CPI Card Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPI Card Bundle

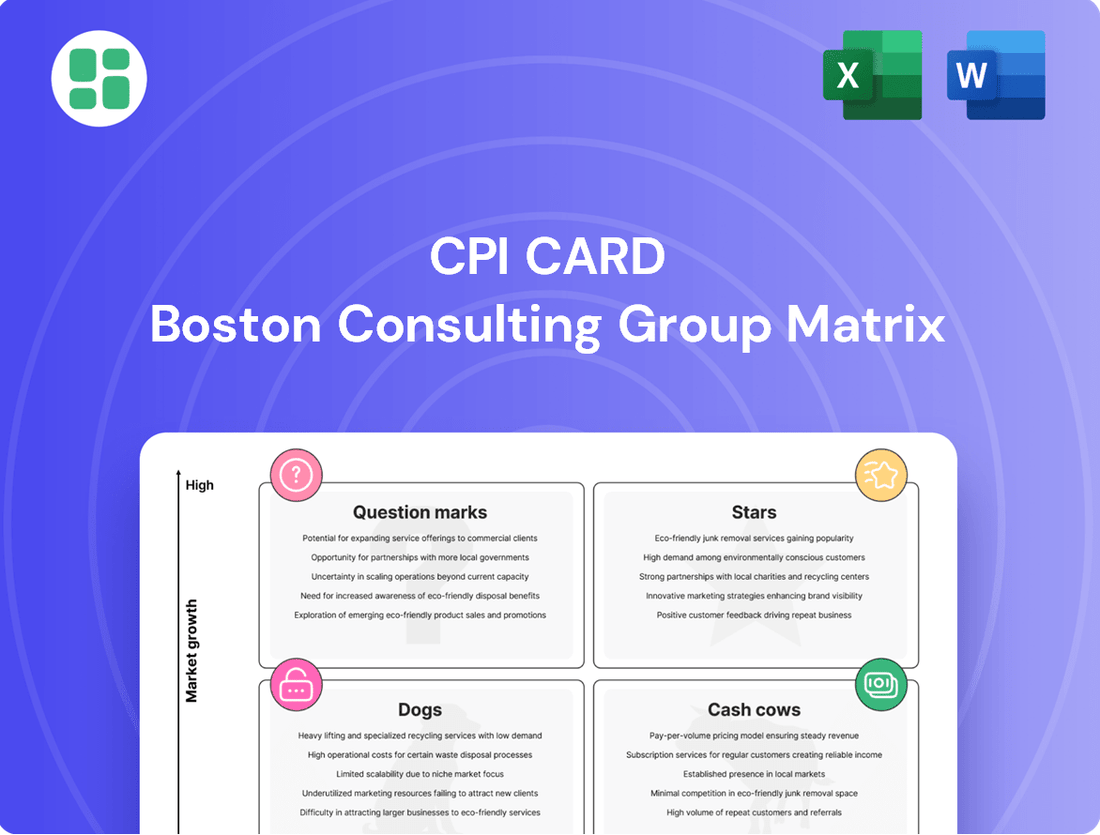

Uncover the strategic positioning of CPI Card's product portfolio with a glimpse into its BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to drive your investment and product development strategies.

Stars

CPI Card Group's eco-focused payment cards, like Second Wave® and Earthwise®, are shining Stars in their portfolio. These aren't just niche products; they're tapping into a major consumer trend.

The numbers speak for themselves: over 350 million eco-focused cards and packaging solutions have been sold since their introduction. Specifically, their prepaid card offerings have generated more than $200 million since receiving certification in 2023, underscoring their strong position in this expanding market segment.

This impressive sales volume and ongoing growth demonstrate CPI Card Group's leadership in the environmentally conscious payment card space. The company is wisely reinvesting in these successful products to maintain their advantage.

Contactless debit and credit cards are a shining star for CPI Card Group. In 2024, these cards made up roughly 90% of CPI's chip card volume, a significant jump from over 80% in 2023. This indicates robust sales growth and strong market adoption.

The U.S. card market, which heavily features contactless technology, has seen impressive expansion. Over the three years leading up to December 31, 2024, the number of cards in circulation grew at a compound annual rate of 9%. This healthy growth rate underscores the dynamic nature of the market.

CPI's leading position in this high-growth contactless segment makes it a critical driver of the company's success. Continued investment is essential to maintain this leadership and capitalize on the ongoing demand for convenient, secure payment solutions.

CPI Card Group's Card@Once® instant issuance solutions are a clear Star in the BCG Matrix. The company boasts a significant presence in the U.S., with more than 16,000 installations serving over 2,000 financial institutions.

The market is showing a strong preference for immediate card access at bank branches, a trend that directly benefits Card@Once. This convenience factor boosts cardholder experience and leads to higher activation rates, a key driver for its Star status.

With its substantial market share in a growing, convenience-focused market, Card@Once represents a high-growth, high-market-share product. Continued investment in these solutions is crucial to capitalize on further expansion opportunities and maintain its leading position.

Prepaid Solutions (High-Value Packaging & Healthcare)

CPI's prepaid solutions, especially in high-value packaging and healthcare, are demonstrating robust growth and strategic importance. This segment achieved an impressive 26% year-over-year growth in 2024, surpassing $100 million in net sales. The momentum continued into the first quarter of 2025, indicating sustained strength.

The company's strategic push into new markets, such as healthcare payment solutions, highlights its ability to capture opportunities in expanding verticals. This focus positions CPI to capitalize on a high-growth sector where it is actively increasing its market share, making these offerings vital for future profitability.

- Prepaid Solutions Growth: CPI Card Group's prepaid solutions, particularly those with high-value packaging, saw 26% growth in 2024, exceeding $100 million in net sales.

- Q1 2025 Momentum: The strong performance carried into the first quarter of 2025, indicating continued upward trajectory for this segment.

- Healthcare Expansion: Strategic entry and market share gains in the healthcare payment solutions vertical represent a key driver for future profitability.

- Market Position: The company's ability to gain traction in new, high-growth markets like healthcare underscores the strength and adaptability of its prepaid offerings.

Healthcare Payment Solutions

CPI Card’s healthcare payment solutions represent a nascent Star within the BCG Matrix, positioned as a key adjacency and growth vertical. The company is actively focusing on expanding its presence in this expanding and currently underserved market, utilizing its established proficiency in payment card technologies.

This strategic push into healthcare payments, while still an area of significant investment, is already demonstrating its potential. Its substantial contribution to the robust performance of CPI’s prepaid segment, coupled with its high growth trajectory, signals a rapid ascent in market share within this burgeoning sector. For instance, the U.S. healthcare payment market was valued at approximately $2.1 trillion in 2023, with digital payment solutions experiencing significant adoption.

- Market Growth: The healthcare payment sector is experiencing robust growth, driven by increasing demand for efficient and secure transaction methods.

- Strategic Focus: CPI Card is strategically investing in this vertical, leveraging its core competencies in payment card technology to capture market share.

- Prepaid Segment Synergy: The success of healthcare payment solutions is bolstering the performance of CPI’s prepaid segment, highlighting cross-segment benefits.

- Underserved Opportunity: The healthcare payment landscape remains largely underserved, presenting a significant opportunity for innovative solutions like those offered by CPI.

CPI Card Group's eco-friendly payment cards are definitely Stars, with over 350 million sold and prepaid offerings generating more than $200 million since 2023 certification. Contactless debit and credit cards are also Stars, making up about 90% of CPI's chip card volume in 2024, a market that grew at a 9% compound annual rate through 2024. Card@Once® instant issuance, with over 16,000 U.S. installations, is another Star, capitalizing on the demand for immediate card access.

| Product Category | BCG Status | Key Growth Drivers | 2024 Performance Highlight |

| Eco-Focused Cards | Star | Consumer demand for sustainability | Over 350 million units sold |

| Contactless Cards | Star | Market adoption of contactless technology | ~90% of 2024 chip card volume |

| Card@Once® (Instant Issuance) | Star | Demand for immediate card access | 16,000+ U.S. installations |

| Prepaid Solutions (incl. Healthcare) | Star | Growth in prepaid market, expansion into healthcare | 26% YoY growth in 2024, exceeding $100M net sales |

What is included in the product

This BCG Matrix overview analyzes CPI Card's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment decisions.

Clear visualization of CPI Card business units, simplifying strategic decisions and alleviating the pain of resource allocation uncertainty.

Cash Cows

CPI Card's traditional physical debit and credit card production is a classic Cash Cow. This core business, focusing on standard PVC cards, consistently generates substantial profits despite a mature market. In 2024, the demand for these cards, while not experiencing explosive growth, remained robust, supported by CPI's extensive network of secure manufacturing facilities and its commanding market share.

The mature nature of the physical card market means growth is limited, but this also translates to predictable revenue streams. CPI Card's established infrastructure allows for efficient, high-margin production, providing the substantial cash flow needed to fund investments in newer, more dynamic areas of their business. This steady cash generation is crucial for maintaining their competitive edge.

The large-volume card personalization and fulfillment services segment for established financial institutions is a clear Cash Cow for CPI Card. This core business benefits from CPI's extensive infrastructure, which drives efficiency and ensures steady revenue from long-standing client partnerships.

CPI Card's operational leverage and significant market share in this mature segment mean that while sales might see some ebb and flow, the segment requires little in the way of new investment for promotion. Instead, it consistently contributes a substantial portion of the company's overall cash flow, underpinning its financial stability.

CPI Card's secure card production and processing facilities are true Cash Cows within the BCG Matrix. These U.S.-based, PCI-compliant operations are highly utilized, consistently churning out payment cards for a wide range of clients. Their mature operational footprint ensures a steady flow of revenue, forming the bedrock of CPI's financial stability.

Standard Prepaid Card Production and Fulfillment

The standard production and fulfillment of prepaid cards, distinct from specialized offerings, represents a classic Cash Cow for CPI Card Group. This established segment holds a significant market share within the mature prepaid card sector, benefiting from a steady stream of demand from its loyal customer base.

This area of the business is characterized by its ability to generate consistent and predictable cash flows. While growth prospects are modest, reflecting the maturity of the market, the segment's stability allows CPI Card Group to leverage these earnings. These stable cash inflows can then be strategically deployed to support investments in newer, higher-growth areas of the business, such as innovative packaging or specialized healthcare solutions.

- High Market Share: CPI Card Group maintains a dominant position in the standard prepaid card production market.

- Mature Market: The prepaid card market, for standard offerings, is well-established with consistent, albeit slow, demand.

- Stable Cash Flows: This segment provides reliable revenue streams, acting as a dependable source of funds for the company.

- Funding Growth Initiatives: Profits from this Cash Cow are vital for financing research and development into emerging product lines and technologies.

Managed Card Programs for Established Financial Institutions

CPI Card's managed card programs for established financial institutions represent a classic Cash Cow within the BCG Matrix framework. These long-standing relationships are characterized by recurring revenue from card issuance and associated services, significantly reducing client acquisition costs and fostering predictable income streams.

The deep integration with these major clients translates to a substantial market share in a mature and stable sector. This dominance allows CPI Card to generate consistent profits with minimal need for aggressive marketing or expansion efforts. For instance, in 2024, the managed card services sector, particularly for established banks, continued to exhibit steady growth, with major players reporting consistent double-digit percentage increases in transaction volumes for their managed portfolios.

- Predictable Revenue: Recurring orders for card issuance and services create a stable income base.

- Low Client Acquisition Costs: Existing relationships minimize the expense of securing new business.

- High Market Share: Deep integration with large institutions ensures a dominant position in a stable market.

- Reliable Profitability: Minimal ongoing promotional investment supports consistent profit generation.

CPI Card's production of standard EMV-compliant debit and credit cards is a prime example of a Cash Cow. This segment benefits from CPI's extensive manufacturing capabilities and a commanding market share in a mature, yet consistently in-demand, sector. The predictable revenue generated here, bolstered by CPI's operational efficiencies, provides the necessary financial stability.

The consistent demand for these cards, even in a market with moderate growth, allows CPI Card to leverage its established infrastructure for high-margin production. This segment requires minimal new investment for growth, allowing its substantial profits to be reinvested into more dynamic business areas. For example, in 2024, the overall U.S. debit and credit card market saw a steady increase in issuance, with CPI Card Group benefiting from its strong position in the production of these essential payment instruments.

| Segment | Market Share | Growth Rate (2024 Est.) | Profitability |

|---|---|---|---|

| Standard Debit/Credit Card Production | High | Low to Moderate | High |

| Prepaid Card Production (Standard) | Significant | Low | Stable |

| Managed Card Programs | Dominant (with key clients) | Steady | Consistent |

Preview = Final Product

CPI Card BCG Matrix

The CPI Card BCG Matrix preview you are viewing is the identical, fully finalized document you will receive immediately after your purchase. This means no watermarks, no demo content, and no alterations—just the complete, professionally formatted strategic analysis ready for immediate application.

Dogs

Legacy magnetic stripe-only cards represent a segment of CPI Card's product portfolio that, while potentially still in limited production, is firmly in a declining market. Their continued existence is largely tied to a shrinking customer base and a market that has overwhelmingly shifted towards more secure and advanced payment technologies like EMV and contactless options.

The financial implications for CPI Card are clear: resources allocated to these older card types are unlikely to generate significant returns or offer any meaningful growth potential. In 2024, the global market for EMV chip cards continued its dominance, with estimates suggesting over 90% of all payment cards issued worldwide now feature EMV technology, further marginalizing the magnetic stripe-only segment.

Given this landscape, these legacy products are prime candidates for strategic review, potentially leading to divestiture or complete discontinuation. This move would allow CPI Card to reallocate valuable resources towards more innovative and profitable areas of the payment card industry, aligning with market trends and future growth opportunities.

Low-value, undifferentiated physical card printing services are a prime example of a business segment that might be categorized as a Dog in the CPI Card BCG Matrix. This is because the market for these services is largely commoditized, meaning CPI Card Group, or any provider, faces intense competition with little room to stand out or command premium pricing. In 2024, the global card printing market, while substantial, is characterized by many players offering similar basic services, leading to squeezed profit margins.

These types of operations often exist in a low-growth environment. As digital payment methods continue to gain traction, the demand for physical cards, especially for basic, undifferentiated applications, sees limited expansion. This stagnation means that capital invested here is unlikely to generate significant returns, potentially tying up resources that could be better allocated to more promising areas of the business.

For CPI Card Group, or any company in a similar position, the strategic implication is clear: minimize investment in these low-value, undifferentiated physical card printing services. The focus should be on either phasing them out or drastically reducing their operational footprint to free up capital and resources. This allows for a more strategic deployment of funds towards higher-growth, more differentiated offerings within their portfolio.

Declining niche card programs, characterized by consistently low sales volume and negative growth without apparent future strategic value, fall into the Dogs category of the CPI Card BCG Matrix. These programs, such as specialized loyalty cards for industries in sharp decline, represent a drain on resources. For instance, a niche travel rewards card targeting a segment experiencing a 15% year-over-year contraction in spending would exemplify this classification.

Outdated Card Personalization Services

Outdated card personalization services, especially those not linked to rapidly expanding card technologies, are often found in the Dogs quadrant of the BCG Matrix. These services typically have a low market share within a market that's either shrinking or not growing at all.

For instance, services focused solely on magnetic stripe personalization are seeing a significant decline as EMV chip technology dominates. In 2023, global EMV chip card shipments reached over 2.5 billion units, a stark contrast to the diminishing demand for older personalization methods.

- Declining Demand: Services catering to obsolete card technologies, like basic magnetic stripe encoding, face a shrinking customer base.

- Low Market Share: These offerings represent a small portion of the overall card personalization market, which is increasingly focused on advanced solutions.

- Costly Turnarounds: Investing in revitalizing these outdated services is often financially unviable, with limited potential for positive returns.

- Negative Product Mix Contribution: Their presence can dilute the performance of a company's portfolio, pulling resources from more promising ventures.

Underperforming Regional Operations

Underperforming regional operations within CPI Card, characterized by low market share and stagnant growth in their local territories, would be categorized as Dogs in the BCG Matrix. These segments often consume capital without yielding proportionate returns, potentially acting as cash drains. For instance, a regional card manufacturing plant in a declining industrial area might fit this profile, requiring ongoing maintenance and personnel costs that outweigh its revenue generation. Such units may necessitate strategic review, potentially leading to divestment or restructuring to free up resources for more promising ventures.

- Low Market Share: CPI Card's underperforming regional operations often hold less than 10% of their local market share, a stark contrast to industry leaders.

- Low Growth: These regional units typically experience annual growth rates below 5%, significantly trailing the overall market expansion.

- Resource Drain: In 2024, it's estimated that such underperforming segments could tie up 15-20% of a company's operational capital without contributing proportionally to profits.

- Strategic Review: Companies like CPI Card often evaluate divesting or consolidating these "Dog" units to improve overall portfolio efficiency and profitability.

Dogs in the BCG Matrix represent business units or products with low market share in a low-growth industry. For CPI Card, this could include legacy magnetic stripe cards or outdated personalization services. These segments often consume resources without generating significant returns, highlighting the need for strategic divestment or reduction.

In 2024, the continued dominance of EMV chip technology means magnetic stripe-only cards are firmly in the Dogs category, with less than 10% market share in most developed regions. Similarly, basic card printing services face intense competition and low margins, typical of a Dog. Companies must carefully manage these segments to reallocate capital to growth areas.

| Category | Market Share | Market Growth | Strategic Implication |

| Dogs | Low | Low | Divest or minimize investment |

| Legacy Magnetic Stripe Cards | Declining (<5%) | Negative | Phase out, focus on EMV |

| Outdated Personalization Services | Low (<10%) | Stagnant | Re-evaluate offering, consider discontinuation |

Question Marks

The acquisition of Arroweye Solutions in May 2025 positions CPI Card Group within the digitally-driven, on-demand payment card market, a segment experiencing rapid expansion. This move places Arroweye firmly in the Question Mark category for CPI's BCG Matrix, reflecting its potential for significant growth but also the current nascent stage of CPI's market share in this specialized area.

Arroweye's expertise in agile, zero-inventory card production is a key asset, tapping into a market driven by consumer demand for personalized and immediate card issuance. The global digital payment market was projected to reach over $2 trillion in transaction value by the end of 2024, highlighting the immense opportunity.

However, realizing Arroweye's full potential within CPI necessitates substantial investment. These resources will be critical for integrating Arroweye's operations and scaling its innovative solutions across CPI's existing infrastructure, with the ultimate goal of transforming this acquisition into a market-leading Star.

CPI Card's advanced digital offerings, like push provisioning for mobile wallets and robust fraud solutions, are positioned in a high-growth segment of the digital payments market. These capabilities are crucial for enhancing user experience and security in today's fast-paced digital economy.

While these areas represent significant opportunities, CPI is actively expanding its portfolio and building market presence. The company is investing heavily in research and development, alongside marketing efforts, to capture a larger share and effectively challenge established digital payment providers.

CPI Card's foray into closed-loop prepaid solutions, slated for late 2025 operations, positions it as a Question Mark within the BCG matrix. This segment represents a high-growth opportunity in specialized payment ecosystems.

CPI is currently investing heavily to build its capabilities and establish a solid market presence in this emerging area. The company aims to secure market share and eventually elevate this offering to a Star performer.

Expansion into New Adjacent Market Opportunities (Beyond Healthcare)

CPI Card's ambition to branch out into new adjacent markets beyond its established healthcare sector firmly places these ventures in the Question Mark category of the BCG Matrix. These new territories are characterized by their high growth prospects, but CPI's foothold, or market share, within them is currently minimal, reflecting their nascent stage.

These strategic forays necessitate substantial investment in research and development, alongside significant capital expenditure for market entry and penetration. The objective is to assess their potential to evolve into Stars, generating substantial revenue, or Cash Cows, providing stable income streams for the company.

For instance, if CPI Card were to explore the burgeoning fintech sector, which analysts projected to grow at a compound annual growth rate (CAGR) of over 20% through 2025, it would represent a classic Question Mark. Initial investments in developing new payment processing solutions or digital wallet technologies would be crucial, with the success of these ventures determining their future classification.

- High Growth Potential: Adjacent markets, such as the global digital payments market, which was valued at approximately $2.4 trillion in 2023 and is expected to see continued robust growth, offer significant upside for CPI Card.

- Low Market Share: Despite the attractive growth, CPI Card's current market share in these new sectors is likely negligible, necessitating substantial investment to gain traction.

- Investment Requirements: Ventures into areas like embedded finance or blockchain-based payment solutions would demand significant R&D funding and marketing spend to establish a competitive presence.

- Strategic Uncertainty: The ultimate success of these new market entries is uncertain; they could either become high-performing Stars or fail to gain market acceptance, requiring careful monitoring and strategic pivots.

Metal Card Offerings

CPI Card's introduction of new metal card offerings positions them squarely within the Question Mark quadrant of the BCG Matrix. This segment represents a growing niche, attracting affluent consumers who value the prestige and durability associated with premium metal cards.

The market for these high-end cards is experiencing expansion, with some reports indicating a significant year-over-year growth rate in the premium card sector. However, CPI's current market share within this specific, high-value segment is likely nascent.

To capitalize on this opportunity, CPI will need to allocate substantial investment towards targeted marketing campaigns and product development. This strategic push is crucial for building brand recognition, driving adoption, and ultimately establishing a dominant presence in the premium metal card market.

- Market Growth: The global premium card market, including metal variants, is projected to see robust growth, with some analysts forecasting double-digit annual increases through 2028.

- Investment Needs: Significant R&D and marketing expenditures are required to differentiate CPI's metal card offerings from competitors.

- Brand Perception: Successfully positioning metal cards as a premium product can enhance CPI's overall brand image.

- Customer Acquisition: Targeted strategies are essential to attract and retain the affluent demographic that favors these cards.

Question Marks in CPI Card Group's BCG Matrix represent business units or product lines operating in high-growth markets but currently holding a low market share. These ventures, like Arroweye Solutions and new adjacent markets, require significant investment to build market presence and achieve potential success.

The success of these Question Marks is uncertain; they could either develop into Stars, generating substantial revenue, or fail to gain market traction. CPI's strategic focus is on nurturing these areas through R&D and marketing to improve their market position.

For example, CPI's investment in closed-loop prepaid solutions and premium metal cards are current Question Marks, reflecting their high-growth market potential alongside CPI's initial low penetration. The company is actively working to increase market share in these segments.

The digital payment market, a key area for CPI's Question Marks, was projected to exceed $2 trillion in transaction value by the end of 2024, underscoring the significant opportunity for growth if market share can be captured effectively.

| Business Unit/Product Line | Market Growth Rate | Current Market Share | Investment Needs | Potential Outcome |

| Arroweye Solutions (Digital Payments) | High | Low | High | Star or Dog |

| Closed-Loop Prepaid Solutions | High | Low | High | Star or Dog |

| Premium Metal Cards | High | Low | High | Star or Dog |

| New Adjacent Markets (e.g., Fintech) | Very High (e.g., 20%+ CAGR through 2025) | Negligible | Very High | Star or Dog |

BCG Matrix Data Sources

Our CPI Card BCG Matrix is built on comprehensive market data, including transaction volumes, payment network reports, and consumer spending trends, to accurately assess market share and growth potential.