CPI Card SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPI Card Bundle

CPI Card's strengths lie in its established market presence and diverse product portfolio, but its reliance on specific technologies presents a significant threat.

Want to fully understand CPI Card's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

CPI Card Group boasts a robust and diverse product portfolio, encompassing physical, digital, and virtual payment solutions. This breadth, covering credit, debit, and prepaid options, allows them to serve a wide array of client needs and adapt to changing consumer payment habits. For instance, their Card@Once® instant issuance platform highlights their commitment to innovative, Software-as-a-Service (SaaS) offerings.

CPI Card Group holds a significant position as a leader in the U.S. market for eco-focused payment card solutions. The company has achieved remarkable success, having supplied over 450 million sustainable cards or packaging options to date. This strong track record directly addresses the increasing consumer and institutional preference for environmentally conscious products, setting CPI apart from competitors and creating a distinct market advantage.

CPI Card Group experienced robust performance in its core business segments during 2024. The company saw notable sales expansion, particularly within its prepaid card offerings, and a positive resurgence in its debit and credit card sectors.

This growth was fueled by a strong demand for contactless payment solutions and a strategic push into higher-value packaging. Furthermore, CPI Card Group successfully broadened its reach by entering new market segments, including the healthcare industry, demonstrating its adaptability and market penetration capabilities.

Robust Recurring Revenue Streams

CPI Card Group benefits significantly from robust recurring revenue streams, primarily driven by its Software-as-a-Service (SaaS) instant issuance solutions like Card@Once®. This model ensures a predictable income flow, making it a key strength.

The widespread adoption of Card@Once® is a testament to its value, with over 17,000 installations serving more than 2,000 financial institutions. This extensive client base underpins the stability and reliability of CPI Card's revenue.

- Stable Income Base: SaaS solutions provide consistent, predictable revenue.

- Extensive Client Network: Over 2,000 financial institutions utilize CPI Card's platforms.

- High Installation Volume: 17,000+ installations demonstrate market penetration and reliance.

Commitment to Security and Innovation

CPI Card Group's dedication to security and innovation is a significant strength, particularly in the payments sector. They actively pursue advancements in cardholder experience and technology, such as their work on LED cards and sophisticated chip integrations. This focus is vital for fostering trust with financial institutions and consumers alike, given the highly sensitive nature of payment data.

Their commitment translates into tangible benefits. For instance, in 2024, the demand for secure and advanced payment solutions continued to rise, with a notable increase in contactless payment adoption. CPI Card Group's investment in technologies that enhance security features and user convenience positions them well to capitalize on these market trends.

This strategic emphasis on security and forward-thinking technology development is crucial for maintaining a competitive edge. It allows them to meet evolving regulatory requirements and consumer expectations for safer, more engaging payment methods.

Key aspects of their strengths include:

- Focus on Secure Payment Solutions: Developing and offering products that prioritize data protection and fraud prevention.

- Continuous Technological Innovation: Investing in R&D for new card technologies like LED features and advanced chip capabilities.

- Enhanced Cardholder Experience: Aiming to improve user interaction and convenience through innovative card designs and functionalities.

- Building Trust in the Payments Industry: Demonstrating reliability and security to attract and retain partnerships with financial institutions.

CPI Card Group's diverse product range, covering physical, digital, and virtual payment solutions, allows them to cater to a broad customer base and adapt to evolving payment trends. Their leadership in eco-friendly payment cards, with over 450 million sustainable options supplied by 2024, addresses growing consumer demand for environmentally conscious products.

The company's strong recurring revenue from SaaS solutions like Card@Once®, boasting over 17,000 installations across 2,000 financial institutions, provides a stable financial foundation. This extensive client network underscores their market penetration and the reliability of their income streams.

CPI Card Group's commitment to security and innovation, evident in their development of advanced chip integrations and LED cards, builds crucial trust within the sensitive payments industry. This focus on enhancing cardholder experience and security positions them favorably to capitalize on the increasing demand for contactless and secure payment technologies observed throughout 2024.

| Strength Category | Key Aspect | Supporting Data/Metric |

|---|---|---|

| Product Diversification | Comprehensive Payment Solutions | Physical, digital, and virtual payment options |

| Market Leadership | Eco-Friendly Card Solutions | Over 450 million sustainable cards/packaging supplied by 2024 |

| Revenue Stability | SaaS Recurring Revenue | Card@Once®: 17,000+ installations, 2,000+ financial institutions |

| Innovation & Security | Advanced Payment Technologies | Focus on LED cards, chip integrations, contactless solutions |

What is included in the product

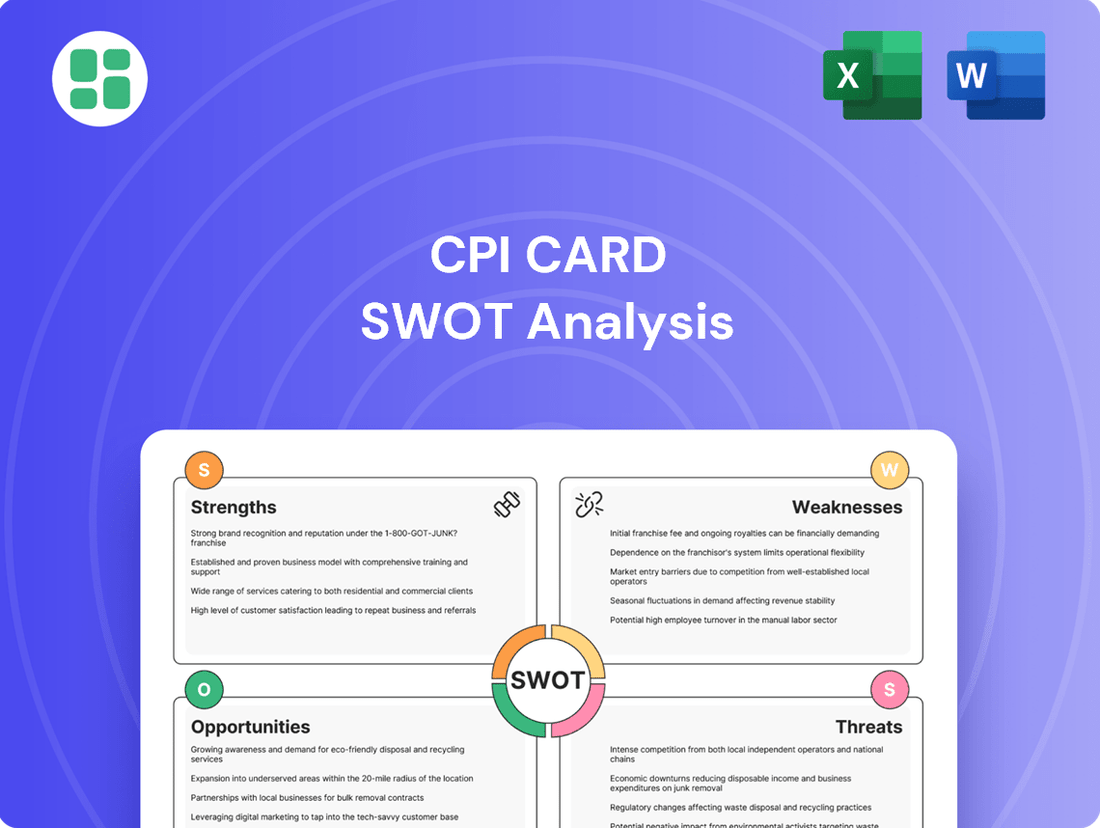

Analyzes CPI Card’s competitive position through key internal and external factors, highlighting its strengths in secure payment solutions and opportunities in emerging markets while addressing weaknesses in diversification and threats from rapid technological change.

Offers a clear, actionable framework to identify and address potential threats and capitalize on emerging opportunities within the payment card industry.

Weaknesses

CPI Card Group's reliance on physical card manufacturing presents a significant weakness. While they are expanding digital services, their primary revenue stream still comes from producing plastic cards. This is concerning given the clear global shift towards digital payments, with projections indicating a continued decrease in the use of physical cash and traditional cards.

CPI Card has faced significant margin compression, with gross profit margins declining to 28.5% in the second quarter of 2025. This downturn is attributed to a strategic shift towards lower-margin product offerings and an increase in production costs, particularly for raw materials.

These factors highlight the company's susceptibility to pricing pressures within the competitive payment solutions market and the impact of evolving product mix strategies on its bottom line. Such fluctuations can hinder consistent profitability and investor confidence.

In 2024, CPI Card Group experienced a notable dip in net income, largely attributed to the expenses associated with debt refinancing. These costs, while crucial for optimizing the company's capital structure, directly impacted short-term profitability. For instance, the company reported that refinancing activities incurred significant one-time charges that weighed on earnings for that fiscal year.

Looking ahead to 2025, the integration of Arroweye Solutions presented another challenge to net income. The acquisition, a strategic move to expand CPI Card's capabilities, came with substantial integration and associated costs. These expenses, including transaction fees and initial operational adjustments, temporarily suppressed the company's bottom line, a common occurrence during significant M&A activities.

Integration Challenges from Acquisitions

The 2025 acquisition of Arroweye Solutions, while a strategic move for CPI Card, presents significant integration challenges. These challenges manifest as immediate integration costs, which are currently impacting earnings and making the acquisition dilutive in the short term. Successfully merging Arroweye's operations and realizing the anticipated synergies are paramount for the acquisition's success. However, this process demands substantial resources and management focus, potentially diverting attention from other critical business areas.

The integration process itself is a complex undertaking, requiring careful planning and execution to ensure seamless operation. CPI Card must navigate the complexities of combining different technological platforms, operational procedures, and corporate cultures. The realization of expected synergies, such as cost savings and revenue enhancements, is not guaranteed and depends heavily on the effectiveness of the integration strategy. Failure to achieve these synergies could prolong the dilutive impact on earnings and hinder the achievement of the acquisition's strategic objectives.

- Integration Costs: The immediate financial outlay for integrating Arroweye Solutions is a notable weakness, impacting CPI Card's bottom line.

- Dilutive Earnings: The acquisition is currently diluting earnings per share, a metric closely watched by investors.

- Synergy Realization Risk: The successful achievement of expected synergies is a critical factor, but poses a significant near-term challenge.

- Resource Diversion: The integration effort may divert valuable resources and management attention away from other growth initiatives.

Vulnerability to Supply Chain Disruptions and Tariffs

CPI Card Group, as a manufacturer, faces significant risks from supply chain disruptions and fluctuating transportation costs. For instance, the global shortage of semiconductors, a critical component for smart cards, directly impacts their production capacity and lead times. This vulnerability was highlighted in their 2023 performance, where increased input costs put pressure on their gross profit margins.

Furthermore, the imposition of tariffs on imported materials, such as those for microchips, can directly escalate production expenses. This not only affects the cost of goods sold but also potentially reduces the company's competitive pricing power. CPI Card Group's reliance on a global supply chain means that geopolitical events and trade policies can have an immediate and adverse effect on their financial results.

- Supply Chain Sensitivity: Reliance on global component suppliers, particularly for semiconductors, exposes CPI Card Group to shortages and price volatility.

- Tariff Impact: Potential tariffs on key raw materials or finished components could directly increase manufacturing costs.

- Transportation Costs: Rising fuel prices and shipping rates add to the overall cost of bringing materials in and finished products out, impacting profitability.

CPI Card Group's reliance on physical card manufacturing is a significant weakness, especially as the world increasingly moves towards digital payments. While they are expanding digital services, their core business remains tied to plastic cards, a market facing a long-term decline. This dependence on a shrinking physical product segment limits their growth potential in the evolving financial technology landscape.

Full Version Awaits

CPI Card SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for CPI Card. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It provides a clear snapshot of CPI Card's strategic positioning.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. Gain immediate access to the complete, actionable insights.

Opportunities

The global digital payment market is booming, with digital wallets and contactless transactions becoming the norm for both online and in-person purchases. This trend is projected to reach $1.4 trillion in transaction value by 2025, a significant jump from previous years.

CPI Card is well-positioned to benefit from this shift. Their expertise in push provisioning for mobile wallets and their range of contactless card solutions directly address the growing consumer demand for these payment methods.

CPI Card Group is strategically broadening its reach by entering new, related market segments. A key focus is on developing payment solutions for the healthcare industry and expanding its presence in closed-loop prepaid card programs. This diversification is a deliberate move to tap into previously underserved markets.

By venturing beyond its core customer base of traditional financial institutions, CPI Card Group aims to unlock substantial new revenue streams and growth opportunities. For instance, the prepaid card market, particularly for closed-loop systems, has shown robust growth. In 2024, the global prepaid card market was valued at approximately $3.2 trillion and is projected to reach over $5.8 trillion by 2030, indicating a significant addressable market for CPI's expansion efforts.

CPI Card Group can significantly boost its competitive edge by embracing advancements like artificial intelligence (AI) and machine learning (ML) within payment processing. These technologies are proving invaluable for sophisticated fraud detection, a critical area for card manufacturers and issuers. For instance, AI-powered systems can analyze transaction patterns in real-time, identifying anomalies that human oversight might miss, thereby reducing financial losses for both CPI and its clients. In 2024, the global AI in fraud detection market was valued at approximately $40 billion, with projections showing substantial growth, indicating a strong demand for such integrated solutions.

Furthermore, the integration of blockchain technology presents a compelling opportunity for CPI to enhance the security and transparency of its card production and supply chain. Blockchain’s immutable ledger can provide a verifiable audit trail for every card manufactured and distributed, mitigating risks of counterfeiting and unauthorized duplication. This can streamline operations by reducing manual reconciliation processes and increasing trust among stakeholders. The global blockchain in finance market is expected to reach over $15 billion by 2025, highlighting the increasing adoption and perceived value of this technology in financial services.

Increasing Demand for Eco-Friendly Solutions

The escalating global focus on sustainability, driven by both consumer preferences and stricter environmental regulations, is creating a significant surge in demand for eco-friendly products and manufacturing methods. This trend presents a substantial opportunity for companies like CPI Card Group.

CPI is well-positioned to capitalize on this growing market. Their established leadership in developing environmentally conscious card solutions, such as the Second Wave® and Earthwise® product lines, provides a strong foundation. By further investing in and promoting these innovative, sustainable options, CPI can aim to expand its market share and continue to lead in eco-focused card manufacturing.

Key opportunities stemming from this trend include:

- Expanding Market Share: Leveraging existing eco-friendly product lines to attract environmentally conscious consumers and businesses, potentially increasing sales volume.

- Innovation in Sustainable Materials: Further research and development into new biodegradable or recycled materials for card production to meet evolving consumer and regulatory demands.

- Enhanced Brand Reputation: Strengthening CPI's brand image as a leader in sustainability, which can translate into a competitive advantage and attract partnerships.

- Regulatory Compliance: Proactively meeting and exceeding upcoming environmental regulations, ensuring continued market access and avoiding potential penalties.

Strategic Partnerships and Acquisitions to Broaden Offerings

CPI Card's strategic moves are clearly aimed at expanding its services. The recent integration of MEA Financial Enterprises and the acquisition of Arroweye Solutions are prime examples, bolstering their digital payment solutions and on-demand card manufacturing. This proactive approach to broadening their offerings positions them well for future growth.

These strategic maneuvers are not just about adding services; they're about strengthening CPI Card's market presence. By acquiring companies like Arroweye Solutions, CPI Card gains access to advanced technologies and a wider customer base, enhancing its competitive edge in the evolving payments landscape.

- MEA Financial Enterprises Partnership: This collaboration aims to enhance digital offerings and customer engagement.

- Arroweye Solutions Acquisition: This move significantly boosted CPI Card's on-demand card production and personalization capabilities.

- Market Expansion: Future partnerships and acquisitions are key to entering new markets and diversifying revenue streams.

- Technological Advancement: Integrating new technologies through acquisitions is crucial for staying ahead in the digital payments sector.

CPI Card Group is strategically expanding into new markets, notably the healthcare payment sector and closed-loop prepaid card programs. The global prepaid card market, valued at approximately $3.2 trillion in 2024, presents a substantial growth avenue, with projections reaching over $5.8 trillion by 2030. This diversification taps into underserved segments, offering significant new revenue potential.

Threats

The accelerating trend towards fully digital, embedded, and invisible payments, such as biometric and in-app transactions, poses a significant threat by potentially reducing the long-term demand for physical cards. This fundamental shift in consumer behavior challenges companies like CPI Card, whose core business is rooted in physical card production.

For instance, by the end of 2024, it's projected that over 70% of all payment transactions in many developed markets will be cashless, with a substantial portion occurring through mobile devices or wearables, directly impacting the need for traditional card infrastructure.

CPI Card Group faces significant headwinds from intense competition within the payment technology sector. Major players like Worldpay, Galileo, and Euronet Worldwide actively vie for market share, creating a challenging environment. This rivalry often triggers price wars, which can compress profit margins for all participants.

The need for constant, substantial investment in innovation to stay ahead of competitors is a critical threat. For instance, the ongoing shift towards advanced security features and contactless payment solutions demands considerable research and development expenditure. Companies that fail to innovate risk becoming obsolete in this rapidly evolving market.

The payments industry is a prime target for increasingly sophisticated cyber threats, including advanced fraud schemes and large-scale data breaches. In 2023, the global average cost of a data breach reached $4.45 million, a 15% increase over two years, highlighting the escalating financial impact.

For CPI Card Group, a company entrusted with highly sensitive financial data, maintaining a cutting-edge security infrastructure is not just a necessity but a critical survival factor. Failure to adapt to evolving threats, such as sophisticated phishing attacks or ransomware, could result in catastrophic reputational damage and significant financial penalties, impacting customer trust and market standing.

Economic Volatility and Inflationary Pressures

Global economic forecasts for 2024 and 2025 point to persistent geopolitical tensions, fluctuating interest rates, and ongoing inflationary pressures. These conditions directly impact consumer confidence and discretionary spending, which are crucial for card usage and, consequently, for companies like CPI Card. Higher inflation also translates to increased operational expenses for card manufacturers, affecting their bottom line.

The continued volatility in the economic landscape presents a significant threat. For instance, if inflation remains elevated, it could erode purchasing power, leading consumers to reduce spending on non-essential items, including those often paid for with cards. This directly impacts transaction volumes and revenue for card issuers and processors.

- Inflation Impact: Persistent inflation, potentially averaging 3.5% to 4.0% globally in 2024 according to various economic projections, can dampen consumer spending on cards.

- Interest Rate Sensitivity: Unstable interest rates can increase borrowing costs for consumers and businesses, further restricting card spending.

- Geopolitical Risks: Escalating geopolitical conflicts can disrupt supply chains and create economic uncertainty, negatively affecting consumer and business confidence in card-based transactions.

Regulatory Changes in the Payment Industry

Regulatory shifts pose a significant threat. For instance, Europe's Instant Payments Regulation, pushing for wider, cheaper instant payment access, could demand substantial upgrades to CPI Card's infrastructure. Such compliance efforts often translate into increased operational costs and require strategic reinvestment, potentially squeezing margins and altering established revenue streams.

The ongoing evolution of data privacy laws, such as potential updates to GDPR or similar frameworks globally, also presents a challenge. Ensuring compliance with stricter data handling and consent requirements necessitates robust security measures and potentially limits how customer data can be leveraged for product development and marketing. This could impact the effectiveness of personalized services and data-driven insights.

Furthermore, potential changes in interchange fee regulations or network rules, which govern the fees charged for processing card transactions, could directly affect CPI Card's revenue. For example, if regulators mandate lower interchange fees, this could reduce the profitability of core transaction processing services, especially given that interchange fees are a critical component of revenue for many payment processors. In 2024, ongoing discussions around interchange fees in various markets continue to be a point of scrutiny.

The increasing adoption of digital wallets and contactless payment methods, like those integrated into smartphones and wearables, directly challenges the relevance of physical payment cards. This trend is accelerating, with projections indicating that by the end of 2024, over 70% of transactions in many developed economies will be cashless, further diminishing the reliance on traditional card infrastructure.

Intense competition from established players and emerging fintech companies creates pressure on pricing and necessitates continuous innovation. The need for substantial investment in R&D for advanced security and contactless solutions is a constant threat, as companies failing to adapt risk obsolescence. For example, the global average cost of a data breach in 2023 rose to $4.45 million, a 15% increase over two years, underscoring the high stakes of cybersecurity.

Economic volatility, including persistent inflation and fluctuating interest rates, can dampen consumer spending and increase operational costs. Geopolitical risks further exacerbate uncertainty, impacting consumer confidence and potentially disrupting supply chains. For instance, elevated inflation in 2024 could lead to reduced discretionary spending, directly affecting card transaction volumes.

Evolving regulatory landscapes, such as mandates for instant payments or stricter data privacy laws, can impose significant compliance costs and necessitate infrastructure upgrades. Changes in interchange fee regulations, a key revenue driver for payment processors, also pose a direct financial threat, with ongoing scrutiny in various markets throughout 2024.

| Threat Category | Specific Threat | Impact on CPI Card | Data/Projection (2024-2025) |

|---|---|---|---|

| Technological Shift | Digital Wallets & Contactless Payments | Reduced demand for physical cards | 70%+ cashless transactions by end of 2024 in developed markets |

| Competitive Landscape | Intense industry competition | Price wars, margin compression | N/A (Market dynamic) |

| Innovation Demands | R&D for security & contactless | High investment needs, risk of obsolescence | Global data breach cost up 15% to $4.45M (2023) |

| Economic Volatility | Inflation & Interest Rate Fluctuations | Lower consumer spending, higher operational costs | Global inflation projected at 3.5%-4.0% (2024) |

| Regulatory Changes | Data privacy & Interchange Fees | Compliance costs, revenue impact | Ongoing scrutiny of interchange fees in various markets (2024) |

SWOT Analysis Data Sources

This CPI Card SWOT analysis is built upon a foundation of robust data, including official company financial filings, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate assessment.