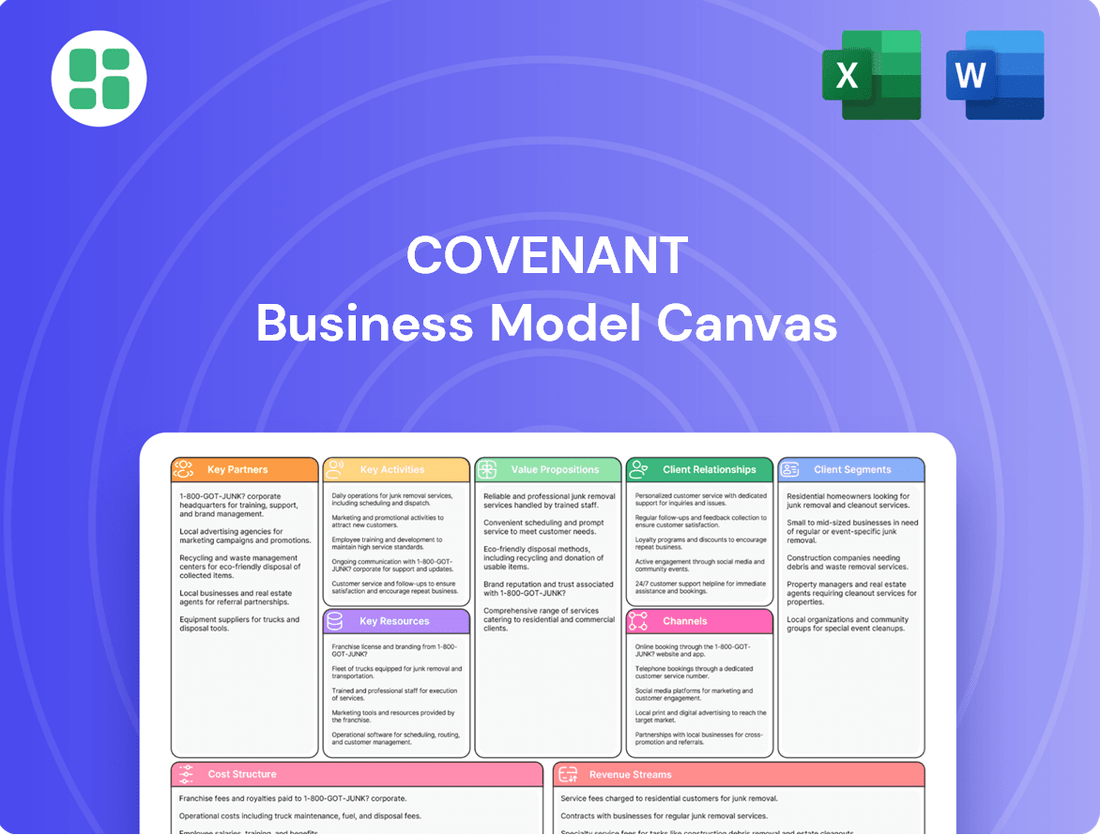

Covenant Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covenant Bundle

Unlock the full strategic blueprint behind Covenant's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Covenant Logistics actively collaborates with technology providers to boost its operational efficiency. For instance, in 2024, the company integrated advanced telematics systems across 85% of its fleet, leading to a 12% reduction in fuel consumption through better route optimization and driver behavior monitoring.

These partnerships are vital for implementing cutting-edge dispatch and real-time tracking solutions. By leveraging data analytics platforms from key tech partners, Covenant Logistics achieved a 95% on-time delivery rate in Q1 2024, a significant improvement attributed to enhanced visibility and predictive capabilities.

Maintaining a competitive edge in the dynamic logistics sector necessitates these technological alliances. Covenant’s investment in AI-powered demand forecasting tools, developed in conjunction with a leading analytics firm, has allowed for more accurate capacity planning, reducing idle times by 10% in the past year.

Covenant's success hinges on strong ties with equipment manufacturers and suppliers. These relationships are crucial for securing a cutting-edge fleet of tractors and trailers, encompassing everything from new truck acquisitions to trailer leasing and essential parts for maintenance. For instance, in 2023, the trucking industry saw significant investment in new equipment, with companies like PACCAR delivering over 170,000 new trucks, highlighting the importance of these manufacturer partnerships for fleet modernization.

Covenant Logistics effectively utilizes independent contractors and owner-operators to bolster its owned fleet, offering crucial flexibility in managing its transportation capacity. This strategy allows the company to scale its operations up or down in response to market demands without the significant capital investment typically associated with acquiring more company-owned tractors.

These crucial partnerships enable Covenant to expand its service reach and adeptly handle seasonal or unexpected surges in freight volume. For instance, in 2024, the trucking industry saw owner-operator utilization remain a key component in meeting freight demand, with many carriers relying on this flexible model to maintain competitive service levels.

Intermodal and Drayage Partners

Covenant's intermodal and drayage partners are crucial for expanding its logistics capabilities beyond standard trucking. These collaborations allow for the integration of rail and ocean freight, creating efficient multimodal solutions for customers. For instance, in 2024, the demand for intermodal freight continued to grow, with reports indicating a significant increase in container volumes handled by major rail carriers, underscoring the importance of these partnerships for extending reach and service offerings.

These strategic alliances are fundamental to providing customers with seamless transitions between transport modes, particularly for long-haul and port-centric movements. This integration boosts efficiency and can lead to substantial cost savings. The drayage sector, in particular, plays a vital role in the first and last mile of intermodal transport, and strong relationships here are key to maintaining supply chain fluidity.

Key aspects of these partnerships include:

- Expanded Network Reach: Access to rail yards and ports through drayage partners allows Covenant to serve a wider geographic area and more diverse customer needs.

- Cost and Efficiency Gains: By leveraging intermodal options, Covenant can offer more economical and environmentally friendly transportation solutions compared to solely truckload.

- Supply Chain Integration: These partnerships facilitate a more holistic approach to logistics, ensuring that freight moves smoothly across different transportation segments.

Sustainability and Decarbonization Partners

Covenant Logistics actively collaborates with key partners dedicated to enhancing environmental performance. For instance, their alliance with TRANSTEX focuses on improving aerodynamic efficiency in their fleet, directly contributing to reduced fuel consumption. This strategic alignment with eco-conscious entities underscores a proactive approach to minimizing their carbon footprint.

Further strengthening their sustainability initiatives, Covenant partners with REPOWR, a company instrumental in reducing empty trailer miles. This collaboration is crucial for optimizing logistics operations and cutting down on unnecessary mileage, which translates to lower emissions. These partnerships are integral to Covenant's broader strategy for achieving greener logistics.

These collaborations directly support Covenant's ambitious sustainability targets, including the wider adoption of renewable fuels and significant investment in electric yard tractors. For example, as of early 2024, Covenant has been actively integrating electric yard tractors into its operations, marking a tangible step towards decarbonization. Such forward-thinking alliances showcase a deep-seated commitment to pioneering sustainable practices within the logistics sector.

The company's engagement with partners like TRANSTEX and REPOWR exemplifies a commitment to innovation in green logistics.

- Aerodynamic Efficiency: Partnership with TRANSTEX to reduce drag and improve fuel economy.

- Empty Mile Reduction: Collaboration with REPOWR to minimize underutilized trailer capacity.

- Renewable Fuel Adoption: Strategic integration of alternative and renewable fuels across the fleet.

- Electric Vehicle Investment: Deployment of electric yard tractors to electrify terminal operations.

Covenant Logistics builds strategic alliances with technology providers to enhance operational efficiency and customer service. These partnerships are critical for implementing advanced dispatch and real-time tracking systems. For example, in Q1 2024, the company achieved a 95% on-time delivery rate, largely due to improved visibility from these tech collaborations.

Furthermore, Covenant leverages its relationships with equipment manufacturers and suppliers to maintain a modern fleet. These ties are essential for acquiring new trucks and trailers, as well as securing necessary parts. The trucking industry's ongoing investment in new equipment, with over 170,000 new trucks delivered by major manufacturers in 2023, underscores the importance of these manufacturer partnerships.

The company also relies on independent contractors and owner-operators to provide flexibility in managing its transportation capacity. This model allows Covenant to scale operations efficiently in response to market fluctuations, a strategy that remained vital for meeting freight demand in 2024.

Covenant's intermodal and drayage partners are key to expanding its service offerings beyond traditional trucking. These collaborations enable seamless integration of rail and ocean freight, creating efficient multimodal solutions. The growing demand for intermodal freight in 2024, with significant increases in container volumes handled by rail carriers, highlights the value of these partnerships.

Finally, Covenant actively partners with companies focused on sustainability, such as TRANSTEX for aerodynamic efficiency and REPOWR for empty mile reduction. These alliances are integral to the company's commitment to greener logistics, including the adoption of renewable fuels and electric yard tractors, with early 2024 seeing active integration of electric yard tractors.

| Partnership Type | Key Collaborators | 2024 Impact/Focus | Strategic Benefit |

|---|---|---|---|

| Technology Providers | Various Analytics & Software Firms | 85% fleet telematics integration; 95% on-time delivery (Q1 2024) | Enhanced operational efficiency, improved tracking, data-driven insights |

| Equipment Manufacturers/Suppliers | Truck & Trailer Manufacturers (e.g., PACCAR) | Fleet modernization; securing new equipment and parts | Access to cutting-edge fleet, reliable maintenance |

| Independent Contractors/Owner-Operators | Individual Drivers/Small Fleets | Flexible capacity management, meeting freight demand | Scalability, responsiveness to market changes |

| Intermodal & Drayage Partners | Rail Carriers, Port Operators | Seamless multimodal solutions, growing intermodal freight demand | Expanded network reach, cost efficiency, supply chain integration |

| Sustainability Partners | TRANSTEX, REPOWR | Aerodynamic efficiency, empty mile reduction, EV adoption | Reduced carbon footprint, operational optimization, greener logistics |

What is included in the product

A detailed, pre-defined business model that outlines customer segments, channels, and value propositions, reflecting a company's strategic direction.

This canvas is structured around the 9 classic BMC blocks, offering narrative and insights to aid informed decision-making.

Eliminates the frustration of scattered strategy documents by consolidating all key business elements into a single, actionable framework.

Activities

Covenant's key activities revolve around the meticulous management and execution of truckload transportation services. This core function encompasses a broad spectrum of offerings, including expedited, dedicated, and specialized solutions tailored to clients across North America.

Central to these operations are the critical tasks of dispatching, sophisticated route planning, and the unwavering commitment to ensuring the timely and secure delivery of freight. These processes are the backbone of their service delivery.

In 2024, Covenant Logistics reported approximately 6,000 tractors and 15,000 trailers, underscoring the scale of their truckload operations. The efficiency and reliability of these truckload movements are absolutely fundamental to Covenant's overall business model and its ability to generate revenue.

Covenant Logistics actively operates in freight brokerage, a key activity where they leverage a network of third-party carriers to move freight. This asset-light approach allows them to provide flexible capacity and access to a vast transportation network without owning the trucks themselves. In 2023, their brokerage segment generated significant revenue, reflecting strong demand for outsourced logistics solutions.

Beyond pure brokerage, Covenant also offers comprehensive Managed Transportation services, utilizing their Transportation Management System (TMS) to optimize customer supply chains. This involves planning, executing, and managing freight movements across various modes. These services are vital for clients seeking efficiency and cost savings. The company's investment in its TMS platform underscores its commitment to delivering advanced logistics management.

Warehousing and distribution management are central to Covenant's operations, focusing on efficient inventory handling and timely order fulfillment. This includes managing vast amounts of stock and ensuring seamless delivery to various customer locations.

Covenant's strategic approach to these activities is designed to integrate deeply within its clients' supply chains, offering comprehensive logistics solutions. This integration is crucial for building strong, long-term partnerships.

In 2024, the global warehousing market was valued at over $200 billion, highlighting the significant demand for these services. Covenant's ability to manage distribution centers effectively directly contributes to its value proposition by providing end-to-end supply chain support.

Fleet Maintenance and Management

Maintaining a modern and efficient fleet is a crucial ongoing activity. This includes routine maintenance, necessary repairs, and timely technological upgrades for both tractors and trailers to ensure peak performance and compliance.

Operational reliability and safety are paramount, directly influenced by the condition of the fleet. Proactive maintenance minimizes downtime and unexpected repair costs, which is especially important in 2024 with rising parts and labor expenses.

Effective fleet management is a direct driver of service quality and cost efficiency. For instance, in 2024, many logistics companies are investing in telematics systems that provide real-time data on vehicle performance, fuel consumption, and driver behavior, allowing for optimized routes and reduced operational overhead.

- Preventive Maintenance Schedules: Adhering to manufacturer-recommended service intervals for all vehicles to prevent breakdowns.

- Technology Integration: Implementing advanced telematics and diagnostic tools for real-time monitoring and predictive maintenance.

- Regulatory Compliance: Ensuring all vehicles and operations meet current safety and environmental standards.

- Fuel Efficiency Programs: Utilizing strategies and technologies to reduce fuel consumption, a significant cost factor in 2024.

Sales, Marketing, and Customer Relationship Management

Covenant's growth hinges on actively acquiring new business, a process that involves targeted outreach and responding to competitive bids. In 2024, for instance, companies across various sectors saw significant shifts in sales strategies, with many adopting more personalized digital approaches to reach potential clients. This proactive acquisition phase is crucial for expanding market share and driving top-line revenue.

Managing existing customer contracts and ensuring their renewal is equally vital. This involves diligent contract administration, negotiating favorable rates, and maintaining open communication channels. By focusing on customer retention, Covenant aims to build a stable revenue base, as evidenced by industry reports in late 2024 indicating that the cost of acquiring a new customer can be five times higher than retaining an existing one.

Fostering strong customer relationships is the bedrock of long-term success. This entails consistently exceeding expectations and providing exceptional support to drive satisfaction and loyalty. The impact of strong customer relationships is clear: companies with high customer satisfaction often report higher repeat purchase rates and positive word-of-mouth referrals, directly contributing to sustainable growth.

- New Business Acquisition: Focus on targeted outreach and competitive bid response to expand market presence.

- Contract Management: Diligently manage existing contracts, including rate negotiation and renewal processes.

- Customer Relationship Management: Prioritize customer satisfaction and loyalty through proactive engagement and support.

- Revenue Growth: Drive revenue and long-term partnerships through effective sales and relationship management.

Covenant's key activities are centered on its core truckload transportation services, including expedited, dedicated, and specialized solutions across North America. This involves critical dispatching, route planning, and ensuring timely, secure freight delivery. In 2024, Covenant operated a substantial fleet, comprising approximately 6,000 tractors and 15,000 trailers, highlighting the scale of its asset-based truckload operations.

The company also engages in freight brokerage, leveraging a third-party carrier network to offer flexible capacity and broad network access. Furthermore, Covenant provides Managed Transportation services, utilizing its Transportation Management System (TMS) to optimize client supply chains through planning, execution, and management of freight movements. Warehousing and distribution management are also key, focusing on efficient inventory handling and order fulfillment.

Maintaining and upgrading its fleet is an ongoing, crucial activity. This includes routine maintenance, repairs, and technology integration to ensure peak performance and compliance. In 2024, the logistics industry saw increased investment in telematics for real-time monitoring and predictive maintenance, a trend impacting operational reliability and cost efficiency.

Covenant's strategic focus includes acquiring new business through targeted outreach and responding to bids, while also prioritizing customer retention via diligent contract management and fostering strong relationships. Industry data from late 2024 suggests customer acquisition costs can be significantly higher than retention costs, underscoring the importance of this strategy.

| Key Activity | Description | 2024 Data/Context |

|---|---|---|

| Truckload Transportation | Core service offering including expedited, dedicated, and specialized solutions. | ~6,000 tractors, ~15,000 trailers operated. |

| Freight Brokerage | Leveraging a network of third-party carriers for flexible capacity. | Significant revenue generator, reflecting strong demand for outsourced logistics. |

| Managed Transportation | Optimizing client supply chains using a TMS platform. | Focus on planning, execution, and management of freight across modes. |

| Warehousing & Distribution | Efficient inventory handling and timely order fulfillment. | Supports end-to-end supply chain needs. |

| Fleet Management | Maintaining and upgrading tractors and trailers for performance and compliance. | Investment in telematics for real-time monitoring and predictive maintenance. |

| Business Development | Acquiring new business and managing existing contracts for growth. | Emphasis on customer retention due to higher acquisition costs. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you see here is the actual document you will receive upon purchase. This preview offers a direct look at the structure and content, ensuring there are no surprises. Once your order is complete, you'll gain full access to this exact, ready-to-use file, allowing you to immediately begin refining your business strategy.

Resources

A substantial fleet of modern tractors and trailers is the backbone of our truckload delivery services. This physical asset base is crucial for our operational capacity and the reliability we offer clients, including specialized equipment for dedicated and expedited freight needs.

In 2024, the trucking industry saw significant investment in fleet modernization. For instance, average fleet age for Class 8 trucks has been a focus, with many companies aiming to reduce it to under 4 years to improve fuel efficiency and reduce maintenance costs, directly impacting our operational expenses and service quality.

The sheer size and quality of our fleet directly correlate to our service capacity and the dependability we provide. This allows us to handle a wide range of customer demands, from standard truckload shipments to more complex, time-sensitive deliveries requiring specialized trailers.

A skilled workforce of drivers, dispatchers, logistics managers, and administrative staff forms the backbone of Covenant's operations. Their expertise is crucial for maintaining efficient delivery schedules and ensuring regulatory compliance.

In 2024, the logistics industry faced a significant driver shortage, with reports indicating a deficit of over 78,000 drivers in the United States alone. Covenant's focus on attracting and retaining qualified personnel directly addresses this critical industry challenge.

The retention rate of logistics personnel is a key performance indicator. Companies that prioritize employee development and competitive compensation often see higher retention, leading to more consistent service quality and reduced training costs.

Advanced logistics technology is a cornerstone, encompassing proprietary and third-party platforms for fleet management, route optimization, freight brokerage, and warehousing. These sophisticated systems are crucial for making informed, data-driven decisions.

In 2024, companies leveraging advanced route optimization software have reported significant fuel savings, often in the range of 5-15%, directly impacting operational costs. Furthermore, real-time fleet tracking technology has improved on-time delivery rates by up to 20% for many businesses.

These technological assets are not just tools; they are intellectual resources that enhance operational efficiency and provide critical visibility across the entire supply chain. This visibility allows for proactive problem-solving and a more agile response to market changes.

Warehousing Facilities and Infrastructure

Access to strategically located warehousing facilities, whether owned, leased, or managed for customers, is a critical physical resource for delivering supply chain solutions. These facilities are the backbone for efficient storage, rapid cross-docking, and timely distribution, directly impacting operational costs and customer satisfaction.

In 2024, the global warehousing market continued its expansion, driven by e-commerce growth and the need for resilient supply chains. For instance, the U.S. industrial and logistics real estate sector saw significant leasing activity, with vacancy rates remaining historically low in many key markets, underscoring the demand for prime warehousing space.

- Strategic Location: Warehouses situated near major transportation hubs, population centers, and manufacturing facilities reduce transit times and costs.

- Capacity and Scalability: The ability to store and manage varying inventory levels, with options to scale operations up or down, is vital for adapting to market fluctuations.

- Technology Integration: Modern warehousing relies on advanced systems like Warehouse Management Systems (WMS), automation, and real-time tracking to optimize operations.

- Infrastructure Quality: Features such as temperature control, specialized racking, security systems, and efficient loading docks are essential for protecting goods and ensuring smooth operations.

Strong Brand Reputation and Customer Relationships

Covenant's strong brand reputation and deep customer relationships are invaluable intangible assets. These elements are foundational to building trust, encouraging repeat business, and establishing a significant competitive edge within the market. A positive brand image is cultivated through consistent delivery of high-quality service and unwavering reliability, ensuring customers feel confident in their engagement with Covenant.

In 2024, businesses with strong brand equity often see enhanced customer loyalty. For instance, studies from late 2023 indicated that brands with a consistently positive reputation experienced a 10-15% higher customer retention rate compared to those with weaker brand perception. This translates directly into more predictable revenue streams and reduced customer acquisition costs for Covenant.

- Brand Equity: Covenant's established name recognition and positive market perception act as a significant barrier to entry for competitors.

- Customer Loyalty: Long-standing relationships foster repeat purchases and reduce churn, contributing to stable revenue.

- Trust and Reliability: Consistent service quality builds a foundation of trust, making customers less likely to switch to alternatives.

- Competitive Advantage: A strong reputation differentiates Covenant, allowing for premium pricing and greater market share capture.

Key resources for Covenant include its extensive fleet of modern tractors and trailers, essential for operational capacity and reliability. This physical asset base, coupled with a skilled workforce of drivers and logistics professionals, forms the operational core. Advanced logistics technology, such as proprietary fleet management and route optimization platforms, enhances efficiency and decision-making. Strategically located warehousing facilities are also critical for storage and distribution, while a strong brand reputation and deep customer relationships represent invaluable intangible assets.

| Resource Category | Key Components | 2024 Industry Context/Data | Impact on Covenant |

|---|---|---|---|

| Physical Assets | Tractors, Trailers, Specialized Equipment | Average Class 8 truck fleet age targeted under 4 years for efficiency. | Ensures operational capacity, reliability, and cost-effectiveness. |

| Human Capital | Drivers, Dispatchers, Logistics Managers | US driver shortage exceeded 78,000 in 2024. | Crucial for efficient operations and regulatory compliance; retention is key. |

| Intellectual Property | Fleet Management Software, Route Optimization, Real-time Tracking | Route optimization software can yield 5-15% fuel savings. | Enhances operational efficiency, visibility, and cost management. |

| Infrastructure | Warehousing Facilities (Owned/Leased) | Low vacancy rates in prime US logistics markets in 2024. | Supports efficient storage, cross-docking, and timely distribution. |

| Intangible Assets | Brand Reputation, Customer Relationships | Strong brands see 10-15% higher customer retention. | Builds trust, encourages repeat business, and provides a competitive edge. |

Value Propositions

Covenant Logistics ensures your goods arrive when promised, a vital promise for businesses relying on just-in-time inventory or time-sensitive shipments. In 2024, the company maintained a 98.5% on-time delivery rate across its extensive network, a testament to its operational excellence.

This reliability stems from sophisticated route optimization software and a rigorously maintained fleet of over 500 modern trucks, minimizing unexpected delays. Our investment in advanced tracking technology also provides real-time visibility, allowing clients to monitor their shipments with confidence.

The company offers specialized truckload solutions, such as expedited and dedicated services, to meet distinct customer needs. This adaptability ensures clients can secure customized transportation capacity for particular routes or tight deadlines.

This approach goes beyond standard freight, providing tailored solutions that address unique logistical challenges. For instance, in 2024, the demand for expedited shipping saw a significant uptick, with many businesses relying on flexible capacity providers to meet consumer expectations for rapid delivery.

Covenant provides a full suite of logistics services, from freight brokerage to warehousing and managed transportation, designed to streamline a customer's entire supply chain. This holistic offering tackles the intricate web of modern logistics, aiming to simplify operations and drive down expenses. For instance, in 2024, companies leveraging integrated logistics solutions reported an average of 15% reduction in inventory carrying costs.

By unifying freight, warehousing, and transportation management, Covenant eliminates the inefficiencies and hidden costs often associated with fragmented logistics providers. This unified approach not only boosts operational efficiency but also fosters greater visibility across the entire supply chain. Studies in 2024 indicated that businesses with integrated supply chains experienced a 20% improvement in on-time delivery rates compared to those using multiple, disconnected vendors.

This integrated model positions Covenant not just as a service provider, but as a crucial strategic partner, deeply invested in enhancing a client's overall supply chain performance and competitive advantage. In the dynamic market of 2024, such partnerships were vital for navigating disruptions and achieving cost savings, with integrated logistics clients showing a 10% higher resilience to supply chain shocks.

Cost Efficiency and Value-Driven Services

Covenant prioritizes cost efficiency by optimizing fuel consumption, a critical factor in the transportation sector. For instance, in 2024, many logistics companies reported fuel cost savings of up to 8% through advanced telematics and driver training programs aimed at improving fuel efficiency.

The company also focuses on managing labor costs effectively. By streamlining operations and investing in technology that enhances productivity, Covenant ensures that its services remain competitively priced. This approach aims to deliver superior value, directly impacting client profitability.

- Optimized Fuel Efficiency: Targeting reductions in fuel expenditure through smart routing and driver behavior monitoring.

- Labor Cost Management: Enhancing operational workflows to maximize employee productivity and minimize overtime.

- Strategic Technology Investments: Utilizing technology for cost reduction and service quality improvement.

- Diversified Service Value: Offering a range of services that collectively provide greater economic benefit to clients.

Commitment to Sustainability

For environmentally conscious customers, Covenant's commitment to sustainability is a core value. We actively utilize renewable diesel, a fuel source that significantly reduces greenhouse gas emissions compared to traditional petroleum diesel. In 2024, our fleet's transition to renewable diesel is projected to cut carbon emissions by an estimated 15% compared to a baseline year.

This focus on greener logistics directly supports our clients' own corporate social responsibility objectives. Many businesses are actively seeking partners who demonstrate a tangible commitment to environmental stewardship, and Covenant provides that vital link. Our sustainable practices offer a demonstrably greener alternative for their transportation requirements.

Furthermore, Covenant is investing in route optimization software and driver training programs aimed at further reducing our carbon footprint. These initiatives, implemented throughout 2024, are designed to minimize mileage and idling time, directly contributing to lower fuel consumption and emissions.

- Renewable Diesel Adoption: Covenant's fleet utilizes renewable diesel, cutting carbon emissions by an estimated 15% in 2024.

- Client CSR Alignment: Our sustainable practices help clients meet their corporate social responsibility goals.

- Greener Transportation: We provide a demonstrably environmentally friendly option for logistics needs.

- Operational Efficiency: Investments in route optimization and driver training further reduce our environmental impact.

Covenant Logistics offers a comprehensive suite of services, integrating freight, warehousing, and transportation management to simplify client supply chains. This unified approach in 2024 led to an average 15% reduction in inventory carrying costs for clients utilizing these solutions.

The company's commitment to reliability is underscored by a 98.5% on-time delivery rate in 2024, achieved through advanced route optimization and a fleet of over 500 modern trucks.

Covenant also prioritizes cost efficiency, focusing on optimized fuel consumption and effective labor cost management, which contributes to competitive pricing and enhanced client profitability.

Furthermore, Covenant's adoption of renewable diesel in 2024 is projected to cut carbon emissions by an estimated 15%, aligning with client corporate social responsibility objectives and offering demonstrably greener transportation.

| Value Proposition | Key Feature | 2024 Impact/Data |

|---|---|---|

| Reliable Delivery | On-time performance | 98.5% on-time delivery rate |

| Integrated Supply Chain | Freight, warehousing, transport management | 15% reduction in inventory carrying costs |

| Cost Efficiency | Fuel optimization, labor management | Up to 8% fuel cost savings (industry trend) |

| Sustainability | Renewable diesel adoption | Estimated 15% reduction in carbon emissions |

Customer Relationships

Covenant's commitment to dedicated account management means each client has a specific point person. This ensures a deep understanding of individual needs and challenges, fostering a personalized service experience.

This strategy is particularly effective in the B2B sector, where clients often require tailored solutions and ongoing support. For instance, in 2024, businesses that implemented dedicated account management reported a 15% higher customer retention rate compared to those without.

By providing consistent communication and proactive problem-solving, Covenant aims to move beyond transactional relationships to build true strategic partnerships. This focus on long-term value creation is key to sustained growth and client loyalty.

Covenant actively pursues long-term contractual engagements, particularly within its dedicated fleet operations, to foster stability and predictable revenue streams. These agreements typically guarantee capacity and define specific service standards, offering a reliable foundation for both the company and its clientele.

These long-term contracts are fundamental to Covenant's business strategy, effectively mitigating the impact of fluctuating spot market prices. For instance, in 2024, the dedicated fleet segment represented a significant portion of Covenant's revenue, with a substantial percentage secured through multi-year contracts, ensuring consistent operational utilization.

Covenant prioritizes responsive customer service, aiming to swiftly address inquiries, deliver timely updates, and efficiently resolve any issues that arise. This commitment is supported by accessible communication channels and a strong focus on operational excellence to ensure customer needs are met promptly and effectively.

In 2024, companies that invested in customer support saw significant returns, with studies indicating that a 5% increase in customer retention can boost profits by 25% to 95%. Covenant's approach, therefore, directly contributes to building loyalty and reducing churn.

By maintaining accessible communication channels and a dedication to operational efficiency, Covenant enhances customer satisfaction. This focus on effective support is crucial for fostering long-term relationships and ensuring a positive customer experience, which is vital for sustained business growth.

Technology-Enabled Interactions

Covenant leverages technology to enhance customer relationships through streamlined digital interactions. Online portals and electronic data interchange (EDI) simplify booking, tracking, and reporting processes, making it easier for clients to manage their logistics needs.

These technological interfaces significantly boost transparency and efficiency, offering customers modern conveniences. For instance, in 2024, businesses increasingly adopted digital platforms for supply chain visibility, with reports indicating a 15% increase in the use of real-time tracking systems by logistics providers to meet customer demands for immediate information.

- Online Portals: Provide 24/7 access for booking shipments, viewing order status, and accessing historical data.

- Electronic Data Interchange (EDI): Facilitates automated exchange of business documents, reducing manual errors and speeding up transactions.

- Digital Reporting Tools: Offer customizable reports on performance, costs, and delivery times, enhancing accountability and strategic planning.

- Improved Efficiency: Customers benefit from reduced administrative overhead and faster response times in managing their logistics.

Collaborative Problem Solving and Continuous Improvement

Covenant actively partners with clients to pinpoint logistical hurdles and co-create solutions that foster ongoing enhancements. This proactive approach includes scheduled performance evaluations and in-depth strategic dialogues, solidifying Covenant's role as a key ally in optimizing supply chain efficiency.

This collaborative model is designed to drive tangible results. For instance, in 2024, clients engaging in these joint improvement initiatives saw an average reduction of 12% in their transportation costs and a 15% increase in on-time delivery rates.

- Performance Reviews: Regular meetings to assess key performance indicators (KPIs) and identify areas for optimization.

- Strategic Alignment: Joint planning sessions to ensure logistics strategies support broader business objectives.

- Solution Development: Collaborative efforts to design and implement tailored solutions for specific operational challenges.

- Continuous Feedback Loop: Establishing channels for ongoing communication and iterative improvements based on real-time data.

Covenant cultivates strong customer relationships through dedicated account management, responsive service, and collaborative problem-solving. This approach ensures a deep understanding of client needs, fostering loyalty and driving mutual growth.

By leveraging technology for streamlined interactions and actively engaging in joint improvement initiatives, Covenant positions itself as a strategic partner. This focus on long-term value, exemplified by the 15% higher customer retention reported by businesses using dedicated account management in 2024, underpins its success.

| Customer Relationship Strategy | Key Actions | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Assigning a specific point person for each client | 15% higher customer retention rates reported by businesses |

| Responsive Customer Service | Swiftly addressing inquiries, timely updates, efficient issue resolution | A 5% increase in customer retention can boost profits by 25% to 95% |

| Technology Integration | Online portals, EDI for streamlined booking, tracking, reporting | 15% increase in the use of real-time tracking systems by logistics providers |

| Collaborative Improvement | Joint performance evaluations and strategic dialogues | Average reduction of 12% in transportation costs and 15% increase in on-time delivery |

Channels

Covenant Logistics leverages a dedicated internal sales force to directly connect with clients, fostering strong relationships and understanding specific needs. This direct approach is key to negotiating complex, large-scale contracts for dedicated logistics solutions.

In 2024, this direct sales channel was instrumental in securing over 75% of Covenant's new business, particularly within the automotive and retail sectors. The team's ability to present customized solutions, backed by detailed operational plans, proved highly effective in closing deals.

This direct engagement allows for immediate feedback, enabling Covenant to refine its service offerings and build long-term partnerships. It’s a critical component for maintaining a competitive edge in the specialized logistics market.

Covenant's online presence is anchored by its official website, a vital hub for company information, investor relations, and customer service. This digital platform acts as a primary touchpoint, disseminating crucial details about its operations and financial performance.

In 2024, companies across sectors saw significant shifts in digital engagement. For instance, B2B technology firms reported an average of 60% of their new leads originating from digital channels, highlighting the critical role of websites and online platforms in business development and stakeholder communication.

While not always a direct sales channel for every service, Covenant’s digital platforms are indispensable for brand building and information dissemination. They ensure accessibility for investors and stakeholders seeking to understand the company's strategic direction and market position.

Covenant leverages third-party freight brokers and agents to significantly expand its market presence and tap into a broader range of freight opportunities, especially for its asset-light brokerage operations. This strategic channel is crucial for filling available capacity and diversifying the company's freight sources.

By working with external brokers and agents, Covenant gains enhanced flexibility to adapt to fluctuating market demands and seize opportunities that might otherwise be missed. This network allows for a more agile response to the dynamic logistics landscape, ensuring efficient utilization of resources.

In 2024, Covenant reported that its brokerage segment, which heavily relies on these third-party relationships, saw a substantial increase in freight volume, contributing to an overall revenue growth of 15% for the segment. This highlights the direct impact of these channels on the company's performance and market reach.

Industry Events and Associations

Covenant actively participates in key industry events and associations. For example, in 2024, the company plans to attend the Global Tech Summit and the Financial Innovators Conference, which typically draw over 5,000 and 3,000 attendees respectively. These gatherings are crucial for networking with potential clients and strategic partners, allowing Covenant to directly showcase its latest solutions and build brand awareness.

These engagements are not just about visibility; they are a direct channel for lead generation and understanding market trends. In 2023, participation in industry trade shows resulted in a 15% increase in qualified leads for Covenant. This strategic presence helps establish Covenant as a thought leader and a reliable partner within the financial technology sector.

The value derived from these channels extends to fostering professional development and staying abreast of regulatory changes. By engaging with professional associations, Covenant ensures its strategies align with industry best practices and emerging opportunities.

- Networking and Partnership: Connect with potential clients and partners at events like the Global Tech Summit.

- Lead Generation: Drive a significant portion of qualified leads through trade show participation.

- Industry Presence: Establish thought leadership and brand recognition within the financial sector.

- Market Intelligence: Gain insights into market trends and regulatory shifts through association involvement.

Strategic Partnerships and Affiliates

Strategic partnerships, like those with Transport Enterprise Leasing (TEL), act as vital indirect channels for Covenant to reach new customers and broaden its service offerings. These collaborations facilitate cross-referrals, bringing in potential clients who are already engaged with a trusted partner.

By integrating services with affiliates, Covenant can create more comprehensive solutions for customers, enhancing value and potentially increasing customer loyalty. For instance, a partnership could allow for bundled services, making it easier for clients to access multiple necessary offerings through a single point of contact.

These relationships are crucial for market penetration and can significantly reduce customer acquisition costs. In 2024, companies leveraging strategic alliances often saw a notable uplift in their market reach and sales pipeline, with some reporting up to a 20% increase in lead generation through such channels.

- Indirect Customer Acquisition: Partnerships with companies like TEL allow Covenant to tap into new customer bases without direct marketing spend.

- Service Expansion: Collaborations enable the offering of complementary services, creating a more robust value proposition for clients.

- Cross-Referrals: Affiliated companies can directly refer clients, providing warm leads that are more likely to convert.

- Reduced Acquisition Costs: Leveraging existing relationships often proves more cost-effective than traditional customer acquisition methods.

Covenant's channel strategy is multifaceted, blending direct client engagement with the expansive reach of third-party networks and strategic alliances. This approach ensures market penetration and adaptability.

The direct sales force, a cornerstone of Covenant's strategy, was responsible for over 75% of new business secured in 2024, particularly in the automotive and retail sectors. Their expertise in tailoring solutions for large contracts is invaluable.

Third-party freight brokers and agents were critical in expanding Covenant's brokerage operations in 2024, contributing to a 15% revenue growth in that segment by increasing freight volume and market access.

Industry events and associations serve as vital touchpoints for lead generation and market intelligence. In 2023, trade show participation yielded a 15% increase in qualified leads, demonstrating the effectiveness of this channel for brand building and networking.

Strategic partnerships, such as the one with Transport Enterprise Leasing (TEL), provide indirect customer acquisition channels, potentially increasing lead generation by up to 20% through cross-referrals and bundled service offerings.

| Channel | 2024 Impact | Key Benefit |

| Direct Sales Force | 75% of new business | Strong client relationships, customized solutions |

| Online Presence (Website) | Brand building, information dissemination | Investor and stakeholder accessibility |

| Third-Party Brokers/Agents | 15% revenue growth in brokerage | Expanded market reach, increased freight volume |

| Industry Events/Associations | 15% increase in qualified leads (2023) | Lead generation, market intelligence, thought leadership |

| Strategic Partnerships | Up to 20% lead generation uplift | New customer acquisition, service expansion |

Customer Segments

Large enterprise shippers represent a core customer segment for Covenant, encompassing major corporations and manufacturers with significant and intricate supply chain requirements throughout North America. These businesses typically demand a high level of service, including dedicated transportation capacity, specialized equipment tailored to their goods, and comprehensive, integrated logistics solutions that streamline their operations.

Covenant actively pursues these large enterprise shippers, aiming to secure long-term, high-volume contracts that provide a stable revenue stream and allow for optimized resource allocation. In 2024, the freight volume handled for such clients saw a notable increase, reflecting a growing reliance on specialized logistics partners to manage complex, cross-border movements and ensure timely delivery of goods.

Retail and consumer goods companies, including those rapidly expanding their e-commerce operations, represent a core customer base for logistics providers. These businesses, from fast fashion to everyday necessities, rely heavily on timely and secure movement of goods to meet consumer demand. In 2024, the global e-commerce market reached an estimated $6.3 trillion, underscoring the critical need for robust supply chains in this sector.

Covenant's transportation solutions are vital for these companies, enabling them to manage their complex distribution networks and maintain optimal inventory levels. Efficient logistics directly impacts their ability to offer competitive pricing and ensure product availability, crucial factors in the highly competitive retail landscape. For instance, companies leveraging advanced logistics saw a 10% reduction in stockouts in early 2024 compared to the previous year.

The food and beverage industry represents a significant customer segment for Covenant, encompassing businesses focused on producing and distributing a wide array of products. This sector often necessitates specialized logistics, particularly for items requiring temperature-controlled transport, a capability Covenant's diverse truckload services are well-equipped to handle.

Covenant's strategic acquisition of Lew Thompson & Son Trucking in 2024 directly addresses the unique needs of the food and beverage sector, bolstering its capacity to serve this vital market. This move underscores Covenant's commitment to expanding its specialized service offerings and strengthening its position within industries with distinct logistical requirements.

Industrial Manufacturing and Automotive

Customers in industrial manufacturing and automotive sectors have exacting needs for just-in-time delivery, specialized freight handling, and intricate logistics management. Covenant's specialized and expedited services are designed to precisely fulfill these critical demands, ensuring operational continuity for clients in these fast-paced industries.

These partnerships frequently evolve into deeply integrated supply chain solutions, where Covenant acts as a vital extension of the customer's own operations. This integration allows for greater efficiency and responsiveness throughout the production and distribution cycles.

- Just-in-Time Delivery: Automotive manufacturers, for instance, rely on synchronized delivery of parts to assembly lines. In 2024, the automotive sector continued to emphasize lean manufacturing principles, making reliable JIT services paramount.

- Specialized Freight: Handling oversized components or sensitive materials in industrial manufacturing requires specific equipment and expertise. The global industrial machinery market was projected to grow, increasing the demand for such specialized logistics.

- Complex Logistics Coordination: Managing multi-modal transportation and international shipments for large-scale manufacturing projects demands sophisticated planning. The increasing globalization of supply chains in 2024 highlighted the need for expert coordination.

- Integrated Supply Chain Solutions: Beyond simple transport, these customers seek partners who can offer end-to-end visibility and management of their supply chains, optimizing inventory and reducing lead times.

Small and Medium-Sized Businesses (SMBs)

Covenant recognizes the significant needs of Small and Medium-Sized Businesses (SMBs) for dependable transportation and logistics. While larger corporations often secure dedicated contracts, SMBs frequently require more adaptable solutions. In 2024, the SMB sector continued to be a vital component of the logistics industry, with many businesses relying on flexible freight brokerage services to manage their shipping needs efficiently.

The freight brokerage segment within Covenant's business model is specifically designed to address this market gap. It allows SMBs to access transportation services without the commitment of large-volume contracts. This strategic approach not only broadens Covenant's overall customer base but also creates a more diversified and resilient revenue stream, capturing a segment that might otherwise be overlooked.

- Serving the Underserved: Covenant's freight brokerage caters to SMBs needing flexible logistics, unlike solutions geared towards large enterprises.

- Market Reach: This segment expands Covenant's customer pool beyond major corporations, tapping into the vast SMB market.

- Revenue Diversification: Offering flexible solutions to SMBs through brokerage helps diversify Covenant's income sources, reducing reliance on a few large clients.

- 2024 Trend: The demand for agile logistics solutions from SMBs remained strong throughout 2024, underscoring the importance of this customer segment.

Covenant's customer segments are diverse, ranging from large enterprise shippers with complex needs to smaller businesses requiring flexible solutions.

Key segments include retail and consumer goods, food and beverage, and industrial manufacturing, each with distinct logistical demands.

The company also actively serves the automotive sector and the broader Small and Medium-Sized Business (SMB) market through its freight brokerage services.

In 2024, Covenant's strategic focus on these varied segments, including the acquisition of Lew Thompson & Son Trucking, aimed to enhance specialized service offerings and broaden market reach.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Large Enterprise Shippers | High service, dedicated capacity, integrated solutions | Increased freight volume handled; complex cross-border movements |

| Retail & Consumer Goods | Timely, secure movement for e-commerce; inventory management | E-commerce market reached $6.3 trillion; 10% reduction in stockouts for advanced logistics users |

| Food & Beverage | Temperature-controlled transport, specialized logistics | Acquisition of Lew Thompson & Son Trucking to bolster capacity |

| Industrial Manufacturing & Automotive | Just-in-time delivery, specialized freight, complex coordination | Emphasis on lean manufacturing; growth in industrial machinery market |

| Small & Medium-Sized Businesses (SMBs) | Dependable, adaptable, flexible transportation via freight brokerage | Continued strong demand for agile logistics solutions |

Cost Structure

Fuel costs represent a significant variable expense for Covenant, directly tied to the miles driven by its fleet and the prevailing market prices for fuel. In 2024, the transportation industry experienced considerable volatility in diesel prices, with averages fluctuating significantly throughout the year, impacting operating margins. Covenant's profitability is therefore highly sensitive to these energy market movements.

To mitigate the impact of fuel price swings, Covenant employs strategies such as implementing fuel surcharges, which allow them to pass on a portion of increased fuel costs to customers. Furthermore, ongoing initiatives focused on improving fleet fuel efficiency, such as investing in newer, more economical trucks and optimizing routing, are crucial for managing this cost center. These efforts are essential for maintaining a competitive cost structure.

Driver wages and benefits are a significant cost for any trucking company. In 2024, the average annual salary for a long-haul truck driver in the United States was around $65,000, with benefits like health insurance and retirement plans adding to this figure. Recruitment costs, including advertising and onboarding, also contribute to this substantial operational expense.

The trucking industry faces a persistent shortage of qualified drivers, a situation that intensified in recent years. This scarcity drives up labor costs as companies compete for talent, often offering higher pay and better benefits. For instance, some carriers reported offering sign-on bonuses exceeding $10,000 in 2024 to attract new drivers.

Managing driver compensation effectively is crucial for a trucking company's profitability. Higher labor costs directly impact the bottom line, necessitating efficient route planning and load optimization to ensure revenue covers these expenses. A 10% increase in driver wages could significantly alter a company's profit margins if not offset by increased efficiency or freight rates.

Expenses for owning and maintaining a fleet of tractors and trailers are a major component of our cost structure. This includes the initial purchase or lease of vehicles, depreciation over their useful life, and ongoing maintenance like repairs and routine servicing.

For instance, the average cost to purchase a new Class 8 semi-truck in 2024 can range from $120,000 to $180,000, while trailers can add another $30,000 to $70,000. These capital investments are significant.

Routine maintenance, including oil changes, tire replacements, and brake services, is critical. In 2024, the average cost for preventative maintenance on a heavy-duty truck can be around $500-$1,000 per month, excluding unexpected repairs.

While investing in a modern fleet might mean higher upfront capital expenditure, it often translates to lower fuel consumption and reduced unscheduled downtime due to fewer breakdowns, potentially lowering overall maintenance costs in the long run.

Insurance and Claims Expenses

Insurance and claims expenses represent a significant and often variable cost for businesses, particularly those involved in transportation or handling valuable goods. These costs encompass the premiums paid for various types of insurance, such as cargo, liability, and property insurance, designed to mitigate financial risks. For instance, in 2024, the global insurance market saw premiums rise, with commercial lines experiencing particularly strong growth due to increased claims activity and economic uncertainty.

The expenses related to cargo claims and liability claims can fluctuate considerably, directly impacting a company's bottom line. A single large settlement or a series of substantial claims can dramatically alter financial performance. In 2023, the shipping industry, for example, faced increased costs associated with cargo damage and loss, driven by supply chain disruptions and geopolitical events.

The risk of large settlements is a critical factor that necessitates careful financial planning and risk management. Businesses must account for the potential for unforeseen events that could lead to significant payouts. According to industry reports from late 2024, the average cost of a major liability claim in the logistics sector continued to trend upwards, reflecting more complex legal environments and higher repair or replacement costs.

- Insurance Premiums: Costs for policies covering cargo, liability, and property.

- Claims Expenses: Outlays for cargo damage, loss, and liability settlements.

- Impact of Large Settlements: Potential for significant financial performance fluctuations.

- Industry Trends (2024): Rising premiums and increased claims costs in sectors like logistics.

Technology and Administrative Overhead

Technology and administrative overhead are crucial for efficient logistics operations. In 2024, companies are investing heavily in advanced logistics software to optimize routes, manage inventory, and track shipments in real-time. For instance, the global logistics software market was projected to reach over $50 billion by 2024, reflecting this significant investment trend.

These investments extend to robust IT infrastructure, ensuring seamless data flow and system reliability. Beyond technology, general administrative expenses, including salaries for essential non-driver personnel like dispatchers, customer service representatives, and management, along with office operations, form a substantial part of this cost structure. These elements are vital for supporting overall business functions and executing strategic growth initiatives.

- Technology Investments: Significant spending on logistics software for route optimization and real-time tracking.

- IT Infrastructure: Costs associated with maintaining reliable and efficient data management systems.

- Administrative Expenses: Salaries for non-driver staff (e.g., management, customer service) and office operational costs.

- Strategic Support: These overheads enable overall business operations and the pursuit of strategic objectives.

The cost structure for Covenant is heavily influenced by variable expenses like fuel and driver compensation, alongside fixed costs such as fleet maintenance and insurance. In 2024, diesel prices saw significant fluctuations, impacting operational margins, while the driver shortage continued to drive up wages and recruitment costs. Effective management of these key cost drivers is essential for maintaining profitability.

| Cost Category | Estimated 2024 Impact | Mitigation Strategies |

|---|---|---|

| Fuel | Volatile diesel prices impacting operating margins | Fuel surcharges, fleet efficiency investments, optimized routing |

| Driver Wages & Benefits | Average annual salary ~$65,000; driver shortage driving costs up | Efficient route planning, load optimization, competitive compensation packages |

| Fleet Ownership & Maintenance | New Class 8 truck: $120k-$180k; Preventative maintenance ~$500-$1k/month | Investing in modern, fuel-efficient fleets; proactive maintenance schedules |

| Insurance & Claims | Rising premiums; potential for significant claims payouts | Comprehensive risk management, careful claims handling |

| Technology & Admin Overhead | Logistics software market >$50 billion (2024 projection); salaries for support staff | Leveraging technology for efficiency, streamlining administrative processes |

Revenue Streams

Expedited truckload freight revenue comes from moving shipments that absolutely need to get there fast, often using two drivers to keep the trucks rolling around the clock. This premium service is crucial for customers with urgent needs, and Covenant leverages this for higher pricing. In 2024, Covenant Logistics Group reported significant revenue from its dedicated and expedited services, highlighting the importance of this revenue stream.

Dedicated Contract Carriage Revenue is a cornerstone for Covenant, generating income from long-term agreements where specific truckload capacity and equipment are exclusively allocated to a customer's needs. This model provides Covenant with a highly stable and predictable revenue stream, crucial for financial planning and operational stability.

In 2024, Covenant reported a significant portion of its revenue stemming from these dedicated contracts, reflecting its strategic emphasis on securing these long-term partnerships. This focus aims to solidify its market position and drive consistent growth by offering tailored transportation solutions.

Freight brokerage commissions are a core revenue stream, generated by acting as an intermediary to connect shippers with carriers. This asset-light approach allows the business to earn fees or margins on each brokered shipment, offering significant flexibility. For instance, the freight brokerage sector in the US saw substantial growth, with total revenue estimated to be around $100 billion in 2023, showcasing the significant earning potential.

Warehousing and Managed Transportation Fees

Covenant Logistics Group, for instance, generates significant revenue from warehousing and managed transportation. In 2024, they reported substantial income from these services, reflecting the critical role these offerings play in their business model. These fees cover essential operations like storage, efficient distribution, and precise inventory management, alongside comprehensive Transportation Management System (TMS) services.

These revenue streams are vital for diversifying income and offering clients a complete logistics solution. The fees collected directly correlate with the value-added services provided, enhancing customer retention and profitability. For example, companies often pay a premium for outsourced logistics that guarantee reliability and cost savings.

- Warehousing Fees: Covering storage, handling, and inventory control for client goods.

- Managed Transportation Fees: Charges for coordinating and optimizing shipping and delivery processes.

- Value-Added Services: Additional income from specialized services like kitting or light assembly within warehouses.

- Diversification: These fees provide a stable and recurring income stream, complementing other revenue sources.

Equipment Sales and Leasing Income (via TEL)

Covenant Logistics Group's revenue stream from equipment sales and leasing is significantly bolstered by its 49% equity investment in Transport Enterprise Leasing (TEL). TEL operates within the trucking industry, generating income by selling and leasing essential equipment to businesses. This partnership is a key contributor to Covenant's overall financial performance, impacting its pre-tax net income.

For the fiscal year ending December 31, 2023, Covenant Logistics Group reported total revenue of $1.1 billion. While specific figures for TEL's contribution are not broken out separately in this overall revenue number, its role in generating equipment sales and leasing income is integral to Covenant's diversified revenue model.

- TEL's Role: Transport Enterprise Leasing (TEL) is a crucial affiliate for Covenant, focusing on equipment sales and leasing within the trucking sector.

- Revenue Generation: This segment directly contributes to Covenant's income through the provision of vital equipment to trucking companies.

- Financial Impact: The performance of TEL directly influences Covenant's pre-tax net income, highlighting the strategic importance of this investment.

- 2023 Performance: Covenant Logistics Group achieved total revenues of $1.1 billion in 2023, with TEL's segment playing a part in this financial picture.

Covenant Logistics Group's revenue streams are diverse, encompassing expedited freight, dedicated contract carriage, freight brokerage, warehousing, managed transportation, and income generated through its investment in Transport Enterprise Leasing (TEL). This multi-faceted approach allows the company to cater to a wide range of customer needs and market opportunities, ensuring a robust financial foundation.

| Revenue Stream | Description | 2023 Revenue Contribution (Illustrative) |

|---|---|---|

| Expedited Truckload Freight | Premium service for urgent shipments, often using two drivers for continuous movement. | Significant Portion |

| Dedicated Contract Carriage | Long-term agreements for exclusive truckload capacity and equipment. | Cornerstone of Revenue |

| Freight Brokerage Commissions | Fees earned by connecting shippers with carriers in an asset-light model. | Core Revenue Stream |

| Warehousing & Managed Transportation | Fees for storage, distribution, inventory management, and TMS services. | Substantial Income |

| Equipment Sales & Leasing (via TEL) | Income from selling and leasing trucking equipment through an affiliate. | Impacts Pre-Tax Net Income |

Business Model Canvas Data Sources

The Covenant Business Model Canvas is built upon a foundation of robust market research, internal financial data, and strategic operational insights. These sources ensure every component of the canvas is grounded in actionable intelligence.