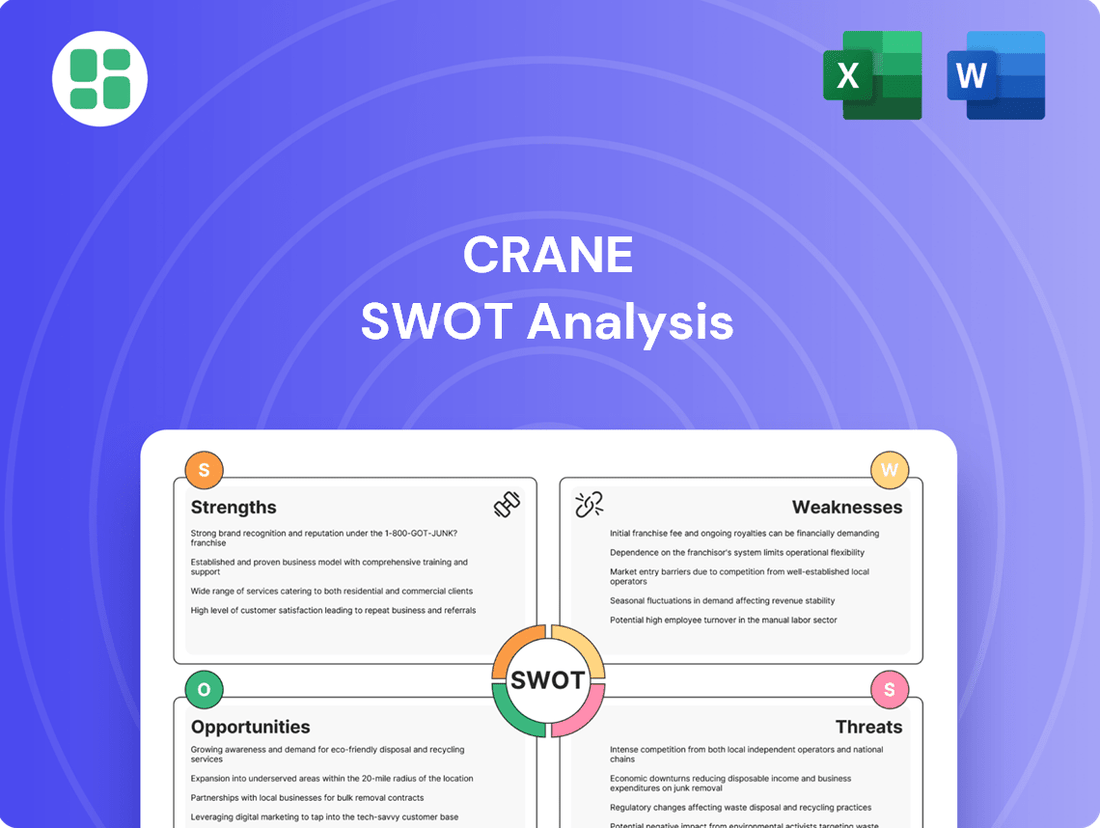

Crane SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane Bundle

Crane's robust engineering capabilities and strong brand reputation are significant strengths, while its reliance on specific industries presents a notable weakness. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Crane's market position, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Crane Company benefits from a strategically diversified portfolio, primarily in Aerospace & Electronics and Process Flow Technologies. This diversification helps mitigate risks by reducing reliance on any single market.

The divestiture of its Engineered Materials segment in January 2025 is a key strength, sharpening its focus on its core, higher-growth segments. This strategic move allows for more efficient capital deployment and a concentrated effort on optimizing operations within its remaining businesses.

Crane Company has demonstrated a robust financial performance, with core sales increasing by 5% in the first quarter of 2024. This growth is expected to continue into 2025, with management projecting a 6-8% increase in core sales for the full year. The company's adjusted earnings per share (EPS) also saw a healthy rise, up 12% year-over-year in Q1 2024.

This consistent financial strength is underpinned by a solid balance sheet and strong cash flow generation, which Crane leveraged to repurchase $100 million of its stock in the first half of 2024. This financial discipline allows for continued strategic investments in innovation and potential acquisitions, while also supporting attractive shareholder returns.

Crane's expertise in highly engineered, mission-critical products for demanding sectors like aerospace and defense provides a significant strength. These specialized components, essential for functions in challenging environments, contribute to a stable demand and often command premium pricing. For instance, in 2023, Crane's Aerospace & Electronics segment reported strong performance, driven by demand for its advanced components in commercial and defense platforms.

Operational and Commercial Excellence

Crane's dedication to operational discipline and commercial excellence has been a significant driver of its success, contributing to enhanced earnings and historically high segment margins. This focus on efficiency and customer satisfaction fuels ongoing improvements and solidifies its market standing.

In 2023, Crane reported record segment margins, a testament to these initiatives. For instance, its Engineered Materials segment achieved impressive results, reflecting strong execution and a keen understanding of market needs.

- Operational Discipline: Crane consistently implements strategies to streamline processes and reduce costs, leading to greater efficiency across its business units.

- Commercial Excellence: The company actively pursues initiatives that enhance customer relationships and market penetration, driving revenue growth and profitability.

- Record Segment Margins: Crane has demonstrated an ability to achieve and sustain high profit margins within its various operating segments, showcasing strong performance.

- Continuous Improvement: A culture of ongoing enhancement ensures that Crane remains agile and competitive, adapting to market dynamics and customer expectations.

Strategic Acquisitions and Innovation

Crane's strategic acquisition approach has been a significant driver of its growth, particularly in areas like cryogenics and fluid management. For instance, in 2023, the company completed several acquisitions that bolstered its presence in these key markets. This inorganic expansion, coupled with a strong focus on organic innovation, allows Crane to consistently enhance its product portfolio and technological edge.

The company's commitment to innovation is evident in its ongoing investment in research and development. Crane consistently introduces new products and upgrades existing technologies, ensuring it remains competitive. This dual strategy of smart acquisitions and internal development strengthens its market position and expands its revenue streams.

- Strategic Acquisitions: Crane has a history of acquiring companies that align with its growth platforms, such as its 2023 acquisitions in the cryogenics sector, which expanded its technological capabilities.

- Innovation Focus: The company invests heavily in R&D to develop new products and enhance existing technologies, particularly within its key growth areas.

- Market Expansion: This combination of inorganic and organic growth allows Crane to broaden its market offerings and strengthen its competitive standing.

Crane's diversified business model, with significant contributions from Aerospace & Electronics and Process Flow Technologies, provides a stable revenue base. The successful divestiture of its Engineered Materials segment in early 2025 sharpens its strategic focus on these higher-growth areas, allowing for more efficient capital allocation.

The company's financial health is a key strength, marked by a 5% core sales increase in Q1 2024 and projected 6-8% growth for the full year 2024. This is supported by a 12% year-over-year rise in adjusted EPS in Q1 2024 and a $100 million stock repurchase in the first half of 2024, demonstrating strong cash flow and shareholder commitment.

Crane excels in producing highly engineered, mission-critical components for demanding industries like aerospace and defense. This specialization ensures consistent demand and premium pricing, as evidenced by strong performance in its Aerospace & Electronics segment during 2023.

Operational discipline and commercial excellence have led to historically high segment margins, with record margins achieved in 2023. This focus on efficiency and customer satisfaction drives continuous improvement and market competitiveness.

Crane's growth is bolstered by strategic acquisitions, such as its 2023 investments in cryogenics, which enhance its technological capabilities. Coupled with a strong R&D investment for new product development, this approach expands its market offerings and strengthens its competitive edge.

| Metric | Q1 2024 | Full Year 2024 Projection |

|---|---|---|

| Core Sales Growth | 5% | 6-8% |

| Adjusted EPS Growth (YoY) | 12% | N/A |

| Stock Repurchases | $100 million (H1 2024) | N/A |

What is included in the product

Analyzes Crane’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses and threats, alleviating the pain of uncertainty.

Weaknesses

Crane Company's reliance on the industrial and aerospace sectors, despite its diversification efforts, presents a notable weakness. These markets are inherently cyclical, meaning demand can swing significantly with broader economic trends and shifts in business investment. For instance, a global economic slowdown, like the one experienced in early 2023, can directly curtail capital spending by industrial clients and reduce aircraft production, impacting Crane's order books.

This sensitivity to economic cycles means that periods of recession or even just slower growth can disproportionately affect Crane's financial performance. In 2023, while many sectors recovered, industrial production growth remained somewhat subdued in certain regions, highlighting the ongoing vulnerability. Any significant downturn in these key end markets could lead to reduced sales and profitability for Crane.

Crane's strategic acquisitions, such as Vian, CryoWorks, and Technifab, while fueling expansion, introduce significant integration risks. Merging diverse operational systems, distinct corporate cultures, and varied technological infrastructures can prove complex and time-consuming, potentially diverting management attention and financial resources.

These integration challenges can lead to temporary disruptions in efficiency and productivity as the newly acquired entities are brought into Crane's existing framework. For instance, the successful assimilation of Vian's specialized fluid handling technologies into Crane's broader offerings requires careful planning to avoid operational silos or compatibility issues.

The financial implications of integration also warrant close monitoring. In 2023, Crane reported that while acquisitions contributed to revenue growth, the associated integration costs and potential for initial inefficiencies could temporarily impact profit margins until synergies are fully realized.

Crane's reliance on intricate global supply chains for its highly engineered products presents a significant weakness. Persistent constraints, such as those impacting the aerospace and defense sectors throughout 2024, directly translate into potential production delays and escalating costs.

These disruptions can hinder Crane's ability to fulfill customer orders effectively, impacting revenue and market share. For instance, the semiconductor shortage that extended into 2024 affected numerous manufacturing sectors, highlighting the systemic risks Crane faces.

Divestiture Impacts and Recasting of Financials

The divestiture of Crane's Engineered Materials segment, finalized in January 2025, while a strategic move to streamline operations, necessitated a significant recasting of historical financial statements. This restructuring can complicate year-over-year financial comparisons, potentially making it harder for investors and analysts to accurately assess performance trends. For instance, the segment represented approximately 15% of Crane's 2024 revenue, meaning its absence will notably alter the company's financial profile going forward.

This recasting of financials, though a standard practice after major divestitures, can temporarily introduce uncertainty. It might lead to a period where analytical models need to be recalibrated to account for the altered historical data. This adjustment phase could influence investor sentiment or require additional due diligence to fully grasp the company's ongoing financial trajectory. The impact on earnings per share (EPS) from continuing operations in 2024, for example, will need careful re-evaluation post-divestiture.

- Financial Recasting: The January 2025 divestiture of Engineered Materials requires restating prior financial results, impacting historical comparisons.

- Analytical Complexity: This recasting can introduce complexities for investors and analysts in evaluating performance trends.

- Investor Perception: The change may temporarily affect investor perception and the reliability of existing analytical models.

- Revenue Impact: The divested segment contributed roughly 15% to Crane's 2024 revenue, a significant shift in the company's financial structure.

Competition in Specialized Markets

Even within its specialized market segments, Crane Company encounters significant competitive pressures. Established players with long-standing reputations and significant market share, alongside agile new entrants, constantly challenge Crane's position. This dynamic environment can lead to pricing erosion, demanding substantial and ongoing investment in research and development to maintain a technological edge. Consequently, expanding market share becomes a more arduous undertaking.

The intense competition necessitates strategic responses, including:

- Continuous product innovation: To differentiate offerings and command premium pricing.

- Cost management: To remain competitive on price without sacrificing quality.

- Strategic partnerships: To access new markets or technologies.

- Aggressive marketing and sales efforts: To capture and retain customer loyalty.

Crane's concentrated reliance on the industrial and aerospace sectors, despite diversification efforts, leaves it vulnerable to economic downturns. These sectors are inherently cyclical, meaning demand can fluctuate significantly with broader economic trends. For example, a slowdown in global capital expenditure, as seen in parts of 2023, directly impacts industrial clients' investment and aircraft production, affecting Crane's order pipelines.

This sensitivity to economic cycles means that periods of recession or even slower growth can disproportionately impact Crane's financial performance. In 2023, industrial production growth remained subdued in some regions, underscoring this vulnerability. Any significant downturn in these key end markets could lead to reduced sales and profitability for Crane.

Crane's strategic acquisitions, while driving expansion, introduce substantial integration risks. Merging diverse operational systems, corporate cultures, and technological infrastructures can be complex and resource-intensive, potentially diverting management focus and capital. For instance, successfully integrating Vian's specialized fluid handling technologies requires careful planning to avoid operational silos or compatibility issues.

These integration challenges can cause temporary disruptions in efficiency and productivity as newly acquired entities are assimilated. In 2023, Crane reported that while acquisitions contributed to revenue growth, associated integration costs and initial inefficiencies could temporarily impact profit margins until synergies are fully realized.

Crane's dependence on intricate global supply chains for its engineered products is a significant weakness. Persistent constraints, such as those impacting the aerospace sector throughout 2024, directly translate into potential production delays and increased costs. For example, the semiconductor shortage that extended into 2024 affected numerous manufacturing sectors, highlighting systemic risks for Crane.

The divestiture of Crane's Engineered Materials segment in January 2025, while streamlining operations, necessitated a significant recasting of historical financial statements. This restructuring complicates year-over-year financial comparisons, making it harder for investors to assess performance trends accurately. The divested segment represented approximately 15% of Crane's 2024 revenue, a notable shift in its financial profile.

This financial recasting can temporarily introduce analytical complexity for investors and analysts in evaluating performance trends. The change might also affect investor perception and the reliability of existing analytical models until they are recalibrated. The impact on earnings per share (EPS) from continuing operations in 2024, for instance, will require careful re-evaluation post-divestiture.

Crane faces intense competition from established players and agile new entrants across its specialized market segments. This dynamic environment can lead to pricing pressures, requiring substantial ongoing investment in research and development to maintain a technological edge and making market share expansion more challenging.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Sectoral Reliance | Dependence on cyclical industrial and aerospace markets. | Vulnerability to economic downturns, impacting sales and profitability. | Industrial production growth was subdued in some regions in 2023. |

| Acquisition Integration | Risks associated with merging diverse acquired entities. | Potential for operational disruptions, increased costs, and temporary margin erosion. | Integration costs can temporarily impact profit margins until synergies are realized. |

| Supply Chain Dependence | Reliance on complex global supply chains. | Susceptibility to disruptions leading to production delays and cost increases. | Semiconductor shortages extended into 2024, affecting manufacturing sectors. |

| Financial Restructuring | Impact of the January 2025 Engineered Materials divestiture. | Complicates historical financial comparisons and analytical model recalibration. | Divested segment was ~15% of 2024 revenue. |

| Competitive Pressure | Intense rivalry from established and new market entrants. | Leads to pricing erosion and necessitates continuous R&D investment. | Market share expansion is a more arduous undertaking. |

Preview the Actual Deliverable

Crane SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Crane's Process Flow Technologies segment is well-positioned to benefit from significant growth opportunities in key end markets. Demand for advanced fluid handling solutions in the chemical industry is projected to rise, fueled by the increasing focus on process efficiency and specialty chemical production.

The water and wastewater treatment sector presents a substantial opportunity, driven by global initiatives to improve water quality and manage resources sustainably. Crane's expertise in filtration and separation technologies aligns perfectly with these critical infrastructure needs. For instance, global spending on water and wastewater infrastructure is expected to reach over $1 trillion by 2030, offering a vast market for Crane's solutions.

Furthermore, the pharmaceutical and biotechnology industries continue to expand, requiring highly specialized and reliable fluid control systems for drug manufacturing and research. The cryogenics market is also experiencing robust growth, particularly with the increasing demand for liquefied natural gas (LNG) and advancements in medical technologies, creating further avenues for Crane's specialized valve and equipment offerings.

Crane can capitalize on technological advancements like the Industrial Internet of Things (IIoT) and automation to boost its product portfolio and streamline operations. For instance, in 2024, the industrial automation market was projected to reach over $200 billion, highlighting significant growth potential for companies integrating smart solutions.

By investing in predictive maintenance technologies, Crane can offer enhanced service offerings and improve the reliability of its equipment, particularly within its Aerospace & Electronics and Process Flow Technologies segments. This focus on smart solutions is crucial for building a competitive edge in the evolving industrial landscape.

Crane Company could significantly boost its innovation and market presence by forging strategic partnerships. For instance, collaborating with leading technology providers in automation or AI could accelerate the development of next-generation construction equipment, potentially capturing a larger share of the projected $1.7 trillion global construction market in 2024.

These alliances can also facilitate entry into new geographical markets, sharing the financial burden of expansion. Imagine partnering with a local distributor in a rapidly developing region like Southeast Asia, where infrastructure spending is expected to rise by 7% annually through 2027, thereby reducing Crane's upfront investment and risk.

Aftermarket Services Growth

Crane's aftermarket services, encompassing maintenance, repair, and overhaul (MRO), offer a substantial avenue for growth, especially within the thriving aerospace industry. This segment is a key driver for recurring revenue and deeper customer engagement.

The aerospace aftermarket is experiencing robust expansion. For instance, the global aerospace MRO market was valued at approximately $77.9 billion in 2023 and is anticipated to reach $112.2 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.4% during this period. This trend underscores the significant potential for Crane to capitalize on increased demand for its specialized services.

- Aerospace MRO Market Growth: Projected to grow from $77.9 billion in 2023 to $112.2 billion by 2030, with a 5.4% CAGR.

- Recurring Revenue Streams: Aftermarket services provide a stable and predictable income source, complementing new equipment sales.

- Customer Retention: Strong MRO capabilities foster loyalty and create stickier customer relationships, leading to long-term partnerships.

Global Infrastructure and Sustainability Investments

Global governments are channeling significant capital into infrastructure upgrades and sustainable technologies. For instance, the Biden administration's Infrastructure Investment and Jobs Act, enacted in 2021, allocated over $1 trillion for roads, bridges, public transit, and clean energy projects. This trend creates a substantial opportunity for Crane's fluid handling and specialized products, particularly in areas like water management and energy efficiency.

The increasing focus on environmental, social, and governance (ESG) principles is further accelerating investments in sustainability. In 2024, global sustainable investment assets were projected to reach over $50 trillion, according to various market analyses. Crane's expertise in areas such as advanced filtration and corrosion-resistant materials positions it to benefit from this growing demand for environmentally sound solutions.

- Growing Infrastructure Spending: Increased government and private sector investment in infrastructure projects worldwide, including those focused on water and wastewater systems, directly boosts demand for Crane's core product offerings.

- Sustainability Initiatives: The global push for cleaner energy, reduced emissions, and efficient resource management, particularly in water and waste treatment, presents a significant market for Crane's specialized fluid handling technologies.

- Energy Transition Support: As nations invest in renewable energy sources and upgrade their energy grids, Crane's components can play a crucial role in managing the complex fluid dynamics involved in these evolving energy systems.

Crane is well-positioned to capitalize on the growing demand for advanced fluid handling solutions across various critical sectors. The increasing global investment in water and wastewater infrastructure, projected to exceed $1 trillion by 2030, presents a substantial market for Crane's filtration and separation technologies.

The expansion of the pharmaceutical and biotechnology industries, coupled with the robust growth in the cryogenics market, particularly for LNG and medical advancements, offers significant opportunities for Crane's specialized valve and equipment offerings. Furthermore, the company can leverage technological advancements like IIoT and automation, with the industrial automation market projected to surpass $200 billion in 2024, to enhance its product portfolio and operational efficiency.

Strategic partnerships can accelerate Crane's innovation and market reach, potentially tapping into the $1.7 trillion global construction market in 2024. The aerospace aftermarket, expected to grow from $77.9 billion in 2023 to $112.2 billion by 2030, offers a strong avenue for recurring revenue through MRO services, fostering customer loyalty.

Global infrastructure spending, bolstered by initiatives like the Infrastructure Investment and Jobs Act, and the increasing focus on ESG principles, with sustainable investment assets projected to exceed $50 trillion in 2024, create a favorable environment for Crane's sustainable and efficient fluid management solutions.

| Opportunity Area | Market Size/Growth | Crane's Relevance |

| Water & Wastewater Infrastructure | Over $1 trillion by 2030 | Filtration and separation technologies |

| Pharmaceuticals & Biotechnology | Expanding industries | Specialized fluid control systems |

| Cryogenics (LNG, Medical) | Robust growth | Specialized valves and equipment |

| Industrial Automation & IIoT | Over $200 billion (2024 projection) | Integrating smart solutions |

| Aerospace Aftermarket (MRO) | $77.9 billion (2023) to $112.2 billion (2030) | Maintenance, repair, and overhaul services |

| Global Infrastructure Spending | Significant government capital allocation | Fluid handling and specialized products |

| Sustainability Initiatives (ESG) | Over $50 trillion (2024 projection for sustainable investments) | Advanced filtration, corrosion-resistant materials |

Threats

Broader economic downturns pose a significant threat to Crane. For instance, a global recession, potentially exacerbated by ongoing geopolitical instability, could sharply reduce capital expenditures across key sectors like construction and energy. This directly impacts Crane's order volumes, as customers delay or scale back projects. In 2024, many economists are forecasting a slowdown in global GDP growth, with the IMF projecting a 2.9% growth for 2024, down from 3.0% in 2023, highlighting the heightened risk of reduced demand.

Crane faces significant threats from intensifying competition within the industrial components and specialized manufacturing sectors. Competitors frequently introduce similar solutions at lower price points, directly challenging Crane's market share and potentially eroding profit margins. This pricing pressure is a persistent concern, especially as global supply chains become more efficient, allowing rivals to undercut established players.

Crane faces potential headwinds from evolving regulatory landscapes. For instance, stricter emissions standards, like those being phased in across Europe and North America for heavy machinery, could necessitate significant investment in cleaner technologies, impacting Crane's capital expenditures and potentially increasing the cost of goods sold. Furthermore, shifts in international trade policies or tariffs could disrupt supply chains and affect pricing strategies in key markets.

Technological Obsolescence and Disruption

The rapid pace of technological change poses a significant threat. Competitors introducing advanced automation or digital solutions could quickly make Crane's current offerings less appealing. For instance, advancements in AI-powered predictive maintenance in the construction equipment sector, a key market for Crane, could outpace Crane's own development cycles if not proactively addressed.

Disruptive innovations, such as the emergence of entirely new equipment designs or rental-focused digital platforms, could fundamentally alter market dynamics. Crane's reliance on traditional product sales might be challenged by business models that prioritize access over ownership, especially as the industry increasingly embraces digitization. The company must continuously invest in research and development to ensure its technological roadmap aligns with, or ideally anticipates, these shifts.

Specific areas of concern include:

- Emerging autonomous construction machinery: Competitors are actively developing self-operating equipment, which could reduce the need for human operators and impact Crane's traditional product lines.

- Digitalization of equipment management: The shift towards integrated IoT platforms for monitoring and managing fleets could leave Crane's less connected products at a disadvantage.

- New materials and manufacturing techniques: Advances in lighter, stronger materials or additive manufacturing could lead to more efficient and cost-effective equipment from rivals.

Supply Chain and Geopolitical Risks

Crane's operations are vulnerable to ongoing global supply chain disruptions. For instance, events like the Red Sea shipping crisis, which intensified in late 2023 and continued into early 2024, significantly impacted transit times and shipping costs for many industries, including those relying on heavy machinery components. This can directly affect Crane's production schedules and the cost of goods sold.

Trade tensions and geopolitical conflicts pose a significant threat by potentially restricting access to critical raw materials and components. For example, heightened trade disputes between major economies could lead to increased tariffs or export controls on specialized metals or electronic parts essential for manufacturing advanced lifting equipment. This volatility directly impacts profitability and the ability to maintain competitive pricing.

The availability and cost of raw materials, such as steel and specialized alloys, are subject to fluctuations driven by geopolitical instability and global demand. Reports from early 2024 indicated continued volatility in commodity markets, with steel prices experiencing upward pressure due to production cutbacks in certain regions and robust demand from infrastructure projects. This directly influences Crane's input costs.

- Supply Chain Vulnerability: Crane faces risks from shipping delays and increased freight costs, as seen with disruptions impacting global trade routes in 2023-2024.

- Geopolitical Impact: Trade wars or regional conflicts could lead to tariffs or restrictions on key components, increasing operational expenses.

- Material Cost Fluctuations: Volatile commodity markets, particularly for steel, directly affect Crane's manufacturing costs and profit margins.

- Production Delays: Sourcing challenges for specialized parts can lead to extended lead times and impact Crane's ability to meet customer demand promptly.

Crane faces threats from intense competition, with rivals often offering similar products at lower prices, potentially squeezing profit margins. Furthermore, evolving regulatory environments, such as stricter emissions standards for heavy machinery, could necessitate costly technological upgrades, impacting capital expenditure and the cost of goods sold. Rapid technological advancements, including AI-driven predictive maintenance and emerging autonomous machinery, also present a risk if Crane's innovation pace lags behind competitors.

Supply chain disruptions remain a significant concern, with events like the Red Sea shipping crisis in late 2023 and early 2024 impacting transit times and costs. Geopolitical tensions and trade disputes can further exacerbate these issues, leading to tariffs or restrictions on essential components and raw materials like steel. Commodity price volatility, particularly for steel, directly affects Crane's manufacturing costs, as seen with upward price pressures in early 2024 due to production cutbacks and infrastructure demand.

| Threat Area | Specific Risk | Impact on Crane | Example/Data Point (2023-2025) |

|---|---|---|---|

| Competition | Price Undercutting | Reduced Market Share & Profit Margins | Competitors frequently introducing similar solutions at lower price points. |

| Regulatory Changes | Stricter Emissions Standards | Increased Capital Expenditure, Higher COGS | Phasing in of stricter emissions standards across Europe and North America. |

| Technological Disruption | Emergence of Autonomous Machinery | Potential Obsolescence of Traditional Product Lines | Competitors actively developing self-operating construction equipment. |

| Supply Chain Disruptions | Shipping Delays & Increased Freight Costs | Production Delays, Higher Input Costs | Red Sea shipping crisis (late 2023-early 2024) impacted transit times and costs. |

| Geopolitical Factors | Tariffs & Export Controls | Restricted Access to Critical Components, Increased Costs | Heightened trade disputes potentially affecting specialized metals or electronic parts. |

| Raw Material Costs | Commodity Price Volatility | Fluctuating Manufacturing Costs, Impacted Profitability | Steel prices saw upward pressure in early 2024 due to production cutbacks and demand. |

SWOT Analysis Data Sources

This Crane SWOT analysis draws from robust data, including company financial reports, global construction market trends, and expert opinions from industry analysts to provide a comprehensive strategic overview.