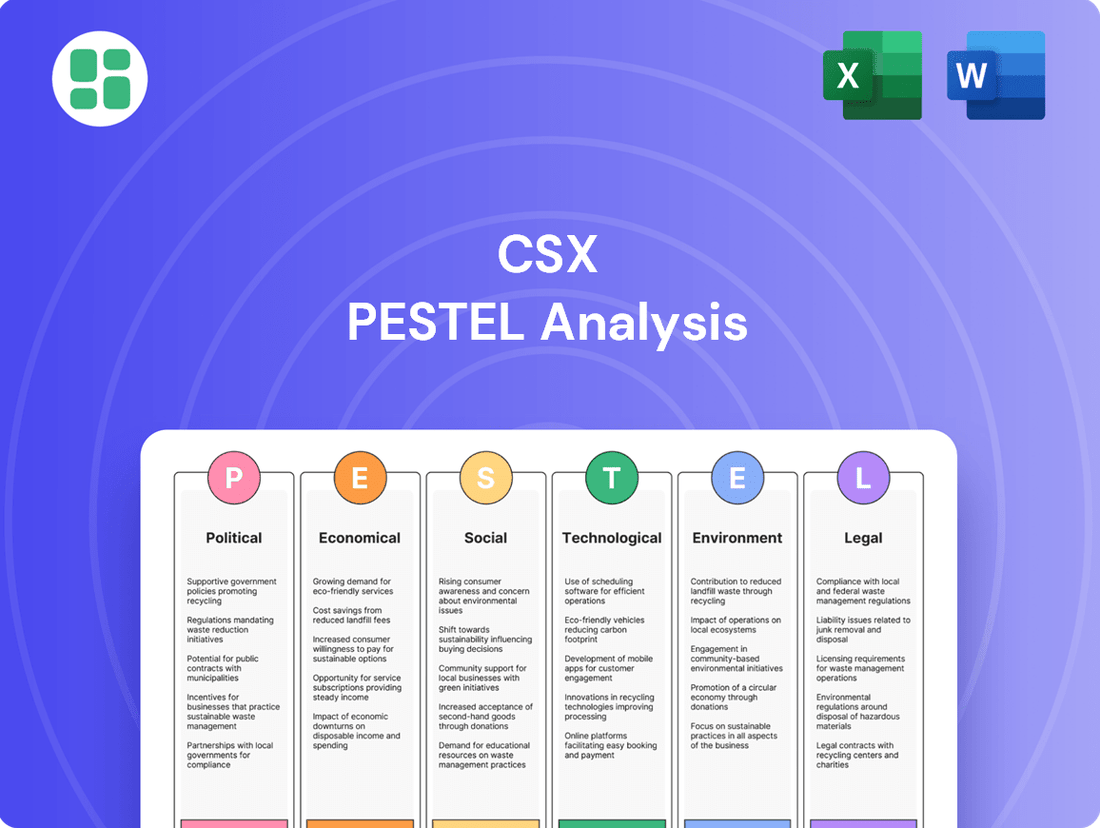

CSX PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSX Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping CSX's future. Our meticulously researched PESTLE analysis offers a strategic roadmap for navigating industry shifts and identifying growth opportunities. Don't get left behind; download the full, actionable report now to gain a decisive competitive edge.

Political factors

The freight rail sector, including CSX, operates under the watchful eye of federal bodies such as the Surface Transportation Board (STB) and the Federal Railroad Administration (FRA). These agencies set the rules for everything from safety standards to how rates are determined and what service levels are expected.

Any adjustments to these regulations, whether concerning safety protocols, pricing structures, or operational requirements, can directly influence CSX's ability to function efficiently and generate profits. For instance, the STB's recent review of demurrage and accessorial charges in 2024 could lead to revised policies impacting rail carrier revenue streams.

Furthermore, shifts in the political landscape can introduce new legislative priorities. These might include increased government investment in rail infrastructure, as seen in some infrastructure bills proposed in 2024, or the implementation of stricter environmental mandates that could affect operating costs and fleet modernization for CSX.

International trade policies and tariffs significantly shape the volume and nature of goods CSX transports. As a key player in moving commodities and intermodal containers, CSX's operations are directly impacted by trade agreements, sanctions, and any trade disputes involving the United States.

Favorable trade policies typically lead to increased freight volumes for CSX, as seen in the robust cross-border trade between the US and Canada/Mexico. For instance, the USMCA (United States-Mexico-Canada Agreement) has aimed to streamline trade, potentially benefiting rail carriers. Conversely, protectionist measures, such as new tariffs on imported goods or retaliatory tariffs on exports, can dampen freight demand, affecting CSX's overall revenue streams.

Government investment in transportation infrastructure directly benefits CSX. For instance, the Infrastructure Investment and Jobs Act of 2021 allocated $110 billion for roads, bridges, and other major projects, with a significant portion earmarked for rail improvements and intermodal connectivity. This funding can lead to more efficient port operations and expanded highway networks, both of which bolster CSX's intermodal services by reducing transit times and improving access to key markets.

Labor Relations and Union Policies

The rail sector, including CSX, relies heavily on a unionized workforce, making labor relations a critical political factor. Government policies and collective bargaining agreements significantly shape operational costs and stability. For instance, the Railway Labor Act governs labor relations in the industry, influencing negotiation processes and dispute resolution.

Potential government intervention in labor disputes, such as imposing cooling-off periods or binding arbitration, can directly affect CSX's ability to operate without disruption. Changes in labor laws, for example, those impacting strike rights or mandating specific working conditions, could alter the company's cost structure and efficiency. Political leanings towards supporting unions or management can sway negotiation outcomes.

- Unionization Rate: Historically, a high percentage of rail industry workers are unionized, impacting wage negotiations and benefit packages.

- Labor Dispute Impact: Major rail strikes can halt operations, leading to significant economic losses across supply chains. For example, the potential 2022 rail strike, averted by congressional action, highlighted the economic sensitivity.

- Political Influence: Lobbying efforts by both rail companies and unions aim to influence legislation affecting labor practices and working conditions.

Geopolitical Stability and Conflicts

Global geopolitical events and conflicts directly influence supply chain integrity and the flow of goods, impacting CSX's freight volumes. For instance, ongoing tensions in Eastern Europe, as observed throughout 2024, have continued to affect energy commodity routes and manufacturing output, indirectly influencing North American intermodal traffic that CSX handles.

While CSX's operations are predominantly within North America, a significant portion of its cargo is linked to international trade. Political instability in key trading regions, such as disruptions in the Red Sea impacting shipping lanes in early 2024, can reroute vessels, leading to increased reliance on land-based logistics and potentially shifting demand for certain commodities or creating economic uncertainty that affects overall freight demand.

- Supply Chain Disruptions: Geopolitical flashpoints can halt or reroute international shipping, forcing greater reliance on North American rail networks like CSX for certain goods.

- Commodity Flow Shifts: Conflicts can alter the global supply and demand for key commodities, impacting the types and volumes of freight moved by CSX.

- Economic Uncertainty: Broader geopolitical instability can dampen global economic activity, leading to reduced consumer and industrial demand that translates to lower freight volumes.

Government regulations are a primary political factor for CSX, with agencies like the STB and FRA setting safety standards and pricing rules. For example, the STB's 2024 review of demurrage charges could impact CSX's revenue. Political shifts can also bring increased infrastructure investment, like the proposed rail funding in 2024 infrastructure bills, or stricter environmental mandates affecting operational costs.

Trade policies and international relations directly influence the volume of goods CSX transports. Favorable trade agreements, such as the USMCA, can boost cross-border freight, while tariffs or trade disputes can reduce demand. Geopolitical events also play a role, with global instability potentially rerouting trade and impacting commodity flows that CSX handles.

Labor relations are critical, as CSX relies on a unionized workforce, with government policies like the Railway Labor Act shaping negotiations. Potential government intervention in labor disputes could impact operations. For instance, the averted 2022 rail strike highlighted the economic sensitivity of labor stability.

What is included in the product

This CSX PESTLE analysis provides a comprehensive overview of how external macro-environmental factors influence the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into emerging threats and opportunities, enabling strategic decision-making for CSX's continued success.

A concise CSX PESTLE analysis summary that can be easily dropped into presentations or used in group planning sessions, alleviating the pain of information overload.

Economic factors

CSX's freight volumes are closely tied to the U.S. economy's vitality and industrial output. When the economy expands, we see higher manufacturing, more consumer spending, and a greater need for transporting materials and products, all of which benefit rail traffic. For instance, in Q1 2024, U.S. real GDP grew at an annual rate of 1.3%, indicating a moderate economic expansion that supports freight demand.

Industrial production figures directly impact CSX. A robust manufacturing sector means more goods moving by rail. The Federal Reserve reported industrial production increased by 0.9% in May 2024, suggesting a positive trend for sectors that utilize rail for their supply chains. Conversely, economic slowdowns or recessions would naturally lead to reduced freight volumes across the board.

Fuel is a substantial operating expense for CSX, meaning the company is quite sensitive to changes in crude oil and diesel prices. For instance, in the first quarter of 2024, CSX reported that fuel costs represented a significant portion of their operating expenses, though specific percentages fluctuate with market conditions.

When fuel prices climb, CSX's profit margins can shrink unless these increased costs are effectively managed through fuel surcharges or by finding ways to operate more efficiently. This sensitivity was evident in 2023 when volatile energy markets presented challenges to maintaining consistent profitability.

Conversely, periods of stable or falling fuel prices offer a direct boost to CSX's bottom line. The company's ability to pass on some of these savings through adjusted rates can lead to improved profitability, as seen during periods of declining oil prices in late 2023 and early 2024.

Interest rates directly affect CSX's cost of capital, influencing how affordably it can finance its vast network, rolling stock, and technological advancements. For instance, if the Federal Reserve maintains its target federal funds rate in the 5.25%-5.50% range, as it did through early 2024, CSX's borrowing expenses for new equipment or infrastructure projects will be higher than in periods of lower rates.

Elevated interest rates can make borrowing more expensive, potentially causing CSX to reconsider or delay significant capital investments, such as expanding intermodal facilities or upgrading its locomotive fleet. This could impact its long-term growth and operational efficiency.

Securing financing on favorable terms remains a critical component for CSX's strategic initiatives, including its network modernization efforts. The ability to access capital at competitive rates, even amidst fluctuating economic conditions, is paramount for executing its long-range plans.

Inflation and Consumer Spending

Inflation directly impacts CSX by increasing the cost of essential inputs like fuel, materials for track maintenance, and labor. For instance, the Producer Price Index (PPI) for transportation and warehousing services saw significant increases throughout 2023 and into early 2024, indicating higher operating expenses for rail companies like CSX. These rising costs can put pressure on profit margins if not passed on to customers.

Consumer spending is a critical driver for CSX's freight volumes, particularly for intermodal services that carry consumer goods. In the first quarter of 2024, retail sales showed resilience, but forecasts for the remainder of the year suggest a moderation in growth due to persistent inflation impacting household budgets. A slowdown in consumer spending could lead to reduced demand for goods, translating into lower freight volumes for CSX.

- Rising Input Costs: Fuel prices, a major expense for CSX, experienced volatility in 2023 and early 2024, with crude oil prices fluctuating significantly.

- Consumer Demand Sensitivity: Inflationary pressures on consumers, evidenced by a slight dip in real disposable income growth in late 2023, could curb demand for discretionary goods.

- Intermodal Freight Impact: The health of the consumer economy directly influences the volume of goods transported via CSX’s intermodal network.

- Margin Squeeze Potential: If CSX cannot fully offset increased operating costs through price adjustments, profit margins may be compressed.

Competition from Other Modes of Transport

CSX faces significant economic competition from trucking, barge, and air freight services. Fluctuations in fuel prices, for instance, directly impact the cost-effectiveness of each mode. In early 2024, diesel prices averaged around $3.90 per gallon, while jet fuel and bunker fuel for barges can present different cost structures, influencing shipper decisions.

Highway congestion and the availability of truck drivers are critical factors that can sway freight volumes toward rail. A shortage of qualified truck drivers, a persistent issue in recent years, can increase trucking costs and transit times, making rail a more attractive option for certain long-haul shipments. The Intermodal Association of America reported that trucking capacity remained tight in many regions throughout 2024, benefiting rail intermodal services.

The overall cost-effectiveness and efficiency of rail transportation relative to these other modes remain paramount. For bulk commodities and long-distance freight, rail often offers superior cost per ton-mile. However, for time-sensitive or less-than-truckload (LTL) shipments, trucking's flexibility and speed can be more advantageous, especially with improvements in logistics technology and dedicated freight lanes.

- Fuel Price Volatility: Diesel prices impact trucking costs, a key competitor to rail.

- Trucking Capacity: Driver shortages and congestion in trucking can shift freight to rail.

- Cost-Per-Ton-Mile: Rail's inherent advantage for bulk, long-haul freight is a constant economic consideration.

- Service Differentiation: Speed and flexibility of trucking remain competitive advantages for certain freight types.

Economic growth directly fuels CSX's freight volumes, as increased industrial activity and consumer spending necessitate more transportation. U.S. real GDP growth of 1.3% in Q1 2024 signals moderate economic expansion, supporting freight demand. Conversely, economic downturns would naturally reduce the need for rail transport.

Inflationary pressures, seen in rising producer prices for transportation services in 2023-2024, increase CSX's operating costs for fuel and materials. While CSX can implement fuel surcharges, persistent inflation can still squeeze profit margins if costs aren't fully passed on.

Interest rates, such as the Federal Reserve's target range of 5.25%-5.50% through early 2024, impact CSX's borrowing costs for capital investments. Higher rates can make financing new equipment or infrastructure upgrades more expensive, potentially delaying strategic projects.

CSX's competitive positioning is influenced by fuel prices and trucking capacity. With diesel prices around $3.90 per gallon in early 2024 and ongoing trucking driver shortages, rail often remains a more cost-effective option for long-haul, bulk freight.

Full Version Awaits

CSX PESTLE Analysis

The preview shown here is the exact CSX PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of CSX provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. The content and structure shown in the preview is the same document you’ll download after payment.

You can trust that what you’re previewing here is the actual file, offering a detailed understanding of CSX's strategic landscape, delivered fully formatted and professionally structured.

Sociological factors

The United States experienced a population growth of 0.9% in 2023, reaching an estimated 334.8 million people. This continued growth, coupled with an aging population, means shifts in where people live and consume goods, directly impacting the demand for CSX's freight services and the strategic placement of their distribution networks.

Urbanization remains a significant trend, with over 83% of the U.S. population residing in urban areas as of 2022. This concentration of consumers drives demand for efficient, last-mile delivery solutions, often facilitated by intermodal transport, but also presents hurdles for CSX in expanding rail infrastructure through increasingly developed landscapes.

Consumer preferences are rapidly shifting, with a significant surge in e-commerce driving demand for speed and convenience. This directly impacts the logistics sector, pushing for more efficient intermodal solutions that CSX is well-positioned to provide. For example, in 2024, e-commerce sales in the US were projected to reach over $1.7 trillion, a substantial portion of which relies on robust freight transportation.

The growing emphasis on sustainability and ethical sourcing is also influencing consumer choices and, consequently, supply chain design. Companies are increasingly seeking transportation partners that demonstrate environmental responsibility and supply chain transparency, areas where CSX is investing in initiatives like low-emission locomotives and network optimization.

The transportation industry, including CSX, faces a significant challenge with an aging workforce. For instance, in 2024, the average age of a Class I railroad engineer can be in the late 40s, highlighting a need for proactive succession planning. This demographic trend directly impacts the availability of skilled labor, such as engineers and conductors, crucial for CSX's operations.

Attracting and retaining talent in today's competitive labor market is paramount for CSX's future growth. Companies are increasingly focusing on diversity and inclusion initiatives to broaden their talent pool and foster innovation. In 2024, the rail industry is seeing a concerted effort to recruit from a wider range of backgrounds, aiming to improve employee satisfaction and operational continuity.

Labor relations and employee satisfaction are vital sociological components for CSX. Positive relationships with unions and a focus on employee well-being contribute to a stable workforce. For example, CSX's reported employee satisfaction metrics in 2024 are closely monitored, as high satisfaction often correlates with lower turnover and improved productivity.

Public Perception and Community Relations

CSX's extensive rail network inevitably intersects with communities, leading to potential impacts such as noise pollution, vibrations, and safety concerns at numerous rail crossings. For instance, in 2024, CSX reported addressing over 1,000 public inquiries related to operational impacts, highlighting the ongoing need for community engagement.

Maintaining positive public perception and fostering strong community relations is paramount for CSX's long-term success. This involves demonstrating responsible operations, actively engaging in environmental stewardship initiatives, and participating in local community development programs. In 2023, CSX invested over $15 million in community projects and safety initiatives across its service areas.

Negative public sentiment can directly translate into tangible obstacles for the company. This could manifest as local opposition to proposed infrastructure expansions or increased regulatory scrutiny, potentially delaying or increasing the cost of vital projects. A notable example from 2024 involved community pushback delaying a yard expansion project in Ohio, underscoring the financial implications of public relations challenges.

- Noise and Vibration: Communities near CSX lines frequently report concerns about the noise and vibrations generated by freight trains, impacting quality of life.

- Safety at Crossings: Rail crossing safety remains a critical public concern, with CSX actively participating in programs to reduce incidents and improve awareness.

- Community Investment: CSX's commitment to community relations is demonstrated through investments in local projects and philanthropic efforts, aiming to build goodwill.

- Regulatory Impact: Negative public perception can trigger heightened regulatory oversight, potentially affecting operational flexibility and expansion plans.

Health and Safety Awareness

Public and regulatory scrutiny regarding health and safety in industrial sectors, including rail transportation, is intensifying. This heightened awareness directly impacts CSX, driving expectations for enhanced safety protocols in operations and the transportation of hazardous materials. For instance, in 2023, the Federal Railroad Administration (FRA) reported a 4.5% decrease in total train accidents compared to 2022, signaling a trend towards greater safety, a benchmark CSX must meet and exceed.

Meeting these demands involves not just compliance with regulations but also cultivating a robust safety culture that prioritizes employee well-being and community protection. This social expectation translates into a need for continuous investment in training, technology, and operational procedures designed to minimize risks. CSX’s commitment to safety is a key component of its social license to operate, influencing public perception and stakeholder trust.

- Increased Regulatory Oversight: Agencies like the FRA are implementing stricter safety mandates, impacting operational costs and procedures.

- Public Perception: Incidents, even minor ones, can significantly damage public trust and lead to calls for more stringent controls.

- Employee Well-being: A strong safety culture is crucial for attracting and retaining talent, as employees increasingly value safe working environments.

- Hazardous Material Transport: Public concern over the safe transit of chemicals and other dangerous goods places a significant emphasis on CSX's handling protocols.

Societal shifts significantly influence CSX's operational landscape, from demographic changes to evolving consumer behaviors. The aging workforce, for instance, presents a challenge for skilled labor availability, with the average age of a Class I railroad engineer hovering around the late 40s in 2024, necessitating robust succession planning.

Consumer demand is increasingly shaped by e-commerce growth, projected to exceed $1.7 trillion in the US for 2024, which fuels the need for efficient, rapid freight solutions. Simultaneously, a growing emphasis on sustainability pushes companies like CSX to invest in eco-friendly operations, such as low-emission locomotives, to align with public expectations.

Community relations are paramount, as CSX's operations impact local areas through noise and safety concerns, prompting over 1,000 public inquiries in 2024 alone. The company's investment of over $15 million in community projects in 2023 underscores its commitment to maintaining positive public perception and a social license to operate.

Public and regulatory scrutiny on safety, particularly in hazardous material transport, is intensifying, with the FRA reporting a 4.5% decrease in train accidents in 2023, setting a high bar for industry safety standards.

| Factor | Trend/Impact | Data Point (2023-2024) |

| Demographics | Aging workforce | Average Class I railroad engineer age: ~48 years (2024) |

| Consumer Behavior | E-commerce surge | US E-commerce sales projected > $1.7 trillion (2024) |

| Sustainability | Demand for eco-friendly ops | CSX invested in low-emission initiatives |

| Community Impact | Noise, vibration, safety | CSX addressed >1,000 public inquiries (2024) |

| Safety Focus | Increased regulatory/public scrutiny | 4.5% decrease in total train accidents (2023) |

Technological factors

CSX's integration of automation, including autonomous inspection systems and automated switching, is poised to dramatically boost operational efficiency and safety. For instance, in 2024, the company continued to invest in technologies aimed at reducing manual labor and improving the precision of its rail yard operations.

Artificial intelligence is a key driver for optimizing CSX's network. AI-powered predictive maintenance, which analyzes vast datasets to anticipate equipment failures, is projected to reduce unscheduled downtime. This technology also enhances train scheduling and route planning, leading to significant cost savings and more reliable delivery times for customers, a critical factor in the competitive logistics landscape of 2024-2025.

CSX is significantly leveraging digitalization and big data analytics to refine its operations. By analyzing vast datasets, the company gains critical insights into network efficiency, enabling the optimization of freight movement and proactive identification of potential maintenance issues. This data-driven approach is central to improving decision-making across the board.

The implementation of these technologies directly enhances customer experience by providing shippers with greater visibility into their cargo's journey. Furthermore, CSX is using its advanced analytical capabilities to foster innovation, leading to the development of new and improved service offerings tailored to the evolving needs of the logistics market.

CSX continues to invest in Positive Train Control (PTC) systems, recognizing their critical role in preventing accidents like collisions and derailments. This commitment is driven by both regulatory requirements and the pursuit of enhanced operational safety and efficiency. By optimizing PTC technology, CSX aims to reduce the frequency and impact of incidents, thereby lowering associated costs.

Intermodal Technology and Smart Logistics

Innovations in intermodal technology are making rail and truck integration smoother. Smart containers, equipped with tracking and sensor capabilities, are becoming more prevalent, offering real-time visibility into cargo location and condition. This is a significant upgrade from traditional methods.

Advancements in logistics software are also playing a crucial role. These platforms are designed to better integrate rail with truck transportation, streamlining operations from origin to destination. For instance, CSX has been investing in digital tools to enhance its own intermodal network efficiency.

These technological improvements directly benefit supply chains by increasing visibility and reducing transit times. This makes intermodal solutions a more appealing and competitive option for businesses looking to optimize their transportation. The global smart logistics market is projected to grow significantly, indicating strong adoption trends.

- Smart Container Adoption: The market for smart containers is expanding, with an increasing number of shipping lines and logistics providers adopting them for enhanced tracking and monitoring.

- Logistics Software Integration: Companies are investing in integrated logistics platforms that connect various modes of transport, with CSX actively enhancing its digital offerings to improve customer experience and operational efficiency.

- Efficiency Gains: Improved visibility and reduced transit times through these technologies can lead to substantial cost savings and improved reliability in the supply chain, making intermodal transport increasingly attractive.

Alternative Fuels and Propulsion Systems

CSX is closely monitoring advancements in alternative fuels and propulsion systems for locomotives. Research into hydrogen, natural gas, and battery-electric power represents a significant long-term technological shift. These innovations have the potential to substantially impact CSX's operational expenses and its environmental impact, aligning with evolving sustainability mandates and future energy regulations.

The transition to cleaner energy sources is gaining momentum across the transportation sector. For instance, in 2023, the U.S. Department of Transportation announced new initiatives to support the development and adoption of zero-emission rail technologies, potentially offering grants and research funding that could benefit companies like CSX in their exploration of these new power sources.

- Hydrogen Fuel Cells: Ongoing pilot programs globally are testing hydrogen-powered trains, demonstrating reduced emissions and comparable performance to diesel locomotives.

- Battery-Electric Locomotives: Several manufacturers are developing battery-electric models, suitable for shorter routes and yard operations, with potential for significant reductions in local air pollution.

- Natural Gas (LNG/CNG): While not zero-emission, liquefied or compressed natural gas offers a cleaner-burning alternative to traditional diesel, with established infrastructure for fueling.

- Hybrid Systems: Combining diesel engines with battery storage or other alternative power sources can improve fuel efficiency and reduce emissions during peak power demand.

CSX's technological focus in 2024-2025 centers on automation and AI to enhance efficiency and safety. Investments in autonomous inspection and AI-driven predictive maintenance are key, aiming to reduce downtime and optimize network performance. Digitalization and big data analytics are also crucial for improving decision-making and customer visibility.

The company is also prioritizing Positive Train Control (PTC) systems for accident prevention and is exploring advancements in intermodal technology, such as smart containers and integrated logistics software, to streamline operations and improve transit times. These advancements are expected to make rail transport more competitive.

CSX is actively investigating alternative fuel sources for locomotives, including hydrogen, natural gas, and battery-electric power. These innovations are critical for reducing operational costs and environmental impact, aligning with increasing sustainability mandates and potential future regulations. Pilot programs for hydrogen and battery-electric trains are showing promising results globally.

| Technology Area | CSX Focus/Investment | Projected Impact | 2024-2025 Data/Trend |

|---|---|---|---|

| Automation & AI | Autonomous inspection, AI predictive maintenance, automated switching | Increased efficiency, reduced downtime, improved safety | Continued investment in AI for network optimization; early 2024 saw reports of efficiency gains from automation pilots. |

| Digitalization & Data Analytics | Big data for network optimization, enhanced customer visibility | Improved decision-making, cost savings, better customer service | Leveraging data to refine freight movement; customer portals offering real-time tracking are expanding. |

| Positive Train Control (PTC) | Continued implementation and optimization | Enhanced safety, accident prevention, reduced incident costs | PTC systems are largely implemented across Class I railroads, with ongoing upgrades for functionality and reliability. |

| Intermodal Technology | Smart containers, integrated logistics software | Smoother rail-truck integration, increased cargo visibility, reduced transit times | Growing adoption of smart containers; CSX investing in digital tools for its intermodal network. Global smart logistics market projected for significant growth. |

| Alternative Fuels | Research into hydrogen, natural gas, battery-electric locomotives | Reduced operational costs, lower environmental impact, compliance with regulations | Global pilot programs for hydrogen and battery-electric trains are active; U.S. DOT supporting zero-emission rail development. |

Legal factors

CSX navigates a complex web of railroad safety regulations, primarily overseen by the Federal Railroad Administration (FRA). These rules are comprehensive, dictating everything from the upkeep of tracks and the condition of rolling stock to how trains are operated and how crews are trained and certified. Staying compliant is not just about avoiding penalties; it's crucial for preventing accidents that could lead to significant operational downtime and, most importantly, ensuring the safety of the public and CSX employees. In 2023, the FRA reported a 7% decrease in overall railroad accidents compared to 2022, a trend CSX aims to continue by adhering to these rigorous standards.

CSX, as a dominant force in North American freight rail, faces significant antitrust and competition law oversight. Regulatory bodies like the Surface Transportation Board (STB) closely monitor its mergers, acquisitions, and overall competitive conduct to prevent monopolistic practices and ensure a level playing field for other industry participants.

CSX's operations are heavily influenced by federal labor laws, particularly the Railway Labor Act, which governs its interactions with a unionized workforce. This act sets the framework for collective bargaining, including the procedures for wage and benefit negotiations and dispute resolution, directly impacting operational continuity.

The Railway Labor Act also outlines the conditions under which strikes or lockouts can occur, presenting potential risks to CSX's service reliability and financial performance. For instance, in 2023, ongoing labor negotiations across the rail industry highlighted the sensitivity of these processes, with potential disruptions impacting supply chains nationwide.

Environmental Regulations and Permitting

CSX navigates a dense landscape of environmental statutes, including those from the Environmental Protection Agency (EPA) governing air emissions, the safe transport of hazardous substances, and responsible waste management. For instance, the EPA’s National Ambient Air Quality Standards (NAAQS) directly impact locomotive emissions, requiring ongoing compliance strategies.

Securing and retaining necessary permits for operational activities and new infrastructure development, such as rail line expansions, presents a continuous legal challenge. CSX must also actively manage potential environmental liabilities stemming from historical operations or accidental releases.

- EPA Regulations: CSX must adhere to EPA standards for locomotive emissions, which are subject to review and potential tightening in future regulations.

- Hazardous Materials: Compliance with Department of Transportation (DOT) regulations for transporting hazardous materials is critical to prevent incidents and associated legal ramifications.

- Permitting: Obtaining environmental permits for new construction or operational changes, like upgrading rail yards, involves rigorous review and adherence to specific conditions.

- Land Use: CSX's operations across vast landholdings necessitate compliance with local, state, and federal land use regulations, including those related to protected habitats.

Data Privacy and Cybersecurity Laws

CSX navigates a complex web of data privacy and cybersecurity laws, a critical legal factor impacting its operations. As a company managing extensive operational and customer data, CSX must adhere to evolving state-specific regulations and potential federal data privacy frameworks. This includes ensuring the security of its IT infrastructure against sophisticated cyber threats, a non-negotiable requirement to prevent data breaches and uphold customer trust. For instance, the increasing stringency of regulations like the California Privacy Rights Act (CPRA) sets a precedent for data handling practices across industries.

The legal landscape demands robust cybersecurity measures to safeguard sensitive information. Failure to comply can result in significant financial penalties and reputational damage. In 2024, the cybersecurity threat landscape continues to evolve, with ransomware attacks and sophisticated phishing schemes posing persistent risks to critical infrastructure sectors like transportation. CSX's commitment to legal compliance in this area is paramount for maintaining operational integrity and stakeholder confidence.

- Data Protection Compliance: Adherence to state and federal data privacy laws is mandatory for handling customer and operational data.

- Cybersecurity Mandates: Legal obligations require strong IT infrastructure resilience against cyber threats.

- Breach Prevention: Protecting sensitive information is a key legal duty to avoid breaches and maintain trust.

- Regulatory Evolution: Keeping pace with new and updated privacy laws, such as potential federal data privacy legislation, is crucial.

CSX's operations are subject to stringent federal safety regulations, primarily from the Federal Railroad Administration (FRA), covering everything from track maintenance to crew training. Compliance is vital for accident prevention and public safety, with the FRA reporting a 7% decrease in railroad accidents in 2023 compared to 2022.

Antitrust and competition laws, overseen by bodies like the Surface Transportation Board (STB), are critical. These regulations scrutinize CSX's market conduct to prevent monopolistic practices and ensure fair competition within the rail industry.

Labor relations are governed by the Railway Labor Act, impacting collective bargaining and dispute resolution with its unionized workforce, which can affect operational continuity. Potential labor disputes, as seen in industry-wide negotiations in 2023, highlight the sensitivity of these legal frameworks.

Environmental laws from the EPA, such as those concerning air emissions and hazardous material transport, necessitate ongoing compliance strategies. For example, EPA's National Ambient Air Quality Standards directly influence locomotive emission controls.

| Legal Area | Key Regulations/Acts | Impact on CSX | Recent Data/Trends |

|---|---|---|---|

| Safety | Federal Railroad Administration (FRA) regulations | Mandates track, rolling stock, and operational standards; crucial for accident prevention. | FRA reported a 7% decrease in railroad accidents in 2023 vs. 2022. |

| Competition | Antitrust laws, Surface Transportation Board (STB) oversight | Regulates mergers, acquisitions, and competitive conduct to prevent monopolies. | STB continues to monitor market concentration and service adequacy. |

| Labor | Railway Labor Act | Governs union relations, collective bargaining, and dispute resolution. | Labor negotiations remain a key factor for operational stability. |

| Environment | EPA regulations (NAAQS, hazardous materials) | Dictates standards for emissions, transport of dangerous goods, and waste management. | Ongoing focus on reducing locomotive emissions and safe handling of materials. |

Environmental factors

CSX is under growing pressure to cut greenhouse gas emissions from its trains, a move driven by global climate change efforts. This means significant investment in newer, more fuel-efficient engines and research into alternative fuels like hydrogen or advanced biofuels. Optimizing routes and train schedules is also crucial to shrink the carbon footprint across their extensive rail system.

The increasing frequency and intensity of extreme weather events, like the severe flooding impacting the Midwest in early 2024, directly threaten CSX's extensive rail infrastructure. These events can cause significant delays and damage, leading to substantial repair costs and lost revenue.

CSX is investing in infrastructure resilience, focusing on enhanced drainage systems and reinforced track beds to better withstand floods and heavy loads, a strategy that became even more critical following the widespread disruptions from winter storms in late 2023 and early 2024.

CSX's operations are intrinsically linked to resource availability, particularly water, which is crucial for everything from cooling equipment to dust suppression. In 2024, regions like the American Southwest, through which CSX operates, continue to grapple with persistent drought conditions, impacting water access and increasing operational costs. This scarcity necessitates robust water management strategies to ensure continuity and minimize environmental impact.

The availability of materials for maintaining its vast rail infrastructure, such as ballast and ties, also presents an environmental challenge. As global supply chains face volatility and demand for construction materials rises, CSX must secure these resources sustainably. This involves exploring recycled materials and optimizing logistics to reduce the environmental footprint associated with material sourcing and transportation, a trend likely to intensify through 2025.

Biodiversity and Land Use Impacts

CSX's vast rail infrastructure crosses numerous ecosystems, raising concerns about biodiversity and the preservation of sensitive habitats. The company must balance operational needs with environmental stewardship, particularly regarding land use changes. In 2024, CSX continued to invest in environmental compliance and mitigation efforts, reflecting the growing importance of these factors in the transportation sector.

Key considerations for CSX include responsible land management practices along its extensive network, which spans over 21,000 route miles. This involves minimizing the footprint of new construction or expansions and actively working to mitigate any potential disruptions to local flora and fauna. Adherence to federal and state regulations designed to protect endangered species and their critical habitats remains a paramount concern.

- Habitat Mitigation: CSX's commitment to environmental protection includes programs aimed at restoring or enhancing habitats impacted by its operations.

- Species Protection: The company actively works to comply with the Endangered Species Act, implementing measures to safeguard protected species along its routes.

- Land Use Planning: Strategic planning for network development incorporates assessments of potential environmental impacts, prioritizing sustainable land use.

Waste Management and Pollution Prevention

CSX faces ongoing environmental responsibilities in managing operational waste, such as used lubricants and retired rail ties, and preventing pollution incidents like hazardous material spills. In 2023, CSX reported investing $216 million in environmental stewardship initiatives, underscoring their commitment to these areas. Robust waste management programs and effective emergency response plans are crucial for maintaining regulatory compliance and safeguarding their corporate reputation.

Key aspects of CSX's environmental management include:

- Waste Stream Reduction: Implementing strategies to minimize the generation of waste from maintenance and operational activities.

- Pollution Prevention Programs: Developing and executing plans to prevent spills and leaks of hazardous materials, with a focus on proactive measures and containment.

- Emergency Response Preparedness: Maintaining and regularly testing comprehensive emergency response plans to address potential environmental incidents swiftly and effectively.

- Compliance and Reporting: Adhering to all relevant environmental regulations and transparently reporting on environmental performance and incidents.

CSX is actively addressing environmental factors, including pressure to reduce greenhouse gas emissions and invest in cleaner technologies. The company is also focused on enhancing infrastructure resilience against extreme weather events, a concern heightened by events in late 2023 and early 2024.

Water scarcity in regions like the Southwest impacts CSX operations, necessitating efficient water management. Furthermore, securing sustainable materials for infrastructure maintenance presents ongoing challenges, with a growing emphasis on recycled options. Biodiversity and habitat protection are also key considerations, requiring responsible land management and compliance with environmental regulations.

CSX's commitment to environmental stewardship is evident in its $216 million investment in such initiatives in 2023, focusing on waste reduction, pollution prevention, and emergency preparedness.

| Environmental Factor | CSX Action/Impact | Data Point/Year |

|---|---|---|

| Greenhouse Gas Emissions | Investment in fuel-efficient engines and alternative fuels | Ongoing |

| Extreme Weather Events | Infrastructure resilience investments (drainage, reinforced beds) | Late 2023/Early 2024 |

| Water Scarcity | Focus on robust water management strategies | 2024 |

| Material Sourcing | Exploring recycled materials and optimizing logistics | Through 2025 |

| Biodiversity/Habitat | Land management, mitigation efforts, regulatory compliance | 2024 |

| Waste Management & Pollution Prevention | Environmental stewardship initiatives investment | $216 million in 2023 |

PESTLE Analysis Data Sources

Our CSX PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic research institutions, and reputable industry-specific reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting CSX's operating environment.