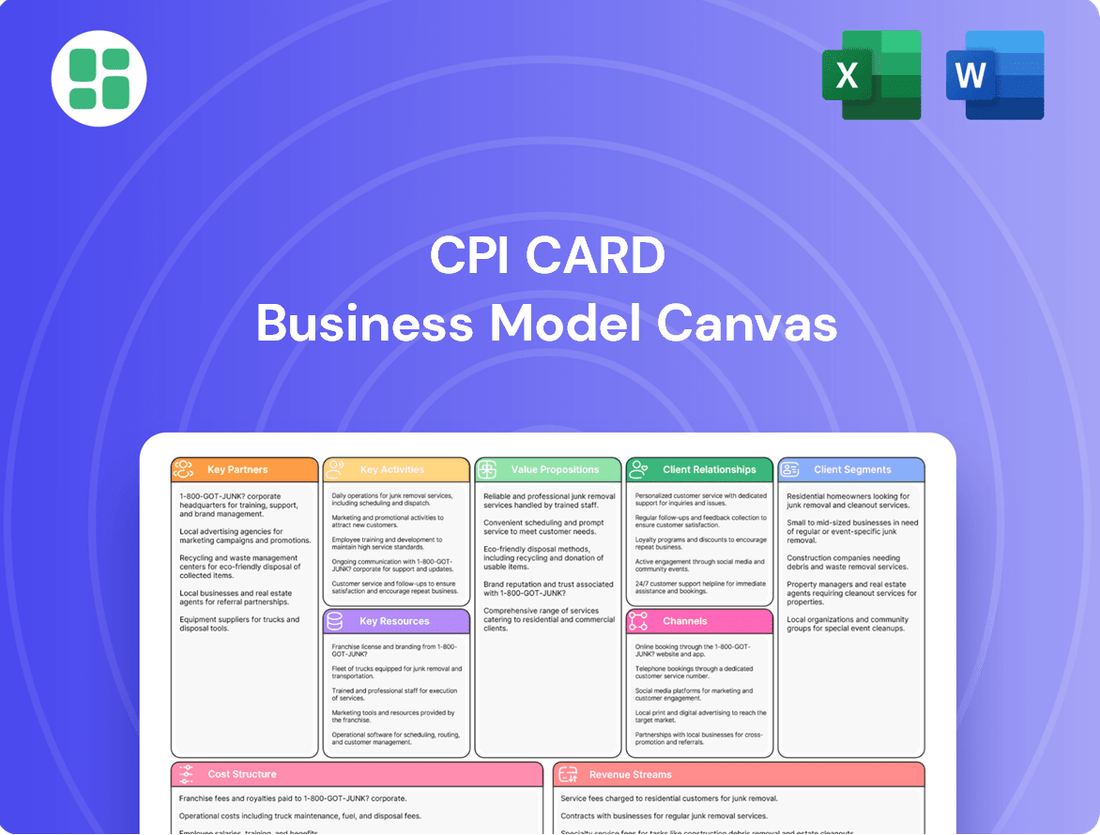

CPI Card Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPI Card Bundle

Unlock the full strategic blueprint behind CPI Card's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CPI Card Group's relationships with major payment networks, including Visa and Mastercard, are fundamental to their business. These collaborations ensure CPI's card products adhere to strict industry standards, guaranteeing their acceptance across a vast global network. In 2024, the continued emphasis on secure and seamless transactions underscores the importance of these foundational partnerships for CPI's credit, debit, and prepaid offerings.

These alliances are critical for the widespread functionality and interoperability of CPI's card solutions. By aligning with the evolving requirements and technological advancements from these networks, such as the growing adoption of contactless payment technology, CPI maintains its competitive edge and delivers relevant products to the market.

CPI Card Group's key partnerships are with a vast network of financial institutions, serving as their primary customers for payment card production and related services. This includes major card issuers, large bank platforms, and even smaller community banks and credit unions, totaling thousands of partnerships.

In 2024, CPI continued to solidify these relationships, aiming to be the preferred partner by consistently delivering high-quality products and exceptional service. Their extensive client base underscores their critical role in the financial services ecosystem, enabling secure and reliable payment solutions for millions of consumers.

CPI Card partners with leading technology providers like Infineon to leverage advanced chip solutions. For instance, Infineon's SECORA Pay Green technology allows CPI to offer cards with enhanced design flexibility and a reduced environmental footprint, a key differentiator in 2024's sustainability-conscious market.

These collaborations are crucial for integrating the latest advancements, such as next-generation contactless payment capabilities, directly into physical payment cards. This ensures CPI remains at the forefront of payment technology innovation.

By working with chip providers, CPI can proactively address evolving market demands for both sophisticated features and eco-friendly product options, a strategy that proved increasingly important throughout 2024.

Acquired Entities for Expanded Capabilities

CPI Card Group strategically acquires companies to bolster its offerings and market reach. A prime example is the acquisition of Arroweye Solutions, Inc., a leader in on-demand, digitally driven payment card solutions. This move, completed in May 2025, significantly enhances CPI's technological capabilities and production capacity.

This expansion allows CPI to provide a wider array of card products and cater to a broader customer base. Such strategic acquisitions are fundamental to CPI's long-term growth strategy, fostering diversification and strengthening its competitive position in the payments industry.

- Acquisition of Arroweye Solutions, Inc. in May 2025

- Expansion of digitally-driven, on-demand payment card solutions

- Increased technological capabilities and production capacity

- Strengthened long-term growth and diversification strategy

Industry Associations and Supply Chain Collaborators

CPI Card Group actively cultivates relationships with key industry associations, such as the Smart Card Alliance, to stay ahead of evolving standards and best practices in secure payment and identification technologies. These collaborations are crucial for ensuring their product development aligns with market demands and regulatory requirements, particularly in the rapidly advancing payments sector.

Furthermore, CPI's commitment to sustainability is deeply intertwined with its supply chain collaborators. A prime example is their partnership with suppliers to implement programs for reusing plastic spools, a direct initiative supporting circular economy principles within their manufacturing operations. This focus on resource efficiency is not just environmentally responsible but also enhances operational cost-effectiveness.

- Industry Associations: CPI's engagement with bodies like the Smart Card Alliance facilitates knowledge sharing and adherence to emerging payment technology standards.

- Supply Chain Collaboration: Partnerships with suppliers enable initiatives like plastic spool reuse, promoting a circular economy and reducing waste.

- ESG Initiatives: These relationships bolster CPI's Environmental, Social, and Governance (ESG) performance, demonstrating a commitment to sustainable business practices.

- Continuous Improvement: Collaborations drive ongoing enhancements in operational efficiency and product innovation within CPI's business model.

CPI Card Group's key partnerships extend to a broad spectrum of financial institutions, acting as their primary clients for payment card production and related services. This encompasses major card issuers, large banking platforms, and smaller community banks and credit unions, totaling thousands of such relationships. In 2024, CPI continued to strengthen these alliances, aiming to be the preferred partner through consistent delivery of high-quality products and exceptional service, reinforcing their integral role in the financial ecosystem.

Collaborations with major payment networks like Visa and Mastercard are fundamental, ensuring CPI's card products meet strict industry standards for global acceptance. These partnerships are vital for the widespread functionality and interoperability of CPI's card solutions, enabling them to align with evolving requirements and technological advancements, such as the growing adoption of contactless payment technology, to maintain a competitive edge in 2024.

Strategic acquisitions, such as Arroweye Solutions, Inc. in May 2025, bolster CPI's offerings and market reach by enhancing technological capabilities and production capacity for digitally-driven, on-demand payment cards. Furthermore, partnerships with technology providers like Infineon for advanced chip solutions, such as SECORA Pay Green, allow CPI to offer cards with improved design flexibility and a reduced environmental footprint, a key differentiator in the sustainability-conscious market of 2024.

| Partner Type | Key Partners | 2024/2025 Impact |

|---|---|---|

| Payment Networks | Visa, Mastercard | Ensured global acceptance and adherence to industry standards; facilitated contactless payment integration. |

| Financial Institutions | Major Issuers, Banks, Credit Unions | Provided essential payment card production and services to thousands of clients, supporting millions of consumers. |

| Technology Providers | Infineon | Integrated advanced chip solutions (e.g., SECORA Pay Green) for enhanced design and sustainability. |

| Acquisitions | Arroweye Solutions, Inc. (May 2025) | Significantly expanded technological capabilities and production capacity for on-demand card solutions. |

What is included in the product

A detailed blueprint of CPI Card's operations, outlining key activities, resources, and partnerships to deliver secure payment solutions.

Focuses on customer relationships, revenue streams, and cost structures to support its position in the payment card industry.

The CPI Card Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of a company's strategic elements, simplifying complex business structures for easier understanding and adaptation.

Activities

A fundamental activity for CPI Card Group is the secure manufacturing and production of payment cards. This includes everything from traditional magnetic stripe cards to the more advanced EMV chip cards and contactless payment solutions. Ensuring the physical integrity and security of each card is paramount, adhering to the stringent standards set by major payment networks like Visa and Mastercard.

CPI's operational backbone for this key activity is its network of highly secure production facilities. These state-of-the-art plants, primarily situated within the United States, are designed to handle the intricate processes of card personalization and issuance. For instance, in 2024, CPI continued to invest in its manufacturing capabilities, focusing on advanced personalization technologies to meet the evolving demands of the financial industry.

CPI Card Group offers extensive personalization services, encompassing data preparation, magnetic stripe encoding, and secure PIN management, all customized for each cardholder. In 2024, the demand for personalized payment solutions continued to rise, with financial institutions increasingly relying on partners like CPI to meet specific customer needs.

Beyond personalization, CPI excels in managing the entire fulfillment and mailing process for both routine and large-scale card programs. This end-to-end solution ensures that cards are not only securely customized but also dispatched efficiently to the end-user, a critical function for banks and credit unions operating in a competitive market.

A crucial activity for CPI Card Group is the ongoing development and integration of digital payment solutions. This includes creating and refining Software-as-a-Service (SaaS) platforms for instant card issuance and enabling digital push provisioning for mobile wallets, a feature increasingly expected by consumers.

These digital initiatives are vital for staying competitive, as they allow CPI to offer enhanced cardholder experiences and modern payment options. For instance, by mid-2024, the global digital payment market was projected to reach over $2.5 trillion, highlighting the demand for such integrated services.

Continuous research and development are therefore essential. This ensures that CPI can offer a comprehensive suite of digital functionalities that complement their physical card offerings, meeting evolving customer needs in a rapidly digitizing financial landscape.

Innovation in Eco-Focused and Advanced Card Technologies

CPI Card Group's commitment to innovation is a cornerstone of its business model, particularly in developing eco-friendly and technologically advanced card solutions. They actively invest in research and development to bring these cutting-edge products to market, ensuring they stay ahead of evolving customer demands.

This focus on sustainability and advanced features is a key driver for customer loyalty and for attracting new business. By offering solutions like their Second Wave® and Earthwise® cards, which utilize recycled content, and innovative options such as LED-embedded cards, CPI provides tangible value and differentiation in a competitive landscape.

The success of their eco-focused initiatives is evident in their sales figures. Since their launch, CPI has sold over 350 million eco-focused card solutions, demonstrating significant market adoption and the effectiveness of their strategy.

- Research & Development Investment: CPI prioritizes R&D for new card technologies, including sustainable materials and advanced features.

- Eco-Focused Product Lines: Development and promotion of environmentally friendly card options like Second Wave® and Earthwise®.

- Advanced Card Features: Innovation in areas such as LED-embedded cards to offer enhanced functionality and appeal.

- Market Traction: Over 350 million eco-focused card solutions sold since their introduction, highlighting strong customer acceptance.

Market Expansion and Diversification

CPI Card Group actively seeks to broaden its reach by introducing new payment and card solutions to both its current client base and emerging industries. This strategic move involves tapping into new customer segments, such as the healthcare and transit sectors, where their payment expertise can address specific needs. For example, in 2024, the company continued to focus on these diversification efforts, aiming to capture a larger share of these growing markets.

The company's approach to market expansion is twofold: deepening relationships with existing customers by offering a wider array of services and attracting new customers in previously unaddressed verticals. This dual strategy allows CPI Card Group to leverage its core competencies in secure payment solutions across a more diverse economic landscape.

A significant move illustrating this commitment to diversification was the acquisition of Arroweye Solutions. This acquisition, completed in recent years, was designed to enhance CPI Card Group's capabilities in areas like card personalization and fulfillment, thereby enabling them to serve a broader range of customer needs and enter new market niches more effectively.

Key activities in market expansion and diversification include:

- Developing and launching innovative payment solutions tailored for specific industry verticals like healthcare and transit.

- Expanding the customer base by cross-selling existing products and services into new market segments.

- Strategic acquisitions, such as Arroweye Solutions, to gain access to new technologies, customer bases, and market opportunities.

- Investing in research and development to create differentiated offerings that meet evolving market demands.

CPI Card Group's core activities revolve around the secure manufacturing and personalization of payment cards, a process that demands high levels of precision and adherence to industry standards. This is supported by their advanced production facilities, which in 2024 saw continued investment in cutting-edge personalization technologies to meet evolving financial industry needs.

The company also excels in end-to-end fulfillment and mailing, ensuring cards reach end-users efficiently. Furthermore, CPI is actively engaged in developing digital payment solutions, including SaaS platforms for instant issuance and mobile wallet integration, recognizing the significant growth in the digital payment market, projected to exceed $2.5 trillion by mid-2024.

Innovation is a key activity, with a strong focus on R&D for eco-friendly and technologically advanced card solutions. This includes their successful eco-focused product lines, with over 350 million units sold, and the development of features like LED-embedded cards.

Market expansion and diversification are also critical, involving the development of tailored solutions for sectors like healthcare and transit, and strategic acquisitions such as Arroweye Solutions to enhance capabilities and market reach.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Card Manufacturing & Personalization | Secure production of physical payment cards, including EMV and contactless technologies. | Investment in advanced personalization technologies. |

| Digital Payment Solutions | Development of SaaS platforms for instant issuance and mobile wallet integration. | Addressing the growing digital payment market (>$2.5 trillion by mid-2024). |

| Innovation & R&D | Creating eco-friendly and advanced card features. | Over 350 million eco-focused cards sold; development of LED-embedded cards. |

| Market Expansion & Diversification | Targeting new verticals (healthcare, transit) and acquiring complementary businesses. | Acquisition of Arroweye Solutions to enhance capabilities. |

What You See Is What You Get

Business Model Canvas

The CPI Card Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can confidently assess the quality, structure, and content before committing. Upon completing your order, you will gain full access to this exact, professionally formatted Business Model Canvas, ready for immediate use and customization.

Resources

CPI Card Group's high-security production and card services facilities, all situated within the United States, are foundational to its business model. These sites are crucial for the secure manufacturing, personalization, and fulfillment of payment cards, ensuring compliance with stringent industry standards like PCI DSS.

The company's commitment to secure operations is evident in its existing infrastructure. For instance, in 2023, CPI Card Group reported that its facilities adhere to the highest security protocols, safeguarding sensitive customer data throughout the card lifecycle.

Further demonstrating their dedication to growth and enhanced capabilities, CPI Card Group announced plans for a significant investment in a new production facility in Indiana. This expansion is designed to increase their overall production capacity and introduce advanced card manufacturing technologies, anticipating future market demand.

CPI Card Group's proprietary technology and intellectual property are foundational to its business model, particularly in card manufacturing and digital solutions. This includes patented processes for card production and unique digital platforms like Card@Once® for instant issuance, offering clients speed and convenience.

This intellectual capital creates a significant competitive advantage. For instance, their integrated chip and antenna technology allows for greater flexibility in card design and functionality, a crucial factor in a rapidly evolving payment landscape. In 2023, CPI Card Group reported a 3% increase in their secure card segment revenue, partly driven by demand for these advanced technological solutions.

CPI Card's skilled workforce is a cornerstone of its business model, offering deep expertise in payment technology, secure card production, and customer support. This human capital is essential for navigating the dynamic payments landscape and developing cutting-edge solutions.

The company's commitment to its employees is evident, as CPI was honored as one of the 2024 Best Companies to Work For by U.S. News & World Report. This recognition underscores the value CPI places on its team and their collective knowledge, which is critical for maintaining its market leadership.

Established Customer Relationships and Market Position

CPI Card Group's established customer relationships are a cornerstone of its business model, acting as a significant intangible asset. These aren't just casual acquaintances; we're talking about long-standing partnerships with thousands of clients, including major financial institutions and prepaid program managers. This deep integration means CPI is often the go-to provider for critical payment card needs.

Their strong market position, cultivated through a consistent focus on customer service, product quality, and ongoing innovation, directly translates into their ability to capture and retain market share. This dedication to excellence fosters loyalty and makes it harder for competitors to penetrate their established client base. In 2023, CPI reported that approximately 70% of their revenue came from existing customers, underscoring the stability these relationships provide.

- Customer Retention: CPI's long-term relationships with major financial institutions and prepaid program managers provide a stable revenue base.

- Market Share Dominance: A focus on service, quality, and innovation has secured CPI a strong position in the payment card market.

- Reputation as a Key Asset: These established ties are a crucial intangible asset, contributing significantly to their competitive advantage.

- Revenue Stability: In 2023, approximately 70% of CPI's revenue was generated from their existing customer base, highlighting the strength of these relationships.

Robust Supply Chain and Inventory Management

CPI Card Group’s robust supply chain and inventory management are foundational to its business model. This includes the meticulous handling of raw materials, such as plastic resins and microchips, and finished goods, like secure payment cards and packaging. In 2023, CPI Card Group reported a significant focus on optimizing inventory levels to reduce carrying costs while ensuring product availability.

The company's supply chain efficiency is further bolstered by its commitment to sourcing eco-friendly materials, aligning with growing market demand for sustainable products. Integrating new technologies, like advanced tracking and forecasting software, directly enhances production capabilities and cost-effectiveness. For instance, the integration of the Arroweye acquisition is designed to enable a zero-inventory model for its digitally-driven, on-demand card solutions, a key differentiator in the market.

- Inventory Optimization: CPI Card Group actively manages inventory for card components and packaging to balance availability with carrying costs, a critical factor in maintaining competitive pricing and service levels.

- Supply Chain Efficiency: The company’s ability to efficiently manage its supply chain, including the procurement of materials and logistics, directly influences its production capacity and overall cost structure.

- Sustainable Sourcing: A key resource involves securing eco-friendly materials, reflecting a strategic commitment to environmental responsibility and meeting evolving customer preferences for sustainable products.

- Technological Integration: The adoption of new technologies within the supply chain, such as advanced inventory management systems, is crucial for enhancing operational efficiency and enabling flexible production models like on-demand solutions.

CPI Card Group's physical facilities, including its secure production and personalization centers in the United States, are vital resources. These sites are engineered for the secure handling and creation of payment cards, adhering to strict industry security mandates.

The company's investment in advanced manufacturing technology and proprietary intellectual property, such as its Card@Once® platform, provides a significant competitive edge. This technological foundation enables efficient, secure, and innovative card solutions, as demonstrated by their reported 3% revenue increase in the secure card segment in 2023, partly due to these advanced offerings.

CPI Card Group's skilled workforce, recognized by its inclusion as one of the 2024 Best Companies to Work For by U.S. News & World Report, is a critical asset. Their expertise in payment technology and secure production is essential for maintaining market leadership and developing new solutions.

Established customer relationships, particularly with major financial institutions, represent a significant intangible asset, contributing to revenue stability. In 2023, approximately 70% of CPI's revenue was derived from its existing customer base, underscoring the value of these deep partnerships.

The company's efficient supply chain and inventory management, including the sourcing of eco-friendly materials and the integration of technologies like those from the Arroweye acquisition, are key to its operational success and ability to offer on-demand solutions.

| Key Resource | Description | Impact on Business Model | 2023/2024 Data Point |

|---|---|---|---|

| Physical Facilities | Secure production and personalization centers in the US. | Enables secure card manufacturing and fulfillment. | Facilities adhere to highest security protocols. |

| Proprietary Technology & IP | Card@Once®, integrated chip/antenna tech. | Drives innovation, efficiency, and competitive advantage. | 3% revenue increase in secure cards driven by tech. |

| Skilled Workforce | Expertise in payment tech, secure production. | Maintains market leadership and solution development. | Named a 2024 Best Company to Work For. |

| Customer Relationships | Long-term partnerships with financial institutions. | Provides revenue stability and market share. | 70% of 2023 revenue from existing customers. |

| Supply Chain & Inventory | Efficient management of materials and finished goods. | Ensures product availability, cost-effectiveness, and sustainability. | Focus on optimizing inventory levels in 2023. |

Value Propositions

CPI Card Group streamlines the production of secure payment cards, offering financial institutions a comprehensive, end-to-end solution. This includes manufacturing, personalization, and fulfillment, all while meeting rigorous security standards. In 2024, CPI reported a significant increase in their secure card production capacity, handling millions of units monthly to meet growing demand.

CPI Card Group focuses on elevating the cardholder experience through a suite of innovative payment solutions. They offer physical and digital products like advanced contactless cards and instant issuance capabilities, ensuring cardholders receive their new cards quickly and seamlessly. In 2024, the demand for enhanced security and convenience continues to drive adoption of these technologies.

Visually striking designs, including those with LED illumination, contribute to a more engaging and personalized cardholder experience. This focus on aesthetics, coupled with user-centric features, builds significant value and fosters trust. CPI's commitment to rapid delivery and cutting-edge technology directly addresses evolving consumer expectations in the payments landscape.

Furthermore, CPI's 'All-in-One' chip technology provides expanded design possibilities, allowing for more creative and functional card products. This innovation not only enhances the visual appeal but also integrates multiple functionalities, streamlining the user experience and reinforcing CPI's position as an innovator in the card manufacturing industry.

CPI Card Group provides a wide array of payment solutions, encompassing traditional plastic cards like credit, debit, and prepaid options. They also emphasize eco-friendly card materials, reflecting a growing demand for sustainability in the financial sector.

Beyond physical cards, CPI offers robust digital and virtual payment products. This includes Software-as-a-Service (SaaS) for instant issuance and seamless push provisioning to mobile wallets, crucial for meeting contemporary consumer expectations.

The strategic acquisition of Arroweye in 2023 significantly boosted CPI's on-demand digital printing capabilities, further diversifying their product range and enhancing their ability to deliver customized, immediate payment solutions.

Commitment to Sustainability with Eco-Focused Solutions

CPI Card Group's dedication to sustainability is a cornerstone of its value proposition, particularly through its eco-focused payment card solutions. These offerings, like the Second Wave® and Earthwise® cards, are crafted using upcycled materials, directly addressing the increasing consumer and financial institution demand for environmentally responsible products.

This commitment is backed by significant market penetration. As of early 2024, CPI has successfully supplied over 350 million eco-focused card solutions, demonstrating a tangible impact on reducing the environmental footprint of the payment card industry. This scale of adoption highlights the market's readiness for and acceptance of sustainable alternatives.

- Eco-Focused Product Lines: CPI offers Second Wave® and Earthwise® cards, utilizing upcycled materials.

- Market Adoption: Over 350 million eco-focused card solutions have been sold by CPI.

- Addressing Market Demand: These products cater to the growing preference for sustainable options among consumers and banks.

- Alignment with Trends: CPI's strategy aligns with global environmental sustainability initiatives and evolving customer expectations.

Agility and Rapid Turnaround Times

CPI Card Group's agility and rapid turnaround times are a significant value proposition, particularly in the financial services sector. Through solutions like Card@Once®, they provide instant card issuance, enabling financial institutions to offer immediate card access to their customers. This is a critical advantage in a market where speed and convenience are paramount.

The acquisition of Arroweye further bolsters CPI's capabilities in this area. Arroweye's digitally-driven on-demand platform revolutionizes card fulfillment by eliminating the need for customers to manage physical inventory. This allows for hyper-personalization and expedited delivery, directly addressing the demand for faster, more tailored card solutions.

This enhanced agility is not just about speed; it's about enabling financial institutions to respond swiftly to market changes and customer needs. For example, in 2024, the demand for instant credentialing for new account openings and replacement cards continued to grow, making CPI's rapid issuance capabilities a key differentiator.

- Instant Issuance: Card@Once® provides immediate card production and personalization at the point of need.

- On-Demand Fulfillment: Arroweye's platform enables digital, just-in-time card delivery, reducing inventory burdens.

- Hyper-Personalization: The digital-first approach allows for greater customization of card features and designs.

- Market Responsiveness: CPI's agile model helps financial institutions quickly adapt to evolving customer expectations and market trends.

CPI Card Group offers a comprehensive suite of secure payment card production and personalization services, acting as an end-to-end solution provider for financial institutions. Their commitment to security is paramount, enabling them to handle millions of card units monthly, a capacity that saw significant expansion in 2024 to meet escalating market demands.

CPI enhances the cardholder experience through innovative physical and digital payment products, including advanced contactless cards and instant issuance capabilities. This focus on seamless and rapid delivery aligns with the growing 2024 consumer preference for convenience and enhanced security features.

CPI Card Group's value proposition is built on delivering secure, innovative, and convenient payment solutions. They provide financial institutions with end-to-end production, personalization, and fulfillment, ensuring adherence to stringent security standards. In 2024, CPI's production capacity expanded to millions of secure cards monthly, reflecting strong market demand for these essential financial tools.

Furthermore, CPI prioritizes an elevated cardholder experience through advanced technologies like contactless payments and instant issuance. This allows banks to provide new cards quickly and efficiently, a critical factor in customer satisfaction, especially as demand for these convenient features surged in 2024.

CPI Card Group offers a diversified product portfolio, including traditional plastic cards and a growing range of eco-friendly options like their Second Wave® and Earthwise® cards, made from upcycled materials. By early 2024, over 350 million of these sustainable solutions had been supplied, demonstrating a significant market shift towards environmentally conscious payment products.

The company also excels in digital payment solutions, providing Software-as-a-Service for instant issuance and mobile wallet provisioning. The 2023 acquisition of Arroweye significantly bolstered these digital capabilities, enabling hyper-personalized and immediate payment solutions that cater to modern consumer expectations.

| Value Proposition Area | Key Offerings | 2024 Market Relevance/Data | Impact |

|---|---|---|---|

| Secure Production & Fulfillment | End-to-end manufacturing, personalization, security compliance | Millions of units produced monthly; increased capacity | Meets rigorous financial industry security demands. |

| Enhanced Cardholder Experience | Contactless, instant issuance, visually striking designs | Growing demand for convenience and personalization | Improves customer satisfaction and brand loyalty. |

| Sustainability | Eco-focused cards (Second Wave®, Earthwise®) using upcycled materials | Over 350 million eco-cards supplied by early 2024 | Addresses growing consumer and institutional demand for green solutions. |

| Agility & Speed | Card@Once®, Arroweye acquisition for on-demand, personalized issuance | Critical for rapid credentialing and market responsiveness | Enables financial institutions to quickly meet customer needs. |

Customer Relationships

CPI Card Group prioritizes cultivating personalized, trust-based partnerships, understanding that the payments landscape is always changing. They focus on deeply understanding each client's unique needs to offer customized solutions that truly bolster their brand presence and market strategy.

This dedication to individual client success is evident in CPI Card Group's robust, long-standing relationships with many of its top-tier customers. These enduring connections underscore the effectiveness of their trust-driven approach, demonstrating a commitment that goes beyond transactional interactions.

CPI Card Group prioritizes exceptional customer service, employing experienced staff to guide clients through the intricacies of payment card issuance. Their commitment extends to providing continuous operational support, ensuring a smooth experience for every partner.

This dedicated approach aims to not just meet, but exceed customer expectations, fostering strong, lasting relationships. For instance, in 2023, CPI reported a significant increase in customer satisfaction scores, directly attributed to their proactive support initiatives.

CPI Card Group positions itself as a strategic partner, not just a supplier, by offering consultative services. This means they actively help clients design and implement effective card programs, ensuring they are aligned with market demands and technological advancements.

For instance, CPI guides clients through significant industry shifts, such as the growing demand for eco-friendly payment cards. In 2024, the market for sustainable payment cards saw a notable increase in interest, with many financial institutions exploring options made from recycled or biodegradable materials. CPI's advisory services help clients navigate these choices, from material selection to program launch.

Furthermore, CPI advises on leveraging new technologies, including the rapid adoption of digital payments and contactless solutions. Their expertise helps clients optimize their payment offerings, enhancing customer experience and maintaining a competitive edge in an evolving financial landscape.

Long-Term Relationship Management

CPI Card Group places a strong emphasis on cultivating long-term customer relationships, a cornerstone of their business model. This isn't about quick sales; it's about building trust and loyalty over time. Their success in retaining clients, with some partnerships extending for nearly two decades, highlights a deep commitment to customer satisfaction and consistent value delivery.

The longevity of these relationships, with some key accounts dating back to 2005, underscores CPI's ability to consistently meet and exceed customer expectations in the demanding card manufacturing and personalization industry. This sustained engagement is a testament to their reliable product quality and dedicated service, fostering enduring partnerships that drive repeat business and mutual growth.

- Customer Retention: CPI boasts an impressive customer retention rate, with key accounts maintained for approximately 20 years.

- Relationship Focus: The business prioritizes building enduring partnerships over short-term, transactional engagements.

- Quality Assurance: Consistent delivery of high-quality card products and related services is fundamental to nurturing these long-standing relationships.

- Customer Loyalty: This long-term approach fosters significant customer loyalty, a key indicator of CPI's market standing.

Innovation-Driven Engagement

CPI Card Group's customer relationships thrive on a foundation of continuous innovation. By consistently introducing new products and features, they ensure clients have access to the latest advancements in payment technology. This proactive approach keeps their customers competitive in a rapidly evolving market.

For example, CPI's development of advanced solutions such as LED cards, which offer enhanced security and user experience, directly addresses emerging market demands. Similarly, their work on new chip technologies demonstrates a commitment to staying ahead of the curve. In 2024, the global smart card market was valued at approximately $12.5 billion, with a significant portion driven by payment applications, highlighting the importance of such technological advancements.

- Innovation as a Differentiator: CPI's focus on R&D allows them to offer unique, high-value products that set them apart.

- Client-Centric Development: By collaborating with clients, CPI ensures their innovations meet specific market needs and challenges.

- Staying Ahead of Trends: The timely release of new technologies, like advanced chip functionalities, empowers clients to maintain a competitive edge.

- Market Responsiveness: CPI's ability to innovate quickly ensures their clients are not left behind in the fast-paced payments landscape.

CPI Card Group cultivates deeply ingrained customer relationships by acting as a strategic partner, offering consultative services that extend beyond mere product supply. This collaborative approach ensures clients receive tailored solutions aligned with market dynamics and technological progress, fostering mutual growth and sustained loyalty.

Their commitment to exceptional service and continuous innovation, including the development of sustainable card options and advanced chip technologies, solidifies these partnerships. This focus on long-term value and client success is reflected in their impressive customer retention rates, with many relationships spanning nearly two decades.

| Customer Relationship Aspect | CPI Card Group's Approach | Impact/Data Point |

|---|---|---|

| Partnership Model | Strategic, consultative, and trust-based | Long-standing relationships with top-tier customers |

| Service Excellence | Personalized support, experienced staff, continuous operational guidance | Increased customer satisfaction scores in 2023 |

| Innovation Collaboration | Co-development of new products and features (e.g., eco-friendly cards, advanced chip tech) | Clients stay competitive with emerging trends like sustainable payments in 2024 |

| Longevity of Relationships | Focus on enduring partnerships over transactional engagements | Key accounts maintained for approximately 20 years |

Channels

CPI Card Group's direct sales force is instrumental in connecting with a broad spectrum of clients, from major financial institutions to smaller credit unions. This approach fosters deep relationships and allows for a nuanced understanding of each customer's unique payment solution requirements.

In 2024, CPI Card Group reported that its direct sales channel was a key driver of its business, enabling them to secure contracts with significant players in the financial services industry. This direct engagement model is crucial for delivering customized card manufacturing and payment solutions.

CPI leverages indirect sales channels, notably through prepaid program managers, to significantly expand its market penetration. These managers act as resellers, offering CPI's services to a vast network of their own indirect customers, particularly within the burgeoning prepaid market.

This indirect approach proved substantial in 2024, with a single major customer, operating through such channels, contributing 18% to CPI's net sales. This highlights the critical role of indirect partners in amplifying CPI's reach and revenue generation.

CPI's online customer portal acts as a crucial digital gateway, allowing clients to effortlessly manage orders, access vital account information, and engage with the company's comprehensive suite of services. This digital channel significantly boosts customer convenience and operational efficiency.

Further extending its digital reach, CPI offers innovative solutions such as Software as a Service (SaaS)-based instant issuance. These platforms are designed for seamless integration with core banking systems and popular mobile banking applications, thereby establishing multiple digital touchpoints for enhanced customer interaction and service delivery.

Industry Events and Trade Shows

Industry Events and Trade Shows are a vital part of CPI Card Group's strategy to connect with the market. They actively participate in major global fintech gatherings like Money 20/20, which saw over 10,000 attendees in 2023, to exhibit their cutting-edge products and engage with a broad range of financial industry professionals.

These events are instrumental in showcasing CPI's technological advancements, including their eco-friendly card options and sophisticated chip technologies. By demonstrating these innovations, CPI aims to capture market attention and generate valuable leads, reinforcing their position as an industry innovator.

Participation in these high-profile events directly contributes to CPI Card Group's market visibility and business development efforts. For instance, in 2024, the company highlighted its commitment to sustainability by showcasing its recycled PETG cards, aligning with a growing consumer demand for environmentally conscious products.

- Showcasing Innovation: CPI Card Group uses events to display new technologies like advanced chip solutions and eco-friendly card materials.

- Client Engagement: These platforms allow for direct interaction with existing and potential clients, fostering stronger business relationships.

- Market Visibility: Participation in major trade shows significantly boosts brand awareness and industry presence.

- Lead Generation: Events serve as a primary channel for identifying and acquiring new business opportunities.

Strategic Technology Integrations

CPI Card Group strategically integrates its technology with financial institution platform providers, card processors, and mobile banking app developers. This approach acts as a crucial channel for distributing their expanding suite of digital solutions.

These deep integrations facilitate the smooth delivery of services such as digital push provisioning and instant issuance, directly within their clients' existing technological frameworks. For instance, in 2024, CPI reported a significant increase in the adoption of its digital issuance solutions, with a 35% year-over-year growth, directly attributable to these embedded channel strategies.

This embedded strategy not only streamlines operations for CPI's clients but also significantly enhances the end-customer experience by making advanced card services readily accessible.

- Embedded Channel Expansion: CPI leverages partnerships with financial institutions and processors to embed digital card solutions directly into existing banking platforms.

- Streamlined Service Delivery: Integrations enable seamless deployment of services like digital push provisioning and instant issuance.

- Enhanced Customer Experience: This approach provides end-users with immediate access to digital card functionalities through familiar banking apps.

CPI Card Group utilizes a multi-faceted channel strategy to reach its diverse customer base, encompassing direct sales, indirect partnerships, and robust digital platforms. In 2024, the company highlighted that its direct sales force was a primary driver, fostering deep relationships with financial institutions. Indirect channels, particularly through prepaid program managers, proved substantial, with one major customer via this route contributing 18% to CPI's net sales for the year.

CPI's digital engagement is bolstered by an online customer portal for order management and account access, alongside SaaS-based instant issuance solutions integrated with banking apps. The company also actively participates in industry events like Money 20/20 to showcase innovations, such as their eco-friendly PETG cards, and generate leads. Strategic integrations with platform providers and processors further expand the reach of their digital solutions, with a reported 35% year-over-year growth in digital issuance adoption in 2024.

| Channel Type | Key Features | 2024 Impact/Focus |

|---|---|---|

| Direct Sales | Personalized client engagement, deep relationship building | Key driver of business, securing major financial institution contracts |

| Indirect Sales (Prepaid Program Managers) | Market penetration through resellers, access to vast networks | Significant revenue contribution, one customer accounted for 18% of net sales |

| Digital Platforms (Online Portal, SaaS) | Customer convenience, order management, integrated digital issuance | Enhanced customer interaction, seamless integration with banking systems |

| Industry Events & Trade Shows | Showcasing innovation, lead generation, market visibility | Highlighting sustainability (PETG cards), engaging with fintech professionals |

| Embedded Channel Integrations | Partnerships with processors/platform providers, digital solution distribution | 35% YoY growth in digital issuance adoption, streamlined service delivery |

Customer Segments

Large financial institutions and top card issuers are a cornerstone of CPI Card's customer base. These clients, including major banks and credit unions, demand high-volume production of secure credit and debit cards. They rely on CPI for advanced security features and extensive personalization services to meet the complex needs of their vast customer networks.

CPI's ability to deliver robust and reliable solutions at scale is critical for these significant players in the financial industry. For instance, in 2024, the global payment card market was projected to reach over $1.2 trillion, highlighting the sheer volume these institutions handle. These relationships often represent a substantial portion of CPI's overall revenue, underscoring their importance to the company's financial health.

CPI Card Group actively supports thousands of smaller financial institutions, such as community banks and credit unions, by offering specialized solutions like their Card@Once instant issuance platform. These institutions often seek payment card technologies that are both effective and easy to implement, aiming to improve their customer offerings without significant capital investment or complex IT setups.

For 2024, CPI is strategically prioritizing sales growth within this vital segment, recognizing the demand for adaptable and user-friendly card services. This focus allows them to cater to the specific needs of these institutions, providing them with the tools to compete and enhance their member or customer experience.

Prepaid Program Managers are key clients for CPI Card, encompassing businesses that oversee gift cards, reloadable cards, and other prepaid payment solutions. CPI offers them card production and specialized packaging, aiming to help them reach new customer groups.

CPI has seen significant success in the prepaid sector. For instance, in 2023, the prepaid segment contributed substantially to CPI's revenue growth, with projections for continued expansion in 2024 driven by demand for flexible payment options.

Retail Market

CPI Card Group serves the retail market by offering a diverse range of payment solutions. These include essential tools like gift cards, loyalty programs, and private label credit cards, all designed to enhance customer engagement and drive sales for retailers.

Retailers leverage CPI's expertise for customized card designs that align with their brand identity. The company also emphasizes eco-friendly card options, catering to a growing consumer demand for sustainable products. This focus on customization and sustainability helps retailers stand out in a competitive landscape.

CPI's general-purpose card solutions are highly adaptable, meeting the varied needs of different retail sectors. For instance, in 2024, the demand for contactless payment solutions in retail continued to surge, with many retailers adopting these technologies to streamline checkout processes and improve customer experience.

- Retail Payment Solutions: Gift cards, loyalty cards, and private label credit cards are key offerings.

- Customization & Sustainability: Retailers benefit from personalized card designs and eco-conscious material options.

- Market Adaptability: CPI's general-purpose cards are versatile for various retail applications.

- Industry Trend: The retail sector saw continued growth in contactless payment adoption throughout 2024, a trend CPI supports.

Healthcare and Transit Markets

CPI is expanding its reach into the healthcare and transit sectors, offering specialized payment and non-payment card solutions. This strategic move capitalizes on their existing technological capabilities to serve these distinct markets.

The healthcare payment solutions segment has shown significant promise, contributing to robust growth in CPI's prepaid card business. This indicates a strong market demand for their tailored offerings in this vertical.

- Healthcare Payment Solutions: CPI provides specialized card products designed to streamline payments and administrative processes within the healthcare industry, enhancing efficiency for both providers and patients.

- Transit Services: The company also targets the transit market, offering solutions that facilitate fare collection and passenger management, aiming to modernize public transportation payment systems.

- Prepaid Growth Driver: The healthcare payment solutions have been a key factor in the strong growth observed in CPI's overall prepaid card segment, demonstrating successful diversification.

CPI Card Group serves a diverse customer base, including large financial institutions that require high-volume, secure card production, and smaller community banks and credit unions seeking user-friendly, instant issuance solutions. The company also caters to the retail sector with gift cards and loyalty programs, and is expanding into specialized markets like healthcare and transit.

| Customer Segment | Key Needs | CPI Offerings |

|---|---|---|

| Large Financial Institutions | High-volume production, advanced security, personalization | Secure credit/debit cards, extensive personalization |

| Small Financial Institutions | Effective, easy-to-implement solutions, instant issuance | Card@Once instant issuance, adaptable card services |

| Retailers | Customer engagement, brand identity, eco-friendly options | Gift cards, loyalty cards, private label cards, sustainable materials |

| Prepaid Program Managers | Card production, specialized packaging, reaching new customers | Prepaid card production, packaging solutions |

| Healthcare & Transit | Streamlined payments, fare collection, administrative efficiency | Specialized payment/non-payment cards, transit fare solutions |

Cost Structure

Manufacturing and production costs are a substantial part of CPI Card's operations. These expenses encompass the raw materials needed for card creation, such as various types of plastics, increasingly eco-friendly alternatives, and even metals for premium cards. Labor involved in both the general manufacturing process and the crucial personalization of each card also contributes significantly to this cost category.

Energy consumption for running their production facilities is another key component. CPI's strategic emphasis on eco-focused cards, while beneficial for market positioning, can influence the cost of these materials. For instance, the adoption of recycled or biodegradable plastics might carry a different price point than traditional PVC. In 2024, CPI Card announced plans for a new facility in Indiana, which will involve considerable capital expenditures to set up and equip, directly impacting their manufacturing cost structure.

CPI Card Group's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These costs are vital for creating new products, improving current offerings, and building out their digital capabilities, such as advanced chip technology and instant issuance platforms.

In 2024, a substantial portion of CPI's operational budget was allocated to R&D, underscoring the strategic importance of staying ahead in a rapidly evolving market. This investment fuels their ability to explore novel areas like advanced card materials and expand into services such as enhanced fraud prevention solutions, directly contributing to their competitive advantage and market growth.

Selling, General, and Administrative (SG&A) expenses are a significant component of the CPI Card business model, covering everything from marketing campaigns and sales team salaries to the operational costs of running the company and performance-based bonuses for employees. These costs aren't static; they tend to move with the company's ambitions, expanding when there are major growth pushes or new strategic projects underway.

In 2024, CPI Card experienced a notable trend where rising SG&A expenses partially counteracted the positive effects of increased sales and improved profit margins. For instance, while sales might have grown, a substantial portion of that gain was absorbed by higher spending in these operational areas, impacting the net profitability picture.

Technology and Security Infrastructure Costs

CPI Card Group, like many in the payment processing industry, faces significant expenses in maintaining secure technology and infrastructure. This is crucial for safeguarding sensitive customer data and adhering to stringent payment brand regulations.

These costs encompass ongoing investments in advanced software, reliable hardware, and robust cybersecurity solutions to prevent data breaches. For instance, in 2024, the global average cost of a data breach reached $4.45 million, highlighting the critical nature of these expenditures.

Furthermore, ensuring continuous compliance with standards like PCI DSS represents a perpetual operational cost. This involves regular audits, system updates, and employee training to maintain the highest security levels.

- Software and Hardware: Investments in secure data management systems, encryption tools, and reliable IT hardware.

- Cybersecurity Measures: Ongoing spending on firewalls, intrusion detection systems, and threat intelligence platforms.

- PCI Compliance: Continuous operational costs for audits, certifications, and adherence to Payment Card Industry Data Security Standard requirements.

- Infrastructure Maintenance: Costs associated with maintaining secure production facilities and robust IT networks.

Debt Servicing and Capital Expenditures

CPI Card's cost structure includes significant outlays for debt servicing and capital expenditures. These are crucial for maintaining operations and investing in future growth.

- Debt Refinancing Costs: In 2024, CPI Card incurred $8.8 million in pre-tax costs related to debt refinancing, highlighting the expenses associated with managing its debt obligations.

- Interest Payments: The company faces ongoing interest payments on its senior secured notes, which represent a fixed cost that impacts profitability.

- Capital Spending: Significant capital expenditures are allocated for facility upgrades and the acquisition of new equipment. This investment is vital for enhancing operational efficiency and expanding production capacity.

- Future Expectations: CPI anticipates higher cash interest payments and increased capital spending in 2025, reflecting continued investment in long-term growth initiatives.

CPI Card's cost structure is heavily influenced by its manufacturing operations, including raw materials and labor for card production. Investments in R&D for new technologies and digital capabilities are also substantial. Furthermore, the company incurs significant costs for maintaining secure technology infrastructure and compliance with industry standards, alongside debt servicing and capital expenditures for growth.

| Cost Category | Key Components | 2024 Impact/Notes |

|---|---|---|

| Manufacturing & Production | Raw materials (plastics, eco-alternatives), labor (general & personalization) | New Indiana facility capital expenditures impact structure. |

| Research & Development (R&D) | New product development, digital capabilities (chip tech, instant issuance) | Substantial budget allocation in 2024 for advanced materials and fraud prevention. |

| Selling, General & Administrative (SG&A) | Marketing, sales salaries, operations, bonuses | Rising SG&A in 2024 partially offset sales growth and margin improvements. |

| Technology & Security | Secure software/hardware, cybersecurity measures, PCI compliance, infrastructure maintenance | Global data breach cost averaged $4.45 million in 2024; PCI DSS compliance is a perpetual cost. |

| Financing & Capital Expenditures | Debt refinancing, interest payments, capital spending | $8.8 million in pre-tax debt refinancing costs in 2024; anticipated higher interest and CapEx in 2025. |

Revenue Streams

CPI Card Group’s primary revenue comes from selling credit, debit, and prepaid cards to banks and other financial entities. This encompasses traditional plastic cards, but also the growing demand for contactless options, environmentally friendly cards, and premium packaging.

In 2024, the company saw its sales boosted significantly by a robust performance in its prepaid card segment, alongside strong demand for contactless debit and credit cards. This indicates a clear market shift towards convenient and modern payment solutions.

CPI Card Group generates revenue from fees associated with personalizing cards, embedding unique cardholder data, and managing the entire fulfillment process, which includes secure mailing. These crucial services, often integrated with card production, are also available as separate offerings, providing flexibility for clients.

The company has seen its net sales grow, partly driven by increased demand for its card personalization services. For instance, in the first quarter of 2024, CPI Card Group reported net sales of $81.8 million, showing a continued reliance on these value-added services within their overall business model.

CPI Card Group's digital solutions, particularly its Software-as-a-Service (SaaS) offerings like Card@Once® for instant card issuance, are a key revenue driver. While currently a smaller contributor, revenues from other digital solutions, such as digital push provisioning, are anticipated to expand significantly in the coming years.

The strategic acquisition of Arroweye Solutions further bolsters this revenue stream by incorporating digitally-powered, on-demand payment card solutions into CPI's portfolio. This integration is expected to enhance their digital service capabilities and market reach.

Revenue from New Market Verticals

CPI Card Group is actively expanding its reach into new customer verticals, notably in healthcare payment solutions and the broader closed-loop prepaid market. This strategic diversification is a key driver for generating new revenue streams and significantly broadening CPI's total addressable market.

The company's foray into healthcare payment solutions has already shown promising results, contributing to robust prepaid growth throughout 2024. This success underscores the potential for further revenue generation as these new markets mature and CPI solidifies its presence.

- Healthcare Payment Solutions: A significant contributor to prepaid growth in 2024, opening new revenue avenues.

- Closed-Loop Prepaid Market: Expansion here diversifies CPI's offerings and increases its market reach.

- Strategic Diversification: Initiatives aim to reduce reliance on traditional segments and tap into emerging payment needs.

- Total Addressable Market (TAM) Expansion: Entering new verticals directly increases the overall market potential for CPI's products and services.

On-Demand and Specialty Card Solutions

CPI Card Group's acquisition of Arroweye Solutions significantly bolstered its revenue streams through on-demand payment card solutions. This move allows for hyper-personalization and eliminates the need for customers to hold large inventories, creating a more efficient model. For instance, in 2024, CPI saw increased demand for these tailored card offerings, contributing to a more dynamic revenue base.

Beyond standard payment cards, CPI is also generating revenue from specialty card products. This includes premium options like metal cards and innovative designs featuring elements such as LED lights. These niche products often command higher profit margins due to their unique value proposition and appeal to a segment of consumers seeking differentiated card experiences.

- On-Demand Solutions: Revenue generated from personalized, just-in-time card production, reducing customer inventory costs.

- Specialty Cards: Income derived from premium offerings like metal cards and cards with advanced features such as LED integration.

- Higher Margins: Specialty and on-demand cards typically contribute to higher profit margins due to their unique features and value-added services.

- Market Expansion: The Arroweye acquisition broadened CPI's market reach, tapping into growing consumer and business demand for customized and premium card products.

CPI Card Group's revenue streams are diverse, encompassing the sale of traditional and innovative payment cards, personalization and fulfillment services, and growing digital solutions. The company also actively pursues new market verticals like healthcare payment solutions, diversifying its income base.

In 2024, CPI Card Group reported net sales of $81.8 million in the first quarter, with a significant portion attributed to strong demand for prepaid and contactless cards. The acquisition of Arroweye Solutions further bolstered revenue by integrating on-demand, digitally-powered card production, offering hyper-personalization and reducing client inventory needs. Specialty cards, such as metal or LED-integrated options, also contribute to revenue with higher profit margins.

| Revenue Stream | Description | 2024 Performance Indicator |

|---|---|---|

| Card Sales | Credit, debit, and prepaid cards (traditional, contactless, eco-friendly) | Boosted by prepaid segment and contactless demand |

| Personalization & Fulfillment | Data embedding, personalization, secure mailing | Increased demand contributed to net sales growth |

| Digital Solutions (SaaS) | Instant card issuance (Card@Once®), digital push provisioning | Anticipated significant expansion; Arroweye acquisition enhances capabilities |

| New Verticals | Healthcare payment solutions, closed-loop prepaid market | Promising results in healthcare, contributing to prepaid growth |

| Specialty Cards | Metal cards, LED-integrated cards, premium designs | Higher profit margins due to unique value proposition |

Business Model Canvas Data Sources

The CPI Card Business Model Canvas is built using a combination of transaction data, customer analytics, and market intelligence. These sources provide a comprehensive view of customer behavior and market opportunities.