Covenant SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covenant Bundle

Our Covenant SWOT analysis reveals critical insights into its market standing, highlighting key advantages and potential challenges. Understanding these dynamics is crucial for anyone looking to invest, partner, or compete effectively.

Want to fully grasp Covenant's strategic position and unlock its growth potential? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and decision-making.

Strengths

Covenant Logistics Group boasts a broad spectrum of services, encompassing everything from expedited and dedicated truckload to freight brokerage, warehousing, and managed transportation. This wide offering acts as a buffer against downturns in any single sector, fostering a more consistent revenue flow.

For instance, in the first quarter of 2024, Covenant reported a 10.6% increase in total revenue to $262.3 million, with their dedicated segment, a key part of their diversified portfolio, showing particular strength. This breadth allows them to cater to a wider client base and remain agile in response to market shifts.

Covenant's strategic emphasis on its dedicated fleet business and specialized high-service niches is a key strength. This focus typically leads to more stable, contracted revenue streams and improved profit margins when contrasted with the unpredictable spot market. This deliberate shift aims to mitigate the impact of market volatility and bolster the company's overall profitability.

The acquisition of Lew Thompson & Son, a company specializing in poultry-related freight, directly supports this strategy. This move underscores Covenant's commitment to expanding its footprint in specialized, dedicated services, a segment that often provides a more predictable financial performance. For instance, in Q4 2023, Covenant reported that its dedicated segment accounted for a significant portion of its revenue, demonstrating the growing importance of this strategic pillar.

Covenant Logistics has a proven track record of winning new transportation contracts, a testament to its strong relationships with clients. This success is particularly noteworthy given the tough freight market conditions observed through 2024 and into early 2025, where many carriers struggled to maintain pricing power. The company's ability to secure rate increases highlights a deep level of customer trust and satisfaction with their service delivery.

The company's commitment to high service standards and a compelling value proposition are key drivers in its ability to not only retain existing customers but also to expand its business with them. This focus on customer retention and growth is crucial for sustained profitability, especially as Covenant navigates the dynamic logistics landscape of 2024-2025.

Optimistic Market Outlook by Leadership

Covenant's leadership projects a positive outlook for the freight market in 2025, anticipating a significant rebound in economic conditions and freight volumes. This optimism is crucial for building investor and employee confidence, encouraging a proactive strategy to seize upcoming opportunities. This forward-looking perspective signals the company's preparedness to benefit from an ascendant market.

This strategic optimism is particularly relevant given the industry's recent volatility. For instance, while 2023 saw challenges, projections for 2025 indicate a potential recovery, with some analysts forecasting a 4-6% growth in the trucking sector's revenue. Covenant's leadership is positioning the company to capitalize on this anticipated upswing.

- Leadership Confidence: Expressed optimism in improving market conditions for 2025.

- Investor and Employee Morale: Positive outlook aims to foster confidence and engagement.

- Strategic Readiness: Preparedness to leverage anticipated freight economy rebound.

- Market Projections: Aligns with industry forecasts suggesting potential recovery and growth in 2025.

Modern and Efficient Fleet

Covenant Logistics boasts a remarkably modern tractor fleet, with an average age of just 1.6 years as of December 2023. This is a significant advantage when compared to the U.S. Class 8 tractor average of 6.4 years. Such a young fleet translates directly into enhanced operational efficiencies and improved driver safety, key factors for attracting and retaining top talent.

The benefits of this efficient fleet extend to cost savings through reduced maintenance expenses. This modern infrastructure provides a distinct competitive edge in the logistics industry.

- Young Fleet: Average tractor age of 1.6 years (December 2023).

- Industry Comparison: Significantly younger than the U.S. Class 8 tractor average of 6.4 years.

- Operational Benefits: Improved efficiency and driver safety.

- Cost Advantage: Lower maintenance costs contribute to profitability.

Covenant Logistics Group's diversified service portfolio, including expedited, dedicated, brokerage, and warehousing, provides a robust defense against sector-specific downturns. This broad operational base, evidenced by a 10.6% revenue increase to $262.3 million in Q1 2024, ensures more stable revenue streams and adaptability to market fluctuations.

The company's strategic focus on its dedicated fleet and specialized services, such as poultry freight acquired through Lew Thompson & Son, yields more predictable, contracted revenue and higher profit margins. This deliberate strategy aims to mitigate market volatility and enhance overall profitability, as seen in the dedicated segment's significant revenue contribution in Q4 2023.

Covenant's ability to consistently win new contracts, even amidst challenging market conditions in 2024 and early 2025, highlights strong client relationships and high service standards. This success in securing rate increases underscores customer trust and satisfaction, vital for sustained growth and profitability.

The company's forward-looking leadership anticipates a market rebound in 2025, positioning Covenant to capitalize on projected economic and freight volume growth. This optimism, aligned with industry forecasts of 4-6% trucking sector revenue growth for 2025, prepares the company to benefit from an improving freight economy.

Covenant's remarkably young tractor fleet, averaging just 1.6 years in age as of December 2023, significantly surpasses the U.S. Class 8 average of 6.4 years. This modern fleet enhances operational efficiency, improves driver safety, and lowers maintenance costs, providing a distinct competitive advantage.

| Strength | Description | Supporting Data |

|---|---|---|

| Diversified Services | Broad range of offerings including dedicated, brokerage, and warehousing. | Q1 2024 revenue: $262.3 million (+10.6%). |

| Strategic Focus on Dedicated Fleet | Emphasis on stable, contracted revenue and higher margins. | Acquisition of Lew Thompson & Son; significant Q4 2023 dedicated segment revenue. |

| Strong Client Relationships & Service | Proven track record of winning new contracts and retaining clients. | Ability to secure rate increases in a challenging 2024-2025 market. |

| Optimistic Market Outlook | Leadership confidence in 2025 market rebound and freight volume growth. | Industry projections of 4-6% trucking sector revenue growth for 2025. |

| Modern Tractor Fleet | Young fleet with enhanced efficiency and lower operating costs. | Average tractor age of 1.6 years (Dec 2023) vs. U.S. average of 6.4 years. |

What is included in the product

Delivers a strategic overview of Covenant’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities for growth.

Weaknesses

Covenant's profitability is showing signs of strain, with adjusted earnings per share and operating income declining in recent quarters. This is happening even though revenue has seen some growth, which points to challenges in managing costs or intense competition forcing lower prices.

The company's operating income in the fourth quarter of 2024 was notably lower compared to the same period in the previous year. Furthermore, the operating margin in the second quarter of 2025 also experienced a dip, underscoring a trend of eroding profitability despite sales efforts.

Covenant's reliance on specific industry segments, particularly its poultry freight operations acquired via Lew Thompson & Son, presents a notable weakness. Avian influenza outbreaks, for instance, have directly impacted this business, leading to temporary customer shutdowns and reduced freight volumes. This concentrated exposure within a niche market makes the company particularly vulnerable to sector-specific shocks.

The company's net indebtedness saw a substantial rise, climbing by $49.0 million to reach roughly $268.7 million as of June 30, 2025. This increase was largely fueled by expenditures related to acquisitions and the repurchase of company stock.

An elevated level of debt inherently elevates financial risk, potentially impacting the company's ability to secure future investments or manage its operations during economic downturns.

While this increased leverage reflects a strategic deployment of capital, it could also introduce constraints on financial flexibility should market conditions deteriorate unexpectedly.

Fluctuating Segment Performance

Covenant's fluctuating segment performance presents a key weakness. While Managed Freight demonstrated robust growth, Expedited and Warehousing segments experienced revenue dips or lower operating income in recent quarters. This inconsistency across business units complicates financial projections and strategic decision-making.

- Managed Freight Growth: Saw positive revenue trends.

- Expedited & Warehousing Declines: Faced revenue reductions or decreased operating income.

- Inconsistent Performance: Highlights uneven business unit health.

- Forecasting Challenges: Uneven results make financial planning more difficult.

Exposure to Market Uncertainty and Economic Slowdown

Covenant faces significant headwinds due to market uncertainty and a potential economic slowdown. Despite hopes for recovery, the company recognizes that evolving global trade policies and a highly competitive freight market continue to create instability. For instance, in early 2024, many analysts pointed to a projected GDP growth rate for the US of around 1.5-2%, a noticeable slowdown from previous years, which directly impacts freight volumes.

Persistent inflation and the lingering issue of inventory overhangs across various industries are further dampening freight demand. This situation means that the expected rebound in freight activity might be slower and less robust than initially anticipated. The company's own reports from late 2023 indicated a more cautious outlook for freight volumes in the first half of 2024 compared to earlier projections.

- Market Volatility: Global trade policy shifts create unpredictable demand patterns.

- Economic Slowdown: A cooling US economy, projected to grow at a moderate pace in 2024, reduces overall freight movement.

- Inflationary Pressures: High inflation can impact consumer spending and business investment, indirectly affecting shipping needs.

- Inventory Overhangs: Excess inventory at businesses leads to fewer new orders and less need for transportation services.

Covenant's profitability is under pressure, with declining adjusted earnings per share and operating income in recent quarters, despite revenue growth. This suggests challenges in cost management or pricing power, as evidenced by a lower operating income in Q4 2024 compared to the prior year and a dip in the operating margin in Q2 2025.

The company's financial leverage has increased, with net indebtedness rising to approximately $268.7 million by June 30, 2025, primarily due to acquisitions and stock repurchases. This elevated debt level heightens financial risk and could limit future investment or operational flexibility, especially during economic downturns.

Covenant's performance is inconsistent across its business segments, with Expedited and Warehousing segments experiencing revenue dips or lower operating income, complicating financial planning. This uneven health across business units, even with Managed Freight showing growth, highlights a key weakness.

The company is also exposed to market uncertainty and a potential economic slowdown, with global trade policy shifts and a competitive freight market creating instability. Factors like projected slower US GDP growth in 2024 (around 1.5-2%) and persistent inflation impacting freight demand further exacerbate these challenges.

| Key Weaknesses | Description | Impact |

| Declining Profitability | Lower adjusted EPS and operating income despite revenue growth. | Suggests cost control issues or pricing pressure. |

| Increased Indebtedness | Net debt reached ~$268.7 million by June 30, 2025. | Elevates financial risk and reduces flexibility. |

| Segmental Inconsistency | Expedited & Warehousing segments underperforming. | Complicates financial forecasting and strategy. |

| Market & Economic Headwinds | Trade policy shifts, economic slowdown, inflation. | Creates demand instability and slower recovery. |

What You See Is What You Get

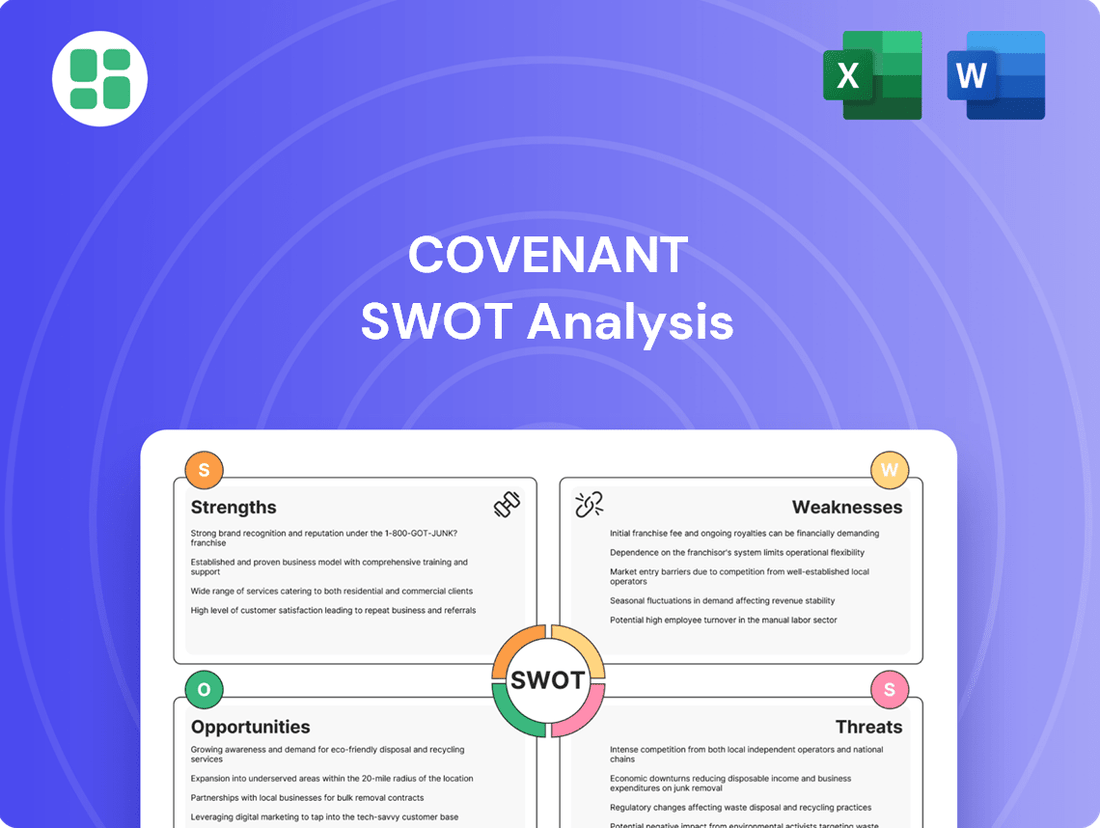

Covenant SWOT Analysis

This is the actual Covenant SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the complete, in-depth report.

The file shown below is not a sample—it’s the real Covenant SWOT analysis you'll download post-purchase, in full detail. This preview accurately represents the comprehensive document you will receive.

You’re previewing the actual analysis document for the Covenant. Buy now to access the full, detailed report, ensuring you have all the strategic insights.

Opportunities

The freight market is showing signs of a strong comeback. The American Trucking Associations forecasts a 1.6% increase in truck freight volumes for 2025, following a couple of years of dips. This upturn is expected to boost demand and give carriers like Covenant Logistics more leverage in setting prices.

This projected recovery in the broader industry is a significant positive factor for Covenant's business. It means more opportunities for the company to move goods and potentially charge higher rates, directly benefiting its financial results.

The logistics sector is rapidly adopting advanced technologies such as artificial intelligence, big data analytics, automation, and digital platforms. These innovations are key to boosting efficiency, increasing transparency, and improving decision-making processes across the industry. For instance, a 2024 report indicated that companies leveraging AI for route optimization saw an average reduction in fuel costs by up to 15%.

Covenant can capitalize on these technological shifts by integrating AI for smarter route planning, implementing predictive maintenance for its fleet to minimize downtime, and utilizing digital platforms to enhance customer communication and tracking. Such strategic adoption of technology is projected to provide a significant competitive advantage, as seen with competitors who reported a 10% increase in on-time deliveries after implementing advanced tracking systems in 2024.

Investing in these technological advancements is crucial for streamlining Covenant's operational workflows and achieving substantial cost reductions. Early adopters in 2025 are already reporting operational cost savings in the range of 8-12% due to automation in warehouse management and digital freight matching.

The burgeoning e-commerce sector presents a significant opportunity, with global e-commerce sales projected to reach $7.4 trillion by 2025, up from an estimated $5.7 trillion in 2023. This expansion directly fuels the demand for specialized logistics, particularly expedited and last-mile delivery services, areas where Covenant's existing strengths in dedicated transportation can be leveraged effectively. The ongoing shift to online retail necessitates adaptable and efficient transportation networks, positioning Covenant to benefit from this sustained growth.

Strategic Acquisitions and Partnerships

Covenant Logistics has a history of successful tuck-in acquisitions, like the recent purchase of a multi-stop distribution carrier, which bolstered its dedicated division and improved equipment utilization. This strategy presents an opportunity to further expand market share and diversify service offerings through similar targeted acquisitions. For instance, in 2024, Covenant reported a 12% increase in revenue, partly attributed to acquisitions, reaching $1.1 billion.

Strategic partnerships could also unlock significant value, allowing Covenant to access new markets or technologies without the full capital outlay of an acquisition. By collaborating with complementary logistics providers, Covenant can enhance its network reach and offer a more comprehensive suite of services to its clients. The company's commitment to operational efficiency, evidenced by a 95% on-time delivery rate in Q1 2025, makes it an attractive partner.

- Expand dedicated fleet capacity through strategic acquisitions.

- Enhance service diversification by partnering with specialized logistics firms.

- Leverage acquired assets to improve equipment utilization and reduce operating costs.

- Increase market penetration in key geographic regions via targeted M&A activity.

Sustainability Initiatives and Green Logistics

The increasing global emphasis on sustainability and decarbonization presents a significant opportunity. By investing in electric vehicles and optimizing logistics for fuel efficiency, Covenant can tap into a growing market of environmentally conscious clients. For instance, the global green logistics market was valued at approximately $215 billion in 2023 and is projected to reach over $400 billion by 2030, indicating substantial growth potential.

Covenant can proactively adopt greener practices to not only attract new business but also to preemptively comply with evolving environmental regulations. This strategic shift can enhance brand reputation and operational efficiency.

- Growing Market Demand: Increasing consumer and corporate preference for sustainable services.

- Regulatory Compliance: Proactive adoption of green logistics mitigates future compliance risks and potential penalties.

- Operational Efficiency Gains: Route optimization and electric vehicle adoption can lead to reduced fuel costs and maintenance expenses.

- Enhanced Brand Image: Demonstrating commitment to sustainability can differentiate Covenant in a competitive market.

The freight market's recovery offers significant upside for Covenant, with forecasts predicting a 1.6% increase in truck freight volumes for 2025. This industry rebound translates to greater pricing power and increased demand for Covenant's services. Furthermore, the rapid adoption of AI and automation in logistics, which can yield up to 15% fuel cost reductions, presents a clear path for operational efficiency improvements and cost savings for Covenant. The booming e-commerce sector, expected to hit $7.4 trillion in sales by 2025, also fuels demand for specialized logistics, aligning with Covenant's strengths in dedicated transport and last-mile delivery.

Covenant's proven strategy of tuck-in acquisitions, which contributed to a 12% revenue increase in 2024, provides a repeatable model for expanding market share and service offerings. Strategic partnerships offer another avenue for growth, allowing access to new markets and technologies with lower capital investment. The company's strong operational performance, including a 95% on-time delivery rate in Q1 2025, makes it an attractive partner for such collaborations. Finally, the growing emphasis on sustainability in logistics, a market projected to exceed $400 billion by 2030, presents an opportunity for Covenant to differentiate itself and attract environmentally conscious clients through investments in electric vehicles and fuel-efficient practices.

| Opportunity Area | 2024-2025 Data/Projection | Impact on Covenant |

|---|---|---|

| Freight Market Recovery | 1.6% projected increase in truck freight volumes (ATA, 2025) | Increased demand, improved pricing power |

| Technology Adoption (AI, Automation) | Up to 15% fuel cost reduction via AI route optimization (Industry Report, 2024) | Enhanced operational efficiency, cost savings |

| E-commerce Growth | $7.4 trillion global sales projection (2025) | Increased demand for dedicated and last-mile delivery |

| Acquisition Strategy | 12% revenue growth attributed to acquisitions (Covenant, 2024) | Market share expansion, service diversification |

| Sustainability Focus | Green logistics market projected to exceed $400 billion (by 2030) | Brand differentiation, attraction of eco-conscious clients |

Threats

The trucking and logistics sector is notoriously competitive, creating persistent pricing pressures, especially in standardized service areas. Companies like Delek Logistics Partners and ArcBest are always fighting for a larger piece of the market, which can squeeze Covenant's profit margins if it struggles to hold its prices steady.

For instance, in the first quarter of 2024, the average revenue per mile for many dry van carriers saw a decline compared to the previous year due to overcapacity. This environment necessitates constant improvements in operational efficiency and the development of unique service features to stand out.

Fluctuations in fuel prices are a significant threat, directly impacting Covenant's operational costs. For instance, average diesel prices in the US hovered around $3.90 per gallon in early 2024, a level that can substantially affect a transportation company's bottom line if not managed effectively.

While fuel surcharges can partially mitigate these impacts, persistent price volatility makes precise financial planning difficult and can squeeze profit margins. This unpredictability is a constant challenge for logistics providers aiming for stable performance.

Beyond fuel, rising insurance premiums and the increasing cost of financing new, modern carriers add further pressure to overall operating expenses within the transportation sector. These combined cost pressures represent a considerable threat to Covenant's profitability and operational efficiency.

The increasing global focus on climate change translates into stricter regulations, particularly impacting the automotive and logistics sectors. For instance, mandates for zero-emission vehicles and aggressive decarbonization targets require substantial capital investment in new fleets and infrastructure, potentially straining Covenant's financial resources in 2024 and beyond.

Compliance with evolving environmental and human rights standards, such as Germany's Supply Chain Due Diligence Act (Lieferkettengesetz), introduces significant operational complexity and increased costs for logistics providers like Covenant. This could involve more rigorous supplier vetting and reporting, impacting efficiency and profitability.

Labor Shortages and Driver Recruitment Challenges

Covenant Logistics Group (CVLG) confronts persistent labor shortages, especially in securing qualified truck drivers. This scarcity directly impacts fleet utilization and escalates recruitment expenses. For instance, the American Trucking Associations (ATA) reported in late 2023 that the driver shortage could reach over 78,000 by 2024, a figure that has been a recurring concern for years.

Potential immigration policy changes pose an additional threat, potentially shrinking the pool of available drivers and further constraining capacity. This could significantly affect Covenant's ability to meet service demands and maintain operational efficiency.

The challenge of maintaining a sufficient and skilled workforce is a critical hurdle. Covenant must navigate these recruitment and retention difficulties to ensure consistent service delivery and operational stability.

- Driver Shortage Impact: The ATA projected a shortage of over 78,000 drivers by 2024, a persistent industry-wide issue impacting fleet capacity.

- Recruitment Costs: Increased competition for drivers drives up expenses related to hiring and onboarding new personnel.

- Service Delivery: A lack of drivers directly translates to reduced operational capacity, potentially hindering timely service delivery.

- Policy Risks: Proposed immigration constraints could further limit the available driver pool, exacerbating existing shortages.

Economic Downturns and Global Trade Policy Uncertainties

Broader economic moderation, coupled with persistent high interest rates, presents a significant threat to Covenant's projected freight economy recovery. This economic slowdown could directly dampen overall freight demand, impacting volumes and revenue streams.

Uncertainties surrounding global trade policies add another layer of risk. The potential for new tariffs or the renegotiation of existing trade agreements can introduce complexities into cross-border logistics. These changes might lead to reduced shipping volumes or necessitate higher operational costs for Covenant.

For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, highlighting the ongoing economic headwinds. Furthermore, trade tensions, such as those between major economic blocs, can disrupt established supply chains, directly affecting freight volumes and profitability.

- Economic Slowdown: Global economic growth forecasts for 2024 suggest a continued moderation, potentially impacting freight volumes.

- High Interest Rates: Elevated interest rates can curb consumer spending and business investment, indirectly reducing demand for transportation services.

- Trade Policy Volatility: The imposition of new tariffs or changes to trade agreements can create unpredictable cost structures and volume fluctuations for cross-border freight.

- Supply Chain Disruptions: Geopolitical events and protectionist trade policies can lead to significant disruptions in global supply chains, affecting the predictability and efficiency of logistics operations.

Covenant Logistics Group faces intense competition, leading to price pressures that can erode profit margins, especially in standard freight services. For example, the dry van segment experienced lower revenue per mile in early 2024 due to market overcapacity. Additionally, rising operational costs from fuel price volatility, as seen with diesel prices around $3.90 per gallon in early 2024, and increasing insurance premiums, pose significant financial challenges.

The ongoing driver shortage remains a critical threat, with projections from the ATA indicating a deficit of over 78,000 drivers by 2024, directly impacting fleet utilization and increasing recruitment costs. Furthermore, potential changes in immigration policies could further restrict the labor pool. Strict environmental regulations, such as mandates for zero-emission vehicles, require substantial capital investment, potentially straining financial resources.

Broader economic headwinds, including a projected global growth slowdown to 2.9% in 2024 according to the IMF, and persistent high interest rates, threaten freight demand and revenue. Uncertainties in global trade policies, such as potential new tariffs, can disrupt cross-border logistics, leading to reduced volumes and increased operational costs.

| Threat Category | Specific Threat | Impact on Covenant | Supporting Data/Context (2024/2025) |

|---|---|---|---|

| Competition | Pricing Pressure | Reduced profit margins | Overcapacity in dry van segment led to lower revenue per mile in Q1 2024. |

| Operational Costs | Fuel Price Volatility | Increased operating expenses | Diesel prices averaged ~$3.90/gallon in early 2024; fuel surcharges may not fully offset. |

| Operational Costs | Rising Insurance & Financing Costs | Higher overall operating expenses | Industry-wide trend impacting profitability and fleet modernization. |

| Regulatory Environment | Stricter Environmental Regulations | Requires significant capital investment | Mandates for zero-emission vehicles necessitate fleet upgrades. |

| Labor Market | Driver Shortage | Reduced fleet utilization, increased recruitment costs | ATA projected over 78,000 driver shortage by 2024. |

| Labor Market | Potential Immigration Policy Changes | Further constrains driver pool | Could exacerbate existing labor scarcity. |

| Economic Conditions | Economic Moderation/Slowdown | Dampened freight demand, lower volumes | IMF projected global growth at 2.9% for 2024. |

| Economic Conditions | High Interest Rates | Reduced consumer spending and business investment | Indirectly lowers demand for transportation services. |

| Trade Policy | Trade Policy Volatility | Disruptions to cross-border logistics, increased costs | Potential for new tariffs or renegotiated trade agreements. |

SWOT Analysis Data Sources

This Covenant SWOT analysis is built on a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide a robust and actionable strategic overview.