Coterra Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

Uncover the strategic brilliance behind Coterra Energy's marketing efforts with our comprehensive 4Ps analysis. We delve into their product offerings, pricing strategies, distribution channels, and promotional activities, revealing the interconnectedness that drives their market presence.

Go beyond the surface-level understanding of Coterra Energy's marketing. Our full analysis provides actionable insights into their product positioning, pricing architecture, channel strategy, and communication mix, empowering you with the knowledge to benchmark and strategize.

Save valuable time and gain a competitive edge. This professionally written, editable 4Ps Marketing Mix Analysis for Coterra Energy is ready for immediate use in presentations, reports, or academic assignments, offering a deep dive into their market success.

Product

Coterra Energy's primary products are crude oil, natural gas, and natural gas liquids (NGLs), forming the backbone of their operations. These commodities are vital for powering industries and meeting everyday energy demands.

The company actively manages its production mix across strategic basins like the Permian and Marcellus. For instance, as of Q1 2024, Coterra reported producing approximately 267,000 barrels of oil equivalent per day (BoE/d), with a balanced distribution across oil, natural gas, and NGLs reflecting their portfolio strategy.

Coterra Energy strategically concentrates its operations in premier unconventional basins, notably the Marcellus Shale in northeast Pennsylvania and the Permian Basin spanning west Texas and southeast New Mexico. These areas are celebrated for their substantial hydrocarbon potential and the efficiency with which resources can be extracted.

The company's commitment to the Permian Basin was underscored by a significant expansion in January 2025, when Coterra acquired roughly 83,000 net acres in the Northern Delaware sub-basin. This move bolsters its position in a region recognized for its prolific and cost-effective oil and natural gas production.

Coterra Energy integrates sustainable and responsible development into its core product strategy, recognizing the growing demand for environmentally conscious energy solutions. Their 2024 Sustainability Report details significant progress, including a reduction in Scope 1 greenhouse gas emission intensity to 6.9 kg CO2e/boe and methane intensity to 0.04%, showcasing tangible environmental stewardship.

This commitment to ESG principles directly impacts the marketability and long-term value of Coterra's energy products. By actively managing and reducing operational impacts, such as achieving a flare intensity of 0.01%, Coterra aligns its offerings with investor and consumer preferences for responsible resource development, thereby strengthening its market position.

Value Creation through Efficiency

Coterra Energy's product strategy centers on generating value by maximizing resource recovery and maintaining strict capital discipline. The company is committed to enhancing capital efficiency, boosting well performance, and lowering operational costs to ensure better production and financial outcomes.

This focus on efficiency translates into strategic adjustments in where Coterra invests its capital. For instance, during periods of favorable natural gas prices, the company has increased its activity in the Marcellus basin, demonstrating a dynamic approach to capital allocation based on market signals.

- Capital Efficiency: Coterra aims to improve the return on its investments through more efficient operations and resource extraction.

- Cost Reduction: Continuous efforts are made to lower operating expenses, enhancing profitability.

- Strategic Basin Allocation: Capital is shifted between regions, such as the Marcellus, based on prevailing market conditions, particularly natural gas prices.

- Optimized Production: The combination of efficiency gains and strategic investment leads to improved production volumes and financial performance.

Diversified Asset Base

Coterra Energy's diversified asset base is a key strength, offering significant flexibility. This allows the company to adjust its product mix and navigate volatile commodity prices effectively. For instance, while its roots are in the natural gas-rich Marcellus shale, Coterra has strategically increased its focus on oil-producing regions like the Permian and Anadarko basins. This pivot reflects a response to evolving market conditions and the pursuit of more favorable economics.

This strategic diversification is designed to create a more stable free cash flow generation and build resilience against the inherent cyclicality of energy markets. As of early 2024, Coterra's production mix reflects this strategic shift, with a notable contribution from its oil and gas assets in the Permian and Anadarko regions, complementing its established natural gas position.

- Asset Diversification: Coterra operates across multiple key U.S. shale plays, including the Marcellus, Permian, and Anadarko basins.

- Strategic Resource Allocation: The company has actively shifted capital towards oil-weighted assets to capitalize on favorable market dynamics.

- Resilience and Cash Flow: Diversification enhances financial stability and supports a consistent free cash flow profile through commodity price fluctuations.

- Production Mix Evolution: As of the latest available data, Coterra's production reflects a balanced approach, with significant contributions from both natural gas and oil/liquids.

Coterra Energy's product offering is centered on essential energy commodities: crude oil, natural gas, and natural gas liquids (NGLs). These products are fundamental to global energy needs and industrial processes. The company's strategic focus on premier basins like the Permian and Marcellus ensures efficient extraction of these valuable resources.

As of Q1 2024, Coterra reported an average production of approximately 267,000 barrels of oil equivalent per day (BoE/d). This output is strategically balanced across its oil, natural gas, and NGL segments, reflecting a deliberate portfolio management approach. The company's recent acquisition of approximately 83,000 net acres in the Northern Delaware sub-basin in January 2025 further solidifies its commitment to high-potential, cost-effective production areas.

Coterra's product strategy emphasizes sustainability, with significant efforts to reduce its environmental footprint. For instance, by Q1 2024, the company achieved a Scope 1 greenhouse gas emission intensity of 6.9 kg CO2e/boe and a methane intensity of 0.04%. This commitment to responsible development enhances the marketability of its products to an increasingly ESG-conscious investor and consumer base.

| Product Category | Key Basins of Operation | Q1 2024 Production (approx. BoE/d) | Recent Strategic Activity |

|---|---|---|---|

| Crude Oil | Permian Basin, Anadarko Basin | ~120,000 (Oil equivalent) | Acquisition in Northern Delaware sub-basin (Jan 2025) |

| Natural Gas | Marcellus Shale, Permian Basin | ~110,000 (Gas equivalent) | Increased activity in Marcellus based on price signals |

| Natural Gas Liquids (NGLs) | Marcellus Shale, Permian Basin | ~37,000 (NGL equivalent) | Integrated with gas production, optimizing recovery |

What is included in the product

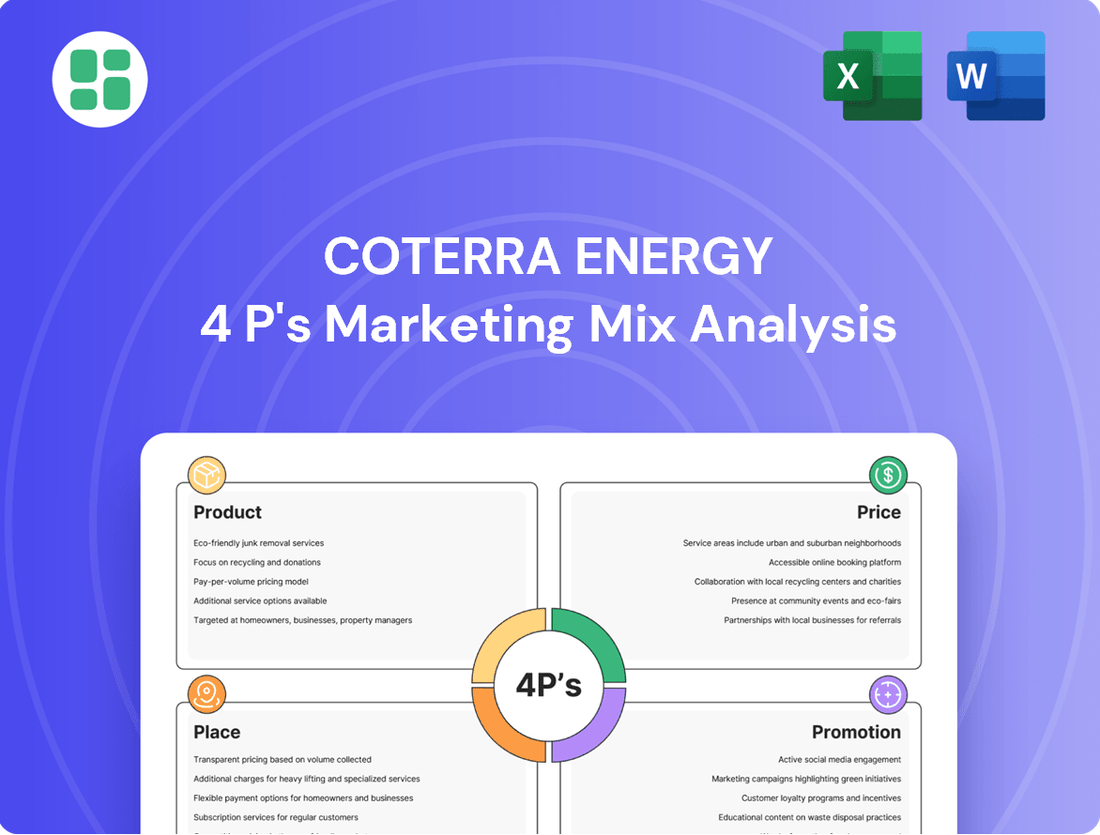

This analysis provides a comprehensive examination of Coterra Energy's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Provides a clear, actionable framework for Coterra Energy to address market challenges and optimize its strategic approach.

Simplifies complex marketing decisions by offering a structured analysis of Coterra's 4Ps, easing the burden of strategic planning.

Place

Coterra Energy's oil, natural gas, and NGLs reach markets directly through an extensive infrastructure network. This integrated midstream system is crucial for their operations.

Pipelines, processing plants, and storage facilities in key basins like the Marcellus Shale, Permian Basin, and Anadarko Basin efficiently connect production to end-users. This direct-to-market approach is essential given the nature of their energy products.

Coterra Energy's strategic basin concentration is a cornerstone of its 'Place' strategy, focusing operations in the Marcellus Shale and the Permian Basin. This deliberate geographic focus enhances logistical efficiency and reduces transportation expenses, directly impacting profitability.

The company's operations in the dry gas window of Susquehanna County, Pennsylvania, within the Marcellus, and the Delaware Basin across Texas and New Mexico, position it advantageously. This proximity to major demand centers and established pipeline networks is crucial for cost-effective product placement.

For instance, Coterra reported in its Q1 2024 earnings that its Permian Basin assets generated significant free cash flow, underscoring the value of its concentrated presence in high-demand regions. This strategic placement allows for optimized market access and delivery.

Coterra Energy effectively markets its natural gas to a wide array of clients, including industrial consumers, local distribution companies, and major energy firms. This broad customer reach, encompassing oil and gas marketers, pipeline operators, and power generators, highlights robust and varied distribution pathways within the energy market. For instance, in Q1 2024, Coterra reported an average realized natural gas price of $2.54 per Mcf, reflecting the demand across these diverse segments.

The company also strategically directs its oil and Natural Gas Liquids (NGLs) to specialized market participants. These customers are equipped for the refining and further processing necessary to transform these products into usable commodities. This segmented approach ensures that each product stream finds its optimal outlet, maximizing value across Coterra's portfolio.

Flexibility in Capital Allocation by Region

Coterra Energy's approach to 'place' in its marketing mix is characterized by a strategic and adaptable capital allocation across its key operating regions. This flexibility is crucial for navigating the volatile energy markets and maximizing shareholder value.

The company actively shifts investment between the Marcellus, Permian, and Anadarko basins. This dynamic allocation is driven by real-time assessments of market conditions and the prevailing commodity price outlook. For instance, in early 2024, Coterra signaled a focus on optimizing returns in the Permian while maintaining disciplined activity in other basins, reflecting their strategic priorities.

This regional flexibility allows Coterra to:

- Respond to regional economics: Adjusting capital deployment based on basin-specific cost structures and production efficiencies.

- Optimize timing of production: Bringing new volumes online when market demand is strongest and prices are favorable.

- Mitigate commodity price risk: Diversifying investments across different geographies to buffer against price downturns in any single basin.

- Capitalize on opportunities: Quickly reallocating capital to areas offering the highest potential returns, as seen with their strategic acreage acquisitions in the Permian throughout 2023 and into 2024.

Long-term Export Contracts

Coterra Energy has strategically secured long-term export contracts for its Natural Gas Liquids (NGLs), demonstrating a commitment to global market penetration. These agreements are set to deliver NGLs to key markets in Europe and Asia, with terms extending from 2027 through 2038. This forward-thinking placement strategy is crucial for diversifying revenue and solidifying Coterra's international presence.

These long-term contracts are more than just sales agreements; they represent Coterra's proactive approach to managing market volatility and ensuring consistent demand for its products. By locking in these export deals, the company effectively mitigates future uncertainties in the domestic and international energy landscapes. This focus on securing future revenue streams through strategic placement highlights Coterra's robust business planning.

- Global Reach: Contracts extend to Europe and Asia, covering 2027-2038.

- Revenue Security: Long-term agreements provide predictable income streams.

- Market Diversification: Reduces reliance on domestic NGL markets.

- Strategic Placement: Mitigates future market uncertainties and strengthens global positioning.

Coterra Energy's 'Place' strategy leverages its integrated midstream infrastructure to efficiently deliver oil, natural gas, and NGLs. This network, spanning key basins like the Marcellus and Permian, ensures direct access to markets and diverse customer segments, including industrial users and power generators.

The company's strategic concentration in the Marcellus Shale and Permian Basin, specifically in areas like Susquehanna County, PA, and the Delaware Basin, minimizes logistical costs and maximizes market access. This geographic focus is a critical driver of profitability and efficient product placement.

Coterra's adaptable capital allocation across its operating regions allows it to respond to regional economics and optimize production timing, as demonstrated by its focus on Permian returns in early 2024. Furthermore, securing long-term NGL export contracts through 2038 to Europe and Asia diversifies revenue and strengthens its global market position.

| Asset Type | Key Basin | Market Access | 2024 Strategic Focus | Notable Data Point |

|---|---|---|---|---|

| Natural Gas | Marcellus Shale | Industrial consumers, LDCs, energy firms | Disciplined activity | Average realized price Q1 2024: $2.54/Mcf |

| Oil & NGLs | Permian Basin | Refiners, NGL processors | Optimizing returns | Significant free cash flow generation (Q1 2024) |

| NGLs | Global Markets | Europe & Asia (via export contracts) | Securing future demand | Contracts extend 2027-2038 |

Same Document Delivered

Coterra Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Coterra Energy's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Coterra Energy prioritizes transparent investor relations through comprehensive financial reporting. This includes detailed quarterly earnings calls, investor presentations, and regular guidance on production, capital expenditures, and financial outlook. For instance, their fourth-quarter and full-year 2024 results, released in early 2025, alongside their 2025 guidance, underscore this commitment.

Coterra Energy actively promotes its dedication to sustainability and Environmental, Social, and Governance (ESG) leadership. Their annual Sustainability Report, such as the 2024 edition, serves as a key promotional tool, detailing progress in areas like emission reduction and water stewardship.

This transparent reporting showcases Coterra's commitment to responsible operations, resonating with investors and regulators increasingly focused on ESG performance. For instance, their 2023 ESG performance data highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to a 2019 baseline.

Coterra Energy demonstrates strong industry participation, notably at events like the New Mexico Oil and Gas Association's (NMOGA) Annual Meeting. In 2024, their executives actively contributed to discussions, emphasizing science-based policies and responsible energy development. This engagement is crucial for shaping public opinion and solidifying Coterra's image as a leader committed to sustainable practices.

Corporate Website and Digital Presence

Coterra Energy leverages its corporate website as a crucial digital platform, acting as a central repository for vital company information. This includes detailed investor relations materials, comprehensive sustainability reports, and timely company news updates, ensuring transparency and accessibility. For instance, as of their Q1 2024 earnings report, the investor relations section prominently featured data and presentations relevant to financial professionals and individual investors alike.

This robust digital presence is the primary conduit for disseminating information to a wide audience, from seasoned financial analysts to individual shareholders. It guarantees that crucial data, such as operational highlights and financial performance, is readily available. Coterra also utilizes this platform to schedule and host webcasts for their earnings calls, further enhancing engagement with stakeholders.

- Website as Information Hub: Serves as the central point for investor relations, sustainability reports, and company news.

- Broad Audience Accessibility: Ensures information is readily available to financial professionals, investors, and the general public.

- Earnings Call Webcasts: Facilitates direct engagement and information dissemination through scheduled online events.

- Digital Presence Strategy: Reinforces Coterra's commitment to transparency and stakeholder communication in the digital age.

Strategic Communications on Market Outlook

Coterra Energy's leadership actively engages in strategic communications about market outlooks, particularly their positive view on natural gas price recovery. This optimism is largely driven by the anticipated increase in liquefied natural gas (LNG) export capacity, a key factor expected to absorb excess supply and bolster prices. For example, Coterra has highlighted its expectation for improved natural gas pricing in its 2024-2025 guidance, projecting stronger demand from new LNG facilities coming online throughout the period.

This proactive approach to managing investor expectations is crucial in the volatile energy sector. By clearly articulating their foresight and adaptability, Coterra demonstrates a strategic understanding of market dynamics. These communications, often delivered during quarterly earnings calls and through official press releases, provide valuable insights into the company's strategic positioning and its confidence in navigating future market conditions.

Key elements of Coterra's strategic communications on market outlook include:

- Natural Gas Price Recovery: Coterra anticipates a rebound in natural gas prices, supported by significant new LNG export capacity scheduled to commence operations.

- Investor Expectation Management: Through transparent communication, Coterra aims to align investor sentiment with its forward-looking strategy, fostering confidence in its operational and financial performance.

- Adaptability and Foresight: The company emphasizes its ability to adapt to market shifts and its foresight in capitalizing on emerging opportunities, such as the growing global demand for LNG.

- Communication Channels: Coterra utilizes earnings calls and press releases as primary platforms to disseminate its market outlook and strategic insights to stakeholders.

Coterra Energy's promotional efforts center on transparent communication and demonstrating ESG leadership. Their investor relations strategy, highlighted by detailed quarterly reports and guidance, aims to build trust. For instance, their 2024 guidance, released in early 2025, provided clarity on production and capital expenditure plans.

The company actively promotes its commitment to sustainability through its annual Sustainability Report, with the 2024 edition detailing progress in emission reductions and water management. This focus on ESG performance, evidenced by a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity by 2023 compared to a 2019 baseline, resonates with increasingly conscious investors.

Coterra's engagement in industry events, such as the 2024 New Mexico Oil and Gas Association Annual Meeting, further amplifies its message of responsible energy development. Their corporate website acts as a vital hub, offering accessible information on investor relations, sustainability, and company news, including webcasts for earnings calls.

Furthermore, Coterra proactively communicates its positive outlook on natural gas prices, anticipating a recovery driven by increased LNG export capacity. This strategic communication, often shared during earnings calls and press releases, showcases their foresight in capitalizing on growing global LNG demand, projecting improved pricing throughout 2024-2025.

Price

Coterra Energy's revenue is directly shaped by global commodity prices for oil, natural gas, and natural gas liquids (NGLs). These prices are notoriously volatile, reacting to shifts in supply and demand, international relations, and the overall health of the economy. For instance, West Texas Intermediate (WTI) crude oil prices averaged around $77.50 per barrel in early 2024, while Henry Hub natural gas hovered near $2.00 per million British thermal units, demonstrating the fluctuating nature of these key benchmarks that impact Coterra's realized prices.

Coterra Energy's pricing strategy is underpinned by its disciplined capital allocation, targeting a conservative reinvestment rate. For instance, in Q1 2024, Coterra reported discretionary cash flow of approximately $725 million, with capital expenditures around $350 million, suggesting a reinvestment rate of roughly 48%.

This careful management of capital expenditures, even amidst commodity price volatility, is designed to maximize free cash flow generation. This focus directly supports their commitment to maintaining a robust balance sheet, a key factor in delivering sustained long-term shareholder value.

While not a direct pricing tactic, Coterra Energy, like many in the oil and gas sector, likely utilizes hedging strategies to manage the inherent volatility of commodity prices. This approach aims to lock in more predictable revenue streams and cash flows, shielding the company from sharp downturns in the market.

Coterra's reported financial results often present realized average prices that exclude the impact of commodity derivatives, a strong indicator that the company actively engages in hedging. For instance, in Q1 2024, Coterra reported realized prices that benefited from these hedging instruments, contributing to a more stable financial performance despite fluctuating spot market rates.

Cost Efficiency and Operational Excellence

Coterra Energy aggressively pursues cost efficiency and operational excellence, directly impacting the net price they achieve for their oil and gas. By focusing on improving capital efficiency and boosting well productivity, they can realize higher margins regardless of fluctuating market prices. This dedication to streamlining operations is a significant factor in their financial success.

Their commitment to reducing operating expenses is evident. For instance, Coterra reported a production cost of $10.29 per barrel of oil equivalent (BOE) in the first quarter of 2024, a notable improvement. This focus on efficiency allows them to maintain strong profitability even when commodity prices are less favorable.

- Capital Efficiency: Coterra aims to maximize returns on its investments through disciplined capital allocation and efficient project execution.

- Well Productivity: The company consistently works to enhance the output from its wells, leading to lower per-unit production costs.

- Operating Expense Reduction: Ongoing efforts to trim operational costs, from drilling to completion and ongoing production, directly boost profitability.

- Margin Enhancement: These efficiency gains translate into higher profit margins, providing a competitive advantage in the energy market.

Shareholder Return Strategy

Coterra Energy's pricing strategy is intrinsically linked to its commitment to shareholder returns, a core component of its marketing mix. The company has a clear objective to return 50% or more of its annual Free Cash Flow (FCF) to shareholders. This commitment is designed to directly benefit investors through dividends and share repurchases, reflecting the value generated by their operations.

In 2025, Coterra is prioritizing debt reduction, which sets the stage for even greater shareholder returns in the future. This strategic move strengthens the company's financial footing, making it more attractive to investors. The ability to generate substantial FCF, driven by strong commodity prices and operational efficiencies, directly fuels these shareholder return initiatives.

- Target Shareholder Return: Coterra aims to return 50% or more of its annual Free Cash Flow to shareholders.

- 2025 Priority: The company is focusing on debt reduction in 2025 as a key financial objective.

- FCF Drivers: Strong commodity prices and efficient operations are critical for generating the FCF available for shareholder returns.

- Investor Value Proposition: The shareholder return strategy demonstrates the tangible value Coterra delivers to its investors.

Coterra Energy's pricing is fundamentally tied to volatile global commodity markets, with WTI crude oil averaging around $77.50 per barrel and natural gas near $2.00 per MMBtu in early 2024. The company's strategy involves disciplined capital allocation, targeting a reinvestment rate of approximately 48% as seen in Q1 2024, to maximize free cash flow and support shareholder returns. Furthermore, Coterra actively uses hedging to stabilize revenue streams, as evidenced by their reported realized prices that often exclude derivative impacts, ensuring more predictable financial performance.

| Metric | Q1 2024 Data | Significance for Pricing |

|---|---|---|

| WTI Crude Oil Avg. (Early 2024) | ~$77.50/barrel | Directly influences Coterra's oil revenue. |

| Henry Hub Nat. Gas Avg. (Early 2024) | ~$2.00/MMBtu | Impacts Coterra's natural gas revenue. |

| Q1 2024 Discretionary Cash Flow | ~$725 million | Funds capital expenditures and shareholder returns. |

| Q1 2024 Capital Expenditures | ~$350 million | Indicates a reinvestment rate of ~48%. |

| Q1 2024 Production Cost | $10.29/BOE | Lower costs enhance profit margins. |

4P's Marketing Mix Analysis Data Sources

Our Coterra Energy 4P's Marketing Mix Analysis is built upon a foundation of verified public data. We meticulously review SEC filings, investor relations materials, and official company press releases to capture their strategic product offerings, pricing structures, distribution networks, and promotional activities.