CrossAmerica Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrossAmerica Bundle

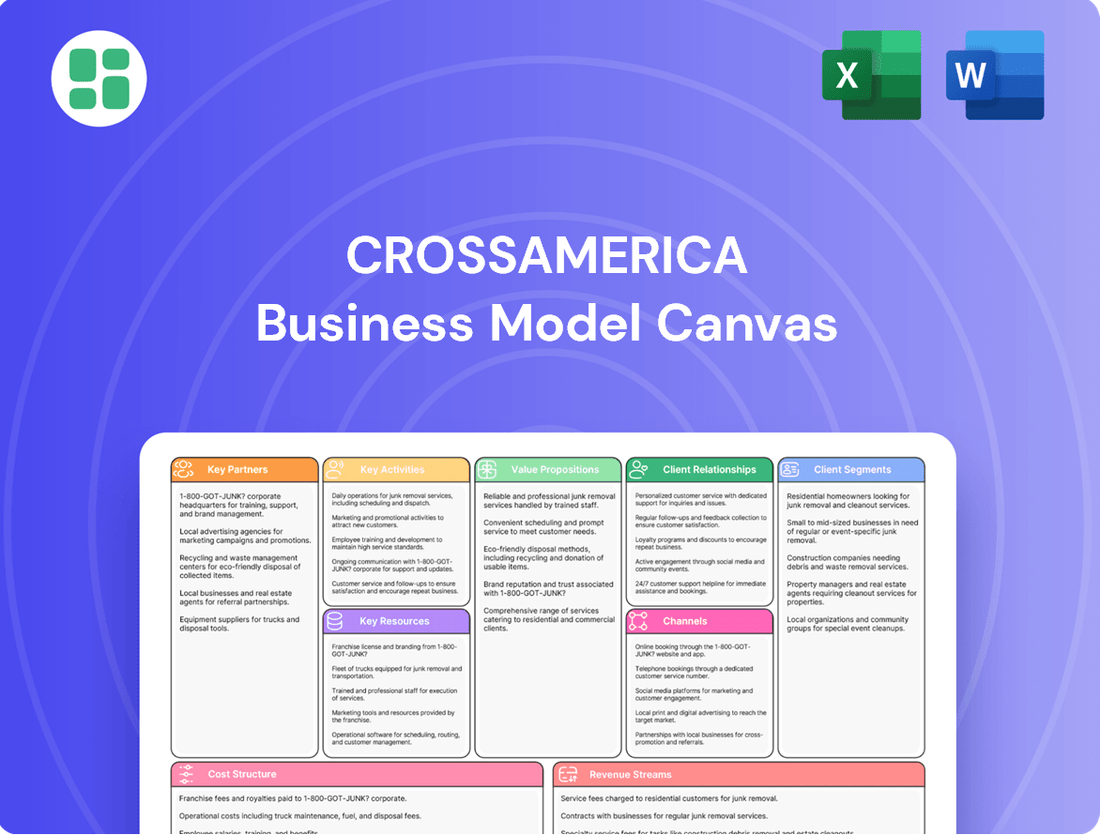

Curious about CrossAmerica's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to unlock actionable strategies for your own venture.

Partnerships

CrossAmerica Partners LP's key partnerships with major fuel refiners and oil brands like ExxonMobil, BP, Shell, Marathon, Valero, and Phillips 66 are foundational to its business. These relationships ensure a steady flow of branded and unbranded motor fuels, vital for its extensive distribution network.

As one of ExxonMobil's largest distributors in the U.S. by volume, CrossAmerica leverages these strong ties to secure competitive pricing and a reliable supply chain. This strategic alignment with major brands underpins its operational efficiency and market presence.

Independent retail site operators are crucial partners for CrossAmerica, forming the backbone of its distribution network. These operators purchase motor fuels from CrossAmerica on a wholesale basis, making them key customers whose business directly fuels CrossAmerica's revenue. In 2024, maintaining and growing these relationships is paramount for the company's wholesale segment success.

CrossAmerica Partners relies heavily on key partnerships with real estate lessors and landlords for a substantial portion of its retail locations. These agreements are fundamental to the company's ability to establish and expand its presence across various markets.

In 2024, CrossAmerica continued to manage a vast portfolio of leased properties, a strategy that facilitates rapid market penetration without the upfront capital investment of property ownership. This approach allows for flexibility in adapting its retail footprint.

These leasing arrangements not only enable expansion but also contribute to CrossAmerica's revenue through rental income generated from its own leased assets. The company actively engages in real estate rationalization, optimizing its leased portfolio for efficiency and profitability.

Logistics and Transportation Providers

CrossAmerica Partners relies heavily on a robust network of logistics and transportation providers to ensure the efficient distribution of motor fuels and other petroleum products across its vast operational footprint, spanning 34 states. These crucial relationships are the backbone of its supply chain, guaranteeing that fuel reaches its 1,700 retail locations and other customer sites reliably and affordably.

The effectiveness of these partnerships directly impacts CrossAmerica’s ability to maintain consistent product availability, a critical factor in customer satisfaction and market share. In 2024, the company continued to focus on optimizing these transport relationships to mitigate rising fuel costs and potential supply chain disruptions.

- Extensive Network: Partnerships with numerous trucking companies and terminal operators facilitate access to a diverse fleet and strategically located distribution points.

- Cost Efficiency: Negotiating favorable transportation rates and optimizing delivery routes helps manage operating expenses, a key focus in 2024's competitive market.

- Reliability: Ensuring timely deliveries is paramount for maintaining uninterrupted supply to retail sites, a core operational requirement for CrossAmerica.

- Regulatory Compliance: Working with partners who adhere to stringent safety and environmental regulations is essential for responsible operations.

Convenience Store Merchandise Suppliers

CrossAmerica Partners relies heavily on its merchandise suppliers to stock its company-operated and commission agent retail locations. These partnerships are essential for providing a wide variety of products that appeal to customers, directly contributing to the gross profit generated by merchandise sales within the retail segment.

Effective management of these supplier relationships is a critical driver of profitability for CrossAmerica's retail operations. For instance, in 2023, CrossAmerica's retail segment generated approximately $1.5 billion in revenue, with merchandise sales forming a significant portion of this. Strong supplier agreements can lead to better product margins and inventory turnover.

- Supplier Agreements: Negotiating favorable terms with suppliers for product pricing, payment terms, and promotional support is key to maximizing retail profitability.

- Product Assortment: Partnerships ensure a diverse and appealing product mix, from snacks and beverages to convenience items, meeting customer demand and driving sales volume.

- Inventory Management: Collaborative efforts with suppliers can improve inventory efficiency, reducing waste and ensuring popular items are consistently available, thereby boosting sales.

CrossAmerica Partners' key partnerships with major fuel refiners, such as ExxonMobil and Shell, are critical for securing a consistent and competitively priced supply of motor fuels. These relationships are the bedrock of its wholesale operations, ensuring product availability across its extensive distribution network. In 2024, maintaining these strong ties remained a priority to navigate a dynamic fuel market.

Independent retail site operators are vital partners, acting as the direct customers for CrossAmerica's wholesale fuel business. These operators purchase fuel on a wholesale basis, directly contributing to the company's revenue streams. Growing and supporting this segment of partners is essential for the continued success of CrossAmerica's wholesale segment.

CrossAmerica also relies on a diverse array of merchandise suppliers to stock its retail locations, ensuring a compelling product offering for customers. These partnerships are crucial for driving sales and profitability within the retail segment, with effective supplier agreements directly impacting gross profit margins.

| Partner Type | Key Role | Impact on CrossAmerica | 2024 Focus |

|---|---|---|---|

| Fuel Refiners (e.g., ExxonMobil, Shell) | Fuel Supply & Pricing | Ensures product availability and competitive costs for wholesale. | Strengthening supply agreements. |

| Independent Retail Site Operators | Fuel Customers | Drives wholesale revenue through fuel purchases. | Expanding customer base. |

| Merchandise Suppliers | Product Provision | Boosts retail sales and profitability via product variety. | Optimizing product mix and margins. |

What is included in the product

A detailed breakdown of CrossAmerica's operational strategy, focusing on its distribution network and retail partnerships.

Highlights key revenue streams and cost structures, providing a clear financial overview of the business.

Provides a clear, structured framework to identify and address critical business challenges, transforming abstract strategies into actionable solutions.

Simplifies complex business operations into a visual, manageable format, enabling teams to pinpoint and resolve pain points efficiently.

Activities

CrossAmerica's primary function revolves around procuring and distributing motor fuels, such as gasoline and diesel, to its extensive network of retail locations. This crucial activity involves managing fuel supply contracts and ensuring timely, efficient deliveries to both company-owned and independently operated stations.

The financial health of the wholesale segment directly reflects the effectiveness of these fuel distribution operations. For instance, in 2024, CrossAmerica reported significant volumes in its wholesale fuel distribution, contributing substantially to its overall revenue streams, underscoring the importance of this core business function.

CrossAmerica actively acquires, leases, and manages retail fuel distribution properties. In 2024, this strategic focus on real estate is crucial for optimizing its network and generating rental income. The company also engages in rationalization, selling non-core assets to enhance its financial health and portfolio efficiency.

CrossAmerica's core activities include the direct operation of its retail convenience stores. This involves the day-to-day management of sales, inventory, and customer service, alongside the critical function of fuel dispensing. The company's strategic shift towards company-operated sites, evidenced by the conversion of lessee dealer locations, directly impacts this key activity.

In 2024, this operational focus is paramount, as the retail segment's gross profit is heavily reliant on the performance of these stores. For instance, CrossAmerica's retail segment generated $300 million in gross profit in 2023, a figure directly attributable to the success of its convenience store operations.

Marketing Branded and Unbranded Petroleum Products

CrossAmerica actively markets both branded and unbranded petroleum products. This involves collaborating with major oil companies to promote their fuel brands, thereby enhancing their market visibility and consumer appeal. Simultaneously, the company focuses on strengthening the market presence of its own unbranded fuel offerings, ensuring competitive positioning.

Effective marketing strategies are crucial for driving sales volume and improving the margin per gallon for CrossAmerica. For instance, in 2024, the company continued to leverage its extensive distribution network to support marketing initiatives, aiming to capture a larger share of the retail fuel market. This dual approach to marketing, encompassing both partnerships and proprietary brand development, underpins its revenue generation and profitability.

- Branded Fuel Marketing: Collaborating with major oil brands to ensure their fuels are prominently featured and promoted at retail locations served by CrossAmerica.

- Unbranded Fuel Marketing: Developing and executing strategies to increase the awareness and sales of CrossAmerica's own unbranded gasoline and diesel products.

- Sales Volume and Margin Enhancement: Implementing targeted marketing campaigns and promotions designed to boost the quantity of fuel sold and increase the profitability per gallon.

- Market Presence: Utilizing its distribution infrastructure and marketing efforts to maintain and expand its footprint in key geographic regions.

Supply Chain and Logistics Optimization

CrossAmerica Partners LP's key activities heavily rely on optimizing its supply chain and logistics. This is crucial for the efficient and timely delivery of fuel and other petroleum products across its extensive network. The company actively manages inventory levels and transportation routes to ensure competitive pricing and dependable service.

This optimization process involves cultivating strong relationships with carriers and continuously seeking ways to improve operational efficiency. For instance, in 2024, CrossAmerica continued to invest in technology and infrastructure to streamline its distribution processes, aiming to reduce transit times and enhance delivery reliability. Their commitment to this area directly impacts their ability to serve a broad customer base effectively.

- Supply Chain Management: CrossAmerica focuses on efficient inventory management and route planning to minimize costs and delivery times.

- Logistics Operations: The company manages a complex network of transportation, including rail, truck, and barge, to ensure product availability.

- Carrier Relationships: Building and maintaining strong partnerships with transportation providers is vital for reliable and cost-effective delivery.

- Geographic Footprint: Optimizing logistics across a wide geographic area, encompassing numerous terminals and customer locations, is a core activity.

CrossAmerica's key activities center on the acquisition, marketing, and distribution of motor fuels. This includes managing fuel supply and ensuring efficient delivery to a wide network of retail sites. The company also directly operates its convenience stores, focusing on sales, inventory, and customer service.

A significant aspect of their operations involves property management, where they acquire, lease, and optimize retail fuel distribution locations. Furthermore, CrossAmerica actively markets both branded and unbranded petroleum products, aiming to boost sales volume and profit margins per gallon.

In 2024, CrossAmerica's wholesale fuel distribution remained a cornerstone, contributing substantially to revenue. The company's retail segment, driven by convenience store performance, generated $300 million in gross profit in 2023, highlighting the importance of these operations.

CrossAmerica also prioritizes optimizing its supply chain and logistics. This involves efficient inventory management, route planning, and strong carrier relationships to ensure timely and cost-effective product delivery across its broad geographic footprint.

| Activity | Description | 2024 Focus/Impact |

|---|---|---|

| Fuel Procurement & Distribution | Sourcing and delivering gasoline and diesel to retail network. | Ensuring timely and efficient deliveries to company-owned and independent stations. |

| Retail Store Operations | Day-to-day management of convenience stores, including sales and fuel dispensing. | Focus on company-operated sites and improving in-store offerings. |

| Property Management | Acquiring, leasing, and optimizing retail fuel locations. | Strategic real estate management to enhance network efficiency and rental income. |

| Fuel Marketing | Promoting branded and unbranded petroleum products. | Leveraging distribution network to increase market share and margin per gallon. |

| Supply Chain & Logistics | Managing inventory, transportation, and carrier relationships. | Investing in technology to streamline distribution and enhance delivery reliability. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final deliverable. Once your order is processed, you will gain full access to this identical, professionally structured file, ready for immediate use and customization.

Resources

CrossAmerica's extensive network of retail sites is its core physical asset, comprising roughly 1,600 to 1,800 fuel distribution locations spread across 34 states. This vast footprint includes approximately 1,000 to 1,100 sites that are either owned or leased, underscoring their significant investment in physical infrastructure.

This broad geographic reach is crucial, enabling CrossAmerica to serve a wide customer base and maintain substantial distribution capacity. The sheer scale and strategic positioning of these retail sites are foundational to the company's entire business model and its ability to compete effectively in the fuel distribution market.

Long-term fuel supply contracts with major oil companies are vital for CrossAmerica's wholesale operations, ensuring a consistent and varied fuel inventory. These established relationships are key intangible assets, granting access to competitive pricing and leveraging strong brand recognition. For instance, CrossAmerica's significant distribution role for brands like ExxonMobil demonstrates the robustness of these partnerships.

CrossAmerica Partners' real estate portfolio is a cornerstone of its business model, comprising owned and leased properties that serve as vital hubs for its operations. This extensive collection of tangible assets generates significant rental income and provides crucial strategic control over prime retail locations across its network.

The company actively manages this real estate, evidenced by ongoing rationalization efforts aimed at optimizing its footprint and maximizing the value of these holdings. As of the first quarter of 2024, CrossAmerica operated approximately 1,700 locations, with a substantial portion of these being company-owned or leased real estate assets.

This robust real estate base is instrumental in supporting both its wholesale fuel distribution and its retail convenience store operations. The strategic placement and management of these properties are key to maintaining competitive advantages and driving revenue growth in its core business segments.

Distribution Infrastructure and Technology

CrossAmerica's distribution infrastructure is a cornerstone of its business model, encompassing a vast network of physical assets and advanced technological systems. This includes strategically located fuel terminals, extensive storage facilities, and a dedicated transportation fleet designed to ensure the efficient movement of petroleum products. In 2024, the company continued to invest in modernizing these assets to enhance operational capabilities and meet market demand effectively.

The efficiency of this infrastructure directly impacts the seamless flow of products from suppliers to a diverse customer base, including branded and unbranded retail outlets, commercial customers, and industrial users. Investments in upgrading technology for logistics, inventory management, and sales tracking are crucial for maintaining a competitive edge and optimizing supply chain performance.

- Fuel Terminals and Storage: CrossAmerica operates numerous fuel terminals and storage facilities across its operating regions, providing critical capacity for product handling and distribution.

- Transportation Fleet: The company manages a significant fleet of transport trucks, ensuring timely and reliable delivery of fuels to customer locations.

- Technology Integration: Investments in technology support real-time inventory tracking, route optimization, and sales data management, driving operational efficiency.

- 2024 Focus: Continued investment in infrastructure modernization and technology upgrades to support growth and enhance supply chain resilience.

Financial Capital and Credit Facilities

CrossAmerica Partners LP (CAPL) relies heavily on its financial capital and credit facilities to power its operations and growth. A key resource is its CAPL Credit Facility, which provides essential funding for day-to-day activities, managing existing debt, and enabling strategic moves like acquisitions or divestitures. This access to capital is fundamental to maintaining financial health.

Maintaining strong liquidity and a prudent leverage ratio are paramount for CrossAmerica's financial stability and its ability to pursue growth opportunities. These financial metrics directly influence the company's capacity to invest in new projects and weather economic fluctuations. Effective capital management is therefore a cornerstone of its business model.

CrossAmerica's financial performance is a direct reflection of its capital management strategies. For instance, as of the first quarter of 2024, the company reported total debt of approximately $2.2 billion. Its ability to manage this debt and maintain access to credit facilities directly impacts its profitability and strategic flexibility.

- Access to Credit Facility: The CAPL Credit Facility is a critical resource for funding operations and strategic initiatives.

- Liquidity and Leverage: Strong liquidity and manageable leverage ratios are vital for financial stability and growth.

- Financial Performance Link: The company's financial results are intrinsically tied to its capital management practices.

- Debt Management: As of Q1 2024, CrossAmerica managed total debt of around $2.2 billion, highlighting the importance of its credit facilities.

CrossAmerica's key resources include its vast network of approximately 1,700 retail locations as of Q1 2024, a significant portion of which are owned or leased, providing a strong physical asset base. Long-term supply contracts with major oil companies, such as ExxonMobil, are crucial intangible assets ensuring consistent fuel inventory and competitive pricing. The company also leverages its extensive distribution infrastructure, including terminals, storage, and a transport fleet, supported by ongoing investments in technology and modernization.

| Key Resource | Description | Significance | 2024 Data/Context |

| Retail Network | Owned/leased fuel distribution sites | Broad customer reach, distribution capacity | ~1,700 locations (Q1 2024) |

| Supply Contracts | Agreements with major oil companies | Consistent fuel inventory, competitive pricing, brand leverage | Partnerships with brands like ExxonMobil |

| Distribution Infrastructure | Terminals, storage, transport fleet, technology | Efficient product movement, supply chain optimization | Ongoing modernization investments |

Value Propositions

CrossAmerica Partners ensures a steady and trustworthy flow of branded and unbranded gasoline and diesel to its wide-reaching network. This consistent availability is paramount for independent fuel retailers who cannot afford disruptions. In 2024, CrossAmerica continued to be a vital link in the fuel supply chain, supporting thousands of businesses across the nation.

The ability to offer both branded and unbranded fuels provides flexibility, allowing customers to align their fuel offerings with their specific market strategies and customer preferences. This dual approach helps independent operators optimize their product mix and profitability.

CrossAmerica's extensive geographic reach is a significant value proposition, with operations in 34 states. This broad footprint allows them to serve a vast customer base and provides partners with access to diverse markets across the United States.

Supplying fuel to approximately 1,600 to 1,800 locations, CrossAmerica boasts a robust distribution network. This ensures widespread availability of petroleum products, making them a reliable supplier for a multitude of businesses and consumers.

The company's ability to cater to varied market demands across its operational states strengthens its value proposition. This extensive geographic presence and distribution capability offer a competitive advantage in the fuel supply industry.

CrossAmerica Partners offers a distinct value proposition by seamlessly integrating fuel distribution with real estate ownership and leasing for retail locations. This dual capability streamlines the process for fuel retailers looking to establish or grow their businesses, providing a one-stop solution.

This integrated model simplifies site selection, development, and ongoing operations for their partners. For instance, in 2024, CrossAmerica continued to leverage its extensive real estate footprint, which includes thousands of owned and leased retail sites, to support its fuel distribution network.

Furthermore, the strategic management of this vast real estate portfolio adds significant value. By optimizing property utilization and offering flexible leasing terms, CrossAmerica enhances the attractiveness and accessibility of its retail locations for fuel brand partners, fostering mutual growth.

Operational Support and Expertise for Retailers

CrossAmerica offers vital operational support and expertise to its retail partners, focusing on optimizing site performance and profitability. This includes guidance on merchandise management and the implementation of retail best practices. In 2024, their focus on these areas directly supported fuel margins and merchandise sales, crucial drivers for their network of company-operated and commission agent sites.

- Merchandise Management: Providing retailers with strategies to effectively manage inventory and product selection.

- Retail Best Practices: Sharing operational knowledge to enhance customer experience and efficiency.

- Profitability Optimization: Direct support for fuel margins and merchandise sales to boost partner success.

- Site Performance Enhancement: Expertise aimed at improving the overall operational output of each location.

Strategic Portfolio Optimization for Long-Term Value

CrossAmerica's strategic portfolio optimization focuses on enhancing long-term value through active real estate rationalization and class of trade adjustments. This involves divesting non-core assets and strategically converting existing sites to boost overall portfolio performance.

This disciplined approach is designed to cultivate a more robust and resilient business structure. The company's efforts are geared towards delivering sustained stability and fostering growth opportunities for its diverse stakeholder base, including investors and business partners.

- Real Estate Rationalization: Identifying and selling underperforming or non-strategic real estate assets to free up capital and improve asset allocation.

- Class of Trade Optimization: Adjusting the mix of fuel and convenience store offerings at sites to better align with market demand and profitability potential.

- Portfolio Enhancement: The overarching goal is to create a more efficient and profitable network of locations, driving enhanced returns.

- Stakeholder Value: This strategy aims to build a stronger financial foundation that benefits shareholders through increased stability and growth prospects.

CrossAmerica Partners provides a reliable supply of both branded and unbranded fuels, a critical service for independent retailers. Their extensive network, spanning 34 states and serving approximately 1,600 to 1,800 locations, ensures consistent product availability across diverse markets. This broad reach and dependable supply chain are cornerstones of their value proposition.

The integration of fuel distribution with real estate ownership and leasing offers a streamlined, one-stop solution for retail partners. This model simplifies site acquisition and development, allowing businesses to focus on operations. In 2024, CrossAmerica continued to leverage its substantial real estate portfolio to support its distribution network, enhancing accessibility for fuel brand partners.

CrossAmerica offers crucial operational support, including merchandise management and best practices, to boost site performance and profitability. Their focus in 2024 on optimizing fuel margins and merchandise sales directly benefited their company-operated and commission agent sites, driving success for their retail partners.

The company actively optimizes its portfolio by rationalizing real estate and adjusting its class of trade. This strategic approach, evident in their ongoing efforts, aims to enhance long-term value and build a more resilient business structure, ultimately benefiting all stakeholders.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Fuel Supply Reliability | Consistent availability of branded and unbranded gasoline and diesel. | Supports thousands of independent fuel retailers nationwide. |

| Integrated Real Estate & Distribution | Combines fuel distribution with retail site ownership/leasing. | Leverages extensive real estate footprint for network support. |

| Operational Support & Profitability Enhancement | Guidance on merchandise, best practices, and site performance. | Directly supported fuel margins and merchandise sales for partners. |

| Strategic Portfolio Optimization | Active real estate rationalization and class of trade adjustments. | Aims to create a more efficient and profitable network of locations. |

Customer Relationships

CrossAmerica actively cultivates long-term contractual partnerships with its independent dealer sites and branded fuel partners. These agreements are the bedrock of the company's stable supply chain, offering predictable revenue streams and operational consistency.

In 2024, CrossAmerica's strategy of securing these enduring relationships continued to pay dividends. The company's focus on these contractual ties provides a robust foundation for its distribution network, ensuring reliable access to fuel for its partners.

CrossAmerica Partners offers dedicated account management for its wholesale clients and independent operators. This personalized service ensures their unique requirements are addressed, fostering robust and supportive partnerships.

This direct engagement helps swiftly resolve operational challenges. For instance, in 2023, CrossAmerica reported that its dedicated support teams contributed to a 15% reduction in average issue resolution time for its wholesale partners.

Having direct contact points streamlines communication, allowing for quicker problem-solving and a more efficient operational flow for all parties involved.

CrossAmerica actively partners with its retail sites and independent dealers to drive operational enhancements and foster business development. This collaborative spirit is key to boosting the collective performance and expansion of their ventures.

A prime example of this teamwork is seen in strategic site conversions, where joint efforts are made to optimize and grow these locations. In 2024, CrossAmerica's focus on these partnerships is expected to yield significant improvements in efficiency and market reach.

Investor Engagement and Transparency

CrossAmerica Partners actively cultivates robust relationships with its limited partners and the broader financial community. This is primarily accomplished through consistent communication channels designed to foster trust and provide clarity on operational performance and strategic direction. For instance, in 2024, the company continued its practice of holding regular investor calls, offering a direct forum for dialogue and inquiry.

Transparency is a cornerstone of CrossAmerica's investor relations strategy. The company provides detailed financial reports, ensuring stakeholders have access to comprehensive data regarding its financial health and operational achievements. This commitment to openness is further reinforced through timely news releases, keeping the market informed of significant developments. As of the latest reporting periods in 2024, these efforts aim to equip investors with the necessary information for informed decision-making.

- Regular Investor Calls: Providing a platform for direct engagement with management.

- Detailed Financial Reports: Offering in-depth insights into company performance.

- News Releases: Communicating timely updates on strategic initiatives and financial results.

- Investor Relations Website: Serving as a central hub for all stakeholder information.

Responsive Problem Solving and Service

CrossAmerica Partners is dedicated to offering prompt service and effective problem-solving for its extensive network of fuel distribution sites and retail locations. This focus on responsiveness is crucial for ensuring uninterrupted fuel supply and seamless retail operations.

By swiftly addressing any operational hurdles, CrossAmerica maintains the efficiency of its supply chain, directly impacting the reliability of its partners. For instance, in 2024, the company reported a focus on optimizing its logistics to reduce delivery times, a key component of its service promise.

- Responsive Service: Swiftly addressing inquiries and issues from franchise partners and company-operated sites.

- Problem Resolution: Implementing efficient solutions for logistical or operational challenges in fuel distribution.

- Partnership Strength: Building trust and ensuring reliability through consistent and effective support.

- Operational Efficiency: Maintaining smooth fuel flow and retail site functionality through proactive service.

CrossAmerica's customer relationships are built on strong, long-term contractual agreements with independent dealers and branded fuel partners, ensuring a stable supply chain and predictable revenue. This strategic focus on enduring partnerships continued to be a cornerstone of their business in 2024, providing a reliable foundation for their extensive distribution network.

The company also emphasizes dedicated account management and collaborative business development with its retail sites and independent dealers. This direct engagement and joint effort in areas like site conversions aim to optimize operations and foster mutual growth, as seen in their ongoing efforts in 2024 to improve efficiency and market reach.

Furthermore, CrossAmerica maintains robust relationships with limited partners and the financial community through transparent communication, including regular investor calls and detailed financial reporting. This commitment to openness, reinforced by timely news releases in 2024, ensures stakeholders are well-informed for effective decision-making.

Channels

CrossAmerica's direct sales force and business development team are crucial for growth, actively seeking new independent dealer partners and branded relationships. This proactive approach ensures the company’s distribution network continuously expands.

This dedicated team manages the entire outreach process, from initial contact to negotiating vital supply agreements. Their efforts are directly responsible for building and strengthening CrossAmerica's extensive network of partners.

By engaging directly, CrossAmerica can offer highly customized solutions to potential partners, fostering robust relationships. This personalized strategy is key to securing long-term, mutually beneficial agreements.

CrossAmerica's network of owned and leased retail sites acts as its primary conduit to customers, offering both fuel and convenience items. These locations, whether company-managed or leased, are the most direct and visible way the company interacts with the public. In 2024, CrossAmerica operated approximately 1,700 sites across 37 states, underscoring the breadth of this crucial channel.

The strategic conversion of sites, a key element of their business model, further strengthens this retail channel by optimizing product offerings and customer experience. These physical touchpoints are vital for driving sales of both motor fuels and the diverse range of convenience store merchandise.

The online dealer portal serves as a crucial digital channel for CrossAmerica's independent operators, providing them with 24/7 access to vital business metrics and reporting. This platform significantly boosts efficiency by allowing partners to conveniently manage their operations and access information whenever needed.

Industry Conferences and Trade Shows

CrossAmerica Partners leverages industry conferences and trade shows as key channels to connect with stakeholders in the petroleum distribution and convenience retail sectors. These events are crucial for networking, which can lead to new business partnerships and customer acquisition. For instance, participation in events like the National Association of Convenience Stores (NACS) Show allows direct engagement with a significant portion of their target market.

These forums provide CrossAmerica with a platform to showcase its services and value proposition to a concentrated audience. By exhibiting or attending, the company can gain insights into market trends and competitor activities. In 2023, the NACS Show attracted over 1,100 exhibitors and more than 20,000 attendees, offering substantial visibility opportunities.

- Networking Opportunities: Connect with potential partners, suppliers, and clients in a focused environment.

- Service Showcase: Display offerings and innovations to a relevant industry audience.

- Market Intelligence: Gather insights on emerging trends and competitive landscape.

- Brand Reinforcement: Enhance market presence and brand recognition within the petroleum and convenience retail industries.

Investor Relations Website and Financial Media

CrossAmerica Partners LP leverages its investor relations website and financial media to communicate with its financial stakeholders and the broader public. This dedicated online presence, along with strategic engagement with financial news outlets, serves as a primary conduit for disseminating critical company information.

These channels provide direct access to essential documents such as annual reports, quarterly earnings releases, and timely press releases, ensuring transparency. For instance, in their 2024 filings, CrossAmerica detailed their capital allocation strategies and operational performance, offering investors a clear view of the business.

- Investor Relations Website: Serves as a central hub for financial reports, SEC filings, and investor presentations.

- Financial Media Engagement: Utilized for press releases, earnings call transcripts, and interviews to reach a wider audience.

- Transparency: Crucial for building and maintaining investor confidence by providing timely and accurate financial data.

- Information Dissemination: Key for communicating strategic updates, operational highlights, and financial performance to all stakeholders.

CrossAmerica's retail sites are its most direct customer interface, offering fuel and convenience items. In 2024, the company managed approximately 1,700 such locations across 37 states. These sites are essential for driving sales and brand visibility.

The online dealer portal provides independent operators with 24/7 access to business metrics and reporting, enhancing operational efficiency. This digital channel ensures partners can manage their businesses effectively.

Industry conferences and trade shows, such as the NACS Show, are vital for networking and showcasing services to a concentrated audience. These events facilitate new partnerships and market intelligence gathering.

| Channel Type | Description | Key Function | 2024 Data/Example |

|---|---|---|---|

| Retail Sites | Company-owned and leased locations | Direct customer sales (fuel & convenience) | ~1,700 sites across 37 states |

| Online Dealer Portal | Digital platform for independent operators | Operational management & reporting | 24/7 access to business metrics |

| Industry Events | Trade shows and conferences | Networking, market intelligence, brand showcase | NACS Show participation |

Customer Segments

Independent retail fuel station operators form a foundational customer segment for CrossAmerica Partners. These are typically small to medium-sized businesses that own and operate individual gas stations, depending on CrossAmerica for their consistent supply of motor fuels. The company's vast distribution infrastructure and established ties with major fuel brands are critical advantages for these operators.

The success and volume of these independent operators directly influence CrossAmerica's wholesale fuel sales. In 2024, the fuel distribution industry continued to see steady demand, with independent operators playing a vital role in reaching diverse geographic markets. CrossAmerica's ability to reliably deliver fuel to these locations underpins their operational viability and contributes significantly to CrossAmerica's overall revenue streams.

Branded fuel companies like ExxonMobil, BP, and Shell are crucial customer segments for CrossAmerica Partners. These major brands rely on CrossAmerica's extensive distribution network to get their products to market, making them key partners and, in a way, customers. CrossAmerica's infrastructure is vital for extending the reach of these established fuel providers.

These partnerships are typically long-term, fostering a mutually beneficial relationship where CrossAmerica's logistical capabilities support the brand's market presence. For instance, CrossAmerica's role in distributing fuel for these brands directly contributes to their sales volumes and market share. In 2023, CrossAmerica distributed approximately 3.4 billion gallons of fuel, a significant portion of which was for branded customers.

CrossAmerica's company-operated retail sites are a crucial customer segment, acting as direct purchasers of fuel and merchandise from its wholesale operations. The financial performance of these sites, measured by fuel volumes and merchandise gross profit, is a key driver of the company's overall retail segment results. In 2024, CrossAmerica continued its strategy of converting acquired sites into company-operated locations, further solidifying this internal customer base.

Commercial and Industrial Businesses

CrossAmerica Partners serves commercial and industrial (C&I) businesses by distributing not only motor fuels but also a range of lubricants and other specialized petroleum products. This approach broadens their market reach beyond individual consumers and traditional gas stations. In 2024, the company continued to leverage its extensive distribution network to meet the unique demands of these industrial clients.

This C&I segment is crucial for CrossAmerica's diversification strategy, reducing reliance on the more volatile retail fuel market. These businesses, from manufacturing plants to transportation companies, often require bulk deliveries and specific product formulations tailored to their operational needs. For instance, their lubricant offerings cater to machinery requiring high-performance protection in demanding environments.

The company's commitment to this sector is reflected in its operational focus. In the first quarter of 2024, CrossAmerica reported that its wholesale and commercial segment contributed significantly to its overall revenue, highlighting the importance of these industrial relationships. This segment often involves long-term contracts and consistent demand, providing a stable revenue stream.

- Targeted Distribution: Focuses on delivering specialized petroleum products like lubricants to industrial clients.

- Diversification Benefit: Reduces reliance on retail fuel sales by expanding into a different customer base.

- Specific Needs Fulfillment: Caters to the unique requirements of commercial and industrial operations for petroleum products.

- Revenue Stability: Industrial contracts often provide consistent demand and a stable income source for the company.

Real Estate Investors and Developers

CrossAmerica actively partners with real estate investors and developers looking to acquire or lease properties from its extensive portfolio. These collaborations are crucial for the company's real estate rationalization strategy, directly impacting asset sales and debt management.

These relationships are not just transactional; they represent strategic alliances aimed at optimizing CrossAmerica's property holdings. By engaging with these market players, CrossAmerica can efficiently divest non-core assets and enhance its financial flexibility.

- Strategic Partnerships: Collaborates with investors and developers for property acquisition and leasing.

- Financial Impact: Transactions contribute to asset sales gains and debt reduction.

- Portfolio Optimization: Key players in streamlining CrossAmerica's real estate assets.

- Market Engagement: Leverages external expertise to maximize property value.

CrossAmerica Partners serves a diverse customer base, including independent retail fuel station operators who rely on its extensive distribution network for motor fuels. Branded fuel companies, such as ExxonMobil and BP, also depend on CrossAmerica's infrastructure to reach consumers. Additionally, the company's own company-operated retail sites act as internal customers, purchasing fuel and merchandise.

Beyond retail, CrossAmerica supplies commercial and industrial (C&I) businesses with motor fuels, lubricants, and specialized petroleum products, diversifying its revenue streams. The company also engages with real estate investors and developers to manage and optimize its property portfolio.

| Customer Segment | Key Role | 2024 Focus/Data Point |

|---|---|---|

| Independent Retail Fuel Operators | Consistent fuel supply | Vital for reaching diverse markets |

| Branded Fuel Companies | Distribution partner | 3.4 billion gallons distributed in 2023 |

| Company-Operated Retail Sites | Internal fuel/merchandise purchaser | Strategy to convert acquired sites |

| Commercial & Industrial (C&I) Businesses | Specialized petroleum product consumer | Wholesale/commercial segment a significant revenue contributor in Q1 2024 |

| Real Estate Investors/Developers | Property acquisition/leasing partners | Key to asset sales and debt management |

Cost Structure

Fuel procurement is the largest expense for CrossAmerica, directly tied to the fluctuating prices of crude oil and refined products. In 2024, the company's cost of goods sold, heavily influenced by these fuel purchases, represented a significant portion of its revenue, underscoring the importance of effective sourcing and hedging strategies to protect gross margins.

CrossAmerica Partners' cost structure heavily relies on real estate, encompassing acquisition, leasing, and ongoing maintenance for its extensive network of properties. These expenses are critical to its operational footprint.

In 2024, the company's commitment to optimizing these significant real estate expenditures is evident through its rationalization efforts. This strategic approach aims to streamline operations and reduce associated costs.

Beyond direct property expenses, depreciation and potential impairment charges on these assets also factor into the overall cost structure, impacting financial statements and requiring careful management.

CrossAmerica Partners incurs substantial costs for transporting and delivering fuel and petroleum products throughout its extensive distribution network. These expenses encompass fuel for its fleet, ongoing vehicle maintenance, and the overall management of logistics operations.

In 2024, efficient logistics management is paramount for CrossAmerica to control costs and ensure the timely supply of products to its customers. For instance, the company's capital expenditures on its fleet and distribution infrastructure directly impact these transportation and logistics expenses.

Operational Expenses for Retail Sites

CrossAmerica Partners LP's retail segment faces significant operational expenses for its company-operated convenience stores. These costs include essential elements like employee wages, electricity and other utility bills, the ongoing cost of stocking merchandise, and various other site-specific overheads necessary for day-to-day operations.

The company has noted that these operational expenses have seen an increase, directly correlating with its strategic expansion of company-operated retail locations. Effective management of these costs is therefore a critical factor in determining the overall profitability of the retail segment.

- Labor Costs: A primary driver of operating expenses, reflecting wages and benefits for store staff.

- Utilities: Expenses for electricity, gas, water, and other essential services to run the stores.

- Inventory Management: Costs associated with purchasing, storing, and managing merchandise for sale.

- Site Overheads: Includes rent, property taxes, insurance, repairs, and maintenance for each location.

Debt Service and Financing Costs

Interest expenses on its credit facilities, like the CAPL Credit Facility, and other borrowings are a significant cost for CrossAmerica. For instance, in the first quarter of 2024, CrossAmerica reported interest expenses of $49.7 million. These financing costs directly impact the cash available for distribution to unitholders.

High debt levels can indeed put pressure on distributable cash flow. CrossAmerica's strategic focus on deleveraging aims to mitigate these financing costs, thereby improving its financial health and strengthening its balance sheet for the future.

- Interest Expense: $49.7 million in Q1 2024.

- Impact: Directly reduces distributable cash flow.

- Strategy: Deleveraging to lower financing costs.

- Goal: Strengthen the balance sheet.

CrossAmerica's cost structure is dominated by fuel procurement, with 2024 data showing cost of goods sold as a significant revenue portion. Real estate expenses, including acquisition and maintenance, are also critical. Transportation and logistics costs, covering fleet operations and delivery, are substantial, as are operational expenses for company-operated convenience stores, such as labor and utilities.

| Cost Category | Key Components | 2024 Relevance/Data |

| Fuel Procurement | Crude oil and refined product prices | Largest expense; impacts gross margins |

| Real Estate | Acquisition, leasing, maintenance | Critical for operational footprint; rationalization efforts |

| Transportation & Logistics | Fleet fuel, maintenance, logistics management | Efficient management key to cost control |

| Retail Operations (Company-Operated Stores) | Labor, utilities, inventory, site overheads | Increased with store expansion; impacts segment profitability |

| Financing Costs | Interest on credit facilities and borrowings | Q1 2024 interest expense: $49.7 million; reduces distributable cash flow |

Revenue Streams

CrossAmerica's primary revenue engine is the wholesale distribution of motor fuels, primarily gasoline and diesel. This segment fuels its operations by supplying both company-owned and independent retail locations.

The financial performance in this area hinges on two key drivers: the sheer volume of fuel sold and the average gross profit earned on each gallon. For instance, in the first quarter of 2024, CrossAmerica reported that its wholesale fuel sales generated substantial revenue, underscoring its foundational role.

CrossAmerica Partners LP generates substantial rental income from its owned and leased real estate, which is then leased to independent operators. This creates a dependable, recurring revenue stream that acts as a valuable addition to its core fuel distribution operations. The company actively manages its real estate assets to maximize this income potential.

CrossAmerica also generates revenue through the wholesale distribution of lubricants and specialized petroleum products. This segment serves a variety of commercial and industrial clients, broadening its income sources beyond just fuel sales. For instance, in 2023, the company reported significant sales in its wholesale fuel and lubricants segment, contributing to its overall financial performance.

Branded Fuel Marketing Fees/Commissions

CrossAmerica Partners, as a significant marketer of branded petroleum products, generates revenue through fees and commissions earned from major oil companies. These earnings stem from their role in distributing and promoting these brands' fuels across their extensive network. This revenue stream is directly linked to their strategic brand partnerships.

In 2024, CrossAmerica's focus on branded fuel marketing continues to be a core component of its business model. The company's ability to leverage its vast infrastructure and established customer relationships allows it to secure favorable terms with brand partners. This strategic alignment ensures a steady flow of income derived from the volume and promotion of specific fuel brands.

- Branded Fuel Marketing Fees: Commissions paid by major oil brands to CrossAmerica for distributing and promoting their fuel products.

- Network Leverage: Fees are earned by utilizing CrossAmerica's extensive network of retail locations and distribution capabilities.

- Brand Partnerships: Revenue is directly tied to the agreements and relationships established with specific petroleum brands.

Gains from Strategic Asset Sales

CrossAmerica Partners (CAPL) actively manages its real estate portfolio, strategically divesting non-core or underperforming assets. These sales generate significant gains, bolstering the company's financial health.

In 2024, such strategic asset sales are a crucial revenue stream, providing capital that can be directed towards reducing debt or funding new growth initiatives. This dynamic component directly enhances net income and overall financial flexibility.

- Real Estate Rationalization: Ongoing sales of underutilized or non-strategic properties.

- Capital Generation: Proceeds from sales are used for debt reduction and reinvestment.

- Net Income Enhancement: Gains from these transactions directly contribute to profitability.

- Financial Flexibility: Provides a flexible source of capital for strategic opportunities.

CrossAmerica's revenue streams are diverse, anchored by wholesale fuel distribution, which saw robust performance in early 2024. Complementing this is significant rental income from leased real estate to independent operators, providing a steady, recurring income. The company also benefits from fees and commissions earned through branded fuel marketing agreements with major oil companies, leveraging its extensive distribution network.

| Revenue Stream | Description | Key Drivers | 2024 Data Highlight |

|---|---|---|---|

| Wholesale Fuel Distribution | Sales of gasoline and diesel to retail locations. | Volume sold, gross profit per gallon. | Substantial revenue generated in Q1 2024. |

| Rental Income | Leasing owned and leased real estate to operators. | Real estate portfolio management, lease terms. | Dependable, recurring income stream. |

| Branded Fuel Marketing | Fees and commissions from major oil companies. | Brand partnerships, network utilization. | Core component of business model in 2024. |

| Lubricants & Specialty Products | Wholesale distribution to commercial/industrial clients. | Sales volume to diverse client base. | Significant sales reported in 2023. |

| Real Estate Asset Sales | Proceeds from divesting non-core properties. | Strategic asset management, market conditions. | Crucial for capital generation in 2024. |

Business Model Canvas Data Sources

The CrossAmerica Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and financial performance metrics. These diverse data sources ensure a robust and accurate representation of the company's strategic framework.