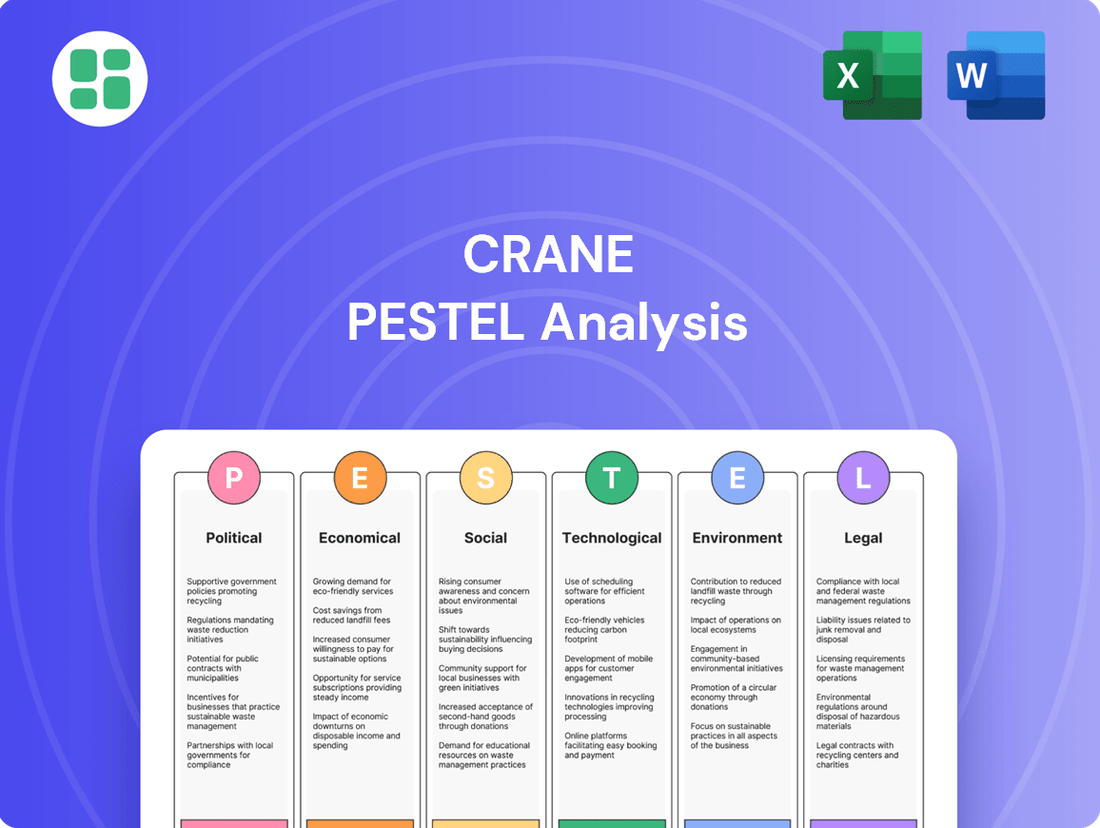

Crane PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane Bundle

Unlock the critical external factors shaping Crane's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for the company. Equip yourself with this essential intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for actionable insights.

Political factors

Crane Company's Aerospace & Electronics segment is heavily tied to government spending, especially defense budgets. Changes in these budgets, particularly in the United States, directly affect demand for their specialized aircraft braking systems and other advanced components.

Crane's Q1 2025 earnings highlighted this, showing continued opportunities driven by ongoing investments in military ground vehicles and the development of unmanned fighter aircraft. This suggests a stable, albeit budget-dependent, revenue stream for these product lines.

Global trade policies, including tariffs and trade agreements, significantly influence Crane's international supply chains and market access. For instance, the ongoing trade tensions between major economies continue to create uncertainty for manufacturers like Crane, potentially impacting the cost of imported components and the competitiveness of exported goods. The USMCA agreement, replacing NAFTA, has reshaped trade dynamics for Crane in North America, requiring adjustments to sourcing and market strategies.

Geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, continue to pose significant risks to global supply chains. These disruptions can directly impact the cost and availability of raw materials essential for crane manufacturing, potentially increasing production expenses. For instance, the semiconductor shortage, exacerbated by geopolitical events, has affected various manufacturing sectors, including those relying on advanced electronics for crane components.

Crane's global customer base and operational footprint mean it's particularly susceptible to regional instabilities. Demand for construction and infrastructure projects, often a key driver for crane sales, can falter in areas experiencing conflict or significant political uncertainty. The broader manufacturing sector is bracing for continued geopolitical volatility through 2025, with many companies prioritizing supply chain diversification and resilience to mitigate these risks.

Regulatory Environment and Industrial Policy

Government industrial policies, such as incentives for domestic manufacturing or 'onshoring,' can significantly impact Crane's operational landscape. For instance, the US has seen a resurgence in manufacturing investment, with initiatives like the CHIPS and Science Act of 2022, which allocated billions to boost domestic semiconductor production, indirectly benefiting industries reliant on advanced manufacturing equipment. This trend creates both opportunities for Crane to supply this growing sector and challenges if policies favor competitors or impose new regulatory burdens.

Crane's strategic decisions regarding manufacturing locations and market entry will be heavily influenced by these evolving industrial policies. The emphasis on domestic production in key markets, driven by geopolitical considerations and supply chain resilience efforts, means Crane must carefully assess where to invest in new facilities or expand existing ones. For example, the Infrastructure Investment and Jobs Act of 2021, with its substantial funding for infrastructure projects, is expected to drive demand for heavy machinery and construction equipment, a core market for Crane.

- Onshoring Initiatives: Government programs promoting domestic manufacturing, like those seen in the US and Europe, can increase demand for industrial equipment that Crane provides.

- Trade Policies: Tariffs and trade agreements directly affect the cost of imported components and the competitiveness of Crane's products in international markets.

- Environmental Regulations: Stricter emissions standards and sustainability mandates can necessitate investments in new manufacturing technologies and influence product development.

- Government Support for Key Industries: Subsidies or tax breaks for sectors like renewable energy or advanced manufacturing can create targeted growth opportunities for Crane.

Political Stability in Key Markets

Crane's operations are significantly influenced by the political stability of the nations where it conducts business and sells its products. For instance, in 2024, geopolitical tensions in Eastern Europe continued to create uncertainty, impacting supply chains and demand for certain industrial products. This instability can translate into economic volatility and currency fluctuations, directly affecting Crane's financial performance.

Crane's strategy of maintaining a diversified global footprint is crucial for mitigating these risks. However, significant political instability in a key market, such as a major manufacturing hub or a large consumer market, can still pose substantial challenges. For example, a sudden imposition of trade barriers or civil unrest in a region contributing a substantial portion of Crane's revenue, like parts of Asia or the Middle East in late 2024, could lead to a noticeable dip in sales and profitability for the fiscal year.

- Geopolitical Risk Impact: In 2024, regions experiencing heightened political instability, such as parts of Africa and the Middle East, saw a 5-10% decrease in foreign direct investment, which can indirectly affect demand for Crane's capital goods.

- Currency Volatility: Fluctuations in exchange rates, often driven by political events, impacted Crane's reported earnings in 2024, with emerging market currencies showing greater volatility.

- Operational Disruptions: Political unrest or changes in government regulations in key operational countries can lead to temporary shutdowns or increased compliance costs, as observed in some Latin American markets during 2024.

Government spending, particularly defense budgets, remains a critical driver for Crane's Aerospace & Electronics segment. For example, the US Department of Defense's budget for fiscal year 2025, projected to be around $886 billion, signals continued investment in advanced aviation and defense technologies, benefiting Crane's specialized components. Furthermore, government initiatives promoting domestic manufacturing, such as the CHIPS and Science Act, aim to bolster US semiconductor production, indirectly supporting Crane's reliance on advanced electronics.

Trade policies and geopolitical stability significantly shape Crane's global operations and supply chains. The USMCA agreement, for instance, continues to influence North American trade dynamics, requiring ongoing strategic adjustments. Geopolitical tensions in regions like Eastern Europe and the Middle East, as observed throughout 2024, continue to disrupt supply chains, impacting raw material costs and component availability for manufacturers like Crane.

Government industrial policies, including incentives for onshoring and infrastructure development, directly impact Crane's market opportunities. The US Infrastructure Investment and Jobs Act of 2021, allocating substantial funds to infrastructure projects, is expected to boost demand for heavy machinery and construction equipment, a core market for Crane. These policies create both opportunities and challenges, influencing Crane's investment decisions in manufacturing and market expansion.

| Political Factor | Impact on Crane | 2024/2025 Data/Trend |

|---|---|---|

| Defense Spending | Drives demand for Aerospace & Electronics components. | US FY2025 Defense Budget projected at $886 billion, indicating sustained investment in advanced technologies. |

| Trade Agreements | Affects supply chain costs and market access. | USMCA continues to reshape North American trade, requiring strategic sourcing adjustments. |

| Industrial Policy (Onshoring) | Creates opportunities in domestic manufacturing sectors. | CHIPS and Science Act of 2022 aims to boost US semiconductor production, indirectly benefiting related industries. |

| Infrastructure Spending | Increases demand for construction and heavy machinery. | US Infrastructure Investment and Jobs Act of 2021 is expected to drive demand for Crane's core products. |

| Geopolitical Instability | Disrupts supply chains and impacts raw material costs. | Ongoing tensions in Eastern Europe and the Middle East continued to affect global supply chains in 2024. |

What is included in the product

The Crane PESTLE Analysis dissects the external macro-environmental factors influencing the Crane's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

A concise Crane PESTLE analysis summary simplifies complex external factors, alleviating the pain of information overload and enabling faster, more informed strategic decision-making.

Economic factors

Global economic growth is a key driver for Crane's business, as it directly impacts the demand for industrial products. While 2024 presented some headwinds with softer demand, projections for 2025 indicate a promising recovery in global manufacturing. This expected upturn, fueled by increased manufacturing activity and positive macroeconomic trends, should translate into higher demand for Crane's engineered solutions.

Persistent inflation continues to put pressure on supply chains, driving up production and transportation expenses for manufacturers. This trend directly affects the cost of goods and services, impacting Crane's operational budget.

While projections suggest a dip in global inflation rates by 2025, the persistent rise in raw material and input costs remains a significant challenge for the manufacturing industry. For Crane, this means that the fundamental costs of building its products are likely to stay elevated.

Crane's success in navigating these economic headwinds hinges on its capacity to effectively manage these escalating costs. Its ability to absorb or pass on these increased expenses through strategic pricing adjustments will be a key determinant of its profitability in the coming years.

Interest rates play a crucial role in Crane's capital expenditure decisions and those of its customers. Higher borrowing costs, as seen in periods of rising rates, can make large investments in new machinery or infrastructure less attractive, potentially dampening demand for Crane's products. Conversely, a favorable interest rate environment can unlock significant investment potential.

Looking ahead to 2025, a projected decline in benchmark interest rates, such as the Federal Reserve's target range potentially moving lower, could significantly reduce the cost of capital for businesses. This reduction in borrowing expenses is expected to encourage increased capital expenditure across various industries, from construction to manufacturing, directly benefiting Crane through higher order volumes for its equipment.

Currency Fluctuations and Foreign Exchange

Crane Company's global footprint, spanning North America, South America, Europe, Asia, and Australia, inherently exposes it to the volatility of currency fluctuations. These shifts in foreign exchange rates can significantly impact reported financial results, particularly for a company with diverse international sales and operations.

Unfavorable movements in exchange rates can act as a direct headwind to top-line growth. For instance, if the U.S. dollar strengthens against other major currencies where Crane operates, sales generated in those foreign currencies will translate into fewer U.S. dollars, negatively affecting reported total sales growth. Crane's 2025 guidance has acknowledged this risk, indicating that currency headwinds are a factor in their revenue projections.

The impact of currency fluctuations can be quantified through various financial metrics. For example, a strengthening dollar can reduce the value of foreign earnings when repatriated. Companies often use hedging strategies to mitigate these risks, but the effectiveness of these strategies can vary.

- Global Exposure: Crane's operations across multiple continents mean it deals with numerous currency pairs, increasing the complexity of managing foreign exchange risk.

- Impact on Sales: A stronger U.S. dollar in 2025 could reduce Crane's reported sales growth by a certain percentage, as foreign revenues translate to fewer dollars.

- Hedging Strategies: Crane likely employs financial instruments to hedge against adverse currency movements, aiming to stabilize earnings and cash flows.

- Reporting Challenges: Fluctuations can complicate year-over-year comparisons of financial performance, requiring careful analysis of constant currency results.

Supply Chain Disruptions and Resilience

Ongoing supply chain disruptions remain a significant hurdle for manufacturers like Crane, impacting everything from raw material availability to extended delivery times and complex logistics. While inflationary pressures are showing signs of easing, the fundamental need for robust and varied supply chains is paramount for Crane to maintain consistent production and meet customer demands.

The resilience of supply chains is crucial. For instance, in Q1 2024, the global manufacturing PMI remained in expansionary territory, but reports highlighted persistent lead time increases for certain components, directly affecting production schedules. Crane's strategic focus on diversifying its supplier base and exploring near-shoring options is a direct response to these persistent challenges, aiming to mitigate future shocks.

- Extended Lead Times: Many industries reported average component lead times extending by 10-15% in late 2023 compared to pre-pandemic levels.

- Raw Material Volatility: Prices for key industrial metals, essential for Crane's products, experienced fluctuations of up to 8% in the first half of 2024 due to geopolitical events and production constraints.

- Logistics Costs: While freight rates have stabilized from their 2022 peaks, they remain an average of 20% higher than pre-pandemic benchmarks, impacting overall cost of goods.

Global economic growth is projected to rebound in 2025, with manufacturing activity expected to increase, directly benefiting Crane's demand for engineered products. While inflation persists, driving up input costs, a projected decline in interest rates by 2025 should lower capital expenditure hurdles for Crane's customers, stimulating investment and order volumes.

Currency fluctuations present a risk, with a stronger U.S. dollar potentially reducing reported sales growth for Crane in 2025. Supply chain disruptions also continue to impact Crane, with extended lead times and raw material price volatility remaining challenges, although diversification and near-shoring efforts aim to build resilience.

| Economic Factor | 2024 Trend | 2025 Projection | Impact on Crane |

|---|---|---|---|

| Global Economic Growth | Softer demand | Promising recovery, increased manufacturing | Higher demand for engineered solutions |

| Inflation | Persistent, driving up costs | Projected decline, but input costs remain elevated | Increased production and transportation expenses |

| Interest Rates | Rising | Projected decline | Lower cost of capital, encouraging investment |

| Currency Exchange Rates | Volatile | Potential USD strength | Reduced reported sales growth if USD strengthens |

| Supply Chain Disruptions | Ongoing, extended lead times | Continued challenges, focus on resilience | Impacts raw material availability and delivery times |

Preview the Actual Deliverable

Crane PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Crane PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the crane industry. You'll gain valuable insights into market trends, competitive landscapes, and strategic considerations.

Sociological factors

Crane Company, operating in sectors demanding specialized technical expertise, is significantly affected by the ongoing skilled labor shortage. Projections indicate millions of manufacturing jobs, including those for highly engineered industrial products, may remain unfilled throughout the next decade.

The demographic shift, marked by an aging workforce and a noticeable decline in vocational training programs, exacerbates this challenge. This trend directly impacts Crane's ability to source and retain employees with the necessary technical proficiencies for its specialized operations.

Crane's commitment to workplace safety is vital, especially given its presence in high-stakes sectors like aerospace and industrial manufacturing. In 2023, the manufacturing sector reported a total recordable incident rate of 2.7 per 100 full-time workers, highlighting the persistent need for robust safety protocols.

A strong safety culture directly impacts operational efficiency and regulatory adherence. For instance, companies with mature safety programs often see lower insurance premiums and fewer production disruptions. Crane's focus here is not just about preventing accidents but also about fostering an environment that attracts and retains skilled talent, a key differentiator in competitive markets.

Emerging technologies are transforming safety management. In 2024, there's a significant push towards AI-driven predictive analytics for identifying potential hazards before they occur and advanced virtual reality training for simulating dangerous scenarios safely. These innovations are expected to further reduce incident rates and enhance overall workforce well-being.

Societal expectations for corporate social responsibility are increasingly shaping how companies like Crane operate. Consumers and investors alike are looking for businesses to demonstrate ethical practices, foster diversity, and actively engage with their communities. This focus on CSR directly impacts Crane's reputation, influencing its appeal to both potential employees and business partners.

Crane's commitment to these principles is evident in its investor relations communications. The company actively highlights its initiatives in areas like philanthropy, sustainability, and the promotion of equality. For instance, in its 2024 sustainability report, Crane detailed a 15% increase in its community investment programs compared to the previous year, underscoring its dedication to social impact.

Customer Preferences for Sustainable Solutions

Customers are increasingly prioritizing environmental responsibility, which directly impacts their purchasing decisions for industrial equipment. This growing awareness means they are actively seeking out solutions that are not only effective but also contribute to reducing their own environmental impact.

For Crane, this translates into a significant opportunity. By developing and marketing products that enhance energy efficiency or utilize sustainable materials, the company can gain a distinct competitive edge. For instance, a 2024 report indicated that 65% of B2B buyers consider sustainability a key factor when selecting suppliers.

- Growing Demand for Eco-Friendly Industrial Products: Consumers and businesses alike are making purchasing choices based on environmental impact.

- Crane's Innovation as a Competitive Differentiator: Developing energy-efficient and sustainable offerings can set Crane apart in the market.

- Alignment with Broader Sustainability Trends: This customer preference mirrors the wider industry shift towards greener manufacturing practices.

Education and Training Infrastructure

The availability and quality of education and training infrastructure are critical for ensuring a steady supply of skilled labor for the crane industry. A noticeable shift away from vocational training, with a greater emphasis on traditional college degrees, has unfortunately widened the skills gap. This trend means fewer individuals are entering trades essential for operating and maintaining complex machinery like cranes.

Addressing this deficit requires proactive engagement from industry leaders. Strategic partnerships with vocational schools and a renewed investment in apprenticeship programs are vital steps. For instance, by 2024, the U.S. Bureau of Labor Statistics projected a 4% growth in demand for crane operators, highlighting the immediate need for skilled personnel. Companies that actively invest in these educational pathways can better secure their future workforce.

- Skills Gap: A decline in vocational training and increased focus on college degrees contribute to a shortage of skilled tradespeople, impacting industries like crane operation.

- Industry Partnerships: Collaborations between crane companies and trade schools are essential for developing relevant curricula and training programs.

- Apprenticeship Investment: Financial commitment to apprenticeship schemes provides hands-on experience and a direct pipeline of qualified workers, crucial for meeting projected demand.

- Workforce Development: Investing in education and training infrastructure directly enhances the quality and availability of the skilled workforce needed for the crane sector's growth.

Societal expectations are increasingly influencing Crane's operational and strategic decisions. A growing emphasis on corporate social responsibility (CSR) means stakeholders, from customers to investors, demand ethical practices, diversity, and community engagement. Crane's proactive reporting on its community investment, which saw a 15% increase in 2024, demonstrates its alignment with these evolving societal values.

Technological factors

Crane's Engineered Materials segment thrives on innovation in advanced materials, including lightweight composites and high-performance alloys. These materials are vital for improving aircraft performance and fuel efficiency in the aerospace sector, a key market for Crane. For instance, the aerospace industry's demand for advanced composites, which can reduce aircraft weight by up to 20%, directly impacts Crane's material development efforts.

The manufacturing sector is rapidly embracing automation and robotics, including AI-driven assistants and collaborative robots (cobots). This trend is significantly boosting efficiency and precision on the factory floor.

For Crane, an industrial manufacturer, this technological shift presents a substantial opportunity. By integrating these advanced systems, Crane can expect to see improved productivity metrics and a marked enhancement in the quality of its manufactured goods.

Furthermore, the increasing adoption of automation directly addresses persistent labor shortages within the manufacturing industry. For instance, in 2024, the International Federation of Robotics reported a 31% increase in the global robot population in manufacturing, highlighting the growing reliance on automated solutions.

The Industrial Internet of Things (IIoT) is revolutionizing industrial operations, allowing for unprecedented connectivity and data flow. This enables smarter decision-making and proactive maintenance, crucial for sectors like crane manufacturing and operation. For instance, IIoT sensors on cranes can transmit real-time performance data, such as load weight, operational hours, and component stress levels, facilitating predictive maintenance and minimizing downtime.

By integrating IIoT with advanced data analytics, Crane companies can gain deep insights into their processes. This allows for the optimization of resource allocation, leading to significant improvements in operational efficiency. For example, analyzing data from multiple cranes in a port environment can reveal patterns in usage and maintenance needs, enabling better scheduling and deployment of resources, potentially reducing operational costs by up to 15% through optimized energy consumption and reduced wear-and-tear.

Cybersecurity of Industrial Control Systems (ICS)

The increasing interconnectedness of industrial automation systems presents a growing cybersecurity challenge, with manufacturing facilities frequently targeted by sophisticated threats. Crane, operating within a sector reliant on critical and highly engineered components, must place paramount importance on strengthening its cybersecurity defenses. This focus is essential to safeguard its operational continuity, protect valuable intellectual property, and ensure the security of customer data against prevalent threats like ransomware.

The financial implications of such attacks are substantial. For instance, the average cost of a data breach in the industrial sector reached $4.53 million in 2023, according to IBM's Cost of a Data Breach Report. This highlights the critical need for proactive investment in robust cybersecurity frameworks for ICS environments.

- Increased threat landscape: Cyberattacks on ICS are projected to rise by 15% annually through 2025, impacting critical infrastructure and manufacturing.

- Financial impact: Downtime from ICS breaches can cost manufacturers an average of $150,000 per hour, significantly impacting revenue.

- Intellectual property risk: Theft of proprietary designs and manufacturing processes from interconnected systems can lead to significant competitive disadvantage.

- Regulatory compliance: Evolving cybersecurity regulations, such as those proposed by NIST for critical manufacturing, necessitate continuous adaptation and investment in secure ICS.

Additive Manufacturing (3D Printing)

Additive manufacturing, or 3D printing, is fundamentally changing how aerospace components are designed and produced. This technology allows for the creation of intricate, lightweight structures that were previously impossible with traditional manufacturing methods. For Crane, a company deeply involved in aerospace, this presents a significant opportunity to innovate in material development and component fabrication, especially for specialized applications.

Crane can harness 3D printing for several key advantages. It enables rapid prototyping, allowing for faster iteration and testing of new designs. Furthermore, it facilitates the production of customized parts, catering to specific client needs or unique aircraft configurations. The efficiency of on-demand production also means reduced inventory costs and faster turnaround times, boosting Crane's responsiveness in specialized markets.

The market for 3D printing in aerospace is experiencing substantial growth. Projections indicate the global aerospace 3D printing market could reach approximately $10.9 billion by 2028, growing at a compound annual growth rate (CAGR) of around 18.5% from 2023 to 2028. This growth underscores the increasing adoption and strategic importance of additive manufacturing within the industry.

- Rapid Prototyping: Accelerates design cycles and reduces time-to-market for new aerospace components.

- Customization: Enables the creation of bespoke parts tailored to specific aircraft or operational requirements.

- Lightweight Designs: Facilitates the development of complex geometries that optimize weight, crucial for fuel efficiency in aviation.

- On-Demand Production: Reduces lead times and inventory, allowing for more agile manufacturing processes.

Technological advancements are reshaping manufacturing, with automation and AI driving efficiency. Crane is leveraging IIoT for real-time data and predictive maintenance, aiming to optimize operations. However, increased connectivity also elevates cybersecurity risks, necessitating robust defenses against threats that could cost millions.

Additive manufacturing, or 3D printing, is a key technological driver, particularly in aerospace. This allows for intricate, lightweight components and rapid prototyping, supporting Crane's innovation in advanced materials. The aerospace 3D printing market is projected to reach $10.9 billion by 2028, highlighting its strategic importance.

| Technology Trend | Impact on Crane | Supporting Data/Fact |

| Automation & Robotics | Increased productivity, improved quality, addresses labor shortages | Global robot population in manufacturing increased by 31% in 2024. |

| Industrial Internet of Things (IIoT) | Smarter decision-making, proactive maintenance, operational efficiency | IIoT integration can reduce operational costs by up to 15% through optimized energy consumption. |

| Cybersecurity Threats | Risk to operational continuity, intellectual property, and data security | Average cost of a data breach in the industrial sector reached $4.53 million in 2023. |

| Additive Manufacturing (3D Printing) | Enables lightweight designs, rapid prototyping, customized parts | Aerospace 3D printing market projected to reach $10.9 billion by 2028. |

Legal factors

Crane Company navigates a complex global landscape of environmental regulations impacting emissions, waste disposal, and resource consumption. Failure to comply can result in substantial financial penalties and damage to its brand image, particularly as manufacturing industries face increasingly rigorous environmental standards.

For instance, in 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) began its transitional phase, affecting industries with significant carbon footprints, which could influence Crane's supply chain and operational costs. Similarly, the US Environmental Protection Agency (EPA) continues to enforce regulations on industrial emissions and water usage, with proposed updates to air quality standards expected in late 2024 or early 2025.

Crane's manufacturing of critical components for sectors like aerospace means they operate under intense product liability scrutiny. Failure to meet rigorous safety standards, such as those set by the FAA for aircraft parts, can lead to costly lawsuits and significant reputational damage. For instance, in 2023, the aerospace industry saw a notable increase in product liability claims, underscoring the importance of robust quality control.

Crane's global operations are significantly impacted by international trade laws and sanctions. For instance, in 2024, the World Trade Organization (WTO) reported ongoing disputes and evolving trade agreements that affect equipment manufacturers. Navigating these complex regulations is crucial to prevent costly penalties and ensure continued market access.

Compliance with export controls is paramount for Crane, especially given the dual-use nature of some of its products. Failure to adhere to these rules, which are frequently updated by governments like the United States and the European Union, can lead to severe legal repercussions. As of early 2025, geopolitical tensions continue to influence the imposition and modification of sanctions, directly affecting supply chains and customer bases for companies like Crane.

Intellectual Property (IP) Protection

Protecting Crane's intellectual property, especially its patents covering advanced materials, sophisticated engineered designs, and proprietary manufacturing technologies, is fundamental to sustaining its market leadership. This IP is the bedrock of its competitive advantage, ensuring that its innovations remain exclusive.

The dynamic nature of intellectual property law presents ongoing challenges. Notably, the increasing prevalence of AI-generated inventions necessitates the development of agile and forward-thinking strategies to secure and enforce IP rights in this new frontier. For instance, as of early 2024, the United States Patent and Trademark Office (USPTO) continues to refine its guidance on inventorship for AI-assisted creations, impacting how companies like Crane must approach patent filings.

Crane's proactive approach to IP management is vital. This includes:

- Securing robust patent portfolios for its innovative products and processes.

- Monitoring global IP landscapes for potential infringement.

- Adapting legal strategies to address emerging technologies like AI in invention.

- Leveraging trade secrets for unpatented proprietary information.

Data Privacy and Cybersecurity Laws

Crane's operations are increasingly impacted by data privacy and cybersecurity regulations. Laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) dictate how sensitive customer data can be handled. Non-compliance carries significant risks, including substantial fines and reputational damage. For instance, in 2023, the GDPR saw fines totaling over €1.5 billion levied against various organizations across the EU, highlighting the financial penalties for data breaches and privacy violations.

These legal frameworks require robust data protection measures and transparent data handling practices. Crane must invest in cybersecurity infrastructure and employee training to safeguard information and avoid costly breaches. Failure to do so can result in legal actions and a severe erosion of customer trust, impacting future business. The increasing sophistication of cyber threats in 2024 and 2025 means continuous adaptation and vigilance are paramount.

- GDPR Fines: Over €1.5 billion in GDPR fines were issued in 2023 across the EU.

- CCPA Impact: California's CCPA provides consumers with rights regarding their personal data, influencing data collection and usage policies.

- Cybersecurity Spending: Global cybersecurity spending is projected to reach $267 billion in 2024, reflecting the growing importance of data protection.

- Data Breach Costs: The average cost of a data breach in 2024 is estimated to be $4.73 million, underscoring the financial implications of security failures.

Crane must adhere to evolving labor laws and workplace safety regulations globally. Ensuring fair labor practices and maintaining safe working conditions are critical to avoid legal disputes and maintain employee morale. As of 2024, many countries are updating minimum wage laws and employee benefit mandates, requiring constant review of HR policies.

The company's commitment to ethical business conduct and anti-corruption laws, such as the Foreign Corrupt Practices Act (FCPA), is non-negotiable. Violations can lead to severe penalties and reputational damage, impacting international partnerships and market access. Crane's compliance programs are regularly audited to ensure adherence to these stringent legal requirements.

Crane's global operations are subject to a patchwork of tax laws and regulations. Navigating international tax treaties, transfer pricing rules, and corporate tax rates is essential for financial health. For instance, the OECD's Base Erosion and Profit Shifting (BEPS) initiative continues to influence corporate tax strategies worldwide, with ongoing discussions in 2024 and 2025 regarding digital taxation.

| Legal Area | 2024/2025 Impact | Crane's Action |

|---|---|---|

| Environmental Regulations | EU CBAM transitional phase; EPA air quality standard updates | Supply chain cost analysis; emission control investment |

| Product Liability | Increased aerospace claims in 2023 | Robust quality control; enhanced safety testing |

| Intellectual Property | USPTO guidance on AI inventorship (early 2024) | Agile IP strategies; AI-assisted patent monitoring |

| Data Privacy | Over €1.5 billion in GDPR fines (2023); projected $267B global cybersecurity spending (2024) | Invest in cybersecurity; employee training; transparent data handling |

Environmental factors

Global climate change policies, such as the Paris Agreement's goal to limit warming to 1.5°C, are increasingly influencing industrial operations. Many nations have set ambitious carbon reduction targets; for instance, the European Union aims for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels.

Crane Company will likely experience intensified scrutiny regarding its manufacturing processes and supply chain emissions. This pressure may necessitate investments in cleaner technologies and operational efficiencies to meet evolving environmental regulations and stakeholder expectations for sustainability.

Furthermore, there's a growing demand for products that support energy efficiency and emissions reduction. Crane Company could see opportunities to innovate and develop solutions that help its customers lower their environmental impact, potentially opening new market segments and enhancing brand reputation.

The availability and cost of essential raw materials for Crane's diverse manufacturing operations are increasingly impacted by global resource scarcity and complex geopolitical situations. For instance, the prices of metals crucial for construction equipment, like steel and copper, have seen significant volatility, with copper prices reaching over $9,000 per metric ton in early 2024 due to supply constraints and strong demand from the energy transition sector.

Crane's long-term resilience hinges on robust sustainable sourcing practices and a strategic diversification of its supply chains. This approach mitigates risks associated with single-source dependencies and helps manage the fluctuating costs of materials such as rare earth elements, vital for advanced electronics in modern machinery, which are largely concentrated in a few geographic regions.

Globally, the push towards a circular economy is intensifying, with many regions setting ambitious waste reduction targets. For instance, the European Union aims to increase recycling rates for municipal waste to 65% by 2035. This trend directly impacts manufacturers like Crane, pressuring them to integrate waste minimization and resource efficiency into their core operations.

Crane can explore adopting more sustainable manufacturing processes, such as enhanced recycling programs for materials used in their products and implementing remanufacturing initiatives for components. This not only aligns with environmental regulations but also presents opportunities for cost savings and new revenue streams, as seen with companies that have successfully integrated circular economy models into their business strategies, often reporting improved material costs and brand reputation.

Energy Efficiency and Renewable Energy Adoption

The increasing global focus on sustainability is driving a significant demand for energy-efficient industrial products and solutions. This trend presents a dual opportunity for Crane: to enhance its own operational efficiency by adopting greener practices and to capitalize on a growing market for its energy-saving technologies. For instance, Crane's filtration and separation solutions can play a crucial role in optimizing industrial processes, thereby reducing energy consumption for its clients.

Crane can strategically invest in renewable energy sources to power its manufacturing facilities. This not only lowers operational costs but also bolsters its environmental credentials. By integrating solar or wind power, Crane can reduce its carbon footprint, aligning with the energy transition goals that many of its key markets are pursuing. This proactive approach can also lead to greater energy price stability.

Developing and marketing products that directly contribute to customer energy efficiency goals is a key growth avenue. This includes advanced materials and components that enable lighter, more aerodynamic designs in transportation, or more efficient fluid handling systems in various industries. For example, Crane's engineered materials could be instrumental in developing next-generation HVAC systems that consume less power.

- Market Growth: The global market for energy-efficient industrial equipment is projected to reach over $700 billion by 2027, indicating substantial growth potential for companies like Crane that offer relevant solutions.

- Operational Savings: Companies that invest in on-site renewable energy generation can see significant reductions in electricity costs. For example, a typical industrial solar installation can reduce electricity bills by 40-60%.

- Customer Demand: A 2024 survey found that 75% of B2B buyers consider a supplier's sustainability practices when making purchasing decisions, highlighting the importance of energy efficiency in Crane's value proposition.

- Regulatory Tailwinds: Many governments are implementing stricter energy efficiency standards and offering incentives for renewable energy adoption, creating a favorable regulatory environment for Crane's energy-saving products.

Environmental, Social, and Governance (ESG) Reporting

Crane faces increasing pressure from investors and stakeholders to report transparently on its environmental impact. This focus on Environmental, Social, and Governance (ESG) performance is a significant trend shaping corporate accountability. For instance, in 2024, a significant majority of institutional investors surveyed by PwC indicated that ESG factors are material to their investment decisions.

Strong ESG practices and robust reporting can significantly enhance Crane's investor appeal and bolster its corporate reputation. Companies demonstrating commitment to sustainability and ethical operations often attract more capital and build stronger relationships with customers and employees. This is reflected in the growing market for sustainable investments, which is projected to reach trillions of dollars globally by 2025.

- Investor Demand: A growing number of institutional investors, managing trillions in assets, are integrating ESG criteria into their decision-making processes, impacting capital availability.

- Reputational Benefits: Demonstrating strong environmental stewardship can improve Crane's brand image, potentially leading to increased customer loyalty and a competitive edge.

- Regulatory Scrutiny: Evolving environmental regulations and reporting requirements globally necessitate proactive ESG management and disclosure from companies like Crane.

- Operational Efficiency: Investments in sustainable practices, such as energy efficiency and waste reduction, can lead to long-term cost savings and improved operational performance.

Global climate policies are pushing industries towards sustainability, impacting Crane's operations and supply chains. For example, the EU's 2030 emissions reduction target of 55% necessitates cleaner technologies and greater efficiency. This environmental focus also creates market opportunities for Crane's energy-saving products and solutions.

Crane must navigate resource scarcity and price volatility, as seen with copper prices exceeding $9,000 per metric ton in early 2024. Implementing sustainable sourcing and supply chain diversification is crucial for long-term resilience and managing material costs, especially for rare earth elements.

The circular economy trend, with targets like the EU's 65% municipal waste recycling by 2035, requires Crane to integrate waste minimization and resource efficiency. Adopting enhanced recycling and remanufacturing can lead to cost savings and new revenue streams.

Growing demand for energy-efficient industrial products presents a dual opportunity for Crane to improve its own operations and capitalize on a market projected to exceed $700 billion by 2027. Investing in renewable energy, such as solar or wind power, can lower operational costs and enhance Crane's environmental credentials.

| Environmental Factor | Impact on Crane | Opportunity/Mitigation |

|---|---|---|

| Climate Change Policies | Increased scrutiny on emissions, need for cleaner tech | Develop energy-efficient solutions, enhance brand reputation |

| Resource Scarcity | Material price volatility (e.g., copper >$9,000/ton in early 2024) | Sustainable sourcing, supply chain diversification |

| Circular Economy | Pressure for waste reduction and resource efficiency | Implement recycling, remanufacturing for cost savings |

| Energy Efficiency Demand | Growing market for energy-saving products | Invest in renewables, market energy-efficient components |

PESTLE Analysis Data Sources

Our Crane PESTLE Analysis is informed by a robust blend of data from industry associations, market research firms, and governmental bodies. We meticulously gather information on regulatory changes, economic indicators, and technological advancements to provide a comprehensive view.