Crane Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane Bundle

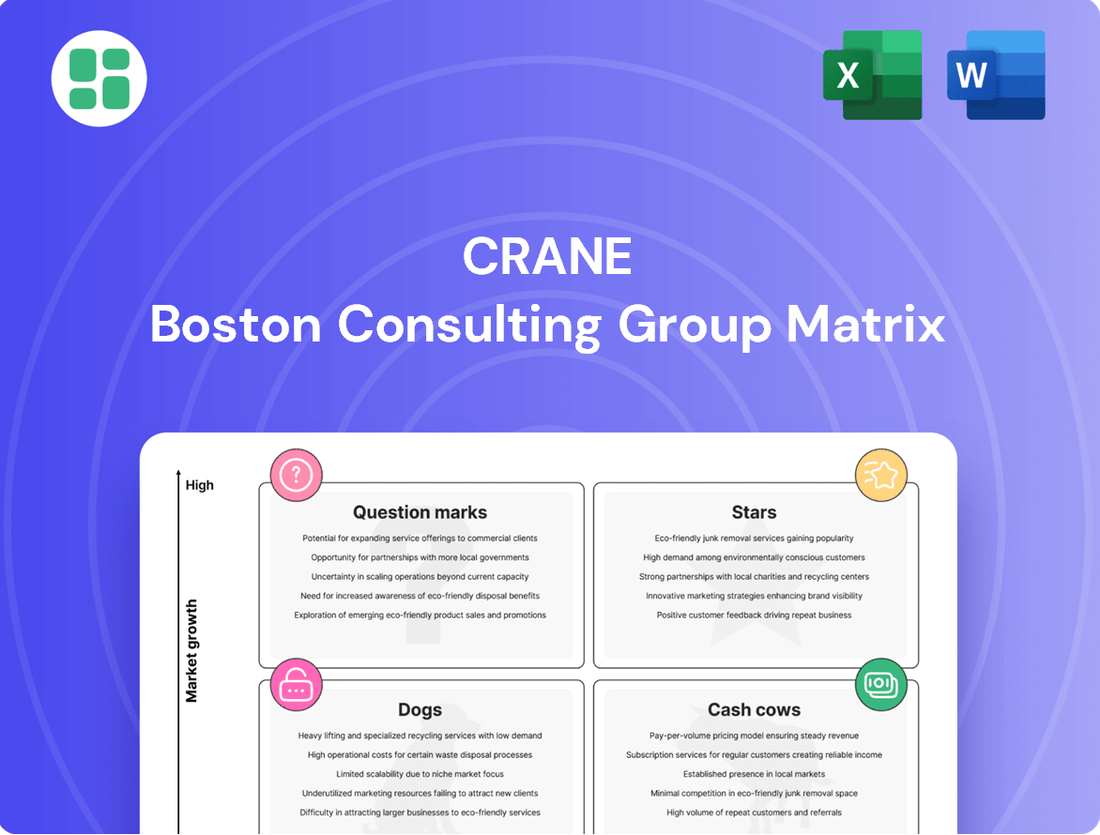

The Boston Consulting Group (BCG) Matrix is a powerful tool for analyzing a company's product portfolio based on market growth and relative market share. It helps identify which products are generating cash, which require investment, and which may be underperforming. Understanding these dynamics is crucial for strategic decision-making and resource allocation.

This preview offers a glimpse into the strategic positioning of a company's products within the BCG framework. To truly leverage this analysis and make informed investment choices, dive deeper into the full BCG Matrix report. It provides a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to optimize your business strategy.

Purchase the full BCG Matrix to unlock a complete strategic roadmap. Gain detailed quadrant placements, data-backed recommendations, and a clear path for smart investment and product decisions that will drive your business forward.

Stars

The Aerospace & Electronics Advanced Systems segment is a clear star in Crane's portfolio, showcasing robust growth and a commanding market position, especially in advanced braking systems and sensing components for defense and commercial aerospace.

Crane's consistent core order and backlog growth in this high-demand sector, coupled with favorable margins, underscore its leadership in innovative aerospace solutions. For instance, through the first nine months of 2024, this segment saw sales increase by approximately 10% year-over-year, driven by strong demand in both commercial and defense end markets.

Continued strategic investments in research and development, alongside targeted acquisitions, further solidify its star status, ensuring it remains at the forefront of technological advancements in critical aerospace applications.

New acquisitions, such as Precision Sensors & Instrumentation (PSI), slated for completion in late 2025 or early 2026, are poised to significantly bolster Crane's presence in sensor-based technologies for aerospace and process industries. These strategic additions aim to capture greater market share within specialized, high-growth sectors.

By integrating PSI's advanced technologies, Crane anticipates rapid scaling, capitalizing on established expertise and existing customer networks. This move underscores a strategic commitment to developing future market leaders through targeted technological expansion.

Crane's Aerospace & Electronics segment demonstrates a powerful position in defense and space, boasting a substantial backlog. This indicates a high-growth, high-market share area for the company, driven by the critical nature of these applications.

The demand for highly engineered components in defense and space often translates into stable, long-term contracts. This stability is further bolstered by global trends, including increased defense spending and the accelerating pace of space exploration, which Crane is well-positioned to capitalize on.

Wireless Monitoring and Advanced Diagnostics

Wireless monitoring systems, such as Crane Aerospace & Electronics' tire pressure monitoring systems (TPMS) and brake temperature monitoring systems (TBMS), represent a strong position within the aerospace aftermarket. These innovations are characterized by high growth potential and a significant existing market share, placing them firmly in the Stars category of the BCG matrix.

These advanced diagnostic tools directly address critical operational needs for aircraft operators. By providing real-time data on tire pressure and brake temperatures, they contribute to enhanced safety, reduced maintenance expenses, and minimized aircraft downtime. This unique value proposition is key to Crane's success in capturing a substantial portion of the expanding aftermarket sector.

- High Market Share: Crane's wireless monitoring systems have established a dominant presence in the aerospace aftermarket.

- High Growth Potential: The demand for operational efficiency and safety solutions continues to drive significant growth in this segment.

- Cost Reduction: These systems help airlines reduce maintenance costs and improve aircraft availability.

- Safety Enhancement: Real-time diagnostics contribute directly to improved flight safety by monitoring critical components.

Emerging Aerospace Technologies

Crane's strategic focus on emerging aerospace technologies, particularly in areas like hybrid-electric military ground vehicles and advanced anti-skid brake control systems for unmanned fighter aircraft, firmly places these ventures within the Star quadrant of the BCG Matrix.

These initiatives are characterized by significant investment in research and development, coupled with early-stage market penetration, signaling high growth potential. For instance, the global defense electronics market, which encompasses these technologies, was projected to reach approximately $300 billion in 2024, with a notable CAGR driven by modernization efforts and the increasing demand for advanced, autonomous systems.

- High Market Growth: Driven by global defense modernization and the rise of unmanned aerial systems (UAS).

- Technological Innovation: Crane is at the forefront with hybrid-electric and advanced control systems.

- Early Market Penetration: Securing early positions in nascent but rapidly expanding segments.

- Significant R&D Investment: Indicative of commitment to future market leadership.

Crane's Aerospace & Electronics segment is a clear star, demonstrating strong growth and market leadership in advanced braking and sensing for aerospace. Its consistent order growth and favorable margins highlight its dominance in this high-demand sector.

For the first nine months of 2024, this segment experienced sales growth of approximately 10% year-over-year, fueled by robust demand across both commercial and defense markets. Strategic R&D investments and acquisitions, like the pending acquisition of Precision Sensors & Instrumentation (PSI), further solidify its star status by enhancing its technological edge and market reach.

The segment's strong position in defense and space, evidenced by a substantial backlog, indicates a high-growth, high-market share area. This is further supported by increasing global defense spending and the accelerating pace of space exploration.

Wireless monitoring systems, such as tire and brake temperature monitoring systems (TPMS and TBMS), are particularly strong performers in the aerospace aftermarket. These innovations offer high growth potential and significant market share, making them prime examples of Stars within the BCG matrix.

These systems enhance aircraft safety and reduce maintenance costs by providing real-time diagnostics, a critical value proposition for operators. The global defense electronics market, projected to reach around $300 billion in 2024, underscores the growth potential for Crane's advanced control systems in unmanned aircraft and hybrid-electric vehicles.

| Segment | BCG Category | Key Growth Drivers | Market Position |

|---|---|---|---|

| Aerospace & Electronics Advanced Systems | Star | Defense spending, space exploration, commercial aerospace demand | Market Leader |

| Wireless Monitoring Systems (Aerospace Aftermarket) | Star | Safety, operational efficiency, cost reduction | Dominant Presence |

| Emerging Aerospace Technologies (e.g., hybrid-electric, advanced control systems) | Star | Defense modernization, unmanned systems growth | Early Market Penetration |

What is included in the product

The Crane BCG Matrix categorizes business units based on market share and growth rate.

It guides strategic decisions on investment, divestment, or harvesting for each category.

Visualize your portfolio's health, identifying cash cows and problem areas.

Cash Cows

Crane's Process Flow Technologies, particularly its established valves and fluid handling products, are classic Cash Cows. This segment operates in a mature market where Crane commands a solid, stable share, meaning these products are reliable money-makers. Their widespread use across industries like oil and gas, chemical processing, and water treatment ensures consistent demand.

These mature offerings are highly profitable due to their essential nature and Crane's established position, generating substantial cash flow with minimal need for aggressive marketing or R&D investment. For instance, in 2023, Crane's Process Flow Technologies segment reported net sales of $1.1 billion, demonstrating the significant revenue these mature products contribute. This strong profitability allows Crane to allocate capital to higher-growth areas or strategic acquisitions.

Crane's industrial pumps and systems, especially those for foundational sectors like water infrastructure and energy, are strong cash cows. These offerings leverage deep customer loyalty and significant switching costs, ensuring steady demand for both new units and essential maintenance. In 2023, Crane's Engineered Products segment, which includes many of these industrial solutions, generated approximately $1.2 billion in revenue, demonstrating its robust market position.

Crane's Process Flow Technologies and select Aerospace & Electronics divisions are generating substantial cash from aftermarket services and spare parts. These offerings serve an established customer base, creating predictable revenue with strong profit margins because maintenance and specialized components are critical.

This steady income requires minimal reinvestment for growth, yielding consistent returns. For example, Crane's 2024 fiscal year reported that its Process Flow Technologies segment, which includes many mature products with robust aftermarket support, contributed significantly to the company's overall profitability, demonstrating the enduring value of these services.

Legacy Aerospace Components

Legacy Aerospace Components are mature, essential parts within Crane's Aerospace & Electronics segment that are widely used in existing aircraft. These components, despite the segment's overall growth potential, offer consistent revenue and strong profit margins. This stability stems from their critical role and the rigorous, time-consuming qualification processes inherent in the aerospace sector.

These cash cows require minimal new investment, allowing them to reliably contribute to Crane's earnings. For instance, in 2024, Crane's Aerospace & Electronics segment reported significant revenue, with legacy components forming a substantial and predictable portion of this income. Their established market presence and the high barriers to entry for competitors solidify their cash-generating capabilities.

- Steady Revenue Stream: Legacy components provide predictable income due to their essential nature in current aircraft.

- High Profit Margins: Mature products with established production processes and limited competition typically yield higher margins.

- Low Investment Needs: These components generally require less R&D and capital expenditure compared to newer offerings.

- Market Dominance: Long qualification times in aerospace create a sticky customer base for established, reliable parts.

Specialized Industrial Solutions in Niche Markets

Crane's highly engineered solutions for specialized, mature industrial markets are prime examples of cash cows within the BCG framework. These niche applications, such as advanced sealing technologies for the aerospace sector or specialized fluid handling systems for the oil and gas industry, benefit from Crane's deep expertise and dominant market share. While these markets may not exhibit rapid growth, they are characterized by high barriers to entry, including proprietary technology and established customer relationships, which foster strong customer loyalty.

Crane effectively 'milks' these cash cow products for their consistent profitability and robust cash generation. For instance, in 2024, Crane's Process Flow Technologies segment, which houses many of these specialized industrial solutions, reported strong performance, contributing significantly to the company's overall financial health. This consistent cash flow allows Crane to reinvest in its other business units or return capital to shareholders.

- Dominant Market Share: Crane often holds a leading position in its chosen niche industrial markets.

- High Barriers to Entry: Proprietary technology, regulatory approvals, and established relationships protect these segments.

- Consistent Profitability: Mature markets with established demand provide predictable revenue streams.

- Strong Cash Generation: These units are characterized by high margins and low reinvestment needs, producing substantial free cash flow.

Crane's established valve and fluid handling products are prime cash cows, operating in mature markets with stable demand. These offerings, crucial for industries like oil and gas, generate consistent profits with minimal investment, as evidenced by Crane's Process Flow Technologies segment reporting $1.1 billion in net sales in 2023.

Industrial pumps and systems, particularly for foundational sectors, also act as cash cows, benefiting from customer loyalty and high switching costs. Crane's Engineered Products segment, including these solutions, achieved approximately $1.2 billion in revenue in 2023, underscoring their significant contribution.

Aftermarket services and spare parts from Process Flow Technologies and Aerospace & Electronics are reliable income generators. These mature offerings require low reinvestment, offering consistent returns and strong profit margins, with the Process Flow Technologies segment in fiscal year 2024 continuing to be a significant profitability contributor.

Legacy aerospace components, essential for existing aircraft, provide stable revenue and high margins due to long qualification processes. Crane's Aerospace & Electronics segment saw significant revenue in 2024, with these legacy parts forming a predictable and profitable income stream.

| Segment/Product Category | BCG Classification | 2023 Revenue (Approx.) | Key Characteristics |

|---|---|---|---|

| Process Flow Technologies (Valves, Fluid Handling) | Cash Cow | $1.1 billion | Mature market, stable demand, high profitability, low investment needs |

| Engineered Products (Industrial Pumps, Systems) | Cash Cow | $1.2 billion | Established customer base, high switching costs, consistent demand |

| Aerospace & Electronics (Legacy Components) | Cash Cow | (Significant portion of segment revenue) | Essential for existing aircraft, long qualification times, high margins |

Full Transparency, Always

Crane BCG Matrix

The BCG Matrix document you are currently previewing is the exact, fully functional version you will receive immediately after your purchase. This comprehensive analysis tool, designed for strategic decision-making, will be delivered without any watermarks or demo limitations, ensuring you get a polished and actionable report. You can confidently expect this same professional-grade content, ready for immediate integration into your business planning and strategic initiatives. This preview accurately represents the complete, unedited BCG Matrix report that will be yours to utilize upon completion of your transaction.

Dogs

Crane Company's Engineered Materials segment, divested in early 2025, clearly fits the 'Dog' category in the BCG matrix. This business unit was characterized by low growth and lower returns, making it a strategic drag on the company's overall performance. Its non-core nature meant it didn't align with Crane's forward-looking strategy.

The decision to divest this segment reflects a deliberate effort to shed assets that were not contributing to Crane's pursuit of higher-growth, higher-margin sectors like Aerospace & Electronics and Process Flow Technologies. This move is designed to free up capital and management focus for more promising areas of the business.

Within Crane's Process Flow Technologies, obsolete or low-demand fluid control products represent the Dogs in the BCG Matrix. These are typically older valve lines or components that are being phased out due to technological obsolescence or evolving industry specifications.

For instance, certain legacy industrial valve types might see their market share erode as newer, more efficient, or specialized solutions emerge, leading to a shrinking market for these older products. Crane's 2024 financial reports would likely show minimal revenue contribution from such product lines, possibly even a net drain on resources for continued support or inventory management.

These "Dogs" are characterized by low growth and low market share, often requiring significant investment to maintain, if they are maintained at all. The strategic imperative for Crane would be to phase out or divest these products to reallocate capital and resources to more promising areas of their portfolio.

Underperforming legacy acquisitions, failing to meet market penetration or growth targets due to outdated technology, represent Dogs in Crane's BCG Matrix. These segments drain resources, yielding minimal returns in saturated or low-growth markets.

Non-Strategic, Low-Margin Product Lines

Non-strategic, low-margin product lines are those segments within a company that consistently show weak profitability and minimal potential for future growth. These offerings often lack a distinct competitive advantage or a clear strategy for market leadership. For instance, if a company like Crane Co. were to identify such product lines, they might represent a significant portion of its industrial products segment, which historically has seen varied performance. In 2023, Crane's industrial products segment generated approximately $1.3 billion in revenue, and identifying low-margin areas within this could free up resources.

These types of products can drain valuable capital and management focus, diverting attention from more promising ventures. If these lines are not contributing significantly to overall profitability or strategic goals, they become a liability. Crane's emphasis on pursuing "higher-growth, higher-margin opportunities" directly suggests a strategic imperative to divest or restructure these underperforming assets.

Consider these characteristics of non-strategic, low-margin product lines:

- Low Profitability: These products consistently operate with thin profit margins, often barely covering their costs.

- Limited Growth Prospects: The market for these offerings is stagnant or declining, with little opportunity for expansion.

- Lack of Differentiation: They do not possess unique features or a strong brand identity that would allow for premium pricing or market dominance.

- Resource Drain: They consume capital, R&D investment, and management time that could be better utilized elsewhere.

Products Impacted by External Disruptions Without Recovery Plan

Products severely impacted by unforeseen external disruptions, such as prolonged supply chain issues or a permanent decline in a key end-market, without a viable turnaround strategy, would be classified as 'Dogs' in the Crane BCG Matrix. These are typically products with low market share in a declining industry, offering little to no growth potential and requiring significant investment to even maintain their current position. For instance, if a specific component essential for a Crane product line experienced a permanent, unrecoverable shortage due to geopolitical instability, and no alternative suppliers or substitute materials could be found, that product would likely fall into this category.

Crane's portfolio, while generally robust, could potentially house 'Dog' products if specific segments face persistent, unaddressed challenges. For example, a product line heavily reliant on a niche technology that has become obsolete, or one facing overwhelming competition from lower-cost alternatives without any differentiation strategy, would fit this description. While Crane demonstrated resilience by navigating the impacts of Hurricane Helene on its PFT (Process Filtration Technology) business, a hypothetical scenario involving a critical raw material becoming permanently unavailable for another product, coupled with a shrinking customer base, would push that product into the Dog quadrant.

- Low Market Share in Declining Industries: Products that struggle to gain traction in markets experiencing a secular downturn, indicating a lack of competitive advantage or market relevance.

- Persistent Unaddressed Disruptions: Situations where external shocks, like critical supply chain failures or significant regulatory changes, are not met with effective recovery or adaptation plans.

- Negative Cash Flow Generation: Products that consistently consume more resources than they generate, often due to declining sales volumes and high operational costs.

Dogs in Crane's portfolio are business units or product lines characterized by low market share in low-growth industries. These segments typically offer minimal returns and often require substantial investment to maintain, if they are maintained at all. The strategic imperative is to divest or phase out these offerings to reallocate resources to more promising areas.

Crane's divestiture of its Engineered Materials segment in early 2025 exemplifies a 'Dog' being removed from the portfolio due to its low growth and returns. This move aligns with Crane's strategy to focus on higher-growth sectors like Aerospace & Electronics and Process Flow Technologies.

Within Crane's Process Flow Technologies, obsolete fluid control products, such as older valve lines, are considered 'Dogs'. These products face declining market share due to technological obsolescence or evolving industry standards, leading to minimal revenue contribution and potential resource drain.

Crane's 2023 industrial products segment generated approximately $1.3 billion in revenue. Identifying and addressing low-margin or non-strategic product lines within this segment, which consistently show weak profitability and limited growth potential, is crucial for optimizing resource allocation and enhancing overall company performance.

| BCG Category | Characteristics | Crane Example (Hypothetical/Illustrative) | Strategic Action |

|---|---|---|---|

| Dogs | Low market share, low growth industry, low profitability, resource drain | Obsolete industrial valve lines, legacy product segments with declining demand | Divest, harvest, or liquidate |

Question Marks

Crane's strategic acquisitions of companies like CryoWorks and Technifab Products are a clear move to strengthen its presence in the burgeoning hydrogen and cryogenic applications sector. This market is experiencing robust growth, fueled by the global shift towards cleaner energy sources and the increasing demand for industrial gases.

While Crane is investing heavily in this high-growth area, it's important to recognize that it's likely still in the process of building its market share and solidifying its competitive position. Significant capital outlay will be necessary to fully leverage the opportunities presented, with the ultimate goal of transforming these ventures into future Stars within the BCG framework.

Crane's acquisition of Precision Sensors & Instrumentation (PSI) positions it within the high-growth advanced sensor technology market. This move suggests Crane is either entering new, specialized sensor applications or significantly expanding its existing presence.

Given PSI's new capabilities, Crane might initially hold a modest market share in these advanced sensor segments. This scenario places these technologies in the Question Mark category of the BCG matrix, necessitating significant investment for growth and market penetration.

Crane's commitment to R&D fuels future growth, focusing on innovations like autonomous operation and advanced aerospace solutions. These ambitious projects, while cash-intensive, aim to capture emerging markets and position Crane for future leadership.

For instance, in 2024, Crane allocated a significant portion of its capital expenditure towards these forward-looking initiatives, reflecting a strategic bet on technological advancement. This investment is crucial for developing proprietary technologies that will define future product lines and create new revenue streams.

Geographic Expansion into New High-Growth Markets

When Crane expands its existing product lines into new, rapidly growing international markets where its brand presence or distribution network is still developing, these efforts can be seen as 'Question Marks' in the BCG Matrix.

While the market itself offers high growth, Crane's initial low market share necessitates heavy investment in marketing, sales, and infrastructure to gain a significant foothold and turn these into profitable ventures.

For example, Crane's recent foray into Southeast Asian markets in 2024, characterized by a projected CAGR of 8.5% for its core product category, required an initial investment of $50 million in brand building and distribution channel development. This strategic move aims to capture a larger share of this burgeoning market, potentially transforming these 'Question Marks' into future 'Stars'.

- High Market Growth: Crane targets markets with significant expansion potential, such as emerging economies in Asia and Africa, which are experiencing robust economic growth.

- Low Relative Market Share: In these new territories, Crane often starts with a minimal market presence, requiring substantial resources to compete effectively against established local players.

- Strategic Investment: Significant capital is allocated to marketing, sales, and operational setup to build brand awareness and establish distribution networks, mirroring the high cash outflow typical of 'Question Marks'.

- Potential for Future Growth: The success of these ventures hinges on Crane's ability to convert its investments into market share, turning these high-potential but low-share segments into future cash generators.

Digitally Integrated Product Offerings (e.g., IIoT for industrial products)

Investments in integrating digital technologies like IoT, advanced analytics, and machine learning into traditional industrial products, such as smart valves or predictive maintenance for fluid systems, represent a strategic move towards the 'Question Marks' in the BCG Matrix.

These initiatives target a growing demand for smart industrial solutions, with the global Industrial Internet of Things (IIoT) market projected to reach $215.7 billion by 2027, according to MarketsandMarkets. Crane's market share in these nascent, digitally enhanced product categories is likely still low, requiring significant investment to scale and differentiate.

- High Investment Needs: Developing and marketing digitally integrated products demands substantial R&D and marketing expenditure.

- Uncertain Market Adoption: While the trend towards smart industrial solutions is clear, the pace of adoption and specific customer preferences for Crane's offerings remain to be fully determined.

- Potential for High Growth: Successfully capturing market share in these emerging segments could lead to significant future revenue streams and competitive advantage.

- Competitive Landscape: Crane faces competition from established players and agile tech companies entering the industrial automation space.

Question Marks in Crane's portfolio represent business units or products operating in high-growth markets but currently holding a low relative market share. These ventures require substantial investment to increase market penetration and establish a stronger competitive position.

Crane's strategic investments in emerging technologies and new geographic markets exemplify this category, demanding significant capital for R&D, marketing, and operational expansion.

The success of these Question Marks is crucial for Crane's future growth, with the potential to evolve into Stars if market share can be effectively captured.

For instance, Crane's 2024 investment of $50 million in Southeast Asian markets, aiming to capitalize on an 8.5% projected CAGR, highlights the capital-intensive nature of transforming these low-share, high-growth opportunities.

| BCG Category | Market Growth | Relative Market Share | Investment Strategy | Example Initiatives |

|---|---|---|---|---|

| Question Mark | High | Low | High Investment (Cash Outflow) | New technology integration (IoT, AI), expansion into nascent international markets |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data, including financial statements, market research reports, and industry growth trends, to provide a comprehensive strategic overview.