CrossAmerica Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrossAmerica Bundle

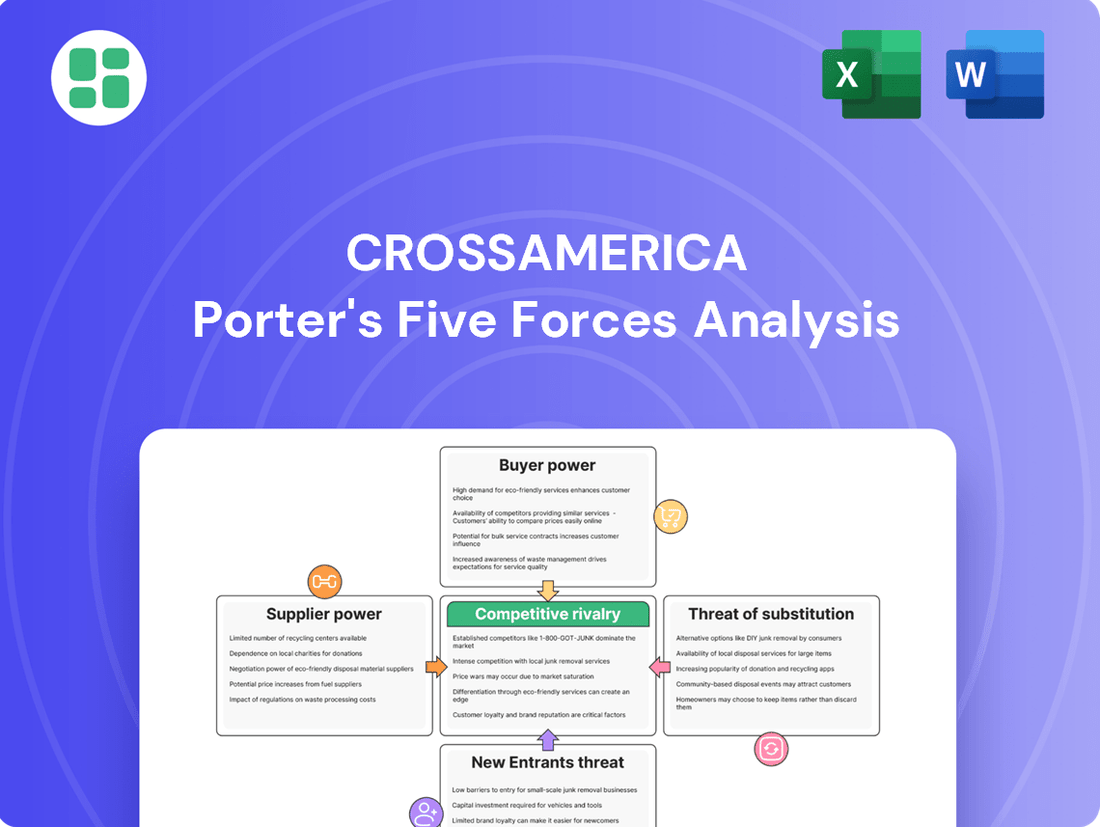

CrossAmerica's competitive landscape is shaped by a complex interplay of forces, from the bargaining power of its suppliers to the ever-present threat of new entrants. Understanding these dynamics is crucial for navigating the fuel and convenience store industry.

The complete report reveals the real forces shaping CrossAmerica’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CrossAmerica Partners' reliance on a few major oil refiners and branded fuel suppliers grants these entities considerable bargaining power. Their substantial scale and control over refining processes and brand licensing mean they can exert significant influence over supply terms.

While CrossAmerica is a major distributor for brands like ExxonMobil, the limited number of key refiners in the market restricts the availability of alternative suppliers. This concentration inherently increases the leverage of existing suppliers, potentially impacting CrossAmerica's cost of goods and operational flexibility.

The global refining industry saw robust profit margins in 2023, with some reports indicating an average net refining margin of around $8 per barrel for major integrated oil companies. However, the forecast for 2024 suggests a more uncertain environment for refiner profitability, which could lead to shifts in supplier leverage and pricing strategies.

Switching fuel suppliers for CrossAmerica isn't a simple price comparison. It involves significant logistical hurdles, the need to renegotiate existing contracts, and the potential for strained relationships with retail partners who have agreements tied to specific brands. These complexities create moderate to high switching costs.

CrossAmerica operates a vast network of around 1,800 locations across 34 states. Disrupting this established infrastructure by changing suppliers can lead to considerable expense and operational challenges, reinforcing the high switching costs.

The company's existing relationships with major oil brands such as ExxonMobil, BP, and Shell also play a crucial role in these switching costs. These long-standing partnerships represent a significant investment in brand recognition and customer loyalty, making a change costly.

While motor fuel is primarily a commodity, branded petroleum products allow for some differentiation, giving suppliers with strong brand equity and marketing support leverage. CrossAmerica benefits from this, as these brands attract customers to its retail locations. For instance, major brands often invest significantly in advertising, which indirectly supports CrossAmerica's sales volume.

Threat of Forward Integration by Suppliers

Refiners and major oil companies possess the theoretical ability to integrate forward into wholesale distribution or even retail operations, effectively sidestepping intermediaries like CrossAmerica. This would represent a significant shift in the supply chain, potentially altering established business models.

However, such a move is a substantial undertaking, requiring immense capital investment and navigating complex operational challenges. CrossAmerica itself demonstrates this complexity through its vast network of owned or leased real estate, a critical asset for distribution. The sheer scale and specialized nature of wholesale distribution, coupled with the significant investment in infrastructure, make widespread direct forward integration by all major refiners a less probable, though not impossible, threat.

- Capital Intensity: Forward integration requires substantial investment in distribution networks, terminals, and retail outlets.

- Operational Complexity: Managing logistics, real estate, and customer relationships in the distribution and retail sectors is highly complex.

- Existing Infrastructure: CrossAmerica's established network of owned or leased properties represents a significant barrier to entry for potential integrators.

- Market Realities: While possible, the economic viability and strategic focus of major refiners might not align with the widespread pursuit of direct distribution and retail operations.

Input Importance and Availability

The bargaining power of suppliers for CrossAmerica Partners LP is significantly influenced by the availability and pricing of its primary inputs: refined motor fuels. While global refined product supply has seen an increase, which could theoretically lessen supplier leverage, the underlying stability of crude oil prices and the overall refining capacity remain paramount. For instance, in early 2024, crude oil prices experienced volatility, directly impacting the cost of refined fuels for distributors like CrossAmerica.

The stability of crude oil markets and refining capacity directly dictates the cost and availability of fuel for distributors. Disruptions in these areas, whether due to geopolitical events or maintenance issues at refineries, can quickly shift power towards suppliers, forcing distributors to accept less favorable terms.

- Input Dependence: CrossAmerica relies heavily on refined motor fuels, making it susceptible to supplier pricing power.

- Supply Chain Sensitivity: Global supply chain disruptions or changes in refining capacity can directly affect input availability and cost.

- Market Volatility: Fluctuations in crude oil prices in 2024 have demonstrated the direct impact on the cost of refined fuels for distributors.

CrossAmerica's suppliers, primarily major oil refiners and branded fuel providers, hold considerable sway due to the concentrated nature of the refining industry and the significant investment required to switch brands. The limited number of key refiners, coupled with the logistical and contractual complexities of changing fuel suppliers, creates moderate to high switching costs for CrossAmerica, reinforcing supplier leverage.

The bargaining power of suppliers is further amplified by the brand equity of major oil companies like ExxonMobil and BP, which are crucial for attracting customers to CrossAmerica's retail locations. While crude oil price volatility was a factor in 2024, impacting input costs, the established relationships and brand loyalty create a strong foundation for supplier influence.

| Factor | Impact on CrossAmerica | Supplier Leverage |

|---|---|---|

| Supplier Concentration | Limited alternative suppliers | High |

| Switching Costs | Logistical, contractual, brand-related | Moderate to High |

| Brand Equity | Customer attraction | High |

| Input Dependence | Reliance on refined fuels | High |

What is included in the product

This analysis examines the intensity of competition, buyer and supplier power, the threat of new entrants and substitutes, all specifically within CrossAmerica's operating environment.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

CrossAmerica's customers, mainly independent and company-operated gas stations, face razor-thin margins on fuel sales, often below 2% net profit per gallon. This inherent vulnerability makes them extremely sensitive to wholesale fuel price changes, as even minor shifts can drastically affect their bottom line.

The profitability of these retail sites often leans more heavily on convenience store sales than on fuel itself. Consequently, any increase in fuel costs directly squeezes their already limited operating capacity, further intensifying their price sensitivity.

CrossAmerica Partners distributes fuel to around 1,800 locations, encompassing both independent and company-operated sites. While individual independent operators might not represent massive volumes on their own, their collective purchasing power is substantial.

The bargaining power of customers is influenced by the volume of their purchases. Larger independent chains or significant commercial fleets, due to their higher individual purchase volumes, can exert more pressure on CrossAmerica for better pricing or terms.

The U.S. wholesale fuel market is quite crowded, with more than 2,000 petroleum wholesalers actively operating. This sheer number of suppliers means customers, like gas station owners, have a wide array of choices when looking to source their fuel. This abundance directly translates to increased bargaining power for these customers.

For instance, a retail gas station owner can easily compare prices and terms from numerous distributors. The ability to switch suppliers, particularly for unbranded gasoline which has fewer product differentiation points, further amplifies customer leverage. This ease of switching is a key factor in the competitive landscape.

Customer Information and Transparency

Customer information and transparency significantly influence the bargaining power within the fuel distribution sector. Information regarding wholesale fuel prices is generally accessible, allowing customers, particularly large commercial entities or fleet operators, to compare offers from various distributors. This transparency empowers these customers to negotiate more effectively, as they are aware of prevailing market rates and competitor pricing. The commodity nature of fuel further enhances this informational transparency, making price a primary differentiator.

For instance, in 2024, major fuel distributors often face pressure from large corporate clients who leverage readily available market data to secure more favorable pricing. This can be seen in the competitive bidding processes for large fuel supply contracts, where transparency in pricing structures is a key factor. The ability of customers to easily access and understand these prices directly translates into their capacity to demand better terms.

- Information Accessibility: Wholesale fuel prices are widely available, enabling informed customer comparisons.

- Negotiation Leverage: Transparency empowers customers to negotiate better terms based on market knowledge.

- Commodity Nature: Fuel's status as a commodity amplifies price sensitivity and customer bargaining power.

Threat of Backward Integration by Customers

The threat of customers integrating backward into wholesale distribution is minimal for CrossAmerica Partners. The immense capital required for storage terminals, transportation fleets, and complex supply chain management makes this an improbable strategy for most independent retail fuel stations, which constitute a significant portion of CrossAmerica's customer base.

While larger retail chains might explore such vertical integration, the financial and operational hurdles are substantial, effectively neutralizing this avenue of customer power. For instance, building a single fuel terminal can cost tens of millions of dollars, a prohibitive expense for the vast majority of CrossAmerica's clients.

- High Capital Investment: Establishing wholesale distribution infrastructure, including terminals and fleets, requires hundreds of millions of dollars, far beyond the reach of most independent retailers.

- Supply Chain Complexity: Managing logistics, regulatory compliance, and inventory for wholesale fuel distribution is a sophisticated operation that most retail-focused businesses lack the expertise to undertake.

- Limited Viability for Most Customers: The overwhelming majority of CrossAmerica's customer base, primarily smaller independent stations, simply cannot afford or manage the complexities of backward integration.

- Focus on Core Competencies: Retail fuel stations typically focus on customer-facing operations and marketing, rather than the capital-intensive and logistically demanding wholesale fuel business.

CrossAmerica's customers, primarily independent and company-operated gas stations, possess significant bargaining power. This is driven by the commodity nature of fuel, the high number of competing wholesalers, and the transparency of pricing information. The ease with which customers can compare offers and switch suppliers, especially for unbranded gasoline, allows them to negotiate favorable terms. For example, in 2024, large fleet operators often leverage market data to secure lower prices from distributors.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation (2024) |

|---|---|---|

| Number of Competitors | High | Over 2,000 petroleum wholesalers operate in the U.S. market, offering ample choice. |

| Product Differentiation | Low (for unbranded fuel) | Unbranded gasoline has minimal product differentiation, making price the primary negotiation point. |

| Information Transparency | High | Wholesale fuel prices are readily accessible, enabling informed price comparisons by customers. |

| Switching Costs | Low | Customers can switch suppliers with relative ease, especially for unbranded products. |

Same Document Delivered

CrossAmerica Porter's Five Forces Analysis

This preview displays the complete, professionally crafted CrossAmerica Porter's Five Forces Analysis that you will receive immediately after purchase. You are looking at the exact document, ensuring no discrepancies or placeholder content, and it is fully formatted and ready for your immediate use. This is the final, deliverable analysis, providing you with comprehensive insights into the competitive landscape of CrossAmerica without any need for further customization or setup.

Rivalry Among Competitors

The U.S. wholesale fuel distribution market is a crowded space, featuring over 2,000 petroleum wholesalers. This includes giants like CrossAmerica Partners alongside numerous smaller regional and local distributors, creating a highly fragmented and competitive environment. This sheer number of players means constant pressure on market share.

While the market is diverse, larger companies are actively consolidating it. Many larger chains are expanding their reach and capabilities by acquiring smaller, independent operations. This trend suggests that while the number of competitors remains high, the market might be gradually shifting towards consolidation, with fewer, larger entities dominating.

The motor fuel market is seeing slower growth, with gasoline consumption projected to be flat or slightly down in 2024-2025. This trend is driven by better fuel efficiency and more electric vehicles. For instance, the U.S. Energy Information Administration (EIA) projected a slight decline in gasoline consumption for 2024.

This mature and saturated market means companies like CrossAmerica Partners often compete intensely for existing market share. Instead of benefiting from a growing overall market, rivals must focus on strategies to attract customers from each other.

Motor fuel is largely a commodity, meaning it's difficult for companies like CrossAmerica to make their unbranded products truly stand out. While branded fuels can create some distinction and encourage customer loyalty, the main battleground for competition often comes down to price, ensuring a consistent supply, and the quality of customer service offered.

For retail customers, the costs associated with switching from one fuel distributor to another are typically quite low. This lack of significant switching costs means that distributors are under constant pressure to compete aggressively on price, as customers can easily move to a competitor if they find a better deal.

High Fixed Costs and Exit Barriers

The wholesale fuel distribution industry, which includes owning real estate and infrastructure, demands substantial fixed costs. This reality pushes companies like CrossAmerica Partners to maintain high operating volumes to offset these expenses, intensifying competition as firms vie for gallon throughput.

The significant capital investment and asset specificity inherent in this sector create considerable exit barriers. These barriers compel businesses to stay operational even when market conditions are unfavorable, contributing to sustained competitive rivalry.

- High Fixed Costs: CrossAmerica Partners' business model, involving fuel distribution and real estate, inherently carries significant fixed costs related to infrastructure and property ownership.

- Volume Driven Operations: To achieve profitability, companies must operate at high volumes, leading to aggressive competition to secure and maintain market share in terms of gallons sold.

- Exit Barriers: Substantial capital investments and the specialized nature of assets in fuel distribution make it difficult and costly for companies to exit the market, thus perpetuating rivalry.

- 2024 Data Insight: While specific 2024 fixed cost figures for CrossAmerica's infrastructure are proprietary, the industry trend shows ongoing capital expenditure for terminal upgrades and fleet modernization, reinforcing high fixed cost structures.

Strategic Moves by Competitors

Competitors are actively engaged in strategic maneuvers to bolster their market positions. This includes expanding their network of retail sites, streamlining operational efficiencies, and divesting underperforming or non-core assets to boost overall profitability.

CrossAmerica Partners itself has been increasing its company-operated and commission agent sites, demonstrating a proactive approach to growth. Simultaneously, the company is undertaking real estate rationalization efforts to optimize its asset base.

The convenience store and wholesale fuels sector is experiencing a notable trend of consolidation. Larger, more established chains are acquiring smaller competitors to achieve greater economies of scale, expand their market reach, and enhance their competitive standing.

- Retail Site Expansion: Competitors are focused on increasing their physical footprint.

- Operational Optimization: Efforts are underway to improve efficiency and reduce costs.

- Asset Divestiture: Non-core or underperforming assets are being sold off to improve financial health.

- Industry Consolidation: Mergers and acquisitions are reshaping the competitive landscape.

The competitive rivalry within the wholesale fuel distribution market is intense, driven by a large number of players and the commoditized nature of motor fuel. Companies like CrossAmerica Partners face constant pressure to secure market share in a mature industry with slow growth, where differentiation is challenging and price, supply reliability, and customer service are key battlegrounds. High fixed costs and significant exit barriers further intensify this rivalry, as businesses must maintain high volumes to cover expenses and are compelled to remain operational even in less favorable conditions.

| Key Competitive Factor | Description | Impact on Rivalry |

| Number of Competitors | Over 2,000 wholesalers in the U.S. market. | High fragmentation leads to intense competition for market share. |

| Market Growth | Projected flat to slight decline in gasoline consumption for 2024-2025. | Companies must fight for existing demand rather than benefit from market expansion. |

| Product Differentiation | Motor fuel is largely a commodity; branding offers limited distinction. | Competition centers on price, supply, and service rather than unique product features. |

| Switching Costs | Low costs for retail customers to switch distributors. | Constant pressure on distributors to offer competitive pricing and maintain customer loyalty. |

| Fixed Costs & Exit Barriers | High infrastructure and asset costs, with substantial capital investment. | Drives a focus on high volumes and discourages market exit, perpetuating rivalry. |

SSubstitutes Threaten

Electric vehicles (EVs) pose a substantial threat as substitutes for traditional gasoline and diesel vehicles, directly impacting demand for motor fuels. Global EV sales reached approximately 13.6 million units in 2023, a significant increase from previous years, and are projected to continue this upward trajectory. This shift is already displacing millions of barrels of oil consumption daily, a trend expected to intensify through 2025 and beyond.

The increasing penetration of EVs, driven by technological advancements, government incentives, and growing consumer awareness, directly erodes the market for conventional fuels. For companies like CrossAmerica, which are heavily involved in fuel distribution, this represents a critical long-term challenge to their core business model. Projections indicate that by 2030, EVs could account for a substantial portion of new vehicle sales, further accelerating the decline in demand for gasoline and diesel.

Vehicles running on compressed natural gas (CNG), liquefied natural gas (LNG), and propane present viable alternatives to traditional gasoline and diesel engines, especially within commercial and heavy-duty transportation sectors. These alternative fuels often boast more predictable and sometimes lower price points compared to conventional petroleum-based fuels, offering significant cost advantages for fleet operators.

While electric vehicles (EVs) are gaining considerable traction, these gaseous fuels represent a distinct segment of alternative energy sources for transportation, contributing to a broader diversification of the fuel mix. For instance, in 2023, the U.S. saw continued growth in alternative fuel vehicle registrations, with CNG and propane vehicles playing a role in specific market niches, particularly in regions with readily available infrastructure and supportive policies.

The rise of biofuels like renewable diesel, biodiesel, and ethanol presents a significant threat of substitution for conventional petroleum-based fuels. These alternatives are gaining traction due to a combination of environmental mandates and government incentives, making them increasingly competitive. For instance, global renewable diesel production has seen substantial growth, with industry forecasts indicating this trend will persist.

While the demand growth for biofuels in road transport might moderate post-2030, their expanding presence within the overall energy landscape directly challenges the market share of traditional fossil fuels. This increasing penetration means that for companies like CrossAmerica, which distribute petroleum products, biofuels represent a tangible alternative that could erode demand.

Advances in Fuel Efficiency

Advances in fuel efficiency for internal combustion engine (ICE) vehicles present a persistent threat of substitution for CrossAmerica. These improvements, which reduce the amount of fuel consumed per mile, directly impact the demand for the gasoline and diesel that CrossAmerica distributes. For instance, the U.S. Environmental Protection Agency (EPA) has set increasingly stringent fuel economy standards for new vehicles.

These ongoing advancements in ICE technology, alongside the rising adoption of electric vehicles (EVs), are contributing to a projected stagnation or even a slight decline in overall gasoline consumption in the coming years. This trend directly affects CrossAmerica's core business by potentially lowering the volume of fuel it needs to transport and sell.

- Fuel Efficiency Gains: ICE vehicles are becoming more efficient, meaning they use less fuel to travel the same distance.

- Impact on Demand: This efficiency directly reduces the per-mile demand for gasoline and diesel.

- Projected Consumption: Combined with EV growth, fuel efficiency is a key factor in forecasts for flat or decreasing gasoline consumption.

- Regulatory Influence: Government standards, like those from the EPA, drive these efficiency improvements in new vehicles.

Shifting Transportation Habits

Broader societal shifts are subtly influencing transportation habits, potentially impacting demand for traditional fuels. The rise of remote work, for instance, means fewer daily commutes. In 2024, surveys indicated that a significant percentage of the workforce continued to work remotely at least part-time, reducing overall vehicle miles traveled.

Furthermore, the expansion of public transportation networks and the increasing popularity of micro-mobility options like electric scooters and bike-sharing programs offer viable alternatives to personal car use. These trends, while not directly replacing fuel, collectively contribute to a gradual decrease in the consumption of traditional motor fuels. For example, urban areas are seeing a noticeable uptick in public transit ridership and micro-mobility usage as commuters seek more sustainable and cost-effective ways to navigate cities.

- Societal Shift: Increased remote work reduces daily commuting.

- Micro-mobility Growth: Expansion of bike-sharing and scooter services offers alternatives.

- Public Transit: Growing ridership in urban centers provides another substitute.

- Impact: These trends collectively reduce overall vehicle miles traveled and fuel demand.

The threat of substitutes for CrossAmerica's fuel distribution business is multifaceted, encompassing electric vehicles, alternative fuels like natural gas and biofuels, and even broader societal shifts impacting transportation habits. These substitutes directly challenge the demand for traditional gasoline and diesel, influencing the company's long-term market position.

Electric vehicles (EVs) are a primary substitute, with global sales reaching approximately 13.6 million units in 2023, a trend expected to continue. This growth displaces millions of barrels of oil consumption daily. Additionally, gaseous fuels like CNG and propane, along with biofuels such as renewable diesel and ethanol, offer cost advantages and environmental benefits, further diversifying the fuel mix. Even increased vehicle fuel efficiency and societal changes like remote work contribute to reduced fuel demand.

| Substitute Type | Key Drivers | Impact on Fuel Demand | Example Data (2023/2024) |

|---|---|---|---|

| Electric Vehicles (EVs) | Technological advancements, government incentives, consumer awareness | Directly reduces demand for gasoline and diesel | Global EV sales: ~13.6 million units (2023) |

| Alternative Fuels (CNG, LNG, Biofuels) | Cost predictability, environmental mandates, government incentives | Offers competitive pricing and greener alternatives | Continued growth in renewable diesel production; niche adoption of CNG/propane |

| Fuel Efficiency Improvements | Stricter regulatory standards (e.g., EPA), technological innovation | Reduces fuel consumption per mile for ICE vehicles | Ongoing improvements in new vehicle fuel economy standards |

| Societal Shifts | Remote work, micro-mobility, public transportation expansion | Decreases overall vehicle miles traveled and fuel consumption | Surveys indicate significant portion of workforce working remotely (2024) |

Entrants Threaten

The wholesale fuel distribution sector is characterized by high capital intensity, presenting a significant hurdle for new entrants. Establishing the necessary infrastructure, including fuel terminals, extensive storage facilities, and a dedicated fleet of specialized transport vehicles, demands a substantial upfront investment.

CrossAmerica Partners, for instance, operates a vast network of retail locations, which further escalates the capital requirements for any aspiring competitor. This extensive physical footprint and logistical network create a formidable barrier to entry, making it challenging for new players to compete effectively.

Established players like CrossAmerica Partners leverage substantial economies of scale, particularly in purchasing and logistics. For instance, in 2023, CrossAmerica's refined product gallons sold reached 3.6 billion, highlighting the sheer volume that underpins their cost advantages. New entrants would find it incredibly challenging to match these efficiencies without a similarly vast distribution network and upfront capital investment, making price competition a significant hurdle.

New entrants face substantial hurdles in securing reliable fuel supplies and establishing strong relationships with major refiners and branded petroleum suppliers. These established connections are crucial for consistent product availability and competitive pricing, acting as a significant barrier.

CrossAmerica Partners, for instance, benefits from its extensive history and trust built with key players. Its position as one of the largest distributors for brands like ExxonMobil, a relationship cultivated over many years, provides a distinct advantage that new competitors would find exceptionally difficult and costly to match.

Regulatory and Environmental Hurdles

The fuel distribution sector faces substantial regulatory and environmental barriers. For instance, in 2024, compliance with evolving EPA standards for fuel emissions and storage tank integrity continues to demand significant capital investment from all players, including potential new entrants. Obtaining the myriad of federal, state, and local permits required for operations is a lengthy and often expensive process.

These hurdles create a high cost of entry and operational complexity. New companies must not only secure financing for infrastructure but also invest heavily in legal and consulting expertise to navigate the intricate web of regulations. This can deter smaller or less capitalized firms from entering the market, thereby protecting established companies like CrossAmerica.

- Stringent Environmental Regulations: Compliance with emissions standards and spill prevention measures.

- Fuel Quality Standards: Adherence to specifications for various fuel types.

- Licensing and Permitting: Obtaining approvals from multiple governmental agencies.

- High Capital Investment: Significant upfront costs for infrastructure and compliance.

Brand Loyalty and Market Saturation

Brand loyalty to established petroleum brands, such as ExxonMobil and Shell, can present a significant hurdle for new, unbranded wholesale entrants. Customers often exhibit a preference for familiar brands, even when fuel itself is largely a commodity, making it challenging for newcomers to gain traction. This loyalty is reinforced by established marketing efforts and perceived reliability.

The retail fuel market is already highly saturated, meaning new entrants must contend with a substantial number of existing gas stations. Capturing market share in such a crowded environment requires considerable investment in infrastructure, marketing, and competitive pricing strategies. For instance, in 2024, the U.S. had approximately 150,000 retail fueling locations, demonstrating the intense competition.

- Brand Recognition: Established brands benefit from decades of marketing, fostering trust and recognition among consumers.

- Customer Inertia: Many consumers stick with their preferred brand due to habit or perceived convenience, even if alternatives are available.

- Market Saturation: The sheer number of existing fueling stations limits the available market for new entrants, increasing the cost of customer acquisition.

- Price Sensitivity vs. Brand Preference: While fuel prices are a factor, brand loyalty can sometimes outweigh minor price differences for a segment of consumers.

The threat of new entrants in the wholesale fuel distribution sector is considerably low due to substantial barriers. High capital requirements for infrastructure, extensive regulatory compliance, and established relationships with suppliers and branded marketers create significant hurdles. For example, in 2023, CrossAmerica Partners sold 3.6 billion gallons, indicating the scale needed to achieve cost efficiencies that new players would struggle to replicate.

The established brand loyalty and market saturation further deter new entrants. With around 150,000 retail fueling locations in the U.S. as of 2024, gaining market share is an expensive undertaking. Newcomers must also overcome the entrenched trust and marketing power of brands like ExxonMobil, which CrossAmerica Partners has cultivated over many years.

Navigating the complex web of federal, state, and local permits, alongside evolving environmental regulations like those from the EPA in 2024, demands significant investment in legal and consulting expertise. This adds to the already high cost of entry, making the wholesale fuel distribution market a challenging arena for new, less capitalized companies.

Porter's Five Forces Analysis Data Sources

Our CrossAmerica Porter's Five Forces analysis is built upon a foundation of diverse data sources, including company annual reports, investor presentations, and industry-specific market research from firms like IBISWorld. We also leverage public financial data from SEC filings and macroeconomic indicators to provide a comprehensive view of the competitive landscape.