Covivio PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covivio Bundle

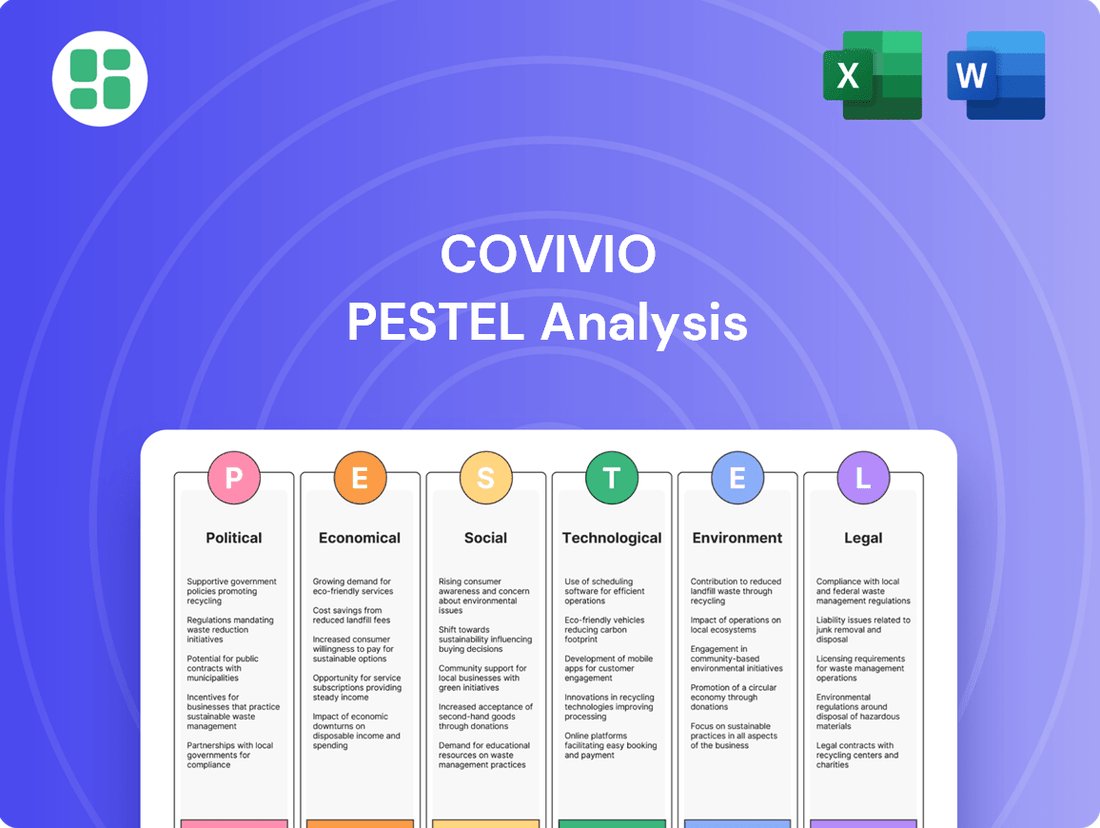

Our PESTEL analysis of Covivio reveals critical external factors shaping its market, from evolving social housing demands to the impact of sustainability regulations. Understand how these forces create both challenges and opportunities for the company. Download the full version to gain actionable intelligence and refine your strategic approach.

Political factors

Government real estate policies significantly shape Covivio's strategic direction. For instance, France's focus on urban regeneration projects, such as the Grand Paris initiative, presents opportunities for large-scale development. Germany's commitment to affordable housing, evidenced by its 2024 targets for new housing construction, influences the demand for specific property types.

Tax incentives for green building developments, a growing trend across all three operating countries, encourage Covivio to invest in sustainable construction. In 2024, Italy introduced new tax credits for energy efficiency renovations, directly impacting the renovation strategies for existing portfolios.

Covivio's operational landscape is significantly shaped by political stability in its key markets: France, Germany, and Italy, as well as the broader European Union. For instance, in 2023, France experienced significant political maneuvering around pension reforms, which, while not directly impacting real estate valuations, highlighted potential for social unrest that can indirectly influence investor sentiment.

Geopolitical risks, such as the ongoing conflict in Eastern Europe and evolving trade relationships, pose a tangible threat. These events can disrupt supply chains for construction materials and dampen cross-border investment, as seen in the broader European real estate market which experienced a slowdown in transaction volumes in early 2024 compared to previous years, reflecting heightened uncertainty.

Covivio's ability to navigate these political and geopolitical currents is crucial for maintaining investor confidence and ensuring stable capital flows. A stable political environment supports predictable regulatory frameworks and consistent economic growth, which are vital for property valuations and sustained demand across its diverse portfolio.

Urban planning and zoning regulations at both local and national levels significantly influence Covivio's operations by defining permissible land use, building heights, density, and architectural standards. These rules are paramount for the company's development pipeline, directly impacting the viability and financial success of new ventures. For instance, in France, the "Plan Local d'Urbanisme" (PLU) is a key document guiding development, and changes to it can delay or alter project scope.

Taxation policies on property ownership and transactions

Changes in property taxes, transaction duties, capital gains taxes, or corporate taxation rates in France, Germany, and Italy can significantly impact Covivio's profitability and investment returns. For instance, France's ongoing efforts to adjust property taxation, including potential shifts in local property tax (taxe foncière) bases, directly influence holding costs. Similarly, variations in transaction taxes like Italy's Imposta di Registro or Germany's Grunderwerbsteuer affect acquisition expenses, a key consideration for Covivio's portfolio growth.

These fiscal policies directly influence acquisition costs, holding costs, and disposal proceeds, thereby impacting the financial viability of real estate assets. For example, a rise in capital gains tax rates on property disposals in any of Covivio's operating markets could reduce net proceeds from asset sales. Monitoring legislative changes is vital for accurate financial forecasting and strategic planning.

Key fiscal considerations for Covivio include:

- Property Tax Adjustments: Fluctuations in property tax rates and assessment methods in France, Germany, and Italy.

- Transaction Duty Variations: Changes in stamp duties, registration fees, and other transaction-related taxes impacting property purchases.

- Capital Gains Tax Impact: Evolving capital gains tax regimes affecting profits realized from property sales.

- Corporate Tax Rates: Shifts in corporate income tax affecting Covivio's overall profitability and reinvestment capacity.

Impact of EU regulations and directives

As a significant operator within the European Union, Covivio must navigate a complex web of EU directives and regulations. These are particularly impactful in areas like energy efficiency, sustainability reporting, and financial transparency, shaping operational strategies and investment priorities. For instance, the EU Taxonomy Regulation, fully applicable from January 1, 2023, mandates detailed reporting on the environmental sustainability of economic activities, directly affecting how Covivio must classify and disclose its real estate portfolio's environmental performance.

While these EU-wide regulations aim to harmonize standards and foster a more sustainable and transparent market, they also introduce new compliance obligations. These can necessitate substantial operational adjustments and significant capital investment to meet evolving requirements, such as those outlined in the Energy Performance of Buildings Directive (EPBD), which continues to be updated, with new revisions expected to be finalized in 2024, pushing for higher energy efficiency standards.

Adherence to these directives is not optional; it is a prerequisite for continued operation within the EU's single market. Covivio's commitment to these regulations, including those related to financial disclosure and corporate governance, is crucial for maintaining market access and investor confidence. For example, the Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies from financial year 2024, requires more extensive and standardized sustainability disclosures.

- Energy Efficiency: Compliance with evolving EPBD standards, potentially requiring retrofitting of existing assets.

- Sustainability Reporting: Meeting the detailed disclosure requirements of the CSRD and EU Taxonomy Regulation.

- Financial Transparency: Adhering to EU financial reporting standards and directives to ensure clarity for investors.

- Market Access: Maintaining compliance as a fundamental requirement for operating across EU member states.

Government policies directly influence Covivio's real estate development and investment strategies. For example, France's urban regeneration projects and Germany's affordable housing targets in 2024 shape demand for specific property types. Tax incentives for green building, such as Italy's 2024 energy efficiency credits, encourage sustainable investments.

Political stability in France, Germany, and Italy is crucial, as demonstrated by the indirect impact of France's 2023 pension reform debates on investor sentiment. Geopolitical risks, like the ongoing conflict in Eastern Europe, have impacted European real estate transaction volumes in early 2024, highlighting supply chain and investment uncertainties.

Urban planning and zoning regulations, such as France's PLU, dictate land use and building standards, directly affecting project viability. Changes in property taxes, transaction duties, and capital gains taxes, like France's ongoing adjustments to the taxe foncière, significantly impact Covivio's profitability and acquisition costs.

Covivio must navigate EU directives like the updated Energy Performance of Buildings Directive (EPBD) and the Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies in 2024. These regulations necessitate compliance for market access and investor confidence, impacting operational strategies and requiring capital for retrofitting and enhanced disclosure.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Covivio, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making by identifying key trends and potential challenges and opportunities within Covivio's operating landscape.

Covivio's PESTLE analysis offers a structured approach to identifying and mitigating external risks, thereby relieving the pain point of uncertainty in strategic decision-making.

Economic factors

Fluctuations in interest rates, particularly those set by the European Central Bank (ECB), directly influence Covivio's financial strategy. For instance, if the ECB maintains its key interest rates at 4.50% as it did in September 2023, this translates to higher borrowing costs for Covivio when financing new acquisitions or ongoing development projects. Conversely, a reduction in these rates, as seen in previous years, would lower debt servicing expenses, potentially boosting profitability and the attractiveness of new investments.

Access to a variety of financing channels is paramount for Covivio. In 2024, the company's ability to secure competitive debt and equity financing will be key to funding its substantial property portfolio, which includes significant investments in healthcare and office real estate. For example, in 2023, Covivio successfully refinanced €1.4 billion of its debt, demonstrating its ongoing need for robust financing relationships to support its growth ambitions.

Inflation significantly impacts Covivio's operational landscape, particularly concerning construction costs. For instance, the Producer Price Index (PPI) for construction inputs in the Eurozone saw a notable increase, contributing to higher material expenses. This trend directly affects the profitability of new development projects and escalates ongoing property management costs.

The elevated cost of construction materials and labor, driven by inflation, necessitates careful financial planning for Covivio. Companies like Covivio must adapt their pricing strategies for rental yields and property valuations to offset these rising expenses and maintain healthy profit margins. Proactive cost management and strategic adjustments are crucial for navigating this economic factor.

Covivio's performance is closely tied to the economic growth forecasts in its core markets of France, Germany, and Italy. For instance, France's GDP growth was projected to be around 1.3% in 2024, while Germany's was anticipated at 0.3% and Italy's at 0.7%, according to IMF estimates in early 2024. These figures directly influence the demand for office, retail, and hospitality spaces, as stronger economic expansion typically fuels business investment and consumer spending, boosting rental income and property valuations.

A robust economy generally translates to increased business activity and higher employment rates across these nations, which in turn supports demand for Covivio's diverse property portfolio. For example, a healthy job market in major French cities like Paris would likely increase demand for office leases, while rising disposable incomes in Germany could boost retail occupancy. Conversely, economic slowdowns or recessions in these key European economies can lead to reduced leasing activity and downward pressure on rental rates and property values.

Employment rates and disposable income

Robust employment rates and increasing disposable income are significant drivers for Covivio's real estate portfolio. In the Eurozone, for instance, unemployment rates have shown a generally downward trend leading up to mid-2024, with many countries reporting levels below 7%. This signifies a larger pool of individuals with stable earnings, directly impacting housing demand and rental affordability.

Rising disposable income further bolsters these trends. As households have more money after essential expenses, they are more likely to invest in housing or spend on retail and office space. This translates to stronger demand for Covivio's residential properties, potentially leading to higher occupancy rates and rental growth, and also supports demand for commercial spaces as businesses expand and consumer spending increases.

- Eurozone unemployment rate: Averaging around 6.0% in early 2024, indicating a healthy labor market.

- Disposable income growth: Expected to see modest but consistent growth across key European markets in 2024-2025, supporting consumer spending.

- Impact on residential: Higher purchasing power and rental affordability for a larger segment of the population.

- Impact on commercial: Increased business confidence and consumer activity driving demand for office and retail spaces.

Real estate market cycles and investment trends

Covivio navigates the inherent cyclicality of real estate markets, which significantly impacts investment strategies. For instance, the European commercial real estate market saw a notable slowdown in transaction volumes during 2023, with a reported 50% year-on-year decrease in major European cities according to JLL. This highlights the importance of anticipating downturns and capitalizing on upswings.

Current investment trends show a strong preference for resilient sectors. The logistics sector, driven by e-commerce growth, and the healthcare real estate segment, fueled by an aging population, are particularly attractive. In 2024, investment in European logistics is projected to remain robust, while healthcare assets continue to demonstrate stable rental growth and low vacancy rates.

Covivio's strategic allocation of capital must consider these evolving trends to optimize portfolio performance. Diversification across sectors and geographies is key to mitigating risks associated with specific market cycles. For example, while office markets faced challenges in 2023, with vacancy rates increasing in many European capitals, sectors like build-to-rent residential and student housing have shown greater resilience.

- European Commercial Real Estate Transaction Volumes: A 50% year-on-year decrease was observed in major European cities during 2023.

- Logistics Sector Investment: Projected to remain strong throughout 2024, supported by sustained e-commerce demand.

- Healthcare Real Estate Performance: Continues to exhibit stable rental growth and low vacancy rates, making it an attractive investment.

- Office Market Challenges: Increased vacancy rates in many European capitals during 2023, impacting traditional office investments.

Economic factors significantly shape Covivio's operational environment. Interest rate decisions by the European Central Bank directly impact borrowing costs, with rates around 4.50% in late 2023 increasing financing expenses for new projects. Inflation, particularly in construction, raises material and labor costs, affecting project profitability and property management expenses. Economic growth forecasts for France, Germany, and Italy, such as projected GDP growth of 1.3%, 0.3%, and 0.7% respectively for 2024, influence demand for Covivio's properties by affecting business activity and consumer spending.

| Economic Factor | 2023/2024 Data Points | Impact on Covivio |

|---|---|---|

| ECB Interest Rates | Around 4.50% (September 2023) | Higher borrowing costs for debt financing. |

| Eurozone Inflation (Construction) | Notable increase in Producer Price Index (PPI). | Increased material and labor costs for development. |

| French GDP Growth (2024 est.) | ~1.3% (IMF early 2024) | Influences demand for office and retail spaces. |

| German GDP Growth (2024 est.) | ~0.3% (IMF early 2024) | Influences demand for office and retail spaces. |

| Italian GDP Growth (2024 est.) | ~0.7% (IMF early 2024) | Influences demand for office and retail spaces. |

| Eurozone Unemployment Rate | ~6.0% (early 2024) | Indicates a healthy labor market supporting housing demand. |

What You See Is What You Get

Covivio PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed Covivio PESTLE analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. It's designed to offer actionable insights for strategic planning and decision-making.

Sociological factors

Demographic shifts, like an aging population and smaller households, are reshaping property demand. For example, in Europe, the proportion of people aged 65 and over is projected to reach 27.7% by 2050, up from around 20% in 2023. This trend increases the need for senior living facilities and adaptable housing solutions.

Urbanization continues to concentrate populations in cities, fueling demand for well-located, integrated living and working spaces. By 2050, it's estimated that 68% of the world's population will live in urban areas, a significant increase from 57% in 2023. Covivio needs to develop properties that offer convenience and accessibility within these growing urban centers.

The rise of hybrid and remote work is fundamentally reshaping office space needs. By 2024, a significant portion of the workforce, estimated to be around 30-40% in many developed economies, is expected to continue working remotely or in a hybrid capacity, according to various industry reports. This trend directly challenges the traditional model of large, centralized office spaces.

Covivio must adapt its portfolio to cater to these evolving work patterns. This means shifting focus from sheer square footage to creating flexible, collaborative, and amenity-rich environments. For instance, offering adaptable layouts, advanced technology infrastructure for seamless hybrid meetings, and on-site services like wellness facilities or co-working hubs will be crucial for attracting and retaining tenants in 2024 and beyond.

Modern tenants and residents are increasingly valuing convenience and a holistic lifestyle, driving demand for properties that seamlessly integrate living, working, and leisure. This shift is evident in the growing popularity of mixed-use developments. For instance, a 2024 survey indicated that over 60% of urban dwellers prefer to live in areas offering easy access to both residential and commercial amenities.

Covivio's strategic emphasis on developing integrated spaces directly addresses this evolving consumer preference. By offering a curated environment that combines residential units with co-working facilities, fitness centers, and retail outlets, the company enhances occupant convenience and overall quality of life. This approach is crucial for maintaining a competitive edge in the current real estate market.

Adapting property design and management to incorporate these integrated living concepts is paramount for Covivio. Understanding that a significant portion of the tenant base, particularly younger professionals, prioritizes flexible work arrangements and on-site amenities means that developers must continue to innovate. In 2025, reports suggest that properties featuring robust co-working infrastructure saw a 15% higher occupancy rate compared to those without.

Demand for sustainable and well-being properties

Societal awareness of environmental and health concerns is rapidly increasing, directly influencing real estate preferences. This growing consciousness fuels a demand for properties that are not only sustainable but also actively contribute to the well-being of their occupants. For instance, a 2024 report indicated that over 60% of European renters now consider energy efficiency a key factor in their housing choices, a significant jump from previous years.

Covivio needs to adapt by developing and managing properties that excel in energy efficiency, ensure excellent indoor air quality, and provide access to natural light and green spaces. These features are no longer niche but are becoming standard expectations, directly impacting property valuation and market appeal. Buildings that prioritize occupant health and environmental performance are demonstrating higher occupancy rates and rental premiums, a trend expected to continue through 2025.

- Growing Demand: Over 60% of European renters in 2024 prioritize energy efficiency.

- Well-being Features: Access to green spaces and good indoor air quality are increasingly important.

- Market Impact: Sustainable properties command higher occupancy and rental premiums.

- Societal Shift: This reflects a fundamental change in consumer values towards health and environment.

Migration patterns and cultural diversity

Migration within Europe and from outside the EU significantly shapes population dynamics in urban centers, directly influencing housing demand and the need for a variety of commercial services. For instance, in 2024, the European Union saw continued net migration contributing to population growth in key cities, a trend expected to persist. This demographic influx enhances cultural diversity, creating new market segments that property developers like Covivio must acknowledge.

Covivio’s strategic planning for new developments and the management of its existing property portfolio needs to be acutely aware of these ongoing demographic shifts. Effectively catering to the diverse needs and preferences of multicultural communities is paramount for success. This includes understanding variations in housing requirements and the demand for specific commercial offerings, such as diverse retail and food services.

- Increased Urbanization: Migration often funnels into major cities, intensifying demand for residential and commercial spaces.

- Cultural Integration: Diverse populations require adaptable living and commercial environments that accommodate various cultural practices and needs.

- New Market Opportunities: The presence of multicultural communities can unlock new revenue streams through specialized services and retail catering to specific ethnic groups.

- Infrastructure Strain: Rapid population growth due to migration can place pressure on existing infrastructure, necessitating careful planning for public services and transportation.

Societal values are shifting, with a growing emphasis on health, well-being, and sustainability influencing housing choices. This means properties that offer green spaces, excellent indoor air quality, and energy efficiency are increasingly sought after. For instance, a 2024 survey revealed that over 60% of European renters consider energy efficiency a primary factor in their decision-making.

Covivio must prioritize developing and managing assets that align with these evolving tenant expectations. Properties demonstrating strong environmental performance and occupant well-being features are likely to command higher occupancy rates and rental premiums, a trend projected to continue through 2025.

Migration patterns are also reshaping urban demographics, increasing demand for diverse housing and commercial services. In 2024, net migration continued to contribute to population growth in key European cities, fostering cultural diversity and creating new market segments for developers to address.

| Sociological Factor | Impact on Covivio | 2024/2025 Data Point |

|---|---|---|

| Health & Sustainability Focus | Increased demand for energy-efficient, healthy living spaces. | 60%+ of European renters prioritize energy efficiency (2024). |

| Urbanization & Migration | Growing demand in cities, need for diverse housing and services. | Continued net migration contributing to urban population growth (2024). |

| Hybrid Work Trends | Need for flexible, amenity-rich office and residential spaces. | 30-40% workforce expected to remain hybrid/remote (2024). |

| Lifestyle Integration | Preference for mixed-use developments offering convenience. | 60%+ urban dwellers prefer easy access to residential/commercial amenities (2024). |

Technological factors

The integration of PropTech, like IoT sensors and AI analytics, is revolutionizing property management. These technologies boost efficiency and tenant satisfaction. For instance, smart building systems can optimize energy usage, with studies suggesting potential savings of 10-20% on utility costs.

Covivio can harness these smart building solutions to streamline maintenance and create personalized living or working spaces. Collecting data through these systems allows for better property performance insights. This proactive approach is crucial for maintaining a competitive edge in the evolving real estate market.

The real estate sector is rapidly embracing digitalization, with platforms now streamlining everything from property sales and leasing to day-to-day management. This shift offers unprecedented transparency and efficiency for all parties involved. For instance, in 2024, PropTech startups in Europe secured over €5 billion in funding, highlighting the significant investment and innovation in this space.

Covivio can leverage these digital advancements to enhance its operations. Imagine using digital tools for seamless tenant communication, digitizing lease agreements for faster execution, and offering virtual property tours to a wider audience. These innovations can significantly cut down on administrative tasks and elevate the customer experience, making property interactions smoother and more engaging.

The ongoing digital transformation is not just a trend; it's a fundamental requirement for staying competitive in today's real estate market. Companies that actively adopt and integrate digital solutions are better positioned to manage assets, attract and retain tenants, and ultimately drive growth and profitability in the coming years.

Innovations like modular construction, 3D printing for building parts, and advanced robotics are reshaping the construction landscape. These technologies promise to slash building times, cut expenses, and minimize waste. For instance, modular construction can speed up project delivery by up to 50% compared to traditional methods.

Covivio can leverage these advancements to boost project completion speed, elevate construction quality, and improve their sustainability profile. This integration could lead to more efficient and eco-conscious developments, fundamentally changing how projects are brought to life. The global 3D printing construction market is projected to reach $1.5 billion by 2027, indicating significant growth potential.

Data analytics for market insights and predictive maintenance

Covivio is increasingly leveraging advanced data analytics to sharpen its understanding of market dynamics, tenant preferences, and the performance of its diverse property portfolio. This allows for more informed strategic planning and operational adjustments, crucial in the fast-evolving real estate sector.

The application of big data analytics enables Covivio to identify emerging market trends and predict tenant behavior with greater accuracy. For instance, analyzing vast datasets on rental demand and occupancy rates across different European cities helps in optimizing leasing strategies and identifying high-potential investment areas. In 2024, the company's focus on data-driven insights is expected to refine its portfolio allocation, potentially leading to improved rental yields.

Predictive maintenance, a key technological factor, is transforming Covivio's property management. By analyzing sensor data from building systems, potential equipment failures can be anticipated, minimizing costly downtime and enhancing operational efficiency. This proactive approach not only reduces repair expenses but also improves tenant satisfaction by ensuring a reliable environment. For example, early detection of HVAC issues in a large office building can prevent significant disruption and associated repair costs, contributing to a better bottom line.

Covivio's strategic adoption of data analytics provides a distinct competitive advantage.

- Market Insights: Enhanced understanding of rental demand, occupancy trends, and geographic market performance.

- Tenant Behavior: Deeper analysis of tenant needs and preferences to optimize service offerings and leasing terms.

- Operational Efficiency: Predictive maintenance reduces unexpected equipment failures, lowering repair costs and improving building uptime.

- Strategic Decision-Making: Data-driven insights support more accurate investment decisions and portfolio optimization.

Cybersecurity risks and data privacy

As Covivio's real estate operations become more digital, cybersecurity risks and data privacy are significant concerns. The company must invest heavily in advanced security measures to shield sensitive tenant information, financial records, and critical operational systems from cyber threats. A 2024 report indicated that the average cost of a data breach for organizations globally reached $4.45 million, highlighting the financial imperative for robust protection.

Maintaining compliance with evolving data privacy regulations, such as the General Data Protection Regulation (GDPR), is essential for Covivio to preserve customer trust and avoid substantial financial penalties. Failure to comply can lead to significant fines; for instance, under GDPR, penalties can reach up to 4% of global annual turnover or €20 million, whichever is greater. Safeguarding digital assets is therefore not just a technical necessity but a fundamental aspect of business continuity and reputation management.

- Increased reliance on digital platforms amplifies the threat landscape for real estate firms like Covivio.

- Significant investment in cybersecurity is crucial to protect tenant data and financial information.

- GDPR and similar data privacy regulations necessitate strict adherence to avoid severe penalties.

- Protecting digital assets is vital for maintaining operational integrity and stakeholder confidence.

Technological advancements are fundamentally reshaping the real estate sector, offering Covivio opportunities for enhanced efficiency and innovation. The integration of PropTech, including IoT sensors and AI analytics, is optimizing property management, with smart building systems potentially reducing utility costs by 10-20%. Digitalization streamlines operations from sales to management, evidenced by over €5 billion in PropTech funding in Europe during 2024, underscoring rapid innovation.

Covivio can leverage these digital tools for improved tenant communication, faster lease processing, and virtual tours, reducing administrative burdens and enhancing customer experience. Innovations like modular construction and 3D printing are also accelerating project delivery by up to 50% and cutting costs, positioning Covivio for more efficient and sustainable developments. The company's focus on data analytics in 2024 aims to refine portfolio allocation for better rental yields.

However, increased reliance on digital platforms elevates cybersecurity risks, with the average cost of a data breach reaching $4.45 million globally in 2024. Covivio must invest in robust security measures to protect sensitive data and ensure compliance with regulations like GDPR, which can impose fines up to 4% of global annual turnover, safeguarding operational integrity and stakeholder trust.

Legal factors

Covivio must meticulously follow stringent national and local building codes, fire safety regulations, and accessibility standards for all its development and renovation endeavors. Failure to comply can result in substantial fines, project postponements, or even orders for demolition. For instance, in 2024, the European Union continued to emphasize stricter energy efficiency standards for new constructions, impacting material choices and design for companies like Covivio.

Covivio operates across France, Germany, and Italy, each with distinct legal landscapes governing tenant rights and landlord obligations. These laws dictate everything from permissible rent increases, such as the controlled rent adjustments in Germany, to the specific procedures for maintenance and eviction, which can be quite stringent in France. Navigating these differences is paramount for Covivio to ensure compliance and foster stable tenant relations across its portfolio.

Understanding these legal nuances is not merely about avoiding penalties; it's about building trust and operational efficiency. For instance, German tenancy law, influenced by the Mietpreisbremse (rent brake) policy, aims to limit rent hikes in high-demand areas, a factor Covivio must consider in its rental income projections. Similarly, French law places significant emphasis on the landlord's duty to provide habitable housing, requiring diligent maintenance and clear communication to prevent disputes.

Covivio's ability to adapt to these varying legal requirements is a key operational strength. With over 43,000 rental units as of the end of 2023, the company’s legal teams must possess deep expertise in each jurisdiction to manage lease agreements, handle potential tenant grievances, and execute property management strategies effectively, thereby minimizing legal risks and ensuring consistent adherence to local regulations.

Environmental protection laws are becoming more rigorous, impacting companies like Covivio. Both national and European Union directives are pushing for higher building performance standards. This means companies must pay close attention to how their properties consume energy, their carbon footprint, and how they manage waste.

Compliance with these evolving regulations, which cover areas like energy usage and sustainable material sourcing, often necessitates substantial investment. For instance, upgrades to meet new energy efficiency standards can be costly. Covivio, like others in the real estate sector, will likely need to allocate capital towards green building certifications and retrofitting existing properties to meet these growing legal demands.

Data protection regulations (e.g., GDPR)

The General Data Protection Regulation (GDPR) significantly impacts how Covivio handles personal data for tenants, employees, and clients. Compliance necessitates stringent measures for data collection, storage, and processing, aiming to safeguard sensitive information. Failure to adhere to GDPR can result in substantial fines, with potential penalties reaching up to 4% of global annual turnover or €20 million, whichever is higher. For instance, in 2023, companies across various sectors faced significant fines for data breaches and non-compliance, highlighting the critical nature of these regulations.

Covivio must maintain robust data security protocols to prevent unauthorized access and breaches. This includes implementing encryption, access controls, and regular security audits. Data privacy is not just a legal obligation but also a crucial aspect of maintaining trust and reputation among stakeholders. A strong commitment to data protection enhances customer loyalty and can be a competitive differentiator in the real estate sector.

- GDPR fines can reach up to 4% of global annual turnover or €20 million.

- Robust data security is essential for tenant and client trust.

- Non-compliance poses significant reputational and financial risks.

Competition law and anti-trust regulations

Covivio operates in real estate markets subject to stringent competition laws and anti-trust regulations, both at national and European Union levels. These rules are in place to prevent monopolistic practices, price-fixing cartels, and other unfair trading behaviors that could stifle competition. For instance, the European Commission actively monitors mergers and acquisitions in sectors like real estate to ensure they do not lead to a significant lessening of competition. In 2024, ongoing investigations into potential anti-competitive behavior within the property development sector underscore the importance of compliance.

These regulations directly impact Covivio's strategic decisions regarding mergers, acquisitions, and any moves that might suggest market dominance. Failure to comply can result in substantial fines and legal challenges, impacting financial performance and reputation. For example, in 2023, a significant fine was levied against a consortium of real estate firms in Germany for bid-rigging, highlighting the enforcement risks.

- Mergers and Acquisitions Scrutiny: Covivio must navigate regulatory approvals for any significant M&A activity to ensure it does not create anti-competitive market structures.

- Anti-Cartel Enforcement: Strict adherence to laws prohibiting price-fixing and market allocation agreements is crucial to avoid severe penalties.

- Market Dominance: Covivio must be mindful of its market share and avoid practices that could be construed as abusing a dominant position.

- Compliance Costs: Maintaining robust internal compliance programs and seeking legal counsel incurs ongoing operational costs.

Covivio's operations are significantly shaped by evolving legal frameworks concerning property development and management, especially regarding environmental standards and energy efficiency. For instance, EU directives in 2024 continue to push for higher building performance, impacting material choices and design for companies like Covivio. Failure to comply with national and local building codes, fire safety, and accessibility standards can lead to substantial fines or project delays.

Environmental factors

Covivio faces significant physical risks from climate change, with an increasing likelihood of extreme weather events like floods and heatwaves directly impacting its property portfolio. For example, the European Environment Agency reported that in 2023, floods caused an estimated €6.5 billion in damages across Europe, highlighting the vulnerability of real estate assets.

To counter these threats, Covivio is actively pursuing adaptation strategies. These include investing in resilient building designs and implementing measures like enhanced flood defenses and heat mitigation systems within its properties. This proactive approach is crucial for safeguarding asset value and ensuring operational continuity in the face of evolving environmental challenges.

Governments and the EU are pushing for ambitious decarbonization, with the building sector facing stringent energy reduction and emissions targets. For instance, the EU's Energy Performance of Buildings Directive (EPBD) is being revised to accelerate renovations and improve energy efficiency, aiming for a net-zero emissions building stock by 2050. This regulatory push necessitates significant investment in energy-efficient technologies, renewable energy integration, and sustainable materials for property portfolios.

Covivio must prioritize investments in upgrades that enhance energy efficiency and incorporate renewable energy sources to align with these evolving environmental standards. This proactive approach not only ensures compliance but also improves the long-term value and appeal of its properties, making it a crucial driver for portfolio modernization and a key factor in maintaining a competitive edge in the real estate market.

The increasing preference for green certifications like LEED and BREEAM is directly impacting property valuations and tenant appeal. For instance, buildings with LEED Platinum certification can command higher rents and occupancy rates compared to those without. This trend is accelerating, with a significant portion of new commercial real estate projects aiming for these environmental standards by 2025.

Covivio's strategic focus on incorporating sustainable, recycled, and low-impact materials in its construction and renovation projects is crucial for securing these sought-after certifications. This not only aligns with growing investor and tenant demands for environmental responsibility but also positions Covivio as a market leader. By prioritizing these materials, the company demonstrably enhances its portfolio's long-term value and attractiveness.

Waste management and circular economy principles

Covivio's commitment to effective waste management, particularly in construction and ongoing operations, is a key environmental consideration. For instance, in 2023, the company reported a focus on reducing construction waste, aiming for a 10% reduction in landfill waste from new projects. This aligns with broader industry trends where companies are increasingly scrutinized for their environmental footprint.

Embracing circular economy principles is central to Covivio's strategy for minimizing waste and conserving resources. This involves prioritizing the reuse of building materials and designing structures with deconstruction in mind, facilitating future material recovery. Such practices are becoming standard, with many European real estate firms setting ambitious targets for material reuse in new developments.

Covivio's initiatives in waste management and circularity directly support a more sustainable approach to the entire building lifecycle. This not only lessens environmental impact but also offers potential for reduced operational costs through efficient resource utilization. For example, by 2024, the company aimed to increase the proportion of recycled materials used in renovations to 30%, a move that can lead to significant savings on raw material procurement.

- Waste Reduction Targets: Covivio aims to decrease landfill waste from construction sites by 10% by the end of 2024.

- Circular Economy Integration: The company is actively incorporating material reuse and design for deconstruction into its development processes.

- Recycled Material Usage: A goal of using 30% recycled materials in renovation projects was set for 2024.

- Operational Efficiency: Sustainable waste management practices are expected to contribute to lower long-term operational expenses.

Biodiversity protection and land use regulations

Environmental regulations are tightening, with a significant focus on safeguarding biodiversity and implementing responsible land use practices, particularly for new construction on undeveloped land. Covivio must proactively evaluate and minimize the ecological footprint of its developments. This could involve integrating elements like green roofs, community gardens, or features specifically designed to support local wildlife into its architectural plans.

The company's commitment to responsible land stewardship is increasingly crucial for securing project approvals and maintaining a positive public image. For instance, in 2024, the European Union continued to advance its Biodiversity Strategy for 2030, aiming to restore nature across the EU's land and seas, which directly impacts development planning and land acquisition processes.

- Biodiversity Impact Assessment: Covivio is expected to conduct thorough ecological surveys for all new projects, identifying potential impacts on local flora and fauna.

- Green Infrastructure Integration: Incorporating features like green walls, permeable paving, and native planting can mitigate environmental damage and enhance urban ecosystems.

- Land Use Compliance: Adherence to zoning laws and environmental impact assessments is paramount for obtaining necessary permits and avoiding legal challenges.

- Stakeholder Engagement: Open dialogue with environmental groups and local communities can foster trust and support for development projects.

Covivio's portfolio faces direct physical risks from climate change, with extreme weather events like floods impacting property values. For example, the European Environment Agency noted that floods caused an estimated €6.5 billion in damages across Europe in 2023, underscoring the vulnerability of real estate assets to such events.

The company is investing in resilient building designs and implementing measures like enhanced flood defenses and heat mitigation systems to counter these threats and safeguard asset value.

Stringent EU decarbonization targets, such as the revised Energy Performance of Buildings Directive aiming for net-zero emissions by 2050, necessitate significant investment in energy efficiency and renewables for Covivio's properties.

Growing tenant and investor demand for green certifications like LEED and BREEAM is influencing property valuations, with certified buildings often commanding higher rents and occupancy rates. Covivio's focus on sustainable materials and waste reduction, including a 2024 target to use 30% recycled materials in renovations, aligns with these market trends and improves portfolio attractiveness.

| Environmental Factor | Covivio's Action/Impact | Relevant Data/Target |

|---|---|---|

| Climate Change Risk | Physical risk from extreme weather | €6.5 billion estimated flood damages in Europe (2023) |

| Decarbonization Targets | Need for energy efficiency and renewables | EU's EPBD aims for net-zero buildings by 2050 |

| Green Certifications | Demand for LEED/BREEAM | Higher rents for certified buildings |

| Waste Management | Focus on circular economy | Target of 30% recycled materials in renovations (2024) |

| Biodiversity & Land Use | Minimizing ecological footprint | EU Biodiversity Strategy 2030 |

PESTLE Analysis Data Sources

Our Covivio PESTLE Analysis draws on a robust blend of official government publications, reputable financial news outlets, and leading real estate industry reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental influences impacting the company.