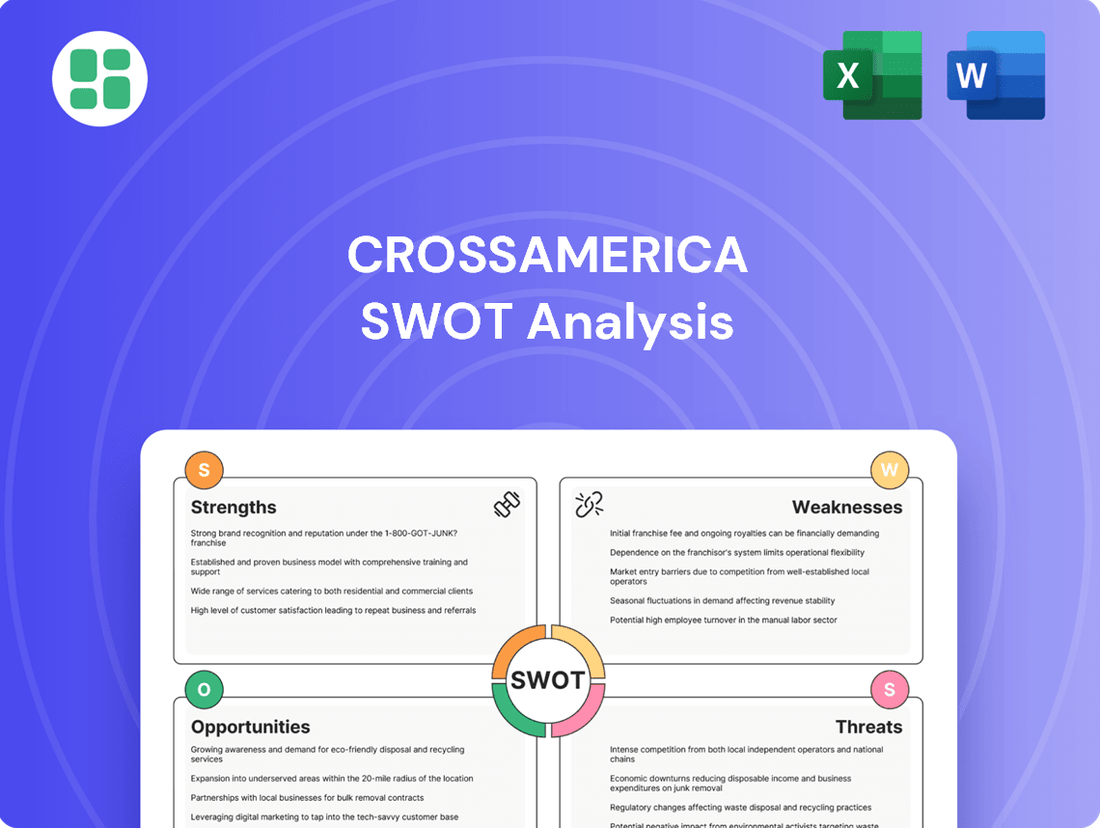

CrossAmerica SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrossAmerica Bundle

CrossAmerica's strategic positioning is bolstered by its extensive network of retail locations and its focus on convenience. However, understanding the competitive pressures and evolving consumer preferences is crucial for sustained growth.

Want the full story behind CrossAmerica's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CrossAmerica Partners (CAP) boasts a robust strength in its diversified revenue streams, a key factor in its financial stability. The company generates income not only from wholesale fuel distribution but also from rental income derived from its extensive real estate holdings and the sale of lubricants. This multi-faceted approach significantly reduces the risk tied to any single business segment.

For instance, in the first quarter of 2024, CAP reported total revenues of $1.1 billion, with its fuels distribution segment contributing the largest portion. However, the steady income from its approximately 1,200 properties, which include retail sites and distribution terminals, provides a consistent revenue floor. This blend of transactional sales and recurring rental income offers a resilient financial structure, particularly valuable in navigating the often-volatile energy market.

CrossAmerica Partners boasts an extensive retail network, encompassing both company-operated and independently operated sites across the United States. This broad reach translates into a robust distribution channel for its motor fuels and petroleum products, significantly boosting market penetration and brand visibility.

As of the first quarter of 2024, CrossAmerica operated approximately 1,700 retail locations, underscoring the sheer scale of its footprint. This vast network not only facilitates consistent product delivery to a diverse customer base but also allows for significant economies of scale in logistics and supply chain operations, strengthening its competitive advantage.

CrossAmerica Partners' ownership of real estate at numerous retail locations forms a substantial tangible asset base. This robust foundation is crucial for its operational stability and financial health.

The company's extensive property portfolio generates consistent rental income, a key driver of predictable cash flow. For instance, in the first quarter of 2024, CrossAmerica reported rental income of $24.3 million, underscoring the significance of this revenue stream.

Beyond income generation, these valuable real estate assets offer significant collateral for securing financing. Furthermore, their inherent value provides a natural hedge against inflationary pressures, bolstering the company's long-term financial resilience.

Essential Product Demand

Motor fuels like gasoline and diesel are still crucial for getting around and for many industries in the US. Even with the shift towards different energy sources, people will keep needing these fuels for a long time, especially for vehicles that use combustion engines. CrossAmerica Partners benefits from this because its main products are in high demand.

This steady demand provides a solid base for CrossAmerica's business and how it makes money. For instance, in 2024, the US Energy Information Administration (EIA) projected that total US motor gasoline consumption would average around 8.9 million barrels per day, and diesel fuel consumption would be about 2.7 million barrels per day. This highlights the ongoing necessity of these products.

- Essential Commodities: Gasoline and diesel are fundamental to transportation and industrial operations.

- Persistent Demand: Despite energy transitions, demand for motor fuels is expected to remain strong.

- Foundation for Revenue: CrossAmerica's focus on these core products ensures a consistent revenue stream.

- Market Stability: The inherent demand for motor fuels provides a degree of stability to the company's business model.

Strategic Wholesaler Position

CrossAmerica Partners' strategic position as a wholesale distributor is a significant strength, placing it as a vital link between fuel producers and retail outlets. This intermediary role allows for strong relationships with major refiners and branded fuel suppliers, ensuring a reliable product flow. For example, in the first quarter of 2024, CrossAmerica reported that its wholesale segment generated $1.2 billion in revenue, highlighting the scale of its operations in this area.

This wholesale focus insulates the company from the direct volatility of retail operations and fluctuating consumer demand at the pump. By managing product distribution rather than direct consumer sales, CrossAmerica benefits from a more stable business model. The company's ability to efficiently manage logistics and supply chain complexities within the petroleum distribution ecosystem provides a competitive edge.

Key advantages of this strategic position include:

- Secured Product Access: Strong ties with major refiners and branded suppliers ensure consistent fuel availability.

- Reduced Retail Risk: Less exposure to the day-to-day challenges and demand swings of retail fuel sales.

- Supply Chain Leverage: The intermediary role offers efficiency and influence within the broader petroleum distribution network.

- Operational Focus: Allows for concentration on logistics and distribution rather than direct consumer engagement.

CrossAmerica Partners benefits from a diversified revenue model, encompassing fuel distribution, rental income from its extensive real estate holdings, and lubricant sales. This multi-pronged approach enhances financial stability by mitigating risks associated with any single revenue source. For instance, in Q1 2024, the company reported $1.1 billion in total revenues, demonstrating the scale of its diversified operations.

The company's expansive retail network, comprising approximately 1,700 locations as of Q1 2024, provides a significant competitive advantage through broad market penetration and economies of scale in logistics. This extensive footprint ensures efficient product delivery and strengthens brand visibility across the United States.

CrossAmerica's substantial real estate portfolio represents a core strength, providing a tangible asset base that generates consistent rental income, such as the $24.3 million reported in Q1 2024. These properties also serve as valuable collateral and offer an inflation hedge, bolstering long-term financial resilience.

The enduring demand for motor fuels like gasoline and diesel, essential for transportation and industry, forms a stable foundation for CrossAmerica's business. Projected US consumption for 2024, with gasoline around 8.9 million barrels per day and diesel at 2.7 million barrels per day, underscores the persistent market need for CAP's primary products.

CrossAmerica's strategic role as a wholesale distributor, evidenced by $1.2 billion in wholesale revenue in Q1 2024, fosters strong relationships with refiners and suppliers, ensuring reliable product flow and reducing exposure to retail demand volatility.

| Strength | Description | Supporting Data (Q1 2024 unless noted) |

| Diversified Revenue Streams | Income from fuel distribution, rental properties, and lubricants. | Total Revenues: $1.1 billion; Rental Income: $24.3 million. |

| Extensive Retail Network | Broad market reach and economies of scale. | Approx. 1,700 retail locations. |

| Significant Real Estate Holdings | Tangible asset base generating rental income and providing financial stability. | Rental Income: $24.3 million. |

| Essential Commodity Focus | Reliance on high-demand motor fuels. | 2024 EIA Projection: Gasoline ~8.9M bpd, Diesel ~2.7M bpd. |

| Wholesale Distribution Model | Strong supplier relationships and reduced retail risk. | Wholesale Segment Revenue: $1.2 billion. |

What is included in the product

Analyzes CrossAmerica’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis to pinpoint and address operational inefficiencies.

Simplifies complex market dynamics into understandable strengths, weaknesses, opportunities, and threats for CrossAmerica.

Weaknesses

CrossAmerica Partners' core business is deeply tied to distributing traditional motor fuels like gasoline and diesel. This reliance on fossil fuels presents a significant long-term risk as the world shifts towards renewable energy sources and electric vehicles. For instance, in 2023, while gasoline demand remained relatively stable, the accelerating adoption of EVs, projected to reach over 20% of new vehicle sales in major markets by 2025, signals a potential long-term erosion of CrossAmerica's primary revenue streams.

CrossAmerica's profitability is sensitive to swings in crude oil and refined product prices. Even with wholesale operations, rapid price shifts can squeeze margins and impact inventory values. For instance, in 2023, West Texas Intermediate (WTI) crude oil prices ranged from approximately $67 to $95 per barrel, demonstrating the potential for significant volatility that could affect CrossAmerica's earnings.

CrossAmerica faces significant regulatory and environmental risks. Evolving environmental regulations, covering fuel standards and emissions, could force substantial capital outlays for compliance or limit operational choices. For instance, the U.S. Environmental Protection Agency (EPA) continually updates fuel efficiency standards, impacting the types of products and infrastructure needed.

Non-compliance with these regulations can result in hefty fines and damage CrossAmerica's reputation. The company's reliance on petroleum products means it's directly exposed to the increasing global and national emphasis on cleaner energy initiatives, posing a persistent challenge to its core business model.

Intense Competition

CrossAmerica Partners operates in a fiercely competitive landscape within the wholesale fuel distribution and retail site ownership sectors. This market includes major integrated oil companies and a multitude of regional distributors, all vying for market share. This intense rivalry often translates into significant pricing pressures and can compress profit margins for participants. For instance, in 2023, the fuel distribution sector experienced fluctuating wholesale prices, impacting the ability of companies like CrossAmerica to maintain consistent margins, especially when facing competitors with greater purchasing power or lower overheads.

The pressure from competitors can make it difficult for CrossAmerica to secure and retain crucial supply contracts and retail partnerships. Competitors might leverage their scale or offer more attractive pricing and terms, directly impacting CrossAmerica's market position and overall profitability. Maintaining a competitive edge necessitates ongoing efforts in operational efficiency and strategic differentiation to stand out in a crowded market.

- Market Saturation: The wholesale and retail fuel market is densely populated, limiting organic growth opportunities and increasing the cost of customer acquisition.

- Price Sensitivity: Fuel is a commodity, making pricing a primary competitive lever, which can erode margins for all players during periods of high volatility.

- Scale Advantages: Larger, integrated competitors often benefit from economies of scale in procurement and operations, allowing them to undercut smaller or mid-sized players.

Capital-Intensive Operations

CrossAmerica's operations are inherently capital-intensive. Maintaining and upgrading its extensive network of retail locations and distribution infrastructure demands substantial ongoing financial commitments. In 2023, the company reported capital expenditures of $353 million, primarily focused on site improvements and new store development, highlighting the significant investment required to keep its physical footprint competitive and compliant with evolving standards.

These high capital expenditure requirements can strain free cash flow, potentially leading to increased reliance on debt financing. This can impact the company's financial flexibility, limiting its capacity to pursue alternative growth strategies or return more capital to its shareholders. For instance, while CrossAmerica aims to balance reinvestment with shareholder returns, the sheer scale of its infrastructure needs can create a delicate balancing act.

- Significant Capital Outlay: Operating and maintaining a vast network of retail sites and distribution infrastructure requires significant capital investment, covering property, facility upgrades, environmental compliance, and technology.

- Impact on Free Cash Flow: High capital expenditure requirements can negatively affect free cash flow, potentially limiting financial flexibility.

- Financing Needs and Debt: The need for ongoing investment may necessitate external financing, which could increase the company's debt levels.

- Constrained Growth Opportunities: Substantial ongoing investment can constrain the company's ability to pursue other growth opportunities or return capital to shareholders.

CrossAmerica's business model is heavily reliant on fossil fuels, which presents a significant long-term weakness as the global shift towards electric vehicles and renewable energy accelerates. By 2025, projections indicate electric vehicles could capture over 20% of new vehicle sales in key markets, directly impacting demand for gasoline. This trend poses a material risk to CrossAmerica's core revenue streams.

The company's profitability is also vulnerable to the volatility of crude oil and refined product prices. Even with its wholesale operations, rapid price fluctuations can compress margins and affect inventory valuations. For example, West Texas Intermediate (WTI) crude oil prices fluctuated considerably in 2023, ranging from approximately $67 to $95 per barrel, highlighting the potential for earnings instability.

CrossAmerica faces substantial regulatory and environmental risks due to its petroleum-based business. Evolving environmental regulations, including fuel standards and emissions controls, could necessitate significant capital expenditures for compliance or restrict operational flexibility. The U.S. EPA's continuous updates to fuel efficiency standards, for instance, directly influence the types of products and infrastructure CrossAmerica must support.

The company operates in a highly competitive fuel distribution and retail market, facing pressure from large integrated oil companies and numerous regional distributors. This intense competition can lead to pricing pressures and reduced profit margins, particularly when competitors possess greater purchasing power or lower operational costs. In 2023, fluctuating wholesale fuel prices exacerbated these margin pressures for companies like CrossAmerica.

Preview the Actual Deliverable

CrossAmerica SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual CrossAmerica SWOT analysis, providing a clear view of its strengths, weaknesses, opportunities, and threats. Once purchased, you'll gain access to the complete, detailed report.

Opportunities

CrossAmerica Partners has a significant opportunity to expand its operational footprint into new geographic markets across the United States where its presence is currently limited. This strategic move could involve acquiring established distribution networks or retail site portfolios in underserved regions, thereby broadening its customer base and increasing sales volumes.

Such geographic expansion would not only diversify market exposure but also unlock new revenue streams. For instance, entering a state with a growing population and limited fuel distribution infrastructure could yield substantial returns. By the end of 2024, CrossAmerica's existing network served approximately 8 million customers across 35 states, highlighting the vast untapped potential for growth in the remaining 15 states.

CrossAmerica could strategically acquire smaller fuel distributors or retail site operators to rapidly expand its distribution network and market share. This inorganic growth approach can also lead to significant economies of scale, improving operational efficiency. For instance, if a competitor with a strong regional presence becomes available, an acquisition could immediately bolster CrossAmerica's footprint in that area.

CrossAmerica Partners can capitalize on the ongoing energy transition by expanding into alternative fuels. This strategic move could involve installing electric vehicle (EV) charging infrastructure at their retail locations, a market projected to see significant growth. For instance, the global EV charging market was valued at approximately $20 billion in 2023 and is expected to grow substantially by 2030.

Furthermore, distributing biofuels, such as ethanol or biodiesel, presents another avenue for diversification. The U.S. renewable diesel production capacity, a key biofuel, has been steadily increasing, with projections indicating continued expansion to meet demand. Exploring hydrogen fueling solutions also aligns with future energy trends, as governments worldwide are investing in hydrogen infrastructure development.

Optimization of Supply Chain

CrossAmerica Partners can unlock substantial cost savings and improve service by adopting cutting-edge supply chain technologies. This involves fine-tuning logistics, inventory control, and delivery routes, which directly impacts operational expenses and customer satisfaction.

Enhanced data analytics will be crucial for more accurate demand prediction and smarter purchasing, thereby cutting down on waste and boosting profit margins. For instance, in 2024, companies that invested in advanced supply chain visibility tools saw an average reduction of 15% in inventory holding costs.

- Improved Efficiency: Streamlining operations can reduce transportation costs by an estimated 10-20%.

- Reduced Waste: Better demand forecasting minimizes product spoilage and excess inventory.

- Enhanced Responsiveness: A more agile supply chain allows for quicker adaptation to market shifts and customer needs.

- Cost Savings: Optimizing routes and inventory can lead to significant reductions in operational expenditures.

Leveraging Technology for Operations

CrossAmerica Partners can significantly boost its operations by embracing new technologies. For instance, implementing advanced analytics could refine fuel pricing strategies across its vast network of retail sites, potentially increasing margins. The adoption of Internet of Things (IoT) devices for predictive maintenance on fuel storage tanks could preempt costly breakdowns and ensure consistent supply, a crucial factor in the fuel distribution industry. Digital platforms can also revolutionize customer loyalty programs, fostering repeat business and gathering valuable consumer data for targeted marketing efforts.

The benefits of this technological integration are manifold. Enhanced operational efficiency, leading to reduced labor and maintenance costs, is a primary advantage. For example, in 2024, many fuel retailers reported efficiency gains of 10-15% through automated inventory management systems. Furthermore, improved customer experiences driven by digital engagement can translate into increased sales volume. CrossAmerica’s investment in digital transformation in 2024 aimed at modernizing its customer-facing interfaces, with a reported 20% increase in app engagement.

- Enhanced Pricing Strategies: Utilizing data analytics for dynamic fuel pricing.

- Predictive Maintenance: Employing IoT sensors for fuel tank upkeep.

- Digital Customer Engagement: Improving loyalty programs and mobile app functionality.

- Operational Efficiency Gains: Streamlining back-office and retail site management.

CrossAmerica Partners can capitalize on the growing demand for convenience by expanding its in-store offerings and enhancing the customer experience at its retail locations. This includes introducing more grab-and-go food options, coffee services, and potentially even small grocery sections to cater to evolving consumer habits.

By leveraging data analytics, CrossAmerica can better understand customer preferences and tailor its product mix accordingly. For example, in 2024, convenience stores that optimized their food service offerings saw an average sales increase of 8% in that category. This focus on convenience and personalized offerings can drive increased traffic and higher transaction values.

CrossAmerica can also explore partnerships with popular food brands or introduce its own private-label convenience food items to differentiate its offerings. Such strategic alliances can attract new customers and build brand loyalty. For instance, collaborations with well-known quick-service restaurants have proven successful for other fuel retailers, boosting overall site profitability.

Threats

The growing popularity of electric vehicles (EVs) and the increasing emphasis on renewable energy sources present a substantial long-term threat to the demand for traditional motor fuels. By the end of 2024, global EV sales are projected to surpass 15 million units, a significant jump from previous years, directly impacting the market for gasoline and diesel.

As more consumers opt for EVs and governments worldwide implement policies encouraging sustainable transportation, CrossAmerica Partners' core business of distributing motor fuels faces a potential, sustained reduction in sales volumes. This shift in consumer behavior and regulatory landscape directly challenges the company's revenue streams.

This ongoing energy transition poses a fundamental challenge to CrossAmerica's established business model, potentially necessitating strategic adjustments to adapt to evolving market demands and maintain profitability in the coming years.

Increasingly stringent environmental regulations, such as potential carbon taxes or mandates for renewable fuel blending, pose a significant threat to CrossAmerica. These could lead to higher operational costs and necessitate costly infrastructure investments. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine vehicle emission standards, which could impact fuel distribution logistics and associated equipment.

Economic downturns present a significant threat to CrossAmerica Partners. Reduced consumer spending during recessions directly impacts demand for motor fuels, a core product. For instance, if a recession in 2024-2025 leads to a 5% decrease in travel, CrossAmerica could see a substantial drop in its sales volumes.

Furthermore, slower industrial activity during economic contractions can curb demand from commercial clients. A prolonged economic slump might also increase the risk of lease defaults or contract terminations from CrossAmerica's independent operators, impacting revenue stability.

Intense Market Competition

CrossAmerica Partners operates in a fiercely competitive wholesale fuel and retail site landscape. Both long-standing industry giants and emerging companies are actively seeking to capture market share. This intense rivalry can significantly impact CrossAmerica's profitability.

Aggressive pricing tactics from competitors, ongoing industry consolidation, or the adoption of innovative business models by rivals could put pressure on CrossAmerica's profit margins and weaken its standing in the market. For instance, in 2024, the retail fuel market has seen price wars in several regions, directly impacting gross margins for many distributors.

The constant need to stay competitive might compel CrossAmerica to accept reduced profit margins or to allocate substantial capital towards customer retention and securing valuable retail locations. This can limit the company's capacity for other strategic investments.

The persistent competitive pressure can cap growth opportunities and hinder overall profitability.

- Intense Competition: The wholesale and retail fuel market is crowded with established and new players.

- Margin Erosion: Aggressive pricing and industry consolidation by competitors can reduce CrossAmerica's profit margins.

- Investment Pressure: Maintaining competitiveness may require significant investment in customer retention and site acquisition.

- Growth Limitations: Continuous competitive pressure can stifle potential for expansion and increased profitability.

Supply Chain Disruptions

CrossAmerica Partners' operations are heavily dependent on a sophisticated supply chain for motor fuels and petroleum products. Potential disruptions, like unexpected refinery shutdowns or transportation strikes, pose a significant threat. For instance, in early 2024, several US refineries experienced unplanned outages, leading to temporary regional fuel price spikes and supply concerns, directly impacting companies like CrossAmerica.

These disruptions can directly translate into supply shortages, escalating operational costs, and an inability to fulfill customer orders, ultimately harming customer relationships and profitability. The company's reliance on a complex network means vulnerability to events ranging from pipeline integrity issues to broader geopolitical instability affecting global energy flows.

To counter these vulnerabilities, building robust supply chain resilience is paramount. This involves diversifying suppliers and transportation methods, as well as investing in inventory management strategies to buffer against unexpected interruptions.

- Supply Chain Vulnerability: Reliance on a complex network of refineries, pipelines, and transportation makes CrossAmerica susceptible to disruptions.

- Cost and Availability Impact: Refinery outages or transportation issues can lead to increased product costs and potential shortages, affecting service levels.

- Geopolitical Risks: Global events can impact crude oil supply and pricing, creating volatility within the fuel distribution sector.

- Mitigation Necessity: Proactive strategies for supply chain resilience are crucial to maintain operational continuity and profitability.

The accelerating shift towards electric vehicles (EVs) represents a significant long-term threat, as global EV sales are expected to continue their upward trajectory, potentially impacting traditional fuel demand. Additionally, evolving environmental regulations and the increasing focus on renewable energy sources could necessitate costly adaptations for CrossAmerica's business model.

Economic downturns also pose a risk, as reduced consumer and industrial activity directly curtails fuel consumption. Furthermore, intense competition within the fuel distribution sector can lead to margin erosion and limit growth opportunities.

Supply chain disruptions, stemming from refinery issues or transportation challenges, can inflate costs and create product availability problems. Geopolitical instability can also introduce volatility into fuel pricing and supply dynamics.

| Threat Category | Specific Threat | Potential Impact | 2024-2025 Data/Trend |

|---|---|---|---|

| Energy Transition | EV Adoption | Reduced demand for motor fuels | Global EV sales projected to exceed 15 million units by end of 2024. |

| Regulatory Environment | Stricter Emission Standards | Increased operational costs, infrastructure investment needs | Ongoing EPA refinement of vehicle emission standards. |

| Economic Conditions | Recessionary Pressures | Lower consumer and industrial fuel demand | Potential 5% decrease in travel during economic downturns. |

| Competitive Landscape | Aggressive Pricing | Erosion of profit margins | Price wars observed in retail fuel markets during 2024. |

| Supply Chain | Unplanned Refinery Outages | Supply shortages, increased costs | Several US refineries experienced outages in early 2024. |

SWOT Analysis Data Sources

This CrossAmerica SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded and accurate strategic overview.