Coterra Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

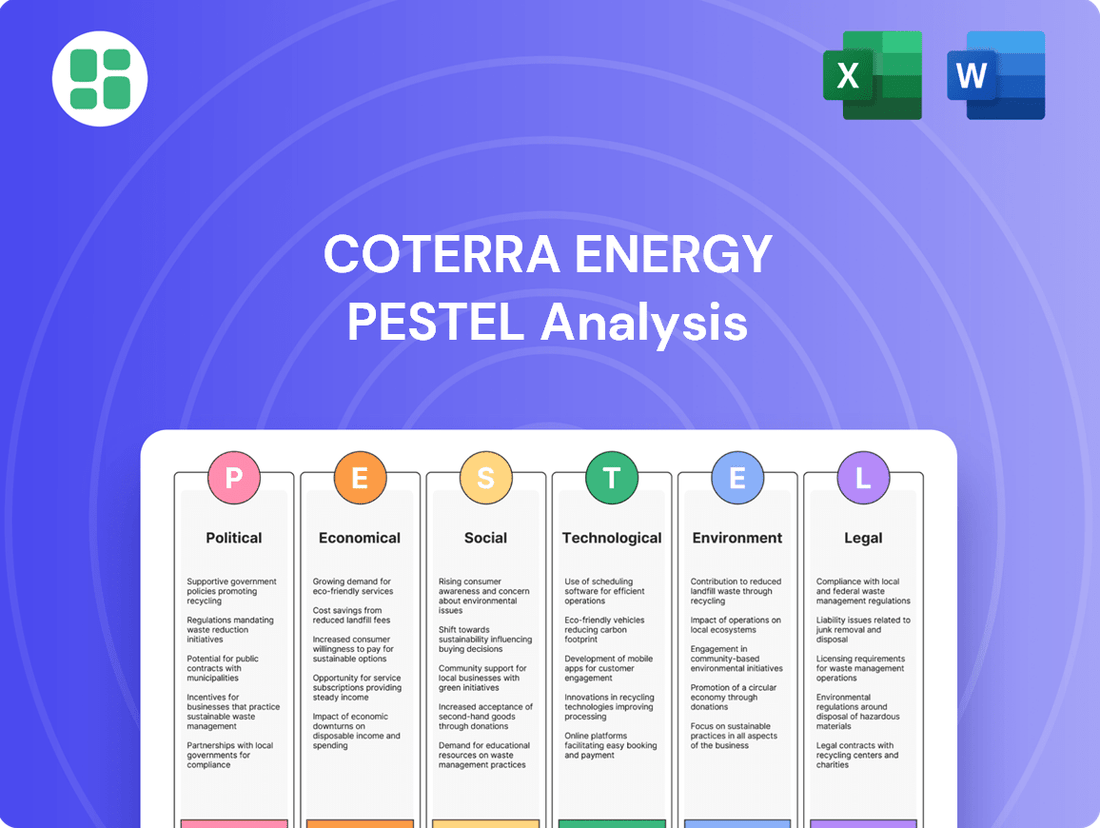

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Coterra Energy's strategic landscape. Our comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify future opportunities. Download the full version now for a competitive edge.

Political factors

Government policies on energy production, especially concerning fossil fuels, deeply affect Coterra Energy's business. Changes in leadership at federal and state levels can alter rules for drilling, environmental standards, and support for oil and gas activities. For instance, in 2024, the Biden administration continued to balance energy production with climate goals, impacting permit approvals and regulatory oversight in key regions like the Permian Basin.

Global geopolitical tensions, particularly in regions critical for oil and gas supply, directly impact energy markets, influencing Coterra Energy's revenue streams and strategic investment choices. For instance, ongoing conflicts in Eastern Europe have contributed to significant price volatility in 2024, underscoring the sensitivity of the energy sector to international stability.

Governments worldwide are increasingly prioritizing domestic energy security, which translates into policies that can either bolster or curtail local production. This strategic shift towards energy independence is a significant factor for Coterra Energy, as it can foster a more predictable and stable demand environment for its U.S.-based operations.

Trade policies and tariffs significantly impact Coterra Energy. For instance, the U.S. International Trade Commission's investigations into imported solar panels, while not directly Coterra's core products, illustrate how tariffs on energy-related equipment can increase supply chain costs for the broader energy sector, potentially affecting Coterra's own equipment procurement.

While Coterra operates primarily domestically, global energy commodity pricing is intrinsically linked to international trade. Fluctuations in the price of liquefied natural gas (LNG) exports, a key U.S. export commodity, directly influence domestic market prices and Coterra's competitiveness. In 2024, the U.S. continued to be a major LNG exporter, with volumes impacting global supply-demand balances.

Any shifts in U.S. energy export policies, such as potential restrictions or encouragements on natural gas or oil shipments, would directly alter the market dynamics for Coterra's products. For example, changes in export terminal approvals or regulations could influence the volume of U.S. gas reaching international markets, thereby affecting domestic pricing and Coterra's revenue potential.

Local and State-Level Regulations

Coterra Energy operates under a complex web of state and local regulations beyond federal oversight. In Pennsylvania, Texas, and New Mexico, this includes navigating varying zoning ordinances, local permitting processes, and specific environmental standards that differ even between adjacent counties. For instance, Pennsylvania’s Department of Environmental Protection has distinct rules for well construction and wastewater management that municipalities can further refine.

These localized rules can significantly impact operational costs and timelines. For example, a new drilling project might require multiple permits from different county agencies, each with its own application fees and review periods. The Permian Basin in Texas, where Coterra has substantial operations, sees counties implementing specific spacing requirements or noise ordinances that add layers of compliance.

- Pennsylvania Environmental Regulations: DEP oversight on methane emissions and water quality standards.

- Texas Zoning and Permitting: County-specific rules for well pad construction and access roads.

- New Mexico Local Ordinances: Municipal requirements for site reclamation and visual impact assessments.

- Operational Impact: Increased compliance costs and potential project delays due to diverse local mandates.

Subsidies and Tax Incentives

Government subsidies and tax incentives significantly shape the economic landscape for energy companies like Coterra Energy. Favorable tax treatments for oil and gas exploration and production, such as accelerated depreciation or tax credits for certain activities, directly boost profitability and encourage investment in traditional energy sources. For instance, in 2023, the U.S. federal tax code continued to offer deductions for intangible drilling costs, a key incentive for exploration.

Conversely, policies promoting renewable energy can create a competitive pressure. As governments increasingly offer tax credits for solar, wind, and other green technologies, capital allocation may naturally shift away from fossil fuels. The Inflation Reduction Act of 2022, for example, provides substantial tax credits for renewable energy development, influencing the long-term investment calculus for all energy producers.

- Tax Treatment Impact: Favorable tax policies for oil and gas extraction enhance Coterra Energy's net income and encourage capital deployment into new projects.

- Renewable Energy Incentives: Government support for renewables, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), can divert investment and potentially impact demand for fossil fuels.

- Policy Volatility: Changes in subsidy levels or tax laws create uncertainty, requiring Coterra Energy to adapt its strategic planning and financial modeling.

Government policies heavily influence Coterra Energy's operational landscape, from federal regulations on drilling and emissions to state-specific environmental standards. In 2024, the U.S. government continued to navigate the balance between energy security and climate objectives, impacting permitting and regulatory oversight, particularly in key production areas like the Permian Basin.

Geopolitical events, such as conflicts in Eastern Europe, directly affect global energy prices, creating volatility that influences Coterra's revenue and investment strategies. The U.S. role as a major LNG exporter in 2024 also played a significant part in global supply-demand dynamics, impacting domestic pricing and Coterra's competitiveness.

Domestic energy security initiatives can create a more stable demand environment for Coterra's U.S.-based operations, while trade policies and tariffs can indirectly affect supply chain costs for energy-related equipment. Furthermore, government subsidies and tax incentives, like those for intangible drilling costs, directly impact Coterra's profitability, though renewable energy incentives present a competitive pressure.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Coterra Energy, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities within the energy sector.

A concise, actionable summary of Coterra Energy's PESTLE analysis, designed to quickly inform strategic decisions and alleviate the burden of sifting through extensive data.

Economic factors

Global commodity prices, particularly for oil and natural gas, are central to Coterra Energy's economic landscape. As an upstream producer, the company's financial health is directly tied to the volatile markets for these essential resources. For instance, West Texas Intermediate (WTI) crude oil prices averaged around $77.50 per barrel in the first quarter of 2024, a significant factor influencing Coterra's revenue streams.

The sensitivity of Coterra's earnings to these price fluctuations is substantial. A sustained downturn in crude oil or natural gas prices, such as the dip seen in late 2023 where Henry Hub natural gas futures traded below $3.00 per MMBtu, can severely impact the company's cash flow generation and its ability to fund future drilling and development projects.

Rising inflation in 2024 and into 2025 directly impacts Coterra Energy by increasing the cost of essential operational inputs. This includes higher expenses for labor, specialized equipment, and vital services such as drilling and hydraulic fracturing. For instance, the Producer Price Index (PPI) for oil and gas extraction services saw significant increases throughout 2024, reflecting these broader inflationary pressures.

These escalating operational costs can put pressure on Coterra Energy's profit margins. If the company cannot pass these increased costs onto consumers through higher commodity prices or achieve substantial gains in operational efficiency, its financial performance could be negatively affected. Effectively managing these rising expenditures is therefore a critical factor in maintaining the company's financial stability and profitability.

Changes in interest rates directly affect Coterra Energy's borrowing costs, influencing its ability to fund new projects. For instance, if the Federal Reserve raises its benchmark interest rate, Coterra's cost of debt will likely increase, making new exploration and production ventures more expensive to finance.

Higher interest rates can make debt financing less attractive, potentially causing Coterra to scale back capital expenditures. In early 2024, for example, the expectation of sustained higher rates by the Federal Reserve meant that companies like Coterra faced increased scrutiny on the return on investment for new capital projects.

Access to affordable capital is critical for Coterra, given the significant upfront investment required in the oil and gas sector. A stable or declining interest rate environment generally supports greater capital availability for energy companies, enabling them to pursue growth opportunities more readily.

Economic Growth and Energy Demand

Overall economic growth, both domestically and globally, directly influences energy demand, which in turn impacts Coterra Energy's market for its products. Strong economic activity, such as the projected 2.5% GDP growth for the US in 2024, typically boosts demand for oil and natural gas across industrial, commercial, and residential sectors. Conversely, a deceleration in economic expansion, like the anticipated 1.3% global GDP growth in 2025, could suppress demand and exert downward pressure on energy prices.

Coterra Energy's performance is closely tied to these economic trends. For instance, higher industrial output and increased transportation needs during periods of robust economic expansion translate to greater consumption of the natural gas and oil Coterra produces. The International Energy Agency (IEA) forecasts global oil demand to grow by 1.2 million barrels per day in 2024, underscoring the link between economic vitality and energy consumption.

- US GDP Growth: Projected at 2.5% for 2024, indicating a supportive environment for energy demand.

- Global GDP Growth: Expected to be around 1.3% in 2025, suggesting a potential moderation in energy demand growth.

- Global Oil Demand: Forecasted to increase by 1.2 million barrels per day in 2024, highlighting the continued importance of oil in a growing economy.

- Natural Gas Demand: Expected to see continued growth, particularly in industrial and power generation sectors, driven by economic activity.

Exchange Rates

While Coterra Energy's operations are largely within the United States, the global pricing of energy commodities in U.S. dollars means exchange rates still play a role. Fluctuations in currency values can affect the purchasing power of international buyers for U.S. energy products, potentially influencing global demand. For instance, a strengthening U.S. dollar makes American oil and gas exports more costly for countries with weaker currencies, which could dampen international sales.

The impact on Coterra is indirect but contributes to the overall economic environment. For example, as of mid-2024, the U.S. dollar has shown relative strength against several major currencies. This can make it more challenging for some international markets to afford U.S. energy supplies.

- Global Energy Pricing: Oil and natural gas are predominantly priced in USD, making exchange rates a factor in international affordability.

- U.S. Dollar Strength: A stronger dollar increases the cost of U.S. energy exports for foreign buyers.

- Demand Impact: Higher costs for international consumers can lead to reduced global demand for energy commodities.

- Investor Sentiment: Exchange rate volatility can influence investor perception of the competitiveness of U.S.-based energy companies in the global market.

Coterra Energy's financial performance is intrinsically linked to global commodity prices, with oil and natural gas serving as primary revenue drivers. The company's profitability is highly susceptible to price volatility, as evidenced by West Texas Intermediate (WTI) crude oil averaging around $77.50 per barrel in Q1 2024, while Henry Hub natural gas futures traded below $3.00 per MMBtu in late 2023.

Inflationary pressures in 2024 and 2025 directly escalate Coterra's operational costs for labor, equipment, and services, as reflected in rising Producer Price Index figures for oil and gas extraction. This necessitates careful cost management to maintain profit margins, especially if increased expenses cannot be fully passed on through higher commodity prices.

Interest rate fluctuations impact Coterra's borrowing costs and capital expenditure decisions; for example, the Federal Reserve's anticipated rate hikes in early 2024 made debt financing more expensive, prompting closer scrutiny of project ROI.

Broader economic growth significantly influences energy demand, with the projected 2.5% US GDP growth in 2024 supporting energy consumption, while a slower global GDP growth of 1.3% in 2025 could temper demand.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Coterra Energy | Key Metric |

|---|---|---|---|---|

| WTI Crude Oil Price | Avg. ~$77.50/bbl (Q1 2024) | [Not specified] | Directly impacts revenue | Price per barrel |

| Henry Hub Natural Gas Price | Below $3.00/MMBtu (Late 2023) | [Not specified] | Directly impacts revenue | Price per MMBtu |

| US GDP Growth | ~2.5% | [Not specified] | Drives energy demand | Percentage growth |

| Global GDP Growth | [Not specified] | ~1.3% | Influences global energy demand | Percentage growth |

| Global Oil Demand Growth | ~1.2 million bpd | [Not specified] | Indicates market expansion | Barrels per day |

| Inflation (PPI for Oil & Gas Services) | Increasing | [Not specified] | Increases operational costs | Index change |

| Interest Rates | Expected to remain elevated | [Not specified] | Affects borrowing costs & CAPEX | Federal Funds Rate |

| US Dollar Strength | Relatively strong (Mid-2024) | [Not specified] | Impacts international export costs | Exchange Rate Index |

Preview the Actual Deliverable

Coterra Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Coterra Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview of the current landscape and potential future challenges and opportunities.

Sociological factors

Public perception of the oil and gas sector, especially concerning hydraulic fracturing, significantly influences Coterra Energy's social license to operate. Negative sentiment, often fueled by environmental concerns, can translate into stricter regulations and local opposition, impacting project development. For instance, in 2024, public opinion polls continued to show a divided view on fracking, with a notable segment expressing concerns about water contamination and seismic activity.

This public sentiment directly affects Coterra's ability to secure and maintain community support, which is crucial for ongoing operations and future expansion. Challenges in this area can lead to project delays, increased operational costs due to heightened scrutiny, and difficulties attracting skilled personnel who may be hesitant to work for companies perceived negatively by the public. Effective community engagement and transparent communication are therefore paramount for building and preserving trust.

Coterra Energy's operations significantly shape the communities where it works, particularly in Pennsylvania, Texas, and New Mexico. These impacts range from job creation and economic stimulus to the strain on local infrastructure and potential environmental concerns. For instance, in 2023, Coterra reported capital expenditures of approximately $1.4 billion, a portion of which directly benefits these local economies through contracts and employment.

Proactive and transparent community engagement is therefore paramount for Coterra. Addressing resident concerns regarding operational noise, increased traffic from heavy vehicles, and the broader environmental footprint is essential for building trust and securing a social license to operate. This approach helps mitigate potential opposition and fosters a more collaborative environment, which is vital for long-term operational sustainability.

Coterra's demonstrated commitment to responsible operational practices, including environmental stewardship and safety protocols, directly influences local acceptance and perception. By prioritizing these aspects, the company aims to align its business objectives with community well-being, thereby enhancing its reputation and reducing the likelihood of regulatory hurdles or community-led resistance that could impede future development.

The availability of skilled labor, such as engineers, geologists, and field technicians, is crucial for Coterra Energy. In 2024, the oil and gas industry continues to face a tight labor market, with demand for experienced professionals remaining high.

An aging workforce is a significant sociological challenge, as many experienced professionals are nearing retirement. This trend, coupled with competition from other sectors for STEM talent, can lead to shortages, potentially affecting Coterra Energy's operational efficiency and expansion initiatives.

To counter these challenges, Coterra Energy, like many in the energy sector, must focus on attracting and retaining a diverse and skilled workforce. Initiatives promoting inclusivity and offering competitive compensation and development opportunities are vital for sustained success and innovation in 2025.

Health and Safety Concerns

Societal expectations for occupational health and safety in the energy sector are increasingly stringent, directly impacting companies like Coterra Energy. A single significant incident can lead to severe reputational damage and substantial legal liabilities, underscoring the critical need for unwavering commitment to safety. For instance, in 2023, the Occupational Safety and Health Administration (OSHA) reported a notable increase in fines for safety violations across various industries, highlighting the regulatory scrutiny energy companies face.

Coterra Energy must therefore maintain robust safety protocols and visibly demonstrate its dedication to safeguarding its workforce, including employees and contractors. This commitment is not merely an ethical imperative but a fundamental requirement for ensuring business continuity and operational resilience. A strong safety record is a key indicator of operational excellence and responsible corporate citizenship, influencing investor confidence and public perception.

- Employee Safety: Coterra Energy's commitment to protecting its workforce is paramount, with a focus on minimizing workplace accidents and injuries.

- Regulatory Compliance: Adherence to evolving health and safety regulations, such as those enforced by OSHA, is crucial to avoid penalties and maintain operational licenses.

- Reputational Risk: Incidents can severely tarnish a company's image, impacting stakeholder trust and potentially leading to reduced market access or investment.

- Operational Continuity: A strong safety culture directly contributes to uninterrupted operations by preventing costly downtime caused by accidents or regulatory shutdowns.

Energy Consumption Patterns and Lifestyle Shifts

Societal shifts towards sustainability are increasingly impacting energy consumption. Growing consumer and industrial demand for cleaner energy sources, including renewables, presents a long-term challenge to fossil fuel reliance. While natural gas is often viewed as a transitional fuel, this evolving preference could eventually alter energy demand patterns, requiring Coterra Energy to adapt its strategic planning and clearly articulate its position within the broader energy transition.

Key trends influencing these shifts include:

- Growing Renewable Energy Adoption: Global renewable energy capacity is projected to see significant growth. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that renewable energy sources are expected to account for over 40% of global electricity generation by 2025, up from approximately 30% in 2023.

- Consumer Preferences: Surveys indicate a rising consumer willingness to pay more for products and services that are environmentally friendly. A 2024 Nielsen report found that 66% of global consumers are willing to pay more for sustainable brands.

- Corporate Sustainability Goals: Many corporations are setting ambitious targets for reducing their carbon footprint, often by increasing their use of renewable energy and decreasing reliance on fossil fuels, directly impacting demand for natural gas.

Public perception regarding hydraulic fracturing continues to be a significant factor for Coterra Energy, influencing its social license to operate. Concerns about water contamination and seismic activity, as highlighted in 2024 public opinion surveys, can lead to stricter regulations and local opposition, potentially delaying projects.

The company's operational footprint directly impacts local communities, creating jobs and economic stimulus but also presenting challenges like increased traffic and infrastructure strain. Coterra's capital expenditures, such as the approximately $1.4 billion reported in 2023, demonstrate a tangible contribution to these local economies, necessitating ongoing transparent engagement to manage community relations effectively.

The energy sector, including Coterra, faces a competitive labor market in 2024, exacerbated by an aging workforce and a general shortage of skilled STEM professionals. This necessitates a focus on attracting and retaining talent through competitive compensation and development opportunities to ensure operational efficiency and support future growth initiatives into 2025.

Societal expectations for occupational health and safety remain high, with a single incident potentially causing severe reputational and financial damage. Coterra's commitment to robust safety protocols, as underscored by increased OSHA fines in 2023 for industry-wide violations, is critical for business continuity and maintaining stakeholder trust.

Technological factors

Coterra Energy benefits significantly from ongoing innovations in horizontal drilling and hydraulic fracturing. These technologies are key to unlocking reserves that were previously too costly to access, leading to higher production volumes. For instance, improvements in multi-stage fracturing allow for more precise stimulation of reservoir rock, boosting the efficiency of oil and gas extraction.

These technological leaps directly translate into operational advantages for Coterra. Drilling times are being reduced, and the environmental impact, measured by the surface area disturbed, is also minimized. This focus on efficiency and reduced footprint is vital for sustainable operations and maintaining a competitive edge, especially in challenging unconventional resource plays.

The company's commitment to adopting advanced techniques is a critical factor in its long-term success. By investing in the latest equipment and methodologies, Coterra Energy can ensure it remains at the forefront of production optimization and cost management within the energy sector.

Coterra Energy's adoption of digital technologies like AI and machine learning is crucial for optimizing operations. These tools enhance reservoir characterization and enable predictive maintenance, directly impacting efficiency and cost reduction.

By leveraging big data analytics, Coterra can gain deeper insights into its assets, leading to smarter resource allocation and minimized downtime. For instance, in 2024, the energy sector saw significant investment in AI for predictive maintenance, with companies reporting an average of 10-15% reduction in unplanned outages.

The advancement and adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies present Coterra Energy with a strategic avenue to reduce its environmental impact. As of early 2024, the global CCUS market is projected to grow significantly, with estimates suggesting a potential market size of over $50 billion by 2030, driven by climate policies and industry decarbonization efforts.

While still in developmental stages for widespread application, CCUS capabilities could offer Coterra a distinct competitive advantage by enabling the sequestration of CO2 from its energy production processes or even direct air capture. This technology is becoming increasingly vital as companies aim to meet net-zero targets, with many nations implementing incentives like tax credits, such as the 45Q tax credit in the United States, which has been expanded and enhanced, making CCUS projects more economically viable.

Engaging with or investing in CCUS projects aligns directly with Coterra's sustainability objectives and anticipates future environmental regulations. For instance, the International Energy Agency (IEA) reported in 2024 that CCUS is essential for achieving net-zero emissions by 2050, highlighting its critical role in the energy transition and the potential for companies to secure their long-term operational licenses and market access.

Automation and Remote Operations

Automation in Coterra Energy's field operations is a significant technological driver. By increasing the use of automated systems, the company can enhance safety protocols and reduce the need for personnel in potentially hazardous environments. This also translates to lower operational costs through reduced labor and improved resource management.

The ability to monitor and control processes remotely is another key technological factor. This allows for more efficient oversight and quicker responses to any operational issues, boosting overall efficiency. For instance, in 2024, the oil and gas industry saw continued investment in digital oilfield technologies, with a focus on remote monitoring solutions that can provide real-time data analytics.

These advancements directly support Coterra Energy's goals for continuous improvement and cost optimization. The integration of advanced automation and remote operational capabilities allows for more agile decision-making and streamlined workflows, ultimately contributing to a more competitive operational stance.

- Enhanced Safety: Automation minimizes human exposure to hazardous field conditions.

- Cost Reduction: Remote operations and automation lead to lower labor and operational expenses.

- Improved Efficiency: Real-time monitoring and control enable faster, more effective operational management.

- Agility: Remote capabilities allow for quicker responses to challenges and adaptive management strategies.

Water Management and Recycling Technologies

Coterra Energy, like many in the energy sector, faces significant operational reliance on water, particularly for hydraulic fracturing. Advancements in water management and recycling technologies are therefore paramount. These innovations directly impact operational efficiency and cost reduction, which is crucial in a fluctuating market. For instance, by investing in and implementing advanced water treatment systems, Coterra can reduce its reliance on fresh water sources and minimize disposal costs. This focus on water reuse is not just about economics; it’s also about environmental stewardship and maintaining positive community relations.

The drive for more sustainable water practices is intensifying, with regulatory bodies and stakeholders increasingly scrutinizing water usage and discharge. Coterra's commitment to efficient water management, including recycling and reuse, directly addresses these concerns. Companies that embrace these technologies can often secure a competitive advantage by lowering their environmental footprint and enhancing their social license to operate. This strategic approach to water management can lead to tangible cost savings, with some industry reports indicating that effective water recycling can reduce freshwater procurement costs by as much as 50%.

- Water Recycling Efficiency: Coterra's adoption of advanced water treatment technologies aims to maximize the recycling and reuse of produced water from hydraulic fracturing operations, potentially reducing freshwater intake by a significant margin.

- Cost Reduction Impact: Efficient water management directly contributes to lower operational expenditures by decreasing freshwater acquisition costs and minimizing wastewater disposal fees.

- Environmental and Social License: Implementing innovative water solutions demonstrates responsible resource management, crucial for maintaining positive relationships with local communities and regulatory bodies, which is vital for long-term operational stability.

Coterra Energy's operational efficiency is significantly boosted by advancements in drilling and completion technologies. Innovations in horizontal drilling and hydraulic fracturing techniques allow for greater access to previously uneconomical reserves, directly increasing production potential. For example, improvements in multi-stage fracturing enable more precise stimulation of rock formations, leading to higher extraction yields.

The company leverages digital technologies like AI and machine learning to optimize its operations. These tools enhance reservoir analysis and enable predictive maintenance, leading to substantial cost reductions and improved efficiency. In 2024, the energy sector saw a notable trend in AI adoption for predictive maintenance, with companies reporting an average of 10-15% decrease in unplanned downtime.

The integration of automation in field operations is a key technological factor for Coterra. Automated systems enhance safety by minimizing human exposure to hazardous environments and reduce operational costs through decreased labor requirements and optimized resource management. Remote monitoring capabilities further improve oversight and response times, contributing to overall efficiency gains.

Coterra Energy is also focused on adopting Carbon Capture, Utilization, and Storage (CCUS) technologies to mitigate its environmental impact. As of early 2024, the CCUS market is projected for substantial growth, driven by climate policies and decarbonization efforts. The US 45Q tax credit, in particular, has made CCUS projects more economically viable, supporting companies in their sustainability goals.

| Technology Area | Impact on Coterra | Key Benefit | 2024/2025 Data Point |

|---|---|---|---|

| Horizontal Drilling & Hydraulic Fracturing | Increased reserve access and production | Higher extraction yields | Continued refinement of multi-stage fracturing techniques |

| AI & Machine Learning | Optimized operations, predictive maintenance | Reduced costs, improved efficiency | 10-15% reduction in unplanned outages reported by industry adopters |

| Automation & Remote Operations | Enhanced safety, cost reduction | Lower labor costs, improved oversight | Increased investment in digital oilfield technologies for remote monitoring |

| CCUS Technologies | Environmental impact reduction, regulatory compliance | Meeting net-zero targets, enhanced social license | Growth in CCUS market driven by incentives like the 45Q tax credit |

Legal factors

Coterra Energy navigates a stringent regulatory landscape, adhering to federal, state, and local environmental statutes covering air quality, water usage, waste management, and site cleanup. This includes compliance with the Clean Air Act and Clean Water Act, which dictate emission standards and discharge limits for operational facilities.

Securing and preserving permits for exploration and production activities represents an ongoing legal obligation for Coterra. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the methane emissions standards for the oil and gas sector, impacting operational permits.

Failure to comply with these environmental mandates can lead to severe repercussions, including significant financial penalties. In 2024, the EPA announced increased civil penalties for violations of environmental laws, underscoring the financial risks associated with non-compliance, alongside potential operational disruptions and damage to Coterra's public image.

Laws governing mineral rights, surface rights, and eminent domain are critical for Coterra Energy, influencing its access to resources in key areas like the Marcellus Shale and Permian Basin. These regulations dictate how the company can acquire and utilize land for drilling and infrastructure.

Successfully navigating varied land ownership, which includes private landowners, state, and federal entities, demands significant legal acumen for lease negotiations. For instance, in 2024, the complexity of securing rights in the Permian Basin continues to be a major operational consideration.

Land use disputes can result in substantial financial penalties and prolonged project timelines, directly impacting Coterra's operational efficiency and profitability. Such legal challenges underscore the importance of robust legal counsel and proactive community engagement.

Coterra Energy operates under strict health and safety regulations, primarily overseen by the Occupational Safety and Health Administration (OSHA). These rules are critical for ensuring the well-being of its workforce, including employees and contractors, across all operations. For instance, in 2023, OSHA reported over 5,000 worker fatalities nationwide, highlighting the importance of robust safety protocols in industries like energy.

Compliance involves comprehensive safety training, rigorous equipment maintenance, and thorough incident reporting. Failure to meet these standards can result in significant financial penalties, as seen with various companies facing fines for safety violations. Beyond financial repercussions, non-compliance can lead to severe injuries or fatalities, damaging Coterra's reputation and operational continuity.

Taxation Laws and Royalties

Taxation policies are a major legal consideration for Coterra Energy. These include federal and state corporate income taxes, severance taxes levied on oil and gas production, and property taxes on its assets. For instance, in 2023, the effective federal income tax rate for many energy companies hovered around 21%, but state-specific severance taxes can add a significant variable cost. Royalties paid to mineral rights holders, typically a percentage of production value, also directly impact the company's bottom line, varying by lease agreement and jurisdiction.

Changes in these legal frameworks can have a substantial effect on Coterra's profitability and the attractiveness of its investments. For example, an increase in severance tax rates, like those seen in some states in recent years, would reduce the net revenue from each barrel of oil or cubic foot of gas produced. Similarly, adjustments to royalty payment structures could alter the cost of accessing reserves.

- Corporate Income Tax: Coterra is subject to a 21% federal corporate income tax rate, alongside varying state income tax rates.

- Severance Taxes: These taxes are applied to the volume or value of extracted oil and gas, with rates differing significantly by state, impacting operational costs.

- Property Taxes: Coterra's physical assets, including wells and pipelines, are subject to local property taxes, which can fluctuate based on property valuations.

- Royalties: Payments to mineral owners are a direct cost of production, typically ranging from 12.5% to 25% of the value of extracted resources.

Climate Change Legislation and Disclosure Requirements

The evolving landscape of climate change legislation presents significant legal challenges and opportunities for Coterra Energy. As governments worldwide implement stricter regulations, such as potential carbon pricing mechanisms and enhanced greenhouse gas emission limits, Coterra must adapt its operations to comply with these new legal obligations. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations impacting methane emissions from oil and gas operations, a key area for energy companies like Coterra.

Furthermore, the growing emphasis on Environmental, Social, and Governance (ESG) disclosures mandates that Coterra Energy provide transparent reporting on climate-related risks and its greenhouse gas emissions data. This includes adhering to frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). In 2024, the Securities and Exchange Commission (SEC) proposed rules for climate-related disclosures, which, if finalized, would require companies to report on climate-related risks, governance, strategy, risk management, and metrics and targets. While the final rule's scope remains subject to ongoing legal review, the trend towards increased disclosure is clear.

- Carbon Pricing: Potential introduction or expansion of carbon taxes or cap-and-trade systems could increase operational costs for Coterra Energy, impacting profitability and requiring strategic adjustments to emissions reduction.

- Emissions Standards: Stricter regulations on methane and other greenhouse gas emissions, such as those being developed by the EPA, necessitate investment in new technologies and operational changes to ensure compliance.

- ESG Disclosure Mandates: Increasing regulatory requirements for detailed ESG reporting, including climate-related financial disclosures, demand robust data collection and transparent communication with stakeholders.

- Litigation Risk: Companies face growing litigation risks related to climate change, including potential lawsuits from environmental groups or shareholders concerning inadequate disclosure or alleged contribution to climate damages.

Coterra Energy faces significant legal obligations related to environmental compliance, requiring adherence to federal and state regulations like the Clean Air Act and Clean Water Act, with penalties for violations increasing in 2024. The company must also manage complex land rights for resource access, as seen in the Permian Basin, where disputes can incur substantial costs. Furthermore, stringent OSHA health and safety standards are paramount, with over 5,000 worker fatalities reported nationwide in 2023 underscoring the critical need for robust safety protocols.

Environmental factors

Coterra Energy's operations, particularly in natural gas extraction, inherently contribute to greenhouse gas emissions, notably methane and carbon dioxide. These emissions are under heightened scrutiny as global concerns about climate change intensify. For instance, in 2023, the energy sector as a whole continued to be a major contributor to global CO2 emissions, with the oil and gas industry playing a significant role in methane releases.

Consequently, Coterra faces increasing pressure from regulators, investors, and the public to mitigate its environmental impact. This involves implementing operational efficiencies, enhancing leak detection and repair programs, and exploring advanced technologies like carbon capture. The company's commitment to reducing its emissions footprint is crucial for its long-term sustainability and adherence to evolving environmental regulations.

Hydraulic fracturing, a core operation for Coterra Energy, demands significant water volumes, making responsible sourcing, efficient usage, and proper wastewater disposal paramount environmental concerns. In 2023, the oil and gas industry, including companies like Coterra, faced increasing scrutiny over water consumption, with some regions experiencing heightened water stress. Effective water management, emphasizing recycling and reuse, is therefore crucial not only for operational efficiency but also for mitigating environmental impact and fostering positive community relationships.

Coterra Energy's operations, particularly in exploration and production, inherently involve land use that can affect local ecosystems and biodiversity. The company's commitment to minimizing its operational footprint is crucial for mitigating these impacts. For instance, in 2023, Coterra reported ongoing efforts in land reclamation and restoration across its operating regions, aiming to return disturbed lands to a more natural state.

Protecting sensitive ecological areas and implementing responsible land management practices are paramount to Coterra's environmental stewardship. This includes adhering to regulations and voluntary initiatives designed to prevent habitat fragmentation and safeguard biodiversity. The company's 2024 sustainability reports highlight continued investment in technologies and methodologies that reduce surface disturbance and improve land rehabilitation effectiveness.

Waste Management and Pollution Prevention

Coterra Energy, like many in the energy sector, manages diverse waste streams including drilling fluids, produced water, and various solid wastes. Effective management is key to preventing soil and water contamination. In 2023, Coterra reported managing millions of barrels of produced water, a significant portion of which was recycled or disposed of in compliance with state and federal regulations.

Robust waste management strategies and pollution prevention are not just environmental necessities but also critical for regulatory compliance and maintaining operational licenses. Adherence to strict waste disposal regulations, such as those outlined by the EPA and relevant state agencies, is paramount to avoid penalties and ensure sustainable operations. For instance, penalties for non-compliance with the Clean Water Act can be substantial, impacting profitability.

Key aspects of Coterra's waste management include:

- Drilling Fluid Management: Proper treatment and disposal of drilling fluids to minimize impact on local ecosystems.

- Produced Water Handling: Implementing advanced treatment and recycling technologies for produced water, reducing the need for disposal wells.

- Solid Waste Segregation: Efficiently segregating and disposing of solid waste generated from operations, prioritizing recycling and waste reduction.

- Regulatory Adherence: Continuous monitoring and updating of practices to comply with evolving environmental regulations and reporting requirements.

Energy Transition and Renewable Energy Integration

The global energy transition, driven by climate concerns and technological advancements, significantly impacts Coterra Energy. As a company focused on oil and gas, the increasing adoption of renewable energy sources like solar and wind power presents a long-term challenge to traditional fossil fuel demand. For instance, by the end of 2023, renewable energy sources accounted for approximately 23% of the total electricity generation in the United States, a figure expected to continue rising.

This shift influences investor sentiment and capital allocation, with a growing preference for companies demonstrating a strategy for navigating the evolving energy landscape. Coterra Energy must consider how this transition affects its operational costs, market access, and overall business model. The International Energy Agency projects that global investment in clean energy technologies will reach $2 trillion annually by 2030, highlighting the scale of this transformation.

- Market Dynamics: Increasing renewable energy penetration could lead to reduced demand for oil and gas, potentially impacting Coterra's revenue streams.

- Investor Expectations: Investors are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance, pushing for clearer transition strategies.

- Diversification Opportunities: Coterra may explore integrating or investing in cleaner energy technologies to hedge against fossil fuel market volatility and align with future energy demands.

- Policy Influence: Government policies promoting renewable energy and carbon reduction targets directly shape the competitive environment for fossil fuel producers.

Coterra Energy's operations directly impact the environment through greenhouse gas emissions, water usage, land disturbance, and waste generation. The company faces increasing regulatory and public pressure to mitigate these effects, necessitating investments in emission reduction technologies, responsible water management, land reclamation, and robust waste handling practices. For example, in 2023, the energy sector continued to be a significant source of global CO2 emissions, with methane releases from oil and gas operations being a particular focus.

PESTLE Analysis Data Sources

Our Coterra Energy PESTLE Analysis is built on a robust foundation of data from official government agencies, leading economic institutions, and reputable industry publications. We meticulously gather information on regulatory changes, market trends, technological advancements, and socio-economic shifts to provide a comprehensive overview.