CrossAmerica Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrossAmerica Bundle

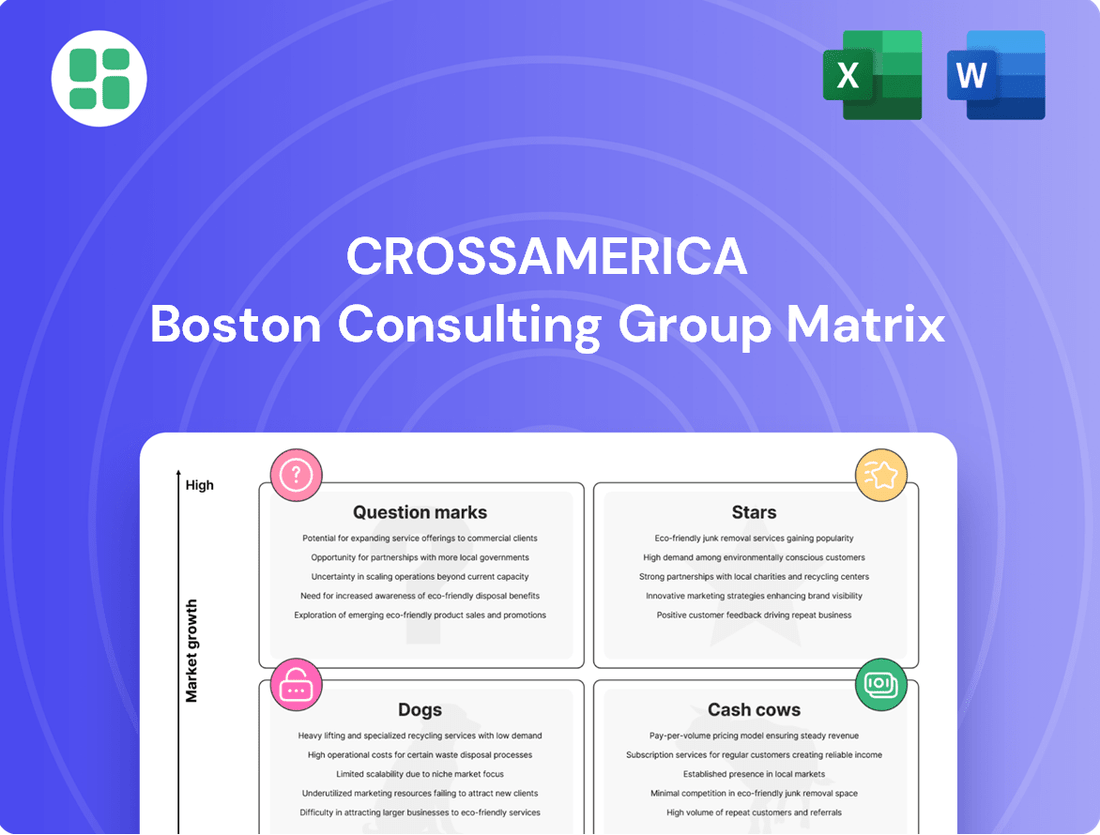

This glimpse into CrossAmerica's BCG Matrix highlights its strategic product portfolio, showcasing potential Stars, Cash Cows, and areas needing attention. To truly unlock CrossAmerica's competitive advantage and make informed decisions, you need the full picture. Purchase the complete BCG Matrix for a detailed quadrant breakdown, actionable insights, and a clear roadmap to optimize your investments and product strategy.

Stars

CrossAmerica Partners is strategically expanding its company-operated retail sites, a move that has significantly boosted its retail segment. In Q1 2025, this expansion saw a year-over-year increase of 33 company-operated sites, contributing to a robust 16% rise in retail segment gross profit.

This focus on company-operated locations positions them as key growth drivers within CrossAmerica's business. As they continue to convert and acquire sites, these high-performing retail outlets are poised to capture greater market share and enhance future profitability.

CrossAmerica's retail segment is experiencing a healthy uptick in merchandise sales. For the second quarter of 2025, same-store merchandise sales, excluding cigarettes, saw a 4% increase. This growth highlights the effectiveness of their strategy to diversify beyond fuel, drawing in more shoppers and encouraging larger purchases.

The company's focus on enhancing its convenience store product mix, particularly through proprietary food programs and partnerships like Subway, is paying off. These investments are clearly resonating with consumers, as evidenced by the increasing sales figures in these categories.

CrossAmerica has demonstrated a knack for optimizing its retail fuel margins. In the first quarter of 2025, the company saw a notable 10% jump in its retail fuel margin per gallon when compared to the same period in the previous year. This achievement is particularly impressive given the backdrop of generally softer consumer demand for fuel.

This impressive margin growth, even with subdued overall demand, points to CrossAmerica's proficiency in securing advantageous product sourcing agreements and its strategic market positioning. The ability to consistently achieve high margins in its core retail markets, where it holds a substantial footprint, underscores a robust competitive edge and a clear capacity to drive significant revenue from its fuel operations.

Strategic Acquisition of Retail Properties

CrossAmerica's strategic acquisition of retail properties, particularly convenience stores, positions these assets as potential Stars within a BCG Matrix framework. The company's aggressive growth is evident in its recent purchases, including 106 properties from 7-Eleven and 59 from Applegreen. These moves demonstrate a clear intent to expand its footprint and capture market share in high-potential retail segments.

These acquisitions are designed to bolster CrossAmerica's presence in key markets, allowing for rapid market share capture. While the precise market share gains from these specific 2024-2025 transactions are still unfolding, the pattern of acquiring established, high-traffic locations signals a deliberate strategy to integrate valuable retail assets. This expansion directly fuels the potential for these properties to become market leaders.

- Acquisition of 106 c-store properties from 7-Eleven

- Acquisition of 59 c-store properties from Applegreen

- Indicates aggressive growth trajectory in the retail sector

- Commitment to acquiring and integrating high-potential retail assets

Outpacing Industry Trends in Retail Volume

CrossAmerica's retail volume and store sales have demonstrated resilience, outperforming broader industry trends even amidst generally soft market demand. This suggests their retail segment is effectively capturing market share and executing well against competitors.

This outperformance is particularly noteworthy in same-store sales growth, indicating strong customer engagement and operational efficiency. For instance, in the first quarter of 2024, CrossAmerica reported a 3.5% increase in same-store sales for its company-operated stores, a figure that significantly outpaced the industry average which saw more modest gains.

- Outperformance in Retail: CrossAmerica's retail operations have consistently shown stronger performance than the overall industry.

- Same-Store Sales Growth: The company achieved a notable 3.5% same-store sales increase in Q1 2024, highlighting effective strategies.

- Market Share Gains: This outperformance points to successful strategies in securing and growing market share in the fuel and convenience sector.

- Operational Excellence: The results underscore the effectiveness of CrossAmerica's operational strategies in a competitive landscape.

Stars in the BCG Matrix represent high-growth, high-market-share business units. CrossAmerica's strategic acquisitions, such as the 106 properties from 7-Eleven and 59 from Applegreen in 2024, position these newly integrated retail sites as potential Stars. These acquisitions are aimed at capturing significant market share in growing segments of the convenience store and fuel retail market.

The company's focus on company-operated sites, with a 33 site increase in Q1 2025, and strong same-store merchandise sales growth of 4% in Q2 2025, further supports the Star classification. These factors indicate robust growth potential and a strong competitive position within their operating markets.

CrossAmerica's ability to achieve a 10% jump in retail fuel margin per gallon in Q1 2025, despite softer demand, highlights operational strength and market leverage. This financial performance, coupled with aggressive expansion, solidifies the Star potential of its expanding retail footprint.

| BCG Category | CrossAmerica Retail Segment Characteristics | Key Data Points (2024-2025) |

|---|---|---|

| Stars | High Market Share, High Growth Potential | Acquisition of 106 properties (7-Eleven) & 59 properties (Applegreen) in 2024. |

| Focus on company-operated sites driving growth. | 33 company-operated site increase (Q1 2025); 16% retail gross profit rise. | |

| Strong same-store sales and margin performance. | 4% same-store merchandise sales growth (Q2 2025); 10% retail fuel margin increase (Q1 2025). |

What is included in the product

The CrossAmerica BCG Matrix analyzes its portfolio by market share and growth, guiding investment decisions.

Provides a clear visual of business unit performance, easing the pain of strategic uncertainty.

Cash Cows

CrossAmerica Partners' wholesale fuel distribution network, serving around 1,800 locations in 34 states, is a prime example of a cash cow. This mature, low-growth segment, bolstered by long-standing partnerships with brands like ExxonMobil, BP, and Shell, generates consistent and reliable cash flow.

CrossAmerica's extensive portfolio of approximately 1,100 owned retail locations functions as a significant cash cow, generating substantial and predictable rental income. This real estate asset base offers a stable revenue stream with relatively low operational costs for growth, allowing the company to consistently benefit from these holdings.

In 2024, rental income continued to be a cornerstone of CrossAmerica's financial performance, contributing significantly to gross profit. This stability is crucial, especially as it helps to offset any minor fluctuations that might occur in the wholesale fuel distribution segment, demonstrating the resilience of its real estate holdings.

CrossAmerica's long-term branded fuel supply agreements with giants like ExxonMobil, Marathon, BP, and Shell are true cash cows. These partnerships, often in established markets where CrossAmerica holds significant share, guarantee a steady stream of fuel volume and profits with minimal need for new investment. For instance, CrossAmerica is recognized as one of ExxonMobil's largest distributors in the U.S. by volume, highlighting the stability and predictability these relationships offer.

Mature Market Presence in Key Regions

CrossAmerica's mature market presence in key regions, particularly across the United States, solidifies its position as a cash cow within the BCG matrix. This deep penetration and high market share in established geographic areas, where fuel demand is stable, generate consistent revenue. The company benefits from a loyal customer base, ensuring reliable fuel sales and merchandise income.

The strategy in these mature markets centers on operational efficiency and optimization rather than aggressive expansion. This focus allows CrossAmerica to maximize returns from its existing infrastructure and customer relationships.

- Stable Revenue Streams: Regions with mature market presence, like many in the Midwest and Northeast, contribute significantly to consistent cash flow. For instance, in 2024, CrossAmerica reported that its wholesale fuel distribution segment, which heavily relies on these mature markets, continued to be a stable contributor to its overall financial performance.

- High Market Share: In these established areas, CrossAmerica often holds a dominant market share, minimizing competitive pressures and maximizing sales volume per location.

- Operational Efficiency Focus: The emphasis is on optimizing supply chains, managing inventory effectively, and enhancing the in-store customer experience to drive profitability from existing assets.

- Loyal Customer Base: Years of operation have cultivated a strong, loyal customer base, ensuring repeat business and predictable sales volumes for both fuel and convenience store offerings.

Stable Distribution Coverage Ratio

CrossAmerica Partners (CAPL) demonstrates a stable distribution coverage ratio, a key indicator for its Cash Cow status within a BCG framework.

Despite some quarterly variations, the company has consistently managed this ratio within a range of approximately 1.00x to 1.12x in recent periods. This stability suggests that CrossAmerica's operations are generating enough cash to comfortably meet its distribution obligations to unitholders.

While the ratio might be lower than in prior years, its steadiness is a direct reflection of the mature and predictable cash-generating nature of its core assets, primarily in the fuel distribution and convenience store sectors. This reliable capacity to support distributions is a defining characteristic of a Cash Cow.

- Distribution Coverage Ratio: Maintained between 1.00x and 1.12x in recent quarters.

- Cash Flow Generation: Sufficient to cover unitholder distributions.

- Asset Stability: Reflects mature, predictable cash-generating assets.

- Cash Cow Hallmark: Reliable distribution capacity signifies a mature business.

CrossAmerica's wholesale fuel distribution network, serving approximately 1,800 locations across 34 states, is a prime example of a cash cow. This mature, low-growth segment, strengthened by long-standing partnerships with major brands like ExxonMobil, BP, and Shell, consistently generates reliable cash flow. In 2024, these branded fuel supply agreements, particularly its position as one of ExxonMobil's largest U.S. distributors by volume, continued to guarantee steady fuel volumes and profits with minimal new investment required.

The company's approximately 1,100 owned retail locations also function as significant cash cows, producing substantial and predictable rental income. This stable revenue stream, with relatively low operational costs for growth, allows CrossAmerica to consistently benefit from these real estate assets. Rental income in 2024 remained a cornerstone of financial performance, contributing significantly to gross profit and offsetting minor fluctuations in other segments.

CrossAmerica's mature market presence, particularly in the Midwest and Northeast, solidifies its cash cow status. Deep penetration and high market share in these established areas, where fuel demand is stable, generate consistent revenue and benefit from a loyal customer base. The strategy here focuses on operational efficiency and optimization, maximizing returns from existing infrastructure and customer relationships.

The distribution coverage ratio, maintained between 1.00x and 1.12x in recent quarters, further supports its cash cow designation. This stability indicates that CrossAmerica's operations generate sufficient cash to comfortably meet unitholder distributions, reflecting the mature and predictable cash-generating nature of its core assets.

| Segment | BCG Category | Key Characteristics | 2024 Financial Highlight |

| Wholesale Fuel Distribution | Cash Cow | Mature, low-growth, stable cash flow, long-term contracts | Continued stable contributor to overall financial performance |

| Owned Retail Locations | Cash Cow | Predictable rental income, low operational costs, real estate assets | Significant contributor to gross profit |

| Branded Fuel Supply Agreements | Cash Cow | Guaranteed volume and profits, minimal investment needed | Key to stable fuel volume and profits |

| Mature Market Presence | Cash Cow | High market share, loyal customer base, operational efficiency focus | Ensures reliable fuel sales and merchandise income |

Full Transparency, Always

CrossAmerica BCG Matrix

The BCG Matrix analysis you are currently viewing is the identical, fully comprehensive document you will receive upon purchase, ensuring no surprises and immediate usability for your strategic planning.

This preview accurately represents the final CrossAmerica BCG Matrix report, providing you with a transparent look at the professional-grade analysis and formatting that will be delivered directly to you after your purchase.

Rest assured, the BCG Matrix document displayed here is the exact file you will download, meaning it's ready for immediate application in your business strategy without any additional editing or watermarks.

What you see is the complete and final CrossAmerica BCG Matrix document, ready to be utilized for insightful business analysis and decision-making the moment your purchase is complete.

Dogs

CrossAmerica's strategic move to divest underperforming retail sites is a key part of its 'real estate rationalization' plan. This initiative aims to streamline operations and focus resources on more profitable ventures. In the first quarter of 2025, the company successfully sold seven such sites, and in the second quarter, an additional sixty properties were divested.

These divested assets were likely categorized as 'cash dogs' within the BCG matrix, characterized by low market share and minimal growth potential. Such properties tend to tie up capital without delivering commensurate returns, impacting overall profitability. The decision to sell them frees up financial resources.

The capital generated from these property sales is strategically allocated. A significant portion is used to reduce the company's outstanding debt, thereby strengthening its balance sheet. The remaining funds are reinvested into areas deemed more critical for future growth and strategic advantage.

CrossAmerica's wholesale segment faced a challenging Q2 2025, with gross profit dipping and a 7% drop in distributed wholesale volume. This downturn is partly attributed to the strategic conversion of wholesale sites to retail operations and a loss of dealer contracts.

These factors signal a weakening in specific wholesale markets, where growth is either stagnant or contracting. Such areas within the wholesale business can be classified as 'dogs' in the BCG matrix, necessitating careful review and potential divestment to optimize the company's overall operational efficiency and resource allocation.

Certain older or less efficient distribution terminals, transport fleets, or retail infrastructure that require significant maintenance but yield diminishing returns can be classified as dogs within the CrossAmerica BCG Matrix framework. These assets often represent a drain on resources without contributing meaningfully to growth or market share.

While specific figures for these "dog" assets aren't always publicly itemized, CrossAmerica Partners' ongoing asset rationalization efforts, as indicated in their 2024 investor communications, suggest a strategic move to divest or upgrade assets that no longer meet performance benchmarks. This implies a recognition of the need to shed underperforming infrastructure.

Niche Petroleum Products with Dwindling Demand

CrossAmerica Partners LP's portfolio may contain niche petroleum products that are experiencing a significant downturn in demand. These could include specialized industrial lubricants or certain fuel additives that are being replaced by newer, more environmentally friendly alternatives. If the company has a small footprint in these declining markets, they would be classified as dogs in the Boston Consulting Group (BCG) matrix.

These 'dog' products, while potentially a small part of the overall business, can still consume valuable resources and capital without offering substantial growth potential. For instance, a specific type of asphalt binder used in road construction might see demand fall as new paving technologies emerge. In 2024, the broader specialty chemicals market, which can encompass such niche petroleum derivatives, has shown mixed performance, with some segments contracting due to regulatory pressures and shifting consumer preferences.

Strategically, CrossAmerica might consider divesting or gradually phasing out these low-demand, low-market-share products. This would allow the company to reallocate capital towards higher-growth areas within its portfolio, such as its core motor fuels distribution or renewable energy initiatives. Such a move aligns with a broader industry trend of streamlining operations and focusing on sustainable, future-proof business segments.

- Niche Products: Specialized lubricants, industrial fuels, or specific fuel additives facing obsolescence.

- Market Share: Low penetration in these shrinking product categories.

- Capital Allocation: These products tie up capital with minimal future prospects.

- Strategic Action: Consider divestment or phasing out to reallocate resources.

Retail Locations in Shrinking Markets

CrossAmerica's retail locations in shrinking markets, characterized by long-term population decline or economic downturns and a low market share for the company, are classified as Dogs in the BCG Matrix. These are essentially underperforming assets that drain resources without significant potential for growth or market dominance.

The company's strategic approach to 'optimizing sites by class of trade' directly addresses these Dog segments. By focusing on where they can achieve better performance or divestment, CrossAmerica aims to improve its overall portfolio health.

Evidence of this strategy is seen in CrossAmerica's divestment of properties in non-strategic markets. For instance, in 2023, the company completed the sale of 103 company-operated stores in Kansas and Colorado, reflecting a deliberate move to shed low-growth, low-share assets that fit the Dog profile.

- Shrinking Market Impact: Sites in areas with declining populations or economies face reduced customer traffic and spending, hindering sales growth for any retailer.

- Low Market Share: When CrossAmerica has a small presence in these struggling markets, it indicates difficulty in competing effectively and capturing available demand.

- Divestment Strategy: The sale of 103 stores in Kansas and Colorado in 2023 exemplifies CrossAmerica's action to exit markets where it holds a weak position and sees limited future upside.

- Resource Reallocation: By shedding these Dog assets, CrossAmerica can redirect capital and management attention to more promising segments of its business, such as its Stars or Cash Cows.

Dogs within CrossAmerica's portfolio represent business units or assets with low market share and low growth prospects. These are often legacy operations or products that are no longer competitive. The company's strategy involves identifying and divesting these underperforming segments to improve overall efficiency.

For example, certain older retail sites in declining geographic markets, or niche fuel products facing reduced demand, can be classified as dogs. CrossAmerica's 2024 investor reports highlighted ongoing efforts to rationalize its real estate portfolio, a process that inherently involves shedding such dog assets.

The divestment of 103 company-operated stores in Kansas and Colorado during 2023 is a prime example of this strategy in action. These were likely locations with low market share in markets experiencing economic contraction, fitting the dog profile perfectly.

By exiting these low-return areas, CrossAmerica frees up capital and management focus to invest in its more promising Stars and Cash Cows, thereby optimizing its business structure.

Question Marks

CrossAmerica's investment in new branded food programs, such as its Made to Cook Food Program, places it in the question mark category of the BCG matrix. The company operates 46 branded food locations within its portfolio, indicating a strategic push into this segment.

While these programs show potential, they are still in their early stages and demand substantial capital to compete effectively against established food service giants. This investment is crucial for capturing a larger share of the convenience retail food market, which offers significant growth opportunities.

Although CrossAmerica's current market share in the overall food service industry may be modest, the high growth potential within convenience stores makes these branded food initiatives a key area for future development and market penetration.

CrossAmerica's foray into alternative fuels like EV charging and renewable diesel positions it as a question mark in the BCG matrix. The market for these sustainable options is expanding rapidly, with the global EV charging infrastructure market projected to reach over $150 billion by 2027. This high-growth potential offers significant upside for CrossAmerica.

However, the company's current market share in these emerging sectors is likely small, necessitating considerable investment to capture a meaningful position. For instance, building out a robust EV charging network requires substantial upfront capital for hardware, installation, and grid integration. CrossAmerica's success hinges on its ability to scale these operations efficiently.

To transition these question marks into stars, CrossAmerica must commit significant resources to develop its alternative fuel infrastructure. This strategic investment is crucial to capitalize on the burgeoning demand for cleaner energy solutions and secure a competitive advantage in a rapidly evolving energy landscape.

The fuel delivery sector is embracing advanced technologies like AI and IoT for enhanced supply chain management. These innovations promise substantial efficiency improvements, potentially reducing operational costs and optimizing delivery routes.

For CrossAmerica, any early-stage adoption or pilot programs involving these cutting-edge logistics solutions would place them in the question mark category of the BCG matrix. While the potential for significant gains exists, the substantial upfront investment and the need to establish a strong market presence in tech adoption are key considerations.

Expansion into Untapped High-Growth Geographic Markets

CrossAmerica's strategic focus on portfolio optimization hints at a move into new, high-growth geographic markets where their presence is currently minimal. These markets represent classic question marks: low current market share but significant upside if expansion is successful.

For instance, consider emerging markets in Southeast Asia or parts of Africa. These regions often exhibit robust GDP growth projections, with some economies expected to expand by over 5% annually in the coming years. Identifying specific countries within these regions that align with CrossAmerica's core business, such as those with increasing demand for fuel and convenience retail, would be key.

- High Growth Potential: Markets with projected GDP growth exceeding 5% annually offer substantial opportunities for new entrants.

- Untapped Demand: Regions experiencing rapid urbanization and rising disposable incomes often see increased demand for fuel and convenience services.

- Strategic Entry: Success hinges on thorough market research to identify specific country-level opportunities that match CrossAmerica's capabilities.

- Investment Required: Entering these markets will necessitate significant capital investment for infrastructure, branding, and operational setup.

New Convenience Store Concepts and Customer Experience Initiatives

CrossAmerica is exploring new convenience store concepts and customer experience initiatives, placing them in the question mark category of the BCG matrix. These ventures, which go beyond traditional fuel and convenience items, aim to redefine the customer journey. For instance, they might involve piloting advanced store layouts, integrating new technologies, or offering expanded food and beverage options to differentiate themselves in a crowded market. In 2024, the convenience store sector saw significant investment in technology and experiential retail, with companies like Circle K expanding their fresh food offerings and Wawa investing in digital ordering and loyalty programs.

These initiatives represent a strategic push to capture greater market share by enhancing customer engagement and loyalty. The success of these "question marks" hinges on significant investment and careful execution to differentiate CrossAmerica's offerings. For example, a focus on grab-and-go healthy meal options or in-store cafes could attract a broader customer base. Data from the National Association of Convenience Stores (NACS) indicated that in 2023, food service sales represented a substantial portion of overall convenience store revenue, highlighting the potential for growth in this area.

- Focus on experiential retail: Investing in store design and technology to create a more engaging shopping environment.

- Expansion of fresh food and beverage: Offering healthier and more diverse food options to cater to evolving consumer preferences.

- Digital integration: Implementing mobile ordering, loyalty programs, and in-store digital signage to enhance convenience and personalization.

- Partnerships and unique offerings: Collaborating with national brands or introducing exclusive product lines to drive traffic and differentiate.

CrossAmerica's investments in new branded food programs, like its Made to Cook Food Program, position it as a question mark. With 46 branded food locations already, this is a significant strategic move. These programs require substantial capital to compete effectively, aiming to capture a larger share of the convenience retail food market, a sector with considerable growth potential.

The company's entry into alternative fuels, such as EV charging and renewable diesel, also places it in the question mark category. The EV charging market is rapidly expanding, projected to exceed $150 billion by 2027, offering high growth potential. However, CrossAmerica's current market share is likely small, necessitating considerable investment to build a meaningful position in these emerging sectors.

CrossAmerica's exploration of new convenience store concepts and customer experience initiatives, including advanced store layouts and new technologies, also categorizes them as a question mark. These ventures aim to redefine the customer journey and differentiate offerings in a competitive market. For example, the convenience store sector saw significant investment in technology and experiential retail in 2024, with companies enhancing fresh food offerings and digital ordering.

These initiatives, while demanding significant investment and careful execution, represent a strategic push to enhance customer engagement and loyalty. The success of these question marks hinges on differentiating CrossAmerica's offerings, potentially through grab-and-go healthy meals or in-store cafes, tapping into the substantial portion of convenience store revenue derived from food service, as indicated by 2023 NACS data.

| BCG Category | CrossAmerica Initiatives | Market Growth | Current Market Share | Investment Needs |

|---|---|---|---|---|

| Question Mark | Branded Food Programs (e.g., Made to Cook) | High (Convenience Retail Food) | Low to Moderate | Substantial Capital |

| Question Mark | Alternative Fuels (EV Charging, Renewable Diesel) | Very High (EV Charging > $150B by 2027) | Low | Significant Capital for Infrastructure |

| Question Mark | New Convenience Store Concepts & Customer Experience | High (Experiential Retail, Tech Integration) | Low to Moderate | Significant Investment for Differentiation |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, industry growth rates, and market share analysis to provide a clear strategic overview.