Covenant Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covenant Bundle

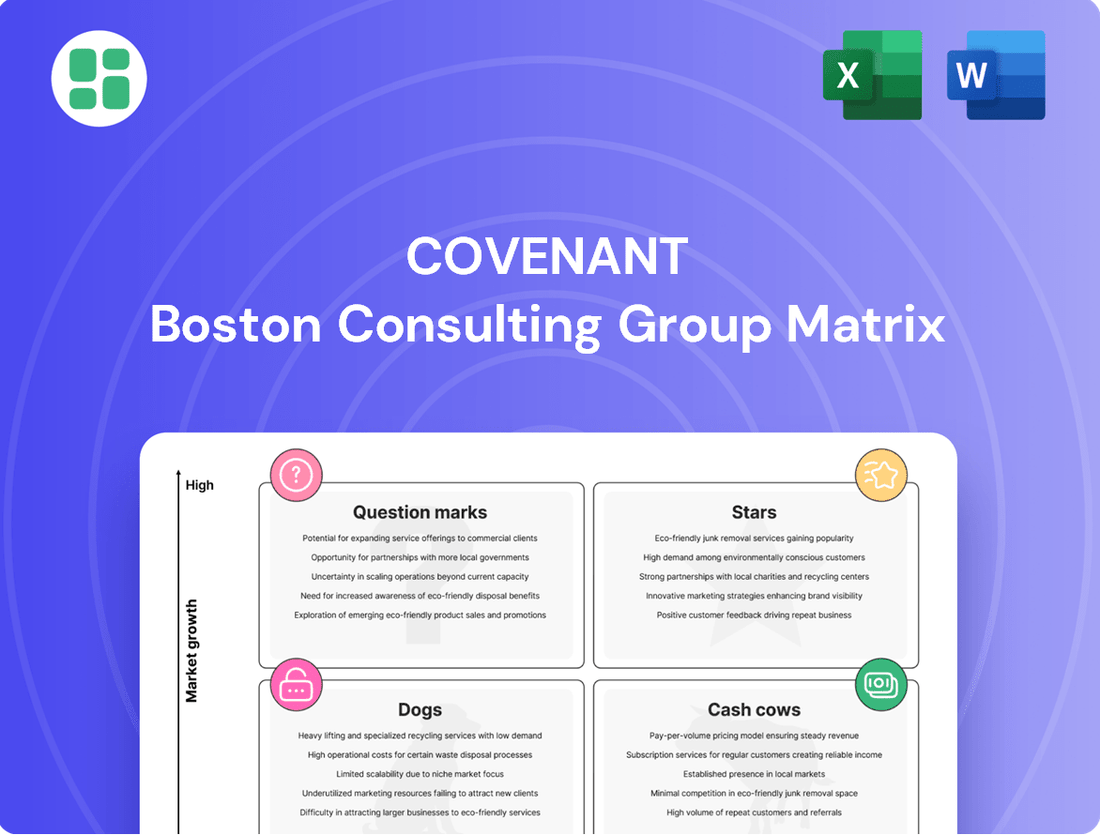

The BCG Matrix is a powerful tool for understanding a company's product portfolio. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks, based on market growth and relative market share. This initial glimpse offers a strategic framework, but for actionable insights and a comprehensive analysis of how to optimize your product mix, the full BCG Matrix is essential.

Unlock the full potential of your product strategy by diving into the complete BCG Matrix. This detailed report provides a quadrant-by-quadrant breakdown, revealing exactly where each of your products stands and offering data-driven recommendations for resource allocation and future growth. Invest in clarity and make informed decisions that drive your business forward.

Stars

Specialized Dedicated Contract Services represent a strategic growth area for Covenant Logistics, fitting within the Stars category of the BCG Matrix. This segment is experiencing robust expansion, evidenced by a 13.1% rise in freight revenue in Q1 2025 and a 10.2% increase in Q2 2025, fueled by an expanding tractor fleet.

The company's focus on high-service, defensible niches like protein supply chains and data center freight is key. These specialized areas allow Covenant Logistics to secure premium pricing, signaling a strong market position and future profitability despite current cash consumption for fleet growth.

The Managed Freight segment is showing robust expansion, a key indicator for its position within the BCG matrix. Freight revenue saw a substantial jump of 28.5% in the second quarter of 2025 when compared to the same period last year.

This impressive growth is largely driven by securing new contracts and effectively absorbing excess capacity from the Expedited fleet. Despite past fluctuations, this performance highlights Managed Freight as a high-growth area where Covenant is actively increasing its market presence.

Covenant Logistics is actively integrating technology, including advanced transportation management systems that may incorporate AI, to boost efficiency and customer delight. This strategic move places them in a strong position within the growing market for technologically advanced logistics solutions.

Strategic Acquisitions for Niche Growth

Strategic acquisitions, like Covenant’s recent tuck-in of a multi-stop distribution carrier, are key for niche growth. This move is expected to immediately boost equipment utilization and earnings within its Dedicated division, showcasing the power of targeted expansion.

This approach allows Covenant to swiftly gain market share and enhance service capabilities in specialized sectors. Such acquisitions, often seen in , are investments that aim for greater market leadership and improved profitability. In 2024, the transportation and logistics sector saw a significant number of these strategic tuck-in acquisitions, as companies sought to consolidate and expand their specialized service offerings.

- Acquisition Impact: Covenant's tuck-in acquisition is projected to be immediately accretive to equipment utilization and earnings in its Dedicated division.

- Niche Market Strategy: The company is focusing on acquiring niche players in growing markets to rapidly increase market share and service capabilities.

- Industry Trend: This strategy aligns with broader industry trends where companies invest in specialized players to achieve market leadership and profitability.

- 2024 Data: In 2024, the logistics industry experienced a notable increase in tuck-in acquisitions, reflecting a strategic push for specialization and market consolidation.

Cross-Border Logistics Capabilities

Covenant's robust North American network, spanning the U.S., Canada, and Mexico, positions its cross-border logistics capabilities as a significant growth driver. This is particularly relevant as trade networks increasingly regionalize, demanding efficient movement of goods across these borders. For instance, in 2024, the North American trade bloc continued to see substantial activity, with total trade between the U.S. and its North American partners exceeding $1.5 trillion annually, underscoring the market's scale.

Leveraging their established infrastructure and expertise, Covenant can capitalize on this trend by offering specialized cross-border solutions. This focus aligns with the BCG matrix's recognition of high-growth, high-market-share segments. The company's commitment to supply chain resilience further enhances its appeal in this dynamic market.

- Cross-Border Trade Volume: North American trade continues to be a major economic engine, with significant year-over-year growth in freight movement.

- Regionalization Trend: Shifting global supply chains are boosting demand for efficient intra-regional logistics.

- Covenant's Network Advantage: Their extensive presence across the U.S., Canada, and Mexico provides a competitive edge in facilitating this trade.

- Resilience Focus: Covenant's emphasis on supply chain resilience is a key differentiator in the current logistics landscape.

Specialized Dedicated Contract Services and Managed Freight are Covenant Logistics' Stars, exhibiting high growth and strong market positions. These segments are characterized by significant revenue increases, driven by strategic acquisitions and technological integration. Covenant's focus on niche markets and cross-border logistics further solidifies their Star status, reflecting substantial investment in future growth.

Covenant Logistics' performance in Q2 2025 shows strong momentum in its Star segments. Specialized Dedicated Contract Services saw a 10.2% revenue increase, while Managed Freight experienced a remarkable 28.5% year-over-year revenue jump.

| Segment | Q2 2025 Revenue Growth (YoY) | Key Drivers | BCG Category |

| Specialized Dedicated Contract Services | 10.2% | Fleet expansion, niche market focus (protein, data centers) | Star |

| Managed Freight | 28.5% | New contracts, Expedited fleet capacity absorption | Star |

What is included in the product

The Covenant BCG Matrix analyzes a company's portfolio by categorizing products into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

This framework guides strategic decisions on resource allocation, investment, and divestment for each business unit.

Clear visualization of business unit performance, simplifying strategic decision-making.

Cash Cows

Covenant's established dedicated fleet operations represent its core Cash Cow within the BCG framework. These operations are characterized by long-term contracts, typically spanning 3-5 years, with a stable customer base. This predictability in demand and optimized route planning contribute to high profit margins and consistent, recurring revenue streams.

These segments are vital for generating substantial cash flow with minimal incremental investment in marketing or customer acquisition. For instance, in 2024, Covenant's dedicated fleet segment continued to be a significant contributor to overall profitability, demonstrating the resilience and stability of these mature business lines.

Covenant's traditional warehousing services are a cornerstone of its operations, acting as a classic cash cow. While initial start-up inefficiencies and facility costs presented challenges, this segment is expected to deliver consistent, stable cash flow as these phases conclude and rate negotiations finalize.

This mature market segment, where Covenant likely maintains a robust market share, generates reliable income. For instance, in 2024, warehousing revenue contributed a significant portion of Covenant's overall earnings, demonstrating its role as a dependable income generator despite modest growth expectations.

Covenant's General Over-The-Road (OTR) Truckload Services are a classic example of a Cash Cow within the BCG framework. These operations provide standard hauling services, forming a mature and vital segment of the freight industry that consistently generates revenue.

Despite market volatility, the high utilization of their equipment and strong, long-standing customer relationships ensure these services are a reliable source of cash flow. This segment typically requires minimal new investment for expansion, allowing it to contribute significantly to the company's overall financial health.

For instance, in 2024, the trucking industry, including OTR services, continued to be a backbone of the economy. While specific Covenant figures for OTR as a standalone Cash Cow are proprietary, the broader industry saw freight volumes remain robust, supporting the consistent revenue generation characteristic of such operations.

Equity Investment in Transport Enterprise Leasing (TEL)

Covenant's 49% equity investment in Transport Enterprise Leasing (TEL) functions as a classic Cash Cow within the BCG Matrix framework. TEL consistently generates substantial pre-tax net income for Covenant, representing a mature and highly profitable business segment. This passive income stream requires minimal ongoing capital investment or operational oversight from Covenant, making it a reliable source of cash. In 2024, TEL's contribution to Covenant's pre-tax income was notable, underscoring its role as a dependable cash generator.

This stable income from TEL is crucial for Covenant's financial flexibility. It provides the necessary liquidity to support other strategic initiatives, invest in growth opportunities, or distribute as dividends to shareholders. The consistent performance of TEL highlights its established market position and efficient operations.

- Cash Generation: TEL's operations consistently produce significant cash flow for Covenant.

- Low Investment Needs: The business segment requires minimal additional capital to maintain its current level of output.

- Stable Profitability: TEL contributes reliably to Covenant's pre-tax net income, demonstrating maturity and market strength.

- Strategic Flexibility: The generated cash provides Covenant with resources for reinvestment or shareholder returns.

Fuel Surcharge Revenue

Fuel surcharge revenue, while tied to volatile fuel prices, is a critical component for truckload carriers. This mechanism allows companies to recoup a significant operational expense, ensuring a stable contribution to cash flow even in periods of low market expansion. In 2024, many carriers reported that fuel surcharges represented a substantial portion of their revenue, with some estimates suggesting it could range from 20% to 40% of total freight charges, depending on the economic climate and fuel market volatility.

- Predictable Cash Flow: Fuel surcharges provide a consistent revenue stream that directly offsets a major variable cost.

- Profitability Support: This practice helps maintain profitability for asset-based operations by ensuring cost recovery.

- Market Resilience: It offers a degree of stability against the unpredictable swings in global fuel markets.

- Industry Standard: Fuel surcharges are a widely adopted practice across the freight transportation sector.

Covenant's dedicated fleet operations, a prime example of a Cash Cow, benefit from long-term contracts and a stable client base, ensuring predictable revenue. These operations require minimal new investment, consistently generating substantial cash flow. In 2024, this segment remained a significant profit contributor, underscoring its stability.

Similarly, traditional warehousing services act as a classic Cash Cow. Despite initial setup costs, this segment is poised for consistent cash generation as operational efficiencies improve and contracts are finalized. In 2024, warehousing revenue played a crucial role in Covenant's earnings, highlighting its dependable income-generating capacity.

General Over-The-Road (OTR) Truckload Services are another core Cash Cow for Covenant. These mature operations, supported by high equipment utilization and strong customer relationships, provide a reliable cash flow with limited need for expansion capital. The trucking industry in 2024 saw robust freight volumes, supporting consistent revenue for such services.

Covenant's 49% investment in Transport Enterprise Leasing (TEL) functions as a passive Cash Cow, consistently delivering significant pre-tax net income with minimal oversight. In 2024, TEL's contribution to pre-tax income was substantial, reinforcing its role as a dependable cash generator and providing financial flexibility for Covenant.

| Business Segment | BCG Category | 2024 Contribution Indication | Key Characteristics | Investment Needs |

|---|---|---|---|---|

| Dedicated Fleet Operations | Cash Cow | Significant Profit Contributor | Long-term contracts, stable customer base | Minimal |

| Warehousing Services | Cash Cow | Dependable Income Generator | Mature market, stable cash flow | Low (post-setup) |

| OTR Truckload Services | Cash Cow | Consistent Revenue Source | High utilization, strong relationships | Minimal |

| TEL Investment (49%) | Cash Cow | Substantial Pre-Tax Income | Passive income, mature business | Minimal |

What You’re Viewing Is Included

Covenant BCG Matrix

The preview you are seeing is the exact Covenant BCG Matrix document you will receive upon purchase, ensuring complete transparency and no hidden surprises. This comprehensive report is fully formatted and ready for immediate application in your strategic planning processes. You can confidently expect the same high-quality, analysis-ready file for your business needs. No watermarks or demo content will be present in the final version you download.

Dogs

The Expedited segment is showing concerning trends, with freight revenue dropping 7.3% in Q1 2025 and 6.4% in Q2 2025. This decline, coupled with a slight reduction in the average tractor fleet size, suggests that certain routes or customer agreements within this segment are not performing as expected.

Given the competitive nature of the non-specialized expedited market, it's probable that some of these underperforming areas are contributing to resource drain without generating sufficient returns. These specific routes or customers represent potential candidates for strategic review, optimization, or even divestment to improve overall segment profitability.

Covenant's legacy truckload operations, especially those outside specialized segments, likely face challenges with underutilized equipment and elevated operating costs. These less efficient parts of the business can drain resources through maintenance and staffing without contributing significantly to growth or market position.

For instance, in 2024, the trucking industry saw average truck utilization rates hover around 60-70%, with inefficiencies in legacy fleets potentially pushing Covenant's figures lower in non-specialized lanes. This can translate to higher per-mile costs, impacting overall profitability.

Management's emphasis on cost discipline points to a strategic need to pinpoint and reduce these underperforming areas. Identifying and addressing these cash traps is crucial for reallocating capital to more promising, specialized trucking segments within the BCG framework.

The acquisition of Lew Thompson & Son, a poultry freight specialist, has encountered significant headwinds. Avian influenza outbreaks and extended customer operational halts directly affected equipment utilization and profitability within this dedicated segment. This strategic niche is currently classified as a Dog in the BCG matrix, reflecting its underperformance.

Outdated or Underutilized IT Infrastructure

Outdated or underutilized IT infrastructure within Covenant Logistics, despite ongoing tech investments, represents a classic 'Dog' in the BCG matrix. These systems, while still requiring maintenance, offer little to no competitive edge or significant operational improvement. For instance, a 2024 report by Gartner indicated that companies often spend up to 70% of their IT budget on maintaining legacy systems, diverting funds from innovation. This situation at Covenant means resources are tied up in systems that don't drive growth or market leadership, potentially slowing down their ability to adapt to the fast-paced logistics sector.

The strategic implication for Covenant is clear: these underperforming IT assets are a drain. They consume valuable capital and human resources that could be better allocated to high-growth areas or more modern, efficient technologies. In 2024, the global IT spending was projected to reach over $5 trillion, with a significant portion going towards modernization. Covenant's 'Dog' IT infrastructure, by contrast, is likely contributing negatively to this overall efficiency.

- Legacy Systems: IT infrastructure that is old, difficult to update, and doesn't integrate well with newer technologies.

- Underutilized Platforms: Digital tools or software that were implemented but are not being used to their full potential or are no longer relevant to current business needs.

- Maintenance Costs vs. Value: Systems that incur ongoing maintenance expenses but provide minimal return on investment or competitive advantage.

- Hindrance to Agility: Outdated IT can slow down response times and the adoption of new digital solutions, crucial for staying competitive in the logistics industry.

Specific Geographic Markets with Weak Demand

Covenant's presence in geographic markets with persistently weak freight demand or overcapacity presents a clear challenge. These regions, characterized by low market share and limited growth prospects, drain resources that could be more effectively deployed in expanding segments. For instance, if a particular trucking lane experienced a 15% year-over-year decline in freight volume in 2024, it would fall into this category.

The strategic implication is that these underperforming areas, if not showing signs of recovery, could become candidates for divestment or a significant reduction in operational focus. This aligns with the company's stated aim to improve market conditions by 2025, which necessitates identifying and addressing these demand-deficient zones.

Consider these factors for markets with weak demand:

- Low Freight Volume: Regions experiencing a sustained decrease in freight movement, potentially due to local economic downturns or shifts in manufacturing.

- Oversaturation of Capacity: Markets where the number of available trucks significantly exceeds the freight demand, driving down rates and profitability.

- Resource Misallocation: Continued investment in these areas diverts capital and management attention from more promising growth opportunities.

- Potential for Divestment: Areas that fail to demonstrate a path to improved demand or profitability may be considered for sale or closure.

Dogs in the BCG matrix represent business units or products with low market share and low market growth. For Covenant Logistics, this could include underperforming routes or legacy operations that consume resources without generating substantial returns. Identifying these 'Dogs' is critical for optimizing capital allocation and focusing on more promising growth areas.

In 2024, the trucking industry faced varying demand, and specific lanes or services within Covenant might have experienced declining freight volumes and overcapacity. These segments, characterized by low utilization and high operating costs, are prime examples of 'Dogs' that require strategic attention, such as optimization or divestment, to improve overall company performance.

Question Marks

Covenant is strategically focusing on emerging high-service niches, notably data center freight and the expansion of its protein supply chain capabilities. These are identified as high-growth areas where the company is making significant investments.

While these new segments offer substantial future potential, Covenant's current market share within these specific sub-segments may be relatively low as they are newly targeted. This is a common characteristic of companies venturing into nascent, specialized markets.

These ventures require considerable capital expenditure, particularly for fleet modernization and the acquisition of specialized equipment necessary for handling sensitive cargo like data center components or temperature-controlled protein shipments. For instance, specialized reefer trailers can cost upwards of $100,000, and data center logistics demand precise temperature and vibration control, adding to equipment costs.

The long-term profitability and market dominance in these emerging niches are still being established. Covenant's success will hinge on its ability to effectively manage these capital-intensive operations and build a strong competitive position in these developing markets.

Covenant's adoption of advanced supply chain technologies like AI for transportation management and fraud detection places these initiatives in the Question Marks quadrant of the BCG Matrix. These are high-growth areas within logistics, reflecting significant market potential. For instance, the global AI in logistics market was valued at approximately $2.5 billion in 2023 and is projected to reach over $10 billion by 2028, indicating a strong growth trajectory.

However, Covenant is likely in the early stages of developing capabilities in these nascent fields. This means they are investing heavily but may not yet possess a dominant market share. The success of these ventures hinges on their ability to scale effectively and gain widespread customer adoption. If these investments pay off and Covenant can capture a substantial portion of this growing market, these technologies could transition into Stars.

Expanding into new geographic markets or intensifying efforts in emerging ones, where Covenant's current foothold is minimal, positions these ventures as Question Marks within the BCG framework. These markets often present significant growth opportunities, perhaps driven by evolving regional economies or rising freight demand, evidenced by the projected 6.1% CAGR for the global logistics market through 2028, reaching an estimated $15.5 trillion.

However, such expansions necessitate considerable upfront investment in establishing infrastructure, building brand awareness, and navigating local regulatory landscapes. For instance, entering a new continent might require setting up new hubs and distribution networks, a capital-intensive process that contrasts with mature market operations. The success of these Question Marks hinges on Covenant's ability to effectively convert this potential into market share, transforming them into future Stars.

Sustainability and Green Logistics Solutions

Sustainability and green logistics solutions are emerging as significant growth areas within the transportation sector, demanding substantial upfront investment. For a company like Covenant, initiatives such as transitioning to electric vehicle fleets or adopting alternative fuels represent high-cost, high-potential ventures where capability building is paramount.

Currently, Covenant's market share in genuinely sustainable logistics might be minimal, positioning these endeavors as question marks that require significant capital infusion and strategic development to evolve into future market leaders. The global green logistics market was valued at approximately $16.5 billion in 2023 and is projected to grow substantially, highlighting the opportunity.

- High Investment, High Potential: Investments in electric trucks and alternative fuels are capital-intensive but tap into a rapidly expanding market.

- Current Market Position: Covenant's existing share in green logistics is likely low, classifying these as question marks needing development.

- Future Growth Trajectory: These initiatives represent a path to becoming future Stars if successful, aligning with industry trends.

- Market Opportunity: The green logistics market is experiencing robust growth, offering significant long-term returns.

Recently Acquired Businesses Requiring Integration

Covenant's Q1 2025 small tuck-in acquisition, while projected to boost earnings, introduces a new entity needing comprehensive integration and scaling. This integration requires significant management focus and capital investment to align the acquired business with Covenant's overarching strategy, particularly within a burgeoning sector.

Newly acquired businesses typically begin as question marks in the BCG matrix, demanding resources and attention to realize their market potential. For instance, if this acquisition is in the renewable energy sector, which saw global investment reach an estimated $1.7 trillion in 2024, the integration process will be critical to capitalize on this growth.

- Integration Focus: The recent acquisition necessitates dedicated resources for operational alignment, system integration, and cultural assimilation.

- Capital Allocation: Significant capital will be required to scale the new entity, potentially impacting short-term cash flows but aiming for long-term accretive growth.

- Market Potential: The business operates in a growth sector, presenting an opportunity to transform it from a question mark into a future star performer with effective integration.

- Management Bandwidth: The integration demands substantial management attention, potentially diverting focus from other core business areas until synergies are realized.

Covenant's investments in emerging, high-growth niches like data center freight and protein supply chains, along with advanced technologies such as AI in logistics, firmly place these initiatives within the Question Marks quadrant of the BCG Matrix. These areas demand substantial capital for specialized equipment and capability building, reflecting their nascent stage and the need for market share development.

The company's expansion into new geographic markets and its focus on sustainability and green logistics also represent significant Question Marks. These require considerable upfront investment to establish infrastructure and build brand presence, with their success hinging on effectively converting potential into market dominance.

A recent small tuck-in acquisition, while projected to boost earnings, also falls into this category due to the integration complexities and capital needed to scale the new entity within its burgeoning sector.

These ventures are characterized by high investment requirements and uncertain future returns, necessitating strategic capital allocation and operational focus to transition them into potential Stars.

| Initiative | Market Growth Potential | Current Market Share (Estimated) | Investment Requirement | BCG Classification |

| Data Center Freight | High | Low | High (Specialized Equipment) | Question Mark |

| Protein Supply Chain | High | Low | High (Temperature Control) | Question Mark |

| AI in Logistics | Very High (Global market ~$2.5B in 2023, projected to exceed $10B by 2028) | Low | High (Technology Development) | Question Mark |

| Green Logistics | High (Global market ~$16.5B in 2023) | Low | High (Fleet Transition) | Question Mark |

| New Geographic Markets | High (Global logistics market projected to reach $15.5T by 2028) | Minimal | High (Infrastructure, Brand Building) | Question Mark |

| Recent Acquisition | Sector-Dependent (e.g., Renewable Energy investment ~$1.7T in 2024) | N/A (New Entity) | High (Integration, Scaling) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth projections to provide a clear strategic overview.