Covenant PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covenant Bundle

Unlock the strategic landscape surrounding Covenant with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its operational environment and future trajectory. Gain a crucial competitive advantage by leveraging these expert insights to inform your own strategic planning and investment decisions. Download the full analysis now for actionable intelligence that can drive your success.

Political factors

Government regulations significantly shape Covenant Logistics' operational landscape. Policies from bodies like the Department of Transportation (DOT) dictate crucial aspects such as driver hours of service, vehicle safety standards, and emission controls. For instance, stricter emission standards, like those being phased in for newer truck models, can increase capital expenditure for fleet upgrades, impacting overall profitability.

These mandates directly influence operational costs and fleet management strategies. The Federal Motor Carrier Safety Administration's (FMCSA) Hours of Service (HOS) rules, for example, affect delivery times and driver availability, potentially requiring more drivers or optimized routing to maintain efficiency. In 2024, ongoing discussions around potential updates to HOS regulations could further necessitate adjustments in Covenant's scheduling and resource allocation.

Changes in international trade agreements and tariffs significantly impact the logistics sector. For instance, the renegotiation of the North American Free Trade Agreement (NAFTA) into the United States-Mexico-Canada Agreement (USMCA) in 2020 aimed to modernize trade rules, potentially affecting cross-border freight volumes for companies like Covenant Logistics.

Tariffs imposed on goods, such as those seen in US-China trade disputes, can directly alter demand for transportation services. If tariffs increase the cost of imported goods, companies might reduce their import volumes, leading to less freight needing to be moved, impacting Covenant's revenue from those lanes.

In 2024, ongoing geopolitical tensions and evolving trade relationships continue to shape global supply chains. For example, discussions around potential tariffs on certain manufactured goods or raw materials could create uncertainty, requiring logistics providers to adapt their strategies and capacity planning to manage fluctuating demand.

Government investment in infrastructure, such as roads and bridges, directly influences the operational efficiency and costs for logistics companies like Covenant. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 with over $1 trillion allocated, is significantly boosting transportation networks. This increased spending aims to improve transit times and reduce vehicle maintenance, directly benefiting companies that rely on timely and efficient deliveries.

Fuel Excise Taxes and Subsidies

Government policies on fuel excise taxes and subsidies represent a significant variable for Covenant Logistics, directly influencing its primary operating cost. Changes in these fiscal measures can alter the economics of transportation, impacting the company's bottom line and its ability to set competitive pricing. For instance, in 2024, many nations continued to grapple with energy price volatility, leading to discussions around fuel tax adjustments and potential support for cleaner transportation alternatives.

These policy shifts can create both opportunities and challenges. A reduction in excise taxes could lower operational expenses, while subsidies for electric or alternative fuel vehicles might encourage fleet modernization, albeit with upfront investment. The specific impact depends on the nature and scale of government interventions, which are often subject to change based on economic conditions and environmental goals.

- Fuel Tax Rates: Fluctuations in excise tax rates directly impact diesel fuel costs, a major component of Covenant Logistics' operating expenses.

- Subsidy Programs: Government incentives for adopting alternative fuels or electric vehicles could influence fleet investment decisions and long-term cost structures.

- Regulatory Environment: Evolving environmental regulations tied to fuel efficiency and emissions standards can necessitate costly upgrades or changes in operational practices.

- Economic Impact: Changes in fuel prices, driven by taxes or subsidies, affect consumer spending and business demand, indirectly influencing freight volumes.

Labor Laws and Unionization Trends

Labor laws significantly shape how companies like Covenant Logistics manage their workforce. Policies on minimum wages, overtime, and worker protections directly affect operational expenses. For instance, in 2024, the debate around increasing the federal minimum wage continued, which could add to labor costs for drivers and warehouse staff.

Unionization trends also play a crucial role. An increase in union activity could lead to higher wages, improved benefits, and potentially more stringent working conditions, impacting Covenant's flexibility and cost structure. For example, in late 2023 and early 2024, several major logistics companies saw increased organizing efforts, highlighting a growing trend that could affect driver availability and negotiation leverage.

Key considerations for Covenant Logistics include:

- Minimum Wage Impact: Potential increases in minimum wage laws could directly raise labor costs for hourly employees, including drivers and warehouse personnel.

- Overtime Regulations: Changes to overtime rules might necessitate adjustments in scheduling and compensation, affecting operational efficiency and costs.

- Unionization Landscape: The ease or difficulty of unionization and the prevalence of union activity in the logistics sector can influence wage negotiations, driver retention, and operational flexibility.

- Driver Shortage and Labor Pool: Policies affecting driver qualifications, working hours, and the overall attractiveness of the driving profession can impact the availability of qualified drivers, a critical resource for Covenant.

Government policies, including infrastructure spending and trade agreements, significantly influence Covenant Logistics' operational environment. The Bipartisan Infrastructure Law, enacted in 2021, allocates over $1 trillion to transportation networks, aiming to improve transit times and reduce vehicle wear by 2025. Discussions around potential updates to Hours of Service (HOS) regulations in 2024 could also necessitate scheduling adjustments.

Fuel tax rates and subsidy programs directly impact Covenant's primary operating cost. Volatility in energy prices in 2024 led to discussions on fuel tax adjustments and support for cleaner transportation, potentially affecting fleet investment decisions and pricing strategies. For example, a 10% increase in diesel prices could add millions to annual operating costs.

Labor laws, minimum wage debates, and unionization trends are critical for managing Covenant's workforce. Potential increases in the federal minimum wage in 2024 could raise labor costs for drivers and warehouse staff. Increased union activity in the logistics sector, as seen in late 2023 and early 2024, can influence wage negotiations and driver retention.

What is included in the product

The Covenant PESTLE Analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Covenant, providing a comprehensive understanding of its external operating landscape.

A PESTLE analysis for The Covenant offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain of information overload.

Economic factors

Fuel price volatility is a significant economic consideration for Covenant Logistics. The fluctuating cost of diesel directly impacts operating expenses, with spikes potentially eroding profit margins. For instance, in early 2024, diesel prices saw considerable swings, with average prices in the US ranging from approximately $3.80 to over $4.20 per gallon, creating a dynamic cost environment for the company.

Fluctuations in interest rates directly impact Covenant Logistics' cost of capital for crucial investments like new equipment, technology upgrades, and fleet expansion. For instance, if the Federal Reserve maintains its benchmark interest rate at 5.25%-5.50% through 2024 and potentially into early 2025, as anticipated by many analysts, borrowing for these capital expenditures becomes more expensive.

Higher borrowing costs can significantly dampen Covenant's appetite for new asset acquisition. This could lead to delays in modernizing its fleet or expanding operational capacity, potentially affecting its competitive edge and ability to meet growing market demand. For example, a 1% increase in interest rates on a $10 million loan for new trucks could add $100,000 annually to financing expenses.

Economic growth is a major driver for Covenant Logistics. When the overall economy is doing well, with rising GDP, strong consumer spending, and increased industrial production, it means more goods are being produced and bought. This translates directly into higher demand for transportation services, as businesses need to move raw materials and finished products.

For instance, in 2024, global GDP growth is projected to be around 2.7%, a slight deceleration from previous years but still indicating expansion. This continued growth, even if moderate, supports freight volumes. In the United States, industrial production saw a modest increase in early 2024, which is a positive sign for logistics providers like Covenant.

Conversely, an economic slowdown or recession significantly impacts freight demand. During downturns, consumer spending typically falls, and businesses reduce production. This leads to fewer shipments, putting downward pressure on freight rates and impacting the revenue and profitability of logistics companies. The resilience of the economy in 2024 and the outlook for 2025 will be crucial indicators for Covenant's performance.

Inflation and Operating Costs

Rising inflation presents a significant challenge for Covenant Logistics, impacting not only fuel but also a wide array of operational inputs. Costs for essential items like tires, spare parts, and routine maintenance are on the upswing, directly affecting the company's bottom line. Furthermore, labor costs are also escalating as businesses compete for skilled workers, adding another layer of expense.

Managing these increasing operating expenses while keeping service prices competitive is paramount for Covenant Logistics' financial health. The company must find ways to absorb or mitigate these cost pressures without alienating its customer base. This balancing act is critical for maintaining profitability and ensuring long-term stability in a dynamic economic environment.

For instance, in 2024, the Producer Price Index (PPI) for transportation and warehousing services saw an increase, reflecting these rising input costs. Specific data from the Bureau of Labor Statistics indicated that maintenance and repair services for vehicles experienced notable price hikes throughout the year. This trend is expected to continue into 2025, necessitating proactive cost management strategies from Covenant Logistics.

- Increased input costs: Beyond fuel, inflation drives up prices for tires, parts, and maintenance, impacting overall operational expenditure.

- Labor cost pressure: A competitive job market contributes to rising wages, further straining the company's budget.

- Pricing strategy challenge: Covenant Logistics must balance cost increases with the need to maintain competitive service pricing.

- Impact on profitability: Unmanaged cost escalations directly threaten the company's financial stability and profit margins.

Consumer Spending Patterns and E-commerce Growth

Consumer spending habits are undergoing a significant transformation, with e-commerce continuing its upward trajectory. This shift directly fuels the demand for efficient, rapid delivery solutions, especially in the crucial last mile. For a company like Covenant Logistics, understanding and adapting to these evolving consumer patterns is paramount to seizing new market opportunities and satisfying increasingly sophisticated customer expectations.

The sustained growth in online retail is a key economic driver impacting logistics. For instance, in 2024, global e-commerce sales were projected to reach over $7 trillion, a figure that underscores the scale of this trend. This expansion necessitates innovative approaches to warehousing, inventory management, and, critically, last-mile delivery to ensure timely and cost-effective fulfillment.

- E-commerce sales are projected to exceed $7 trillion globally in 2024.

- Consumer preference for same-day or next-day delivery is a growing expectation.

- The online grocery sector, a significant contributor to e-commerce, saw substantial growth in 2024.

- Digital payment adoption continues to rise, facilitating seamless online transactions and further boosting e-commerce.

Economic growth directly influences freight volumes for Covenant Logistics, as increased production and consumer spending necessitate more transportation of goods. Continued, albeit moderate, global GDP expansion in 2024, projected around 2.7%, supports freight demand. Conversely, economic downturns reduce shipments and pressure freight rates, impacting Covenant's revenue.

| Economic Factor | Impact on Covenant Logistics | 2024/2025 Data/Trend |

|---|---|---|

| GDP Growth | Drives freight demand | Global GDP projected ~2.7% in 2024; moderate growth expected into 2025. |

| Inflation | Increases operating costs (fuel, parts, labor) | PPI for transportation services rose in 2024; expect continued cost pressure into 2025. |

| Interest Rates | Affects cost of capital for asset acquisition | Fed rates potentially remaining at 5.25%-5.50% through 2024/early 2025, increasing borrowing costs. |

| Consumer Spending (E-commerce) | Boosts demand for delivery services | Global e-commerce sales projected over $7 trillion in 2024; strong demand for last-mile delivery. |

What You See Is What You Get

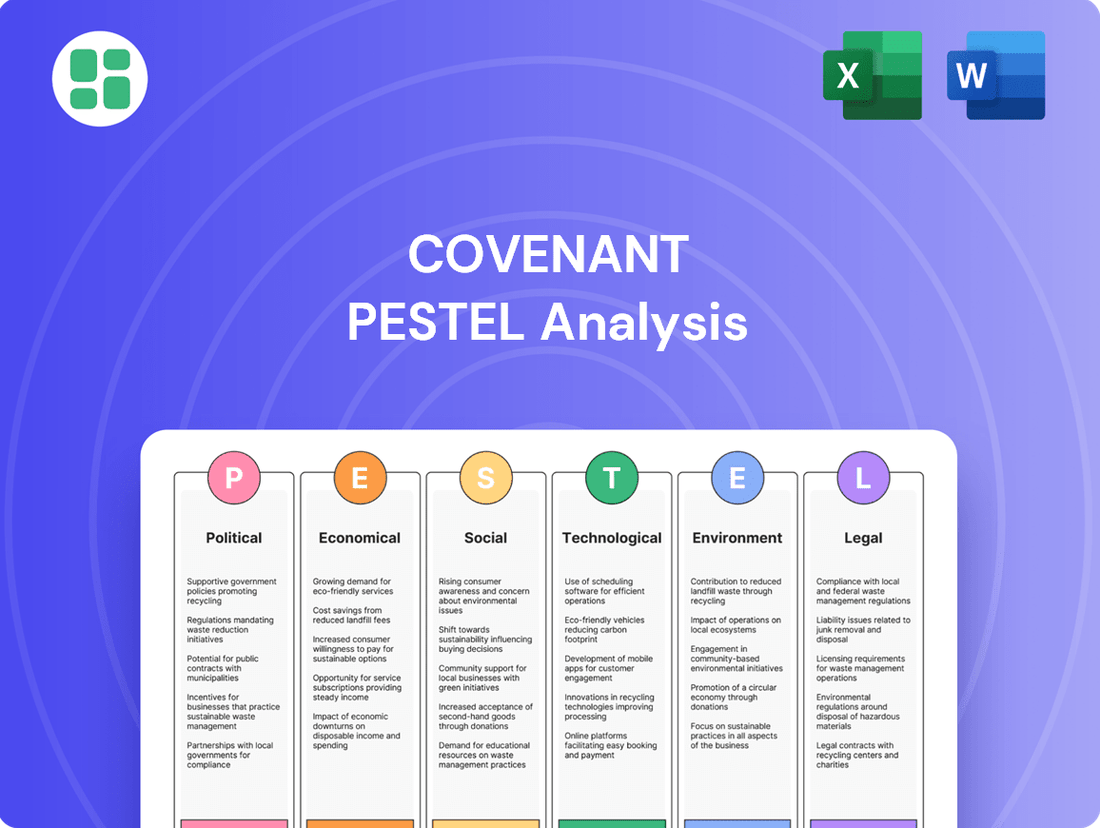

Covenant PESTLE Analysis

The preview shown here is the exact Covenant PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use for your strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, ensuring you get a comprehensive understanding of the Covenant's external environment.

The content and structure shown in the preview is the same Covenant PESTLE Analysis document you’ll download after payment, providing actionable insights for your business.

Sociological factors

The persistent shortage of qualified truck drivers presents a significant sociological challenge for Covenant Logistics. This scarcity directly translates into higher recruitment expenses and upward pressure on driver wages, impacting overall operational costs. For instance, in late 2023, the American Trucking Associations reported a deficit of over 78,000 drivers, a figure expected to grow.

To counter this, Covenant must focus on attracting and retaining its driver workforce. This involves offering competitive compensation packages, enhancing working conditions to improve job satisfaction, and providing opportunities for professional development and career advancement. These efforts are paramount for ensuring consistent operational capacity and service reliability.

Public perception of the trucking industry significantly impacts its operational landscape. Concerns regarding safety, the environmental footprint of freight transport, and the well-being of truck drivers are increasingly shaping societal attitudes. For Covenant Logistics, a positive public image is crucial for navigating regulatory environments and fostering strong community ties.

Negative perceptions can translate into stricter regulations and community opposition, hindering expansion and operational efficiency. Conversely, a proactive approach to addressing these concerns, such as investing in advanced safety technologies and sustainable practices, can build trust and enhance the industry's appeal. For instance, as of early 2025, surveys indicate a growing public demand for greener logistics solutions, with over 60% of consumers expressing a preference for companies demonstrating environmental responsibility.

Furthermore, the industry's ability to attract new talent is directly linked to its societal image. A reputation for demanding working conditions or inadequate driver support can deter potential recruits. Covenant Logistics needs to actively promote initiatives that improve driver welfare and highlight career opportunities to counter these narratives and ensure a robust future workforce.

The aging population in many developed nations, including the US, presents a significant challenge for Covenant Logistics. By 2030, an estimated 20% of the US population will be 65 or older, potentially shrinking the pool of available younger workers for crucial roles like truck drivers. Simultaneously, increasing ethnic and racial diversity within the workforce requires companies to adapt their HR practices and foster inclusive environments to attract and retain talent.

Shifting consumer preferences and geographic distributions also impact demand. For instance, the continued growth of e-commerce, driven by younger demographics, means more frequent, smaller deliveries to diverse urban and suburban areas, requiring flexible and efficient last-mile logistics solutions. The projected growth of the Hispanic population in the US, expected to reach over 60 million by 2025, also signals evolving consumer needs and potential labor market contributions.

Changing Consumer Expectations for Delivery

Modern consumers, fueled by the e-commerce explosion, now demand delivery services that are not only faster but also more transparent and tailored to specific needs. This shift means that companies like Covenant Logistics face increasing pressure to innovate.

To remain competitive, Covenant Logistics must actively adapt its service portfolio, invest in cutting-edge technology for real-time tracking, and refine its operational strategies. Meeting these heightened expectations for speed, visibility, and overall convenience is paramount.

- E-commerce Growth: Global e-commerce sales are projected to reach $7.4 trillion by 2025, up from $5.7 trillion in 2023, underscoring the demand for efficient logistics.

- Same-Day Delivery Demand: A significant percentage of consumers, often exceeding 60% in urban areas, now expect same-day or next-day delivery for online purchases.

- Tracking Expectations: Over 80% of online shoppers consider detailed, real-time tracking information essential for a positive delivery experience.

- Sustainability Concerns: Consumer awareness around environmental impact is growing, with a notable segment willing to wait longer for more eco-friendly delivery options.

Workplace Safety and Employee Well-being Standards

Societal expectations are increasingly prioritizing workplace safety and employee well-being, directly impacting logistics companies like Covenant. This translates into stricter regulations and a greater demand for responsible operational practices.

Covenant's commitment to driver health and safety is crucial for talent retention and operational efficiency. For instance, in 2024, the trucking industry saw an average driver turnover rate of around 90%, highlighting the significant cost of replacing employees. Investing in driver well-being programs, including fatigue management and mental health support, can mitigate these costs.

Adhering to robust safety standards not only reduces the likelihood of costly accidents but also bolsters Covenant's brand image. A strong safety record can be a competitive differentiator, attracting both clients and employees who value a secure working environment.

- Driver Retention: High turnover in the trucking sector suggests that improved well-being initiatives can significantly cut recruitment and training expenses for Covenant.

- Safety Incidents: Investing in safety training and equipment directly correlates with a reduction in accidents, minimizing insurance claims and operational downtime.

- Reputation: A demonstrable commitment to employee welfare enhances Covenant's standing among stakeholders, potentially leading to increased business opportunities.

- Regulatory Compliance: Evolving societal norms necessitate proactive adaptation to safety and well-being regulations to avoid penalties and maintain operational continuity.

Societal expectations regarding delivery speed and transparency are intensifying, driven by the e-commerce boom. Consumers, particularly younger demographics, now anticipate real-time tracking and rapid fulfillment, placing pressure on logistics providers like Covenant. By early 2025, over 80% of online shoppers consider detailed tracking essential for a positive experience.

The industry's public image is also a critical sociological factor. Concerns about driver well-being and environmental impact influence consumer choices and regulatory approaches. Covenant Logistics must actively cultivate a positive reputation, as evidenced by growing consumer demand for greener logistics solutions, with over 60% favoring environmentally responsible companies as of early 2025.

Workplace safety and employee well-being are increasingly paramount societal concerns. High driver turnover, around 90% in the trucking industry during 2024, underscores the need for improved working conditions and support systems to attract and retain talent.

| Sociological Factor | Impact on Covenant Logistics | Supporting Data (2023-2025) |

|---|---|---|

| E-commerce Driven Delivery Expectations | Increased demand for speed, transparency, and customized delivery. | Global e-commerce sales projected to reach $7.4 trillion by 2025. Over 80% of online shoppers expect real-time tracking. |

| Public Perception of Trucking Industry | Influences regulatory environment and talent acquisition. Growing demand for sustainable and ethical practices. | Over 60% of consumers prefer companies with demonstrated environmental responsibility (early 2025). |

| Workplace Safety & Employee Well-being | Crucial for talent retention and operational efficiency. | Trucking industry driver turnover around 90% in 2024. |

Technological factors

Autonomous vehicle and platooning technology presents a significant technological shift for Covenant Logistics. The potential for self-driving trucks and synchronized platooning could dramatically improve fuel efficiency and reduce labor costs. For instance, platooning can reduce aerodynamic drag by up to 10%, translating to substantial fuel savings on long-haul routes.

However, widespread adoption hinges on overcoming substantial hurdles. Significant capital investment is needed for vehicle retrofitting and infrastructure upgrades. Regulatory frameworks for autonomous operation are still evolving globally, with many regions, including key markets for logistics, still defining operational guidelines and safety standards for 2024 and beyond.

Furthermore, addressing public perception, ensuring robust safety protocols, and managing the societal impact of potential job displacement for drivers are critical considerations. The timeline for full integration remains uncertain, with pilot programs and limited deployments expected to continue through 2025.

Advanced telematics and Internet of Things (IoT) sensors are revolutionizing fleet management for companies like Covenant Logistics. These technologies provide real-time vehicle location, driver behavior monitoring, and diagnostic data, directly impacting operational efficiency and safety.

Sophisticated fleet management systems, powered by IoT, enable predictive maintenance, reducing downtime and repair costs. For instance, by analyzing sensor data, potential mechanical failures can be identified before they occur, a critical factor in maintaining a high-performing fleet.

Fuel efficiency monitoring through telematics is another key benefit, with systems capable of tracking fuel consumption per mile and identifying areas for improvement. This focus on efficiency is paramount, especially with fluctuating fuel prices, directly impacting Covenant's bottom line.

Improved asset utilization is a direct outcome of these technological integrations. Real-time tracking and data analytics allow for better route planning and load optimization, ensuring that Covenant's vehicles are operating at peak capacity, thereby maximizing returns on their asset investments.

AI and ML are transforming logistics by optimizing routes and loads. For instance, in 2024, companies are increasingly adopting AI-powered route optimization software, which has shown potential to reduce fuel consumption by up to 15% and decrease delivery times by 10-20%.

Demand forecasting powered by machine learning is also a game-changer. By analyzing historical data and market trends, AI can predict demand with greater accuracy, allowing Covenant Logistics to better manage inventory and fleet allocation, minimizing costly overstocking or stockouts.

Predictive maintenance, another key application, uses AI to anticipate equipment failures before they occur. This proactive approach can significantly reduce downtime, as seen in the trucking industry where predictive maintenance has been reported to cut unscheduled maintenance by as much as 25% in 2024, boosting overall service reliability.

Digital Freight Matching Platforms

Digital freight matching platforms are fundamentally reshaping how logistics companies like Covenant secure business. These online marketplaces connect shippers directly with carriers, streamlining the load-finding process. For instance, platforms like Truckstop.com and DAT Freight & Analytics saw significant user growth in 2024 as companies sought more efficient ways to manage their capacity and find loads.

The impact on Covenant Logistics is twofold. On one hand, integrating with these platforms can boost operational efficiency by providing real-time visibility into available freight and optimizing the matching of their trucks with demand. This can lead to quicker turnarounds and better asset utilization. On the other hand, these platforms introduce a new level of transparency in pricing, potentially intensifying competition and putting pressure on brokerage margins.

- Increased Efficiency: Digital platforms can reduce the time Covenant spends on manual load booking, potentially improving asset utilization by an estimated 5-10% in 2024-2025.

- Enhanced Transparency: Real-time pricing data on these platforms offers greater visibility but also heightens competitive pressures.

- Broader Market Access: These marketplaces allow Covenant to tap into a wider pool of shippers and loads beyond traditional broker relationships.

- Competitive Landscape: The proliferation of digital freight brokers and direct-to-shipper platforms signifies a shift, with many established players investing heavily in technology to keep pace.

Cybersecurity Threats to Logistics Systems

As Covenant Logistics deepens its integration of digital platforms for operations, customer data, and supply chain oversight, cybersecurity emerges as a paramount technological consideration. The increasing sophistication of cyber threats poses a significant risk to the integrity and availability of these critical systems.

Protecting against data breaches, ransomware, and operational disruptions is non-negotiable for maintaining seamless business continuity and preserving customer confidence. The financial implications of a major cyber incident can be substantial, impacting revenue, recovery costs, and brand reputation.

- Increased Ransomware Attacks: In 2024, the logistics sector experienced a notable rise in ransomware attacks, with some estimates suggesting a 30% increase compared to the previous year, leading to significant operational downtime and financial losses for affected companies.

- Data Breach Costs: The average cost of a data breach globally reached $4.45 million in 2024, a figure that includes detection, response, and the long-term impact on customer retention and regulatory fines, highlighting the financial imperative for robust cybersecurity.

- Supply Chain Vulnerabilities: A 2025 report indicated that over 60% of logistics companies identified third-party vendor vulnerabilities as a primary cybersecurity concern, underscoring the need for rigorous vetting and continuous monitoring of all integrated digital partners.

Technological advancements are reshaping the logistics landscape for Covenant. Autonomous vehicles and platooning offer significant efficiency gains, potentially reducing aerodynamic drag by up to 10% and lowering labor costs. However, widespread adoption faces hurdles, including substantial capital investment and evolving regulatory frameworks through 2025.

Advanced telematics and IoT sensors are crucial for real-time fleet management, enabling predictive maintenance and improving fuel efficiency. AI and machine learning are optimizing routes, with AI-powered software showing potential to cut fuel consumption by 15% and delivery times by 20% in 2024. Digital freight matching platforms are streamlining operations, though they also intensify price competition.

Cybersecurity is a critical concern, with logistics experiencing a 30% rise in ransomware attacks in 2024. The average cost of a data breach reached $4.45 million globally in 2024, emphasizing the need for robust protection. Over 60% of logistics firms in 2025 cited third-party vendor vulnerabilities as a key cybersecurity risk.

Legal factors

Covenant Logistics faces significant legal hurdles due to stringent Department of Transportation (DOT) regulations. These rules govern everything from vehicle maintenance and driver licensing to the safe transport of hazardous materials, with violations carrying hefty penalties. For instance, in 2023, the Federal Motor Carrier Safety Administration (FMCSA) collected over $300 million in fines from trucking companies for safety violations, a figure Covenant must actively work to avoid.

Failure to comply with DOT mandates, including hours-of-service rules designed to prevent driver fatigue, can lead to substantial fines and even temporary suspension of operations. In 2024, the DOT continues to emphasize enforcement, particularly concerning driver retention and safety protocols, making adherence critical for maintaining operational continuity and avoiding costly disruptions.

Legal frameworks, like the Fair Labor Standards Act (FLSA) in the U.S., mandate minimum wage and overtime pay, directly affecting Covenant Logistics' labor costs. For instance, in 2024, the federal minimum wage remains $7.25 per hour, though many states and cities have higher rates, impacting operational expenses.

The ongoing debate and legal challenges surrounding the classification of drivers as employees versus independent contractors present a significant risk. A 2023 California Supreme Court ruling, for example, reinforced the strict ABC test for independent contractor status, potentially forcing companies to reclassify many workers, which could increase payroll taxes and benefit costs for Covenant.

Any shift in these legal interpretations or new legislation could necessitate substantial changes to Covenant's business model, potentially impacting its cost structure and driver network efficiency as it navigates compliance with evolving labor laws.

Covenant Logistics navigates a landscape shaped by environmental regulations, particularly those concerning vehicle emissions and fuel efficiency. For instance, the U.S. Environmental Protection Agency (EPA) has set increasingly stringent standards for heavy-duty vehicle emissions, aiming to reduce pollutants like nitrogen oxides (NOx) and particulate matter. These regulations directly impact Covenant's fleet modernization strategies.

Staying compliant with these evolving environmental laws, such as the push for lower greenhouse gas emissions, necessitates significant capital expenditure. Covenant Logistics must invest in newer vehicles that meet these advanced standards, potentially incorporating alternative fuels or electric powertrains. This investment is crucial for avoiding penalties and maintaining operational viability in a sustainability-focused market.

The company's commitment to sustainable operational practices, including efficient waste disposal and adherence to fuel standards, also falls under this regulatory umbrella. For example, the EPA's Renewable Fuel Standard (RFS) encourages the use of biofuels, influencing fuel sourcing decisions for fleets. These environmental factors are not just compliance issues but strategic considerations for long-term operational efficiency and corporate responsibility.

Data Privacy and Cybersecurity Laws

Covenant Logistics must navigate a complex web of data privacy and cybersecurity regulations as its operations become increasingly digital. Laws like the California Consumer Privacy Act (CCPA) and similar state-level privacy acts mandate strict controls over how customer, employee, and operational data is collected, stored, and processed. Failure to comply can result in significant financial penalties, with CCPA fines potentially reaching $7,500 per intentional violation as of 2024.

Robust cybersecurity measures are not just a best practice but a legal imperative to safeguard sensitive information. The increasing sophistication of cyber threats means that organizations like Covenant Logistics must invest heavily in data protection. In 2023, the average cost of a data breach for companies in the transportation and logistics sector was estimated to be around $3.72 million, highlighting the financial risks associated with inadequate security.

- Data Protection Compliance: Adherence to regulations like GDPR (for data of EU citizens) and evolving US state privacy laws is critical for handling customer and operational data.

- Cybersecurity Investment: Companies are increasing cybersecurity budgets, with global spending projected to exceed $200 billion in 2024, to mitigate risks of breaches and ransomware attacks.

- Incident Response Planning: Legal frameworks often require prompt notification of data breaches, making well-defined incident response plans a necessity to avoid further legal repercussions.

- Third-Party Risk Management: Ensuring that all partners and vendors handling sensitive data also meet stringent privacy and security standards is a growing legal requirement.

Contractual Agreements and Liability in Freight Transport

Covenant Logistics navigates a complex web of contractual agreements with shippers, brokers, and 3PL providers, each meticulously outlining responsibilities and liabilities. These contracts are the bedrock of operations, ensuring clarity on service levels, payment terms, and dispute resolution. For instance, in 2024, the average contract length for dedicated fleet services in the US trucking industry remained around 18-24 months, reflecting a commitment to stable partnerships.

Adherence to intricate transportation laws is paramount for mitigating legal risks. This includes understanding regulations surrounding cargo loss and damage, where liability often hinges on factors like proper packaging and timely delivery. In 2025, the Federal Motor Carrier Safety Administration (FMCSA) continues to emphasize compliance with Hours of Service (HOS) regulations, a key area impacting carrier liability for driver fatigue-related incidents. Furthermore, insurance requirements, such as minimum cargo liability coverage, are non-negotiable for operating legally and protecting against financial exposure.

- Contractual Clarity: Ensuring all agreements clearly define scope of work, payment, and liability to prevent disputes.

- Transportation Law Compliance: Staying updated on federal and state regulations impacting freight movement, driver conduct, and cargo handling.

- Liability Management: Proactively addressing potential liabilities related to cargo damage, delays, and accidents through robust operational procedures and insurance.

- Insurance Adequacy: Maintaining sufficient cargo and liability insurance coverage to meet legal minimums and protect against significant financial losses.

Legal factors significantly shape Covenant Logistics' operational landscape, from stringent DOT regulations to evolving labor laws. Adherence to these mandates is crucial to avoid substantial fines and operational disruptions, with the FMCSA actively enforcing safety protocols in 2024.

The company must also navigate complex contractual agreements and transportation laws, ensuring clarity on liabilities and compliance with requirements like Hours of Service (HOS) regulations, which remain a focus for the FMCSA in 2025.

Data privacy and cybersecurity regulations, such as CCPA, necessitate robust data protection measures, with significant financial penalties for violations, underscoring the importance of proactive security investments.

| Regulatory Area | Key Considerations for Covenant Logistics | 2024/2025 Data/Trends |

|---|---|---|

| DOT Regulations | Vehicle maintenance, driver licensing, hazardous materials transport, Hours of Service (HOS) | FMCSA collected over $300M in fines in 2023; continued enforcement on driver retention and safety in 2024. |

| Labor Laws | Minimum wage, overtime pay, driver classification (employee vs. contractor) | Federal minimum wage at $7.25/hr (2024), but state variations impact costs; California's ABC test impacts contractor classification. |

| Environmental Regulations | Vehicle emissions, fuel efficiency, greenhouse gas reduction | EPA setting stricter standards for heavy-duty vehicles; push for alternative fuels and electric powertrains. |

| Data Privacy & Cybersecurity | CCPA, GDPR, data breach prevention, incident response | CCPA fines up to $7,500/intentional violation (2024); average data breach cost in logistics ~$3.72M (2023). |

| Contractual & Transportation Law | Shipper agreements, cargo liability, insurance requirements | Average dedicated fleet contract ~18-24 months (2024); FMCSA emphasizes HOS compliance (2025). |

Environmental factors

Covenant Logistics is navigating a landscape of escalating carbon emission reduction targets and regulations. Many governments, including the United States and European Union nations, are setting ambitious goals for fleet emissions. For instance, the EU aims for a 90% reduction in transport emissions by 2050, impacting logistics companies like Covenant.

To comply, Covenant must invest in cleaner technologies and operational efficiencies. This includes exploring alternative fuels such as hydrogen or electric powertrains, which are seeing significant investment and development in 2024-2025. Route optimization software and more fuel-efficient truck designs are also critical components in meeting these evolving environmental standards.

The global shift towards alternative fuels and electric vehicles (EVs) presents a significant environmental factor for Covenant Logistics. By 2024, the commercial EV market is projected to see substantial growth, with an estimated 20% of new heavy-duty truck sales being electric in some regions by 2030, indicating a clear industry trend.

This transition necessitates substantial investment in new vehicle fleets and charging infrastructure, posing a challenge for Covenant's capital expenditure. However, it also offers opportunities for enhanced operational efficiency and reduced emissions, aligning with increasing stakeholder demand for sustainable practices.

Environmental considerations are crucial for Covenant Logistics, particularly concerning operational waste. This includes managing the disposal of used tires from their fleet, waste oil from vehicle maintenance, and general refuse generated at their facilities. Effective waste management and recycling programs are essential for minimizing their ecological footprint and ensuring adherence to stringent local and federal waste disposal regulations.

In 2023, the United States generated approximately 292.4 million tons of municipal solid waste, with recycling and composting diverting 94 million tons, indicating a significant opportunity for improvement in waste reduction. Covenant Logistics' commitment to robust recycling initiatives for materials like oil and tires not only aids environmental compliance but also presents potential cost savings through reduced disposal fees and the sale of recyclable materials.

Noise Pollution Regulations

Noise pollution regulations are a significant environmental factor for logistics companies like Covenant. These regulations often dictate permissible noise levels for vehicles, especially during certain hours, directly impacting operational flexibility. For instance, in 2024, many European cities are tightening restrictions on heavy-duty vehicle noise, potentially increasing compliance costs for fleet upgrades.

Covenant Logistics must factor these rules into fleet selection, favoring quieter engine technologies. Operational hours might need adjustment in noise-sensitive zones, affecting delivery schedules and efficiency. Route planning also becomes critical, with a need to avoid residential areas during peak quiet hours, potentially leading to longer transit times and increased fuel consumption. By 2025, we anticipate stricter enforcement and a greater emphasis on electric or hybrid vehicle adoption to meet these evolving standards.

- Fleet Modernization: Investing in vehicles with lower decibel ratings to comply with urban noise ordinances.

- Operational Adjustments: Modifying delivery schedules to avoid noise-sensitive periods in residential areas.

- Route Optimization: Developing routes that minimize exposure to communities, even if it means longer distances.

- Technological Integration: Exploring quieter tire technologies and advanced engine silencing systems.

Climate Change Impacts on Supply Chains and Routes

Climate change is increasingly impacting global supply chains, with extreme weather events like hurricanes, floods, and droughts causing significant disruptions. For a company like Covenant Logistics, this translates to damaged infrastructure, delayed deliveries, and increased operational costs. For instance, the intense heatwaves experienced in parts of North America and Europe during the summer of 2024 led to reduced productivity in ports and warehouses, directly affecting shipping schedules.

Adapting logistics strategies to build resilience against these climate-related disruptions is becoming a critical environmental and operational imperative. This involves diversifying transportation routes, investing in more robust infrastructure, and developing contingency plans for weather-related emergencies. The World Economic Forum's 2025 Global Risks Report highlighted supply chain disruption due to climate change as a top concern for businesses worldwide.

- Extreme weather events directly disrupt transportation networks, leading to costly delays and rerouting.

- Infrastructure damage from climate events, such as flooding of ports or roads, impedes the movement of goods.

- Logistics companies must invest in climate-resilient infrastructure and flexible route planning to mitigate these impacts.

- The financial implications include increased insurance premiums, repair costs, and lost revenue due to delivery failures.

Covenant Logistics faces increasing pressure to reduce its environmental footprint through fleet modernization and operational changes. Governments worldwide are implementing stricter emissions standards, pushing companies towards cleaner fuels and more efficient technologies. By 2025, the demand for sustainable logistics practices is expected to intensify, impacting operational costs and strategic planning.

The company must adapt to evolving regulations concerning noise pollution and waste management. Investing in quieter vehicles and robust recycling programs for materials like used oil and tires will be crucial for compliance and cost savings. These environmental factors directly influence fleet acquisition decisions and operational flexibility.

Climate change presents significant challenges through extreme weather events that disrupt supply chains and damage infrastructure. Covenant Logistics needs to build resilience by diversifying routes and investing in robust infrastructure to mitigate these risks. The financial impact includes potential increases in insurance premiums and lost revenue from delivery failures.

| Environmental Factor | Impact on Covenant Logistics | Data/Trend (2024-2025) |

|---|---|---|

| Emissions Targets | Need for investment in cleaner fleets (EVs, hydrogen) | EU aims for 90% transport emission reduction by 2050; commercial EV sales projected to grow significantly. |

| Waste Management | Compliance with disposal regulations, potential cost savings | US generated ~292.4 million tons of MSW in 2023; recycling diverts significant portion. |

| Noise Pollution | Fleet selection, operational hour adjustments, route planning | Tightening restrictions in European cities; emphasis on electric/hybrid vehicles expected by 2025. |

| Climate Change | Supply chain disruption, infrastructure damage, increased costs | World Economic Forum 2025 Global Risks Report highlights climate-driven supply chain disruption as a top concern. |

PESTLE Analysis Data Sources

Our Covenant PESTLE Analysis is constructed using a robust blend of official government publications, reputable market research firms, and academic studies. We meticulously gather data on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.