CSX Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSX Bundle

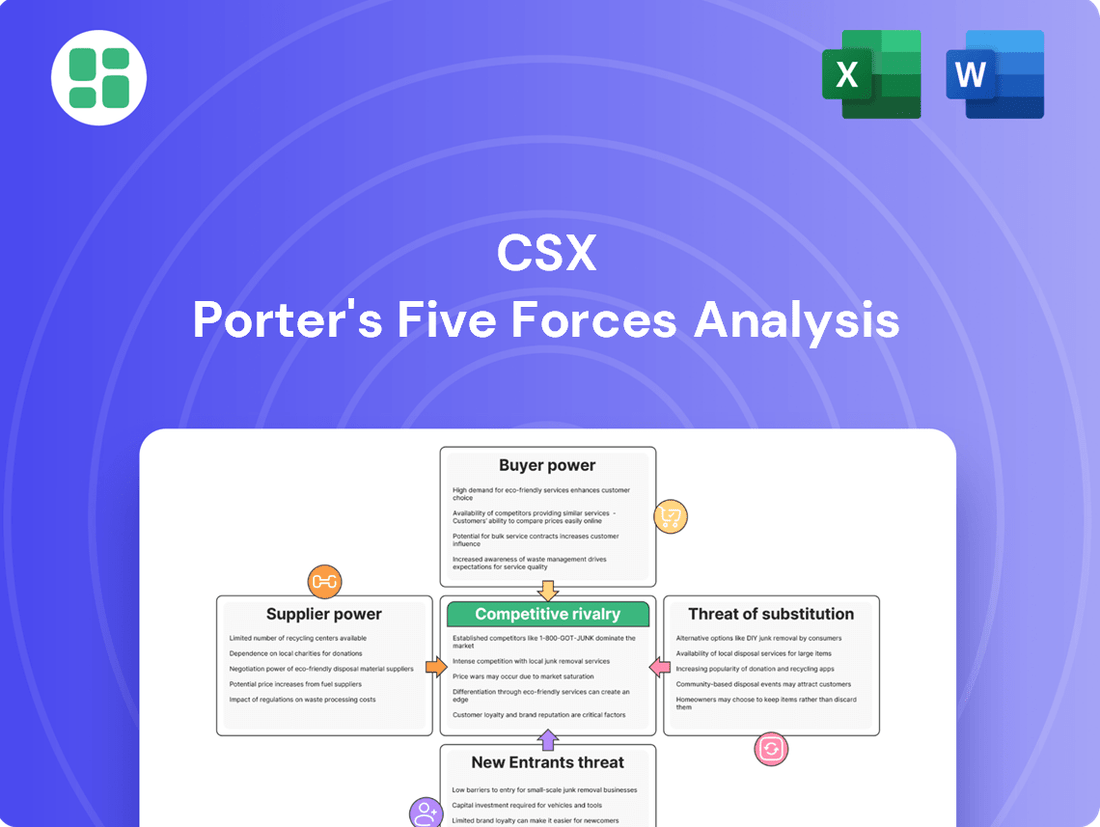

CSX's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the constant threat of new entrants disrupting the rail industry. Understanding these dynamics is crucial for strategic planning and identifying potential advantages.

The complete report reveals the real forces shaping CSX’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CSX's dependence on a small group of highly specialized suppliers for essential equipment like locomotives and rail significantly amplifies supplier bargaining power. For instance, the market for new locomotives is dominated by a few key players, meaning CSX has fewer alternatives when negotiating purchases. In 2024, the rail industry continued to see consolidation among suppliers, further concentrating this power.

Switching suppliers for essential rail infrastructure and rolling stock presents significant hurdles for CSX. The specialized nature of this equipment, from locomotives to track components, means that changing vendors often incurs substantial costs and can lead to considerable operational disruptions. This is because new equipment needs to integrate seamlessly with existing systems, a process that requires extensive testing and potential modifications.

Furthermore, CSX frequently enters into long-term contracts with its critical suppliers. These agreements, while offering a degree of supply chain stability, can also constrain CSX's leverage when negotiating prices for future purchases or upgrades. For instance, in 2023, the rail industry saw continued demand for new locomotives, with major manufacturers like Wabtec delivering advanced models, but the long lead times and established relationships in this sector can solidify supplier power.

The rail industry's reliance on suppliers who adhere to strict quality and safety standards significantly bolsters supplier bargaining power. For instance, the Federal Railroad Administration (FRA) mandates rigorous compliance for all rail components, making it difficult for CSX to switch suppliers if those suppliers consistently meet these high benchmarks.

Suppliers providing materials and equipment that meet these stringent FRA regulations are crucial for CSX's operations. Failure to use compliant parts can result in substantial fines, operational disruptions, and severe legal liabilities, effectively locking CSX into relationships with these dependable suppliers.

Technological Advancements in Supplier Offerings

Suppliers are increasingly embedding cutting-edge technologies like AI for predictive maintenance and exploring alternative fuels, such as hydrogen, in their offerings. This technological leap can bolster supplier leverage, potentially compelling CSX to adopt these advanced, often exclusive, systems to boost operational efficiency and achieve environmental targets.

For instance, the push towards greener logistics means suppliers developing more efficient, lower-emission components or entire locomotive systems gain a significant advantage. Companies investing heavily in R&D for these areas, like Cummins with its hydrogen engine development, position themselves as critical partners for railroads aiming to meet future emissions standards.

- Supplier Innovation: Suppliers are integrating AI for predictive maintenance and developing alternative fuel locomotives (e.g., hydrogen).

- Increased Leverage: This innovation can increase supplier power, as CSX may need to invest in these advanced, proprietary technologies.

- Efficiency and Sustainability: Adoption of these technologies helps CSX enhance efficiency and meet sustainability goals.

- Competitive Advantage: Suppliers at the forefront of technological development, like those in alternative fuels, can command greater influence.

Impact of Raw Material Costs

The cost of essential raw materials like steel for tracks and various components directly impacts CSX's operational expenses. Fluctuations in global commodity prices can significantly empower suppliers, enabling them to negotiate for higher pricing, which in turn affects CSX's bottom line.

CSX's substantial purchasing volume does provide a degree of leverage in negotiations with suppliers. However, this leverage is often tested by the inherent volatility of global commodity markets, particularly for key inputs like steel. For instance, in early 2024, steel prices saw notable increases due to supply chain disruptions and increased demand, potentially squeezing margins for rail companies like CSX.

- Steel Prices: Global steel benchmarks experienced upward pressure in the first half of 2024, impacting the cost of track maintenance and expansion for CSX.

- Component Costs: Prices for specialized rail components, often sourced globally, also saw volatility, influenced by manufacturing capacity and geopolitical factors.

- Negotiating Power: While CSX's scale allows for bulk purchasing, suppliers in concentrated markets can still exert significant pricing influence when raw material costs rise sharply.

CSX's bargaining power with suppliers is moderate, influenced by the specialized nature of rail equipment and the consolidation within key supplier industries. While CSX's large order volumes offer some negotiation leverage, the high switching costs and critical nature of components like locomotives and specialized track materials empower suppliers.

The market for new locomotives, for example, is dominated by a few major manufacturers. This concentration, coupled with the significant investment required for new rolling stock, means CSX has limited options when procuring these essential assets. In 2024, the rail industry continued to see this supplier concentration, with companies like Wabtec holding a substantial share of the locomotive market.

Suppliers' ability to innovate, particularly in areas like alternative fuels and predictive maintenance technologies, further strengthens their position. CSX's need to adopt these advancements for efficiency and sustainability can increase its reliance on specific suppliers, potentially driving up costs.

| Supplier Characteristic | Impact on CSX | 2024 Trend/Data Point |

|---|---|---|

| Supplier Concentration (e.g., Locomotives) | Increases supplier bargaining power | Continued market dominance by key players like Wabtec. |

| Switching Costs (Specialized Equipment) | Limits CSX's flexibility, empowers suppliers | High integration costs for new rolling stock and track components. |

| Supplier Innovation (AI, Alternative Fuels) | Enhances supplier leverage, potential for higher prices | Suppliers investing in hydrogen propulsion and predictive maintenance gain advantage. |

| Raw Material Price Volatility (e.g., Steel) | Can empower suppliers during price hikes | Steel prices saw upward pressure in early 2024 due to supply chain issues. |

What is included in the product

This analysis meticulously examines the five competitive forces impacting CSX, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately, CSX's strategic positioning.

Quickly identify and mitigate competitive threats with a dynamic, interactive five forces model that visually highlights areas of intense pressure.

Customers Bargaining Power

CSX serves a wide range of industries, from coal and chemicals to agriculture and automotive. This diversity helps spread risk, but it also means that large customers within specific sectors can have considerable influence. For example, a major automotive manufacturer shipping thousands of vehicles annually through CSX has significant leverage.

In 2024, the freight volume handled by Class I railroads like CSX remained a critical factor in customer bargaining power. Shippers who can commit to consistently high volumes of goods, such as those in the energy sector or large agricultural cooperatives, are in a stronger position to negotiate favorable rates and service agreements. This concentrated demand from key clients allows them to exert pressure on pricing and service levels.

Rail freight’s inherent cost-effectiveness for bulk and heavy cargo over long distances significantly reduces customer bargaining power. For instance, in 2024, the average cost per ton-mile for rail transport remained substantially lower than trucking for many commodities, making it the preferred choice for businesses prioritizing logistics expenses.

For customers who have invested in dedicated rail infrastructure, such as private sidings or specialized transload facilities, the cost of switching to an alternative transportation mode like trucking or intermodal can be substantial. These significant capital outlays for new equipment, facility modifications, and the complex logistical planning required to reconfigure supply chains effectively limit their ability to easily shift away from rail services.

This deep integration into CSX's network, driven by the sunk costs in specialized infrastructure, inherently reduces the bargaining power of these customers. Once a shipper has committed to rail-specific assets, their leverage to negotiate more favorable terms with CSX diminishes, as the cost and complexity of changing providers are prohibitively high.

Price Sensitivity for Certain Commodities

Customers shipping commodities like coal, which has experienced declining volumes and lower global benchmark rates, exhibit significant price sensitivity. This sensitivity directly impacts CSX's ability to dictate freight rates and fuel surcharges, especially in competitive or shrinking market segments.

- Price Sensitivity for Coal Shipments: Declining coal volumes and lower global benchmark rates in 2023 and early 2024 have made customers highly sensitive to freight costs.

- Impact on CSX Pricing: This sensitivity forces CSX to carefully manage its pricing strategies, particularly concerning fuel surcharges, to remain competitive.

- Competitive Pressure: In markets where alternative transportation options exist or where demand is weak, CSX faces intensified pressure to offer favorable rates.

Availability of Intermodal and Logistics Solutions

CSX's robust intermodal and transload services, seamlessly blending rail with truck transport, offer customers a holistic logistics solution. This integration fosters customer loyalty by providing a more complete supply chain, but it also means CSX faces direct competition from trucking companies within the intermodal market.

In 2024, the demand for integrated logistics solutions continued to grow, driven by supply chain efficiency needs. CSX's intermodal segment, a key area where customer bargaining power is felt, saw continued investment. While specific figures for intermodal customer stickiness are proprietary, the overall growth in intermodal volumes for Class I railroads in recent years, including CSX, indicates the attractiveness of these combined services.

- Intermodal Integration: CSX's strategy emphasizes combining rail's long-haul efficiency with trucking's first-and-last-mile flexibility.

- Customer Value Proposition: Offering end-to-end supply chain management enhances the value for shippers, potentially increasing switching costs.

- Competitive Landscape: The trucking industry remains a significant alternative for intermodal freight, directly impacting CSX's pricing power.

- Market Dynamics: In 2024, the transportation sector continued to navigate fluctuating fuel costs and capacity constraints, influencing customer choices and bargaining leverage in intermodal services.

The bargaining power of CSX's customers is influenced by factors like shipment volume, commodity type, and their investment in specialized infrastructure. Large volume shippers and those in price-sensitive markets, such as coal, can exert more pressure on pricing. Conversely, customers with significant investments in rail-specific assets face higher switching costs, reducing their leverage.

In 2024, the cost-effectiveness of rail freight for bulk commodities remained a key factor limiting customer bargaining power. For example, the average cost per ton-mile for rail transport was notably lower than trucking for many goods, making it the preferred option for businesses focused on logistics expenses.

Customers who have made substantial investments in dedicated rail infrastructure, like private sidings, face considerable costs if they decide to switch to alternative transportation modes. These sunk costs, including new equipment and facility modifications, significantly reduce their ability to negotiate favorable terms with CSX.

| Factor | Impact on Bargaining Power | 2024 Relevance |

|---|---|---|

| Shipment Volume | Higher volume = More leverage | Key for large industrial clients |

| Commodity Type | Price-sensitive commodities = More leverage | Coal shipments show high price sensitivity |

| Infrastructure Investment | High sunk costs = Less leverage | Dedicated rail infrastructure limits switching |

| Alternative Transport Options | Availability of alternatives = More leverage | Trucking remains a viable alternative for some freight |

Same Document Delivered

CSX Porter's Five Forces Analysis

This preview showcases the complete CSX Porter's Five Forces Analysis, identical to the document you will receive immediately after purchase. You can be confident that what you see here is the exact, professionally formatted report, ready for your immediate use without any alterations or placeholders. This ensures you get precisely the in-depth strategic insight you expect for evaluating CSX's competitive landscape.

Rivalry Among Competitors

The North American freight rail sector operates as an oligopoly, with a handful of dominant Class I railroads, including CSX, dictating market dynamics. This concentrated structure means that strategic moves by one of these few giants, such as pricing adjustments or service expansions, directly influence the competitive landscape for all others, leading to a high degree of interdependence.

Railroads like CSX operate with enormous fixed costs, including maintaining extensive track networks, locomotives, and railcars. These capital-intensive operations result in high operational leverage, meaning that once these costs are covered, additional revenue contributes significantly to profits. For instance, Class I railroads in the U.S. collectively invested billions in infrastructure and equipment in 2023, a trend expected to continue.

The substantial investments, coupled with regulatory requirements such as the common carrier obligation to serve all customers, create formidable exit barriers. This makes it exceptionally difficult and costly for companies to leave the industry, thereby intensifying competition among the remaining players who must continue to operate and manage these high fixed costs.

In the rail industry, where price wars are constrained by market structure and regulation, competition among players like CSX intensifies through superior service quality and streamlined operations. This means focusing on on-time performance, cargo handling speed, and network uptime becomes crucial. CSX's commitment to enhancing its infrastructure and adopting advanced technologies directly supports this competitive strategy, aiming to boost both service reliability and overall productivity to outpace rivals.

Mixed Industry Growth and Volume Dynamics

While the North American rail freight market is anticipated to see growth between 2024 and 2029, this expansion isn't uniform across all sectors. Some segments, such as coal shipments, have experienced a downturn, impacting overall volumes. This creates a competitive environment where carriers vie for higher-demand freight.

The mixed volume dynamics directly influence competitive rivalry. As certain freight categories like intermodal and specific merchandise types show upward trends, carriers are intensely competing to capture these more profitable loads. This is particularly true in lanes where rail freight directly challenges trucking services.

- Projected North American rail freight market growth: Expected to expand between 2024 and 2029.

- Segment performance: Coal shipments have declined, while intermodal and certain merchandise categories are growing.

- Competitive impact: Mixed volumes intensify competition for profitable freight, especially against trucking.

Strategic Alliances and Network Reach

Strategic alliances and the breadth of network reach are critical in the railroad industry, as companies like CSX aim to provide integrated, coast-to-coast transportation solutions. These partnerships allow railroads to extend their geographical coverage and offer more comprehensive services to customers. For instance, CSX's extensive network in the Eastern United States, a region boasting significant industrial and port activity, serves as a foundational competitive advantage. This network is further strengthened by its connections to smaller short-line railroads and other major Class I carriers, facilitating more efficient freight movement across diverse regions.

CSX's commitment to expanding its network reach through alliances is evident in its ongoing investments and operational strategies. In 2024, CSX continued to leverage its existing infrastructure, which spans over 21,000 route miles, connecting key manufacturing hubs, agricultural centers, and major East Coast ports. This expansive footprint allows CSX to serve a vast array of industries, from automotive and chemicals to agriculture and intermodal freight. The company’s strategic focus on enhancing its network capabilities through collaborations with other transportation providers directly impacts its competitive positioning by enabling more fluid and cost-effective supply chain solutions for its clients.

- Network Reach: CSX operates over 21,000 route miles, primarily in the Eastern United States, linking major ports and economic centers.

- Strategic Alliances: CSX collaborates with short-line railroads and other Class I carriers to extend its service offerings and improve freight flow.

- Competitive Advantage: A broad and well-connected network allows CSX to offer seamless transportation solutions, enhancing its appeal to a diverse customer base in 2024.

Given the oligopolistic nature of the North American rail freight market, competitive rivalry among Class I railroads like CSX is intense. While direct price wars are uncommon due to market structure and regulatory oversight, companies differentiate themselves through service quality, operational efficiency, and network capabilities. This focus on superior performance and customer solutions is key to gaining market share.

The competitive landscape is further shaped by varying freight volumes across different sectors. As some segments, like coal, face declines, carriers are aggressively competing for growth areas such as intermodal and merchandise transport. This dynamic intensifies the battle for profitable loads, particularly where rail competes directly with trucking services.

CSX's extensive network, spanning over 21,000 route miles in the Eastern U.S., provides a significant competitive edge. By forging strategic alliances with short-line railroads and other Class I carriers, CSX enhances its reach and offers integrated solutions, making it a formidable competitor in securing diverse freight business.

| Competitive Factor | CSX's Approach | Industry Trend (2024) |

|---|---|---|

| Service Quality | Focus on on-time performance, cargo handling speed. | Increasing emphasis on reliability and efficiency. |

| Network Reach | Over 21,000 route miles, strategic alliances. | Expansion and integration of networks to offer end-to-end solutions. |

| Freight Segment Competition | Targeting growth areas like intermodal and merchandise. | Shift in focus from declining sectors (e.g., coal) to high-demand freight. |

SSubstitutes Threaten

Trucking stands as the most potent substitute for rail freight, offering unparalleled flexibility and direct door-to-door delivery. This makes it particularly attractive for shorter distances and for transporting less voluminous or time-sensitive goods, directly impacting CSX's market share for such shipments.

The trucking industry's pricing dynamics and available capacity significantly sway shipper preferences, potentially leading to a 'reverse modal shift' where businesses opt for road transport over rail. For instance, in 2024, while rail carloads saw fluctuations, the trucking sector continued to handle a substantial portion of freight, underscoring its competitive threat.

Rail freight consistently offers superior cost-effectiveness for substantial volumes and extended transit, especially for bulk goods and intermodal shipments. However, this advantage is often balanced by the inherent speed and adaptability of trucking services.

The projected increase in trucking rates for 2025, with some industry forecasts pointing to potential hikes of 5-10% due to driver shortages and fuel price volatility, could significantly shift this balance. This anticipated cost escalation makes rail a more compelling alternative for a broader range of shippers.

The threat from substitute transportation modes for CSX's core freight business remains relatively low. Inland waterways, primarily utilizing barges, offer a cost-effective alternative for bulk commodities but are constrained by geographical limitations and significantly slower transit times compared to rail. For instance, moving goods via barge can take days longer than by rail, making it impractical for many supply chains.

Air freight, while faster, presents a substantial cost disadvantage. In 2024, air cargo rates per ton-mile are often many times higher than rail freight rates, restricting its use to only the most time-sensitive and high-value shipments, which are not typically the primary cargo for CSX. This cost disparity effectively insulates most of CSX's freight volume from direct substitution by air.

Intermodal as a Mitigator and Facilitator

CSX's intermodal services are a key factor in mitigating the threat of substitutes, particularly from trucking. By combining the cost-effectiveness of long-haul rail with the last-mile flexibility of trucking, intermodal offerings present a compelling alternative to pure truckload transportation. This integrated approach allows CSX to capture market share that might otherwise be lost to road-based competitors.

In 2024, intermodal freight continued to be a significant growth area for Class I railroads. For instance, CSX reported robust intermodal volumes throughout the year, reflecting strong demand for this efficient transportation solution. This growth demonstrates how intermodal acts as a facilitator for rail by enhancing its competitiveness against other modes.

- Intermodal Growth: CSX's intermodal volumes in 2024 showed resilience, indicating its effectiveness in capturing freight.

- Cost Efficiency: Rail's inherent cost advantages over trucking for long distances are leveraged through intermodal.

- Flexibility: The integration of trucking for first and last-mile services addresses a key limitation of pure rail transport.

- Competitive Advantage: Intermodal allows CSX to compete more directly with trucking, thereby reducing the threat of substitution.

Innovation in Alternative Transport Technologies

Emerging innovations in transportation, like drone technology for freight delivery, present a potential long-term substitute threat to traditional rail services. While still in early stages, these advancements could eventually offer alternative solutions for certain types of cargo, particularly for last-mile delivery or specialized, time-sensitive shipments.

The rail industry, including companies like CSX, must proactively innovate to counter these evolving logistics solutions. This means investing in technology and exploring new service models to remain competitive.

- Drone Delivery Potential: While not yet widespread for large-scale freight, drone technology is being piloted for various delivery applications, potentially impacting shorter-haul rail freight.

- Evolving Logistics Landscape: The broader logistics sector is seeing increased investment in automation and new transport modes, creating a dynamic environment where substitutes can emerge.

- CSX's Innovation Focus: CSX has been investing in technology to improve efficiency and customer service, which is crucial for fending off potential substitutes. For instance, in 2023, CSX reported significant capital expenditures aimed at network enhancements and technological upgrades.

The threat of substitutes for CSX's core business is primarily from trucking, which offers greater flexibility for shorter hauls and less voluminous goods. While rail remains cost-effective for bulk and long-distance transport, trucking's door-to-door capability presents a direct challenge. However, CSX's intermodal services effectively mitigate this by combining rail's efficiency with trucking's last-mile reach, a strategy that saw strong volume growth in 2024.

Entrants Threaten

The sheer cost of building a new rail network is a massive deterrent for potential competitors. This includes acquiring vast tracts of land, laying miles of track, and purchasing expensive locomotives and freight cars. CSX's own significant infrastructure investments in 2024, amounting to billions of dollars, underscore the immense capital needed to even consider entering this market.

New entrants in the railroad industry, like CSX, confront substantial regulatory and legal obstacles. These include securing operating licenses, meeting rigorous safety regulations from bodies such as the Federal Railroad Administration (FRA), and fulfilling common carrier responsibilities, all of which significantly deter new competition.

Established Class I railroads like CSX possess significant economies of scale, enabling them to operate more cost-effectively than potential newcomers. This scale in operations, maintenance, and procurement translates to lower per-unit costs, a barrier for new entrants. For instance, in 2023, CSX reported operating revenues of $14.5 billion, reflecting the sheer volume of their business.

Furthermore, CSX's extensive, already built-out rail network creates powerful network effects. A larger network means more origin-destination pairs and greater efficiency for customers, making it difficult for new, smaller networks to compete. This existing infrastructure represents a massive capital investment that new entrants would need to replicate.

Difficulty in Replicating Existing Infrastructure and Relationships

The sheer scale and complexity of CSX's established infrastructure present a formidable barrier to new entrants. Building a comparable rail network, spanning thousands of miles and integrating with existing transportation hubs, requires colossal capital investment and decades of development.

CSX's nearly 200-year history has allowed it to cultivate deep, long-standing relationships with a diverse customer base, including major manufacturers, agricultural producers, and port authorities across the Eastern United States. These entrenched partnerships are difficult for newcomers to penetrate and replicate.

Consider these specific aspects:

- Network Reach: CSX operates over 21,000 route miles of track, connecting over two-thirds of the U.S. population and serving major East Coast ports.

- Capital Investment: Building a new, competitive rail network would likely require hundreds of billions of dollars in investment, a prohibitive cost for most potential entrants.

- Regulatory Hurdles: Navigating the complex regulatory landscape for new rail line construction and operation adds significant time and expense.

- Customer Loyalty: Existing customers often prioritize reliability and established service agreements, making it challenging for new entrants to gain market share.

Access to Skilled Labor and Technology

The rail industry, including companies like CSX, demands a highly specialized workforce, encompassing everything from locomotive engineers to intricate maintenance crews. This need for expertise is a significant barrier for potential new entrants.

Furthermore, the operational and safety advancements in railroading require substantial investment in sophisticated technologies. Newcomers would struggle to acquire and implement these advanced systems, adding another layer of difficulty.

- Skilled Workforce Requirements: The rail sector necessitates specialized training and certifications for its employees, making it challenging for new companies to quickly build a competent team.

- Technological Investment: Implementing and maintaining advanced signaling, communication, and rolling stock technologies demands considerable capital outlay, which can deter new entrants.

- Talent Acquisition Challenges: In 2024, the competition for skilled labor across many industries remains fierce. For the rail sector, attracting and retaining experienced professionals would be a significant hurdle for any new player aiming to compete with established entities like CSX.

The threat of new entrants for CSX is significantly low due to immense capital requirements for infrastructure and rolling stock, estimated in the hundreds of billions. Regulatory hurdles, including stringent safety standards from the FRA and licensing, further complicate market entry. Established economies of scale, with CSX's 2023 revenues at $14.5 billion, and strong customer loyalty built over decades also present formidable barriers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Building rail networks, acquiring locomotives, and freight cars require massive upfront investment. | Prohibitive cost for most potential competitors. |

| Regulatory Compliance | Obtaining operating licenses and adhering to safety regulations (e.g., FRA) is complex and time-consuming. | Adds significant delays and expenses, deterring new market participants. |

| Economies of Scale | Established players like CSX benefit from lower per-unit costs due to high operational volumes. | New entrants struggle to match cost efficiency, impacting pricing competitiveness. |

| Network Effects & Customer Loyalty | Extensive existing networks and long-term customer relationships are difficult to replicate. | New entrants face challenges in attracting and retaining customers against established service providers. |

Porter's Five Forces Analysis Data Sources

Our CSX Porter's Five Forces analysis is built upon a robust foundation of data, drawing from CSX's annual reports, SEC filings, and industry-specific publications. We also leverage market research reports and macroeconomic data to provide a comprehensive understanding of the competitive landscape.