Covivio Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covivio Bundle

Unlock the strategic blueprint behind Covivio's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their value proposition, key partnerships, and revenue streams, offering a clear view of how they operate. Perfect for anyone seeking to understand or replicate their market-leading approach.

Partnerships

Covivio collaborates with premier hotel operators, including Accor, IHG, Marriott, B&B Hotels, and NH Hotels, to oversee its vast European hotel properties. These alliances are crucial for professional management, brand visibility, and consistent guest traffic, capitalizing on their operational acumen.

These partnerships typically involve extended lease or management agreements, which are fundamental to generating predictable revenue streams and ensuring operational smoothness for Covivio's real estate assets.

Covivio relies heavily on financial institutions for securing vital funding, including the issuance of green bonds, a testament to its commitment to sustainable development. In 2023, Covivio successfully placed a €500 million green bond, further solidifying its access to capital markets and supporting its environmentally conscious projects.

Engaging with institutional investors is paramount for Covivio's strategic growth, enabling joint ventures and significant capital raises. For instance, partnerships with entities such as CDC Investissement Immobilier and Crédit Agricole Assurances have been instrumental in facilitating large-scale investments and the expansion of its portfolio, particularly within key sectors like residential properties and hotels.

These strategic alliances are the lifeblood of Covivio's development and acquisition strategies, providing the essential capital needed to fuel its ambitious growth plans. This access to crucial funding enhances Covivio's financial flexibility, allowing it to pursue opportunities and maintain a strong capacity for expansion in competitive markets.

Covivio actively collaborates with local authorities and regional partners to shape urban development. These relationships are crucial for creating cohesive living, working, and hospitality environments that align with city planning objectives. For instance, in 2024, Covivio continued its engagement in several European city-center regeneration projects, working hand-in-hand with municipalities to secure permits and ensure developments enhance local communities.

These strategic alliances are fundamental to navigating regulatory landscapes and ensuring project viability. By fostering sustainable relationships, Covivio can effectively integrate its developments into the existing urban fabric, promoting community well-being and economic vitality. This approach was particularly evident in ongoing initiatives to revitalize urban areas, where local government support was instrumental in achieving project milestones and community acceptance throughout 2024.

Construction and Development Companies

Covivio collaborates with a range of construction and development firms to bring its property vision to life. These relationships are fundamental for building and upgrading its portfolio, ensuring each asset aligns with contemporary quality and sustainability benchmarks. For instance, in 2024, Covivio continued its focus on developing new student housing and healthcare facilities, projects heavily reliant on the expertise of these construction partners. These collaborations are critical for timely project completion and effective cost management.

These partnerships are vital for Covivio’s strategy of portfolio enhancement and value creation. By engaging specialized construction and development companies, Covivio can efficiently manage the entire lifecycle of its properties, from initial concept to final delivery. This includes overseeing new builds, extensive renovations, and adaptive reuse projects, all aimed at maximizing asset performance and tenant satisfaction. The successful execution of these projects directly contributes to Covivio's financial results and market position.

Key aspects of these partnerships include:

- Project Execution: Ensuring timely and budget-conscious delivery of construction and renovation projects.

- Quality Assurance: Guaranteeing that all new and refurbished properties meet high standards of quality and durability.

- Sustainability Focus: Working with partners committed to eco-friendly building practices and materials.

- Innovation Integration: Incorporating modern design and construction techniques to create future-ready assets.

Technology and Service Providers

Covivio's strategic alliances with technology and service providers are fundamental to its operational excellence and tenant value proposition. These partnerships enable the integration of smart building technologies, enhancing energy efficiency and occupant comfort. For instance, by collaborating with providers of digital platforms and IoT solutions, Covivio can offer seamless access, personalized environmental controls, and real-time building performance data. This focus on technological advancement is key to their strategy of creating user-centric, adaptable spaces.

These collaborations are particularly vital for Covivio's flexible office brand, Wellio. By partnering with specialized service providers, Wellio can offer a comprehensive suite of amenities and services, from advanced connectivity solutions to on-demand workspace management. This allows Covivio to differentiate its offerings in a competitive market, ensuring tenants and guests experience a high level of convenience and innovation. In 2024, the demand for integrated smart building features and flexible workspace solutions continued to grow, underscoring the importance of these technology partnerships.

- Smart Building Integration: Partnerships with technology firms facilitate the deployment of IoT sensors and data analytics platforms to optimize building performance and resource management.

- Flexible Workspace Solutions: Collaborations with service providers enhance offerings within brands like Wellio, providing tenants with integrated digital tools and on-demand services.

- Enhanced Customer Experience: Leveraging digital platforms and innovative technologies through partnerships directly improves tenant and guest satisfaction by offering seamless interactions and personalized environments.

- Differentiated Offerings: These strategic alliances allow Covivio to create unique, technologically advanced spaces that stand out in the real estate market, catering to evolving user needs.

Covivio's success hinges on strong collaborations with hotel operators, financial institutions, institutional investors, local authorities, construction firms, and technology providers. These partnerships are crucial for operational efficiency, capital access, urban development integration, project execution, and technological advancement, ensuring Covivio's continued growth and market leadership.

What is included in the product

A strategic overview of Covivio's business model, detailing its focus on real estate and healthcare services across key European markets.

This canvas outlines Covivio's approach to customer relationships, revenue streams, and key partnerships in the dynamic real estate and healthcare sectors.

Covivio's Business Model Canvas offers a clear, visual roadmap to navigate complex real estate portfolios, simplifying strategic planning and operational efficiency.

This structured approach helps identify and address key challenges in real estate management, fostering clearer communication and more effective decision-making.

Activities

Covivio's primary function revolves around the strategic acquisition of diverse properties, encompassing office spaces, residential units, and hotels, with a keen eye on major European urban centers. This proactive approach to property acquisition is fundamental to growing its asset portfolio and leveraging market opportunities.

In 2024, Covivio demonstrated a robust commitment to portfolio expansion by investing approximately €1.1 billion. A significant portion of this investment, 67%, was directed towards the hotel sector, underscoring a strategic pivot to bolster its presence in dynamic and high-potential segments of the real estate market.

Covivio's property development and redevelopment activities are central to its strategy. They focus on creating new assets and revitalizing existing ones to boost their worth and utility. This involves significant projects like converting office spaces into modern hotels and upgrading residential properties.

A key aspect is the delivery of new hotel properties, often built to high environmental standards. For instance, in 2024, Covivio continued its commitment to sustainability, with many new developments incorporating advanced eco-friendly features and aiming for certifications like BREEAM or HQE.

These initiatives are crucial for keeping Covivio's portfolio fresh and responsive to changing market needs. By transforming buildings, such as repurposing older structures into contemporary living or hospitality spaces, they ensure their assets remain competitive and attractive to tenants and guests.

Covivio actively manages its extensive real estate portfolio, focusing on maximizing rental income and occupancy. In 2024, the company continued its strategy of optimizing its asset base through proactive leasing and strong tenant relations, aiming for sustained high occupancy rates across its diverse holdings.

Strategic asset rotation is a key activity, involving the sale of underperforming or non-core properties to reinvest capital into more lucrative opportunities. This approach ensures the portfolio remains dynamic and aligned with market demand, contributing to long-term profitability and enhanced asset quality.

Leasing and Tenant Relationship Management

Covivio's core operations revolve around securing and meticulously managing leases for its extensive portfolio of office and residential properties. This also extends to forging enduring agreements with hotel operators, a crucial aspect of their diversified business model.

Maintaining high occupancy rates is paramount, and Covivio achieves this by cultivating robust relationships with its varied tenant base. This focus on tenant satisfaction directly translates into predictable and stable revenue streams, a cornerstone of their financial strategy.

The company actively adapts its property offerings to meet evolving tenant demands and prevailing market trends. For instance, in 2024, Covivio continued its strategic focus on modernizing office spaces to attract and retain premium tenants, with a significant portion of its leasing efforts directed towards ESG-compliant buildings.

- Lease Origination and Negotiation: Securing new tenants and renegotiating existing lease agreements for office, residential, and hotel properties.

- Tenant Relationship Management: Proactively engaging with tenants to ensure satisfaction, address concerns, and foster long-term partnerships.

- Occupancy Rate Optimization: Implementing strategies to minimize vacancies and maximize rental income across the portfolio.

- Portfolio Adaptation: Continuously assessing and adjusting property features and services to align with market demands and tenant preferences, including sustainability initiatives.

Financial Management and Capital Allocation

Covivio's financial management is centered on securing and optimizing capital. This includes actively managing its debt structure and pursuing diverse financing avenues. For instance, in 2024, Covivio continued its strategy of issuing green bonds, reinforcing its commitment to sustainable finance and attracting environmentally conscious investors. This approach helps maintain a healthy balance sheet, crucial for funding its extensive portfolio of real estate assets and development pipelines.

Capital allocation is a critical activity, ensuring resources are directed to projects offering the best potential returns and strategic alignment. The company meticulously plans its investments, balancing acquisitions, development, and renovations across its key sectors: healthcare, hospitality, and residential. This strategic deployment of capital supports both organic growth and opportunistic expansion, aiming to enhance shareholder value while supporting long-term operational goals.

- Financing Strategy Covivio actively uses green bonds to fund its operations and development, aligning with sustainability goals and investor demand.

- Debt Management The company focuses on optimizing its debt profile to ensure financial flexibility and maintain a strong credit rating.

- Capital Allocation Resources are strategically deployed across healthcare, hospitality, and residential real estate to maximize returns and support growth initiatives.

- Financial Planning Robust financial planning underpins Covivio's ability to secure necessary funding for ongoing operations and future expansion projects.

Covivio's key activities involve acquiring, developing, and managing a diverse real estate portfolio across Europe, focusing on offices, residential, and hotels. They actively engage in lease origination, tenant relationship management, and portfolio adaptation to meet market demands. Financial management includes securing capital, managing debt, and strategic capital allocation to drive growth and shareholder value.

| Activity | Description | 2024 Focus/Data |

|---|---|---|

| Property Acquisition | Strategic purchase of diverse properties in major European cities. | Invested €1.1 billion, with 67% allocated to hotels. |

| Development & Redevelopment | Creating new assets and revitalizing existing ones. | Focus on eco-friendly features in new hotel developments. |

| Portfolio Management | Maximizing rental income and occupancy through proactive leasing. | Emphasis on strong tenant relations and high occupancy rates. |

| Financial Management | Securing and optimizing capital, including debt management and financing. | Continued issuance of green bonds; strategic capital allocation across sectors. |

Preview Before You Purchase

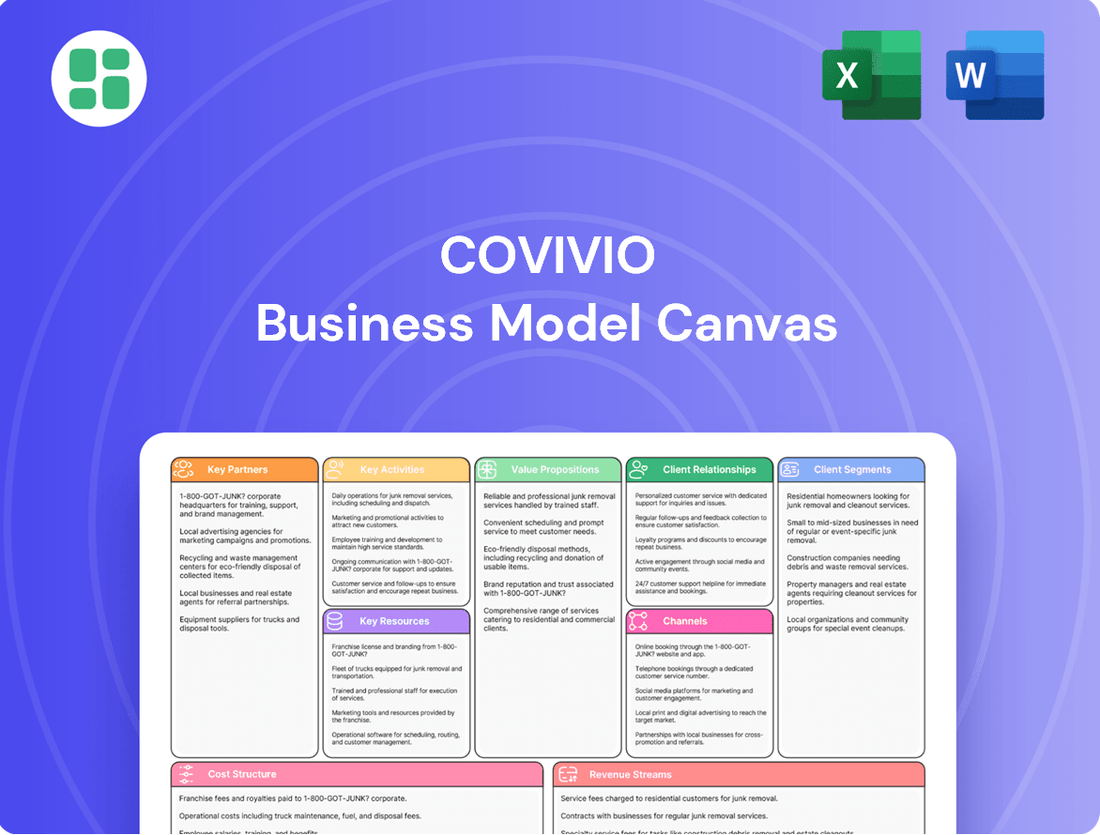

Business Model Canvas

The Covivio Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct snapshot of the complete, professionally structured canvas, ready for your strategic analysis. No mockups or sample sections, just the real deliverable, ensuring you know precisely what you're getting to drive your business forward.

Resources

Covivio's key resource is its extensive and diversified real estate portfolio, encompassing office, residential, and hotel properties. This portfolio was valued at €23.1 billion at 100% and €15.6 billion at the Group share level by the end of 2024. This vast asset base is crucial for generating varied income and ensuring stability across different market conditions.

The strategic concentration of these assets in major European cities, including France, Germany, and Italy, significantly boosts their appeal and overall market value. This geographic focus allows Covivio to capitalize on robust urban economies and demand for quality real estate.

Covivio's access to substantial financial capital is a cornerstone of its business model. This includes a robust mix of equity and debt financing, notably their strategic use of green bonds to fund sustainable development. Their strong network of financial partners is crucial for securing this capital.

In 2024, Covivio demonstrated its financial prowess by securing close to €1.9 billion in financing. This significant inflow of capital directly supports their ongoing investment pipeline and allows for effective management of their existing debt obligations.

This financial capacity is not just about acquiring assets; it's the engine that drives Covivio's growth strategy and underpins its day-to-day operational effectiveness. It allows them to pursue ambitious development projects and maintain a healthy balance sheet.

Covivio's over 1,000 employees are a cornerstone of its business, offering deep expertise in real estate acquisition, development, asset management, and customer relations. This human capital is crucial for navigating diverse property sectors and ensuring operational excellence across its European portfolio.

The team's profound understanding of European real estate markets, cultivated over years of experience, directly fuels strategic decision-making and drives the company's performance. Their specialized knowledge is a key differentiator, fostering innovation in how Covivio manages and grows its assets.

Established Brand and Reputation

Covivio's established brand and reputation are cornerstones of its business model, built on a long-standing presence as a trusted European real estate operator. This deep-rooted credibility fosters sustainable relationships with all stakeholders, from tenants to investors.

The company's commitment to well-being and sustainability further bolsters its market standing, making it an attractive partner and investment. This strong brand equity directly translates into enhanced market credibility and facilitates crucial partnerships.

- Brand Strength: Covivio is recognized for its reliability and tenant-centric approach across its European portfolio.

- Investor Appeal: A strong reputation for stable returns and responsible management attracts a consistent flow of investment capital.

- Partnership Facilitation: The brand's positive image streamlines negotiations and collaborations with developers, service providers, and public entities.

- Sustainability Leadership: Covivio's proactive stance on ESG principles enhances its brand value and appeals to socially conscious investors and tenants.

Technological Platforms and Digital Tools

Covivio leverages a suite of proprietary and adopted technological platforms as crucial resources. These include Wellio, designed for flexible office spaces, and WiZiU, which streamlines hotel operations. These digital tools are fundamental to enhancing efficiency and elevating the customer experience across their diverse property portfolio.

These platforms enable advanced capabilities such as smart building features, sophisticated data analysis for informed decision-making, and efficient property management. For instance, in 2024, Covivio continued to invest in digital transformation, aiming to integrate IoT sensors across its properties to optimize energy consumption and enhance tenant services, contributing to a more modern and agile business model.

- Wellio Platform: Facilitates flexible workspace solutions, managing bookings, access, and tenant services for a seamless user experience.

- WiZiU Hotel Operations: Digital tool for managing hotel services, from check-in/out to guest requests, improving operational flow.

- Smart Building Capabilities: Integration of IoT and data analytics to optimize building performance, energy usage, and tenant comfort.

- Data-Driven Decision Making: Utilizing collected data to inform strategic choices in property management, leasing, and service development.

Covivio's extensive real estate portfolio, valued at €23.1 billion (100%) or €15.6 billion (Group share) by the end of 2024, forms the bedrock of its operations. This diverse collection of office, residential, and hotel properties, strategically located in major European cities, ensures varied income streams and market resilience.

The company's financial strength, evidenced by nearly €1.9 billion in financing secured in 2024, fuels its growth and operational stability. This capital access, bolstered by a strong network of financial partners and the strategic issuance of green bonds, underpins Covivio's ability to pursue development projects and manage its balance sheet effectively.

Covivio's 1,000+ employees bring essential expertise in real estate management, development, and customer relations, driving operational excellence. Their deep understanding of European markets is a key differentiator, fostering innovation and informed strategic decisions.

The brand's reputation for reliability and a tenant-centric approach, combined with its commitment to sustainability, enhances market credibility and investor appeal. This strong brand equity facilitates partnerships and attracts socially conscious stakeholders.

Proprietary technology platforms like Wellio for flexible offices and WiZiU for hotel operations are vital for efficiency and customer experience. Continued investment in digital transformation, including IoT integration in 2024, optimizes performance and tenant services.

| Key Resource | Description | 2024 Data/Impact |

| Real Estate Portfolio | Diversified properties (office, residential, hotel) in key European cities. | Valued at €23.1bn (100%) / €15.6bn (Group share) by end of 2024. |

| Financial Capital | Equity, debt financing, and green bonds. | Secured ~€1.9bn in financing in 2024. |

| Human Capital | Over 1,000 employees with real estate expertise. | Deep market understanding drives strategic decisions and operational excellence. |

| Brand & Reputation | Established trust and credibility as a European operator. | Fosters sustainable relationships and attracts investment. |

| Technology Platforms | Wellio, WiZiU, smart building capabilities, data analytics. | Enhancing efficiency and customer experience; ongoing digital transformation investment. |

Value Propositions

Covivio's core value proposition lies in its creation of integrated living, working, and hospitality spaces. This means they're not just building offices or apartments; they're crafting entire urban ecosystems where people can live, work, and enjoy leisure activities seamlessly.

This mixed-use approach addresses the modern demand for convenience and synergy. By combining these functions, Covivio aims to foster vibrant, dynamic urban environments that cater to evolving lifestyle needs, making cities more livable and efficient.

For instance, in 2024, Covivio continued to focus on developing these holistic urban experiences. Their portfolio actively showcases this strategy, with projects designed to enhance the overall quality of life for residents and professionals alike.

Covivio offers access to a curated portfolio of premium properties, with a strong emphasis on central locations within major European cities. This strategic positioning in hubs like Paris, Berlin, and Milan ensures high visibility and accessibility for tenants.

These prime urban settings enhance the desirability and long-term value of Covivio's assets, making them attractive to a wide range of clients. For instance, in 2024, the company continued to focus on its core markets, with a significant portion of its rental income derived from these highly sought-after central European locations.

Covivio champions sustainable development, with an impressive 98.5% of its property portfolio achieving environmental certification by the close of 2024. This dedication provides tenants and investors with properties that demonstrably minimize their ecological footprint.

These certified buildings translate into tangible benefits, including lower operational expenses thanks to enhanced energy efficiency, a crucial factor in today's cost-conscious environment. Furthermore, this commitment directly addresses the escalating demand for investments that align with robust Environmental, Social, and Governance (ESG) criteria.

By prioritizing sustainability, Covivio not only meets current market expectations but also fortifies the long-term value and market appeal of its assets. This strategic focus ensures continued attractiveness to a growing segment of environmentally conscious stakeholders.

Flexible and Service-Oriented Solutions

Covivio's commitment to flexible and service-oriented solutions is a cornerstone of its business model, particularly within its office and hotel segments. For instance, its Wellio brand offers adaptable office spaces designed to meet evolving work needs. This approach is further exemplified by its diverse hotel operating models, catering to a range of client requirements.

This adaptability is crucial in today's dynamic market. By providing tailored options, Covivio ensures tenants and operators receive solutions that prioritize user experience, comfort, and efficiency. The company's hospitality-inspired ethos underpins this, guaranteeing a high standard of service and prompt responsiveness to client needs.

- Flexible Office Spaces: Wellio provides adaptable workspaces, catering to the changing demands of businesses.

- Diversified Hotel Operating Models: Covivio offers a spectrum of hotel management and operational structures to suit various partners.

- Customer-Centric Approach: Solutions are designed with user experience, comfort, and efficiency at the forefront.

- Service Excellence: A hospitality-driven ethos ensures high levels of service and responsiveness across all offerings.

Long-Term Partnership and Value Creation

Covivio cultivates enduring alliances by acting as a dedicated real estate partner, fostering deep connections with businesses, local authorities, and hospitality brands. This commitment to long-term collaboration is central to its strategy, aiming to jointly develop dynamic environments that enhance partner appeal and promote responsible operations.

The company’s philosophy centers on co-creating vibrant spaces, actively supporting its partners in achieving their objectives for both market attractiveness and sustainable performance. This strategic focus ensures that relationships are built on mutual benefit and shared growth, moving beyond simple transactions to establish lasting value for everyone involved.

- Long-Term Partnership: Covivio prioritizes building lasting relationships, exemplified by its consistent engagement with key clients and regions.

- Value Creation: The company actively contributes to the success of its partners by developing and managing spaces that drive attractiveness and responsible performance.

- Sustainable Relationships: Covivio's model emphasizes mutual growth and enduring value, fostering loyalty and repeat business across its diverse portfolio.

- Co-Inventing Spaces: This collaborative approach allows for the creation of tailored, vibrant environments that meet the evolving needs of businesses and communities.

Covivio's value proposition centers on creating integrated urban living, working, and hospitality experiences. This approach fosters synergy and convenience, addressing the modern demand for dynamic city environments. By combining these functions, Covivio enhances urban livability and efficiency, as seen in its continued development of holistic urban projects throughout 2024.

Customer Relationships

Covivio’s dedicated asset management and leasing teams are central to its customer relationships, focusing on close collaboration with both office tenants and residential occupants. These teams actively engage to understand and fulfill customer needs, fostering loyalty and long-term partnerships.

This direct interaction enables proactive problem-solving and the development of customized solutions, directly addressing tenant requirements. For instance, Covivio reported a strong customer satisfaction score in its 2024 annual report, highlighting the effectiveness of these dedicated teams in enhancing the tenant experience and driving high retention rates.

Covivio cultivates strategic, long-term alliances with prominent hotel brands and operators to manage its extensive hotel portfolio. These collaborations are dynamic, encompassing continuous joint efforts in enhancing asset performance, executing renovation initiatives, and shaping market strategies. For instance, in 2024, Covivio continued its focus on upgrading its German hotel properties, with a significant portion of its capital expenditure dedicated to modernizing its existing hotel assets in partnership with operators like Accor.

The company is increasingly adopting a more integrated model, acting as both an asset manager and a hotel operator. This shift aims to foster more profound engagement and better align interests with its partners, moving beyond traditional landlord-tenant relationships. This integrated approach allows for a more hands-on management style, directly impacting guest experience and operational efficiency, which is crucial for maintaining brand standards and driving revenue growth in a competitive market.

Covivio actively uses digital platforms like Wellio to boost customer engagement and service. These digital tools streamline operations and offer direct access to services, ensuring a smoother experience for users.

The company prioritizes gathering customer feedback through these platforms. This feedback loop is crucial for developing more experiential and hybrid real estate offerings that meet evolving user needs.

By focusing on unique and innovative user experiences, Covivio aims to differentiate its properties. For instance, in 2023, Wellio reported a significant increase in occupancy rates for its flexible office spaces, demonstrating the success of its customer-centric digital strategy.

Community Engagement and Social Responsibility

Covivio actively cultivates relationships with local communities and stakeholders by championing social responsibility and sustainable development. This commitment is demonstrated through tangible support for local associations and active participation in initiatives designed to enhance the well-being of the regions where it operates.

- Community Investment: In 2024, Covivio allocated €5 million towards social impact projects and local partnerships across its European portfolio, focusing on areas like affordable housing and community revitalization.

- Stakeholder Dialogue: The company regularly engages with over 50 local community groups annually through dedicated forums and consultation processes to ensure its development projects align with local needs and aspirations.

- Sustainable Practices: Covivio's commitment to sustainability extends to community engagement, with initiatives like promoting local employment, which saw 70% of construction jobs on recent projects filled by local residents in 2024.

- Social License: This community-centric approach is crucial for building goodwill and reinforcing Covivio's social license to operate, fostering trust and long-term positive relationships with the communities it serves.

Transparent Communication and Investor Relations

Covivio prioritizes transparent communication with its financial stakeholders, offering regular updates through annual reports, financial results, and investor presentations. This approach fosters trust and confidence among shareholders and financial partners, keeping them informed about the company's performance and strategic trajectory.

In 2024, Covivio continued this commitment, with its financial reports detailing key performance indicators and strategic initiatives. For instance, their 2024 interim report highlighted a robust occupancy rate across their portfolio, demonstrating operational resilience.

- Annual Reports: Providing comprehensive overviews of financial health and strategic progress.

- Financial Results: Regular updates on earnings, revenue, and key financial metrics.

- Investor Presentations: Detailed explanations of performance, market outlook, and future plans.

- Shareholder Confidence: Building trust through consistent and clear dissemination of information.

Covivio's customer relationships are built on direct engagement through dedicated asset management and leasing teams, fostering loyalty with both office and residential clients. These teams actively address needs, leading to high satisfaction and retention, as evidenced by strong customer satisfaction scores reported in their 2024 annual report.

Strategic alliances with hotel brands are crucial, involving joint efforts in performance enhancement and renovations, exemplified by their 2024 focus on upgrading German hotel assets with operators like Accor. The company is also increasingly integrating asset management and operational roles to deepen partner engagement.

Digital platforms like Wellio are key for enhanced customer engagement and service delivery, streamlining operations and gathering feedback to inform evolving real estate offerings. This digital-first approach contributed to increased occupancy rates in flexible office spaces in 2023.

Covivio also prioritizes community and financial stakeholder relationships through social responsibility initiatives and transparent financial reporting. In 2024, €5 million was allocated to social impact projects, and the company maintained clear communication with investors regarding its performance and strategic direction.

Channels

Covivio leverages its dedicated direct sales and leasing teams to personally connect with corporate clients and individual residents for its office and residential portfolios. This direct engagement facilitates in-depth property showcases and negotiations, ensuring a customized experience for each prospective tenant.

In 2024, this direct approach was instrumental in maintaining strong occupancy rates across Covivio's assets, demonstrating the effectiveness of personalized client management in a competitive real estate market.

Covivio collaborates with real estate brokers and agencies to expand its property market presence and streamline the leasing and sales processes. These partnerships grant access to a broader pool of prospective tenants and buyers, tapping into the brokers' specialized market insights and established client relationships. This strategy is especially beneficial for significant office and residential property deals.

Covivio leverages its corporate website and specialized property portals like Wellio to showcase its diverse portfolio. This digital presence is crucial for reaching potential tenants and investors, offering detailed property information and company updates.

Social media channels further amplify Covivio's reach, facilitating direct engagement with stakeholders. These platforms are vital for disseminating company news, highlighting new developments, and building brand visibility within the real estate sector.

In 2024, Covivio continued to invest in its digital infrastructure, aiming to enhance user experience and broaden its online audience. The company's digital strategy focuses on providing transparent and accessible information across all its online touchpoints.

Investor Relations and Financial Roadshows

Covivio actively cultivates investor relations through various channels to attract and retain capital. These include the dissemination of detailed financial reports, participation in analyst calls, and the execution of investor roadshows. These engagements are vital for transparently communicating the company's financial health, strategic direction, and environmental, social, and governance (ESG) performance to a global investor base.

In 2024, Covivio continued its commitment to robust investor communication. For instance, their half-year financial report detailed a recurring net income of €235 million, showcasing operational resilience. The company's investor relations efforts aim to build sustained confidence by clearly articulating their value proposition and long-term growth strategy.

- Financial Reports: Providing comprehensive quarterly and annual financial statements, including balance sheets, income statements, and cash flow statements.

- Analyst Calls: Hosting regular conference calls with financial analysts to discuss performance, strategy, and market outlook.

- Investor Roadshows: Engaging directly with institutional investors and potential shareholders through presentations and one-on-one meetings.

- ESG Communications: Highlighting sustainability initiatives and performance metrics to attract ESG-focused investors.

Partnerships with Hotel Operators and Brands

Covivio leverages strategic alliances with leading hotel operators and renowned brands to access a vast customer base. These partnerships are crucial for channeling its hotel properties to travelers, utilizing the operators' extensive booking platforms, loyalty programs, and global marketing reach. For instance, in 2024, Covivio continued to strengthen its relationships with major players like Accor and IHG, which are vital for driving occupancy and ensuring broad visibility for its portfolio.

This collaborative approach allows Covivio to benefit from the established distribution networks and marketing power of its partners. By integrating with their booking systems and loyalty schemes, Covivio ensures its hotel assets are consistently presented to a wide audience. This model, exemplified by its long-standing agreements, provides significant operational efficiencies, as the day-to-day management and guest-facing operations are handled by experienced hotel brands.

- Key Distribution Channels: Partnerships with major hotel operators provide access to their online booking engines, travel agency networks, and corporate client relationships.

- Brand Leverage: Covivio's assets benefit from the marketing campaigns and brand recognition of operators like Accor, enhancing guest acquisition and retention.

- Operational Efficiency: By outsourcing operational management to experienced partners, Covivio reduces its direct involvement in day-to-day hotel operations, focusing on asset ownership and strategic development.

- Market Reach: These alliances grant Covivio access to global travel markets, significantly increasing the potential occupancy rates and revenue generation for its properties.

Covivio's channel strategy is multifaceted, encompassing direct engagement, broker partnerships, and robust digital platforms to reach both tenants and investors. These channels are crucial for showcasing its diverse real estate portfolio and maintaining strong market presence.

In 2024, Covivio's direct sales and leasing teams were key to securing corporate clients and individual residents, ensuring personalized property experiences and contributing to high occupancy rates. This direct approach was further supported by collaborations with real estate brokers, expanding market reach and leveraging specialized insights for significant property transactions.

The company's digital footprint, including its corporate website and property portals like Wellio, along with active social media engagement, amplified its visibility and facilitated direct stakeholder interaction. Investor relations are managed through comprehensive financial reports, analyst calls, and roadshows, with a 2024 half-year report highlighting recurring net income of €235 million, underscoring operational strength.

Strategic alliances with major hotel operators, such as Accor and IHG, in 2024 were vital for channeling hotel properties to travelers through extensive booking platforms and marketing reach, ensuring broad visibility and operational efficiencies.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Leasing | Personalized engagement with corporate clients and residents. | Maintained strong occupancy rates; facilitated customized tenant experiences. |

| Real Estate Brokers | Partnerships to expand market presence and streamline sales. | Provided access to broader tenant pools and market insights. |

| Digital Platforms (Website, Portals) | Showcasing portfolio and company information online. | Enhanced user experience and broadened online audience reach. |

| Social Media | Direct engagement with stakeholders and brand building. | Amplified reach and facilitated dissemination of company news. |

| Investor Relations | Communicating financial health and strategy to investors. | Included detailed financial reports (e.g., €235M recurring net income H1 2024) and analyst calls. |

| Hotel Operator Alliances | Leveraging partners' booking platforms and marketing reach. | Strengthened relationships with Accor, IHG for visibility and occupancy. |

Customer Segments

Corporate tenants, encompassing both large corporations and growing enterprises, are a cornerstone of Covivio's office sector strategy. These businesses actively seek contemporary, strategically positioned, and environmentally conscious office solutions within key European urban centers. In 2024, the demand for prime office space remained robust, with vacancy rates in major European cities like Paris and Berlin hovering around 5-7%, indicating a strong market for well-appointed properties.

Covivio addresses the evolving needs of these tenants by offering adaptable workspaces designed for hybrid work models, complemented by top-tier amenities and seamless connectivity. Companies are increasingly prioritizing employee comfort and productivity, driving the need for spaces that support well-being and foster collaboration. This focus on premium services and sustainability resonates with corporations aiming to enhance their employer brand and demonstrate commitment to environmental, social, and governance (ESG) principles.

Residential tenants and buyers in Germany, particularly in major urban centers like Berlin, represent a core customer segment. These individuals and families are actively searching for well-maintained rental apartments or homes to purchase.

This group prioritizes desirable locations, reliable property upkeep, and equitable rental agreements. For instance, in 2024, the German rental market continued to see strong demand, especially in cities like Berlin, where vacancy rates remained low, indicating a consistent need for quality housing options.

Covivio's strategy here is to address this persistent housing demand, aiming to benefit from potential rent increases and the overall appreciation of property values within its German portfolio.

Hotel Operators and Brands represent a core customer segment for Covivio. These are prominent international and regional hotel groups, such as Accor, IHG, and Marriott, actively seeking reliable real estate partners to fuel their expansion plans and manage their properties effectively.

Covivio offers these operators a broad spectrum of hotel assets, presenting flexible lease and operating agreements that align with their distinct business objectives. For instance, as of early 2024, Covivio's portfolio includes a significant number of hotels across Europe, many of which are operated by leading international brands.

These strategic alliances are fundamental to Covivio's hotel revenue generation. The ability to secure long-term leases with reputable hotel brands provides a stable and predictable income stream, underpinning the financial health of Covivio's hotel division.

Individual and Institutional Investors

Individual and institutional investors form a core customer segment for Covivio. This group encompasses everyone from individual shareholders keen on dividend yields to large institutional funds, private equity firms, and pension funds scrutinizing long-term growth and asset valuation. In 2024, investors are increasingly focused on Covivio's diversified portfolio across Europe, particularly its healthcare and residential real estate assets, alongside its commitments to Environmental, Social, and Governance (ESG) principles.

Covivio actively engages this segment by providing comprehensive financial reporting and dedicated investor relations support. For instance, their 2023 annual report detailed a portfolio valued at over €28 billion, demonstrating the scale of assets under management that attract sophisticated investors. The company's strategy aims to deliver consistent returns, making it an attractive proposition for those seeking stable income and capital appreciation.

- Broad Investor Base: Encompasses individual shareholders to major institutional players like pension funds and private equity.

- Key Interests: Focus on financial performance, dividend yield, asset valuation, and long-term growth prospects.

- Strategic Appeal: Covivio's diversified portfolio and ESG commitments are significant draws for investors in 2024.

- Information Access: Investors rely on Covivio's detailed financial reporting and investor relations for decision-making.

Local Communities and Public Stakeholders

Local communities and public authorities, while not direct revenue sources, are critical partners for Covivio. Their support is essential for project success and long-term sustainability.

Covivio actively engages with these stakeholders, demonstrating its dedication to responsible urban development and corporate citizenship. This engagement is key to securing necessary permits and fostering community acceptance.

- Regulatory Approvals: Positive relationships facilitate smoother navigation of planning permissions and building regulations.

- Social License to Operate: Community buy-in is vital for project acceptance and minimizing potential disruptions.

- Corporate Social Responsibility (CSR): Demonstrating commitment to local well-being enhances Covivio's reputation and brand image.

- Sustainable Development: Collaboration with public bodies ensures projects align with urban planning goals and environmental standards.

Covivio's customer segments are diverse, ranging from large corporations seeking modern office spaces to individual residential tenants and major hotel operators. The company also caters to a broad investor base, from retail shareholders to institutional funds, all attracted by its diversified European real estate portfolio and commitment to ESG principles. Positive engagement with local communities and public authorities is also crucial for project approvals and long-term sustainability.

| Customer Segment | Key Needs/Interests | Covivio's Offering/Strategy | 2024 Relevance/Data Point |

|---|---|---|---|

| Corporate Tenants | Contemporary, sustainable, well-located offices | Adaptable workspaces, premium amenities, hybrid work solutions | Prime office vacancy in Paris/Berlin around 5-7% |

| Residential Tenants/Buyers (Germany) | Quality housing in desirable locations | Well-maintained rental apartments, potential for property appreciation | Consistent demand in German rental market, especially Berlin |

| Hotel Operators & Brands | Reliable real estate partners for expansion | Diverse hotel assets, flexible lease/operating agreements | Significant portfolio of hotels operated by leading international brands |

| Investors (Individual & Institutional) | Financial performance, dividends, long-term growth, ESG | Comprehensive reporting, investor relations, diversified portfolio | Portfolio valued over €28 billion (as of 2023) |

| Local Communities & Public Authorities | Responsible development, CSR, urban planning alignment | Community engagement, adherence to regulations, sustainable practices | Essential for project permits and social license to operate |

Cost Structure

Covivio's cost structure is heavily influenced by property acquisition and development. A significant portion of their expenditure goes into buying new land and existing buildings, alongside the considerable costs of developing and redeveloping these properties. These capital investments are fundamental to expanding and updating their portfolio, requiring substantial initial outlays.

In 2024, Covivio made investments totaling close to €1.1 billion. A substantial part of this investment was directed towards the hotel sector, highlighting a strategic focus on this segment of their property holdings.

Covivio's property management and operating expenses are substantial, covering ongoing costs like management fees, maintenance, repairs, utilities, insurance, and security across its diverse portfolio of offices, hotels, and residential properties. These essential expenditures directly impact asset quality and functionality. For instance, in 2023, Covivio reported operating expenses of €1.2 billion, highlighting the significant investment required to maintain its extensive real estate holdings and ensure their attractiveness to tenants and guests.

Covivio, as a real estate investment firm, faces significant financing costs stemming from its substantial debt obligations. These include interest payments on various loans and bonds, which directly impact profitability. For instance, in 2023, Covivio reported interest expenses of €426 million, highlighting the substantial nature of these costs.

Effectively managing this debt profile is paramount for Covivio's financial health. The company strategically secures new financing and actively refinances existing debt to optimize its interest expenses and maintain a robust financial structure. This proactive approach is crucial for ensuring long-term stability and maximizing returns for stakeholders.

Personnel and Administrative Expenses

Covivio's personnel and administrative expenses are a core component of its cost structure, reflecting the significant investment in its human capital and operational infrastructure. These costs encompass salaries, social security contributions, and other employee benefits for its substantial workforce, which numbered over 1,000 employees as of the end of 2023. The company's operations span multiple European countries, requiring administrative support across diverse functions such as asset management, development, finance, and general corporate services, all contributing to this expense category.

Managing these costs effectively is crucial for Covivio's profitability. The company's commitment to an efficient organizational structure and strategic talent management plays a vital role in optimizing its personnel and administrative overhead. For instance, in 2023, Covivio reported personnel expenses of €145.9 million, a slight increase from €142.5 million in 2022, highlighting the ongoing investment in its teams while demonstrating a focus on controlled growth within these operational expenditures.

- Personnel Costs: Salaries, social security, and benefits for over 1,000 employees across Europe.

- Administrative Overhead: Costs related to managing diverse functions like asset management, development, and finance.

- 2023 Personnel Expenses: €145.9 million, indicating ongoing investment in the workforce.

- Cost Control Focus: Emphasis on efficient organizational structure and talent management to optimize overhead.

Marketing and Sales Costs

Covivio’s cost structure heavily features marketing and sales expenses, vital for securing and retaining tenants. These outlays cover everything from broad advertising campaigns to the specific costs associated with attracting new occupants and managing the leasing process. For instance, in 2024, a significant portion of their budget was allocated to digital marketing and property showcasing to maintain competitive occupancy levels across their diverse portfolio.

Key components within this cost category include advertising expenditures, which aim to reach potential tenants for both their real estate and hotel segments. Additionally, broker commissions are a substantial expense, reflecting the reliance on external agents to facilitate property transactions and leases. The operational costs of proprietary platforms, such as Wellio, which enhances tenant experience and engagement, also fall under this umbrella. These investments are critical for driving demand and ensuring the efficient utilization of their assets.

- Advertising and Promotion: Costs associated with online advertising, print media, and promotional events to showcase properties.

- Brokerage Fees: Commissions paid to real estate agents and brokers for securing new leases or sales.

- Platform Operations: Expenses related to the development, maintenance, and marketing of digital platforms like Wellio.

- Sales Team Expenses: Salaries, commissions, and operational costs for the internal sales and leasing teams.

Covivio's cost structure is dominated by property acquisition and development, with significant outlays for land and building purchases, as well as renovation projects. This is complemented by substantial property management and operating expenses, covering maintenance, utilities, and insurance across its extensive portfolio. Financing costs, primarily interest on debt, also represent a major expenditure, underscoring the capital-intensive nature of its real estate operations.

| Cost Category | 2023 Data | Notes |

|---|---|---|

| Property Acquisition & Development | Approx. €1.1 billion (2024 Investments) | Includes hotel sector investments. |

| Operating Expenses | €1.2 billion (2023) | Covers maintenance, utilities, insurance, etc. |

| Financing Costs (Interest Expense) | €426 million (2023) | Direct impact of debt obligations. |

| Personnel Expenses | €145.9 million (2023) | Salaries, benefits for over 1,000 employees. |

Revenue Streams

Covivio's primary revenue engine is the rental income derived from its substantial collection of office buildings strategically located across France, Germany, and Italy. These long-term lease agreements with established corporate clients ensure a consistent and reliable stream of cash flow, forming the bedrock of their financial stability.

The office rental market demonstrated robust health in 2024, with like-for-like office rents experiencing a notable increase of 8.1%. This upward trend underscores the strong demand and performance within the key markets where Covivio operates its office property portfolio.

Covivio's business model heavily relies on rental income from its extensive residential property holdings, particularly in Germany. This consistent stream of revenue forms a core part of their financial stability.

Beyond rentals, Covivio also capitalizes on the sale of individual residential units, a process often referred to as privatization. This offers an additional avenue for revenue generation and portfolio management.

The company has demonstrated strong performance in its residential segment, with a notable example being the +4.3% like-for-like rental growth in its German residential portfolio during 2024. This growth directly translates into increased overall revenues for Covivio.

Covivio's hotel segment generates revenue through two primary avenues: fixed-indexed leases with hotel operators and variable revenues from properties the company directly operates. This dual approach creates a resilient and diversified revenue stream.

In 2024, the hotel segment demonstrated robust growth, with revenues increasing by 7.2% on a like-for-like basis. A significant contributor to this rise was the 11.9% surge in variable revenues, highlighting the positive impact of operational performance on the company's top line.

Property Sales and Disposals

Covivio actively manages its property portfolio by selling assets, focusing on non-core holdings or those where their value has been significantly enhanced. This strategic approach allows for capital rotation, enabling reinvestment into more promising opportunities.

In 2024, Covivio demonstrated strong execution in this area, signing €766 million in new disposal agreements. These sales were frequently achieved at premiums over their appraised values, highlighting the company's ability to maximize returns from its property disposals.

- Strategic Asset Rotation: Covivio sells properties to optimize its portfolio and reinvest capital.

- 2024 Disposal Value: €766 million in new disposal agreements were signed in 2024.

- Premium Sales: Disposals were often completed at a premium to appraisal values.

Development and Asset Management Fees

Covivio, as a significant real estate operator, likely generates revenue through development and asset management fees. These fees are crucial for profitability, especially as the company enhances its role as an integrated asset manager for its extensive hotel portfolio. This strategy leverages their specialized knowledge to add value beyond simple property ownership.

These fee-based revenues contribute to Covivio's overall financial health by diversifying income streams and capitalizing on their operational expertise. In 2024, the real estate sector saw a continued focus on operational efficiency and value creation, making such fee structures increasingly important for companies like Covivio.

- Development Fees: Earned from managing and executing new real estate projects, from conception to completion.

- Asset Management Fees: Generated by overseeing and optimizing the performance of owned or managed properties, including hotels.

- Portfolio Enhancement: These fees reflect Covivio's growing capability to manage assets strategically, increasing overall portfolio value.

Covivio's diversified revenue streams are anchored by rental income from its extensive office and residential portfolios, particularly strong in Germany. The company also generates income through the sale of residential units and robust performance in its hotel segment, which benefits from both fixed-indexed leases and variable revenues from directly operated properties. Strategic asset rotation, including significant disposals in 2024, further bolsters revenue and allows for capital reinvestment.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Office Rentals | Income from long-term leases with corporate clients in France, Germany, and Italy. | +8.1% like-for-like office rent increase. |

| Residential Rentals | Rental income from residential properties, primarily in Germany. | +4.3% like-for-like rental growth in German portfolio. |

| Residential Sales (Privatization) | Revenue generated from selling individual residential units. | An additional avenue for revenue generation. |

| Hotel Operations | Revenue from fixed-indexed leases with operators and variable income from directly managed properties. | +7.2% like-for-like revenue growth; +11.9% surge in variable revenues. |

| Asset Disposals | Proceeds from selling non-core or enhanced-value properties. | €766 million in new disposal agreements signed; sales often at a premium. |

| Development & Asset Management Fees | Fees earned from managing and optimizing real estate projects and portfolios. | Crucial for profitability and value creation, especially in the hotel segment. |

Business Model Canvas Data Sources

The Covivio Business Model Canvas is built upon a foundation of robust financial reports, comprehensive market analysis, and internal strategic planning documents. These data sources ensure each element of the canvas is grounded in verifiable information and reflects current operational realities.