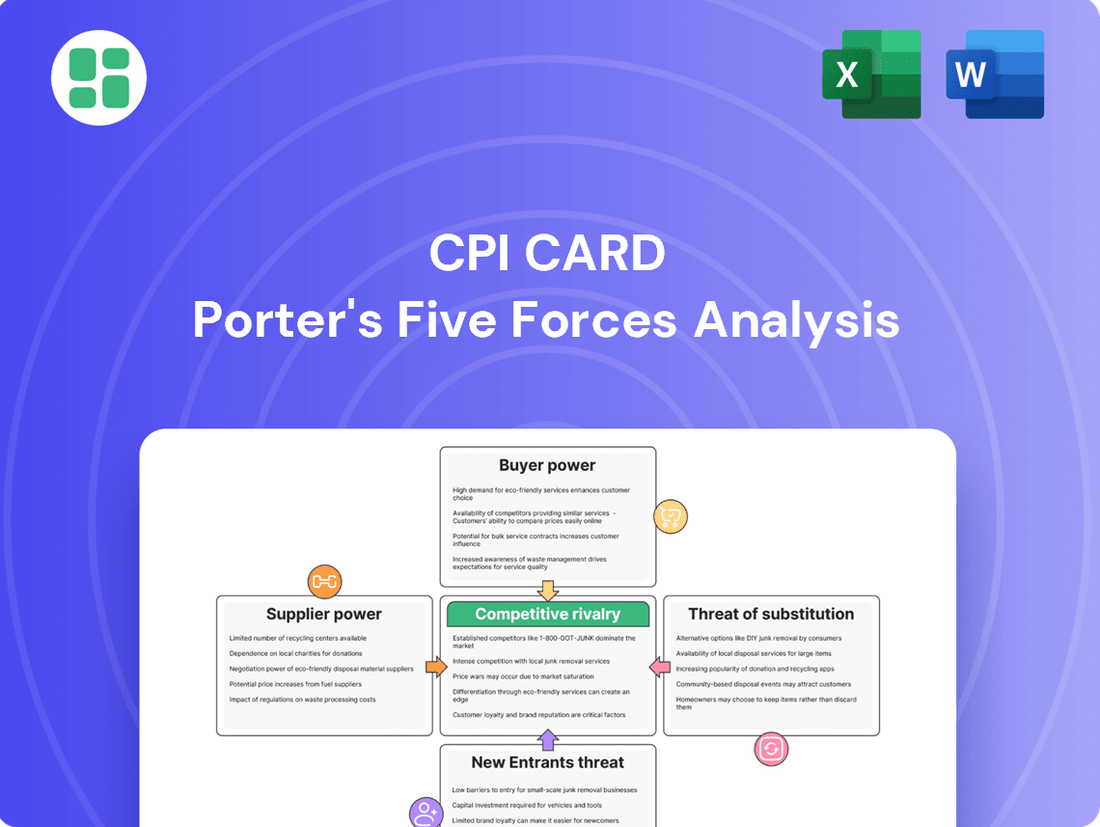

CPI Card Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPI Card Bundle

CPI Card operates in a dynamic environment shaped by intense rivalry and the constant threat of new entrants. Understanding the bargaining power of buyers and suppliers is crucial for navigating this landscape. The availability of substitutes also presents a significant challenge.

The complete report reveals the real forces shaping CPI Card’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration for critical components like plastic resins, metal, chips, and specialized printing inks is a key factor. If a limited number of large suppliers control these essential materials, they gain significant leverage. This dominance allows them to potentially dictate pricing, impose stricter terms, or even limit availability, directly impacting CPI Card Group's production expenses and profitability.

The uniqueness of inputs significantly influences the bargaining power of suppliers for CPI Card Group. If CPI relies on highly specialized or proprietary materials, such as advanced secure chip technology or unique biometric components for its cards, suppliers of these inputs hold considerable leverage. For instance, a supplier offering a patented anti-counterfeiting feature for payment cards would be difficult for CPI to replace.

The switching costs associated with finding alternative suppliers for such specialized inputs can be substantial for CPI Card Group. These costs might include the expense of retooling manufacturing processes, extensive research and development to qualify new materials, and potential delays in production. In 2024, the increasing demand for secure and sustainable card materials, like recycled plastics or biodegradable alternatives, means suppliers offering these niche inputs can command higher prices and more favorable terms.

The bargaining power of suppliers for CPI is significantly influenced by switching costs. If CPI faces substantial expenses and complexities when changing providers for critical components or technology, suppliers gain leverage. These costs can include re-tooling manufacturing lines, obtaining new certifications for materials, or integrating entirely new software systems, all of which can be time-consuming and capital-intensive.

For instance, if a core processing chip supplier for CPI's payment terminals requires extensive re-engineering and testing to replace, the existing supplier can demand higher prices. In 2024, the semiconductor industry, a key area for technology integration in payment solutions, continued to experience supply chain challenges and price volatility, potentially exacerbating these switching costs for companies like CPI.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers in the card manufacturing and payment solutions industry is a significant factor influencing the bargaining power of suppliers. If key suppliers, such as chip manufacturers or plastic card producers, possess the capability and the incentive to move into card production or even offer payment processing services, their leverage over companies like CPI Card Group would substantially increase. This could manifest as a threat to discontinue supply or to directly compete, thereby altering the competitive landscape.

For instance, a major semiconductor supplier could potentially leverage its expertise to enter the secure element manufacturing space for payment cards, directly competing with existing card manufacturers. This would allow them to capture a larger portion of the value chain. In 2024, the global market for payment terminals and card manufacturing is a multi-billion dollar industry, with specialized component suppliers holding critical intellectual property and production capabilities.

- Capability Assessment: Suppliers with advanced technological capabilities, such as those producing secure microcontrollers or advanced printing technologies, are better positioned to integrate forward.

- Incentive Analysis: Suppliers may be motivated to integrate forward if they perceive higher profit margins in card manufacturing or payment solutions compared to their current component supply business.

- Competitive Threat: If suppliers can readily become competitors, they gain the power to dictate terms, potentially increasing costs for card manufacturers or limiting their access to essential components.

- Market Dynamics: The overall growth and profitability of the payment solutions market, including areas like contactless technology and secure card personalization, can further incentivize suppliers to explore forward integration strategies.

Importance of CPI to Supplier's Business

The significance of CPI Card Group's business to its key suppliers is a crucial factor in assessing supplier bargaining power. If CPI accounts for a minor fraction of a supplier's overall sales, that supplier might be less inclined to offer competitive pricing or prioritize CPI's specific requirements. This dynamic can shift leverage towards the supplier, potentially leading to less favorable terms for CPI Card Group.

For instance, if a primary supplier of specialized plastic resins, a key component in card manufacturing, derives only 1% of its total revenue from CPI Card Group, that supplier has little incentive to negotiate aggressively on price or expedite deliveries for CPI. Conversely, if CPI represents a substantial portion of a supplier's customer base, the supplier would likely be more accommodating to maintain that relationship.

Understanding this dependency is vital. If CPI Card Group's suppliers are large, diversified entities, they are generally less reliant on any single customer. For example, a global chemical company supplying resins to multiple industries would possess considerable bargaining power compared to a smaller, niche provider whose business is heavily concentrated on CPI.

Key considerations regarding supplier importance include:

- Revenue Dependence: The percentage of a supplier's revenue generated from CPI Card Group.

- Supplier Market Share: The supplier's position and concentration within its own market.

- Switching Costs: The difficulty and expense CPI would incur to find and onboard alternative suppliers for critical inputs.

- Supplier's Customer Base: The diversity of a supplier's customer portfolio.

The bargaining power of suppliers for CPI Card Group is influenced by the availability of substitute inputs. If alternative materials or components can readily replace those currently used by CPI, suppliers' leverage diminishes significantly. For example, if multiple manufacturers can produce the specialized polycarbonate used in durable payment cards, CPI has more options and can negotiate better terms.

In 2024, the push for sustainable materials in the payment card industry has led to an increase in the availability of recycled plastics and biodegradable alternatives. This growing supply of substitutes can reduce the bargaining power of traditional virgin plastic suppliers. However, suppliers of highly specialized, secure chip technologies or unique biometric features often face fewer direct substitutes, granting them greater influence over pricing and terms.

| Factor | Impact on CPI Card Group | 2024 Relevance |

|---|---|---|

| Availability of Substitutes | Lowers supplier power | Increasing availability of recycled/biodegradable card materials |

| Supplier Concentration | Increases supplier power | Dominance of key chip manufacturers |

| Switching Costs | Increases supplier power | High for specialized secure chip integration |

| Threat of Forward Integration | Increases supplier power | Potential for component suppliers to enter card manufacturing |

| Importance of CPI to Supplier | Decreases supplier power | Low if CPI is a small customer; High if CPI is a major client |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to CPI Card's position in the payment processing industry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

CPI Card Group's customer base is notably concentrated, with a significant portion of its revenue historically derived from a few large financial institutions and major retailers. For instance, in 2023, the company reported that its top ten customers represented approximately 45% of its total net sales, highlighting the substantial purchasing power these entities wield.

This concentration means that large clients, such as major banks or national retail chains, can exert considerable pressure on CPI Card Group for more favorable pricing and terms due to their substantial order volumes. Their ability to shift business to competitors, or even insource certain production capabilities, further amplifies their bargaining leverage.

CPI Card Group's customers, primarily financial institutions and retailers, face moderate switching costs. Transitioning to a new card manufacturer involves significant effort in data migration, system integration, and ensuring brand consistency across payment products. For instance, the process of re-certifying with payment networks like Visa and Mastercard after changing suppliers can be time-consuming and costly.

Customer price sensitivity is a significant factor for CPI Card Group. In 2023, the payment card industry saw continued emphasis on cost-effectiveness, with many financial institutions and businesses scrutinizing their expenditures. This heightened awareness means customers are more likely to compare pricing across different card manufacturers and solution providers, directly impacting CPI Card's ability to command premium prices.

Threat of Backward Integration by Customers

Large customers, such as major banks and retail chains, possess the financial resources and technical expertise to potentially develop their own payment card solutions or even manufacture cards in-house. This capability, even if not fully realized, acts as a significant lever in their negotiations with CPI Card Group.

The incentive for these customers to integrate backward is driven by potential cost savings, greater control over product development and security, and the desire to differentiate their offerings. For instance, a large bank might see value in developing proprietary payment processing technology to reduce reliance on third parties and enhance customer experience.

- Customer Capability: Major financial institutions and large retailers have the capital and access to technology required for in-house payment card production or solution development.

- Customer Incentive: Cost reduction, enhanced control over security and innovation, and market differentiation are key drivers for backward integration.

- Credible Threat: The mere possibility of customers developing their own solutions increases their bargaining power, forcing CPI Card Group to remain competitive on price and service.

- Market Impact: A credible threat of backward integration can pressure CPI Card Group to offer more favorable terms, impacting its profit margins and market position.

Customer Information and Product Differentiation

Customers' bargaining power is significantly influenced by their access to information and the degree to which CPI Card Group's products are differentiated. When customers are well-informed about competitors' pricing and offerings, and when CPI Card's products are perceived as commodities, their ability to negotiate lower prices or demand better terms increases substantially. In 2024, the market for payment cards, while mature, still sees opportunities for differentiation through security features and loyalty programs, which can mitigate this power.

If products are largely undifferentiated and customers have full market information, their bargaining power is higher as they can easily compare and choose the lowest-cost option. For CPI Card Group, the ability to offer unique security features or specialized card materials can create a competitive advantage. For instance, advanced security technologies like EMV chips and contactless payment capabilities, while becoming standard, still present avenues for differentiation that can influence customer loyalty and reduce price sensitivity.

- Customer Information: The widespread availability of online price comparison tools and industry reviews means customers are generally well-informed about alternative providers and pricing for payment card solutions.

- Product Differentiation: CPI Card Group's ability to differentiate its offerings through enhanced security features, material innovation (e.g., sustainable card materials), and value-added services directly impacts customer bargaining power.

- Impact on Pricing: High customer information and low product differentiation empower customers to seek the lowest prices, potentially squeezing profit margins for CPI Card Group if it cannot establish a unique value proposition.

- Mitigation Strategies: CPI Card Group can counter this by focusing on innovation in product features, customer service, and supply chain reliability, thereby building customer loyalty beyond mere price considerations.

CPI Card Group's customers, particularly large financial institutions and retailers, possess significant bargaining power due to their concentrated purchasing volume and the moderate switching costs involved in changing suppliers. In 2023, the top ten customers accounted for approximately 45% of net sales, underscoring their influence on pricing and terms.

The threat of backward integration, where customers might develop their own card production capabilities, also strengthens their negotiating position. This is driven by potential cost savings and a desire for greater control over security and innovation. For instance, a large bank might explore in-house solutions to reduce reliance on third-party manufacturers.

Furthermore, the availability of market information and the degree of product differentiation play a crucial role. When card products are perceived as commodities, customers can more easily leverage price comparisons, pressuring CPI Card Group to offer competitive pricing. In 2024, while differentiation opportunities exist through advanced security and loyalty programs, the general market trend still emphasizes cost-effectiveness.

| Factor | Description | Impact on CPI Card Group |

| Customer Concentration | A few large clients represent a significant portion of revenue. | Amplifies customer bargaining power due to substantial order volumes. |

| Switching Costs | Moderate costs associated with data migration and system integration. | Limits customers' ability to easily switch, but still provides leverage. |

| Backward Integration Threat | Potential for customers to produce cards in-house. | Acts as a credible threat, forcing competitive pricing and service. |

| Information Availability & Differentiation | Well-informed customers and undifferentiated products increase leverage. | Pressures CPI Card Group to offer value beyond price, like enhanced security. |

Same Document Delivered

CPI Card Porter's Five Forces Analysis

This preview showcases the comprehensive CPI Card Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholders. You're looking at the actual deliverable, ready for your strategic planning and business insights the moment your transaction is complete.

Rivalry Among Competitors

The payment card industry, including CPI Card Group, faces intense competition from a broad spectrum of players. Major card manufacturers like Gemalto (now part of Thales), Oberthur Technologies, and Datacard are direct rivals, each vying for market share in physical card production. The digital payment landscape introduces further complexity, with fintech innovators such as Square, Stripe, and PayPal offering alternative payment solutions that challenge traditional card-based transactions.

This crowded field, populated by both established giants and nimble startups, significantly escalates competitive rivalry. For CPI Card Group, this means constant pressure on pricing as competitors seek to undercut each other. Innovation also becomes paramount, as companies race to develop more secure, feature-rich, and user-friendly payment technologies to capture market attention and loyalty.

The payment card and digital payment solutions industry is experiencing robust growth, a trend that generally tempers intense competitive rivalry. In 2023, global digital payment transaction volume was projected to reach $10.75 trillion, indicating a dynamic and expanding market. This expansion allows for more participants to gain traction without necessarily engaging in direct, aggressive battles for existing market share.

CPI Card Group's product differentiation appears to be moderate. While they offer a range of secure payment cards, the core functionality is largely similar across the industry. This can lead to price-based competition unless CPI can highlight unique security features or value-added services.

Switching costs for CPI's customers, primarily financial institutions, are generally considered low to moderate. Once a contract is established and production lines are set up for a particular card manufacturer, the effort to switch might involve some administrative and technical adjustments, but it's not prohibitively complex.

In 2024, the payment card industry continues to be competitive. Companies like Entrust and Gemalto (now Thales) are significant players, often competing on price and the breadth of their offerings. CPI's ability to maintain market share will depend on its efficiency and ability to innovate in areas like contactless technology and enhanced security features to offset the inherent price pressures.

Exit Barriers

The payment card industry, including major players like Visa and Mastercard, faces significant exit barriers. These include substantial investments in proprietary technology infrastructure, global processing networks, and established brand recognition. Furthermore, long-term contracts with financial institutions and merchants create a sticky environment, making it difficult for companies to simply walk away.

These high exit barriers can unfortunately contribute to persistent overcapacity. When it's costly and complex to leave the market, even struggling or unprofitable firms might continue operations, leading to prolonged periods of intense competition. This dynamic can suppress overall industry profitability as firms fight for market share rather than exit.

Consider the capital expenditures involved. For instance, maintaining and upgrading the complex payment processing systems requires continuous, significant investment. In 2024, major card networks continue to invest billions annually in technology and security to stay competitive and compliant, making a sudden shutdown economically unfeasible for most.

- High Capital Investment: Significant upfront and ongoing investment in technology, data centers, and security infrastructure.

- Specialized Workforce: Reliance on highly skilled personnel in areas like cybersecurity, network engineering, and regulatory compliance.

- Long-Term Contracts: Established agreements with banks, merchants, and technology partners create contractual obligations.

- Brand Reputation: The value of established brands and customer trust is difficult to divest or abandon.

Strategic Stakes and Intensity of Competition

The payment card industry is a battleground where major players like Visa and Mastercard vie for market leadership and technological supremacy. This intense focus on dominance fuels aggressive strategies, including significant investments in research and development to innovate payment solutions and substantial marketing budgets to capture consumer mindshare.

These high stakes translate into fierce competition, often manifesting as price wars on transaction fees or lucrative partnership deals with financial institutions. For instance, in 2024, Visa and Mastercard continued to heavily invest in expanding their contactless payment infrastructure and digital wallet capabilities, recognizing the strategic imperative to lead in evolving payment ecosystems.

- Market Share Battles: Companies like Visa and Mastercard constantly fight for a larger share of global transaction volume, a key metric for their revenue.

- Technological Innovation: The race to develop and implement new payment technologies, such as tokenization and advanced fraud detection, is a critical differentiator.

- Partnership Alliances: Securing exclusive or preferred partnerships with major banks and merchants is a strategic move to lock in transaction flows.

- Brand Dominance: Building strong, trusted brands is essential for consumer adoption and loyalty in a crowded market.

Competitive rivalry within the payment card industry is notably high, driven by a mix of established giants and emerging fintech players. Companies like Entrust and Thales (which acquired Gemalto) are key competitors to CPI Card Group, often engaging in price-sensitive bidding for contracts. The constant push for innovation in areas like contactless technology and enhanced security features is crucial for differentiation in this crowded market.

In 2024, the intense competition means that CPI Card Group faces ongoing pressure on its pricing strategies. To maintain and grow market share, the company must not only offer competitive pricing but also emphasize unique security protocols or value-added services that set it apart from rivals. The moderate switching costs for financial institutions also contribute to this competitive dynamic, as clients can shift providers with some effort.

The market's growth, with global digital payment transaction volume projected to exceed $10 trillion in 2023, does provide room for multiple players. However, this growth also attracts new entrants, further intensifying the rivalry. CPI's success hinges on its ability to navigate these pressures through operational efficiency and strategic innovation.

| Competitor | Key Offerings | Competitive Strategy Focus |

|---|---|---|

| Entrust | Secure payment cards, digital identity solutions | Broad product portfolio, security features |

| Thales (Gemalto) | Payment cards, SIM cards, digital security | Global reach, integrated security solutions |

| Datacard | Card personalization, issuance solutions | Efficiency in card issuance processes |

SSubstitutes Threaten

The threat of substitutes for payment cards is significant, driven by the increasing availability and adoption of alternative payment methods. Mobile wallets like Apple Pay and Google Pay, along with QR code payment systems and peer-to-peer apps such as Venmo and Zelle, offer consumers convenient ways to transact without traditional cards. By mid-2024, mobile payment transaction volumes were projected to surpass $3 trillion globally, demonstrating a clear shift away from card reliance.

The price-performance trade-off of substitute payment methods poses a significant threat to CPI Card Group. Digital wallets like Apple Pay and Google Pay, for instance, offer enhanced convenience with quick tap-to-pay functionality, often at no direct transaction cost to the consumer. While CPI Card Group focuses on the secure issuance of physical and digital payment cards, these digital alternatives can provide a comparable or even superior user experience for everyday transactions, potentially eroding demand for traditional card services.

Customer willingness to switch from traditional payment cards to alternatives is a key consideration. In 2024, we're seeing a significant uptick in mobile payment adoption, with estimates suggesting over 80% of smartphone users in developed markets have at least one mobile payment app installed. This high penetration indicates a growing comfort level with new technologies.

Factors like enhanced security features, greater convenience, and the integration of loyalty programs are driving this shift. For instance, the perceived seamlessness of tap-to-pay and QR code transactions, combined with real-time settlement notifications, offers tangible benefits over traditional card swipes.

Trust in new systems is also crucial. As more established financial institutions and tech giants invest heavily in secure and user-friendly payment platforms, consumer confidence is steadily rising. This increased trust directly correlates with a higher propensity to substitute away from older payment methods.

Evolution of Digital and Contactless Payments

The threat of substitutes for CPI Card Group is significant due to the rapid evolution of digital and contactless payment technologies. Innovations like biometrics, tokenization, and wearable payment devices are increasingly becoming mainstream. These advancements offer consumers convenient and secure alternatives to traditional physical cards, potentially reducing demand for CPI's core products.

For instance, the global digital payments market was valued at approximately $7.7 trillion in 2023 and is projected to grow substantially. This growth indicates a clear shift towards non-card-based payment methods. As these technologies become more integrated into daily life, they incrementally erode the necessity for physical payment cards, directly impacting CPI Card Group's market share.

- Biometric Authentication: Fingerprint and facial recognition are becoming standard on smartphones, enabling seamless payments without a physical card.

- Tokenization: This technology replaces sensitive card data with a unique token, enhancing security and facilitating payments through various digital channels.

- Wearable Payment Devices: Smartwatches and fitness trackers now commonly feature payment capabilities, offering further convenience and a substitute for physical cards.

- Mobile Wallets: Platforms like Apple Pay and Google Pay, which leverage tokenization and biometrics, saw widespread adoption, with transaction volumes increasing by over 20% year-over-year in many regions during 2023.

Regulatory and Infrastructure Support for Substitutes

The regulatory landscape and the evolution of payment infrastructure significantly influence the threat of substitutes for traditional card payments. Favorable government policies and the development of new payment rails can rapidly accelerate the adoption of alternative methods.

For instance, open banking initiatives, driven by regulations like PSD2 in Europe, have fostered an environment where third-party providers can offer innovative payment solutions, directly challenging card networks. As of early 2024, many jurisdictions are actively exploring or implementing frameworks to support real-time payments, further reducing reliance on established card systems.

- Regulatory Tailwinds: Initiatives like PSD2 in Europe and similar open banking efforts globally empower new payment providers, creating a more competitive landscape for card networks.

- Infrastructure Advancements: The rollout of instant payment schemes, such as FedNow in the US and UPI in India, provides faster and often cheaper alternatives, eroding the convenience advantage of cards.

- Government Support: Proactive government policies aimed at financial inclusion and digital payments often prioritize the development of infrastructure that can bypass or compete with card-based systems.

- Interoperability Focus: Growing emphasis on interoperability between different payment systems, encouraged by regulators, makes it easier for consumers and businesses to switch away from card-centric solutions.

The threat of substitutes for payment cards is intensifying as digital payment methods gain traction. Mobile wallets, QR codes, and peer-to-peer apps offer convenient alternatives. By mid-2024, global mobile payment transaction volumes were projected to exceed $3 trillion, underscoring a significant shift away from traditional card reliance and impacting companies like CPI Card Group.

These substitutes often provide a superior price-performance trade-off, with digital wallets offering enhanced convenience and often no direct transaction cost to consumers. This can erode demand for traditional card services as users prioritize seamless, quick transactions.

Consumer willingness to adopt these substitutes is high, with over 80% of smartphone users in developed markets having at least one mobile payment app installed by early 2024. This widespread adoption is fueled by convenience, security features, and integrated loyalty programs.

| Substitute Payment Method | Key Features | 2023-2024 Impact Indicators |

| Mobile Wallets (Apple Pay, Google Pay) | Tap-to-pay convenience, tokenization, biometrics | Transaction volumes up >20% YoY in many regions; widespread adoption |

| QR Code Payments | Ease of use, integration with loyalty programs | Significant growth in emerging markets, increasing merchant acceptance |

| Peer-to-Peer (P2P) Apps (Venmo, Zelle) | Direct money transfer, social integration | High transaction volumes for personal payments, expanding to small business use |

| Wearable Payment Devices | Convenience, discreet transactions | Growing integration into smartwatches and fitness trackers |

Entrants Threaten

Starting a payment card manufacturing business demands a massive upfront investment. Think about acquiring specialized machinery for embossing, encoding, and personalization, which can easily run into millions of dollars. On top of that, you need secure production facilities to protect sensitive data and invest in research and development for cutting-edge card technologies, like advanced security features or contactless capabilities. These substantial capital requirements create a formidable barrier for any potential new competitors looking to enter the market.

CPI Card Group, like many established players in the secure card manufacturing industry, benefits significantly from economies of scale. This means they can produce cards at a much lower cost per unit due to high-volume operations in procurement, production, and distribution. For instance, their ability to negotiate bulk discounts on raw materials like polycarbonate and security features directly impacts their cost structure. In 2023, CPI Card Group reported net sales of $364.1 million, indicating a substantial operational scale that new entrants would find challenging to replicate quickly.

New entrants face significant hurdles in accessing established distribution channels within the card payment industry. Gaining entry requires cultivating deep relationships with major financial institutions and the dominant payment networks like Visa and Mastercard. These existing partnerships are often built on years of trust and volume, making it difficult for newcomers to secure comparable agreements.

Proprietary Technology and Certifications

Proprietary technologies, like advanced security features and sustainable card materials, are crucial differentiators in the payment card sector. For instance, the development of secure contactless payment protocols requires significant R&D investment. Industry certifications, such as EMVCo compliance and PCI DSS (Payment Card Industry Data Security Standard), are also vital. Achieving these certifications involves rigorous audits and ongoing compliance efforts, creating substantial barriers for newcomers.

The cost and time associated with developing and maintaining proprietary technologies and securing necessary certifications are significant deterrents. For example, a new entrant might spend millions on R&D for a unique security chip and then face substantial costs for PCI DSS Level 1 compliance, which can range from tens of thousands to over a hundred thousand dollars annually depending on the scope. This financial and operational hurdle effectively limits the threat of new entrants.

- Proprietary Technology: Companies invest heavily in unique security features, such as tokenization or advanced encryption, making it difficult for new players to replicate these innovations quickly.

- Industry Certifications: Essential certifications like EMVCo for chip-based payments and PCI DSS for data security require considerable investment in compliance and ongoing audits, acting as a significant barrier.

- Cost of Entry: The combined expenses for technology development, certification processes, and establishing secure operational infrastructure can easily run into millions of dollars, deterring smaller or less capitalized entrants.

- Time to Market: The lengthy process of developing, testing, and certifying new payment technologies can take several years, giving established players a substantial first-mover advantage and discouraging rapid market entry by new firms.

Brand Loyalty and Customer Switching Costs

Brand loyalty significantly deters new entrants in the payment card industry. Established players like Visa and Mastercard have cultivated strong brand recognition over decades, fostering trust and preference among consumers. For instance, in 2024, Visa reported processing over 200 billion transactions globally, a testament to its widespread adoption and customer reliance.

Switching costs for consumers are also a considerable barrier. These costs aren't just monetary; they include the inconvenience of updating payment information across numerous recurring subscriptions, loyalty programs, and online accounts. The effort required to change primary payment methods can deter even dissatisfied customers from moving to a new provider, thereby solidifying the market position of incumbents.

- Brand Recognition: Established payment card brands benefit from high consumer awareness and trust, making it difficult for new entrants to gain traction.

- Customer Switching Costs: The time, effort, and potential disruption involved in changing payment providers create a significant hurdle for new competitors.

- Network Effects: The value of a payment network increases with the number of users (both consumers and merchants), creating a virtuous cycle for incumbents that new entrants struggle to replicate.

The threat of new entrants in the payment card industry is generally low due to significant capital requirements, including specialized manufacturing equipment and secure facilities, often costing millions. CPI Card Group's substantial scale, evidenced by its $364.1 million in net sales in 2023, allows for economies of scale that are difficult for newcomers to match. Furthermore, securing essential industry certifications like EMVCo and PCI DSS involves extensive investment and time, creating substantial barriers to entry.

Porter's Five Forces Analysis Data Sources

Our CPI Card Porter's Five Forces analysis is built upon a robust foundation of data, drawing from financial statements, credit rating agency reports, and industry-specific market research from firms like Gartner and IDC to assess competitive intensity.