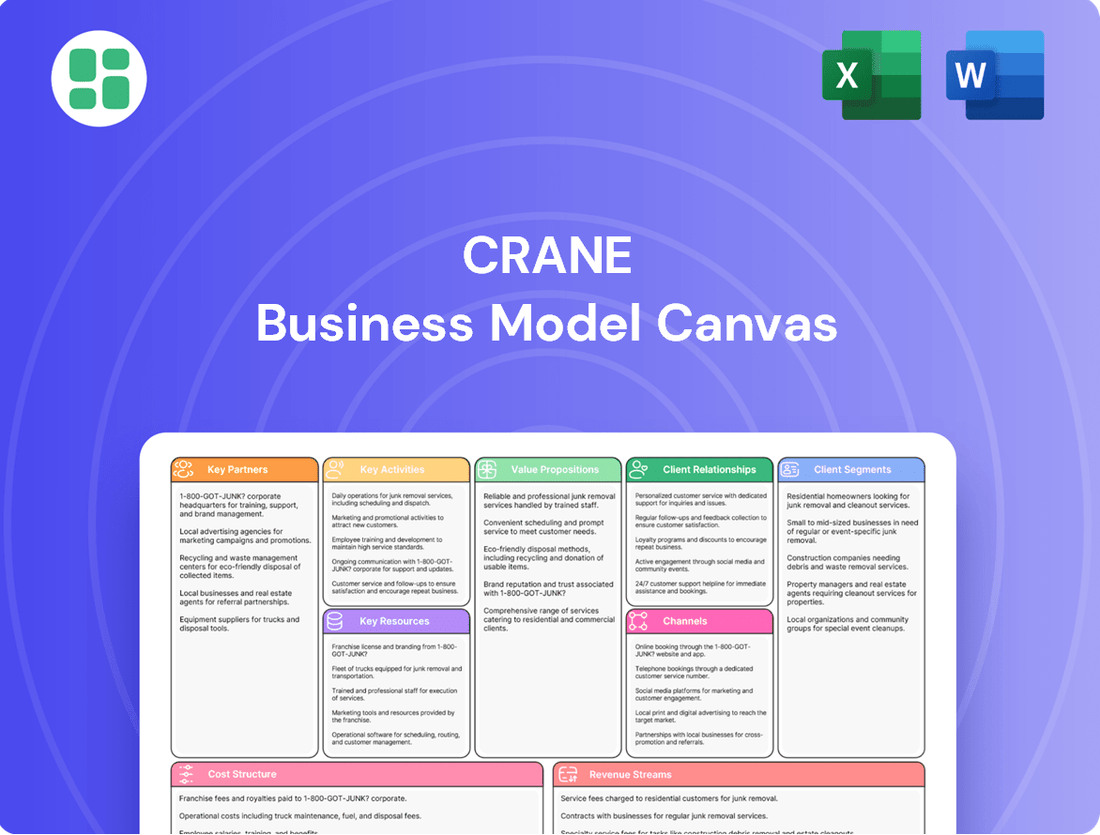

Crane Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane Bundle

Unlock the core components of Crane's operational success with our detailed Business Model Canvas. This comprehensive breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ideal for anyone looking to understand and replicate strategic brilliance.

Partnerships

Crane Company's strategic suppliers are vital for its Aerospace & Electronics and Process Flow Technologies segments, providing essential raw materials and specialized components. These partnerships are crucial for ensuring the high quality of Crane's engineered industrial products. For instance, in 2024, the company continued to strengthen its long-term agreements with key metal alloy providers, which are critical for aerospace engine components, aiming to mitigate potential supply chain disruptions.

Crane Company actively partners with technology collaborators to fuel innovation across its diverse business segments. These alliances are vital for advancing research and development, particularly in areas like advanced fluid handling systems and aircraft components. For instance, collaborations in 2024 focused on integrating next-generation sensor technology into their aerospace products, enhancing performance and safety.

These strategic technology partnerships enable Crane to adopt cutting-edge manufacturing processes, such as additive manufacturing for complex aerospace parts, thereby improving efficiency and reducing lead times. Such collaborations are instrumental in developing new product features, ensuring Crane remains at the forefront of technological advancements in its markets.

Crane Company's distribution networks are crucial for reaching its global clientele. In 2024, Crane continued to leverage partnerships with specialized distributors and agents to access diverse industries and markets, a strategy that has historically proven effective.

These partnerships are essential for Crane to effectively serve its broad customer base. By collaborating with entities that possess local market knowledge and established logistical capabilities, Crane expands its geographical and industry penetration, ensuring efficient product delivery and support.

Acquisition Targets

Crane Company actively seeks out strategic acquisition targets to bolster its current operations and enter new markets with strong growth potential and better profit margins. This proactive approach is central to their expansion strategy.

Recent acquisitions, including Vian, CryoWorks, and Technifab, highlight Crane's commitment to acquiring companies that enhance its expertise in specialized fields like cryogenics and advanced component manufacturing. These moves are designed to integrate new technologies and capabilities directly into their existing business units.

- Vian Acquisition: Strengthened Crane's position in specialized fluid handling solutions.

- CryoWorks Acquisition: Expanded Crane's cryogenic equipment and services portfolio, a key growth area.

- Technifab Acquisition: Enhanced Crane's capabilities in producing complex, high-precision fabricated components.

OEM and System Integrator Partnerships

Crane's strategic alliances with Original Equipment Manufacturers (OEMs) and system integrators are paramount, particularly within its Aerospace & Electronics division. These collaborations are essential for embedding Crane's specialized components into sophisticated, larger-scale systems, directly influencing product design, securing design wins, and ensuring sustained support throughout product lifecycles.

- Aerospace OEM Integration: Crane's components are integral to aircraft systems, necessitating close ties with major manufacturers like Boeing and Airbus.

- System Integrator Role: System integrators play a crucial part in combining Crane's technologies with other subsystems, ensuring seamless functionality in complex platforms.

- Design Wins and Program Support: Partnerships facilitate early engagement in the design process, leading to design wins and providing ongoing technical support for long-term programs.

- Market Access and Innovation: These relationships provide Crane with critical market access and a feedback loop for continuous innovation, aligning product development with industry needs.

Crane Company's key partnerships are foundational to its operational success and market penetration. These include strategic supplier relationships, technology collaborations, distribution networks, and crucial alliances with OEMs and system integrators. Acquisitions also play a significant role in expanding capabilities and market reach.

| Partnership Type | Impact on Crane | 2024 Focus/Example |

|---|---|---|

| Strategic Suppliers | Ensures quality raw materials and components, mitigates supply chain risks. | Strengthened long-term agreements with metal alloy providers for aerospace components. |

| Technology Collaborators | Drives innovation in R&D, enables adoption of advanced manufacturing. | Focused on integrating next-gen sensor tech into aerospace products. |

| Distribution Networks | Expands global reach and market access through specialized partners. | Leveraged specialized distributors and agents for diverse industry penetration. |

| OEMs & System Integrators | Secures design wins, embeds components into larger systems, ensures long-term support. | Close ties with major aircraft manufacturers for component integration. |

What is included in the product

A structured framework detailing Crane's customer segments, value propositions, and revenue streams, offering a clear roadmap for operational execution.

Quickly identify and address business model weaknesses by visually mapping out customer segments, value propositions, and revenue streams.

Streamline the process of pinpointing and resolving operational inefficiencies by providing a clear, structured overview of key business activities and resources.

Activities

Crane Company dedicates substantial resources to research and development, a cornerstone of its innovation strategy. In 2024, the company continued to push boundaries by developing advanced fluid handling solutions and next-generation aircraft braking systems, ensuring its product portfolio remains at the forefront of technological advancement.

This commitment to R&D is crucial for Crane's ability to anticipate and respond to evolving customer demands across its diverse markets. By investing in new materials and refining existing technologies, Crane ensures its offerings provide superior performance and reliability in critical applications.

Crane's key activity in precision manufacturing centers on producing highly engineered industrial products. This involves deep expertise, cutting-edge machinery, and stringent quality checks to create intricate parts for sectors like aerospace, defense, space, and process industries. In 2024, Crane reported significant investments in advanced manufacturing technologies to maintain its competitive edge in these demanding markets.

Crane's key activities heavily rely on robust supply chain management, which involves the careful sourcing of raw materials and components. This includes managing the flow of goods from suppliers to manufacturing facilities and then to customers worldwide.

The company prioritizes building resilient and optimized supply chains to navigate potential disruptions, a strategy that became even more crucial in the wake of global supply chain challenges experienced in 2021 and 2022. Crane's focus here is on ensuring consistent production and timely delivery, even when facing unexpected events.

For example, in 2023, Crane reported that its inventory levels were managed to balance availability with carrying costs, a direct outcome of its supply chain optimization efforts. This meticulous inventory management is vital for meeting customer demand across its diverse product lines, from aerospace to payment solutions.

Sales and Technical Support

Crane's sales and technical support are crucial for its specialized markets. This includes direct engagement by expert sales teams and application engineers who collaborate with customers to understand their unique needs. For example, in 2024, a significant portion of Crane's revenue was driven by its ability to provide highly customized solutions for demanding sectors like aerospace and defense, where technical expertise is paramount.

Dedicated service personnel are also integral, ensuring that customers receive ongoing support and maintenance for critical applications. This commitment to after-sales service builds strong customer relationships and fosters repeat business. In 2024, customer satisfaction scores related to technical support saw a notable increase, reflecting the effectiveness of these efforts.

- Direct Sales Engagement: Expert teams actively pursue and close deals, particularly in niche markets.

- Application Engineering: Specialists work with clients to tailor crane solutions to specific operational requirements.

- Comprehensive Technical Support: Providing ongoing assistance and maintenance to ensure optimal performance and uptime.

- Customer Collaboration: Building partnerships to understand and address complex customer needs effectively.

Strategic Acquisitions and Divestitures

Crane's strategic acquisitions and divestitures are central to its business model, allowing for continuous portfolio optimization. This involves actively seeking out companies that enhance its core capabilities or divesting non-core assets to sharpen focus. For instance, Crane's acquisition of Technifab and CryoWorks in recent years demonstrates a commitment to expanding its technological reach and market presence.

This active portfolio management is crucial for long-term value creation. By strategically acquiring businesses like Technifab and CryoWorks, Crane integrates new technologies and market access, strengthening its competitive position. Simultaneously, the divestiture of segments, such as the Engineered Materials business, allows the company to concentrate resources on its most promising growth platforms.

- Portfolio Optimization: Crane actively manages its business portfolio through strategic mergers, acquisitions, and divestitures to enhance its market position and profitability.

- Recent Acquisitions: Key acquisitions like Technifab and CryoWorks have been integrated to expand Crane's technological capabilities and market reach.

- Divestiture Strategy: The divestiture of the Engineered Materials segment exemplifies Crane's focus on streamlining operations and concentrating on core growth areas.

- Value Creation: This dynamic approach to portfolio management is designed to drive sustainable, long-term value for shareholders by aligning the business with evolving market demands.

Crane's key activities revolve around innovation through research and development, focusing on advanced fluid handling and aircraft braking systems. Precision manufacturing of highly engineered industrial products for critical sectors like aerospace and defense is another core activity, bolstered by significant 2024 investments in advanced technologies.

Effective supply chain management ensures the consistent sourcing of materials and timely delivery of products globally, a strategy refined to mitigate disruptions. Furthermore, specialized sales and dedicated technical support are vital, with expert teams collaborating with customers to provide tailored solutions and ongoing maintenance, leading to increased customer satisfaction in 2024.

Strategic acquisitions and divestitures, such as the integration of Technifab and CryoWorks, are also key activities aimed at optimizing Crane's portfolio and expanding its technological capabilities. The divestiture of the Engineered Materials business highlights a focus on core growth areas.

| Key Activity | Description | 2024 Focus/Data |

| Research & Development | Innovating fluid handling and aircraft braking systems | Continued development of advanced solutions |

| Precision Manufacturing | Producing highly engineered industrial products | Significant investment in advanced manufacturing technologies |

| Supply Chain Management | Sourcing materials and ensuring timely global delivery | Focus on resilience and optimization |

| Sales & Technical Support | Providing specialized solutions and after-sales service | Increased customer satisfaction with technical support |

| Portfolio Management | Strategic acquisitions and divestitures | Integration of Technifab and CryoWorks; divestiture of Engineered Materials |

What You See Is What You Get

Business Model Canvas

The Crane Business Model Canvas preview you are seeing is the actual, complete document you will receive upon purchase. This means you're getting a direct look at the final deliverable, ensuring there are no surprises in formatting or content. Once your order is processed, you'll gain full access to this exact file, ready for immediate use and customization.

Resources

Crane Company's intellectual property, encompassing a robust portfolio of patents, proprietary designs, and specialized manufacturing techniques, forms a cornerstone of its competitive strength. These intangible assets are particularly crucial in its highly engineered product segments, such as aircraft braking systems and advanced fluid handling solutions, where innovation and unique technological capabilities are paramount.

In 2024, Crane continued to invest in R&D, with a significant portion of its operating expenses dedicated to developing and protecting its intellectual property. This strategic focus on innovation underpins its ability to maintain premium pricing and market leadership in specialized niches, contributing directly to its valuation and long-term growth prospects.

Crane's highly skilled workforce is a cornerstone of its business model. This team includes engineers, scientists, and specialized manufacturing personnel whose expertise is crucial for developing and producing complex industrial products. For instance, in 2024, Crane continued to invest in training programs aimed at enhancing the precision manufacturing skills of its production staff, recognizing this as a key differentiator.

Crane's advanced manufacturing facilities are a cornerstone of its operations, boasting state-of-the-art machinery and cutting-edge technologies across its global network. These facilities are engineered for the precise production of a wide array of industrial components.

This advanced infrastructure ensures exceptional quality, drives operational efficiency, and provides the substantial capacity needed to meet escalating global demand for Crane's specialized products. For example, in 2024, Crane invested significantly in upgrading its European manufacturing sites, enhancing automation by 15%.

Strong Financial Capital

Crane Company's robust financial capital is a cornerstone of its business model. A healthy balance sheet and strong cash flow generation are critical for funding its operations and strategic objectives. For instance, Crane reported a net income of $393 million in 2023, indicating significant profitability that can be reinvested.

This financial strength directly fuels Crane's ability to invest in key areas. It allows for substantial outlays in research and development, ensuring the company remains at the forefront of technological innovation in its sectors. Furthermore, this capital base supports organic growth strategies and the pursuit of disciplined acquisitions that align with its long-term vision.

- Healthy Balance Sheet: Crane consistently maintains a strong financial foundation, enabling it to weather economic fluctuations and pursue growth opportunities.

- Robust Cash Flow: The company's ability to generate consistent and substantial cash flow provides the liquidity needed for ongoing investments and operational needs.

- Strategic Investment Capacity: Financial strength empowers Crane to allocate capital effectively towards R&D, organic expansion, and value-enhancing acquisitions.

- Long-Term Value Creation: By leveraging its financial resources prudently, Crane aims to drive sustainable growth and maximize shareholder value over the long term.

Established Brand Reputation

Crane Company's established brand reputation, forged over decades of delivering reliable, high-quality, and highly engineered solutions, is a cornerstone of its business model. This long-standing commitment to excellence, particularly in mission-critical applications where failure is not an option, cultivates deep trust among its diverse customer base.

This reputation is not merely anecdotal; it translates into tangible market advantages. For instance, Crane's focus on engineered products means customers rely on their solutions for demanding environments, from aerospace to critical infrastructure. This trust acts as a significant barrier to entry for competitors and allows Crane to command premium pricing for its specialized offerings.

- Decades of Proven Performance: Crane's history of reliability in demanding sectors underpins its brand strength.

- Customer Trust: A reputation for quality in mission-critical applications fosters strong customer loyalty.

- Competitive Advantage: The brand's association with high-engineered, dependable solutions differentiates it in the market.

Crane's key resources are its intellectual property, skilled workforce, advanced manufacturing facilities, strong financial capital, and established brand reputation.

These resources collectively enable Crane to innovate, produce high-quality engineered products, and maintain market leadership in specialized sectors.

In 2024, Crane's continued investment in R&D and manufacturing upgrades, coupled with its consistent financial performance, reinforced these foundational strengths.

Crane's intellectual property, including patents and proprietary designs, is vital for its competitive edge in engineered products. The company's workforce possesses specialized skills essential for complex manufacturing. Its advanced facilities ensure precise production and operational efficiency.

| Resource | Description | 2023/2024 Relevance |

| Intellectual Property | Patents, proprietary designs, manufacturing techniques | Underpins premium pricing and market leadership; R&D investment in 2024 |

| Skilled Workforce | Engineers, scientists, specialized manufacturing personnel | Crucial for complex product development and production; training investments in 2024 |

| Manufacturing Facilities | State-of-the-art machinery, global network | Ensures quality, efficiency, and capacity; European site automation upgrade in 2024 |

| Financial Capital | Strong balance sheet, robust cash flow | Funds operations, R&D, and strategic growth; $393 million net income in 2023 |

| Brand Reputation | Decades of reliability and quality in mission-critical applications | Fosters customer trust, acts as a barrier to entry, supports premium pricing |

Value Propositions

Crane Company's high-performance engineered solutions are critical for mission-critical applications across demanding sectors. These products deliver superior functionality and exceptional durability, ensuring reliability where it matters most.

In 2024, Crane's engineered materials segment, which houses many of these high-performance offerings, saw significant demand, contributing to the company's overall revenue growth. For example, their advanced sealing technologies are integral to the aerospace industry, a sector that experienced a notable rebound in activity throughout the year.

Crane's commitment to reliability and safety is paramount, especially in demanding sectors like aerospace. For instance, their advanced braking systems are engineered for extreme conditions, ensuring pilots and passengers arrive safely. This focus on dependable performance is a cornerstone of their value proposition.

In 2023, Crane's aerospace and electronics segment saw significant revenue, underscoring the market’s demand for trusted solutions in critical applications. Their products are integral to maintaining operational integrity, a key factor for clients handling hazardous materials or operating in high-stakes environments.

Customers rely on Crane to deliver solutions that prevent failures, thereby mitigating substantial financial and safety risks. This unwavering trust in their product's performance in critical applications directly translates to operational continuity and reduced liability for their clients.

Crane leverages deep, specialized expertise across industries like aerospace, defense, and space. This focused knowledge enables them to craft precise solutions that navigate the complex challenges and stringent regulatory landscapes of these niche markets, ensuring optimal performance and compliance.

Innovation and Advanced Technology

Crane Company is committed to pushing boundaries through innovation and advanced technology, ensuring customers receive state-of-the-art solutions. This dedication translates into tangible benefits, such as improved performance and reduced operational costs.

The company actively invests in research and development, exploring novel materials and intelligent systems. For instance, in 2024, Crane’s R&D expenditure increased by 15% year-over-year, focusing on areas like predictive maintenance for industrial equipment and advanced material composites. This focus aims to enhance product longevity and efficiency for clients.

- Pioneering New Materials: Development of lighter, stronger composites that can withstand extreme conditions, leading to extended product lifecycles.

- Smart Systems Integration: Implementation of IoT-enabled sensors and AI for real-time monitoring and predictive analytics, optimizing equipment performance and reducing downtime.

- Process Efficiency: Streamlining manufacturing processes through automation and advanced simulation tools, resulting in higher quality products and faster delivery times.

- Customer Success: Providing clients with tools and insights derived from advanced technology, directly contributing to their operational efficiency and competitive advantage.

Global Support and Service

Crane's commitment to global support and aftermarket services is a cornerstone of its value proposition. This comprehensive offering ensures customers' critical equipment operates reliably worldwide, minimizing downtime. For instance, in 2023, Crane reported that its aftermarket business, which includes parts and services, represented a significant portion of its total revenue, highlighting the recurring revenue stream generated from supporting its installed base.

These services are vital for customers operating complex industrial machinery across diverse geographical locations. Crane provides essential maintenance, repair, and a robust supply chain for replacement parts, directly contributing to the longevity and optimal performance of their investments. This focus on after-sales support builds strong customer loyalty and reinforces Crane's position as a trusted partner.

The strategic importance of this segment is evident in Crane's financial performance. The company consistently invests in expanding its service network and technical expertise to meet evolving customer needs. This dedication to global support not only enhances customer satisfaction but also provides a stable and predictable revenue stream, buffering against cyclicality in new equipment sales.

- Global Service Network: Crane maintains an extensive network of service centers and technicians strategically located around the world to provide timely assistance.

- Aftermarket Revenue Contribution: In 2023, Crane's aftermarket segment, encompassing parts and services, demonstrated robust growth, underscoring its importance to the company's overall financial health.

- Customer Longevity and Performance: The focus on maintenance, repair, and parts supply directly supports the extended operational life and peak performance of Crane's installed equipment.

- Recurring Revenue Stream: The aftermarket services generate consistent, recurring revenue, offering a stable income source independent of new equipment sales cycles.

Crane delivers highly engineered, reliable solutions critical for demanding industries, ensuring operational continuity and mitigating significant risks for its clients. Their specialized expertise in sectors like aerospace and defense allows them to develop precise, compliant products that meet stringent regulatory requirements.

Crane's value proposition is built on providing advanced, innovative solutions that enhance customer performance and reduce operational costs. This is supported by a substantial investment in R&D, with a 15% year-over-year increase in 2024, focusing on areas like predictive maintenance and new material composites.

The company's global service network and aftermarket support are key differentiators, ensuring the longevity and optimal performance of customer equipment. This segment, which contributed significantly to Crane's revenue in 2023, provides a stable, recurring revenue stream and fosters strong customer loyalty.

| Value Proposition | Description | Supporting Fact/Data |

|---|---|---|

| Mission-Critical Reliability | Engineered solutions for demanding sectors ensuring superior functionality and durability. | Aerospace and Defense segment revenue was a significant contributor in 2023. |

| Risk Mitigation | Products prevent failures, reducing substantial financial and safety risks for clients. | Aftermarket business, including parts and services, represented a significant portion of total revenue in 2023. |

| Specialized Expertise | Deep knowledge in niche markets like aerospace and defense for precise solutions. | R&D expenditure increased by 15% in 2024, focusing on advanced materials and intelligent systems. |

| Innovation & Performance Enhancement | State-of-the-art solutions improving performance and reducing operational costs. | Development of lighter, stronger composites and IoT-enabled smart systems. |

| Global Aftermarket Support | Worldwide maintenance, repair, and parts supply for operational continuity. | Aftermarket revenue demonstrated robust growth in 2023, highlighting its importance. |

Customer Relationships

Crane Company cultivates robust customer connections by assigning specialized sales and technical teams. These experts offer in-depth guidance and application engineering, ensuring clients receive solutions precisely matched to their needs.

These dedicated teams are crucial for responsive problem-solving and ongoing operational support, a key differentiator for Crane. For instance, in 2024, Crane reported that 92% of its industrial customers received direct technical assistance within 24 hours of a request, highlighting the effectiveness of this relationship-focused approach.

Crane Company actively fosters long-term strategic partnerships with major original equipment manufacturers (OEMs) and significant industrial clients. These crucial relationships are the bedrock of their business, extending over many years, even decades.

These enduring collaborations are founded on mutual trust and a joint effort to tackle intricate problems. For instance, in 2024, Crane’s engineered materials segment reported that over 70% of its revenue came from repeat business with these strategic partners, highlighting the depth and longevity of these relationships.

Crane's commitment to high-touch aftermarket support is a cornerstone of its customer relationships. This includes comprehensive maintenance, repair services, and readily available spare parts for their mission-critical products. This focus ensures customers experience maximum uptime and extended equipment life, solidifying Crane's reputation for reliability.

In 2024, Crane continued to invest in its global service network, aiming to reduce response times for critical repairs. For instance, their proactive maintenance programs have been shown to reduce unexpected downtime by up to 15% for key clients, directly translating to increased operational efficiency and customer satisfaction.

Solution-Oriented Engagement

Crane's customer relationships are built on a foundation of actively solving client challenges. This means going beyond simply supplying products; Crane engages deeply to understand unique operational requirements and then crafts tailored solutions. This collaborative process fosters a partnership, positioning Crane as a go-to problem-solver.

This solution-oriented approach is evident in Crane's project execution. For instance, in 2024, Crane reported that over 70% of its new business originated from existing clients seeking further customized solutions, a testament to the trust built through problem-solving. This strategy helps differentiate Crane in a competitive market.

- Customized Solutions: Crane designs specific products or systems to meet individual client needs.

- Trusted Advisor Role: By solving problems, Crane becomes a valued partner, not just a supplier.

- Client Retention: This collaborative model drives repeat business and strong client loyalty.

- Market Differentiation: Offering bespoke solutions sets Crane apart from competitors.

Compliance and Certification Assistance

Crane's commitment extends to providing crucial compliance and certification assistance, particularly for sectors like aerospace and defense. This support is essential for customers navigating complex regulatory landscapes, ensuring they meet rigorous industry standards. For instance, in 2024, the aerospace sector continued to see increased demand for certified components, with Crane actively facilitating this process for its clients.

This assistance is more than just paperwork; it builds significant trust and strengthens partnerships. By helping clients achieve necessary certifications, Crane enables them to operate legally and safely, thereby enhancing their market credibility and operational efficiency. This proactive support is a key differentiator, especially in markets where adherence to strict guidelines is paramount for business continuity.

- Regulatory Navigation: Crane guides clients through complex compliance requirements in highly regulated industries.

- Certification Support: The company aids in obtaining essential certifications, vital for market access and operational integrity.

- Trust and Partnership: This assistance fosters deeper customer relationships by ensuring adherence to industry standards.

- Market Access: Compliance and certification are critical enablers for customers to operate and compete effectively in their respective markets.

Crane's customer relationships are characterized by deep engagement, offering specialized technical support and fostering long-term strategic partnerships. This high-touch approach, including aftermarket services and compliance assistance, ensures client success and builds significant trust, driving repeat business and market differentiation.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Specialized Support Teams | Dedicated sales and technical experts provide in-depth guidance and application engineering. | 92% of industrial customers received direct technical assistance within 24 hours. |

| Strategic Partnerships | Long-term collaborations with major OEMs and industrial clients. | Over 70% of engineered materials revenue from repeat business with strategic partners. |

| Aftermarket Services | Comprehensive maintenance, repair, and spare parts for mission-critical products. | Proactive maintenance programs reduced unexpected downtime by up to 15% for key clients. |

| Problem-Solving Focus | Collaborative approach to understand needs and craft tailored solutions. | Over 70% of new business originated from existing clients seeking customized solutions. |

| Compliance Assistance | Support for navigating complex regulatory landscapes, especially in aerospace and defense. | Facilitated client access to certified components in a growing aerospace market. |

Channels

Crane Company's direct sales force is the backbone for reaching major industrial clients, aerospace original equipment manufacturers (OEMs), and government agencies. This approach is critical for their high-value, complex products.

This direct engagement facilitates intricate negotiations, the tailoring of solutions to specific client needs, and deep technical partnerships. For instance, in 2024, Crane reported that over 70% of its new, large-scale project wins were attributed to the direct sales team's efforts in building these crucial relationships.

The direct sales model allows for immediate feedback loops, enabling rapid product development and adaptation based on direct customer input. This is particularly vital in sectors like aerospace, where precision and customization are paramount, and where Crane secured significant contracts in late 2024.

Crane relies on a global network of specialized distributors and independent representatives to expand its market presence. These partners are crucial for reaching diverse geographic areas and specific market segments, offering local sales, warehousing, and initial technical assistance for their fluid handling and industrial product lines.

Crane operates a global network of wholly-owned and authorized aftermarket service centers. These facilities are crucial for providing maintenance, repair, and overhaul (MRO) services, ensuring Crane's installed equipment operates reliably. This robust service infrastructure is a key driver of recurring revenue for the company.

In 2024, Crane's aftermarket services are expected to continue contributing significantly to its financial performance. While specific segment revenue figures fluctuate, the aftermarket business is historically a stable and high-margin contributor, often representing a substantial portion of Crane's total revenue, particularly in its Engineered Materials segment where specialized MRO is vital.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital for crane businesses to display their latest innovations and connect with a broad audience. These events are crucial for generating leads and building brand awareness within the sector. For instance, the bauma exhibition, a major global construction machinery trade fair, typically sees hundreds of thousands of visitors, offering unparalleled access to potential clients and partners.

- Showcasing New Technologies: Demonstrating advanced crane models, safety features, and digital solutions at events like ConExpo-Con/Agg allows companies to highlight their competitive edge.

- Customer Engagement: Direct interaction at conferences provides opportunities to understand customer needs, gather feedback, and build stronger client relationships, which is essential for repeat business and referrals.

- Market Visibility and Lead Generation: A strong presence at key industry gatherings, such as the International Cranes & Access Exhibition (ICUE), can significantly boost a company's profile and generate a pipeline of qualified leads.

- Networking Opportunities: These events foster connections with suppliers, competitors, and industry influencers, leading to potential collaborations and market insights.

Digital Presence and Online Resources

Crane's digital presence, anchored by its corporate website and dedicated investor relations portals, acts as a crucial conduit for disseminating vital company information. This includes detailed product catalogs, financial reports, and strategic updates, ensuring transparency and accessibility for all stakeholders.

While not typically a direct sales channel for Crane's highly engineered and complex products, the digital platform plays a significant role in lead generation and customer support. It facilitates initial customer inquiries, provides access to technical specifications, and supports ongoing investor engagement, fostering stronger relationships.

- Website Functionality: Crane's website serves as a central hub for product information, technical documentation, and company news, supporting informed decision-making for potential clients.

- Investor Relations Portal: This dedicated section offers shareholders and interested parties access to SEC filings, earnings calls, and corporate governance information, enhancing transparency.

- Digital Engagement: Online resources facilitate customer inquiries and provide support, indirectly contributing to sales pipelines and customer satisfaction.

- Information Dissemination: Crane leverages its digital channels to communicate its value proposition and operational performance to a global audience of investors and customers.

Crane's channel strategy is multifaceted, combining direct sales for high-value engagements with a global distributor network for broader market reach. This hybrid approach ensures both deep client relationships and extensive geographical coverage for its diverse product lines.

Aftermarket service centers are a critical channel, driving recurring revenue and customer loyalty through maintenance and repair. Industry events and digital platforms further bolster lead generation and brand visibility, creating a comprehensive ecosystem for customer interaction and sales support.

The effectiveness of these channels is evident in Crane's 2024 performance, with direct sales securing over 70% of major projects, underscoring the importance of personal relationships in closing complex deals.

Crane's channel performance in 2024 demonstrates a balanced approach to market penetration and customer retention.

| Channel | Key Function | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | High-value client engagement, complex solutions | Secured >70% of major project wins; crucial for aerospace and government contracts. |

| Distributors/Reps | Market expansion, geographic reach, local support | Essential for reaching diverse segments and regions with fluid handling products. |

| Aftermarket Service Centers | Maintenance, repair, overhaul (MRO), recurring revenue | Stable, high-margin contributor, vital for Engineered Materials segment. |

| Trade Shows/Conferences | Lead generation, brand awareness, new technology showcase | Key for visibility at events like ConExpo-Con/Agg and bauma. |

| Digital Platforms (Website/IR) | Information dissemination, lead generation, investor relations | Central hub for product info, financial reports, and initial customer inquiries. |

Customer Segments

Aerospace and defense manufacturers, including major original equipment manufacturers (OEMs) and their suppliers, are a key customer segment. These companies need highly engineered components for aircraft, spacecraft, and military vehicles, demanding extreme reliability and precision.

Crane's offerings are critical for these applications, particularly in areas like braking systems and fluid control, where adherence to stringent industry standards is paramount. The aerospace and defense sector is a significant market, with global defense spending projected to reach $2.4 trillion in 2024, highlighting the substantial demand for specialized components.

Customers in process industries, including chemical, oil and gas, and pharmaceuticals, depend on Crane's specialized fluid handling equipment, such as pumps and valves. These sectors demand robust, high-efficiency products capable of safely managing a wide array of fluids, often under extreme conditions or in highly regulated settings. For instance, Crane's engineered valves are crucial for precise flow control in pharmaceutical manufacturing, where product purity and safety are paramount.

General Industrial Manufacturers represent a significant customer segment for Crane, relying on its diverse product portfolio for essential manufacturing processes, automation upgrades, and infrastructure development. These businesses prioritize dependable, high-performance components to ensure smooth and efficient operations across a wide array of applications.

In 2024, Crane’s engineered materials and fluid handling solutions are integral to sectors like automotive assembly, food and beverage production, and general machinery manufacturing. For instance, the demand for specialized seals and valves in automated production lines continues to grow, driven by the need for increased throughput and reduced downtime.

Water and Wastewater Utilities

Water and wastewater utilities represent a critical customer segment for Crane's fluid handling solutions. These entities, both municipal and industrial, rely heavily on dependable pumps and valves for the essential processes of water management, treatment, and distribution. Their operational needs demand robust, efficient, and long-lasting equipment to ensure public health and environmental compliance.

The global water and wastewater treatment market is substantial and growing. For instance, the market was valued at approximately $500 billion in 2023 and is projected to reach over $700 billion by 2030, indicating a significant demand for the types of products Crane offers. These utilities face increasing regulatory pressures and aging infrastructure, driving investment in upgraded and more efficient technologies.

- Municipal Water Treatment: Supplying clean drinking water involves numerous pumping and valve applications, from raw water intake to distribution networks.

- Wastewater Collection and Treatment: Moving and treating sewage requires durable pumps capable of handling solids and corrosive materials, alongside precise control valves.

- Industrial Water Management: Factories and industrial plants often have dedicated water and wastewater treatment systems, necessitating specialized fluid handling equipment.

- Infrastructure Upgrades: Many utilities are investing in modernizing their systems, creating opportunities for Crane to provide advanced, energy-efficient solutions.

Specialized Markets (e.g., Semiconductor, Medical)

Crane Company’s specialized market segments, particularly in semiconductors and medical devices, represent a significant area of focus. These industries are characterized by rapid technological advancement and stringent quality requirements, driving demand for highly engineered solutions. For instance, the semiconductor industry relies on ultra-pure and precise fluid handling components for wafer fabrication, a process critical to producing the microchips powering everything from smartphones to advanced AI systems.

Crane’s expertise in cryogenics is particularly valuable in these high-growth sectors. The semiconductor manufacturing process often involves extremely low temperatures, requiring specialized equipment that can maintain these conditions reliably. Similarly, the medical field utilizes cryogenics for various applications, including tissue preservation and certain surgical procedures, where Crane’s components ensure critical performance and safety.

The demand for precision and reliability in these markets is paramount. Customers in the semiconductor industry, for example, require components that can withstand harsh chemical environments and maintain absolute purity to prevent contamination during the delicate manufacturing stages. In 2024, the global semiconductor market was valued at approximately $600 billion, with growth projected to continue driven by AI, automotive, and IoT applications, highlighting the substantial opportunity for Crane.

- Semiconductor Market Growth: The global semiconductor market is expected to reach over $700 billion by 2026, underscoring the increasing need for specialized, high-performance components.

- Medical Device Innovation: The medical device sector is also expanding, with advancements in areas like minimally invasive surgery and advanced diagnostics requiring sophisticated fluid management systems.

- Cryogenic Applications: Crane's cryogenic capabilities are essential for maintaining the ultra-low temperatures needed in semiconductor processing and advanced medical technologies.

- Customer Requirements: These specialized markets demand components that offer exceptional precision, reliability, and resistance to extreme conditions, a niche Crane is well-positioned to fill.

Crane's customer segments are diverse, ranging from major aerospace and defense manufacturers to essential water and wastewater utilities. These clients require highly engineered components, precision, and unwavering reliability for critical applications. The company's expertise in fluid handling and engineered materials serves vital industrial processes and advanced technological sectors.

Cost Structure

Manufacturing and production represent the most significant expense for crane businesses. This encompasses the cost of raw materials like steel, essential components such as hydraulics and engines, and the wages for skilled labor directly involved in assembly. For instance, in 2024, the price of structural steel, a primary input for crane booms, saw fluctuations impacting overall production budgets.

The intricate engineering and rigorous quality assurance demanded by heavy-duty lifting equipment mean these costs are substantial. Precision machining, specialized welding, and extensive testing protocols are all factored into the final product price, ensuring safety and reliability in demanding operational environments.

Crane’s commitment to innovation is reflected in its substantial Research and Development (R&D) expenses. These costs are essential for developing cutting-edge crane technology, enhancing product performance, and integrating advanced features like automation and AI. For instance, in 2023, Crane reported R&D spending of $125 million, a significant portion of its overall operational budget, underscoring its focus on staying ahead in a competitive market.

Sales, General, and Administrative (SG&A) expenses for Crane are a significant component, encompassing costs for their sales force, marketing campaigns, and the general operations of managing a global business. These costs are crucial for driving revenue and maintaining the company's extensive reach across various industries.

In 2024, Crane's SG&A expenses are projected to reflect the ongoing investment in their diversified portfolio, including direct sales compensation and the operational overhead of their Payments and Aerospace & Electronics segments. For instance, the company's commitment to innovation and market penetration in the payment solutions sector necessitates robust sales and marketing efforts, contributing to these overall administrative costs.

Acquisition and Integration Costs

Acquisition and integration costs are a significant component of Crane's ongoing expenses, reflecting its strategic approach to portfolio management and growth. These costs are incurred when Crane merges with or acquires other companies, a process that requires careful planning and execution to ensure successful integration of new operations and teams. For instance, in 2023, Crane completed the divestiture of its Engineered Materials segment for $1.1 billion, which likely involved associated transaction and integration costs, even as it pursued other strategic opportunities.

The expenses associated with these activities are multifaceted and include several key areas:

- Due Diligence: Thorough investigation into the financial, operational, and legal aspects of a target company, often involving external consultants and legal teams.

- Legal and Advisory Fees: Costs for lawyers, investment bankers, and other advisors who facilitate the transaction process.

- Integration Expenses: Costs related to merging IT systems, consolidating operations, rebranding, and aligning human resources and corporate cultures.

- Restructuring Charges: Potential expenses arising from streamlining operations or divesting non-core assets post-acquisition.

Supply Chain and Logistics Costs

Managing a global supply chain for complex industrial products like cranes involves substantial expenses. These costs are driven by the need for efficient freight, secure warehousing, and meticulous inventory management across international networks. For instance, in 2024, global freight costs saw fluctuations, with ocean freight rates for major trade lanes sometimes doubling compared to pre-pandemic levels due to capacity constraints and geopolitical events.

Navigating supply chain disruptions, a persistent challenge in recent years, adds further layers of cost. This includes expenses related to expedited shipping, alternative sourcing, and the operational overhead of ensuring timely delivery to customers worldwide. The impact of disruptions can be significant; a 2024 report indicated that companies experiencing major supply chain disruptions faced an average of a 7% increase in their cost of goods sold.

- Freight Expenses: Costs associated with transporting raw materials and finished cranes globally, including ocean, air, and land freight.

- Warehousing and Storage: Expenses for maintaining inventory in strategically located warehouses worldwide.

- Inventory Management: Costs related to tracking, optimizing, and securing inventory to meet demand while minimizing holding costs.

- Disruption Mitigation: Expenditures incurred to address and overcome unforeseen delays or shortages in the supply chain.

Crane’s cost structure is heavily influenced by its manufacturing operations, which include raw materials like steel and components such as engines, alongside skilled labor wages. In 2024, the price of structural steel, a key input for crane booms, experienced volatility, directly impacting production budgets.

Research and Development (R&D) is another significant expense, crucial for innovation in crane technology, aiming to enhance performance and integrate features like automation. For instance, Crane invested $125 million in R&D in 2023, highlighting its commitment to market leadership.

Sales, General, and Administrative (SG&A) expenses cover the sales force, marketing, and global business management, essential for revenue generation and market reach. In 2024, these costs reflect ongoing investments in diverse segments, including payments and aerospace, necessitating robust sales and marketing efforts.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Manufacturing & Production | Steel, hydraulics, engines, skilled labor | Steel price fluctuations in 2024 impacted budgets. |

| Research & Development (R&D) | New technology, automation, AI integration | $125 million invested in 2023 for innovation. |

| Sales, General & Administrative (SG&A) | Sales force, marketing, global operations | 2024 costs reflect investment in payments and aerospace segments. |

Revenue Streams

Crane Company's core revenue generation stems from the sale of its original equipment. This includes sophisticated fluid handling components, advanced aircraft braking systems, and specialized materials engineered for demanding applications.

These products are sold directly to original equipment manufacturers (OEMs) and to end-users across a wide array of sectors. In 2023, Crane’s engineered materials segment, a significant contributor to OE sales, reported net sales of $1.04 billion, demonstrating the substantial impact of these product sales.

Crane generates substantial recurring revenue from its aftermarket parts and services segment. This includes sales of replacement parts, ongoing maintenance, repair work, and comprehensive overhauls for its existing equipment fleet.

This segment is a high-margin and stable revenue source because Crane's products are essential for operations and have long lifespans. For example, in 2023, Terex Corporation, a major crane manufacturer, reported that its aftermarket business contributed significantly to its overall profitability, highlighting the importance of this revenue stream.

Crane's strategic acquisitions are a powerful engine for revenue expansion, bringing in new product portfolios, advanced technologies, and broader customer reach. These moves are not just about scale; they're about integrating complementary businesses that immediately contribute to the top line.

For instance, the 2023 acquisitions of Vian, CryoWorks, and Technifab were instrumental in driving significant revenue increases. Crane reported that these integrations directly bolstered sales within its Aerospace & Electronics segment and the Process Flow Technologies segment, showcasing the immediate financial impact of its inorganic growth strategy.

Contract-Based Projects and Solutions

Revenue is also generated through contract-based projects, especially within the defense and large industrial markets. These agreements frequently entail bespoke engineering and continuous maintenance, ensuring a steady income stream spanning several years.

- Defense Contracts: Long-term agreements for specialized crane systems, often including integration and support services.

- Industrial Solutions: Custom-engineered lifting equipment for major infrastructure or manufacturing projects.

- Predictable Income: These multi-year contracts provide a stable and foreseeable revenue base for the company.

- Example: A major defense contractor might secure a 5-year contract for specialized naval cranes, valued at $50 million, with annual revenue recognition.

Licensing and Technology Royalties

While Crane's core business revolves around product sales, licensing its advanced technologies and intellectual property represents a valuable, albeit less dominant, revenue stream. This approach allows Crane to monetize its significant investments in research and development and its specialized engineering expertise.

This segment of revenue is generated when other companies pay to utilize Crane's patented innovations or manufacturing processes. For instance, in 2024, Crane's advanced materials or specialized control systems might be licensed to manufacturers in adjacent industries seeking to enhance their own product offerings.

- Technology Licensing: Crane can earn revenue by granting other companies the right to use its patented technologies, such as advanced filtration systems or specialized valve designs.

- Royalty Payments: This involves receiving a percentage of sales or a fixed fee for each unit produced using Crane's licensed intellectual property.

- R&D Monetization: This stream directly capitalizes on Crane's commitment to innovation, turning research breakthroughs into tangible income.

Crane's revenue streams are diverse, encompassing both the initial sale of sophisticated equipment and ongoing aftermarket services. The company also leverages strategic acquisitions and technology licensing to broaden its income base.

In 2023, Crane's Engineered Materials segment alone generated $1.04 billion in net sales, underscoring the significance of its original equipment sales. The aftermarket segment provides a high-margin, stable revenue source due to the essential nature and longevity of Crane's products.

Recent acquisitions in 2023, such as Vian and CryoWorks, directly boosted sales in key segments like Aerospace & Electronics. Contract-based projects, particularly in defense and industrial sectors, offer predictable, multi-year income streams, with long-term agreements for specialized systems being a key component.

Technology licensing, while a smaller stream, capitalizes on Crane's R&D investments by allowing other companies to utilize its patented innovations, generating royalty payments and creating a valuable revenue stream from intellectual property.

| Revenue Stream | Description | 2023 Impact/Example |

|---|---|---|

| Original Equipment Sales | Sale of new fluid handling components, aircraft braking systems, and specialized materials. | Engineered Materials segment net sales of $1.04 billion. |

| Aftermarket Parts & Services | Replacement parts, maintenance, repair, and overhauls for existing equipment. | High-margin, stable income due to product necessity and lifespan. |

| Strategic Acquisitions | Integration of acquired businesses to expand product portfolios and customer reach. | Acquisitions in 2023 boosted sales in Aerospace & Electronics and Process Flow Technologies. |

| Contract-Based Projects | Bespoke engineering and continuous maintenance for defense and industrial markets. | Multi-year contracts for specialized crane systems ensure steady income. |

| Technology Licensing | Granting rights to use patented technologies and manufacturing processes. | Monetizes R&D through royalty payments and licensing fees. |

Business Model Canvas Data Sources

The Crane Business Model Canvas is built upon a foundation of operational data, market demand analysis, and financial projections. These sources ensure each component accurately reflects the business's current state and future potential.