Covivio Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covivio Bundle

Covivio's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of substitute offerings in the hospitality and real estate sectors. Understanding these dynamics is crucial for assessing the company's profitability and strategic positioning.

The complete report reveals the real forces shaping Covivio’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Landowners hold considerable bargaining power, particularly when prime urban locations are scarce in France, Germany, and Italy. Covivio’s focus on integrated living, working, and hospitality spaces necessitates strategic land acquisition, where unique sites can fetch premium prices, underscoring the leverage sellers possess due to limited availability.

Construction companies like Covivio depend heavily on specialized contractors and specific building materials. Recent trends in Europe, such as the 2023 surge in construction material costs, which saw increases of up to 15% for key inputs like steel and concrete, highlight the significant leverage material providers can wield. This volatility directly impacts project budgets and timelines, giving suppliers considerable bargaining power.

Financial institutions hold significant bargaining power over real estate operators like Covivio, as access to competitive financing is essential for capital-intensive property development and acquisitions. While interest rates have shown signs of stabilization and potential decline, the cost and availability of debt remain influenced by banks and other lenders.

Covivio's robust financial standing and favorable credit ratings, such as its BBB- rating from S&P as of early 2024, help to lessen the direct impact of this supplier power. However, broader market conditions and the overall lending environment still exert influence on the terms of financing available to the company.

Specialized Service Providers

Specialized service providers like architects, urban planners, and property management firms possess considerable bargaining power when dealing with companies like Covivio. Their unique expertise in crafting integrated spaces or managing intricate property portfolios is crucial, especially for a company like Covivio that emphasizes innovative and sustainable development.

Covivio's commitment to high-quality, forward-thinking designs necessitates engaging providers with specific, often rare, skill sets. This demand for specialized talent means these firms can leverage their reputations and the scarcity of their services to negotiate favorable terms. For instance, a firm renowned for its sustainable building certifications might command higher fees, impacting Covivio's project costs.

- Specialized Expertise: Architects and urban planners offering unique design solutions or sustainability credentials can dictate terms.

- Portfolio Management: Firms adept at managing complex, multi-location real estate portfolios hold significant sway.

- Reputation and Demand: Covivio's need for high-quality, innovative services amplifies the bargaining power of well-regarded providers.

- Impact on Costs: The specialized nature of these services can directly influence project budgets and operational expenses for Covivio.

Technology and Digital Solution Providers

As real estate increasingly integrates smart building technologies and digital solutions for enhanced management and user experience, providers of these advanced systems are gaining significant leverage. Covivio's strategic focus on developing modern, connected spaces naturally leads to a reliance on cutting-edge technology providers.

The proprietary nature of some of these crucial digital solutions can result in higher switching costs for Covivio. This dependence strengthens the bargaining power of these technology suppliers, as transitioning to alternative providers may involve substantial investment and operational disruption.

- Increased Reliance on Smart Tech: By 2024, the demand for smart building technologies in commercial real estate, including energy management systems and digital access controls, continued its upward trajectory, with an estimated 70% of new office developments incorporating such features.

- Proprietary Software & Integration Costs: The integration of specialized digital platforms for property management, tenant engagement, and data analytics often involves proprietary software. The cost and complexity of replacing or integrating these systems can represent a significant barrier, thereby enhancing supplier power.

- Limited Supplier Pool for Niche Solutions: For highly specialized digital solutions, such as advanced IoT security platforms or AI-driven predictive maintenance software, the number of qualified providers can be limited, further concentrating bargaining power among a few key players.

Covivio's reliance on specialized construction materials and skilled labor grants significant bargaining power to suppliers. Escalating costs for key inputs, such as steel and concrete, which saw European prices rise by up to 15% in 2023, directly impact Covivio's project budgets, giving material providers considerable leverage.

Financial institutions also wield substantial influence, as access to competitive financing is critical for Covivio's capital-intensive operations. While Covivio's BBB- rating from S&P in early 2024 aids in securing favorable terms, the broader lending environment still dictates financing availability and cost.

Providers of specialized services, including architects and property management firms, hold significant bargaining power due to their unique expertise. Covivio's emphasis on high-quality, innovative, and sustainable development necessitates engaging these firms, whose reputations and specialized skills allow them to negotiate premium fees.

The increasing integration of smart building technologies and proprietary digital solutions further empowers technology suppliers. Covivio's dependence on these advanced systems, coupled with high switching costs, strengthens the leverage of these providers, particularly for niche solutions where the supplier pool is limited.

| Supplier Type | Bargaining Power Factor | Impact on Covivio | 2024 Data/Trend |

|---|---|---|---|

| Landowners | Scarcity of prime urban locations | Premium pricing for sites | Continued high demand for urban development sites in France, Germany, Italy. |

| Construction Material Providers | Volatility in raw material costs | Increased project budgets and timelines | European construction material costs up to 15% in 2023; continued supply chain sensitivities. |

| Financial Institutions | Access to capital and financing terms | Cost of debt and capital availability | Interest rate stabilization, but lending environment remains a key factor. Covivio's BBB- rating. |

| Specialized Service Providers (e.g., Architects) | Unique expertise and reputation | Higher fees for design and management | Demand for sustainable and innovative design credentials commands premium pricing. |

| Technology Providers (Smart Building) | Proprietary solutions and integration complexity | Higher switching costs, reliance on specific platforms | ~70% of new office developments in 2024 incorporate smart tech; limited suppliers for niche digital solutions. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Covivio's real estate and hospitality sectors.

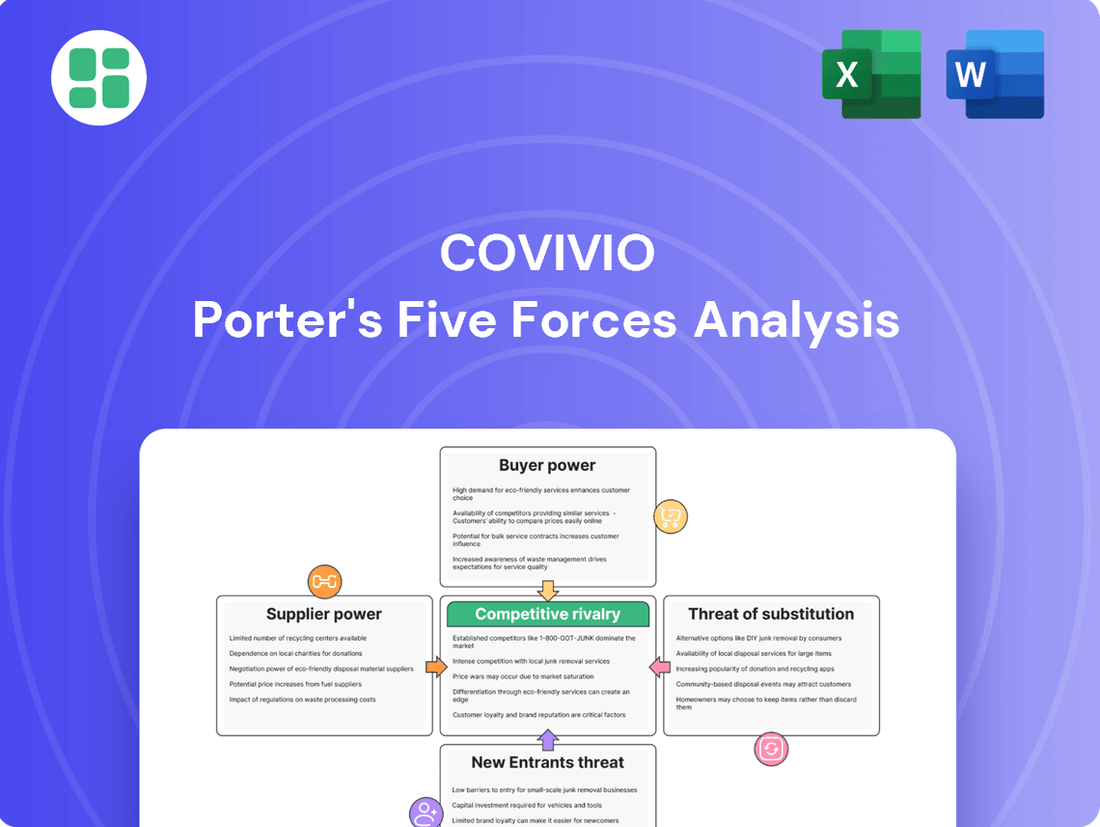

Instantly identify and strategize against competitive pressures with a clear, visual breakdown of Covivio's Porter's Five Forces.

Gain actionable insights into market dynamics, enabling proactive adjustments to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Large corporate office tenants hold significant sway when leasing substantial floor space. Their sheer size and the availability of numerous high-quality alternative office locations across major European cities mean they can negotiate advantageous lease agreements. For instance, in 2024, vacancy rates in prime office markets like Paris and Berlin remained a key factor, allowing large occupiers to secure favorable terms.

The bargaining power of residential tenants within Covivio's portfolio is a key factor to consider. This power isn't uniform; it fluctuates significantly based on the specific market and its location. For instance, in highly sought-after urban centers with a scarcity of available housing, tenant leverage tends to be quite limited.

Conversely, where affordability challenges are prominent or a wide array of housing choices exist, including the option of homeownership, tenants gain more sway. This can translate into greater price sensitivity and a stronger position to negotiate lease terms, impacting rental income for Covivio.

Individual hotel guests typically possess limited bargaining power. The sheer volume of hotels, particularly those accessible via online travel agencies, means a single guest's decision to book elsewhere has minimal impact on a hotel's overall revenue. For instance, in 2024, the global hotel market is characterized by intense competition, with millions of rooms available worldwide, making it difficult for any one customer to exert significant leverage.

However, guest influence can manifest indirectly. Loyalty programs, while designed to retain customers, also signal a guest's potential to switch if value propositions aren't met. Furthermore, the critical role of online reviews in shaping consumer perceptions means that hotels are highly sensitive to guest feedback, indirectly empowering guests to influence service standards and even pricing strategies to maintain positive online reputations.

Hotel Operators (B2B)

For Covivio, the bargaining power of its key hotel operator clients, such as Accor, Marriott, and IHG, is a crucial factor. These operators, managing a significant portion of Covivio's leased properties, wield considerable influence due to their brand recognition and extensive customer reach.

These major hotel groups can leverage their market position to negotiate favorable lease terms with Covivio. This often includes demanding rent structures that are tied to revenue performance, effectively shifting some of the financial risk to the property owner.

The long-term nature of these leasing agreements further solidifies the operators' bargaining power. Their established relationships and the capital invested in their brands mean they can command terms that reflect their contribution to the property's success.

- Significant Operator Influence: Major hotel brands like Accor and Marriott possess substantial bargaining power due to their brand strength and distribution networks.

- Revenue-Based Rent Negotiation: Operators can negotiate variable rent structures, directly linking lease payments to their revenue, impacting Covivio's income predictability.

- Long-Term Lease Advantages: Established, long-term leases provide operators with leverage, allowing them to secure terms that benefit their operational model.

- Brand and Network Strength: The operators' ability to attract and retain customers through their brands and loyalty programs enhances their negotiating position with lessors like Covivio.

Businesses Seeking Integrated Spaces

For businesses seeking Covivio's integrated living, working, and hospitality spaces, their bargaining power hinges on the uniqueness and customization of the services offered. If Covivio provides highly tailored, comprehensive solutions that are difficult for competitors to replicate, customer power is diminished.

In 2024, as businesses increasingly prioritize flexible and amenity-rich environments, the demand for such integrated spaces is growing. However, the availability of comparable offerings from other real estate providers directly influences customer leverage.

- Customer Dependence: The extent to which a business relies on Covivio's specific integrated model for its operations.

- Availability of Substitutes: The presence of alternative providers offering similar integrated living, working, and hospitality solutions.

- Switching Costs: The financial and operational effort required for a business to move from Covivio to another provider.

- Information Availability: How well-informed customers are about market alternatives and pricing.

Covivio's customers, particularly large corporate office tenants, exert considerable bargaining power. This is evident in their ability to negotiate favorable lease terms, especially in markets with higher vacancy rates. For example, in 2024, the availability of prime office space in cities like Paris meant these tenants could secure advantageous agreements, directly impacting Covivio's rental income potential.

Residential tenants' power varies by location; in competitive urban centers, their leverage is lower, while in areas with more housing options or affordability concerns, they gain more influence over pricing and lease conditions.

The hotel operator clients represent a significant customer segment with substantial bargaining power. Major brands like Accor and IHG can negotiate revenue-based rent structures, shifting financial risk to Covivio and influencing lease terms due to their market presence and long-term commitments.

What You See Is What You Get

Covivio Porter's Five Forces Analysis

This preview showcases the complete Covivio Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the real estate sector. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to actionable insights.

You are previewing the final, professionally formatted analysis. Once your purchase is complete, you will gain instant access to this exact document, enabling you to leverage its detailed breakdown of industry rivalry, buyer and supplier power, threat of new entrants, and substitute products without delay.

Rivalry Among Competitors

The European real estate market is a mosaic of many players, making it highly fragmented. Covivio competes across France, Germany, and Italy, where it encounters a wide array of rivals, including other major listed real estate firms, aggressive private equity funds, and nimble local developers.

This intense fragmentation fuels fierce competition. Companies are constantly battling for market share and the opportunity to acquire prime real estate assets. For instance, in 2023, the European commercial real estate investment volume reached approximately €250 billion, a figure that underscores the sheer scale of activity and the intense competition for these opportunities.

Covivio's strategy of a diversified portfolio spanning office, residential, and hotel sectors, with a focus on integrated living, working, and hospitality spaces, naturally places it in competition with numerous specialized players. For instance, in the office segment, it contends with major European office landlords, while the residential sector sees it up against large-scale residential developers and property managers. The hotel division competes with established hotel chains and independent operators, each possessing deep expertise and market share within their respective niches.

Competitive rivalry within the European real estate sector, a key factor influencing Covivio's market position, is intensifying. In 2024, the market is experiencing a stabilization and recovery, with projections indicating a significant uptick in investment volumes, particularly in prime segments. This renewed investor interest naturally fuels competition for high-quality assets and desirable tenants across various property types.

The intensity of this rivalry is directly tied to prevailing market conditions. For instance, in 2024, property values in many European capitals have shown resilience, and rental growth, especially in the office and hotel sectors, is a significant driver. This growth incentivizes more players to enter or expand their presence, leading to a more crowded and competitive landscape for Covivio.

High Fixed Costs and Exit Barriers

The real estate sector, including companies like Covivio, faces intense rivalry driven by substantial fixed costs. These costs are tied to acquiring, developing, and maintaining properties, making it challenging for firms to scale back operations. For instance, in 2024, the average cost of commercial property development in major European cities continued to be a significant barrier to entry and exit.

Exit barriers are also a major factor, stemming from the illiquid nature of real estate assets. Selling properties quickly without substantial loss can be difficult, compelling companies to compete aggressively to ensure consistent occupancy and revenue. This environment pushes firms to focus on maintaining high utilization rates rather than withdrawing from the market.

- High Capital Investment: Real estate development requires substantial upfront capital for land acquisition, construction, and permits.

- Illiquidity of Assets: Properties are not easily converted to cash, creating a disincentive to exit the market quickly.

- Occupancy Focus: Companies strive to maintain high occupancy to cover fixed costs and generate returns, intensifying competition for tenants.

Covivio's strategic management of its portfolio, evident in its strong occupancy rates across office and hotel segments throughout 2024, showcases its ability to effectively manage these competitive pressures. Maintaining high occupancy is crucial for profitability when fixed costs are considerable.

Sustainability and ESG Focus

Competitive rivalry is intensifying as sustainability and ESG factors become paramount. Occupiers and investors are increasingly seeking out green buildings, giving companies like Covivio, which invests in high-quality, ESG-compliant assets, a significant edge. This push compels rivals to also invest in sustainable practices, thereby heightening the competition for prime, future-proof properties.

For instance, in 2024, a significant portion of new real estate investments were directed towards assets with strong ESG credentials. Reports indicate that over 60% of institutional investors consider ESG performance a key factor in their property selection. This trend is not just about compliance; it's about future-proofing assets against regulatory changes and evolving tenant demands.

- ESG Investment Growth: Global sustainable investment assets were projected to exceed $50 trillion by the end of 2024, demonstrating the market's strong commitment to ESG principles.

- Tenant Demand: A 2024 survey revealed that 75% of corporate tenants prioritize energy-efficient and sustainably operated buildings when making leasing decisions.

- Green Building Premiums: Properties with high ESG ratings often command rental premiums of 5-10% compared to their less sustainable counterparts, a key driver of competitive advantage.

- Regulatory Landscape: Upcoming regulations in major European markets by 2025 will mandate stricter energy performance standards for commercial real estate, further incentivizing ESG investments.

Competitive rivalry within Covivio's operating markets remains a significant force, amplified by the fragmented nature of the European real estate landscape. In 2024, the market's recovery and increased investment volumes, particularly in prime segments, have intensified the battle for high-quality assets and desirable tenants across office, residential, and hotel sectors.

The substantial fixed costs associated with property acquisition, development, and maintenance, coupled with the illiquidity of real estate assets, compel companies to compete fiercely for occupancy and revenue, making market exits difficult. This dynamic is further fueled by the growing demand for ESG-compliant properties, with over 60% of institutional investors in 2024 prioritizing sustainability in their real estate selections, creating a premium for green buildings.

| Metric | 2024 Data/Projection | Impact on Rivalry |

|---|---|---|

| European CRE Investment Volume | Projected to exceed €260 billion | Increased competition for attractive deals. |

| ESG Investment Share | Over 60% of institutional investors | Heightened competition for sustainable assets. |

| Rental Growth (Office/Hotel) | Positive growth in key European cities | Attracts new entrants and intensifies competition for tenants. |

| Green Building Premium | 5-10% higher rentals | Drives competition to acquire and develop ESG-certified properties. |

SSubstitutes Threaten

The increasing adoption of remote and hybrid work models acts as a potent substitute for traditional office spaces, directly challenging the demand for conventional office leases. This shift means companies might reduce their physical footprints or embrace co-working solutions, impacting the core business of real estate operators like Covivio.

For instance, in 2024, many businesses continued to re-evaluate their office needs, with some studies indicating a sustained preference for hybrid arrangements. This trend necessitates that real estate providers, including Covivio, must adapt by offering more adaptable, amenity-rich environments to retain tenants and remain competitive in this evolving market.

For Covivio's hotel operations, the threat of substitutes is significant. These include the growing popularity of short-term residential rentals, such as Airbnb, and serviced apartments. Travelers are increasingly seeking alternatives that offer unique experiences and potentially more cost-effective or flexible arrangements compared to traditional hotels.

In 2024, the short-term rental market continued its robust expansion, with platforms like Airbnb reporting a substantial increase in bookings. This trend directly impacts hotels by offering travelers more diverse lodging choices, often at competitive price points, especially for longer stays or group travel. For instance, in major European cities where Covivio has a presence, the availability and appeal of alternative accommodations are high.

This competitive pressure compels hotels, including those in Covivio's portfolio, to differentiate themselves. They must focus on enhancing their value proposition by offering superior services, unique amenities, and memorable guest experiences. The ability to provide personalized service and consistent quality remains a key differentiator against the often more varied and less regulated substitute options.

The rise of online retail presents a significant threat of substitutes for traditional physical retail spaces, a factor that indirectly impacts companies like Covivio, even with their diversified portfolio. As consumers increasingly opt for e-commerce, the demand for brick-and-mortar stores diminishes, potentially affecting the value and occupancy of commercial properties that include retail elements. For instance, global e-commerce sales were projected to reach over $6.3 trillion in 2024, a substantial portion of which bypasses physical stores.

This substitution trend necessitates adaptation within the real estate sector. Companies must rethink the purpose of retail spaces, moving beyond mere transaction points to create engaging, experiential destinations that draw foot traffic. Alternatively, leveraging these spaces for last-mile logistics and fulfillment centers can offer a viable counter-strategy to the online retail onslaught.

Property Ownership for Residential Tenants

For residential tenants, the most significant substitute for renting is outright property ownership. When mortgage rates are low and housing prices are stable or declining, buying a home becomes a more appealing financial prospect for many, potentially reducing demand for rental units. For instance, in early 2024, mortgage rates in many Western markets remained elevated compared to previous years, which could have made renting a more attractive option for some, but the underlying trend of homeownership accessibility remains a key factor.

The affordability of purchasing a home directly impacts the attractiveness of renting. If home prices rise significantly faster than incomes, or if mortgage qualification becomes more stringent, the substitute of ownership weakens, benefiting rental providers like Covivio. Conversely, a market where homeownership is easily attainable and financially rewarding will naturally draw tenants away from the rental market.

- Homeownership Accessibility: Factors like down payment requirements and credit score thresholds for mortgages directly influence the ease with which tenants can become homeowners.

- Mortgage Rate Fluctuations: Changes in interest rates significantly alter the monthly cost of homeownership, making renting more or less appealing.

- Housing Price Trends: Rapid appreciation in property values can deter potential buyers, while falling prices might encourage them to enter the market, impacting rental demand.

Virtual and Digital Experiences

The rise of virtual and digital experiences presents a subtle but growing threat to certain physical real estate segments. As online platforms improve, they can displace the need for physical presence in some areas. For instance, the increasing sophistication of virtual conferences could reduce demand for convention centers, and streaming services might impact cinema attendance.

While not a direct substitute for all real estate, this trend can influence long-term demand for specific commercial and hospitality spaces. For example, the global virtual events market was valued at approximately USD 100 billion in 2023 and is projected to grow significantly, potentially impacting the need for physical event venues.

- Virtual conferences and online collaboration tools may reduce the need for corporate office space and business travel.

- The growth of streaming services and online gaming could decrease demand for physical entertainment venues like cinemas and arcades.

- The metaverse and immersive digital environments might offer alternative social and retail experiences, potentially affecting brick-and-mortar stores and entertainment hubs.

- Remote work trends, accelerated by digital technologies, continue to reshape office space utilization, with companies reassessing their physical footprints.

The threat of substitutes for Covivio's core businesses remains a critical consideration. For its office portfolio, the persistent adoption of remote and hybrid work models in 2024 continues to present a significant substitute for traditional office leases, driving companies to re-evaluate their physical space needs. Similarly, Covivio's hotel segment faces robust competition from short-term rental platforms like Airbnb, which offer travelers more flexible and often cost-effective lodging options.

| Substitute Type | Impact on Covivio | 2024 Trend/Data Point |

|---|---|---|

| Remote/Hybrid Work | Reduced demand for traditional office space | Continued re-evaluation of office footprints by businesses. |

| Short-Term Rentals (e.g., Airbnb) | Competition for hotel bookings | Robust expansion of the short-term rental market, increasing traveler choice. |

| Online Retail | Diminished demand for physical retail spaces | Global e-commerce sales projected to exceed $6.3 trillion in 2024. |

| Virtual Experiences | Potential impact on demand for physical venues | Global virtual events market valued at approx. USD 100 billion in 2023. |

Entrants Threaten

The real estate sector, especially for development and managing large portfolios, demands significant financial backing. This includes costs for acquiring land, building properties, and ongoing management, creating a substantial hurdle for newcomers. For instance, in 2024, major European real estate development projects often require hundreds of millions of euros in upfront capital.

Securing the necessary funding for these ventures is a major challenge for potential new entrants. This high capital requirement effectively limits the number of companies that can realistically enter the market and compete with established players like Covivio.

Covivio, having been in the market for some time, benefits from its established financial strength and ability to access various funding sources. This allows them to operate with economies of scale, further solidifying their competitive position against smaller, less capitalized potential competitors.

New players entering the European real estate sector, particularly in markets where Covivio operates like France, Germany, and Italy, face significant regulatory challenges. These include intricate zoning laws and planning permissions that can be time-consuming and costly to navigate. For instance, obtaining building permits in major German cities can extend over several months, sometimes even exceeding a year, depending on the project's complexity and location.

Covivio, as an established player, benefits from significant advantages in securing prime real estate locations and land banks across key European urban centers. This existing portfolio and access represent a substantial barrier for newcomers.

New entrants face the formidable challenge of acquiring desirable, well-situated land, which is either scarce or prohibitively expensive. For instance, in 2024, prime office space acquisition costs in cities like Paris or Berlin continued to escalate, making it extremely difficult for new developers to enter the market on a competitive footing.

Brand Reputation and Tenant Relationships

Building a strong brand reputation and cultivating long-term relationships with tenants, businesses, and local authorities is a time-intensive endeavor. Covivio's established presence and extensive network offer a significant competitive advantage, making it difficult for new entrants to replicate this trust and secure high-quality tenants and partnerships quickly.

Newcomers face substantial hurdles in mirroring Covivio's established market position and tenant loyalty. For instance, in the competitive European real estate market, securing prime locations and favorable lease agreements, which Covivio has achieved through years of relationship building, requires significant upfront investment and proven reliability.

- Brand Equity: Covivio's established brand name facilitates easier tenant acquisition and retention, a significant barrier for new entrants.

- Tenant Relationships: Long-standing partnerships with key tenants, often secured through tailored service and reliability, are difficult for new players to forge rapidly.

- Local Authority Engagement: Navigating local regulations and building trust with municipal bodies, crucial for development and operations, is a slow process for newcomers compared to established firms like Covivio.

Operational Expertise and Economies of Scale

Real estate development and management demand deep operational know-how, covering everything from construction oversight to tenant satisfaction. Established entities like Covivio leverage significant economies of scale in purchasing, administration, and funding. This efficiency advantage allows them to offer competitive pricing and superior service, creating a substantial barrier for newcomers aiming to enter the market.

- Operational Expertise: Covivio's experience in managing diverse property portfolios, including hotels and healthcare facilities, translates into streamlined operations and risk mitigation.

- Economies of Scale: For instance, in 2024, large real estate firms often secure bulk discounts on construction materials and property management software, which smaller competitors cannot match.

- Barriers to Entry: The capital intensive nature of real estate development, coupled with the need for specialized skills, significantly raises the hurdle for new entrants attempting to compete with established players like Covivio.

The threat of new entrants for Covivio in the real estate sector is generally moderate to low due to substantial barriers. High capital requirements, estimated in the hundreds of millions of euros for major European developments in 2024, are a primary deterrent. Navigating complex regulatory landscapes, such as lengthy permit processes in German cities that can exceed a year, further discourages new players.

Covivio's established brand equity, strong tenant relationships built over years, and access to prime locations present significant competitive advantages. Newcomers struggle to replicate this trust and secure favorable lease agreements, especially given escalating prime property costs in cities like Paris and Berlin in 2024.

Furthermore, Covivio benefits from operational expertise and economies of scale, allowing for bulk discounts on materials and software in 2024, which new entrants cannot easily match. These factors collectively create a challenging environment for new companies seeking to enter and compete effectively.

| Barrier Type | Description | Impact on New Entrants | Covivio Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment for land acquisition and development. | Significant hurdle, limiting market entry. | Established financial strength and access to funding. |

| Regulatory Hurdles | Complex zoning laws, planning permissions, and building permits. | Time-consuming and costly to navigate. | Experience in managing regulatory processes. |

| Brand & Relationships | Building reputation, tenant loyalty, and local authority trust. | Slow and difficult to establish. | Long-standing market presence and established networks. |

| Economies of Scale | Cost efficiencies in purchasing, administration, and operations. | Disadvantage for smaller, new players. | Leverages scale for competitive pricing and service. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Covivio leverages a comprehensive blend of data, including Covivio's official annual reports and investor presentations, alongside industry-specific market research from reputable firms like Statista and IBISWorld.