CrossAmerica PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrossAmerica Bundle

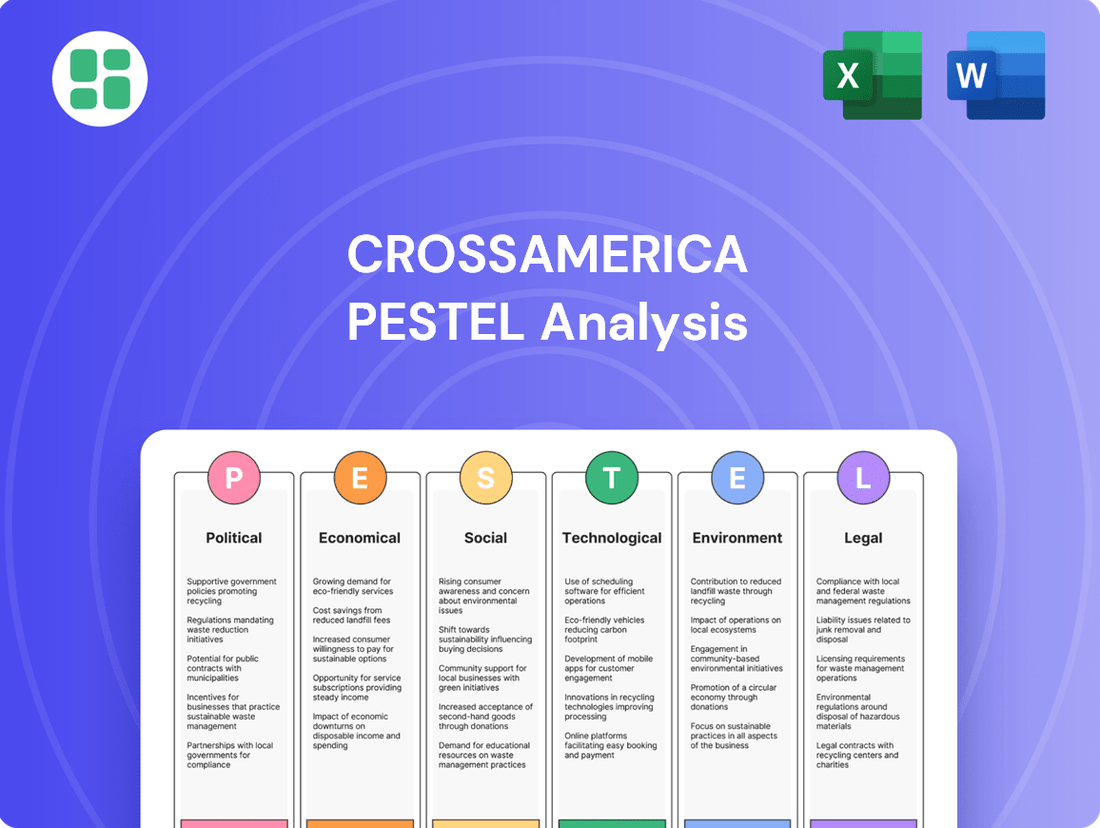

Navigate the complex external forces shaping CrossAmerica's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage. Download the full PESTLE analysis now for a deeper understanding.

Political factors

Government policies on fuel standards, renewable fuel mandates, and excise taxes significantly shape CrossAmerica Partners' operational costs and product distribution. For instance, the Environmental Protection Agency's (EPA) Renewable Fuel Standard (RFS) mandates the blending of renewable fuels like ethanol into the nation's gasoline supply. In 2024, the EPA proposed increasing the total renewable fuel volumes for 2025, signaling a continued push towards biofuels which can affect the demand for traditional gasoline and diesel fuels CrossAmerica distributes.

Shifts in these regulations, such as the implementation or modification of low-carbon fuel standards in various states, directly influence supply chain logistics and CrossAmerica's profitability. These standards can create opportunities for distributing alternative fuels but also require adaptation in infrastructure and product offerings. The evolving regulatory environment necessitates ongoing strategic adjustments to maintain competitiveness and compliance.

Federal and state governments are increasingly implementing mandates to accelerate the energy transition, directly impacting demand for traditional motor fuels. For instance, by 2035, California aims for all new passenger car sales to be zero-emission vehicles, a significant policy shift that will gradually reduce gasoline consumption. CrossAmerica Partners needs to closely track these legislative developments, including potential federal incentives for electric vehicle infrastructure and mandates for renewable diesel or other alternative fuels.

Fluctuations in fuel taxes at federal, state, and local levels directly impact the retail price of gasoline and diesel. For instance, in 2024, the federal excise tax on gasoline remains at 18.4 cents per gallon, while state taxes vary significantly, with California’s reaching over 60 cents per gallon. These changes directly influence consumer demand and CrossAmerica's sales volumes.

Subsidies for alternative fuels or infrastructure, such as those supporting electric vehicle charging stations or renewable diesel production, could gradually shift market dynamics away from traditional fuel distribution. While these may not directly benefit CrossAmerica's core business, understanding their impact on overall energy consumption is crucial for long-term strategic planning.

Monitoring these fiscal policies is essential for financial forecasting and strategic planning. For example, any proposed increase in federal fuel taxes, as debated in infrastructure discussions, could necessitate adjustments to CrossAmerica's pricing strategies and inventory management to mitigate potential impacts on sales volume.

Geopolitical Stability

Global geopolitical events, especially those impacting oil-producing nations, directly influence crude oil prices, consequently affecting the wholesale costs of motor fuels. For instance, in early 2024, ongoing conflicts in Eastern Europe and the Middle East contributed to Brent crude oil prices fluctuating around $80-$90 per barrel, impacting fuel distribution costs.

Supply disruptions or international trade disagreements can introduce significant market uncertainty. CrossAmerica Partners, as a fuel distributor, faces exposure to these price fluctuations, which can alter their procurement expenses and pricing approaches.

- Price Volatility: Geopolitical instability can lead to sharp swings in crude oil prices, impacting CrossAmerica's cost of goods sold.

- Supply Chain Risks: Trade disputes or regional conflicts can disrupt fuel supply routes, potentially affecting delivery schedules and availability.

- Strategic Adjustments: The company must adapt its purchasing and pricing strategies to navigate these unpredictable market conditions.

Infrastructure Spending

Government investment in transportation infrastructure, like roads and bridges, directly influences motor fuel demand by enabling more vehicle travel. For example, the Infrastructure Investment and Jobs Act, enacted in 2021, allocates substantial funds towards these areas, with over $110 billion dedicated to roads, bridges, and other major projects. CrossAmerica Partners needs to monitor how these federal and state spending plans align with their existing distribution and retail network, as a shift towards public transit or electric vehicle charging infrastructure could reduce reliance on traditional fuels.

The allocation of infrastructure funds is a critical factor for CrossAmerica.

- Increased spending on roads and bridges generally supports demand for motor fuels.

- Investments favoring public transit or EV charging may signal a long-term decrease in traditional fuel infrastructure needs.

- CrossAmerica's strategy must consider how infrastructure spending aligns with its current distribution and retail network.

Government policies continue to shape the energy landscape, with mandates for renewable fuels like ethanol and biodiesel influencing demand for traditional motor fuels. For instance, the EPA's 2024 proposal to increase renewable fuel volumes for 2025 signals a sustained push towards biofuels. State-level initiatives, such as California's 2035 zero-emission vehicle sales target, also represent significant long-term shifts impacting fuel consumption patterns.

Federal and state fuel taxes remain a key factor, directly affecting retail prices and consumer demand. In 2024, the federal gasoline excise tax stands at 18.4 cents per gallon, while state taxes vary widely, with some exceeding 60 cents per gallon. These tax structures are critical for CrossAmerica's pricing strategies and sales volume projections.

Investments in transportation infrastructure, like the over $110 billion allocated to roads and bridges under the Infrastructure Investment and Jobs Act, generally support motor fuel demand. However, a growing focus on public transit and electric vehicle charging infrastructure could gradually reduce reliance on traditional fuels, requiring strategic adaptation from distributors like CrossAmerica.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CrossAmerica, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify opportunities within CrossAmerica's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the external landscape impacting CrossAmerica.

Economic factors

Crude oil price volatility directly impacts CrossAmerica Partners' operational costs, as it's the main driver of wholesale gasoline and diesel prices. For instance, during 2024, crude oil prices saw significant swings, with Brent crude averaging around $80-$85 per barrel for much of the year, impacting fuel procurement costs. This fluctuation necessitates robust inventory management and dynamic pricing to protect profit margins.

Geopolitical events and OPEC+ decisions heavily influence these price swings. In late 2024, renewed tensions in the Middle East and continued production adjustments by OPEC+ led to periods of sharp price increases, pushing Brent crude briefly above $90 per barrel. CrossAmerica must be prepared to adapt its strategies rapidly to these external shocks to maintain profitability.

Inflationary pressures directly impact CrossAmerica Partners by increasing their operational expenses. For instance, the cost of diesel fuel, a critical component for their transportation and distribution network, saw significant volatility throughout 2024. Higher inflation also means increased costs for maintaining their extensive network of gas stations and convenience stores, affecting everything from utilities to repair services.

Furthermore, widespread inflation can reduce consumer discretionary spending, potentially leading to lower demand for motor fuels at CrossAmerica's retail locations. As of late 2024, average gasoline prices have remained elevated compared to previous years, a trend that could strain consumer budgets and impact fuel volumes.

The challenge for CrossAmerica lies in absorbing these rising input costs without alienating customers through price hikes. Balancing competitive pricing for motor fuels and convenience store products against the backdrop of increasing operational expenditures is a crucial economic tightrope they must walk.

Consumer spending habits are a significant driver for CrossAmerica Partners, as economic health and consumer confidence directly impact discretionary travel and commuting patterns, which in turn affect motor fuel demand. A slowdown in consumer spending or a notable shift towards more fuel-efficient vehicles could lead to reduced sales volumes for the company. For instance, in early 2024, consumer confidence indices showed some volatility, reflecting ongoing economic uncertainties that can influence travel decisions.

Interest Rate Environment

The interest rate environment significantly impacts CrossAmerica Partners' financial operations. Changes in benchmark rates directly affect the cost of borrowing for capital-intensive projects, like expanding their retail network or modernizing existing fuel stations. For instance, if the Federal Reserve raises the federal funds rate, CrossAmerica's interest expenses on new debt will likely increase, potentially reducing profitability.

Higher interest rates can also indirectly influence CrossAmerica's business by affecting consumer spending patterns. When borrowing costs rise for consumers, it can lead to a slowdown in new vehicle sales, which in turn may decrease overall demand for fuel. This dynamic requires careful monitoring of central bank pronouncements and their anticipated impact on economic activity.

As of mid-2024, the Federal Reserve has maintained a relatively stable interest rate policy, though discussions around potential rate adjustments are ongoing. For example, the federal funds rate target range has remained at 5.25%-5.50% for a considerable period, but market participants are closely watching for any shifts that could signal future changes. This stability, while beneficial, necessitates continued vigilance regarding monetary policy shifts that could alter borrowing costs and consumer demand for fuel.

- Borrowing Costs: Higher interest rates directly increase the cost of debt for CrossAmerica, impacting the financial feasibility of expansion and infrastructure upgrades.

- Consumer Demand: Elevated interest rates can dampen consumer spending on big-ticket items like vehicles, potentially leading to lower fuel consumption.

- Monetary Policy: Close observation of central bank actions, such as Federal Reserve rate decisions, is crucial for forecasting future borrowing costs and economic conditions.

- Capital Expenditures: The cost of financing capital expenditures is directly tied to prevailing interest rates, influencing the pace and scale of CrossAmerica's growth initiatives.

Economic Growth Forecasts

Overall economic growth is a critical driver for CrossAmerica Partners, directly influencing industrial activity, commercial transportation, and consumer travel, all of which boost demand for motor fuels. A robust economy generally means increased fuel consumption, which benefits CrossAmerica's core business. For instance, the U.S. GDP growth was projected to be around 2.3% for 2024, indicating a supportive economic environment for fuel demand.

CrossAmerica Partners' financial performance is intrinsically linked to both national and regional economic trends. Therefore, macroeconomic forecasts are essential for shaping the company's strategic planning and outlook. The International Monetary Fund (IMF) projected global GDP growth of 3.2% for both 2024 and 2025, suggesting a generally stable, albeit moderate, global economic backdrop that should underpin fuel demand.

Key economic indicators to monitor include:

- GDP Growth: Continued positive GDP growth in the U.S. supports higher industrial and consumer spending, directly impacting fuel volumes.

- Inflation Rates: While high inflation can dampen consumer spending, moderate inflation can sometimes accompany economic expansion, requiring careful monitoring of its impact on operating costs and consumer purchasing power.

- Unemployment Figures: Low unemployment rates generally correlate with higher consumer confidence and spending, leading to increased demand for transportation fuels.

- Industrial Production: Growth in industrial output signifies increased activity in sectors that heavily rely on transportation and energy, benefiting CrossAmerica.

Economic factors significantly influence CrossAmerica Partners' profitability through fuel prices, operational costs, and consumer spending. Volatile crude oil prices, as seen with Brent crude averaging $80-$85 per barrel in 2024, directly impact procurement costs. Inflation increases operational expenses and can reduce consumer discretionary spending, affecting fuel demand. For instance, elevated gasoline prices in late 2024 strain consumer budgets.

Interest rate policies by central banks, like the Federal Reserve's stable federal funds rate target of 5.25%-5.50% as of mid-2024, affect borrowing costs for expansion. Overall economic growth, with projected U.S. GDP growth around 2.3% for 2024, generally supports fuel demand, though global GDP growth forecasts of 3.2% for 2024-2025 suggest a moderate economic environment.

| Economic Factor | Impact on CrossAmerica Partners | 2024/2025 Data/Trend |

| Crude Oil Prices | Affects wholesale fuel costs and profit margins. | Brent crude averaged $80-$85/barrel in 2024; brief spikes above $90 due to geopolitical events. |

| Inflation | Increases operational expenses; can reduce consumer spending. | Elevated diesel and utility costs; consumer spending impacted by high gasoline prices. |

| Interest Rates | Impacts borrowing costs for capital projects. | Federal funds rate target range 5.25%-5.50% (mid-2024); ongoing monitoring for potential shifts. |

| Economic Growth (GDP) | Drives fuel demand through industrial and consumer activity. | Projected U.S. GDP growth ~2.3% for 2024; global GDP growth forecast 3.2% for 2024-2025. |

Preview the Actual Deliverable

CrossAmerica PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CrossAmerica Partners LP, providing valuable insights for strategic planning.

Sociological factors

Consumer interest in electric vehicles (EVs) is growing significantly, signaling a societal move away from traditional gasoline-powered cars. This shift directly impacts the long-term demand for motor fuels, a core business for companies like CrossAmerica Partners. As of early 2024, EV sales continue to climb, with projections indicating further acceleration in adoption rates over the next few years.

The increasing availability of EV charging stations and the decreasing cost of EVs are making them a more viable option for a broader range of consumers. For instance, by mid-2024, the number of public charging ports in the US had surpassed 150,000, a substantial increase from previous years. This expanding infrastructure makes EV ownership more practical, further encouraging the transition and potentially reducing reliance on fossil fuels at retail locations.

CrossAmerica Partners must closely track these evolving consumer preferences and technological advancements. Proactive strategies, such as exploring opportunities to integrate EV charging services at their existing retail sites or diversifying into alternative energy solutions, will be crucial for adapting to this evolving market landscape and ensuring sustained business relevance.

Public awareness regarding climate change and environmental sustainability is on the rise, significantly shaping consumer behavior. This growing concern is leading individuals to favor greener options, such as driving less or choosing vehicles with better fuel economy. For instance, a 2024 survey indicated that 65% of consumers consider environmental impact when making purchasing decisions, a notable increase from previous years.

This societal trend directly impacts industries reliant on traditional energy sources, potentially diminishing demand for petroleum products. CrossAmerica Partners, as a distributor of motor fuels, must recognize this evolving consumer mindset. Adapting their brand perception and future business strategies to align with these environmental values will be crucial for long-term relevance and success.

The rise of remote and hybrid work models, accelerated by events in 2020, has significantly altered commuting habits. For instance, a 2023 U.S. Bureau of Labor Statistics report indicated that approximately 29% of workers were working remotely at least some of the time. This shift directly reduces the frequency of daily commutes, potentially leading to lower gasoline demand at CrossAmerica's retail sites.

Urbanization continues to influence transportation choices, with ongoing investments in public transit infrastructure in many metropolitan areas. As of 2024, cities like New York and Chicago continue to expand their public transportation networks, offering alternatives to personal vehicle use. This sociological trend can further decrease reliance on fuel for daily travel, impacting sales volumes for fuel distributors.

Demographic Changes

Demographic shifts are a significant driver for CrossAmerica Partners, impacting regional fuel demand. Population growth, particularly in Sun Belt states, is projected to continue, with the U.S. Census Bureau estimating a 7.9% population increase by 2030, reaching over 360 million. This growth, coupled with evolving age distributions, directly influences how and where fuel is consumed.

The age distribution within the U.S. presents a nuanced picture for fuel demand. While an aging population, with the proportion of those 65 and older expected to reach 21.7% by 2030 according to the U.S. Census Bureau, may lead to a slight decrease in overall vehicle miles traveled per capita, this is offset by other trends.

Migration patterns, especially the ongoing movement towards suburban and exurban areas, are crucial for CrossAmerica. This trend often correlates with increased reliance on personal vehicles, boosting demand for gasoline and diesel fuel. For example, data from the U.S. Department of Transportation indicated a rise in vehicle miles traveled in non-metropolitan areas in recent years, a pattern that supports CrossAmerica's distribution network.

- Population Growth: U.S. population projected to exceed 360 million by 2030, increasing overall fuel consumption potential.

- Aging Population: While potentially reducing per capita travel, this segment still requires fuel for essential mobility and services.

- Suburbanization: Expansion into suburban and exurban areas drives higher vehicle miles traveled, benefiting fuel retailers.

- Regional Demand: Understanding these demographic shifts allows CrossAmerica to strategically position its retail sites and optimize distribution to meet localized demand fluctuations.

Health and Safety Perceptions

Public perception of fuel handling, storage, and emissions significantly shapes regulatory environments and local acceptance of fuel retail locations. For CrossAmerica Partners, negative incidents or media coverage concerning environmental impacts or safety lapses can damage its reputation and jeopardize operational permits.

Maintaining stringent safety protocols and open communication is paramount to mitigating these risks. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations aimed at reducing emissions from transportation fuels, impacting how companies like CrossAmerica operate and manage their retail sites.

- Public Sentiment: A growing public awareness of climate change and environmental justice can increase scrutiny on fuel infrastructure.

- Regulatory Impact: Perceived safety risks can lead to stricter zoning laws and permitting processes for new or existing fuel stations.

- Reputational Risk: Safety incidents, even minor ones, can generate negative press, affecting consumer trust and investor confidence.

- Operational Costs: Enhanced safety measures and compliance with evolving environmental standards often translate to increased operational expenditures.

Societal shifts towards sustainability and environmental consciousness are profoundly influencing consumer behavior and, consequently, the demand for traditional fuels. The increasing adoption of electric vehicles, supported by growing charging infrastructure, presents a significant challenge to fossil fuel distributors like CrossAmerica Partners. For example, by mid-2024, the U.S. had over 150,000 public EV charging ports, a number expected to rise substantially.

Demographic trends, including population growth in certain regions and evolving age distributions, directly impact fuel consumption patterns. Migration towards suburban areas, for instance, often correlates with increased vehicle miles traveled, benefiting fuel retailers. The U.S. population is projected to surpass 360 million by 2030, suggesting a continued baseline demand for transportation fuels.

Public perception regarding the safety and environmental impact of fuel handling and emissions plays a crucial role in shaping regulatory landscapes and operational viability. Negative sentiment or incidents can lead to stricter regulations and increased operational costs. For instance, the EPA's continued enforcement of emission standards in 2023 affects how fuel distributors manage their retail sites.

Technological factors

The rapid expansion of electric vehicle (EV) charging technology presents a significant shift for traditional fuel retailers like CrossAmerica Partners. As EV adoption accelerates, the demand for accessible charging infrastructure will grow, potentially altering the primary function of many current fuel stations.

CrossAmerica needs to evaluate the strategic implications of incorporating EV charging into its network of owned and leased sites. For instance, by the end of 2024, it's projected that over 1.5 million public charging points will be available in the US, a substantial increase from previous years, highlighting the market's growth trajectory.

This technological evolution offers an opportunity to transform existing retail locations into comprehensive energy hubs, catering to a broader range of consumer needs beyond just gasoline and diesel. Such a move could ensure CrossAmerica's continued relevance and profitability in a transitioning energy landscape.

Advancements in alternative fuels like hydrogen, biofuels, and synthetic fuels, along with their distribution infrastructure, pose both threats and opportunities for CrossAmerica Partners. While these are currently niche markets, significant technological breakthroughs could dramatically shift demand away from traditional gasoline and diesel in the long term. For instance, the U.S. Department of Energy aims to reduce the cost of green hydrogen production by 80% to $1 per kilogram by 2030, a development that could accelerate the transition.

CrossAmerica Partners needs to closely monitor these evolving technologies. A failure to adapt could lead to a decline in demand for their core products. Conversely, strategic investments or partnerships in alternative fuel infrastructure could open new revenue streams. The global alternative fuels market was valued at approximately $1.2 trillion in 2023 and is projected to grow significantly, highlighting the potential scale of this shift.

The landscape of digital payment systems is rapidly evolving, with mobile payments and contactless options significantly reshaping the customer experience at fuel retail locations like those operated by CrossAmerica Partners. These advancements are not just about convenience; they are becoming a critical component of operational efficiency and customer satisfaction.

CrossAmerica Partners needs to actively integrate and keep pace with these digital payment innovations. For instance, by mid-2024, it's estimated that over 80% of consumers in developed markets will be using some form of contactless payment, highlighting the urgency for businesses to adapt their infrastructure to accommodate these preferences and streamline transactions.

Supply Chain Optimization Tech

Technological advancements are revolutionizing CrossAmerica Partners' supply chain. Innovations in logistics, inventory management, and route optimization are directly impacting their wholesale distribution efficiency. For instance, the adoption of telematics allows for real-time tracking of their fleet, enabling better management and more efficient delivery routes.

The integration of AI-driven demand forecasting is a key technological factor. This helps CrossAmerica Partners predict fuel demand more accurately, leading to optimized inventory levels and reduced waste. Automated inventory systems further streamline operations, ensuring product availability and minimizing stockouts.

- AI-powered demand forecasting is projected to improve accuracy by up to 15% for fuel distributors by 2025, reducing carrying costs.

- Telematics adoption across the transportation sector has shown an average reduction in fuel consumption by 5-10% through optimized routing.

- Automated inventory systems can decrease stock discrepancies by over 20%, improving order fulfillment rates.

- CrossAmerica Partners' investment in technology aims to cut operational costs, with a target of 5% efficiency gain in logistics by the end of 2024.

Fuel Efficiency Innovations

Ongoing advancements in engine technology are significantly boosting vehicle fuel efficiency, allowing them to cover more miles per gallon. For instance, by early 2024, the average fuel economy for new passenger vehicles in the U.S. reached approximately 26.4 mpg, a steady increase driven by these innovations. This trend, while positive for consumers, can lead to a gradual decrease in overall fuel demand.

CrossAmerica Partners needs to integrate this long-term erosion of fuel demand into its strategic planning and growth forecasts. The company's reliance on fuel sales means it must anticipate and adapt to a future where less fuel is consumed per vehicle. This necessitates exploring diversification strategies and optimizing distribution networks to maintain profitability.

- Technological Advancement: Continued innovation in internal combustion engines and the rise of more efficient hybrid powertrains are key drivers.

- Demand Impact: Improved fuel economy directly translates to lower per-mile fuel consumption, potentially dampening overall demand growth for gasoline and diesel.

- Strategic Consideration: CrossAmerica must evaluate how these efficiency gains will affect its long-term revenue streams and consider investments in alternative energy or related services.

The accelerating adoption of electric vehicles (EVs) necessitates CrossAmerica Partners' strategic integration of EV charging infrastructure. By the close of 2024, the U.S. is expected to have over 1.5 million public charging points, a significant increase underscoring the growing demand for alternative fueling solutions.

Technological advancements in alternative fuels such as hydrogen and biofuels also present both challenges and opportunities, with the U.S. Department of Energy targeting a substantial reduction in green hydrogen costs by 2030. Furthermore, the widespread adoption of digital payment systems, with over 80% of consumers in developed markets expected to use contactless payments by mid-2024, requires CrossAmerica to enhance its payment infrastructure for improved customer experience and operational efficiency.

| Technology | Impact on CrossAmerica | 2024/2025 Data/Projection |

|---|---|---|

| EV Charging Infrastructure | Opportunity to diversify revenue, transform sites into energy hubs | Over 1.5 million U.S. public charging points by end of 2024 |

| Alternative Fuels (Hydrogen, Biofuels) | Potential long-term shift away from traditional fuels | U.S. DOE aims for $1/kg green hydrogen by 2030 |

| Digital Payments | Enhanced customer experience, operational efficiency | >80% contactless payment usage in developed markets by mid-2024 |

Legal factors

CrossAmerica Partners navigates a complex web of environmental regulations, including the Clean Air Act and Clean Water Act, impacting its fuel operations. Compliance with these federal, state, and local laws, particularly those concerning underground storage tanks (USTs), is paramount to avoid substantial penalties and legal entanglements. The company's commitment to continuous monitoring and investment in environmental compliance measures is a critical operational necessity.

Federal and state regulations, such as those from the Environmental Protection Agency (EPA) and state-level environmental agencies, set stringent fuel quality standards for motor fuels. These standards cover critical aspects like octane ratings, maximum sulfur content, and mandated additive packages, ensuring environmental protection and engine performance.

CrossAmerica Partners is legally obligated to ensure all motor fuels it distributes adhere to these precise specifications. Non-compliance can lead to significant penalties, including substantial fines and potential operational disruptions, which could impact their 2024 revenue streams. Maintaining legal compliance is fundamental to their operational integrity and safeguarding consumer confidence.

To meet these requirements, CrossAmerica Partners implements rigorous quality control and regular testing protocols throughout its supply chain. For instance, the EPA's Renewable Fuel Standard (RFS) mandates the blending of renewable fuels, and adherence to these blending percentages is a key compliance area that requires constant monitoring.

CrossAmerica Partners, operating numerous retail locations and a distribution network, navigates a complex web of labor and employment laws. These include federal and state regulations concerning minimum wage, overtime, workplace safety as mandated by OSHA, and anti-discrimination statutes. For instance, in 2024, the national minimum wage remains $7.25 per hour, but many states and cities have enacted higher rates, impacting CrossAmerica's payroll expenses across different operating regions.

Shifts in labor legislation, such as potential increases in minimum wage or changes to independent contractor versus employee classifications, directly influence CrossAmerica's operational costs and human resource strategies. The growing trend of unionization in various sectors also presents a factor that could affect employee relations and collective bargaining agreements, potentially altering compensation and benefits structures.

Real Estate Zoning Regulations

Real estate zoning regulations significantly influence CrossAmerica Partners' operations, as many of its retail locations are owned or leased properties. These local ordinances, land use restrictions, and building codes directly affect the company's capacity for expansion, renovation, and the development of new sites. Navigating these legal frameworks is paramount for securing permits and sidestepping potential legal entanglements with local authorities and communities.

Compliance with zoning laws is not merely a procedural step but a critical factor in CrossAmerica's strategic growth. For instance, a proposed new fueling station or a significant upgrade to an existing convenience store must align with the specific zoning classifications of the municipality. Failure to adhere to these regulations can lead to costly delays, fines, or even the outright denial of essential development permits, impacting the company's ability to capitalize on market opportunities.

The dynamic nature of zoning laws means CrossAmerica must maintain constant vigilance and adapt its site development strategies accordingly. As of early 2024, municipalities continue to update their land use plans, often with increased emphasis on environmental considerations and community impact assessments. These evolving legal landscapes require proactive engagement and careful planning to ensure long-term operational viability and regulatory adherence.

- Zoning Impact: Local zoning ordinances dictate permissible land uses, building heights, and setback requirements for CrossAmerica's retail sites.

- Expansion Hurdles: Restrictions can limit the size and scope of new construction or renovations, potentially delaying or preventing growth initiatives.

- Permitting Process: Obtaining necessary permits is contingent on strict adherence to building codes and land use regulations, a process that can be time-consuming.

- Legal Compliance: Non-compliance can result in fines, litigation, and reputational damage, underscoring the importance of diligent legal oversight.

Antitrust Enforcement

Antitrust enforcement remains a critical legal factor for CrossAmerica Partners. The wholesale distribution and retail petroleum sectors are heavily regulated by laws aimed at preventing monopolistic practices, price collusion, and other forms of unfair competition. For instance, the Federal Trade Commission (FTC) actively scrutinizes mergers and acquisitions within the energy sector to ensure they do not stifle competition. In 2023, the FTC continued its robust enforcement actions, reviewing numerous transactions that could impact market dynamics.

CrossAmerica must meticulously ensure its operational strategies, including pricing models and any potential acquisitions, adhere strictly to these antitrust regulations. Failure to comply can trigger costly investigations, protracted legal battles, and substantial financial penalties. Companies in this space often face fines that can run into millions of dollars for violations. For example, in past years, major energy companies have paid significant settlements to resolve antitrust allegations.

- Regulatory Scrutiny: Antitrust laws are designed to prevent market dominance and ensure fair pricing in the petroleum distribution sector.

- Compliance is Key: CrossAmerica's pricing strategies and acquisition plans must align with antitrust guidelines to avert legal challenges and financial repercussions.

- Legal Counsel and Programs: Maintaining strong legal counsel and comprehensive compliance programs is essential for navigating these complex regulations.

- Financial Risk: Violations can lead to severe penalties, including significant fines and potential operational restrictions.

CrossAmerica Partners operates under a stringent legal framework governing fuel quality and environmental standards. Federal regulations like the Clean Air Act and state-specific mandates dictate permissible fuel compositions, including octane ratings and sulfur content, to protect public health and the environment. Compliance with the EPA's Renewable Fuel Standard (RFS), which mandates the blending of renewable fuels, is a critical aspect of operations, with adherence percentages requiring constant monitoring to avoid penalties.

Labor laws significantly impact CrossAmerica's operational costs and human resource strategies. Federal and state minimum wage laws, workplace safety regulations enforced by OSHA, and anti-discrimination statutes are paramount. For instance, the divergence in minimum wage rates across states, with many exceeding the federal $7.25 per hour in 2024, directly affects payroll expenses and requires careful management of compensation structures.

Zoning regulations are critical for CrossAmerica's site development and expansion plans. Local ordinances dictate land use, building requirements, and permit processes for its numerous retail locations. Failure to comply with these evolving land use plans, which often incorporate environmental and community impact assessments as seen in early 2024 updates, can lead to significant delays, fines, and stalled growth initiatives.

Antitrust laws are a key legal consideration, with regulatory bodies like the FTC scrutinizing the petroleum distribution sector for monopolistic practices. CrossAmerica must ensure its pricing and acquisition strategies align with antitrust guidelines to prevent costly investigations and potential penalties, which can amount to millions of dollars for violations as demonstrated by past industry enforcement actions.

Environmental factors

Increasing regulatory pressure to reduce greenhouse gas emissions, such as potential carbon taxes or cap-and-trade systems, could directly impact the cost of producing and distributing fossil fuels. For instance, the U.S. Environmental Protection Agency (EPA) has been progressively tightening emissions standards, with ongoing reviews and potential new regulations for the transportation sector anticipated through 2025.

While CrossAmerica Partners is primarily a distributor, these upstream and downstream regulations can influence market demand for refined products and affect operational costs, including transportation logistics. The company's reliance on existing infrastructure for fossil fuel distribution means it must navigate evolving environmental compliance measures.

Adapting to a lower-carbon economy presents a significant long-term environmental challenge. As of early 2024, the global energy landscape is seeing increased investment in renewable energy sources, which could gradually shift demand away from traditional fossil fuels, impacting distribution volumes over time.

Broader climate change initiatives, like government mandates for renewable energy sources and incentives for electric vehicles, are actively pushing for a reduction in fossil fuel dependency. For instance, the Inflation Reduction Act of 2022 in the United States offers significant tax credits for renewable energy projects and electric vehicle purchases, signaling a strong governmental commitment to this transition.

While these initiatives may not directly regulate CrossAmerica's current operations, they establish a significant macro-environmental trend that could gradually shrink the long-term market demand for their core products, primarily gasoline and diesel fuel. This evolving energy landscape necessitates careful strategic planning to adapt to potential shifts in consumer behavior and energy infrastructure.

CrossAmerica Partners' retail operations, like many in the fuel and convenience store sector, produce a range of waste, from used motor oil and contaminated absorbent materials to everyday trash. Managing this waste effectively is a significant operational consideration.

The company must adhere to stringent environmental regulations concerning the disposal of hazardous waste, which can include materials from vehicle maintenance or spills. Failure to comply can result in substantial fines and reputational damage. For instance, in 2024, the EPA continued to emphasize strict enforcement of hazardous waste regulations across industries, with penalties for non-compliance often reaching tens of thousands of dollars per violation.

In 2024 and into 2025, there's a growing expectation for companies like CrossAmerica to not only comply but also to proactively implement sustainable waste management practices. This includes exploring options for recycling, waste reduction, and responsible disposal methods to minimize environmental impact and demonstrate corporate citizenship.

Resource Depletion Concerns

While CrossAmerica Partners LP, primarily a distributor of motor fuels, might not face an immediate crisis from fossil fuel depletion, the long-term global trend is undeniable. The increasing awareness of finite fossil fuel reserves directly impacts energy policies worldwide, encouraging a significant shift towards renewable energy investments. This environmental factor, though indirect for a distributor, emphasizes the inherent limitations of CrossAmerica's core product, underscoring the strategic imperative for energy diversification and a proactive approach to future energy landscapes.

The global energy market is already showing signs of this transition. For instance, in 2024, investments in renewable energy sources are projected to surpass those in fossil fuels for the first time, with estimates suggesting over $2 trillion globally. This trend is expected to accelerate through 2025 and beyond, driven by government incentives, technological advancements, and growing environmental consciousness.

- Global renewable energy investments are projected to exceed $2 trillion in 2024.

- The International Energy Agency (IEA) forecasts a continued rise in renewable energy's share of the global energy mix, potentially reaching over 50% by 2030.

- Countries are setting ambitious targets for electric vehicle adoption, which will impact demand for traditional motor fuels. For example, by 2030, several major economies aim for 30-50% of new vehicle sales to be electric.

- The finite nature of oil reserves necessitates a long-term strategy for companies reliant on its distribution.

Pollution Control Measures

CrossAmerica Partners faces significant environmental responsibilities, particularly concerning pollution control. The company must comply with stringent regulations governing air and water quality, especially given its operations involving fuel. This includes managing potential emissions from its extensive transportation fleet and preventing fuel spills from its terminals and distribution network. For instance, in 2024, the Environmental Protection Agency (EPA) continued to emphasize reductions in volatile organic compound (VOC) emissions from fuel handling operations, a key area for distributors like CrossAmerica.

To meet these obligations and mitigate risks, CrossAmerica invests in robust pollution control technologies. This involves implementing advanced spill prevention and containment systems at its facilities. Regular maintenance of its transportation equipment, such as trucks and storage tanks, is also critical to minimize leaks and emissions. These proactive measures are not just about compliance; they are essential for protecting natural resources and maintaining the company's operational license and public reputation.

Key pollution control efforts for CrossAmerica Partners include:

- Implementing advanced leak detection and repair (LDAR) programs for storage tanks and pipelines.

- Investing in vapor recovery units at terminals to capture fuel vapors during loading and unloading.

- Ensuring all transportation vehicles meet current emissions standards and undergo regular inspections.

- Maintaining comprehensive emergency response plans and training personnel for spill containment.

Environmental factors present a complex landscape for CrossAmerica Partners, primarily driven by the global shift towards decarbonization and stricter emissions regulations. Growing pressure to reduce greenhouse gases could increase operational costs through potential carbon taxes or cap-and-trade systems, impacting the distribution of refined fuels. The company must navigate evolving compliance measures for its existing infrastructure, while also adapting to a future where renewable energy investments are increasingly favored, potentially reducing long-term demand for fossil fuels.

PESTLE Analysis Data Sources

Our CrossAmerica PESTLE Analysis is grounded in comprehensive data from reputable sources, including government statistics, industry-specific market research, and international economic reports. We meticulously gather information on political stability, economic indicators, technological advancements, societal trends, environmental regulations, and legal frameworks to provide a robust overview.