CSX Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSX Bundle

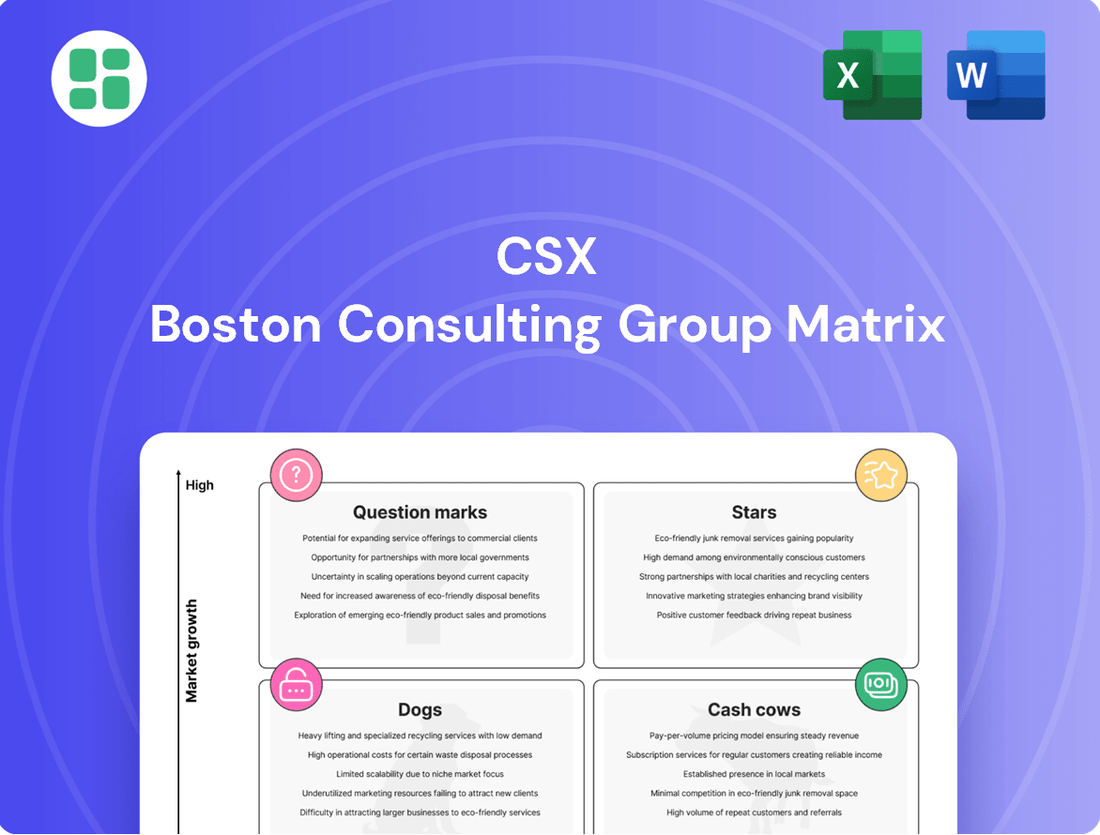

Understand the strategic positioning of CSX's diverse business units with our insightful BCG Matrix preview. See how their operations stack up as Stars, Cash Cows, Dogs, or Question Marks in the current market landscape. Purchase the full BCG Matrix to unlock detailed quadrant analysis, actionable strategies, and a clear roadmap for optimizing CSX's portfolio and driving future growth.

Stars

The Howard Street Tunnel project is a key CSX initiative, allowing for expanded double-stack intermodal capacity, especially along the vital I-95 corridor. This strategic infrastructure upgrade directly caters to the increasing need for efficient containerized freight movement.

By enabling double-stacking, CSX anticipates a significant boost in annual loads, enhancing its competitive edge against trucking and other rail carriers. This project is projected to improve supply chain reliability and capture a greater share of the growing intermodal market.

CSX's Strategic Industrial Development Initiatives are a cornerstone of its growth strategy, focusing on creating new, rail-dependent demand. The company has an impressive pipeline of over 550 industrial development projects, designed to attract businesses to locate along its extensive rail network.

These initiatives are particularly impactful for the merchandise business, projected to generate significant new annual carloads by 2027. By fostering these new traffic sources, CSX is actively expanding its market share within key industrial sectors.

CSX's investment in advanced digital logistics, including the ShipCSX platform modernization and GPS tracking, positions it strongly in a high-growth segment. This focus directly addresses shipper demand for real-time data and integrated supply chain solutions. For instance, by Q1 2024, CSX reported a significant increase in digital platform adoption, indicating a positive customer response to these enhanced visibility tools.

Transportation of Renewable Energy and Infrastructure Materials

The transportation of materials for renewable energy infrastructure and major construction projects is a rapidly growing area for rail carriers like CSX. This sector demands the movement of heavy and bulk goods, such as aggregates for construction and large components for wind turbines. CSX's extensive network is well-suited to capitalize on this trend, facilitating the energy transition and infrastructure development.

CSX's strategic positioning in this market allows it to capture a larger share of a burgeoning industry. The demand for these specialized transport services is projected to continue its upward trajectory. For instance, in 2024, the global renewable energy market experienced significant investment, driving the need for efficient logistics solutions.

- Market Growth: The renewable energy sector is a key driver of demand for bulk material transport.

- CSX Network Advantage: CSX's rail infrastructure is ideal for moving large, heavy components and raw materials.

- Strategic Importance: Serving this sector aligns with broader economic trends in energy transition and infrastructure spending.

- Revenue Potential: Expansion into this segment offers substantial opportunities for increased market share and revenue for CSX.

Cross-Border Intermodal Services with Mexico/Canada

Cross-border intermodal services with Mexico and Canada are a significant growth area, driven by trends like nearshoring and increased North American trade. CSX's new direct interline service with Canadian Pacific Kansas City (CPKC) is strategically positioned to capitalize on this expansion, connecting the Southeast U.S. with key markets in Texas and Mexico.

This collaboration significantly enhances CSX's network reach for international freight. For instance, in 2024, North American trade volume is projected to see continued strength. This partnership allows CSX to tap into a larger share of these growing cross-border movements.

- Nearshoring Trends: Companies are relocating production closer to home, boosting demand for efficient cross-border logistics.

- CPKC Partnership: The new interline service with CPKC provides direct access to Mexico from the Southeast.

- Market Share Capture: This strategic move enables CSX to secure a greater portion of the expanding international freight market.

- Trade Growth: North American trade continues its upward trajectory, creating substantial opportunities for intermodal providers.

Stars in the BCG Matrix represent business segments with high market share in a rapidly growing industry. CSX's focus on industrial development projects, particularly those attracting new rail-dependent demand, aligns with this category. These initiatives are designed to capture future growth, much like a star leverages its strong position to benefit from an expanding market.

The company's investment in advanced digital logistics also fits the Star profile, as it targets a high-growth segment with increasing shipper demand for real-time data and integrated solutions. By modernizing platforms like ShipCSX, CSX is solidifying its position in a market poised for significant expansion.

Furthermore, CSX's strategic engagement with the renewable energy and infrastructure construction sectors positions it to benefit from substantial market growth. Transporting heavy and bulk materials for these industries, which saw significant global investment in 2024, is a clear indicator of Star potential.

Cross-border intermodal services, especially with the new CPKC partnership facilitating access to Mexico, also represent a Star opportunity. Driven by nearshoring and increasing North American trade, this segment offers high growth and allows CSX to leverage its network for expanding international freight volumes.

| CSX Business Segment | BCG Matrix Category | Rationale | Key Data/Facts (as of mid-2024) |

|---|---|---|---|

| Industrial Development Projects | Star | High market share in attracting new rail-dependent demand within a growing industrial landscape. | Pipeline of over 550 projects projected to generate significant new annual carloads by 2027. |

| Digital Logistics (ShipCSX) | Star | Leader in a high-growth segment driven by shipper demand for visibility and integrated solutions. | Increased digital platform adoption reported by Q1 2024, indicating strong customer response. |

| Renewable Energy & Infrastructure Transport | Star | Capitalizing on rapid growth in sectors requiring specialized bulk and heavy material transport. | Global renewable energy market saw significant investment in 2024, driving logistics demand. |

| Cross-Border Intermodal (CPKC Partnership) | Star | Strong position in expanding North American trade and nearshoring trends, with enhanced network reach. | New direct interline service with CPKC connects Southeast U.S. to Mexico, tapping into growing trade volumes. |

What is included in the product

This BCG Matrix analysis for CSX categorizes its business units, guiding strategic decisions on investment, holding, or divestment.

CSX BCG Matrix: A clear visual roadmap to strategically allocate resources, transforming underperforming "Dogs" into market-leading "Stars."

Cash Cows

CSX's core merchandise freight services, particularly in chemicals and agricultural products, are firmly positioned as Cash Cows within its BCG Matrix. These segments benefit from CSX's established dominance and consistent demand within its Eastern U.S. network.

These mature markets deliver stable, predictable revenue streams, contributing significantly to CSX's overall financial health. For instance, in 2024, agricultural products and chemicals together represented a substantial portion of CSX's merchandise revenue, demonstrating their ongoing importance.

Despite potential market volume shifts, these businesses consistently generate robust cash flow. The relatively low need for substantial new capital investment in these established areas allows CSX to leverage this cash for other strategic initiatives.

CSX's established automotive rail transport network is a classic Cash Cow. The company moves a substantial volume of finished vehicles and parts across North America, serving major automakers. In 2024, CSX reported moving millions of vehicles, a testament to its dominance in this mature market segment.

This segment benefits from CSX's significant investment in specialized railcars and dedicated routes, solidifying its high market share. The consistent demand and operational efficiency in this area mean it reliably generates substantial, predictable cash flow for CSX, funding other business initiatives.

CSX's extensive Eastern U.S. rail network, a true geographic dominance, acts as a powerful cash cow. This vast infrastructure, covering key industrial and population centers, ensures consistent freight volume and high market share within its operating region. For 2024, CSX reported that its Eastern network generated substantial operating income, underscoring its role as a reliable cash generator.

Major Port Access and Traditional Export/Import Logistics

CSX's extensive direct connections to major East Coast ports, including Savannah, Charleston, and New York/New Jersey, form a cornerstone of its operations. This established infrastructure facilitates a consistent and high-volume movement of goods, both for export and import. These port-to-inland logistics represent a mature market segment where CSX holds a significant market share, generating reliable and substantial revenue streams.

This segment functions as a classic cash cow for CSX due to its consistent demand and the company's strong competitive position.

- High Market Share: CSX benefits from established relationships and infrastructure at key East Coast ports.

- Consistent Revenue: The steady flow of export and import traffic provides a predictable and significant revenue source.

- Mature Market: The logistics of port access and traditional freight movement are well-understood and stable.

- Operational Efficiency: Direct connections minimize transit times and costs, enhancing profitability.

Traditional Long-Haul Bulk and Diversified Carload Services

Traditional long-haul bulk and diversified carload services represent CSX's cash cows. This segment, characterized by the cost-effective rail transport of various bulk commodities and mixed freight over long distances, is mature with limited growth potential.

Despite low growth, CSX's robust market share and operational efficiency in these established services generate significant and stable cash flow. For instance, in 2024, CSX reported that its merchandise and coal segments, which largely encompass these services, continue to be foundational to its overall financial performance, contributing a substantial portion of operating income.

- Mature Market: Low growth prospects are typical for established, essential services.

- Strong Market Share: CSX benefits from its dominant position in key long-haul routes.

- Consistent Cash Flow: These services are reliable generators of substantial earnings.

- Operational Efficiency: CSX leverages its network to maintain cost advantages.

CSX's established chemical and agricultural product transportation services are classic cash cows, benefiting from consistent demand and CSX's strong market position in the Eastern U.S. These mature segments provide stable, predictable revenue, with 2024 data showing their significant contribution to merchandise revenue, underpinning CSX's financial stability.

The automotive rail transport segment, moving millions of vehicles and parts in 2024, is another prime cash cow. CSX's investment in specialized equipment and dedicated routes ensures high market share and reliable, substantial cash flow from this mature market.

CSX's extensive Eastern U.S. rail network itself functions as a cash cow, its geographic dominance ensuring consistent freight volume and market share. The substantial operating income generated by this network in 2024 highlights its role as a reliable cash generator.

Direct port connections, like those to Savannah and Charleston, represent a mature, high-volume segment where CSX's market share yields consistent and significant revenue. These logistics are a stable cash cow due to consistent demand and CSX's operational efficiency.

Traditional long-haul bulk and diversified carload services are also cash cows. Despite low growth, CSX's market share and efficiency in these essential services, including merchandise and coal transport which contributed substantially to operating income in 2024, generate significant and stable cash flow.

| Segment | BCG Classification | Key Characteristic | 2024 Relevance |

| Chemicals & Agriculture | Cash Cow | Stable demand, strong market share | Substantial merchandise revenue contribution |

| Automotive Transport | Cash Cow | High volume, specialized infrastructure | Millions of vehicles transported |

| Eastern U.S. Rail Network | Cash Cow | Geographic dominance, consistent volume | Significant operating income generator |

| Port Logistics | Cash Cow | High volume, direct connections | Reliable revenue from export/import |

| Long-Haul Bulk/Diversified | Cash Cow | Mature market, operational efficiency | Foundational to overall financial performance |

What You’re Viewing Is Included

CSX BCG Matrix

The CSX BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive upon purchase. This means no watermarks or demo content, ensuring you get a complete, ready-to-use strategic analysis for CSX's business units. You can trust that the insights and structure presented here are exactly what you'll leverage for your decision-making. This preview guarantees the final product's quality and completeness, allowing you to confidently assess its value for your strategic planning needs.

Dogs

CSX's domestic thermal coal transport faces a significant challenge, categorized as a Dog in the BCG Matrix. This sector is experiencing a prolonged downturn, driven by the global energy transition and a growing preference for cleaner energy alternatives. In 2023, U.S. coal consumption for electricity generation fell to its lowest point since 1978, impacting volumes for transporters like CSX.

The shrinking demand and lower benchmark pricing for thermal coal mean this segment is a drag on CSX's overall revenue and volume performance. Despite efforts to maintain efficiency, the fundamental decline in the market makes it a low-growth area where CSX's competitive position is also weakening, further solidifying its status as a Dog.

Short-haul freight in heavily contested trucking lanes presents a challenge for CSX. These routes, often saturated with carriers, offer limited growth opportunities for rail. In 2024, trucking companies continued to leverage their agility for these short hauls, making it difficult for rail to compete effectively on price and speed.

The inherent flexibility and cost advantages of road transport for short distances mean that rail services often struggle to capture significant market share in these segments. This can lead to operations that are less profitable for CSX, potentially acting as cash traps due to the high competition and low growth potential.

CSX's specialized railcar fleets, designed for industries with dwindling demand, often become underutilized assets. These niche cars, built for specific, declining freight types, incur significant maintenance costs without generating proportional revenue. This situation mirrors a 'Dog' in the BCG matrix, representing a low-growth, low-market share offering that drains resources.

Certain Legacy Metals or Forest Products Sub-Segments

Certain legacy metals or forest products sub-segments within CSX's operations could be classified as Dogs in the BCG Matrix. These are areas where demand is consistently shrinking, and CSX might not possess a strong competitive advantage. For instance, while overall merchandise volume is robust, specific niche markets for certain types of lumber or metal products may be in long-term decline.

If CSX's market share in these particular shrinking niches is not dominant, they represent potential Dogs. This classification suggests that these segments generate low returns and have limited growth prospects. Managing these Dogs requires careful consideration, potentially involving cost reduction strategies or even divestiture to reallocate resources to more promising areas of the business.

- Declining Demand: Specific legacy metals or forest products face persistent long-term demand erosion.

- Low Market Share: CSX may not hold a dominant position in these shrinking niches.

- Resource Allocation: These segments require careful management or potential divestiture to optimize resource deployment.

- Impact on Overall Performance: While merchandise freight is a cash cow, these specific sub-segments can drag down overall efficiency if not addressed.

Non-Integrated, Fragmented Local Drayage Operations

Non-integrated, fragmented local drayage operations within CSX's network can be classified as dogs in the BCG matrix. These services often struggle with intense local competition from numerous smaller trucking companies, leading to thin profit margins. For instance, in 2024, the average operating margin for independent trucking companies in the U.S. hovered around 5-8%, significantly lower than more integrated logistics providers.

These fragmented operations typically lack the scale and efficiency of CSX's core intermodal services. Their individual market share is often minimal, making it difficult to achieve economies of scale. This can result in a low return on investment when compared to the capital required for maintaining and managing these dispersed assets.

- Low Profitability: Fragmented drayage faces price pressure from numerous small competitors, limiting profit potential.

- Limited Market Share: Individual operations rarely capture a significant portion of their local market.

- High Competition: The barrier to entry for local drayage is relatively low, fostering a crowded marketplace.

- Suboptimal Resource Allocation: Investment in these non-core, fragmented services may divert resources from more profitable, integrated segments of CSX's business.

Certain legacy metals or forest products sub-segments within CSX's operations can be classified as Dogs in the BCG Matrix, characterized by shrinking demand and potentially a less dominant competitive position. For example, while overall merchandise volume is robust, specific niche markets for certain types of lumber or metal products may be in long-term decline. If CSX's market share in these particular shrinking niches is not dominant, they represent potential Dogs, generating low returns and having limited growth prospects.

| Segment | BCG Classification | Key Characteristics | 2024 Outlook/Data Point |

|---|---|---|---|

| Thermal Coal Transport | Dog | Declining demand due to energy transition, low growth, weakening competitive position. | U.S. coal consumption for electricity generation reached its lowest point since 1978 in 2023, impacting volumes. |

| Short-Haul Trucking Lanes | Dog | Intense competition, limited growth, trucking agility often preferred. | Trucking companies in 2024 continued to leverage agility for short hauls, challenging rail competitiveness. |

| Specialized Railcar Fleets (Declining Industries) | Dog | Underutilized assets, high maintenance costs, low revenue generation. | Niche car fleets for declining freight types represent a drain on resources without proportional returns. |

| Niche Legacy Metals/Forest Products | Dog | Persistent long-term demand erosion, potentially low market share in specific niches. | While overall merchandise is strong, specific product lines may face secular decline, impacting profitability. |

| Fragmented Local Drayage | Dog | Low profitability, limited market share, high competition, suboptimal resource allocation. | Average operating margins for independent U.S. trucking companies in 2024 were around 5-8%, indicating low profitability in fragmented local services. |

Question Marks

CSX is actively exploring hydrogen fuel cell and battery-electric locomotives, positioning them as potential future stars in their fleet. These innovative technologies represent a high-growth area, though commercial deployment is still nascent. While CSX's current market share in these specific segments is minimal, the company's investment signifies a strategic bet on future industry transformation.

The demand for specialized, temperature-controlled cold chain logistics is a rapidly expanding market, fueled by evolving consumer tastes for fresh and frozen goods, alongside increasingly stringent regulatory mandates for food safety and pharmaceutical integrity. CSX's strategic positioning in this high-value niche reflects a growing recognition of its potential.

While the overall cold chain market is projected to reach over $600 billion globally by 2027, according to various industry analyses, CSX's current penetration in highly specialized, temperature-sensitive segments may still be nascent. This presents a clear opportunity for growth, likely requiring targeted investments in infrastructure and technology to capture a larger share of this lucrative sector.

CSX's internal prowess in predictive maintenance for its extensive rail network and equipment presents a compelling opportunity. Offering these advanced services externally to other rail operators or industrial sectors targets a potentially lucrative, high-growth market. This strategic move aligns with industry trends where companies leverage specialized internal capabilities for external revenue streams.

As a new market entry, CSX's advanced predictive maintenance services for external entities would likely be positioned as a Question Mark on the BCG Matrix. This is due to its high growth potential coupled with a currently low market share. Significant investment will be necessary to build out the service infrastructure, sales channels, and client acquisition strategies to scale effectively in this new venture.

Specialized Bulk Transport for Emerging Biofuels/Renewable Diesel Feedstocks

The burgeoning biofuels sector, especially renewable diesel, is driving significant new demand for transporting specialized feedstocks like used cooking oil and animal fats. CSX can leverage its network for these emerging bulk transport routes, though its current market share in these niche areas may be limited. Capturing this growth will necessitate strategic investments in specialized equipment and operational adjustments to efficiently handle these unique materials.

For instance, the U.S. renewable diesel production capacity was projected to reach approximately 6 billion gallons by the end of 2023, a substantial increase from previous years. This expansion directly translates to increased feedstock movement. CSX's ability to adapt its services to accommodate the specific handling requirements of these diverse feedstocks will be crucial for securing a competitive edge.

- Emerging Demand: Growth in renewable diesel production fuels demand for specialized feedstock transport.

- Market Position: CSX's current market share in these specific lanes may be nascent, presenting an opportunity.

- Investment Needs: Targeted investments in specialized railcars and handling infrastructure are likely required.

- Industry Growth: The U.S. renewable diesel capacity highlights the scale of the potential market.

Strategic Expansion into New Intermodal Lanes and Logistics Hubs

CSX's strategic expansion into new intermodal lanes and logistics hubs can be viewed as a potential Stars or Question Marks in the BCG matrix. These initiatives, targeting emerging markets or less established routes, require substantial upfront investment to build market share and establish a competitive presence. For example, investments in new logistics hubs near growing industrial centers represent a commitment to future growth, even if current volumes are modest.

- Targeting Emerging Markets: CSX's development of new, less established intermodal lanes aims to capture growth in areas with lower initial market share.

- Logistics Hub Investments: Building new hubs to serve emerging industrial parks or distribution centers signifies a long-term strategy for market penetration.

- High Growth Potential: These ventures target high-growth geographic areas or customer segments, indicating a focus on future revenue streams.

- Significant Upfront Investment: Gaining traction in these new areas necessitates considerable capital expenditure to establish infrastructure and service capabilities.

CSX's foray into offering advanced predictive maintenance services to external entities represents a classic Question Mark. It's a high-growth potential area, leveraging internal expertise, but currently holds a low market share. Significant investment is needed to build the necessary infrastructure, sales teams, and client relationships to truly capitalize on this opportunity.

The company's strategic push into new, less-established intermodal lanes and the development of new logistics hubs also fall into the Question Mark category. These initiatives are designed to tap into high-growth potential markets, but require substantial upfront capital to establish a competitive foothold and build volume.

Similarly, CSX's exploration of hydrogen fuel cell and battery-electric locomotives positions them in a high-growth, albeit nascent, market. While their current share in this segment is minimal, the investment signifies a strategic bet on future industry shifts, requiring further development and market penetration.

The burgeoning biofuels sector, particularly the transport of renewable diesel feedstocks, presents another Question Mark. CSX is poised to benefit from increased demand, but its current market share in these specialized transport lanes is likely limited, necessitating investment in specific equipment and operational adjustments.

| BCG Category | CSX Initiative | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Question Mark | External Predictive Maintenance Services | High | Low | High |

| Question Mark | New Intermodal Lanes/Logistics Hubs | High | Low | High |

| Question Mark | Hydrogen/Battery-Electric Locomotives | High (Nascent) | Very Low | High |

| Question Mark | Renewable Diesel Feedstock Transport | High | Low | Medium |

BCG Matrix Data Sources

Our CSX BCG Matrix is built on comprehensive data, integrating financial reports, industry growth rates, and competitive analysis to accurately position business units.