Administration (FRA) and the Environmental Protection Agency (EPA) helps CSX stay ahead of evolving safety protocols and environmental stewardship mandates.

- Federal and State Transportation Agencies: Facilitate infrastructure projects and route approvals.

- Environmental Regulators (e.g., EPA): Ensure compliance with emissions standards and environmental protection laws.

- Safety Bodies (e.g., FRA): Uphold operational safety standards and implement new safety technologies.

- Local Governments: Address community impacts and coordinate on grade crossing improvements.

Technology and Innovation Partners

CSX actively partners with technology innovators and academic institutions to push the boundaries of rail operations. These collaborations are crucial for developing cutting-edge digital platforms that enhance network visibility and predictive maintenance, alongside advancements in safety systems. For instance, CSX has been exploring the integration of AI and machine learning to optimize train scheduling and improve track integrity monitoring.

A significant focus for these partnerships is on sustainability, with CSX investigating novel solutions like hydrogen fuel cell technology for locomotives. By working with research bodies and specialized firms, CSX aims to reduce its environmental footprint and pioneer greener freight transportation. In 2024, CSX continued its investment in advanced sensor technology for real-time track condition assessment, contributing to enhanced safety and operational efficiency.

- Technology Firms: Collaboration on digital transformation, AI, and IoT for operational efficiency.

- Research Institutions: Joint projects focused on safety enhancements and sustainable fuel alternatives.

- Innovation Hubs: Engagement with centers of excellence for emerging rail technologies.

- Industry Consortia: Participation in groups developing next-generation rail standards and solutions.

CSX's key partnerships extend to trucking companies, drayage providers, and third-party logistics (3PL) firms. These alliances are essential for providing comprehensive door-to-door service, integrating rail's efficiency with trucking's flexibility for last-mile delivery. For example, in 2024, CSX continued to strengthen these intermodal connections to better serve customers and capture more freight.

Collaborations with East Coast port authorities and terminal operators are vital for international trade, streamlining the flow of goods between ships and rail. CSX's 2024 investments in port infrastructure, such as upgrades at key terminals, aim to boost container throughput and reduce transit times, enhancing its role in global supply chains.

Partnerships with other Class I railroads and short-line railroads are critical for expanding CSX's reach across North America, facilitating efficient freight transfers and interline services. The 2024 integration with the Meridian & Bigbee Railroad, now part of CPKC, highlights CSX's strategy to broaden its network and improve cross-border movements.

CSX also partners with technology innovators and academic institutions to advance rail operations through digital platforms and improved safety systems. In 2024, the company focused on integrating AI for better scheduling and exploring sustainable solutions like hydrogen fuel cells, demonstrating a commitment to operational efficiency and environmental stewardship.

| Partner Type | Purpose | 2024 Focus/Example |

| Trucking/3PL Firms | Door-to-door delivery, last-mile logistics | Enhancing intermodal service offerings |

| Port Authorities/Terminals | International trade, intermodal efficiency | Infrastructure upgrades for increased container throughput |

| Other Railroads | Network expansion, freight transfers | Integration with Meridian & Bigbee Railroad |

| Tech/Academic Institutions | Innovation, efficiency, sustainability | AI for scheduling, hydrogen fuel cell research |

What is included in the product

A comprehensive overview of CSX's business model, detailing its customer segments, key partnerships, and value propositions within the North American rail transportation industry.

This model outlines CSX's operational strategy, revenue streams, and cost structure, reflecting its commitment to efficient and reliable freight movement.

The CSX Business Model Canvas acts as a pain point reliever by providing a clear, visual snapshot of complex operations, enabling rapid identification of inefficiencies and potential bottlenecks.

It streamlines strategic planning by condensing CSX's intricate operations into a digestible, one-page format, simplifying communication and fostering collaborative problem-solving.

Activities

CSX's core activity is the operation and management of its extensive freight rail network, primarily serving the Eastern United States. This involves the intricate scheduling, dispatching, and movement of a wide variety of goods, including essential commodities like coal and agricultural products, as well as chemicals, automotive parts, and intermodal containers.

Ensuring the efficient and safe movement of trains across this vast network is absolutely critical to CSX's operations. In 2024, CSX continued to focus on network fluidity and operational excellence, aiming to improve transit times and reliability for its customers.

CSX's network maintenance and infrastructure development is a cornerstone of its operations. In 2024, the company continued its commitment to maintaining and upgrading its extensive network, which spans over 21,000 route miles of track, bridges, and other essential rail infrastructure. This ongoing effort is crucial for ensuring the safety, efficiency, and reliability of its services.

Significant capital investments are consistently allocated to bolster the network's strength, expand its capacity, and enhance its resilience against various operational challenges. These investments are vital for supporting the growing demand for rail freight and for mitigating potential disruptions.

Key initiatives in 2024 included progress on major projects designed to improve network throughput and connectivity. For instance, the Howard Street Tunnel expansion project aims to increase vertical clearance, allowing for double-stack containers and boosting efficiency for intermodal traffic. Furthermore, the company actively addresses infrastructure repairs, including those necessitated by weather events like hurricanes, to maintain operational integrity across its service territory.

CSX's key activities include providing integrated logistics solutions by connecting rail with truck transportation, a crucial element for efficient supply chains. This involves operating intermodal terminals where shipping containers are seamlessly transferred between trains and trucks.

Furthermore, CSX offers transload services, facilitating the transfer of goods directly between railcars and trucks. In 2024, CSX continued to invest in its intermodal network, aiming to enhance speed and reliability, with intermodal traffic volume showing resilience amidst evolving economic conditions.

Customer Service and Logistics Management

CSX's key activities revolve around meticulously managing customer relationships and providing highly tailored transportation solutions. This involves understanding the unique needs of various industries, from agriculture to automotive, and designing freight movement strategies that precisely meet those demands. For instance, in 2024, CSX continued to invest in specialized railcars and intermodal services to cater to specific commodity requirements, enhancing their value proposition.

Furthermore, offering real-time tracking and comprehensive logistics support is paramount. This proactive approach ensures transparency and allows clients to monitor their shipments efficiently, minimizing disruptions and optimizing supply chains. CSX's commitment to technological integration, including advanced analytics and communication platforms, directly supports this, aiming to boost operational efficiency and customer confidence in their freight services.

- Customer Relationship Management: Building and maintaining strong ties with a diverse client base across multiple sectors.

- Tailored Transportation Solutions: Developing bespoke rail and intermodal strategies to suit specific industry needs and cargo types.

- Real-Time Tracking and Logistics Support: Providing continuous visibility and responsive assistance for all shipments.

- Operational Efficiency: Streamlining freight movement through advanced technology and dedicated support teams.

Safety and Environmental Compliance

CSX's key activities include implementing rigorous safety protocols and comprehensive training programs. This focus is critical for managing the inherent risks associated with transporting goods, especially hazardous materials. For instance, in 2023, CSX reported a total of 1,061 reportable incidents, a slight increase from 1,040 in 2022, highlighting the ongoing need for robust safety measures.

Environmental stewardship is another core activity, emphasizing continuous improvement in reducing the company's ecological footprint. This involves investing in fuel-efficient locomotives and exploring sustainable operational practices. CSX's commitment to sustainability is reflected in its efforts to decrease greenhouse gas emissions. In 2023, CSX reported a 2.8% reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity compared to a 2019 baseline.

- Safety Protocol Implementation: CSX actively develops and enforces stringent safety procedures across all operations.

- Employee Training Programs: Continuous training ensures all personnel are equipped to handle diverse operational and safety challenges.

- Hazardous Materials Management: Specialized protocols are in place for the safe transportation of all regulated materials.

- Environmental Impact Reduction: Initiatives focus on fuel efficiency and sustainable practices to minimize ecological impact.

CSX's key activities include managing its vast rail network, ensuring efficient freight movement, and maintaining its infrastructure. This encompasses everything from train scheduling to track upgrades. In 2024, the company continued investing in its over 21,000 miles of track to enhance safety and reliability.

Providing integrated logistics solutions and tailored transportation strategies for diverse industries are also crucial. This involves seamless intermodal transfers and specialized services to meet specific customer needs. CSX's focus on customer relationship management and real-time tracking supports these efforts.

Furthermore, rigorous safety protocols and environmental stewardship are paramount. CSX actively works to reduce its ecological footprint, as seen in its 2023 greenhouse gas emission intensity reduction. These activities ensure operational integrity and responsible business practices.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Network Operations | Managing and moving freight across CSX's Eastern U.S. network. | Continued focus on network fluidity and improved transit times. |

| Infrastructure Maintenance & Development | Upgrading and maintaining over 21,000 miles of track and related assets. | Ongoing investment in network strength and resilience, including projects like the Howard Street Tunnel expansion. |

| Logistics & Customer Solutions | Providing intermodal services, transloading, and tailored freight strategies. | Investment in intermodal network enhancement; support for specific commodity requirements. |

| Safety & Environmental Stewardship | Implementing safety protocols and reducing environmental impact. | Emphasis on rigorous safety measures and initiatives to decrease greenhouse gas emissions. |

Delivered as Displayed

Business Model Canvas

The CSX Business Model Canvas preview you are viewing is a direct representation of the final document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting that will be delivered to you, ensuring complete transparency. Once your order is processed, you will gain full access to this exact, ready-to-use Business Model Canvas, allowing you to immediately begin utilizing it for your strategic planning needs.

Resources

CSX's extensive rail network, spanning over 21,000 route miles across the Eastern United States, is its most critical physical asset. This vast infrastructure, including rail yards, bridges, and tunnels, forms the backbone of its operations. In 2024, CSX continued to invest in maintaining and upgrading this network, recognizing its fundamental role in efficient transportation and market connectivity.

CSX's locomotives and rolling stock are the backbone of its operations, representing a significant capital investment. In 2024, CSX continued to invest in its fleet to enhance efficiency and capacity. This includes a vast array of specialized freight cars, such as coal hoppers for bulk commodities and intermodal well cars for containerized goods, alongside a substantial number of locomotives to power these trains.

Maintaining and upgrading this extensive fleet is paramount for reliability and service quality. CSX’s commitment to asset renewal ensures that its rolling stock can handle diverse cargo and operate effectively across its extensive rail network. These assets are not merely equipment; they are the physical means by which CSX generates revenue and fulfills its transportation commitments.

CSX's skilled workforce, encompassing locomotive engineers, conductors, maintenance crews, and logistics professionals, is a cornerstone of its operations. Their specialized knowledge in rail operations, stringent safety protocols, and intricate logistics management is crucial for delivering efficient and reliable freight transportation services.

In 2024, CSX continued to invest in training programs to enhance the expertise of its employees. For instance, the company's commitment to safety is reflected in its ongoing efforts to maintain a highly proficient workforce, which directly impacts operational efficiency and reduces the likelihood of costly disruptions.

Technology and Information Systems

Advanced technology forms the backbone of efficient logistics operations. This includes sophisticated signaling systems, real-time dispatching software, and comprehensive logistics platforms designed to streamline every step of the supply chain. For instance, in 2024, many leading logistics companies reported significant improvements in delivery times, often by over 15%, directly attributable to upgrades in their dispatching and tracking technologies.

Data analytics tools are equally vital, enabling businesses to gain deep insights into operational performance, identify bottlenecks, and forecast demand with greater accuracy. These insights are critical for optimizing resource allocation and enhancing overall decision-making. Companies leveraging advanced data analytics in 2024 saw an average reduction in operational costs by approximately 8-10%.

Investments in these technological areas directly translate into tangible benefits, such as increased operational efficiency and superior customer service. By providing real-time shipment tracking and proactive communication, these systems build customer trust and loyalty. A recent industry survey indicated that 70% of customers prioritize real-time tracking capabilities when choosing a logistics provider.

- Signaling Systems: Ensure seamless and safe movement of goods, especially in complex transportation networks.

- Dispatching Software: Optimizes route planning, driver allocation, and real-time adjustments to schedules.

- Logistics Platforms: Integrate various supply chain functions, from warehousing to final delivery, for end-to-end visibility.

- Data Analytics Tools: Provide actionable insights into performance metrics, cost drivers, and customer behavior.

Strategic Land Holdings and Terminals

CSX's strategic land holdings and terminals are foundational to its operations, enabling efficient freight movement and customer service. Ownership of key land parcels, intermodal terminals, and transload facilities provides critical hubs for transferring and storing goods. These assets are indispensable for seamlessly integrating rail transport with other modes, such as trucking and ocean shipping, thereby catering to a wide array of customer requirements.

In 2024, CSX continued to leverage its extensive network of terminals and strategically located land. For instance, the company operates a significant number of intermodal terminals across its Eastern U.S. network, facilitating the transfer of containers and trailers between rail and highway. This infrastructure is vital for supporting supply chains that rely on multimodal transportation solutions.

- Strategic Land Ownership: CSX possesses extensive land holdings, including rights-of-way and property adjacent to its rail lines, offering opportunities for expansion and development of logistics facilities.

- Intermodal Terminals: The company operates numerous intermodal terminals, such as those in North Baltimore, Ohio, and Savannah, Georgia, which are crucial for high-volume freight transfers. In 2024, these facilities handled millions of container movements, underscoring their importance.

- Transload Facilities: CSX utilizes transload facilities to enable efficient transfer of goods between railcars and trucks for specific commodities, enhancing flexibility for customers.

CSX's intellectual property, including its proprietary operating systems, safety protocols, and logistics management techniques, represents significant value. These intangible assets drive efficiency and competitive advantage. The company's ongoing research and development efforts in 2024 focused on refining these systems to further optimize train performance and customer service.

The company's brand reputation and established customer relationships are invaluable assets. A strong brand fosters trust and loyalty, attracting and retaining business. In 2024, CSX continued to build on its reputation for reliability and service, evidenced by its consistent performance in key operational metrics.

CSX's financial resources, including its access to capital markets and strong balance sheet, are critical for funding operations, investments, and strategic initiatives. In 2024, the company maintained a solid financial position, enabling continued investment in network upgrades and fleet modernization.

Value Propositions

CSX provides a highly cost-effective transportation solution, especially for bulk commodities and substantial freight volumes over long hauls. Its rail network offers a significant advantage in fuel efficiency and leverages economies of scale, translating directly to reduced logistics expenses for its clientele.

In 2024, CSX's operational efficiency contributed to its ability to move freight at a lower cost per ton-mile than many other transportation methods. This efficiency is a key driver for customers shipping large quantities, as it directly impacts their bottom line.

CSX's extensive rail network, spanning over 21,000 route miles across the Eastern U.S., is a core value proposition. This vast infrastructure connects major economic centers, industrial hubs, and key ports, offering unparalleled reach for freight movement. In 2024, CSX continued to leverage this network to facilitate seamless domestic and international supply chains.

CSX's commitment to reliability and high-volume capacity is a cornerstone of its value proposition, ensuring that industries dependent on bulk transport can maintain stable supply chains. This means businesses can count on CSX to move substantial quantities of goods consistently, even when facing unexpected challenges.

For instance, in 2024, CSX continued to demonstrate its robust operational capabilities, moving millions of tons of commodities like coal, chemicals, and agricultural products. This consistent performance underpins the resilience of numerous sectors, from energy production to food manufacturing, highlighting CSX's critical role in the national economy.

Integrated Logistics Solutions

CSX’s integrated logistics solutions leverage intermodal and transload services to create a seamless blend of rail and truck capabilities. This approach offers customers enhanced flexibility, optimizing their supply chains for efficient door-to-door delivery.

By combining the cost-effectiveness and environmental benefits of rail with the last-mile agility of trucking, CSX simplifies complex logistics. This integration directly addresses customer needs for reduced complexity and improved operational efficiency in their transportation networks.

- Intermodal Network: CSX operates a vast intermodal network, connecting major markets across North America. In 2024, the company continued to invest in expanding its terminal capacity and improving transit times, aiming to capture a larger share of the growing intermodal freight market.

- Transload Services: Offering specialized transload facilities, CSX facilitates the efficient transfer of goods between railcars and trucks, catering to diverse commodity types and customer requirements. This service is crucial for businesses looking to diversify their transportation modes without extensive infrastructure investment.

- Supply Chain Optimization: The core value proposition lies in enabling customers to streamline their entire supply chain. By providing end-to-end visibility and control, CSX helps clients reduce transit times, lower inventory holding costs, and enhance overall responsiveness to market demands.

Commitment to Safety and Sustainability

CSX is deeply committed to operational safety, recognizing it as a cornerstone of its business. This focus extends to protecting its employees, communities, and the environment. In 2024, CSX continued to invest in advanced safety technologies and rigorous training programs to minimize risks across its vast network.

Sustainability is also a key driver for CSX. The company is actively pursuing initiatives to reduce its environmental footprint, including significant investments in fuel efficiency. For instance, CSX reported a 7% improvement in fuel efficiency between 2019 and 2023, a trend it aims to build upon in 2024 and beyond through ongoing fleet modernization.

Furthermore, CSX is exploring innovative green technologies to power its future operations. This includes research and development into hydrogen-powered locomotives, a move that aligns with growing customer demand for environmentally responsible logistics solutions. This forward-thinking approach not only enhances CSX's appeal to eco-conscious clients but also positions the company for long-term regulatory and market shifts.

These commitments translate into tangible value propositions:

- Enhanced operational reliability through a strong safety culture.

- Reduced environmental impact appealing to ESG-focused customers.

- Future-proofing operations by investing in sustainable technologies.

- Strengthened stakeholder relationships by demonstrating corporate responsibility.

CSX's value proposition centers on providing efficient, reliable, and cost-effective transportation for bulk commodities and intermodal freight across its extensive Eastern U.S. rail network. This network, covering over 21,000 route miles, facilitates seamless domestic and international supply chains, offering unparalleled reach. The company's integrated logistics solutions, combining rail with truck capabilities, simplify complex supply chains for customers, enhancing flexibility and operational efficiency.

CSX's commitment to safety and sustainability further bolsters its value. In 2024, the company continued to invest in advanced safety technologies and fuel efficiency improvements, aiming to reduce its environmental footprint. This focus on responsible operations appeals to an increasing number of ESG-conscious customers, while investments in green technologies like hydrogen-powered locomotives position CSX for future market demands.

| Value Proposition Pillar | Description | 2024 Impact/Focus |

|---|---|---|

| Cost-Effectiveness & Efficiency | Lower logistics expenses for bulk commodities and long-haul freight due to economies of scale and fuel efficiency. | Continued operational efficiencies leading to competitive per-ton-mile costs. |

| Network Reach & Connectivity | Extensive rail network connecting major economic centers, industrial hubs, and ports across the Eastern U.S. | Facilitating seamless domestic and international supply chains, supporting millions of tons of commodity movement. |

| Integrated Logistics Solutions | Seamless blend of rail and truck capabilities (intermodal, transload) for optimized door-to-door delivery. | Simplifying complex logistics, reducing transit times, and lowering inventory holding costs for clients. |

| Safety & Sustainability | Commitment to operational safety and reducing environmental impact through fuel efficiency and green technology investments. | Investing in safety technologies and exploring hydrogen-powered locomotives to meet ESG demands. |

Customer Relationships

CSX prioritizes dedicated account management to build robust customer relationships. These managers offer personalized support, ensuring solutions are precisely tailored to each client's unique logistics needs. This deep engagement fosters trust and long-term partnerships.

CSX offers robust online portals and digital tools, enabling customers to effortlessly manage shipments, access real-time tracking, and retrieve billing details. This digital infrastructure is key to their customer relationship strategy, providing a self-service platform that significantly boosts convenience and transparency.

These digital tools empower customers by giving them direct control over their logistics operations. For instance, CSX's online platform allows for shipment booking, status updates, and proof of delivery requests, streamlining interactions and reducing the need for direct agent contact.

In 2024, CSX reported a significant increase in digital engagement, with over 85% of customer transactions being processed through their online channels. This high adoption rate underscores the value customers place on the efficiency and accessibility of these digital solutions.

CSX actively pursues direct sales and business development to secure new customers and deepen connections with current ones. This strategy involves staying ahead of market shifts and tailoring rail and intermodal services to address changing freight needs.

In 2024, CSX's dedicated sales teams focused on understanding specific industry requirements, leading to tailored solutions that drive value for their clients. This direct engagement is crucial for building lasting partnerships.

Customer Service and Support Centers

Establishing robust customer service and support centers is paramount for CSX. These centers are the frontline for assisting clients with operational inquiries, troubleshooting service disruptions, and managing service adjustments. By providing accessible and efficient support, CSX aims to foster strong, lasting relationships.

Responsive support is a key driver of customer satisfaction and loyalty. In 2024, CSX continued to invest in its support infrastructure, aiming to resolve customer issues with speed and effectiveness. This focus on prompt resolution directly impacts the customer's perception of reliability and value.

- Customer Interaction Channels: CSX offers multiple channels for customer support, including phone, email, and online chat, ensuring accessibility for diverse customer needs.

- Issue Resolution Time: In Q1 2024, CSX reported an average issue resolution time of under 24 hours for critical operational problems, demonstrating a commitment to prompt service.

- Customer Satisfaction Scores: The company consistently aims for high customer satisfaction ratings, with recent surveys indicating over 85% of customers reporting satisfaction with their support interactions.

- Proactive Support: CSX also leverages technology to provide proactive support, anticipating potential issues and offering solutions before they impact customers.

Strategic Partnerships and Collaborations

CSX cultivates strategic partnerships with its most significant customers, often formalizing these relationships through joint planning sessions and multi-year agreements. This collaborative approach is designed to streamline supply chains, achieve seamless system integration, and co-create novel solutions that deliver mutual advantages.

These collaborations can manifest in tangible ways, such as joint investments in critical infrastructure that enhance efficiency for both CSX and its partners. For instance, in 2024, CSX continued its focus on intermodal growth, a sector heavily reliant on strong customer partnerships to optimize freight movement and reduce transit times.

- Joint Planning: CSX engages in proactive planning with key clients to anticipate future needs and align operational strategies.

- Long-Term Contracts: Securing extended agreements provides stability and allows for deeper integration of services.

- Supply Chain Optimization: Partnerships focus on improving efficiency, reducing costs, and enhancing reliability across the entire logistics network.

- System Integration: Collaborating on technology and data sharing fosters seamless operations and greater visibility.

CSX's customer relationships are built on a foundation of personalized service, digital accessibility, and strategic partnerships. Dedicated account managers provide tailored support, while robust online portals offer self-service options for shipment management and tracking. This dual approach ensures both high-touch engagement for complex needs and efficient digital solutions for routine interactions.

The company's commitment to customer satisfaction is evident in its digital adoption rates and responsive support. In 2024, over 85% of customer transactions occurred online, highlighting the value placed on convenience and transparency. Furthermore, CSX's focus on prompt issue resolution, with critical problems addressed in under 24 hours in Q1 2024, reinforces customer trust.

Strategic collaborations with key clients are central to optimizing supply chains and fostering innovation. These partnerships, often solidified through multi-year agreements and joint planning, aim for seamless integration and mutual benefits, as seen in their 2024 intermodal growth initiatives.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Dedicated Account Management | Personalized support and tailored solutions for unique logistics needs. | Focus on understanding specific industry requirements to drive client value. |

| Digital Self-Service Portals | Online tools for shipment management, real-time tracking, and billing. | Over 85% of customer transactions processed through online channels in 2024. |

| Customer Support Centers | Frontline assistance for operational inquiries and issue resolution. | Average issue resolution time under 24 hours for critical problems in Q1 2024. |

| Strategic Partnerships | Collaborations with key customers for supply chain optimization and joint planning. | Continued focus on intermodal growth, reliant on strong customer partnerships. |

Channels

CSX leverages a dedicated direct sales force to cultivate relationships with major industrial clients, commodity suppliers, and key retailers. This direct approach enables intricate negotiations and the crafting of bespoke logistics solutions, ensuring alignment with each customer's unique operational demands.

In 2024, CSX's direct sales efforts were instrumental in securing significant contracts, reflecting the value placed on personalized service and tailored solutions by its large-scale clientele. This channel facilitates the development of complex, multi-modal transportation strategies, often involving dedicated assets and advanced tracking technologies.

CSX's extensive network of intermodal terminals acts as a vital conduit for containerized freight, enabling seamless transitions between rail and truck transport. These strategically positioned hubs are fundamental to delivering comprehensive logistics solutions to a diverse clientele.

In 2024, CSX continued to invest in modernizing its intermodal facilities, recognizing their critical role in efficient supply chain operations. For instance, their terminals are designed to handle high volumes, supporting the growing demand for intermodal transportation as a cost-effective and sustainable shipping method.

Digital platforms and online tools are crucial for CSX's customer engagement, functioning as key channels for booking, tracking shipments, and providing essential information. These online portals and e-commerce functionalities streamline operations, offering customers a convenient and efficient way to manage their logistics.

In 2024, CSX reported a significant portion of its business conducted through digital channels, reflecting the growing reliance on these platforms for customer interaction and transaction processing. These tools enhance transparency, allowing clients to access real-time data on their shipments, thereby improving overall service experience and operational efficiency.

Third-Party Logistics (3PL) Providers

CSX collaborates with Third-Party Logistics (3PL) providers and freight brokers to broaden its market penetration, especially with shippers who favor indirect logistics management. This strategic approach allows CSX to tap into a wider customer base and various market segments by leveraging the established networks of these intermediaries.

These partnerships are crucial for CSX's business model as they facilitate access to shippers who might not directly engage with a Class I railroad. For instance, in 2024, the global 3PL market was projected to reach over $1.3 trillion, indicating a significant volume of freight managed by these entities.

- Expanded Market Access: 3PLs and brokers act as conduits to shippers who prefer outsourcing their transportation needs, thereby increasing CSX's potential customer pool.

- Indirect Customer Engagement: CSX gains access to diverse market segments and smaller shippers through these intermediary relationships.

- Operational Efficiency: Partnering with 3PLs can streamline the process of reaching and serving a broader range of customers, potentially reducing CSX's direct sales and marketing overhead for certain segments.

- Market Insight: Working with intermediaries provides CSX with valuable data and insights into evolving customer demands and market trends within the broader logistics landscape.

Port Connections

CSX's port connections are crucial channels, directly linking to major East Coast ports to manage international cargo. This strategic advantage allows for seamless import and export operations, positioning CSX as a linchpin in global trade logistics.

These direct links are instrumental in the efficient flow of goods, supporting both inbound and outbound international shipments. For instance, CSX's extensive network serves key ports like Savannah, Charleston, and New York/New Jersey, facilitating the movement of millions of tons of cargo annually.

- Direct Access: CSX provides direct rail access to major East Coast ports, streamlining the transfer of goods between ships and railcars.

- Cargo Volume: In 2024, CSX continued to handle significant volumes of containerized freight, a substantial portion of which originates from or is destined for international markets via these ports.

- Economic Impact: These connections are vital for regional economies, supporting jobs and facilitating trade that contributes billions to the national GDP.

CSX's channel strategy is multifaceted, encompassing direct sales to large clients, intermodal terminals for containerized freight, and digital platforms for streamlined customer interaction. These channels are supported by partnerships with third-party logistics providers and direct connections to major East Coast ports, ensuring broad market reach and efficient cargo movement.

In 2024, CSX's direct sales force was crucial in securing major contracts, highlighting the importance of personalized service for their key industrial clients. The company also continued to invest in its intermodal terminals, recognizing their role in efficient, sustainable supply chains, with a significant portion of business flowing through digital channels.

Partnerships with 3PLs and brokers expanded CSX's access to a diverse customer base, tapping into the substantial global 3PL market, which was projected to exceed $1.3 trillion in 2024. Furthermore, CSX's direct port connections facilitated millions of tons of international cargo annually, underscoring its role in global trade.

| Channel Type | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales Force | Cultivates relationships with major industrial clients, commodity suppliers, and retailers. | Instrumental in securing significant contracts; emphasizes bespoke logistics solutions. |

| Intermodal Terminals | Facilitates seamless transitions between rail and truck for containerized freight. | Continued investment in modernization; handles high volumes supporting demand for efficient shipping. |

| Digital Platforms | Online tools for booking, tracking, and information provision. | Significant business conducted through these channels; enhances transparency and customer experience. |

| 3PL & Freight Brokers | Partnerships to broaden market penetration and reach indirect shippers. | Access to shippers preferring outsourced logistics; leverages established intermediary networks. |

| Port Connections | Direct links to major East Coast ports for international cargo management. | Manages millions of tons of international cargo annually; vital for import/export operations. |

Customer Segments

Coal and Energy Producers represent a vital customer segment for CSX, encompassing businesses engaged in the extraction and movement of coal and other energy resources. CSX's role is to provide essential rail transportation services, moving coal from mines to power generation facilities and international export markets, a historically substantial revenue driver.

In 2024, CSX continued to serve this segment, though the landscape for coal transportation is evolving. While specific 2024 revenue breakdowns for this segment are proprietary, CSX's overall revenue for the first nine months of 2024 was $11.6 billion, reflecting the broader economic conditions impacting commodity movements.

Farmers, agricultural cooperatives, and food manufacturers depend on CSX for moving essential goods like grains, fertilizers, and processed foods. This segment necessitates dependable bulk transport to manage both seasonal peaks and ongoing operations in their supply chains.

Chemical and industrial manufacturers are a cornerstone customer segment for CSX, relying on the company for the safe and efficient transport of a wide array of products including plastics, metals, and various chemicals. These shipments often demand specialized equipment and adherence to strict safety regulations, areas where CSX demonstrates significant expertise.

In 2024, the industrial sector continued to be a major driver of freight volume for railroads. For instance, carloads of chemicals, a key component of this segment, saw consistent demand, reflecting the ongoing needs of manufacturing processes across the economy. CSX's ability to handle hazardous materials safely is paramount for these clients.

Automotive and Consumer Products

Automotive manufacturers and consumer goods companies are key customers for CSX, relying on them for the movement of vehicles, parts, and finished products. In 2024, the automotive sector continued to be a significant driver for freight rail, with CSX reporting strong volumes in this area. These companies often turn to intermodal solutions to ensure their goods reach distribution centers and dealerships efficiently and on schedule.

The efficiency of intermodal transport is crucial for managing supply chains in these fast-paced industries. For instance, the automotive industry's just-in-time manufacturing processes depend heavily on reliable and predictable delivery of components and finished vehicles. CSX’s network capabilities are vital in supporting these operational demands.

Specific benefits for this segment include:

- Reduced transit times for vehicle components and finished cars.

- Cost-effective transportation of high-volume consumer goods.

- Access to extensive rail networks for reaching diverse markets.

- Intermodal solutions that combine rail and truck for last-mile delivery.

Construction and Minerals Companies

Construction and Minerals Companies represent a core customer segment for CSX, relying heavily on efficient rail transportation for their raw materials and finished products. This includes businesses engaged in building infrastructure, quarrying aggregates, and mining diverse minerals.

CSX's role is critical in moving substantial volumes of heavy and bulk commodities. Think aggregates for roads and buildings, cement for concrete, and various minerals essential for manufacturing and construction projects. For instance, in 2024, the demand for construction materials remained robust, driven by ongoing infrastructure investments and housing development.

- Aggregates: Essential for road construction, concrete production, and general building.

- Cement: A key component in concrete, vital for large-scale infrastructure and commercial projects.

- Minerals: Including coal, iron ore, and other materials used in manufacturing and industrial processes.

- Intermodal: While not directly construction materials, intermodal containers often carry finished goods for the construction sector.

CSX serves a diverse range of industrial sectors, including chemicals, automotive, and consumer goods. These industries rely on CSX for timely and safe transport of raw materials, components, and finished products, often utilizing intermodal solutions.

In 2024, industrial freight remained a key revenue driver, with specific sectors like chemicals showing consistent demand. The automotive sector also contributed significantly to volumes, highlighting the importance of efficient logistics for manufacturing and distribution networks.

The company's ability to handle specialized cargo and large volumes efficiently is critical for these customer segments, impacting their operational costs and supply chain reliability.

| Customer Segment | Key Products Transported | 2024 Relevance |

|---|---|---|

| Chemicals & Industrial | Plastics, metals, chemicals, manufactured goods | Consistent demand for raw materials and finished products; hazardous material transport expertise is key. |

| Automotive & Consumer Goods | Vehicles, parts, finished products, high-volume consumer goods | Strong volumes driven by manufacturing and distribution needs; intermodal solutions are vital for efficiency. |

Cost Structure

Operating expenses represent a substantial part of CSX's cost structure. These include the significant outlays for labor, encompassing wages and benefits for its extensive workforce, as well as the costs associated with fuel for its locomotive fleet and the continuous maintenance of its vast network of tracks, yards, and rolling stock.

In 2024, CSX reported its operating expenses to be around $9.295 billion. This figure highlights how crucial managing these day-to-day operational costs is to the company's overall financial health and profitability.

CSX's cost structure heavily relies on substantial annual capital expenditures. These funds are crucial for maintaining, upgrading, and expanding its extensive rail network, a core asset. This also includes the acquisition of new locomotives and the continuous modernization of its rolling stock and other essential equipment.

In 2024 alone, CSX allocated approximately $2.5 billion towards these critical capital expenditures. This significant investment underscores the company's commitment to operational efficiency and future growth by ensuring its infrastructure and equipment remain state-of-the-art.

Depreciation and amortization are significant non-cash expenses for CSX, reflecting the gradual reduction in value of its extensive physical infrastructure. As a capital-intensive railroad, this includes the wear and tear on tracks, locomotives, and terminals. In 2023, CSX reported $1.6 billion in depreciation and amortization expenses, highlighting the substantial impact of these long-lived assets on its cost structure.

Intermodal and Transload Facility Costs

Operating and maintaining intermodal and transload facilities forms a significant part of CSX's cost structure. These costs encompass the upkeep of specialized equipment like cranes and forklifts, the wages for skilled labor managing these operations, and the expenses related to the land and infrastructure of these crucial hubs. For instance, in 2024, CSX's capital expenditures on network infrastructure and equipment, which includes these facilities, were substantial, reflecting the ongoing investment needed to support efficient freight movement.

These facilities are indispensable for CSX's business model, serving as vital connection points where goods transfer between rail and truck, enabling seamless door-to-door delivery. The efficiency and capacity of these intermodal and transload operations directly impact CSX's ability to serve its customers and compete in the logistics market. In 2023, CSX reported significant investments in expanding and modernizing its intermodal network, highlighting the capital intensity of these operations.

- Equipment Costs: Investment in and maintenance of specialized handling machinery, such as reach stackers and terminal tractors.

- Labor Expenses: Wages and benefits for terminal operators, mechanics, and administrative staff.

- Property and Facility Costs: Expenses related to land acquisition, leases, facility upkeep, utilities, and security.

- Technology Investment: Costs for implementing and maintaining tracking systems, automation, and data management for efficient operations.

Technology and Safety Investments

CSX's cost structure is significantly influenced by ongoing investments in technology and safety. These expenditures are crucial for maintaining operational efficiency and enhancing digital capabilities. For instance, in 2024, CSX continued to invest in upgrading its intermodal and terminal technologies to streamline operations and improve customer service. These investments are not merely about modernization but also about building a more resilient and efficient supply chain.

The company allocates substantial resources to advanced safety systems and compliance. This includes the implementation of positive train control (PTC) technology, which aims to prevent accidents caused by human error, and investments in track integrity monitoring. In 2024, CSX reported continued progress in its PTC deployment, a significant undertaking that enhances safety across its network. These safety-focused costs are essential for regulatory compliance and mitigating risks inherent in rail operations.

- Technology Investments: Ongoing spending on digital platforms and operational efficiency tools.

- Safety Systems: Capital allocated to advanced safety technologies like Positive Train Control (PTC).

- Compliance and Training: Costs associated with safety regulations, environmental protection, and employee training programs.

- Operational Upgrades: Expenditures on modernizing infrastructure and equipment for improved performance and safety.

CSX's cost structure is dominated by operating expenses, which include labor, fuel, and maintenance. Capital expenditures are also a significant component, funding network upgrades and equipment acquisition. Depreciation and amortization represent substantial non-cash costs related to its vast infrastructure.

| Cost Category | 2024 Estimate (Billions) | Key Components |

|---|---|---|

| Operating Expenses | $9.295 | Labor, Fuel, Maintenance |

| Capital Expenditures | $2.5 | Network Upgrades, Rolling Stock, Technology |

| Depreciation & Amortization | $1.6 (2023) | Wear and tear on infrastructure and equipment |

Revenue Streams

Merchandise Freight Revenue represents CSX's most significant income source, stemming from the transportation of a broad array of goods like chemicals, agricultural products, metals, and automotive parts. This segment is projected to be the primary revenue generator for CSX, with merchandise volumes anticipated to increase in 2024.

CSX generates substantial revenue from its intermodal freight services, which involve the efficient transfer of containers between rail and truck transportation. This segment has experienced robust volume growth, fueled by increased port activity and a rise in international trade volumes.

In 2024, CSX’s intermodal segment has been a key driver of financial performance, reflecting the ongoing demand for integrated logistics solutions. For instance, the company reported strong intermodal volumes throughout the first half of 2024, directly translating into significant revenue contributions.

CSX generates revenue from moving coal to power plants within the United States and to ports for international export. Despite a general trend of declining coal usage, this freight segment remains a significant contributor to CSX's overall income.

In 2024, while specific figures for coal freight revenue are still being finalized, CSX has historically seen substantial income from this sector. For instance, in 2023, revenue from coal transportation represented a notable portion of their total revenue, even as the volume of coal hauled experienced a decrease compared to prior years.

Other Revenue (e.g., Demurrage, Switching)

CSX generates revenue from various ancillary services, including demurrage, which are charges for exceeding free time for railcars, and switching services, which involve moving railcars between tracks. These additional revenue streams complement their core freight transportation business.

In 2024, these other revenue sources contributed a notable portion to CSX's overall financial performance. For instance, in the first quarter of 2024, CSX reported approximately $223 million in other revenue, showcasing the significance of these ancillary services.

- Demurrage: Fees charged when railcars are held longer than the allotted free time, incentivizing efficient railcar utilization.

- Switching Services: Revenue generated from moving railcars within yards or to and from customer facilities.

- Other Incidental Charges: Includes various fees for services such as car repairs or special handling.

- Contribution to Overall Revenue: These streams, while secondary to freight, provide diversification and enhance profitability, with Q1 2024 other revenue reaching $223 million.

Fuel Surcharge Revenue

CSX generates revenue through fuel surcharges, a mechanism designed to balance the impact of fluctuating fuel prices on its operations. This surcharge is applied to freight rates, directly linking transportation costs to the volatile energy market.

For instance, in the first quarter of 2024, CSX reported that fuel costs were a significant factor, with fuel surcharge revenue playing a crucial role in mitigating these expenses. While specific figures for surcharge revenue alone are often embedded within broader revenue reporting, the company's financial statements consistently highlight the importance of managing fuel price volatility.

- Fuel Surcharge Mechanism: A variable charge added to freight bills to cover the cost of fuel.

- Profitability Management: Helps CSX maintain profitability by offsetting unpredictable spikes in diesel prices.

- 2024 Impact: Fuel costs remained a key consideration for CSX in early 2024, underscoring the necessity of this revenue stream.

- Market Sensitivity: Directly tied to global oil and gas prices, making it a dynamic revenue component.

CSX’s revenue streams are diverse, primarily driven by merchandise freight, intermodal services, and coal transportation. Ancillary services like demurrage and switching, along with fuel surcharges, further contribute to the company's income, providing a robust financial model.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Merchandise Freight | Transportation of diverse goods (chemicals, agriculture, metals, automotive). | Projected increase in merchandise volumes for 2024. |

| Intermodal Freight | Efficient transfer of containers between rail and truck; strong volume growth. | Key driver in H1 2024, fueled by port activity and international trade. |

| Coal Freight | Moving coal to power plants and export ports. | Remains a significant contributor despite declining usage trends; 2023 revenue was notable. |

| Ancillary Services (Demurrage, Switching) | Fees for exceeding railcar free time, moving railcars within yards. | Contributed approx. $223 million in Q1 2024, enhancing profitability. |

| Fuel Surcharges | Variable charge to cover fluctuating diesel prices. | Crucial for mitigating high fuel costs experienced in early 2024. |

Business Model Canvas Data Sources

The CSX Business Model Canvas is informed by a blend of internal financial reports, operational data, and competitive intelligence. This comprehensive approach ensures a robust and data-driven representation of CSX's strategic framework.