CPI Card PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPI Card Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting CPI Card's strategic direction. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces effectively. Download the full report to gain a competitive edge and make informed decisions for CPI Card's future.

Political factors

Governments worldwide are tightening their grip on the payment industry, with new regulations emerging for Buy Now, Pay Later (BNPL) services and ongoing exploration of Central Bank Digital Currencies (CBDCs). For instance, the UK's draft Financial Services and Markets Act (Regulated Activities etc) (Amendment) Order 2025 signals a move towards stricter oversight, potentially increasing compliance costs for companies like CPI Card Group.

These evolving rules often focus on enhancing consumer protection through more rigorous affordability checks and clearer risk disclosures. This means CPI Card Group needs to adapt its product development and operational strategies to meet these new standards, which could affect the cost of doing business and the types of payment solutions it can offer.

New legislative efforts, like the Consumer Financial Protection Bureau's (CFPB) ongoing rulemaking concerning data privacy and consumer protections within digital payments, are actively reshaping the legal environment for companies like CPI Card Group.

Existing frameworks such as the Electronic Fund Transfer Act (EFTA) and Regulation E are being interpreted to encompass emerging digital payment systems, thereby safeguarding consumer rights related to dispute resolution and limiting liability for unauthorized transactions. For instance, in 2024, the CFPB continued its focus on ensuring fair practices in digital finance, impacting how payment processors handle consumer data and disputes.

CPI Card Group must therefore ensure its product offerings and operational procedures are fully compliant with these increasingly stringent consumer protection mandates to avoid potential penalties and maintain customer trust.

Geopolitical tensions and evolving international trade policies directly influence the global payments arena, impacting cross-border transaction volumes and market accessibility for companies like CPI Card Group. For instance, the ongoing shifts in global trade relationships, particularly between major economic blocs, create uncertainty that can affect currency exchange rates and the cost of international transactions.

The increasing demand for seamless cross-border payments, fueled by the rise of real-time payment systems linking domestic schemes, underscores the critical need for political stability. As of early 2024, the expansion of instant payment networks, such as those in Europe and Asia, highlights this trend, but their effectiveness across borders is heavily dependent on intergovernmental cooperation and harmonized regulations.

CPI Card Group's capacity to enable secure and efficient international payments is intrinsically linked to a stable global political climate and favorable trade agreements. The World Bank's Ease of Doing Business report, while discontinued, previously highlighted how regulatory environments and trade facilitation measures significantly impacted cross-border commerce, a factor still relevant to payment providers navigating international markets.

Government Support for Digital Transformation

Governments worldwide are increasingly championing digital transformation and financial inclusion. For instance, many nations are exploring or piloting Central Bank Digital Currencies (CBDCs) and implementing real-time payment systems to streamline transactions and lessen dependence on legacy payment infrastructure. This strategic push by governments creates a fertile ground for companies like CPI Card Group to innovate.

CPI Card Group can capitalize on these governmental directives by ensuring its product offerings, both digital and physical payment solutions, are in sync with national digital strategies. This alignment can foster greater adoption of their technologies and drive innovation within the broader payment ecosystem, potentially leading to increased market share.

The global push for digital payments is evident in the projected growth of the digital payments market, which is expected to reach over $15 trillion by 2027, according to Statista. Governments’ active role in promoting these technologies, through supportive policies and infrastructure development, is a significant driver of this expansion.

- Governmental Initiatives: Many countries are actively promoting digital transformation, with a focus on financial inclusion through measures like CBDCs and real-time payment systems.

- Efficiency Gains: These government-led efforts aim to boost operational efficiency and reduce the reliance on traditional, often slower, payment methods.

- Market Opportunity for CPI Card Group: CPI Card Group can leverage these trends by aligning its payment solutions with national digital agendas, thereby encouraging broader adoption and innovation.

- Market Growth: The global digital payments market is experiencing substantial growth, with projections indicating a continued upward trajectory, partly fueled by government support.

Policy Shifts and Regulatory Oversight

New political administrations often signal potential policy shifts that can impact financial services. For instance, a change in government could reignite debates around deregulation or, conversely, lead to intensified regulatory oversight. CPI Card Group needs to be prepared for these potential changes, especially concerning evolving rules around data privacy and consumer protection, which saw significant attention in 2024 with ongoing discussions about data breach notification laws.

While legislative bodies may propose changes to reduce regulatory burdens, the path to implementation is often complex, involving procedural hurdles and legal reviews. Historical patterns indicate that substantial regulatory overhauls, such as those affecting payment processing standards, typically face considerable resistance and take time to materialize. This means CPI Card Group must maintain agile compliance frameworks.

CPI Card Group must actively monitor and adapt to potential regulatory changes, including those that could influence the adoption of new payment technologies or alter the operational landscape for card issuers. For example, the ongoing evolution of Open Banking regulations, which gained traction in 2024 with new directives in several key markets, presents both opportunities and compliance challenges that require proactive engagement.

- Regulatory Uncertainty: Potential shifts in government could alter the regulatory environment for financial services, impacting compliance costs and operational flexibility.

- Advocacy Importance: Maintaining strong government relations and advocacy efforts is crucial for CPI Card Group to influence policy outcomes and navigate potential regulatory changes effectively.

- Compliance Agility: The ability to adapt quickly to new or revised regulations, such as those related to data security and consumer credit, will be a key differentiator for success.

- Market Impact: Changes in regulatory oversight can directly affect market access, product development, and the competitive landscape for card manufacturers and processors.

Governments globally are increasingly focused on consumer protection in financial services, leading to stricter regulations for payment providers. For instance, the UK's proposed Financial Services and Markets Act (Regulated Activities etc) (Amendment) Order 2025 aims to enhance oversight of BNPL services, a move that could increase compliance burdens for companies like CPI Card Group.

These regulatory shifts, including ongoing rulemaking by bodies like the US Consumer Financial Protection Bureau (CFPB) concerning data privacy in digital payments, necessitate that CPI Card Group continually adapts its strategies to meet evolving consumer protection standards and data handling requirements.

Geopolitical stability and trade policies significantly influence international payment flows, impacting companies like CPI Card Group. As of early 2024, the expansion of real-time payment systems across regions highlights the demand for cross-border efficiency, which is contingent on intergovernmental cooperation and harmonized regulations.

Governments are actively promoting digital transformation and financial inclusion, with many exploring Central Bank Digital Currencies (CBDCs) and real-time payment systems. This creates opportunities for CPI Card Group to align its offerings with national digital strategies, potentially driving broader adoption and innovation within the payment ecosystem.

What is included in the product

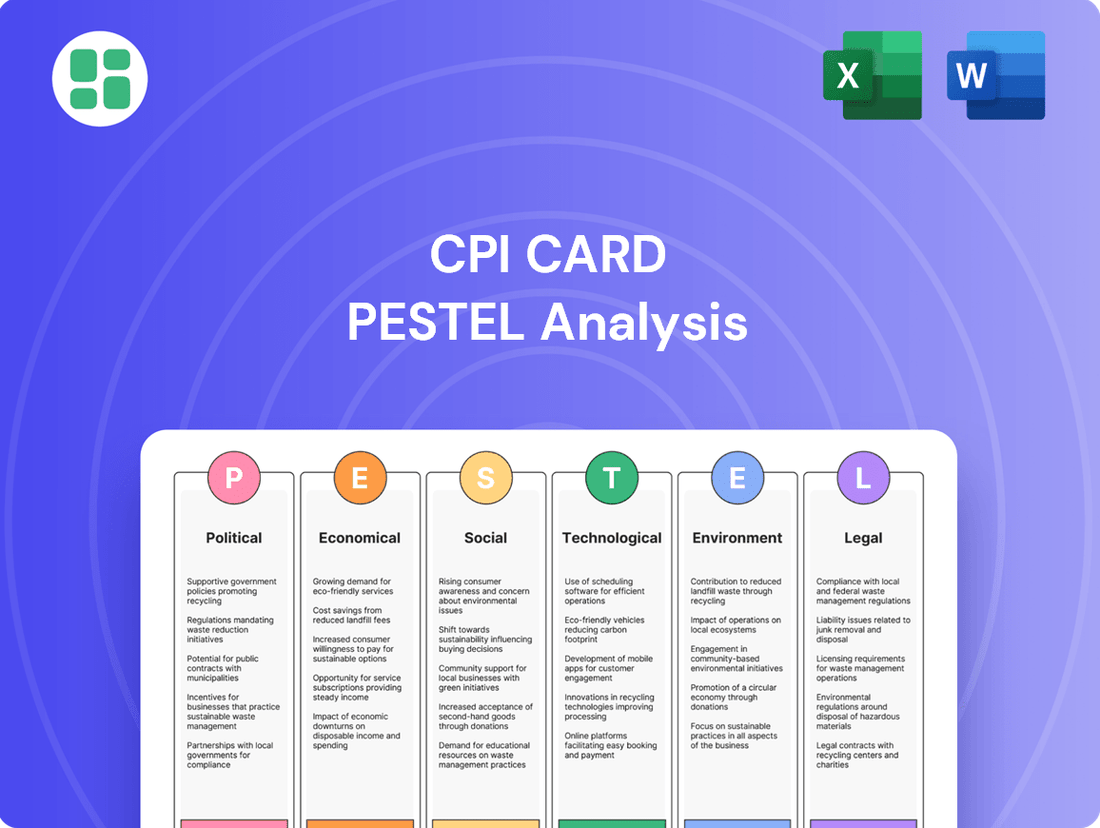

This PESTLE analysis examines the external macro-environmental factors influencing CPI Card, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The CPI Card PESTLE analysis offers a clean, summarized version of external factors, simplifying complex information for easy referencing during meetings and presentations.

Economic factors

Inflation and interest rate shifts are critical for CPI Card Group. When inflation rises, consumers often have less disposable income, leading to reduced spending and potentially lower credit card usage. Conversely, falling inflation can boost consumer confidence and spending power.

Interest rates directly impact the cost of borrowing for consumers and businesses. For example, the Federal Reserve's decision to keep the federal funds rate between 5.25% and 5.50% as of early 2024 means that credit card interest rates remain elevated, potentially dampening consumer appetite for credit.

CPI Card Group's revenue, particularly from credit and debit card programs, is sensitive to these trends. Higher interest rates can increase the cost of capital for card issuers, and if consumer spending slows due to economic uncertainty or reduced purchasing power, it directly affects transaction volumes and the demand for card services.

Overall economic growth and consumer spending power are fundamental drivers for the payment card industry. A robust economy typically leads to increased transaction volumes across credit, debit, and prepaid solutions. For instance, in the United States, consumer spending, which accounts for a significant portion of GDP, remained strong through much of 2024, contributing to higher payment card usage.

CPI Card Group's business performance is closely tied to the health of the markets it serves, including retail, healthcare, and transit. In 2024, retail sales saw continued growth, with e-commerce transactions also expanding, directly benefiting payment card issuers and processors. This increased spending translates to more payment card usage, a key metric for CPI Card Group's volume of card production and personalization services.

The global digital payment transaction volume is on a steep upward trajectory. Projections suggest this trend will persist, with the market expected to reach $15.6 trillion by 2027, a significant jump from previous years. This shift away from traditional cash is a major opportunity for companies like CPI Card Group.

CPI Card Group's strategic focus on expanding its digital and virtual payment product offerings directly mirrors this accelerating market trend. For instance, the company reported a strong performance in its digital solutions segment in early 2024, indicating a successful adaptation to evolving consumer preferences.

Rise of Alternative Payment Methods

The growing popularity of alternative payment methods like Buy Now, Pay Later (BNPL) and cryptocurrencies is significantly altering the payment ecosystem. For CPI Card Group, which has historically concentrated on traditional card products, this trend necessitates a strategic evaluation of how to adapt. Failure to engage with these evolving payment preferences could impact market share.

Consumer demand for flexible and varied payment options is a key driver behind this shift. By 2024, the global BNPL market was projected to exceed $3.5 trillion, demonstrating a clear consumer preference for installment-based purchasing. This indicates a need for companies like CPI Card Group to explore integrations or partnerships to accommodate these emerging payment behaviors and maintain competitiveness.

- Growing BNPL Adoption: The global BNPL market is expected to reach substantial figures, indicating a strong consumer preference for installment payments.

- Cryptocurrency Integration: While still nascent, the increasing acceptance of cryptocurrencies as a payment method presents another area for potential adaptation.

- Embedded Payments: The seamless integration of payments within non-financial platforms (e.g., ride-sharing apps) is becoming standard, requiring new technological approaches.

- Consumer Demand for Flexibility: The overarching trend is a clear consumer desire for more diverse and convenient ways to pay.

CPI Card Group's Financial Performance and Outlook

CPI Card Group demonstrated robust financial performance in 2024, achieving an 8% increase in net sales compared to the previous year. This growth was primarily fueled by strong demand for their contactless card solutions and expansion within the prepaid debit card market. The company's strategic focus on these growing segments clearly resonated with market needs.

Looking ahead to 2025, CPI Card Group has issued an initial financial outlook that anticipates mid-to-high single-digit growth in both net sales and Adjusted EBITDA. This forward-looking guidance reflects a strong sense of optimism regarding sustained customer demand for their essential card products and their ongoing efforts in strategic market penetration.

Key financial highlights and outlook include:

- 2024 Net Sales Growth: 8% year-over-year.

- Key Growth Drivers: Increased demand for contactless cards and the prepaid debit segment.

- 2025 Net Sales Projection: Mid-to-high single-digit growth.

- 2025 Adjusted EBITDA Projection: Mid-to-high single-digit growth.

Economic factors significantly influence CPI Card Group's operations. High inflation can reduce consumer spending power, impacting credit card usage. Conversely, economic growth generally boosts transaction volumes.

Interest rates directly affect the cost of credit. For instance, the Federal Reserve maintained its target rate between 5.25% and 5.50% through early 2024, leading to sustained higher borrowing costs for consumers, which can temper demand for credit products.

| Economic Factor | Impact on CPI Card Group | 2024/2025 Data Point |

|---|---|---|

| Inflation | Reduces consumer disposable income, potentially lowering credit card usage. | Inflation rates varied throughout 2024, impacting consumer spending patterns. |

| Interest Rates | Increases borrowing costs for consumers and issuers, potentially dampening credit demand. | Federal Funds Rate target range: 5.25% - 5.50% (early 2024). |

| Economic Growth | Drives higher transaction volumes and demand for payment solutions. | US consumer spending remained a significant GDP driver in 2024. |

Same Document Delivered

CPI Card PESTLE Analysis

The preview you see here is the exact CPI Card PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CPI Card.

The content and structure shown in the preview is the same document you’ll download after payment, offering immediate insights into CPI Card's strategic environment.

Sociological factors

Consumers are increasingly favoring digital and contactless payment methods due to their enhanced convenience and perceived security. In 2024, digital wallets facilitated half of all online purchases, while contactless payments represented 45% of in-store transactions.

This significant shift in consumer behavior directly impacts CPI Card Group, necessitating continuous innovation in physical card technology to include contactless features and a strategic expansion of their digital payment solutions to align with these evolving expectations.

Consumers increasingly expect quick and effortless transactions, a trend evident in the growing popularity of contactless payments. Globally, contactless payment transactions are projected to reach over $15 trillion by 2025, highlighting the demand for speed and convenience.

This societal shift fuels the adoption of technologies like mobile wallets and in-app payment systems, where the payment process is often invisible to the user. CPI Card Group's innovation in secure, user-friendly card and payment solutions directly aligns with this desire for seamless experiences.

Digital payment advancements are a major driver of financial inclusion, bringing more individuals and businesses into the digital economy. This expansion creates significant market opportunities for payment technology firms by broadening the pool of potential cardholders and users of digital services. For instance, by the end of 2024, it's projected that over 70% of global retail transactions will be digital, a substantial increase from previous years.

CPI Card Group can strategically leverage this trend by developing and offering accessible payment solutions tailored for underserved populations and emerging markets. As of early 2025, an estimated 1.4 billion adults worldwide remain unbanked, presenting a vast untapped market for financial services. CPI's ability to provide secure and user-friendly payment cards and related technologies can be instrumental in onboarding these individuals.

Generational Shifts in Payment Habits

Generational differences significantly shape payment behaviors. Younger consumers, particularly those aged 18-24, increasingly rely on mobile devices for a substantial portion of their transactions, embracing contactless and digital wallet solutions. This trend is projected to continue, with forecasts indicating a further rise in mobile payment adoption among Gen Z and younger Millennials.

CPI Card Group must acknowledge and adapt to these evolving preferences. Developing payment solutions that are seamlessly integrated with mobile platforms and digital wallets is crucial for capturing market share among younger demographics. This strategic pivot will ensure relevance and competitiveness in a rapidly digitizing payment landscape.

- Youthful Adoption: A significant percentage of adults aged 18-24 utilize their mobile phones for over half of their daily payments.

- Digital Wallet Growth: The use of digital wallets is expected to see double-digit growth annually through 2027, driven by younger users.

- Preference Shift: Younger generations exhibit a strong preference for contactless payment methods over traditional card swiping.

- Future Spending Power: As younger demographics gain more spending power, their payment preferences will increasingly dictate market trends.

Data Privacy Concerns and Trust

Consumer trust in payment systems is intrinsically linked to how well their data is protected. With the ongoing shift towards digital transactions, safeguarding personal financial information has become a top priority for individuals worldwide. For companies like CPI Card Group, demonstrating a strong commitment to data security is crucial for maintaining and growing consumer confidence in their payment solutions.

The increasing volume of digital transactions means more sensitive data is being handled, amplifying concerns about breaches and misuse. Studies indicate a growing public awareness of data privacy risks; for instance, a 2024 survey revealed that over 70% of consumers are concerned about how their financial data is used by payment processors. This heightened awareness directly impacts their willingness to adopt new payment technologies.

CPI Card Group's ability to assure customers about the security of their cardholder data is a key differentiator. In 2024, the company reported significant investments in advanced encryption and tokenization technologies, essential for protecting financial information against evolving cyber threats. Maintaining this security posture is not just about compliance; it's about building and preserving the trust necessary for continued market participation.

- Data Privacy as a Trust Anchor: Consumer trust in payment platforms is directly correlated with the perceived strength of their data privacy and security protocols.

- Growing Digital Transaction Concerns: As digital payments become more mainstream, the protection of sensitive financial data is a paramount concern for users.

- CPI Card Group's Security Imperative: To maintain consumer confidence and encourage adoption, CPI Card Group must consistently reinforce its dedication to securing cardholder information.

- Market Impact of Privacy: A 2024 report highlighted that 65% of consumers would switch payment providers if they experienced a data breach, underscoring the financial implications of privacy failures.

Societal attitudes towards financial technology are rapidly evolving, with a growing emphasis on convenience and speed. Consumers increasingly expect seamless, often invisible, payment experiences, driving demand for contactless and mobile solutions. This shift directly influences CPI Card Group's need to innovate beyond traditional card manufacturing.

The push for financial inclusion is also a significant sociological factor, opening new markets for payment providers. As more individuals gain access to digital financial services, the demand for secure and user-friendly payment instruments, like those CPI Card Group provides, is set to rise. This trend is particularly pronounced in emerging economies.

Generational preferences are reshaping the payment landscape, with younger consumers leading the charge towards digital and mobile transactions. CPI Card Group must cater to these evolving preferences to remain competitive, ensuring its offerings align with how Gen Z and Millennials prefer to pay.

Consumer trust, heavily reliant on data security, is paramount in the digital age. CPI Card Group's commitment to protecting cardholder information is a critical factor in maintaining customer confidence and encouraging the adoption of its payment solutions.

| Sociological Factor | 2024/2025 Trend | Impact on CPI Card Group |

|---|---|---|

| Demand for Convenience | Half of online purchases in 2024 were via digital wallets; 45% of in-store transactions were contactless. | Need for advanced contactless features and expanded digital payment solutions. |

| Financial Inclusion | Over 70% of global retail transactions projected to be digital by end of 2024. 1.4 billion adults remain unbanked as of early 2025. | Opportunity to develop accessible payment solutions for underserved markets. |

| Generational Preferences | Younger demographics (18-24) use mobile phones for over half their payments; digital wallet use sees double-digit annual growth. | Crucial to integrate seamlessly with mobile platforms and digital wallets. |

| Data Privacy Concerns | Over 70% of consumers concerned about financial data usage (2024 survey); 65% would switch providers after a breach. | Reinforce commitment to advanced encryption and tokenization to build and maintain trust. |

Technological factors

Artificial Intelligence (AI) and Machine Learning (ML) are transforming payment processing by significantly improving fraud detection and allowing for highly personalized payment experiences. These technologies analyze vast amounts of data rapidly to identify suspicious transactions, thereby strengthening security for consumers and businesses alike.

For instance, in 2024, the global AI in fraud detection market was valued at approximately $15 billion and is projected to grow substantially. AI algorithms can process trillions of data points in mere milliseconds, leading to a dramatic increase in the accuracy of identifying fraudulent activities compared to traditional methods.

CPI Card Group can harness these AI and ML capabilities to develop and offer more robust security features and tailored payment solutions to its financial institution clients, enhancing customer trust and loyalty in an increasingly digital landscape.

Biometric authentication, like fingerprint and facial recognition, is rapidly becoming a standard for payment security, providing a faster and more robust method for transaction verification. By 2025, this technology is projected to be fully integrated into both physical and digital payment platforms, enhancing user experience and security. For instance, a 2024 study indicated that 75% of consumers are comfortable using biometrics for payments, up from 50% in 2022.

CPI Card Group has a significant opportunity to leverage this trend by embedding biometric capabilities into its physical and digital card offerings. This strategic move would directly address the increasing consumer and merchant demand for advanced security and streamlined payment processes. Companies investing in biometric solutions are seeing a reduction in fraud rates; one major financial institution reported a 30% decrease in fraudulent transactions after implementing fingerprint authentication in 2023.

Real-time payment (RTP) systems are rapidly expanding, allowing for immediate fund transfers and settlement. This innovation significantly cuts down waiting periods and boosts cash flow for both businesses and individuals. For instance, by the end of 2023, the U.S. had seen a substantial increase in RTP adoption, with transaction volumes projected to grow considerably through 2027.

CPI Card Group's portfolio, especially its prepaid and debit card solutions, stands to gain immensely from integrating with these RTP infrastructures. This integration would translate to faster, more efficient transactions for CPI's clients, improving the overall user experience and operational effectiveness in the payments ecosystem.

Digital Wallets and Mobile Payment Proliferation

The rise of digital wallets and mobile payment apps is fundamentally changing consumer payment habits, with adoption rates climbing steadily worldwide. These systems provide unparalleled convenience, often linking directly to customer loyalty schemes and streamlining the purchasing process. For instance, global mobile payment transaction volume is projected to reach over $14 trillion by 2027, underscoring this significant shift.

CPI Card Group faces the ongoing challenge of ensuring its physical payment cards remain relevant and functional within this evolving digital landscape. This means innovating to support seamless integration with popular digital wallets and mobile payment platforms. The company's strategy must prioritize compatibility and enhancing the user journey, ensuring that their card products offer a robust and complementary experience to digital payment methods.

- Digital Wallet Growth: Global mobile payment transaction volume is expected to exceed $14 trillion by 2027.

- Consumer Convenience: Digital wallets offer integrated loyalty programs and faster checkout experiences.

- CPI Card Group's Role: Continued innovation is needed to ensure physical cards work seamlessly with digital payment ecosystems.

Blockchain and Central Bank Digital Currencies (CBDCs)

Blockchain technology is rapidly advancing from theoretical discussions to practical, commercial applications, especially within B2B and commercial payment systems. Its potential to significantly boost transaction speed, enhance security, and improve overall efficiency is a key driver of this shift. For instance, a recent report highlighted that the global blockchain market is projected to reach over $150 billion by 2029, indicating substantial commercial interest and investment.

Simultaneously, central banks across the globe are actively researching and piloting Central Bank Digital Currencies (CBDCs). These initiatives aim to modernize national payment systems and explore the potential of digital fiat currency. The Bank for International Settlements (BIS) reported in early 2024 that over 90% of central banks are now engaged in some form of CBDC work, with several advanced pilots underway.

CPI Card Group must closely observe these evolving technological landscapes. The maturation of blockchain and the potential rollout of CBDCs could fundamentally alter existing payment infrastructures. This necessitates a strategic approach to adapt, potentially by developing new product lines or forging partnerships that can accommodate digital assets and the growing trend of tokenized payments to remain competitive.

- Blockchain Commercialization: Global blockchain market expected to exceed $150 billion by 2029.

- CBDC Engagement: Over 90% of central banks are actively researching or piloting CBDCs as of early 2024.

- Industry Impact: Potential reshaping of payment infrastructures requires adaptation in offerings and partnerships for digital assets.

The rapid advancement of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing payment security, with AI in fraud detection valued at approximately $15 billion in 2024 and expected to grow significantly. These technologies enhance transaction verification through biometric authentication, like fingerprint and facial recognition, which saw 75% consumer comfort in 2024, up from 50% in 2022, offering CPI Card Group opportunities to embed these features into their offerings.

Real-time payment (RTP) systems are expanding, facilitating immediate fund transfers and boosting cash flow, with significant adoption growth in the U.S. through 2023. Concurrently, digital wallets and mobile payment apps are reshaping consumer habits, with global transaction volumes projected to exceed $14 trillion by 2027, requiring CPI Card Group to ensure seamless integration of its physical cards with these digital platforms.

Blockchain technology is seeing increasing commercial applications, with the global market projected to exceed $150 billion by 2029, while over 90% of central banks were engaged in CBDC work by early 2024. These trends necessitate CPI Card Group's strategic adaptation to accommodate digital assets and tokenized payments to maintain competitiveness in evolving payment infrastructures.

| Technology | 2024 Value/Adoption | Projected Growth/Adoption | CPI Card Group Opportunity |

|---|---|---|---|

| AI in Fraud Detection | ~$15 Billion | Substantial Growth | Enhanced security features |

| Biometric Authentication | 75% Consumer Comfort | Full integration by 2025 | Embedding into card offerings |

| Digital Wallets | Growing Adoption | >$14 Trillion by 2027 | Seamless physical-digital integration |

| Blockchain | Growing Commercial Use | >$150 Billion by 2029 | Adaptation for digital assets |

| CBDCs | 90%+ Central Bank Engagement | Ongoing Pilots | Partnerships for new payment infrastructures |

Legal factors

The Payment Card Industry Data Security Standard (PCI DSS) v4.0 is a vital framework for any business handling payment card information. Compliance with its latest iteration, including previously recommended practices, becomes fully mandatory by March 31, 2025.

CPI Card Group, operating within the payment technology sector, faces a significant legal imperative to align its operations with all PCI DSS v4.0 requirements. Failure to achieve this compliance by the deadline exposes the company to substantial risks, including financial penalties and reputational damage.

The data protection and privacy landscape is rapidly changing, with regulations like GDPR and CCPA setting stringent standards for how consumer data is handled. New state-level privacy laws are also emerging across the US, further complicating compliance. CPI Card Group, operating in the secure payment solutions sector, must remain vigilant in adapting its data collection, processing, and storage practices to meet these evolving requirements, including obtaining proper consent and safeguarding sensitive personal information.

Stricter Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are paramount in safeguarding the payment ecosystem against financial crime. Financial institutions and payment technology providers like CPI Card Group must deploy rigorous fraud detection and transaction monitoring systems to comply.

The global AML software market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, driven by evolving regulatory landscapes and the increasing complexity of financial transactions. This underscores the critical need for robust compliance measures.

The rapid expansion of real-time payment systems necessitates advanced, automated monitoring tools and exceptionally strong KYC protocols to effectively manage risks and ensure regulatory adherence.

Payment Services Directives (PSD3) and Payment Services Regulations (PSR) Updates

The European Union is on the cusp of finalizing its Payment Services Directive 3 (PSD3), while the United Kingdom is independently updating its Payment Services Regulations (PSR). Both initiatives heavily emphasize the expansion of Open Banking technologies and the secure sharing of financial data, with a core objective of better safeguarding customer funds. These regulatory shifts are designed to significantly boost account-to-account payment services and foster greater competition within the financial sector.

CPI Card Group needs to closely monitor these developments to ensure its offerings remain compliant and competitive. For instance, the EU's PSD3 is expected to further democratize access to payment initiation and account information services, potentially impacting how card networks interact with other payment providers. The UK's PSR updates will similarly shape the competitive landscape for payment service providers operating within its borders.

Key aspects of these updates include:

- Enhanced Data Sharing: Mandating more robust and secure mechanisms for sharing customer financial data between authorized third-party providers.

- Account-to-Account Payments: Promoting the growth of direct bank transfers as a viable alternative to card payments.

- Consumer Protection: Strengthening rules around fraud prevention, dispute resolution, and the safeguarding of customer assets.

- Market Access: Potentially opening up new avenues for innovation and competition by lowering barriers to entry for new payment service providers.

Regulation of Emerging Payment Models

Emerging payment models, particularly Buy Now, Pay Later (BNPL) services, are under increasing regulatory focus globally. For instance, in the United States, the Consumer Financial Protection Bureau (CFPB) has been actively investigating BNPL providers, with a report expected in late 2024 or early 2025 to assess potential risks and recommend regulatory actions. This heightened scrutiny aims to safeguard consumers from potential debt accumulation and ensure transparency in lending practices.

Governments worldwide are responding to the rapid expansion of these payment solutions by developing new frameworks or adapting existing ones. The UK’s Financial Conduct Authority (FCA) has already implemented new rules for the promotion and sale of unregulated credit products, including BNPL, effective from October 2024, requiring clear risk warnings. These regulatory moves signal a trend towards greater oversight, impacting how these services are offered and managed.

CPI Card Group, as a provider of payment solutions, must monitor these evolving legal landscapes. Changes in regulations for BNPL and other innovative payment methods could directly affect the product offerings of its clients and necessitate adjustments in strategic partnerships. Understanding these legal factors is crucial for maintaining compliance and identifying opportunities within the evolving payment ecosystem.

- Global BNPL Market Growth: The global BNPL market was valued at approximately $127.5 billion in 2023 and is projected to reach over $3.2 trillion by 2030, highlighting the scale of regulatory interest.

- Consumer Protection Focus: Regulators are particularly concerned with issues like credit reporting, dispute resolution, and the potential for over-indebtedness among consumers using BNPL services.

- Evolving Regulatory Landscape: Expect continued development of specific regulations for BNPL and other fintech payment solutions in major markets like the US, EU, and Australia throughout 2024 and 2025.

The Payment Card Industry Data Security Standard (PCI DSS) v4.0 compliance deadline of March 31, 2025, is a critical legal factor for CPI Card Group. Navigating the evolving global data privacy landscape, including regulations like GDPR and emerging US state laws, requires continuous adaptation of data handling practices.

Stricter Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are essential for payment providers. The global AML software market, valued at around $2.5 billion in 2023, demonstrates the significant investment required for compliance.

Upcoming regulatory shifts in the EU (PSD3) and UK (PSR) will heavily influence Open Banking and data sharing, impacting payment services. Emerging payment models like Buy Now, Pay Later (BNPL) are also facing increased scrutiny, with the global BNPL market valued at approximately $127.5 billion in 2023.

| Legal Factor | Key Developments | Impact on CPI Card Group | Relevant Data/Timeline |

| PCI DSS v4.0 | Mandatory compliance | Operational adjustments and security investments | Deadline: March 31, 2025 |

| Data Privacy Laws | GDPR, CCPA, new US state laws | Data handling, consent, and security protocols | Ongoing evolution |

| AML/KYC Regulations | Enhanced fraud detection and monitoring | Robust compliance systems | AML Software Market: ~$2.5B (2023) |

| Open Banking (EU/UK) | PSD3, PSR updates | Adaptation to data sharing and competition | Ongoing legislative processes |

| BNPL Regulation | Consumer protection, transparency | Monitoring client product offerings and partnerships | BNPL Market: ~$127.5B (2023) |

Environmental factors

Consumers and financial institutions are increasingly seeking payment cards made from sustainable materials like recycled PVC, bio-sourced PVC, and recycled metal. This shift is fueled by a growing awareness of environmental issues. CPI Card Group has responded to this trend, having already supplied over 350 million eco-focused payment cards, demonstrating their leadership in this evolving market.

The environmental impact of payment systems, particularly their carbon footprint, is increasingly scrutinized. While digital transactions are often perceived as inherently greener, the actual emissions associated with card payments, both physical and digital, are relatively small. For instance, studies indicate that the carbon footprint of a single payment transaction, whether physical card or digital, is negligible, often measured in grams of CO2 equivalent.

CPI Card Group's focus should therefore be on optimizing its production processes for physical cards and exploring more sustainable materials, rather than solely advocating for a complete transition to digital. Enhancing the energy efficiency of manufacturing facilities and utilizing recycled or biodegradable plastics for card production can significantly mitigate environmental impact. For example, in 2023, many card manufacturers began incorporating post-consumer recycled (PCR) content into their card bodies, with some aiming for over 80% PCR material.

Card recycling initiatives are gaining traction as the payment industry seeks to divert plastic cards from landfills. These programs are vital for companies like CPI Card Group to meet their Environmental, Social, and Governance (ESG) goals, with a growing number of financial institutions actively participating. For instance, by 2023, over 50% of major US banks had publicly stated commitments to sustainable card production and end-of-life management.

Corporate Social Responsibility (CSR) and ESG Goals

Financial institutions and payment companies are increasingly prioritizing Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) goals. This shift is driven by growing investor demand and consumer awareness. For instance, a 2024 survey indicated that 70% of institutional investors consider ESG factors when making investment decisions.

Issuers are actively developing products that appeal to environmentally conscious consumers, aiming to boost customer retention and attract new clients. This strategy directly addresses the market's evolving preferences. In 2024, the market for sustainable financial products saw significant growth, with assets under management in ESG-focused funds increasing by 15% globally.

CPI Card Group's dedication to producing eco-friendly cards directly supports these overarching industry ESG objectives. This commitment strengthens its attractiveness to financial clients who place a high value on sustainability in their own operations and product offerings. Many clients are looking for partners that can help them meet their own ESG targets, and CPI's offerings are well-positioned to meet this need.

- Growing Investor Demand: 70% of institutional investors factored ESG into decisions in 2024.

- Market Growth: Sustainable financial products saw a 15% global AUM increase in 2024.

- Consumer Preference: Issuers are creating eco-friendly products to capture environmentally conscious customers.

- Strategic Alignment: CPI Card Group's eco-focused cards align with industry ESG trends, enhancing client appeal.

Energy Consumption of Payment Infrastructure

The energy consumption of the payment infrastructure, particularly data centers powering digital transactions, presents a significant environmental consideration. These digital operations, though less tangible than physical card manufacturing, are increasingly scrutinized for their energy demands. For instance, global data center energy consumption was estimated to be around 1% of total global electricity consumption in 2023, a figure projected to rise with increased digital activity.

CPI Card Group's focus on energy efficiency within its digital solutions and operational infrastructure is crucial for mitigating its environmental footprint. As the digital payment ecosystem expands, the energy intensity of processing and storing transaction data grows in importance. Companies are exploring renewable energy sources and more efficient hardware to address this.

- Data Center Energy Use: Global data centers consumed an estimated 1.5% of global electricity in 2020, a figure expected to climb.

- Digital Transaction Growth: The volume of digital payment transactions continues to surge, amplifying the energy needs of supporting infrastructure.

- Efficiency Initiatives: Leading tech companies are investing heavily in energy-efficient data center designs and renewable energy procurement to offset their carbon footprint.

The increasing demand for sustainable payment cards, utilizing materials like recycled PVC and bio-sourced plastics, highlights a significant environmental trend. CPI Card Group's proactive approach, having already supplied over 350 million eco-focused cards, positions them as a leader in this environmentally conscious market segment. This focus on sustainable materials directly addresses growing consumer and investor concerns regarding the environmental impact of payment products.

Card recycling programs are becoming more prevalent, with a substantial portion of major US banks actively participating in end-of-life card management by 2023. This industry-wide push towards circularity is vital for companies like CPI Card Group to align with their Environmental, Social, and Governance (ESG) objectives and meet the sustainability expectations of their financial institution clients.

The energy consumption of digital payment infrastructure, particularly data centers, is a growing environmental concern, with global data center energy use estimated to be around 1.5% of total global electricity in 2020. CPI Card Group's commitment to energy efficiency in its digital solutions and operations is therefore crucial for minimizing its environmental footprint in an increasingly digital transaction landscape.

| Environmental Factor | Trend/Impact | CPI Card Group Relevance | Data Point/Example |

|---|---|---|---|

| Sustainable Materials | Growing consumer preference for eco-friendly card stock. | Supplied over 350 million eco-focused cards. | Use of recycled PVC, bio-sourced PVC, recycled metal. |

| Card Recycling | Industry-wide adoption of card take-back and recycling programs. | Supports ESG goals and client sustainability requirements. | Over 50% of major US banks had card management commitments by 2023. |

| Digital Infrastructure Energy Use | Increasing scrutiny of data center energy consumption. | Focus on energy efficiency in digital solutions and operations. | Data centers consumed ~1.5% of global electricity in 2020. |

PESTLE Analysis Data Sources

Our CPI Card PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the card industry.