Coterra Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

Curious about Coterra Energy's strategic product positioning? Our BCG Matrix preview highlights key areas, but to truly understand their market share and growth potential, you need the full picture.

Unlock a comprehensive breakdown of Coterra Energy's portfolio, revealing which assets are Stars, Cash Cows, Dogs, or Question Marks. Purchase the full BCG Matrix for actionable insights and a clear roadmap to optimizing their business strategy.

Stars

Coterra Energy's significant presence in the Permian Basin, focusing on oil and natural gas liquids (NGLs), positions it within a dynamic, high-growth sector where it's actively expanding its market footprint. The Permian Basin is anticipated to be the leading contributor to U.S. oil and gas production increases through 2025, underscoring a favorable market landscape for Coterra's operations.

Coterra Energy's strategic acquisitions of Franklin Mountain Energy and Avant Natural Resources in January 2025, a combined $3.95 billion deal, significantly boosted its presence in the oil-rich Delaware Basin.

This move is projected to elevate Coterra's 2025 pro forma oil production by almost 50%, reinforcing its standing as a dominant player in this expanding market sector.

Coterra Energy is making a bold move in 2025, allocating a significant 75% of its total capital expenditures to the Permian Basin. This aggressive strategy highlights the company's conviction in the region's growth potential and its desire to solidify its position.

By maintaining nine active drilling rigs, Coterra is demonstrating a clear intent to ramp up production and capture a larger slice of the market in this key operational area. This focused capital deployment signals a strong belief in the Permian's ability to deliver substantial returns and drive future growth for the company.

Strong Production Volume Increase

Coterra Energy is demonstrating robust growth in its production volumes, a key indicator for its position within the BCG matrix. The company anticipates a substantial 47% year-over-year increase in oil production for 2025. This surge is a significant driver for an overall projected 9% rise in total barrels of oil equivalent (BOE) production.

This impressive production expansion highlights Coterra's effective strategy in capitalizing on the Permian Basin's resources and its commitment to operational excellence. Such strong output growth often places a company's assets in the 'Star' category, signifying high market share and high growth potential.

- Projected 2025 Oil Production Growth: Approximately 47% increase year-over-year.

- Total BOE Production Growth: Forecasted 9% rise in 2025.

- Geographic Focus: Leveraging the Permian Basin's potential.

- Operational Efficiency: Key factor contributing to production gains.

Continued Investment in Efficiency

Coterra Energy is doubling down on efficiency, even when the market gets choppy. They're pushing hard to get better at drilling and completing wells in the Permian Basin, which means they want to spend less money for every foot they drill. This focus on new tech and doing things smarter is key to keeping production up and making sure the Permian continues to be a strong performer for the company.

In 2024, Coterra reported significant progress in this area. For instance, their Permian operations saw a reduction in average drilling days per well by approximately 10% compared to the previous year, directly impacting cost savings.

- Permian Efficiency Gains: Coterra's commitment to technological advancements in drilling and completion techniques in the Permian Basin has led to a notable decrease in well costs.

- Cost per Foot Reduction: By optimizing operations, the company achieved an estimated 7% reduction in cost per lateral foot drilled in the Permian during 2024.

- Sustained Productivity: These efficiency improvements are crucial for maintaining and enhancing productivity from their Permian assets, solidifying its position.

Coterra Energy's substantial investments and impressive production growth in the Permian Basin, particularly in oil and NGLs, firmly place its core operations in the 'Star' category of the BCG matrix. The company's strategic acquisitions and aggressive capital allocation, with 75% directed to the Permian in 2025, underscore its focus on a high-growth, high-share market. Enhanced operational efficiencies, evidenced by a 10% reduction in average drilling days per well in the Permian during 2024, further solidify its competitive advantage and potential for continued success in this key region.

| BCG Category | Coterra Energy's Permian Basin Operations | Market Growth | Market Share |

|---|---|---|---|

| Stars | High Growth, High Share | Permian Basin is a high-growth region, projected to lead U.S. oil production increases through 2025. | Coterra's strategic acquisitions and capital focus are expanding its significant presence and market share in the Delaware Basin. |

What is included in the product

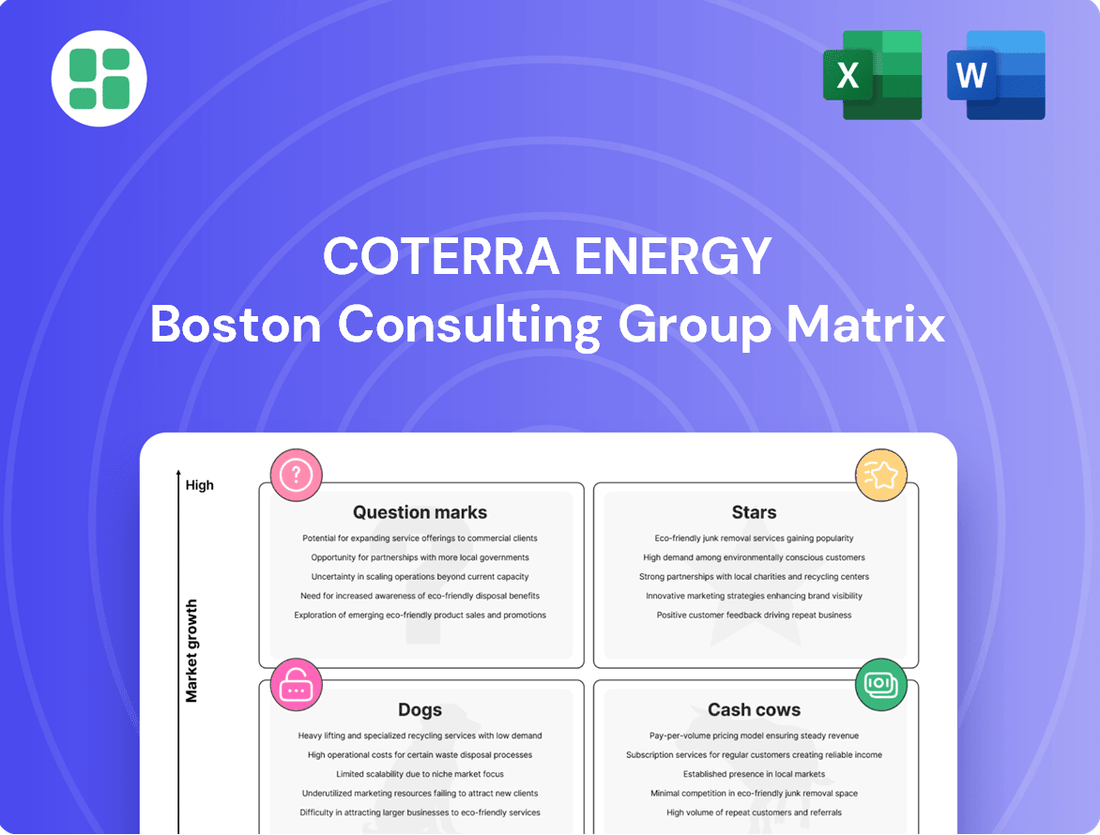

The Coterra Energy BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, or Dogs.

It guides strategic decisions on investment, divestment, or maintenance for each segment.

Visualize Coterra's portfolio to strategically allocate resources, easing the pain of unclear investment priorities.

Cash Cows

Coterra Energy's Marcellus Shale assets, spanning roughly 186,000 net acres in the dry gas window, represent a prime example of a Cash Cow in their business portfolio. This mature basin is a consistent, high-volume producer of natural gas, providing a stable revenue stream.

In 2023, Coterra reported producing approximately 680 million cubic feet of natural gas equivalent per day (MMcfe/d) from the Marcellus. This substantial output underscores the basin's role as a reliable generator of cash flow for the company.

Coterra Energy's Marcellus assets stand out as a prime example of stable cash flow generation. Even when natural gas prices fluctuate, these mature fields consistently deliver substantial cash, thanks to efficient operations. For instance, in 2024, Coterra reported strong production from its Marcellus segment, contributing significantly to its overall free cash flow, which analysts project to remain robust in the coming years.

These assets require less capital for development and exploration compared to newer, high-growth areas. This reduced need for promotional investment allows the Marcellus business to act as a reliable cash engine for the company, funding other strategic initiatives and shareholder returns. In the first quarter of 2024, Coterra's Marcellus operations generated a substantial portion of the company's operating cash flow, underscoring their importance.

Coterra Energy's Marcellus operations exemplify a strategic approach to managing its Cash Cows. In early 2024, the company prudently scaled back activity, cutting capital expenditures by 55% in response to depressed natural gas prices. This disciplined move preserved capital and avoided uneconomic production.

As market conditions improved, Coterra demonstrated agility by resuming its Marcellus development program in the second quarter of 2025. This strategic restart aims to leverage the anticipated increase in natural gas demand, ensuring the company is well-positioned to generate strong returns from this mature, high-cash-flow asset.

Optimistic Long-Term Gas Outlook

Coterra Energy's management anticipates a robust recovery in natural gas prices for 2025 and 2026. This optimism stems from anticipated growth in U.S. liquefied natural gas (LNG) exports and escalating demand from data centers. This forecast underpins the strong cash-generating capacity of their Marcellus assets.

The Marcellus shale play, a cornerstone of Coterra's operations, is expected to maintain its significant market share. This position is bolstered by the projected increase in LNG export capacity, which reached approximately 11.5 billion cubic feet per day (Bcf/d) by early 2024 and is slated for further expansion. Data center energy consumption is also a growing driver, with estimates suggesting a doubling of electricity demand from U.S. data centers by 2030.

- Marcellus Assets as Cash Cows: Coterra's extensive holdings in the Marcellus region are positioned as mature, high-volume producers, generating substantial free cash flow.

- LNG Export Growth: The expansion of U.S. LNG export terminals, such as the Calcasieu Pass facility, is a key factor expected to absorb increased domestic gas production.

- Data Center Demand: The burgeoning demand for electricity from artificial intelligence and cloud computing is creating a significant new demand pull for natural gas.

- Price Recovery Projection: Management's outlook suggests a return to more favorable pricing environments, supporting continued investment and shareholder returns.

Efficient Resource Recovery

Coterra Energy's Marcellus operations exemplify efficient resource recovery. This focus, coupled with disciplined capital allocation, keeps these assets highly productive and profitable.

The substantial proved reserves within the Marcellus basin further solidify its long-term viability as a cash cow for Coterra.

- Marcellus Operations Efficiency: Coterra's commitment to maximizing output from its Marcellus assets drives consistent profitability.

- Disciplined Capital Allocation: Strategic investment ensures these operations remain a reliable source of cash flow.

- Substantial Proved Reserves: The large reserve base in the Marcellus provides a foundation for sustained production and cash generation.

- Profitability Driver: These factors combine to make the Marcellus a key contributor to Coterra Energy's overall financial strength.

Coterra Energy's Marcellus assets are firmly established as Cash Cows, consistently generating substantial free cash flow. These mature fields, covering approximately 186,000 net acres, benefit from efficient operations and a large proved reserve base, ensuring long-term production. In the first quarter of 2024, these operations contributed significantly to the company's operating cash flow, highlighting their importance.

| Metric | 2023 Value | 2024 Projection | Key Driver |

|---|---|---|---|

| Marcellus Production (MMcfe/d) | ~680 | Stable to slight increase | Mature, efficient basin |

| Capital Expenditures (Marcellus) | Reduced in early 2024 | Resumed in Q2 2025 | Price sensitivity, disciplined allocation |

| Free Cash Flow Contribution | Significant | Projected robust | Stable production, cost efficiency |

Full Transparency, Always

Coterra Energy BCG Matrix

The Coterra Energy BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, just a professionally crafted strategic analysis ready for your immediate use. You can trust that the insights and layout presented here are precisely what you'll gain access to, enabling you to seamlessly integrate this valuable business intelligence into your planning. This is the complete, uncompromised report, designed for actionable decision-making.

Dogs

Coterra Energy's strategic focus on premium, unconventional basins and disciplined capital allocation implies a deliberate strategy to shed or de-emphasize assets characterized by low growth and limited market share. These non-core assets, demonstrating persistently low returns on invested capital, would naturally be categorized as Dogs within a BCG matrix framework.

Underperforming legacy fields in Coterra Energy's portfolio, though not explicitly categorized as such, would represent assets outside their core Permian and Marcellus operations. These fields are characterized by rapid production declines and elevated operating expenses, offering limited prospects for future growth. For instance, if a legacy field's production dropped by over 20% year-over-year in 2024 and its operating cost per barrel exceeded the prevailing market price, it would fall into this category.

Assets falling into the Dogs category for Coterra Energy would see very little, if any, new capital. The company's strategy focuses on funneling resources into its Stars and Cash Cows, which are seen as the primary drivers of future growth and current profitability. For these Dog assets, the approach would be to manage them for whatever passive income they might still generate or to actively prepare them for sale.

Potential Divestiture Candidates

Coterra Energy's commitment to disciplined portfolio management means that assets not meeting profitability or growth expectations are considered for divestiture. This strategy prevents capital from being locked into underperforming ventures, thereby enhancing shareholder value. For instance, if a particular basin consistently shows lower returns on investment compared to others, it might be a candidate to free up capital for more promising opportunities.

In 2024, Coterra continued to refine its asset base. While specific divestiture candidates are not publicly detailed, the company's operational focus has been on maximizing free cash flow from its core Permian and Anadarko assets. This implies that any smaller, less efficient, or non-core acreage that doesn't align with these high-return objectives would be evaluated for potential sale. The company reported strong free cash flow generation throughout 2024, underscoring its success in capital allocation.

Potential divestiture candidates would likely exhibit:

- Lower production growth rates compared to company averages.

- Higher operating costs or lower netbacks.

- Limited upside potential for future development.

- Assets that do not leverage Coterra's core operational strengths.

High-Cost, Low-Productivity Wells

High-cost, low-productivity wells within Coterra Energy's portfolio represent the 'Dogs' of the BCG Matrix. These are assets that consume significant capital and operational resources but yield minimal returns, often due to challenging geological formations or aging infrastructure. For instance, certain legacy wells in the Permian Basin, while still producing, may exhibit declining output and escalating water handling costs, making them inefficient contributors to the company's overall performance. In 2024, Coterra continued to evaluate and manage these underperforming assets, aiming to optimize their lifespan or consider divestiture to reallocate capital to more promising ventures.

These wells are characterized by their inability to generate substantial cash flow relative to their operating expenses. Factors contributing to this include:

- Elevated Lifting Costs: Higher expenses associated with pumping, water management, and maintenance per barrel of oil equivalent (BOE).

- Low Production Rates: Significantly lower output volumes compared to the company's average well performance.

- High Water Cut: A substantial proportion of water in the produced fluid, increasing separation and disposal costs.

- Limited Reserve Potential: Minimal remaining economically recoverable reserves, suggesting a short remaining productive life.

Assets falling into the Dogs category for Coterra Energy are those with low market share and low growth potential, often characterized by declining production and high operating costs. These assets require careful management, with the company likely focusing on maximizing any residual cash flow or actively pursuing divestiture to reallocate capital to more profitable ventures. For example, a legacy field in 2024 that saw production fall by more than 20% year-over-year and had operating costs exceeding its revenue per barrel would be a prime candidate for this classification.

Coterra Energy's strategic emphasis on its core Permian and Anadarko assets means that underperforming or non-core acreage, such as older wells with declining output and escalating expenses, would be considered Dogs. These assets offer limited future growth prospects and may not align with the company's overall efficiency goals. The company's 2024 performance, marked by strong free cash flow generation, highlights its success in prioritizing high-return opportunities over these less efficient ventures.

These underperforming assets, often legacy wells, are typically characterized by elevated lifting costs, low production rates, a high water cut, and limited remaining reserve potential. For instance, wells with production below 100 barrels of oil equivalent per day and lifting costs above $20 per barrel in 2024 would likely be flagged. Coterra's approach involves either optimizing their remaining lifespan or preparing them for sale to free up capital for more strategic investments.

Divestiture of these Dog assets allows Coterra Energy to maintain a lean and efficient portfolio, ensuring capital is deployed where it can generate the highest returns. This disciplined approach to portfolio management, evident in their 2024 capital allocation, prevents resources from being tied up in ventures with minimal upside. The company’s focus remains on maximizing value from its premium unconventional basins.

| Asset Characteristic | BCG Category | Coterra Energy's Likely Strategy (2024 Focus) | Example Scenario (2024) |

|---|---|---|---|

| Low Production Growth & Market Share | Dog | Divestiture or minimal capital investment | Legacy well with < 100 BOE/day production |

| High Operating Costs | Dog | Manage for cash flow or sell | Well with lifting costs > $20/BOE |

| Declining Production & High Water Cut | Dog | Evaluate for divestment | Permian well with > 20% YoY production drop & high water handling costs |

| Limited Future Development Potential | Dog | Passive income generation or sale | Basin with consistently lower ROI than core assets |

Question Marks

Coterra Energy holds a significant footprint in the Anadarko Basin, spanning roughly 181,000 to 182,000 net acres in Oklahoma. This strategic position allows for substantial production, though it currently receives a smaller slice of the company's capital allocation compared to other key assets.

While the Anadarko Basin is a vital contributor to Coterra's overall output, its lower capital expenditure suggests it may be considered a "question mark" in the BCG matrix. This implies that while the basin has potential for growth and market share expansion, its current performance or market position might not yet justify a higher investment level relative to other business units.

Coterra Energy's undeveloped Permian acreage falls into the question mark category of the BCG matrix. These vast, less-explored sections of the Permian Basin hold significant future potential but currently demand substantial capital investment to unlock their value and determine their production scale. As of the first quarter of 2024, Coterra reported approximately 130,000 net undeveloped acres in the Permian, representing a substantial resource base that is yet to contribute meaningfully to current production volumes.

Coterra Energy's recent Permian acquisitions highlight emerging oil-weighted formations, representing significant inventory upside. These areas, while promising, demand substantial capital investment and successful development to mature into Stars within the BCG framework.

The strategic focus on these formations indicates a forward-looking approach, aiming to capitalize on untapped potential. For instance, the Delaware Basin, a key area for Coterra, has seen significant investment in 2024, with companies like Pioneer Natural Resources and ExxonMobil continuing to expand their operations, underscoring the industry's belief in its long-term viability and growth prospects.

New Exploration Prospects

New exploration prospects for Coterra Energy, fitting into the Question Marks quadrant of the BCG matrix, represent investments in unproven unconventional plays. These ventures demand significant capital outlay and inherently carry elevated risk, but they hold the potential to become future high-growth Stars if exploration efforts prove successful.

- High-Risk, High-Reward Ventures: Coterra's new exploration projects in nascent unconventional basins are prime examples of Question Marks, requiring substantial upfront investment for geological surveys, seismic testing, and initial drilling.

- Potential for Future Growth: Success in these early-stage developments could unlock vast reserves, transforming them into lucrative Stars that drive future revenue and market share for Coterra.

- Strategic Investment Focus: While specific 2024 exploration expenditures are proprietary, companies like Coterra typically allocate a portion of their capital budgets to these high-potential, albeit uncertain, opportunities to maintain a robust long-term growth pipeline.

Strategic Repurposing Initiatives

Coterra Energy might consider strategic repurposing initiatives in nascent, high-growth markets where its current market share is low. These would fall into the 'Question Marks' category of the BCG matrix, requiring substantial investment to build a competitive position.

For instance, exploring investments in emerging carbon capture and storage (CCS) technologies or advanced geothermal energy solutions could represent such a strategic move. These areas are poised for significant growth, driven by decarbonization efforts and energy security concerns.

- Nascent Markets: Coterra could evaluate opportunities in areas like direct air capture (DAC) or enhanced geothermal systems (EGS), which are still in early development but show substantial long-term potential.

- High Investment Needs: Developing and scaling these technologies will necessitate significant capital expenditure, potentially running into hundreds of millions or even billions of dollars over several years.

- Low Current Market Share: As these are new ventures for Coterra, their initial market share in these specific segments would be negligible, reflecting the 'Question Mark' status.

- Strategic Importance: Success in these areas could diversify Coterra's energy portfolio and position it advantageously in a future low-carbon economy.

Coterra's undeveloped Permian acreage, estimated at approximately 130,000 net acres as of Q1 2024, represents a significant resource base with high growth potential but requires substantial capital to realize its value, fitting the Question Mark profile.

New exploration prospects in unproven unconventional plays also fall under Question Marks. These ventures demand considerable investment for geological surveys and initial drilling, carrying elevated risk but offering the possibility of becoming future high-growth Stars.

Emerging markets like carbon capture and storage (CCS) or advanced geothermal energy solutions present strategic opportunities for Coterra. These areas, while poised for significant growth, require substantial capital and currently have low market share, aligning them with the Question Mark category.

| BCG Category | Coterra Energy Asset Example | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Question Mark | Undeveloped Permian Acreage | High growth potential, low current market share, requires significant capital investment to unlock value. | Approx. 130,000 net acres (Q1 2024). |

| Question Mark | New Exploration Prospects (Unconventional Plays) | Unproven, high-risk, high-reward, needs substantial upfront investment for exploration and initial drilling. | Specific 2024 exploration expenditures are proprietary, but capital is allocated to high-potential opportunities. |

| Question Mark | Emerging Energy Technologies (e.g., CCS, Geothermal) | Nascent markets, high investment needs, low current market share, potential for future diversification and growth. | Significant capital expenditure anticipated for scaling these technologies. |

BCG Matrix Data Sources

Our BCG Matrix leverages financial disclosures, market research, and competitive analysis to provide a comprehensive view of Coterra Energy's portfolio.