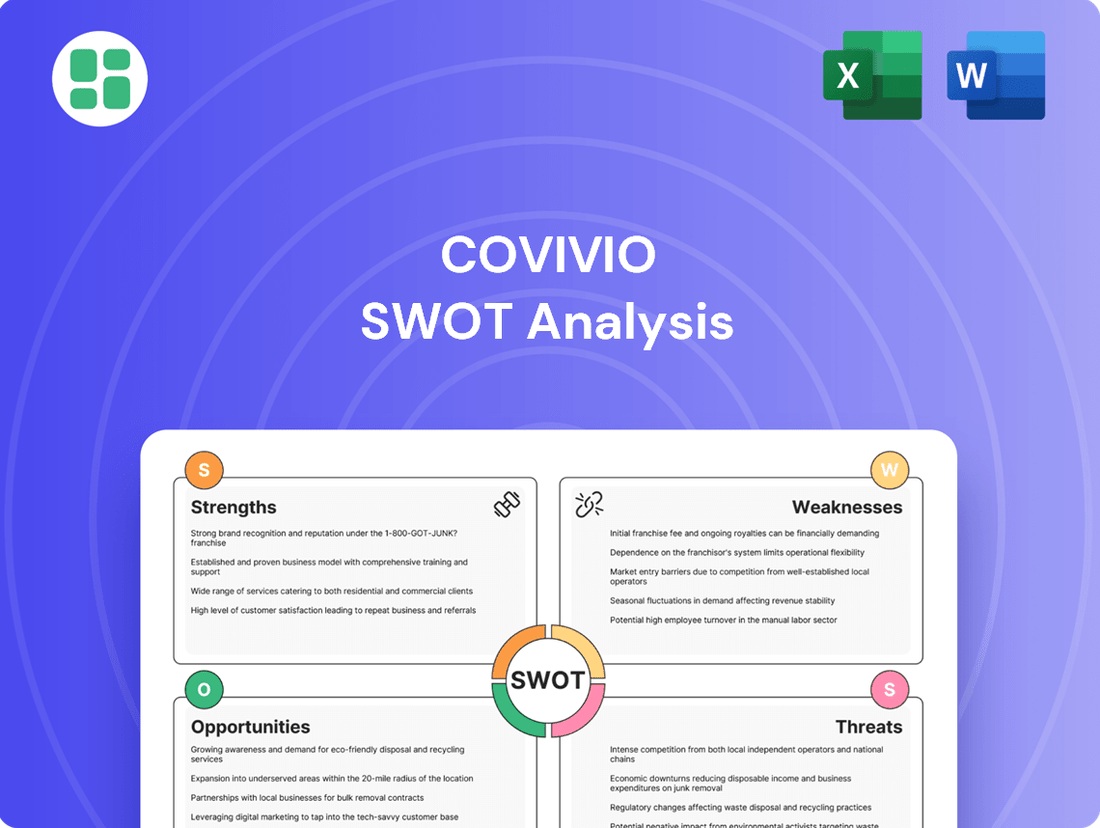

Covivio SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covivio Bundle

Covivio's strategic positioning in the European real estate market presents a compelling mix of strengths, such as its diversified portfolio and strong financial backing, but also highlights potential weaknesses and market threats. Understanding these dynamics is crucial for any stakeholder looking to capitalize on opportunities or mitigate risks within this sector.

Want the full story behind Covivio’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Covivio's strength lies in its geographically and sectorally diversified European portfolio, encompassing office, residential, and hotel properties. This spread across France, Germany, and Italy, among other key markets, effectively reduces exposure to any single market downturn.

As of early 2024, Covivio's portfolio demonstrates significant resilience due to this diversification. For instance, while the office sector might face headwinds, strong performance in residential or hospitality segments can offset these challenges, ensuring a more stable overall financial performance.

Covivio has shown impressive financial strength, with recurring net income seeing a notable increase in 2024, and projections for 2025 remain positive. This financial momentum is underpinned by a healthier balance sheet, evidenced by reduced leverage and enhanced liquidity.

The company's strengthened financial footing provides a solid foundation for ongoing strategic investments and supports the potential for dividend growth, signaling a strong belief in its sustained future performance.

Covivio's integrated operator model, evident in its hotel and office segments through platforms like WiZiU and Wellio, allows for hands-on asset management. This means they can actively renovate and strategically divest properties, a strategy that has demonstrably boosted revenue and portfolio value. For instance, their focus on enhancing user experience in Wellio spaces directly translates to higher occupancy and rental income.

Commitment to ESG and Sustainability Leadership

Covivio demonstrates a significant commitment to ESG principles, with a substantial portion of its real estate portfolio holding environmental certifications. This focus is further evidenced by ambitious targets for carbon reduction, aiming for a greener operational footprint. By the end of 2023, Covivio reported that 98% of its portfolio was environmentally certified, a testament to its dedication.

The company actively finances its sustainable initiatives through financial instruments like EU Green Bonds. In 2024, Covivio continued to expand its ESG-linked debt, representing an increasing share of its overall financing. This strategic approach not only meets evolving regulatory demands but also appeals to a growing segment of investors and tenants prioritizing sustainability.

Covivio's leadership in sustainability positions it favorably in the market, attracting capital from environmentally conscious investors. It also enhances its appeal to tenants seeking to align with businesses that prioritize environmental and social responsibility. This strategic advantage is crucial in the current market landscape.

Strategic Acquisitions and Portfolio Rebalancing

Covivio’s strategic acquisitions, especially within the hotel sector, bolster its market position. For instance, in 2024, the company continued its focus on premium European hospitality assets, aiming to consolidate its presence in key urban centers. This proactive approach to growth, coupled with a clear strategy for portfolio rebalancing, is a significant strength.

The company’s commitment to portfolio rebalancing involves both acquiring high-potential assets and divesting non-core properties. This selective asset rotation, a strategy evident in their 2024 and 2025 plans, ensures that Covivio’s portfolio remains aligned with current market demands and its long-term strategic objectives, thereby enhancing its overall quality and future growth prospects.

- Strategic Acquisitions: Continued investment in premium European hotel assets throughout 2024.

- Portfolio Rebalancing: Active rotation of assets to optimize portfolio quality and growth potential.

- Focus on High-Potential Assets: Consolidation of holdings in key urban hospitality markets.

- Selective Disposals: Offloading of non-core properties to streamline operations and capital allocation.

Covivio's strengths are deeply rooted in its diversified European real estate portfolio, spanning offices, residential, and hotels across key markets like France, Germany, and Italy. This geographical and sectoral spread significantly mitigates risk, ensuring stability even when specific segments face challenges. For example, strong performance in its residential portfolio in early 2024 helped offset potential softness in the office sector, a testament to its balanced approach.

Financially, Covivio demonstrated robust health in 2024, with recurring net income showing a positive trajectory and a strengthened balance sheet featuring reduced leverage. This financial solidity provides ample capacity for strategic investments and supports potential dividend growth, reflecting confidence in its sustained performance and future prospects.

The company's integrated operator model, particularly in its hotel and office segments, enables proactive asset management. This hands-on approach, exemplified by platforms like Wellio, allows for strategic renovations and divestments that have demonstrably enhanced portfolio value and revenue streams. The focus on improving tenant experience in Wellio spaces, for instance, has directly contributed to higher occupancy rates and rental income.

Covivio's unwavering commitment to ESG principles is a significant competitive advantage. By the close of 2023, an impressive 98% of its portfolio held environmental certifications, and the company actively finances these initiatives through instruments like EU Green Bonds, with an increasing portion of its financing linked to ESG performance in 2024. This dedication not only aligns with regulatory trends but also attracts environmentally conscious investors and tenants.

| Key Strength Area | Description | 2024/2025 Relevance |

|---|---|---|

| Portfolio Diversification | Geographically and sectorally spread across Europe (office, residential, hotel). | Reduces market-specific risks, ensuring stable performance. |

| Financial Strength | Increased recurring net income and a healthier balance sheet (reduced leverage). | Supports strategic investments and potential for dividend growth. |

| Integrated Operator Model | Hands-on asset management for hotels and offices (e.g., Wellio). | Drives revenue growth and portfolio value enhancement through improved asset performance. |

| ESG Commitment | High environmental certification (98% by end-2023) and use of Green Bonds. | Attracts ESG-focused capital and tenants, enhancing market appeal. |

What is included in the product

Delivers a strategic overview of Covivio’s internal and external business factors, highlighting its strengths in diversified real estate portfolios and opportunities in sustainable development, while also considering weaknesses in capital intensity and threats from economic downturns.

Offers a clear breakdown of Covivio's strategic landscape, highlighting opportunities to leverage strengths and mitigate weaknesses.

Weaknesses

Covivio's significant presence in France, Germany, and Italy, while a strength, also exposes it to European economic downturns. A slowdown in these key Eurozone markets could dampen demand for its real estate assets, potentially affecting rental income and occupancy levels. For example, Germany's economic growth forecast for 2025 remains modest, and political shifts in France and Germany could introduce further market unpredictability.

Covivio, like many real estate firms, faces significant headwinds from interest rate volatility. Higher borrowing costs directly impact debt servicing, potentially squeezing profitability. For instance, a sustained 1% increase in interest rates on its €6.6 billion debt as of December 31, 2023, could add approximately €66 million to annual expenses.

While the European Central Bank's rate cuts starting in June 2024 offer some relief, the market remains sensitive to any policy reversals or persistent higher-than-anticipated rates. This could dampen investor appetite for real estate assets, affecting valuations and Covivio's ability to refinance existing debt favorably.

Despite Covivio's robust hedging strategy, which stood at 89% of its variable-rate debt hedged at the end of 2023, prolonged periods of elevated interest rates could still strain its financial flexibility and reduce the attractiveness of new property investments.

The European office market is grappling with significant shifts, notably the rise of hybrid work models, which are reshaping demand. This evolving landscape is pushing a greater need for modern, sustainable office spaces. Many older buildings across Western Europe, potentially around 30% by 2030, risk becoming functionally obsolete without substantial investment in upgrades, presenting a considerable capital expenditure challenge for the sector.

While Covivio strategically targets prime office assets, the broader market's health remains a crucial factor. A general slowdown or downturn in the office sector, even for high-quality properties, could still exert pressure on the value and performance of its portfolio. For instance, vacancy rates in some major European cities saw an uptick in late 2023 and early 2024, underscoring the sector's sensitivity to economic conditions and changing work preferences.

Capital Intensive Nature of Real Estate

Covivio's operations are inherently capital-intensive, demanding significant financial resources for property acquisitions, development, and ongoing renovations. This necessitates a constant need for robust financing, which can be influenced by the prevailing market liquidity and the willingness of investors to commit capital. For instance, as of the first half of 2024, Covivio reported a portfolio valued at €28.4 billion, underscoring the scale of investment required.

This reliance on substantial capital exposes the company to execution and financial risks, particularly with large-scale projects. Even with established financing channels, the sheer magnitude of these undertakings means that any missteps in planning or funding could have considerable repercussions.

- High Capital Outlay: Real estate development and management demand significant upfront and ongoing investment.

- Financing Dependence: Covivio relies heavily on debt and equity markets to fund its growth and operations.

- Market Sensitivity: Access to capital can fluctuate based on economic conditions and investor sentiment.

- Project Risk: Large development projects carry inherent risks in terms of cost overruns and timeline adherence.

Competition and Market Oversupply

Covivio faces significant competition within the European real estate sector, with a crowded field of both established and emerging players vying for market share. This intense rivalry is particularly evident in prime urban locations.

A notable weakness is the potential for market oversupply in specific segments. For instance, the office market, especially for older, less sustainable buildings, could experience downward pressure on rental income and occupancy rates. By the end of 2024, reports indicated a vacancy rate of over 10% in some major European office markets, a trend that could impact properties not meeting modern environmental standards.

The ongoing demand for high-quality, sustainable, and well-located assets further intensifies competition for Covivio. Acquiring prime properties requires substantial capital and strategic foresight to outmaneuver competitors, impacting potential returns and growth opportunities.

- Intense Competition: Covivio operates in a fragmented European real estate market with numerous local and international competitors.

- Risk of Oversupply: Certain segments, particularly older office buildings lacking sustainability features, face oversupply risks, potentially leading to lower rents and occupancy.

- Demand for Prime Assets: The continuous need for high-quality, green buildings intensifies competition for Covivio's target acquisitions.

Covivio's substantial capital requirements for acquisitions and development create a significant financial burden. The company's portfolio was valued at €28.4 billion in the first half of 2024, highlighting the scale of investment needed. This reliance on continuous financing makes Covivio vulnerable to market liquidity and investor sentiment shifts, potentially impacting its ability to execute large projects and maintain growth.

What You See Is What You Get

Covivio SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and allows you to assess the quality and depth of our Covivio SWOT analysis before committing.

You are viewing a live preview of the actual SWOT analysis file. The complete version, offering a comprehensive breakdown of Covivio's internal and external factors, becomes available after checkout.

This is a real excerpt from the complete Covivio SWOT analysis. Once purchased, you’ll receive the full, editable version, providing actionable insights for strategic planning.

Opportunities

There's a clear upward trend in the market for modern, flexible, and eco-friendly buildings, covering offices, homes, and hotels. This demand is driven by a growing awareness of environmental impact and a need for adaptable spaces.

Covivio is strategically positioned to benefit from this shift. Their commitment to Environmental, Social, and Governance (ESG) principles and continuous asset upgrades allow them to develop and redevelop properties that meet these evolving tenant needs. This proactive approach is crucial in today's market.

This strategy directly supports EU regulations, such as the Energy Performance of Buildings Directive, pushing for better energy efficiency and near-zero emission buildings. For instance, by 2030, new buildings will need to be nearly zero-emission, a target Covivio's modernization efforts are designed to meet.

The ongoing shift of populations towards major European cities, a trend expected to continue through 2025, directly fuels the demand for integrated living solutions. Covivio's strategic emphasis on mixed-use developments, combining residential, office, and hospitality elements, positions it well to capitalize on this urbanization. For instance, in Germany, urban centers like Berlin and Munich continue to see population growth, driving demand for modern, well-located housing.

Covivio's established expertise in developing these multifaceted urban spaces allows it to effectively meet the changing lifestyles of city dwellers. The residential sector, a key component of this trend, demonstrates robust performance, with many European cities reporting persistently low vacancy rates and upward pressure on rental prices. This fundamental strength in the residential market provides a solid foundation for Covivio's growth ambitions in urban environments.

The European real estate market is showing signs of recovery, with interest rates stabilizing and investment volumes anticipated to rise in 2025. This shift creates a more favorable environment for companies like Covivio.

A lower cost of capital, coupled with narrowing gaps between what buyers and sellers expect, presents a significant opportunity for Covivio to boost its returns. It also opens doors for pursuing attractive acquisition targets that align with its strategy.

The European Central Bank's projected rate cuts are expected to further fuel this recovery in real estate total returns. For instance, analysts forecast a potential 5-7% total return for European real estate in 2025, driven by these supportive monetary policies.

Strategic Expansion and Repurposing of Assets

Covivio has a significant opportunity to grow its footprint in dynamic European urban centers, regions experiencing robust economic activity and population growth. This expansion can be complemented by strategically repurposing its existing real estate assets to align with evolving market needs, such as transforming underutilized office spaces into sought-after residential units or modern hotel accommodations.

This adaptive reuse strategy is a key avenue for unlocking hidden value within Covivio's extensive portfolio, allowing it to proactively respond to changing consumer preferences and economic trends. For instance, the company's ongoing hotel consolidation and renovation initiatives demonstrate a commitment to this approach, aiming to enhance asset performance and market appeal.

The company can leverage its expertise in property management to capitalize on these opportunities. By focusing on high-growth cities, Covivio can tap into increasing demand for diversified real estate solutions.

- Expansion in High-Growth European Cities: Targeting urban areas with strong economic indicators and population influx.

- Strategic Asset Repurposing: Converting existing properties, like offices, into residential or hotel spaces to meet new demands.

- Unlocking Portfolio Value: Adaptive reuse initiatives can significantly increase the revenue potential of current assets.

- Responding to Market Shifts: Proactively adjusting the property mix to align with evolving consumer and business needs.

Technological Adoption in Real Estate (PropTech)

Covivio can leverage PropTech to boost efficiency and tenant satisfaction. Investing in smart building tech, data analytics for portfolio optimization, and digital management platforms can streamline operations and attract modern clients. For instance, the global PropTech market was valued at approximately $25 billion in 2023 and is projected to grow significantly, with AI expected to be a major driver in the coming years.

Further opportunities lie in AI-driven insights for predictive maintenance, personalized tenant services, and optimized leasing strategies. By integrating these technologies, Covivio can enhance asset value and create more engaging living and working environments.

- Smart Building Integration: Implementing IoT sensors and building management systems to optimize energy consumption and enhance occupant comfort.

- Data Analytics for Optimization: Utilizing big data to identify trends, forecast market changes, and improve asset performance.

- Digital Tenant Experience: Developing user-friendly apps for rent payment, maintenance requests, and community engagement.

- AI-Powered Solutions: Exploring AI for automated property valuations, risk assessment, and personalized marketing.

Covivio is well-positioned to capitalize on the increasing demand for modern, sustainable, and adaptable real estate across European cities. Their strategic focus on urban regeneration and mixed-use developments aligns perfectly with demographic shifts and evolving tenant preferences, particularly in high-growth areas. The company's commitment to ESG principles and asset modernization ensures compliance with upcoming regulations and enhances its appeal to environmentally conscious stakeholders.

The stabilization of interest rates and anticipated rate cuts by the European Central Bank in 2025 create a more favorable investment climate, potentially improving Covivio's returns and acquisition opportunities. This environment supports the company's strategy of repurposing existing assets and expanding its footprint in key European urban centers, unlocking significant value within its portfolio.

Leveraging PropTech and AI offers substantial opportunities for Covivio to enhance operational efficiency, tenant satisfaction, and asset performance. Implementing smart building technologies and data analytics can optimize energy usage, personalize tenant experiences, and provide predictive insights for property management, driving future growth and profitability.

| Opportunity Area | Key Drivers | Covivio's Strategic Alignment | Example/Data Point |

|---|---|---|---|

| Urbanization & Integrated Living | Population growth in major European cities | Mixed-use development expertise | Demand in cities like Berlin and Munich continues to rise. |

| ESG & Sustainable Buildings | Environmental awareness, regulatory compliance (EPBD) | Commitment to ESG, asset upgrades | EU targets near-zero emission buildings by 2030. |

| Real Estate Market Recovery | Stabilizing interest rates, ECB rate cuts | Potential for improved returns and acquisitions | European real estate total returns forecast at 5-7% in 2025. |

| PropTech & Digitalization | Efficiency gains, enhanced tenant experience | Investment in smart building tech, AI | Global PropTech market valued at ~$25 billion in 2023. |

Threats

The Eurozone economy, while showing some recovery signs, remains vulnerable to slower growth or a potential recession. For instance, the European Commission's economic forecast in early 2024 projected a modest GDP growth of 0.9% for the Euro area, a figure subject to downward revision if headwinds persist.

A significant economic slowdown would directly impact Covivio by dampening demand across its real estate segments. This could translate into increased vacancy rates and a reduction in rental income, as businesses and individuals cut back on their real estate needs.

Furthermore, a prolonged downturn would likely exert downward pressure on property valuations. Covivio's asset values could see a decline, impacting its balance sheet and potentially its ability to secure financing or pursue new investments.

Geopolitical tensions, particularly in Europe, pose a significant threat to Covivio. Upcoming elections in key markets like France and Germany in 2024 and 2025 could introduce political instability, potentially dampening investor sentiment and deterring new real estate investments. This uncertainty can translate into increased market volatility, directly impacting the volume and pricing of real estate transactions, a core aspect of Covivio's business.

The persistent adoption of remote and hybrid work models poses a considerable threat to Covivio's office portfolio. This shift could prompt corporate tenants to reduce their physical office footprints, potentially impacting rental income and occupancy rates across their holdings. For instance, a mid-2024 survey indicated that 70% of businesses planned to maintain some form of hybrid work, suggesting a sustained reduction in traditional office space demand.

Regulatory and Environmental Compliance Costs

Covivio faces increasing pressure from evolving environmental regulations, particularly those focused on building energy performance. For instance, the EU Directive on Energy Performance of Buildings pushes for near-zero emissions, necessitating substantial capital outlays for asset modernization.

Non-compliance with these stringent rules can lead to significant financial penalties and diminish Covivio's market standing. This poses a considerable financial challenge, especially considering the age of some properties within Covivio's extensive portfolio.

Key compliance costs and risks include:

- Capital expenditure for energy efficiency upgrades: Estimates suggest that retrofitting older buildings to meet new emissions standards can cost tens of thousands of euros per unit.

- Potential fines for non-compliance: Regulatory bodies are increasing enforcement, with fines potentially reaching millions of euros for significant breaches.

- Impact on property valuations: Assets failing to meet environmental standards may see reduced marketability and lower valuations.

Intensified Competition and Supply-Demand Mismatch

Covivio faces a highly competitive European real estate landscape. While demand for top-tier properties remains robust, there's a growing concern about a potential imbalance between the available supply and the evolving needs of the market, particularly for sustainable and adaptable spaces. This dynamic could intensify the race for prime tenants and promising development projects, potentially putting downward pressure on yields in sought-after sectors.

For instance, in 2024, the European office market saw vacancy rates in prime locations remain relatively low, but the demand shift towards ESG-compliant and flexible office solutions is accelerating. This means older, less adaptable stock might struggle to attract tenants, increasing competition for newer, greener buildings. Covivio's portfolio will need to actively address this trend to maintain its competitive edge.

- Intensified Competition: The European real estate market is characterized by numerous players vying for prime assets and tenants.

- Supply-Demand Mismatch: A gap exists between the current real estate supply and the increasing demand for green and flexible spaces.

- Yield Compression Risk: Increased competition for desirable properties and tenants could lead to lower returns in attractive market segments.

- Focus on ESG and Flexibility: Future success hinges on aligning portfolios with evolving tenant preferences for sustainability and adaptability.

Economic headwinds in the Eurozone, marked by projected modest GDP growth in early 2024, present a direct threat to Covivio's revenue through reduced demand and potentially lower property valuations.

The ongoing shift towards remote and hybrid work models is a significant concern for Covivio's office portfolio, potentially leading to reduced rental income and increased vacancy rates as businesses downsize their physical footprints.

Evolving environmental regulations, particularly those mandating energy efficiency upgrades for buildings, necessitate substantial capital expenditure for Covivio to avoid penalties and maintain asset value.

Intensified competition in the European real estate market, coupled with a growing demand for sustainable and flexible spaces, could lead to yield compression for assets that do not align with these evolving tenant preferences.

SWOT Analysis Data Sources

This Covivio SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive market research, and insights from industry experts to provide a well-rounded strategic perspective.