Covenant Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covenant Bundle

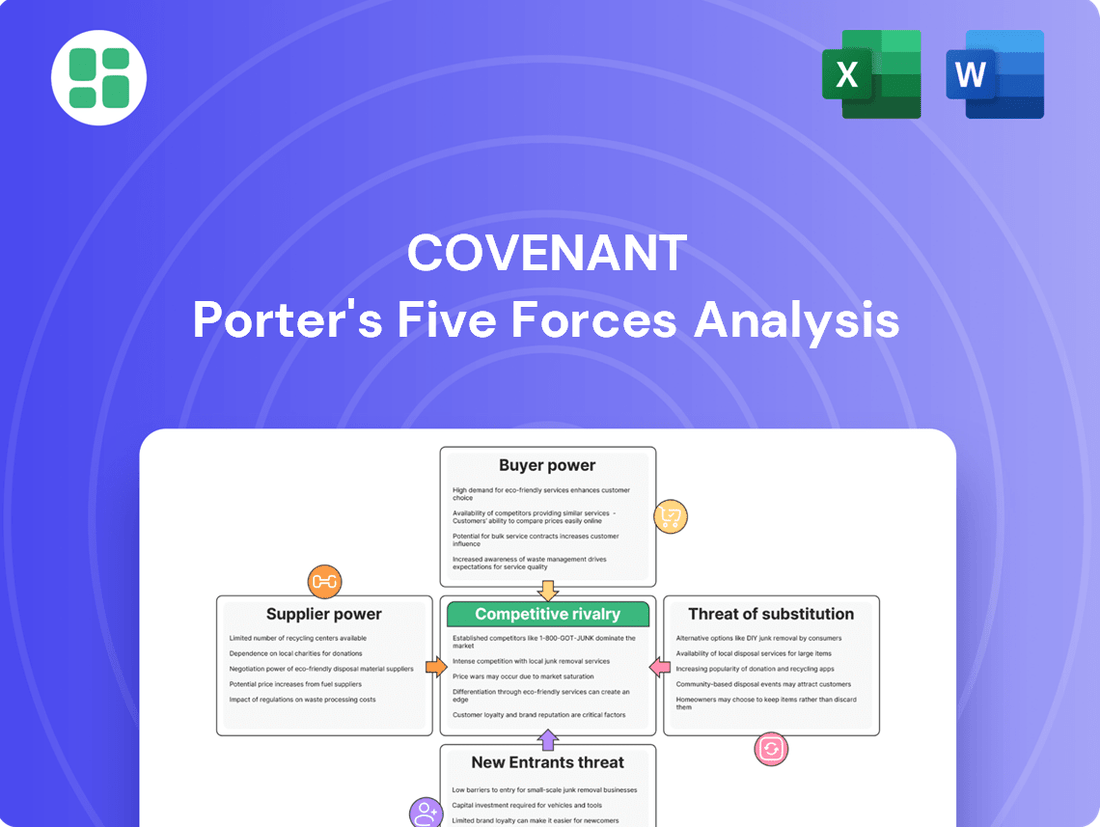

Understanding the competitive landscape is crucial for any business, and Porter's Five Forces provides a powerful framework. For Covenant, this analysis illuminates the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential of substitute products.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Covenant’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The volatile price of diesel, a critical operating expense for trucking firms like Covenant Logistics, directly influences supplier bargaining power. While some projections for 2025 suggested a dip in retail diesel prices, unexpected geopolitical shifts or imbalances in supply and demand can rapidly alter this outlook, squeezing margins for transportation providers.

The persistent shortage of qualified truck drivers, estimated at around 80,000 in late 2024 and expected to worsen, significantly bolsters drivers' bargaining power. This scarcity directly translates into upward pressure on wages and benefits, impacting Covenant's operational expenses and its capacity for fleet expansion.

Equipment manufacturers and technology providers, including those supplying trucks, trailers, and advanced logistics tech like AI and automation, wield significant bargaining power. Covenant Logistics depends on these suppliers for crucial capital expenditures and to maintain a competitive edge. The demand for fuel-efficient and technologically advanced fleets means these suppliers are key partners, especially with new equipment orders generally being subdued across the broader market.

Maintenance and Parts Suppliers

The constant requirement for maintenance and replacement parts for a substantial fleet grants considerable leverage to suppliers in this sector. This ongoing demand means that suppliers can often dictate terms, especially when specialized parts are needed for specific vehicle models within Covenant Logistics' fleet.

Repair expenses for older fleet vehicles can represent a substantial portion of operating costs. For Covenant Logistics, the average age of their tractors being approximately 20 months means that while not excessively old, these vehicles will still necessitate regular and potentially costly maintenance, increasing reliance on part suppliers.

- Supplier Leverage: The continuous need for parts for Covenant's large fleet gives suppliers significant bargaining power.

- Cost Impact: Repair costs for fleet vehicles, even those around 20 months old, can be a major operational expense.

- Specialized Parts: Dependence on specific parts for their tractor models further strengthens supplier positions.

Insurance Providers

Insurance providers wield considerable bargaining power, especially within the trucking sector. Escalating insurance costs, fueled by factors like 'nuclear verdicts' and a surge in litigation, empower these providers. This dynamic translates to higher premiums for companies like Covenant, directly impacting their operational expenses and risk mitigation strategies.

The trucking industry, in particular, has seen a significant uptick in insurance premiums. For instance, reports from 2024 indicated that trucking insurance costs have risen by as much as 20-30% year-over-year in some segments, a direct consequence of increased claims and legal settlements. This trend places substantial pressure on carriers to absorb these costs or pass them on, affecting their profitability.

- Rising Premiums: Increased litigation and jury awards are driving up insurance costs for trucking companies.

- Impact on Overhead: Higher insurance premiums directly increase a company's operating expenses.

- Coverage Restrictions: In some cases, providers may limit coverage or increase deductibles due to perceived risk.

- Negotiating Leverage: The current market conditions give insurance companies more leverage in setting terms and prices.

Suppliers of critical inputs like diesel fuel and specialized truck parts hold significant sway over Covenant Logistics. Fluctuations in fuel prices, with projections for 2025 suggesting potential dips but subject to geopolitical volatility, directly impact operating costs. Furthermore, the scarcity of qualified truck drivers, estimated at 80,000 in late 2024, amplifies their bargaining power, leading to increased wage demands and benefits. This situation creates an environment where suppliers can dictate terms, especially for essential components and labor, squeezing profit margins for transportation providers.

| Supplier Category | Key Factor Affecting Bargaining Power | Impact on Covenant Logistics | Data Point (2024/2025 Projection) |

|---|---|---|---|

| Fuel (Diesel) | Supply/Demand Imbalances, Geopolitical Events | Increased operating expenses, reduced margins | Projections for 2025 suggested dips, but volatility remains |

| Drivers | Shortage of Qualified Personnel | Upward pressure on wages and benefits, limits fleet expansion | Estimated shortage of 80,000 drivers in late 2024 |

| Equipment & Technology | Demand for advanced/efficient vehicles, capital expenditure needs | Leverage for manufacturers on pricing and terms | New equipment orders subdued across broader market |

| Maintenance & Parts | Fleet size and ongoing replacement needs | Suppliers can dictate terms, especially for specialized parts | Average tractor age ~20 months necessitates regular parts |

| Insurance Providers | Increased litigation ('nuclear verdicts'), rising claims | Higher premiums, increased operating overhead | Insurance costs rose 20-30% year-over-year in some segments in 2024 |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Covenant's specific position in the Porter's Five Forces framework.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force, allowing for proactive strategic adjustments.

Customers Bargaining Power

Covenant Logistics benefits from a broad customer base, which generally limits the power of any single buyer. This fragmentation means that no one customer can unilaterally dictate terms. However, the landscape shifts when large, consolidated shippers or those tendering substantial freight volumes enter the picture.

These major players can wield significant influence, particularly in markets with ample carrier capacity. For instance, in 2024, the trucking industry experienced fluctuating demand, giving larger shippers more leverage to negotiate favorable rates and service agreements, potentially impacting Covenant's pricing power.

In a soft freight market, characterized by economic headwinds and reduced demand, customers naturally become more price-sensitive. This heightened sensitivity directly translates into increased bargaining power for buyers. They are more inclined to shop around for the best rates and are less willing to accept price increases, forcing providers like Covenant Logistics to tread carefully when negotiating.

For Covenant Logistics, this dynamic played out in 2024. The company observed that securing rate increases required delicate negotiation, as customers were less receptive to higher prices. Furthermore, the company experienced softer-than-expected volumes in certain operational segments, a clear indicator of customers exercising their leverage by reducing their freight spend or seeking more cost-effective alternatives.

Customers in the transportation sector enjoy a wealth of choices, significantly impacting their bargaining power. They can readily select from a wide array of truckload carriers, freight brokerage firms, and even manage their logistics internally. This abundance of alternatives means customers aren't tied to a single provider, giving them substantial leverage.

The ease with which customers can switch providers if pricing or service levels aren't meeting expectations is a direct consequence of this availability. For instance, in 2024, the US trucking industry saw numerous new entrants, particularly in the less-than-truckload (LTL) and dedicated freight segments, further fragmenting the market and amplifying customer choice.

Demand for Specialized Services

Customers seeking highly specialized services, such as expedited shipping or dedicated fleet solutions, often possess diminished bargaining power. This is because these niche offerings typically carry a higher value proposition and are less commoditized, making it harder for customers to switch or negotiate aggressively. Covenant, recognizing this dynamic, is strategically expanding its specialized dedicated business to capture value from this segment.

For instance, the demand for specialized logistics, including temperature-controlled or hazardous materials transport, continues to grow. In 2024, the global cold chain logistics market was projected to reach over $300 billion, indicating a strong need for these specialized services. Companies like Covenant that can reliably provide these solutions are well-positioned to command better pricing and terms, thereby mitigating customer bargaining power.

- Reduced Price Sensitivity: Customers requiring specialized services are often less sensitive to price increases compared to those seeking standard transportation.

- Higher Switching Costs: The complexity and integration involved in specialized logistics can lead to higher switching costs for customers.

- Covenant's Strategic Focus: Covenant's investment in dedicated fleets and specialized transport capabilities directly addresses this market trend.

- Market Growth: The increasing demand for specialized logistics, such as expedited and dedicated solutions, provides a strong foundation for Covenant's strategy.

Managed Transportation and Warehousing Contracts

Customers in managed transportation and warehousing often sign multi-year agreements. While these contracts offer predictability, they also give customers leverage to secure advantageous pricing and service conditions from the outset. For instance, in 2024, Covenant Logistics Group reported that its warehousing segment experienced rising facility costs that had not yet been fully compensated by corresponding rate adjustments, indicating customer pushback on immediate price hikes.

This dynamic can limit the pricing power of service providers like Covenant. Customers, particularly larger ones with significant shipping volumes, can effectively bargain for lower rates or better service levels by threatening to switch providers or by leveraging their market influence. The ability to lock in terms for extended periods means that providers must carefully balance contract profitability against customer retention.

- Customer Bargaining Power Impact: Longer-term contracts provide customers with negotiation leverage, potentially limiting revenue growth for providers.

- 2024 Warehousing Challenges: Covenant Logistics Group's warehousing segment faced cost pressures from facilities that were not immediately offset by rate increases, illustrating customer resistance to price adjustments.

- Strategic Implications: Providers must balance securing long-term customer relationships with the need to achieve profitable pricing, especially in a cost-increasing environment.

Customers generally hold significant bargaining power when they can easily switch providers or when the cost of switching is low. This is particularly true for standardized services where differentiation is minimal. In 2024, the trucking sector saw an increase in carrier availability, particularly for less-than-truckload (LTL) services, which amplified customer choice and their ability to negotiate better terms.

Conversely, customers requiring highly specialized or integrated logistics solutions often have less bargaining power. The investment in custom solutions or the complexity of switching can create higher barriers. For example, the growing demand for temperature-controlled logistics, a segment Covenant Logistics is expanding into, often involves specialized equipment and processes, reducing customer price sensitivity and increasing switching costs.

Large customers or those tendering substantial volumes can also exert considerable influence, especially in periods of overcapacity. In 2024, economic uncertainties led some larger shippers to consolidate their freight volumes, giving them more leverage to demand lower rates from carriers like Covenant Logistics. This concentration of buyer power can lead to price concessions.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Availability of Alternatives | High when many providers exist | Increased due to new entrants in LTL |

| Switching Costs | Low for standardized services, high for specialized | Low for general freight, high for dedicated fleets |

| Customer Volume/Concentration | High for large, consolidated shippers | Shippers consolidated volumes for leverage |

| Service Specialization | Lowers power due to unique needs | Growing demand for specialized logistics |

What You See Is What You Get

Covenant Porter's Five Forces Analysis

This preview showcases the complete Covenant Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately upon purchase, ensuring no hidden surprises or placeholder content. You can confidently acquire this comprehensive analysis, ready for immediate application to your strategic decision-making.

Rivalry Among Competitors

The North American transportation and logistics sector is incredibly fragmented, featuring a vast number of truckload carriers, freight brokers, and logistics service providers. This sheer volume of players creates a fiercely competitive environment.

This intense rivalry, often exacerbated by periods of carrier oversupply, directly translates into significant pricing pressures and a constant battle for market share. For instance, in early 2024, the U.S. trucking industry experienced a surplus of available capacity, contributing to a decline in spot market rates for many freight lanes.

The freight recession that gripped the industry in 2024 significantly intensified competitive rivalry. Reduced freight volumes and stagnant pricing squeezed margins, forcing companies to compete more aggressively for available business. This environment saw many smaller, less capitalized carriers exit the market, a trend that Covenant Logistics also navigated as it worked through a slow rebalancing.

Competitive rivalry within the freight transportation sector is significantly influenced by service differentiation. Companies actively compete by emphasizing reliability, offering expedited shipping options, and providing customized solutions like dedicated contract carriage. Covenant Logistics Group's strategic emphasis on specialized dedicated business is a direct response to this intense competition, aiming to carve out a niche by excelling in these differentiated service areas.

Technological Adoption and Innovation

Competitive rivalry is intensifying as firms heavily invest in technological adoption and innovation. Companies are increasingly integrating artificial intelligence, automation, and advanced data analytics to streamline operations, improve delivery efficiency, and elevate customer experiences. For instance, in the logistics sector, companies are leveraging AI for predictive maintenance on their fleets, aiming to reduce downtime. In 2024, the global AI market was projected to reach over $200 billion, highlighting the significant investment in this area.

Those businesses that lag in adopting these cutting-edge technologies risk losing their competitive edge. The ability to adapt and innovate technologically is becoming a critical differentiator. For example, real-time data analytics allows for dynamic route optimization, which can lead to substantial cost savings and faster delivery times. Companies that embrace these advancements are better positioned to meet evolving customer demands and market expectations.

- AI in Logistics: Projected to increase efficiency by up to 20% in route planning and execution.

- Automation Adoption: Businesses investing in automation saw an average 15% reduction in operational costs in 2023.

- Data Analytics Impact: Companies utilizing real-time data analytics reported a 10% improvement in customer satisfaction.

- R&D Spending: Technology-focused sectors saw R&D expenditure grow by an average of 8% in the first half of 2024.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) activity is a significant driver of competitive rivalry in the logistics sector. Consolidation through high-profile deals, particularly among freight brokerage firms, signals an intensifying competitive landscape. For instance, in 2023, the logistics industry saw substantial M&A transactions, with companies aiming to bolster market share and expand their service offerings. This trend directly impacts standalone logistics companies, as larger, consolidated entities can leverage increased scale and broader capabilities to outcompete them.

The ongoing consolidation means that larger players are actively acquiring smaller competitors or complementary businesses to enhance their market presence and service portfolios. This strategic move allows them to offer a more comprehensive suite of logistics solutions, from warehousing to last-mile delivery. Such expansion poses a direct threat to independent logistics providers who may lack the resources to compete on price or service breadth.

- Increased Market Concentration: M&A activity leads to fewer, larger players dominating specific logistics segments.

- Enhanced Service Offerings: Acquired companies often integrate new technologies and services, increasing the competitive pressure on those that do not.

- Price Competition: Larger, consolidated firms can often negotiate better rates with carriers and suppliers, leading to more aggressive pricing strategies.

- Threat to Standalone Providers: Companies that remain independent may struggle to match the scale, efficiency, and integrated services of larger, merged entities.

The competitive rivalry in the North American transportation and logistics sector is exceptionally high due to its fragmented nature. This intense competition, driven by numerous players, leads to significant pricing pressures and a constant struggle for market share, particularly evident during periods of oversupply like early 2024.

Technological adoption is a key battleground, with companies investing heavily in AI and automation to boost efficiency and customer experience. For instance, AI in logistics is projected to increase route planning efficiency by up to 20%, while automation adoption saw businesses achieve average operational cost reductions of 15% in 2023.

Mergers and acquisitions are further intensifying this rivalry, leading to market consolidation. Larger, combined entities can leverage scale and broader capabilities, posing a challenge to standalone providers who may struggle to match their integrated services and pricing strategies.

| Metric | 2023/Early 2024 Trend | Impact on Rivalry |

|---|---|---|

| Market Fragmentation | High, vast number of players | Intense price and service competition |

| Carrier Oversupply (Early 2024) | Prevalent, especially in trucking | Downward pressure on spot rates |

| Technology Investment (AI, Automation) | Significant, projected global AI market >$200B (2024) | Drives efficiency, creates competitive advantage for adopters |

| M&A Activity | Substantial in 2023, particularly in brokerage | Increases market concentration, enhances scale of larger players |

SSubstitutes Threaten

For certain freight types, rail intermodal offers a compelling cost alternative to long-haul trucking, particularly for bulk or less time-sensitive cargo. In 2024, the U.S. rail intermodal volume saw fluctuations, but its inherent efficiency for large volumes remains a key factor.

Air freight, while pricier, steps in as a vital substitute for urgent or high-value shipments where speed is paramount. The global air cargo market in 2024 continued to navigate post-pandemic recovery, with demand for expedited services supporting its role as a substitute.

Large shippers increasingly possess the resources and expertise to bring logistics operations in-house, diminishing their need for third-party providers like Covenant Logistics. This trend directly threatens Covenant's brokerage and carrier services, as major clients can bypass them entirely.

For instance, in 2024, many large retailers and manufacturers have invested significantly in private fleets and advanced transportation management systems. This allows them to control costs and delivery schedules more effectively, making outsourcing less attractive.

The ability of these large entities to manage their own logistics creates a significant substitute for Covenant's core offerings. This is particularly true for high-volume, predictable shipping lanes where the cost savings of insourcing can be substantial.

Ocean shipping is a significant substitute for land-based transportation, especially for international trade involving large volumes and less time-sensitive goods. In 2024, global container shipping rates saw fluctuations, with the Drewry World Container Index averaging around $2,000 per 40ft container for major East-West trade routes, demonstrating the cost-effectiveness of this mode for bulk movements compared to air or extensive trucking.

For businesses needing to move substantial quantities of goods across continents, ocean freight offers a compelling alternative to the higher costs and limitations of overland routes. The sheer capacity of container ships means that economies of scale can be realized, making it a primary choice for many importers and exporters, even if transit times are longer than other methods.

Emerging Delivery Technologies

Emerging delivery technologies, such as drone and autonomous vehicle deployment, represent a notable threat of substitutes. These innovations could significantly alter logistics costs and delivery times, especially for last-mile services. For instance, by 2024, the global drone delivery market was projected to reach over $10 billion, indicating substantial investment and potential disruption.

These new methods offer the possibility of bypassing traditional road infrastructure and reducing labor expenses. Companies exploring these avenues aim to achieve faster delivery cycles, potentially making current methods less competitive for certain goods or geographical areas. The ongoing advancements in battery technology and AI for navigation are key enablers for this shift.

- Drone Delivery Growth: The drone delivery market is experiencing rapid expansion, with projections indicating continued strong growth through 2025.

- Autonomous Vehicle Impact: Autonomous vehicles are poised to reduce operational costs in freight transport, potentially impacting long-haul and regional delivery services.

- Cost-Effectiveness: Emerging technologies aim to lower per-delivery costs, creating a price-based substitute for existing delivery networks.

- Speed and Efficiency: Faster delivery times offered by these new methods can become a significant competitive advantage, drawing customers away from slower alternatives.

Shipper-Carrier Direct Relationships

The increasing prevalence of digital freight platforms and direct booking tools is a significant threat of substitutes for traditional freight brokers. These technologies empower shippers to bypass intermediaries and forge direct connections with carriers. This disintermediation can reduce the perceived value of brokerage services, as shippers gain more control and transparency in managing their logistics needs.

For instance, in 2024, the digital freight brokerage market continued its expansion, with platforms facilitating millions of load matches. Shippers leveraging these tools reported an average cost saving of 5-10% on their freight spend by cutting out broker fees. This direct access allows for more streamlined communication and negotiation, directly impacting the revenue streams of traditional brokerage firms.

- Digital platforms offer shippers direct access to carriers, bypassing traditional brokers.

- This trend can lead to reduced brokerage fees and increased shipper control.

- In 2024, shippers using digital freight solutions saw average cost savings of 5-10%.

- The ease of direct booking and negotiation on these platforms presents a strong substitute for broker services.

The threat of substitutes for Covenant Logistics stems from alternative transportation modes and evolving shipper capabilities. Rail intermodal, ocean shipping, and air freight each offer distinct advantages for different freight types and urgency levels. Furthermore, the rise of digital freight platforms and the increasing trend of shippers insourcing logistics operations directly challenge traditional brokerage and carrier services.

| Substitute | Key Advantage | 2024 Data/Trend |

|---|---|---|

| Rail Intermodal | Cost-efficiency for bulk/less time-sensitive cargo | Fluctuating volumes, but inherent efficiency for large volumes remains |

| Air Freight | Speed for urgent/high-value shipments | Global air cargo market navigating post-pandemic recovery, demand for expedited services |

| Ocean Shipping | Cost-effectiveness for international bulk movements | Drewry World Container Index averaged ~$2,000/40ft container on major routes |

| Digital Freight Platforms | Direct access to carriers, reduced fees | Shippers using platforms saw 5-10% cost savings; market expansion |

| Insourcing Logistics | Control over costs and delivery schedules | Large retailers/manufacturers investing in private fleets and TMS |

| Emerging Tech (Drones/AVs) | Potential for faster, lower-cost delivery | Global drone delivery market projected >$10 billion |

Entrants Threaten

The truckload transportation sector demands substantial upfront capital. New companies must invest heavily in purchasing a fleet of trucks and trailers, establishing maintenance facilities, and implementing crucial logistics technology. For instance, the average cost of a new Class 8 semi-truck can range from $120,000 to $180,000, and a trailer can cost upwards of $50,000, quickly escalating the initial outlay for even a modest fleet.

This considerable financial barrier effectively deters many aspiring competitors from entering the market. The sheer scale of investment required to acquire the necessary assets and infrastructure makes it challenging for smaller, less capitalized entities to compete with established players who already possess these resources.

The transportation and logistics sector faces a formidable barrier to entry due to stringent regulatory requirements. New companies must contend with a complex web of safety standards, operational licenses, and environmental compliance mandates. For instance, in 2024, the U.S. Department of Transportation continued to enforce rigorous safety protocols for commercial vehicles, requiring significant investment in training and equipment for any new operator.

Navigating these intricate regulatory landscapes presents a substantial challenge and cost for aspiring entrants. Obtaining necessary permits and adhering to evolving compliance standards, such as those related to emissions in 2024, demands considerable financial resources and specialized expertise. This complexity effectively deters many potential new players from entering the market, thereby reducing the threat of new competition.

Established companies like Covenant Logistics Group (CVLG) leverage deep-seated customer relationships and extensive transportation networks built over years of operation. For instance, in 2023, CVLG reported a significant portion of its revenue derived from long-term contracts with major clients, indicating the stickiness of these relationships. New entrants face a substantial hurdle in replicating this level of trust and logistical reach, requiring considerable investment in time and resources to even begin competing on a similar scale.

Driver Recruitment and Retention Challenges

The persistent truck driver shortage, exacerbated by high turnover rates, presents a substantial hurdle for new entrants seeking to establish a foothold in the transportation sector. This critical labor challenge directly impacts a company's ability to scale and operate efficiently, as a consistent and skilled driver pool is fundamental to success.

In 2024, the American Trucking Associations (ATA) reported a shortage of approximately 78,000 drivers, a figure that has continued to grow. This scarcity makes it exceptionally difficult and costly for new carriers to recruit and retain the necessary personnel, effectively acting as a barrier to entry.

- Driver Shortage: In 2024, the ATA estimated a deficit of 78,000 drivers.

- High Turnover: Industry turnover rates have historically remained high, often exceeding 90% annually for large truckload fleets, making retention a constant battle.

- Recruitment Costs: The expense associated with attracting new drivers, including sign-on bonuses and training, can be prohibitive for startups.

- Operational Impact: Without sufficient drivers, new companies cannot fulfill contracts or meet delivery demands, hindering growth.

Access to Technology and Data

The significant investment required for cutting-edge technology, such as advanced logistics software and data analytics platforms, presents a substantial hurdle for newcomers. For instance, implementing a comprehensive supply chain management system can cost tens of thousands to hundreds of thousands of dollars, not including ongoing maintenance and personnel training.

New entrants often lack the established infrastructure and the financial resources to acquire and integrate complex technologies like artificial intelligence for demand forecasting or sophisticated real-time tracking systems. This technological gap can leave them at a competitive disadvantage compared to established players who have already amortized these costs.

- High upfront costs for advanced logistics software and AI platforms.

- Need for specialized technical expertise to operate and maintain new technologies.

- Established firms benefit from existing technological investments and data accumulation.

- Barriers are amplified for smaller businesses lacking significant capital.

The threat of new entrants into the truckload transportation sector is significantly mitigated by substantial capital requirements, stringent regulatory compliance, and the difficulty in replicating established customer relationships. High upfront costs for fleets, technology, and navigating complex regulations like those enforced by the U.S. DOT in 2024, coupled with the need for deep-seated client trust, create formidable barriers.

The persistent truck driver shortage, estimated by the ATA in 2024 to be around 78,000 drivers, further constrains new companies. High driver turnover rates, often exceeding 90% for large fleets, and the escalating costs of recruitment make it exceedingly difficult for startups to secure essential personnel, directly impacting their ability to scale and operate effectively.

| Barrier Type | Key Factors | Impact on New Entrants |

| Capital Requirements | New truck cost ($120k-$180k), trailer cost ($50k+), maintenance facilities, logistics tech | Requires significant upfront investment, limiting smaller players. |

| Regulatory Compliance | Safety standards, operational licenses, environmental mandates (e.g., emissions) | Demands specialized expertise and financial resources to navigate complex rules. |

| Customer Relationships & Networks | Long-term contracts, established trust, logistical reach | Difficult and time-consuming for new entrants to replicate, requiring substantial investment. |

| Labor (Driver Shortage) | ATA estimate of 78,000 drivers shortage (2024), high turnover (>90%) | Makes recruitment costly and challenging, hindering operational capacity. |

| Technology Investment | Advanced logistics software, AI for forecasting, real-time tracking | High implementation and maintenance costs, requiring specialized expertise. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, publicly available company financial statements, and expert analyses from leading financial institutions. This multi-faceted approach ensures a comprehensive understanding of competitive pressures.