Covivio Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covivio Bundle

This glimpse into Covivio's BCG Matrix highlights their strategic positioning across different market segments. Understand which assets are generating strong cash flow and which require careful consideration for future investment.

Unlock the full potential of this analysis by purchasing the complete Covivio BCG Matrix. Gain a comprehensive understanding of their portfolio, enabling you to make informed decisions about resource allocation and strategic growth.

Stars

Covivio's Southern European hotel portfolio, encompassing Italy and Spain, is a clear star performer. These assets are experiencing robust growth and expanding their market presence.

The company reported significant like-for-like revenue increases in its variable-rent hotels throughout 2024 and into Q1 2025. Specifically, Spain's hotels achieved an impressive +13% RevPAR increase in 2024, underscoring the region's strong performance.

Strategic acquisitions and the integration of operating companies have solidified this segment's leadership in a dynamic and expanding market, further fueling its star status.

Covivio's launch and ongoing development of WiZiU, its integrated hotel management platform, positions it as a Stars category initiative within the BCG Matrix. This strategic move allows Covivio to directly oversee a significant portion of its hotel assets, aiming for enhanced operational efficiency and value generation, especially for recently integrated properties.

The direct management strategy, combined with targeted renovations and new leasing agreements, is designed to accelerate revenue and EBITDA growth. For example, by taking direct control, Covivio can implement standardized best practices across its portfolio, potentially leading to improved guest satisfaction and operational margins. This proactive approach is key to transforming properties into market leaders.

Covivio's prime office assets in Paris's central business districts are performing exceptionally well, even amidst broader market adjustments. These prime locations are experiencing rising rents and consistently high occupancy rates, demonstrating their resilience and desirability.

The Paris CBD office market saw values increase by 3.2% in the second half of 2024. This growth highlights a strong demand for high-quality, ESG-compliant office spaces, a segment where Covivio's portfolio excels.

Covivio's strategic investment in modernizing these city-center properties, coupled with their commitment to achieving high environmental performance, reinforces their leading position in this attractive market segment.

Residential Portfolio in Berlin

Covivio's residential portfolio, heavily concentrated in Berlin, is a standout performer. This segment benefits from robust rental growth and significant rental reversion opportunities.

Berlin's housing market is characterized by a pronounced shortage, which fuels consistent rent increases across both new constructions and existing properties. This dynamic environment allows landlords to achieve higher rents.

Covivio is adept at capitalizing on these market conditions, demonstrating substantial rent uplifts when leases are renewed or new tenants are found. This strong performance in Berlin, a market with a structural undersupply and ongoing demand, highlights its position as a cash cow within Covivio's portfolio.

- Berlin's Rental Growth: The city has seen accelerated rental growth, with average rents increasing by approximately 8% year-on-year in early 2024.

- High Rental Reversion: Covivio reports rental reversion potential of up to 20% on lease renewals in prime Berlin locations.

- Market Share: Covivio holds a significant market share in Berlin's residential rental sector, estimated at over 5% of the total rental units.

- Demand-Supply Gap: Berlin faces a structural housing deficit, with demand consistently outstripping new supply, projected to widen further by 2025.

ESG-Compliant and Certified Portfolio

Covivio's dedication to Environmental, Social, and Governance (ESG) principles is evident in its portfolio. By mid-2024, an impressive 96% of its assets held environmental certifications, with a clear objective to reach 100% by the close of 2025. This robust alignment with sustainability, including adherence to the EU taxonomy, enhances its appeal to a growing segment of tenants and investors prioritizing green real estate.

This focus on sustainability can translate into a competitive advantage for Covivio. As demand for environmentally responsible properties continues to rise, Covivio's certified portfolio is well-positioned to capture a larger market share. The company's proactive approach ensures it meets evolving market expectations and regulatory landscapes, potentially leading to stronger tenant retention and investor confidence.

- ESG Commitment: Covivio aims for 100% environmental certification of its assets by the end of 2025.

- Current Certification: As of mid-2024, 96% of Covivio's assets are environmentally certified.

- Market Appeal: High ESG compliance attracts environmentally conscious tenants and investors.

- Competitive Edge: Certification supports a stronger market position in the growing green building sector.

Covivio's Southern European hotel portfolio, especially in Italy and Spain, is a star performer. These hotels saw significant like-for-like revenue growth, with Spain achieving a +13% RevPAR increase in 2024. Strategic acquisitions and operational integration have cemented their leading market position.

The WiZiU platform represents a key Stars initiative, enabling direct oversight and value enhancement of hotel assets. This direct management, coupled with renovations and new leases, aims to boost revenue and EBITDA growth by implementing best practices and improving operational margins.

Covivio's prime Paris CBD office assets are also stars, showing resilience with rising rents and high occupancy. The Paris CBD office market saw a 3.2% value increase in H2 2024, driven by demand for quality, ESG-compliant spaces, where Covivio's modernized portfolio excels.

Covivio's Berlin residential portfolio, benefiting from a pronounced housing shortage, is a standout performer with robust rental growth. The company effectively capitalizes on market conditions, achieving substantial rent uplifts on lease renewals, positioning this segment as a cash cow.

| Segment | Performance Indicator | 2024 Data/Outlook | Key Drivers | BCG Category |

|---|---|---|---|---|

| Southern Europe Hotels | RevPAR Growth (Spain) | +13% | Market expansion, strategic acquisitions | Stars |

| Paris CBD Offices | Market Value Growth | +3.2% (H2 2024) | High occupancy, rising rents, ESG compliance | Stars |

| Berlin Residential | Rental Growth | ~8% (Early 2024) | Housing shortage, high demand-supply gap | Cash Cow |

| WiZiU Platform | Operational Efficiency | Direct management, value enhancement | Standardized best practices, targeted renovations | Stars |

What is included in the product

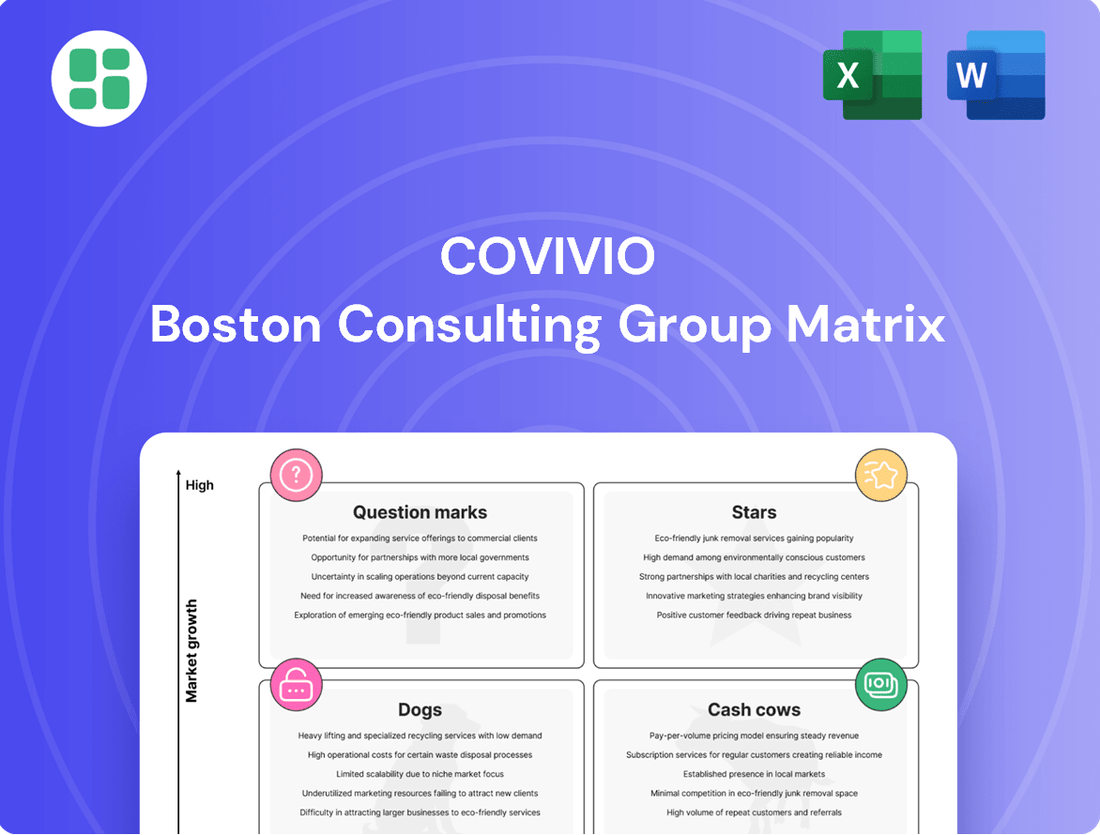

The Covivio BCG Matrix analyzes its real estate portfolio by categorizing assets into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

Gain clarity on Covivio's portfolio by visualizing each business unit's position, alleviating strategic uncertainty.

Cash Cows

Covivio's fixed-rent hotel leases are a cornerstone of its stable revenue generation. A substantial part of their hotel portfolio operates under these agreements, offering predictable income streams. These leases, with an average firm duration of 11.0 years, ensure consistent revenue with very little need for additional investment to drive growth.

These leases hold a significant market share within mature hotel segments, acting as reliable income generators. This consistent income is crucial for funding other strategic initiatives within Covivio's broader business operations.

Covivio's established office portfolio in major German cities and Milan functions as a classic Cash Cow. These prime locations, despite some 2024 adjustments in German office values, demonstrate resilience, particularly Milan's stability. The portfolio boasts a high occupancy rate of 95.5%, underscoring its consistent demand and market strength.

The long lease terms associated with these properties ensure predictable and substantial rental income streams. This stability, coupled with mature market positioning and effective asset management, translates into strong profit margins for Covivio. These assets are reliable contributors to the company's financial performance.

Covivio's core residential portfolio outside of Berlin represents a classic cash cow. These assets, while not experiencing the rapid expansion seen in Berlin, offer a reliable and substantial income stream. Their established nature in mature markets means they require minimal new investment to maintain their strong market position and generate consistent rental revenue.

In 2024, Covivio's German residential segment, which includes these stable assets, continued to be a significant contributor to overall revenue. The strategy for these properties is centered on operational efficiency and maximizing the yield from existing infrastructure, rather than aggressive growth initiatives. This approach ensures predictable cash flow, supporting the company's overall financial health.

Completed Development Projects

Completed development projects, like Corte Italia in Milan, are now fully let and are rapidly becoming significant cash generators for Covivio. These stabilized assets contribute substantially to recurring revenues due to their high occupancy and low ongoing capital expenditure needs.

These projects, having moved past their high-growth development stage, now represent strong cash cows for the company. Their established market presence in their respective sub-markets solidifies their position as reliable income streams.

- Corte Italia, Milan: Fully let and generating stable recurring revenue.

- High Occupancy Rates: Contributing to strong cash flow generation post-development.

- Minimal Ongoing CAPEX: Enhancing profitability of these mature assets.

- Market Share Dominance: Positioning them as established cash cows in their sub-markets.

Diversified Asset Base

Covivio's diversified asset base, spanning office, residential, and hotel sectors across France, Germany, and Italy, functions as a significant cash cow. This broad diversification across different property types and geographies naturally reduces exposure to any single market downturn, fostering a stable and consistent income stream.

The company's robust operational performance further solidifies its cash cow status. As of the first half of 2024, Covivio reported a high overall occupancy rate of 97.3%. This strong occupancy, coupled with an average firm lease term of 6.3 years across its portfolio, indicates a reliable and predictable generation of rental income, a hallmark of a cash cow business.

- Diversified Portfolio: Office, residential, and hotel sectors in France, Germany, and Italy.

- Risk Mitigation: Geographical and sectoral diversification reduces volatility.

- Strong Occupancy: 97.3% overall occupancy rate in H1 2024.

- Stable Lease Terms: Average firm lease term of 6.3 years ensures predictable revenue.

Covivio's mature office portfolio, particularly in prime German locations and Milan, functions as a classic cash cow. These assets, boasting a high 95.5% occupancy rate, generate consistent rental income with minimal need for further investment. The stability of these properties, despite some 2024 market adjustments, underpins their reliable contribution to Covivio's financial performance.

Similarly, Covivio's core residential portfolio outside of Berlin represents another significant cash cow. These established assets in mature markets provide a substantial and predictable income stream, requiring minimal capital expenditure to maintain their strong market position and generate consistent rental revenue. The German residential segment, as a whole, continued to be a revenue driver in 2024, focusing on operational efficiency.

Completed developments, such as Corte Italia in Milan, have now transitioned into cash cows. Fully let and generating stable recurring revenue, these stabilized assets benefit from high occupancy and low ongoing capital expenditure needs, enhancing their profitability and solidifying their role as reliable income generators for Covivio.

| Asset Class | Key Characteristics | Contribution to Cash Flow |

| Office Portfolio (Germany & Milan) | Prime locations, high occupancy (95.5%) | Stable, predictable rental income |

| Residential Portfolio (ex-Berlin) | Mature markets, established assets | Consistent rental revenue, low CAPEX |

| Stabilized Developments (e.g., Corte Italia) | Fully let, high occupancy | Significant recurring revenue, enhanced profitability |

What You’re Viewing Is Included

Covivio BCG Matrix

The Covivio BCG Matrix preview you're currently viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously prepared by industry experts, offers a clear strategic overview of Covivio's portfolio, enabling informed decision-making without any watermarks or demo content. You can confidently expect the exact same analysis-ready file, ready for immediate integration into your business planning and presentations.

Dogs

Covivio's non-strategic retail assets, while not a core focus, would likely be categorized as 'Dogs' in a BCG matrix. These properties typically reside in mature, low-growth markets and possess a small market share, leading to meager profits or even financial drains.

In 2024, Covivio continued its strategic asset rotation, aiming to divest underperforming and non-core retail holdings. This approach is designed to unlock capital from these less productive assets, allowing for reinvestment in more promising areas of their portfolio, such as their growing hotel and residential segments.

Older, less energy-efficient office buildings, particularly those not meeting current environmental standards or situated in less sought-after peripheral locations, can be categorized as Dogs in the Covivio BCG Matrix. The market's strong preference for prime, ESG-compliant office spaces significantly disadvantages these older assets, leading to reduced market share and stagnant or declining rental growth.

The cost of modernizing these properties to meet modern competitiveness and sustainability demands can be substantial, often proving uneconomical given their current market positioning. For instance, in 2024, the average cost to upgrade an older office building to meet LEED Gold certification can range from $50 to $150 per square foot, a significant capital outlay for assets with diminishing rental appeal.

Small, isolated hotel properties in slow markets often represent Covivio's 'Dogs' in the BCG Matrix. These assets may not benefit from the company's strategic regional clustering or newly integrated operating platforms, limiting their potential for growth and efficiency.

If these properties are situated in markets with low tourism growth or lack a distinct competitive advantage, they are likely to face challenges in capturing market share and achieving significant profitability. For instance, a standalone boutique hotel in a rural area with declining visitor numbers might fall into this category.

Their limited contribution to Covivio's overall portfolio value and performance means they could be considered for divestment. This aligns with Covivio's strategy to consolidate and strengthen its core hotel operations, focusing resources on assets with higher growth potential and strategic alignment.

Residential Properties in Stagnant German Sub-Markets

Residential properties held by Covivio in stagnant German sub-markets, characterized by minimal rental growth and flat demand, would likely be classified as Dogs in a BCG matrix. These assets typically exhibit a low market share within their specific geographic areas and offer limited potential for future appreciation or increased rental income.

Such holdings could represent a drag on Covivio's overall portfolio performance, tying up capital that could be deployed in more promising growth segments. For instance, if a particular German city experienced a significant slowdown in population growth or economic activity, its residential rental market might stagnate.

Consider a scenario where a sub-market saw average rental increases of only 0.5% annually between 2023 and 2024, compared to a national average of 2.8% in the same period. Properties within such a sub-market would fit the description of Dogs.

- Low Market Share: Properties in less dynamic German sub-markets may have a small footprint relative to the total rental stock.

- Limited Growth Prospects: Minimal rental growth and flat demand restrict the ability to increase revenue from these assets.

- Capital Tie-up: These properties can immobilize capital with low return on investment potential.

- Strategic Review: Covivio might consider selective divestment of these Dog assets if they do not contribute to the company's strategic goals of achieving substantial rental reversion.

Assets Targeted for Disposal or Conversion

Assets targeted for disposal or conversion by Covivio, such as properties deemed non-core or undergoing repurposing like office-to-hotel transformations, can be temporarily placed in the Dogs category of the BCG Matrix. These assets are often in a transitional phase, characterized by low or negative cash flow and a diminished effective market share as they are prepared for sale or redevelopment. Covivio's strategic disposal plan, which saw a notable number of assets earmarked for sale in 2024, underscores its active management of these transitional properties.

Covivio's strategy in 2024 included the disposal of several non-core assets, aiming to streamline its portfolio and focus on higher-growth segments. For instance, the company continued its strategy of divesting certain office properties that no longer aligned with its long-term vision, a move that directly impacts the composition of its asset base within a BCG framework.

- Non-Core Asset Disposals: Covivio's 2024 disposal program actively managed assets identified as non-core, impacting their categorization within strategic matrices.

- Transitional Properties: Assets undergoing conversion, such as office buildings being redeveloped into hotels, represent a temporary "Dog" status due to their transitional nature and potential for lower immediate returns.

- Portfolio Optimization: The active management and sale of these properties reflect Covivio's commitment to portfolio optimization, aiming to improve overall asset performance and cash flow generation.

Covivio's "Dogs" represent assets with low market share and limited growth prospects, often requiring strategic divestment or repositioning. These include underperforming retail spaces in mature markets and older office buildings not meeting modern ESG standards. For example, in 2024, Covivio continued its strategy of divesting non-core retail holdings, aiming to unlock capital from these less productive assets.

Small, isolated hotel properties in slow-growth tourism markets also fall into this category, lacking the benefits of regional clustering or integrated platforms. Similarly, residential properties in stagnant German sub-markets with minimal rental growth and flat demand are considered Dogs, potentially tying up capital with low ROI. Covivio's 2024 disposal program actively managed these non-core assets, reflecting a commitment to portfolio optimization.

| Asset Type | BCG Category | Characteristics | 2024 Strategic Action | Example Scenario |

| Non-strategic Retail | Dog | Mature markets, low growth, small market share | Divestment of underperforming holdings | Retail units in declining shopping centers |

| Older Office Buildings | Dog | Not ESG-compliant, peripheral locations, low demand | Active management, potential for disposal | Pre-2000 office blocks lacking modern amenities |

| Isolated Hotels | Dog | Low tourism growth, lack of competitive advantage | Focus on consolidation of core operations | Standalone boutique hotel in a rural area |

| Stagnant Residential | Dog | Minimal rental growth, flat demand in specific sub-markets | Selective divestment considered | Apartment buildings in German cities with low population growth |

Question Marks

Covivio is strategically focusing on office-to-hotel conversion projects, especially in eastern Paris. This aligns with a high-growth sector, hotels, though these specific projects are in an early development phase, meaning they currently have a low market share and are not yet generating revenue.

These ventures demand substantial capital, with a reported €150 million budget allocated for two such projects. The potential for high returns, estimated around a 6% yield, makes them attractive, but their ultimate success is contingent on successful market integration and operational efficiency.

Entering new geographical markets or niche real estate sectors like data centers or specialized logistics would position Covivio in potential high-growth areas within Europe. For instance, the European data center market was projected to grow significantly, with some reports indicating a compound annual growth rate exceeding 10% through 2028, presenting a substantial opportunity. These ventures would likely require substantial initial capital investment, acting as cash consumers with uncertain, delayed returns, fitting the profile of question marks in the BCG matrix.

Covivio's early-stage mixed-use development projects, focusing on integrated living, working, and hospitality, are positioned as potential future Stars in the BCG matrix. These ventures, though aligned with a growing urban development trend, currently represent a low market share due to their nascent stage. For instance, in 2024, the company continued to advance several such projects across European cities, requiring significant upfront capital for planning and initial construction phases.

The high capital expenditure for design, permitting, and early construction characterizes these early-stage projects. Their classification as potential Stars hinges on Covivio's strategic execution and the anticipated strong market demand for diversified urban spaces. By 2025, the success of these developments will be a key indicator of their transition from question marks to market leaders in the mixed-use real estate sector.

Exploration of New Technologies or Operational Models

Covivio is actively exploring nascent technologies and operational models that represent potential future growth drivers. These initiatives are characterized by their early-stage development, meaning they currently have a minimal market presence but hold the promise of significant disruption if they gain traction.

These ventures are speculative, demanding substantial research and development investment. Success could lead to a competitive edge, while failure might result in financial losses. For instance, pilot programs in AI-driven property management or the integration of advanced proptech solutions for enhanced tenant experience are areas of focus.

- Emerging Proptech Integration: Investments in pilot programs for AI-powered building diagnostics and predictive maintenance, aiming to reduce operational costs.

- Innovative Leasing Models: Testing flexible lease structures and co-living concepts in select urban markets to capture evolving tenant preferences.

- Sustainability Tech: Evaluating new green building materials and energy-efficient systems for potential large-scale deployment across the portfolio.

- Digital Twin Technology: Piloting the creation of digital twins for key assets to optimize space utilization and streamline facility management.

Minority Stakes in Emerging Ventures

Covivio's approach to minority stakes in emerging ventures, if placed within a BCG Matrix framework, would likely categorize these as Question Marks. These are investments in nascent, high-growth real estate segments or startups that align with future trends but currently hold a low market share for Covivio.

For instance, consider Covivio investing in a proptech startup focused on sustainable urban development. While the market for such solutions is projected to grow significantly, the startup itself is small and not yet a dominant player. This positions it as a Question Mark, requiring strategic evaluation.

- Low Market Share: Covivio's ownership stake is minority, meaning it doesn't control the venture or hold a significant market share within that specific niche.

- High Growth Potential: These ventures are in rapidly expanding sectors, offering the possibility of substantial future returns if they succeed.

- Strategic Decision Point: The core dilemma is whether to nurture these investments, potentially increasing stakes to gain control and market leadership, or to exit if the growth trajectory falters.

- Risk and Reward: Such investments carry inherent risk due to the unproven nature of the ventures but offer the potential for high rewards if they mature into market leaders.

Covivio's investments in nascent technologies and innovative business models, such as AI-driven property management or flexible leasing, are classic examples of Question Marks within the BCG framework. These initiatives are characterized by their early stage, meaning they have minimal market presence but significant potential for future growth and disruption.

These ventures require substantial capital for research, development, and pilot programs, acting as cash consumers with uncertain, delayed returns. For instance, Covivio’s exploration of digital twin technology for asset optimization represents a significant investment in a promising but not yet mainstream area.

The strategic decision for Covivio is whether to invest further to help these Question Marks mature into Stars or to divest if they fail to gain market traction. The success of these early-stage projects, like the pilot programs in advanced proptech, will determine their future contribution to the company's portfolio.

| Initiative | Market Potential | Current Market Share (Covivio) | Investment Needs | BCG Classification |

| AI-driven Property Management | High (Projected growth in proptech solutions) | Low (Pilot stage) | High (R&D, implementation) | Question Mark |

| Flexible Leasing Models | Moderate to High (Evolving tenant preferences) | Low (Testing phase) | Moderate (Market research, platform development) | Question Mark |

| Digital Twin Technology | High (Optimization and efficiency gains) | Very Low (Piloting) | High (Data acquisition, software integration) | Question Mark |

BCG Matrix Data Sources

Our Covivio BCG Matrix is constructed using a blend of internal financial statements, publicly available real estate market data, and expert analyses of growth sectors.