Coterra Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

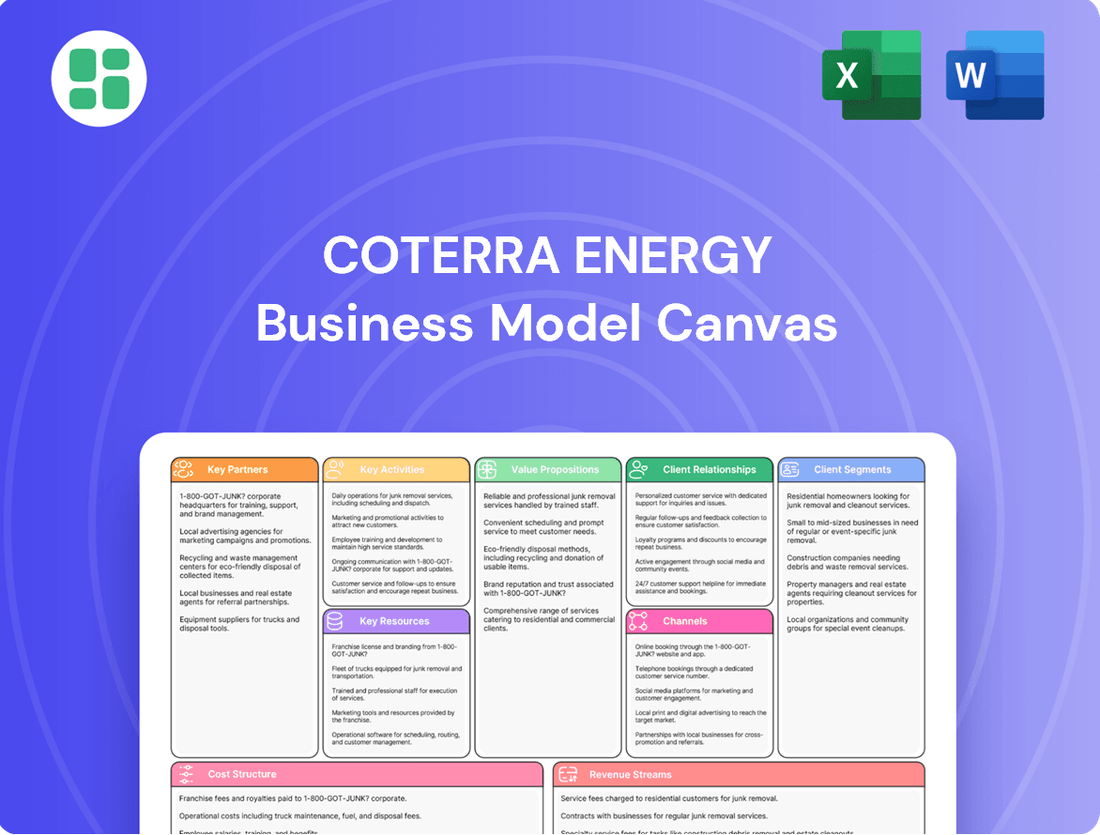

Unlock the strategic blueprint behind Coterra Energy's success with our comprehensive Business Model Canvas. This detailed analysis reveals their approach to value creation, customer engagement, and operational efficiency, offering invaluable insights for anyone studying or competing in the energy sector. Discover the core components that drive their market position and download the full canvas to deepen your understanding.

Partnerships

Coterra Energy relies heavily on specialized oilfield service providers for crucial activities like drilling, well completions, and hydraulic fracturing. These collaborations are vital for maximizing resource recovery and incorporating advanced technologies that boost well performance. For instance, in 2024, Coterra continued to leverage these partnerships to access specialized equipment and expertise, enabling them to maintain efficient operations and adapt to evolving technological demands in the energy sector without incurring substantial upfront capital expenditures.

Coterra Energy relies heavily on midstream partners for the essential transportation and processing of its oil, natural gas, and NGLs. These relationships are fundamental to moving extracted resources from Coterra's operational basins to end markets.

Key agreements involve access to extensive pipeline networks, natural gas processing facilities, and crucial storage infrastructure. These partnerships are vital for ensuring that Coterra's production can be efficiently and economically delivered to customers.

For instance, in 2024, Coterra continued to leverage its midstream infrastructure, including significant pipeline capacity in the Permian Basin and the Marcellus Shale, to facilitate market access and optimize its supply chain.

Coterra Energy cultivates crucial partnerships with landowners and mineral rights owners, securing leases essential for its exploration and production ventures. These agreements are the bedrock for accessing the valuable hydrocarbon reserves found within the Marcellus Shale and Permian Basin. For instance, in 2023, Coterra continued to actively manage and expand its leasehold position, a testament to the ongoing importance of these landowner relationships.

Technology and Innovation Partners

Coterra Energy actively collaborates with technology and innovation partners to deploy cutting-edge solutions. These partnerships are crucial for advancing exploration techniques, boosting drilling efficiency, and improving environmental stewardship. For instance, in 2024, the company continued to explore and implement advanced pumping strategies and automation technologies.

These collaborations focus on integrating data analytics to achieve greater operational excellence and minimize environmental footprints. By adopting these innovative approaches, Coterra Energy aims to drive continuous improvements in capital efficiency and overall productivity, ensuring they remain at the forefront of the industry.

- Technology Integration: Partnering with firms to adopt new pumping strategies and automation.

- Data Analytics: Leveraging data science to enhance exploration and drilling operations.

- Environmental Performance: Collaborating on solutions to reduce environmental impact.

- Efficiency Gains: Driving improvements in capital efficiency and productivity through innovation.

Energy Purchasers and Marketers

Coterra Energy cultivates essential partnerships with a diverse range of energy purchasers. These include industrial consumers who rely on their products, local distribution companies serving communities, and large energy corporations that manage and market these commodities. These relationships are fundamental to ensuring a consistent outlet for Coterra's produced oil, natural gas, and natural gas liquids (NGLs).

Recent strategic moves underscore the importance of these partnerships. For instance, Coterra's agreement with Centrica LNG signifies a deliberate effort to broaden its natural gas marketing reach into international arenas. Such collaborations are crucial for diversifying demand and achieving more favorable pricing for their output in the competitive energy market.

- Industrial Customers: Direct sales to manufacturers and other industrial users.

- Local Distribution Companies (LDCs): Supplying natural gas to utilities that serve residential and commercial customers.

- Major Energy Companies: Partnering with larger entities for broader market access and marketing services.

- International Marketers: Expanding reach into global markets, exemplified by the Centrica LNG agreement.

Coterra Energy's key partnerships are foundational to its operational success and market reach. These include vital collaborations with specialized oilfield service providers for efficient extraction and technology integration, as well as essential midstream partners who ensure the transportation and processing of its hydrocarbons. Furthermore, strong relationships with landowners and mineral rights owners secure access to valuable reserves, while alliances with technology firms drive innovation in operational efficiency and environmental performance.

These partnerships are critical for accessing specialized expertise without significant capital outlay, as demonstrated by Coterra's continued use of advanced pumping strategies and automation in 2024. The company also relies on a diverse base of energy purchasers, from industrial consumers to international marketers like Centrica LNG, to ensure consistent demand and optimize pricing for its oil, natural gas, and NGLs.

| Partnership Type | Key Role | Example/Impact |

| Oilfield Service Providers | Drilling, completions, fracturing | Access to specialized equipment and expertise, cost efficiency. |

| Midstream Partners | Transportation, processing, storage | Facilitates market access and supply chain optimization (e.g., Permian Basin, Marcellus Shale). |

| Landowners/Mineral Rights Owners | Lease agreements for exploration/production | Secures access to hydrocarbon reserves. |

| Technology/Innovation Partners | Deploying cutting-edge solutions | Enhances exploration, drilling efficiency, and environmental stewardship (e.g., advanced pumping, automation). |

| Energy Purchasers | Offtake of produced commodities | Ensures consistent demand and market access (e.g., Centrica LNG agreement for international reach). |

What is included in the product

This Business Model Canvas outlines Coterra Energy's strategy for sustainable energy production, focusing on efficient resource extraction and responsible operations to deliver value to stakeholders.

It details Coterra's core activities, key resources, and revenue streams, emphasizing a commitment to environmental stewardship and shareholder returns.

Coterra Energy's Business Model Canvas offers a clear, structured approach that simplifies complex strategic planning, alleviating the pain of disorganized thinking and lengthy documentation.

It provides a visual, one-page summary, cutting through the noise to highlight key elements and enabling faster, more effective decision-making for Coterra Energy.

Activities

Coterra Energy's exploration and appraisal activities are crucial for its long-term success. These efforts focus on identifying and assessing new hydrocarbon reserves within its core operating areas, particularly the Permian Basin and the Anadarko Basin. The company leverages advanced geological and geophysical technologies to pinpoint promising drilling sites.

In 2024, Coterra continued its strategic exploration program, aiming to replenish its drilling inventory and ensure future production growth. This ongoing investment in understanding subsurface potential is fundamental to maintaining a competitive edge and delivering value to shareholders.

Coterra Energy's core activities revolve around the extensive drilling and completion of wells to extract oil, natural gas, and natural gas liquids (NGLs). This hands-on operational work is fundamental to their business, directly impacting their ability to bring resources to market.

The company strategically deploys drilling rigs and specialized completion crews, with a significant focus on key producing regions like the Permian Basin and the Marcellus Shale. These areas are critical for Coterra's production output and future growth.

In 2024, Coterra continued to emphasize operational efficiency and shortening drilling and completion cycle times. For instance, they reported achieving average cycle times in the Permian of around 30 days for their wells, a testament to their focus on optimizing these key activities to drive capital efficiency and boost production volumes.

Coterra Energy's production and field operations are the engine of its business, focusing on the day-to-day management of its extensive well portfolio. This involves everything from routine maintenance to advanced optimization techniques to keep output steady and costs in check.

In 2024, Coterra continued to prioritize operational efficiency, a key driver for profitability. The company's commitment to this area is evident in its consistent performance metrics, aiming to maximize hydrocarbon recovery while minimizing environmental impact and ensuring safety.

Effective management of water production, a significant byproduct of oil and gas extraction, is also a core activity. By implementing best practices, Coterra aims to reduce disposal costs and enhance the sustainability of its operations, contributing to overall financial health.

Marketing and Sales of Hydrocarbons

Coterra Energy's key activities heavily involve the marketing and sale of its produced hydrocarbons, including oil, natural gas, and natural gas liquids. This process is fundamental to converting extracted resources into revenue. The company actively negotiates sales agreements with a diverse range of customers, ensuring consistent demand for its products.

Managing commodity price exposure is a critical component of these activities. Coterra utilizes strategies such as hedging to mitigate the risks associated with volatile energy markets, aiming to lock in favorable prices and stabilize revenue streams. This proactive approach is vital for financial predictability.

To maximize revenue, Coterra focuses on diversifying its sales channels and optimizing pricing strategies. This includes exploring various market outlets and leveraging market intelligence to secure the best possible prices for its output. For instance, in the first quarter of 2024, Coterra reported an average realized price for natural gas of $2.35 per thousand cubic feet (Mcf), reflecting their sales efforts.

- Marketing and Sales: Core function involves selling oil, natural gas, and NGLs to various buyers.

- Negotiation and Agreements: Securing favorable sales contracts is paramount.

- Commodity Price Management: Employing hedging strategies to mitigate price volatility.

- Revenue Optimization: Diversifying sales channels and optimizing pricing for maximum financial return.

Environmental Stewardship and Regulatory Compliance

Coterra Energy prioritizes minimizing its environmental footprint through targeted initiatives. In 2024, the company continued its focus on reducing greenhouse gas emissions, aiming for a 30% reduction in methane intensity by 2030 compared to a 2019 baseline. This commitment extends to water management, with Coterra recycling approximately 80% of its produced water for reuse in hydraulic fracturing operations. Safe and responsible waste disposal is also a core operational tenet.

Adherence to a complex web of environmental regulations is paramount for Coterra. The company actively engages with regulatory bodies to ensure compliance and often seeks to exceed minimum standards. This proactive approach supports its social license to operate and contributes to achieving its broader sustainability objectives. Transparency in reporting these efforts is key to stakeholder trust.

- Greenhouse Gas Emission Reduction: Coterra targets a 30% reduction in methane intensity by 2030 (vs. 2019 baseline).

- Water Recycling: Approximately 80% of produced water is recycled for operational use.

- Waste Management: Emphasis on safe and responsible disposal practices.

- Regulatory Compliance: Active engagement to meet and exceed environmental standards.

Coterra's key activities include the efficient extraction of oil, natural gas, and NGLs through drilling and completion operations, primarily in the Permian and Anadarko Basins. The company focuses on optimizing cycle times, with Permian wells averaging around 30 days in 2024, enhancing capital efficiency. Furthermore, Coterra actively manages its production portfolio through daily operations, maintenance, and water management, aiming to maximize recovery and minimize costs.

The company is also deeply involved in marketing and selling its produced hydrocarbons, employing hedging strategies to manage commodity price volatility and diversifying sales channels to boost revenue. In Q1 2024, Coterra reported an average realized natural gas price of $2.35 per Mcf. Environmental stewardship is a critical activity, with a goal to reduce methane intensity by 30% by 2030 (vs. 2019) and recycling approximately 80% of produced water.

| Key Activity | Focus Area | 2024 Data/Target | Impact |

| Exploration & Appraisal | Identifying new reserves | Permian & Anadarko Basins | Future production growth |

| Drilling & Completion | Well extraction | Permian cycle time: ~30 days | Capital efficiency, production volumes |

| Production & Field Ops | Asset management | Water recycling: ~80% | Operational efficiency, cost reduction |

| Marketing & Sales | Hydrocarbon sales | Realized Gas Price (Q1 2024): $2.35/Mcf | Revenue generation, price stability |

| Environmental Stewardship | Footprint reduction | Methane intensity reduction target: 30% by 2030 | Sustainability, regulatory compliance |

Delivered as Displayed

Business Model Canvas

The Coterra Energy Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing a direct snapshot of the complete, ready-to-use file, ensuring no discrepancies between the preview and the final deliverable. Once your order is complete, you'll gain full access to this professionally structured and formatted Business Model Canvas.

Resources

Coterra Energy's core strength lies in its extensive hydrocarbon reserves, encompassing both proved and unproved oil, natural gas, and natural gas liquids. This robust reserve base is the bedrock of its operations and future growth potential.

The company holds significant acreage, with approximately 186,000 net acres strategically positioned within the prolific Marcellus Shale. This concentration of high-quality assets provides a substantial platform for consistent natural gas production.

Furthermore, Coterra Energy boasts an impressive 297,000 net acres in the Permian Basin, a globally recognized hub for oil and gas activity. Access to these low-cost, high-return acreage positions is crucial for its oil and natural gas liquid production strategy and long-term value creation.

Coterra Energy operates a substantial fleet of drilling rigs and completion equipment, crucial for its upstream operations. This extensive infrastructure allows the company to efficiently extract oil and natural gas from its reserves. In 2023, Coterra reported capital expenditures of approximately $1.7 billion, a significant portion of which was allocated to drilling and completion activities, underscoring the importance of this key resource.

The company's production facilities, including gathering systems and processing plants, are integral to its business model. These assets enable the transportation and initial processing of hydrocarbons, ensuring they are ready for market. Coterra's commitment to maintaining and optimizing this vital infrastructure directly impacts its ability to meet production targets and manage operational costs effectively.

Coterra Energy relies heavily on its skilled human capital, a diverse team encompassing geologists, reservoir engineers, drilling specialists, and field operators. This expertise is fundamental to their success in unconventional resource development.

The company's operational execution and stringent safety management are directly attributable to the proficiency of its workforce. For instance, in 2024, Coterra continued to emphasize training and development programs aimed at enhancing these critical skill sets across all operational areas.

Investing in and retaining this top talent is a strategic imperative for Coterra, directly fueling innovation and driving operational efficiency. This focus on human capital ensures they remain at the forefront of the energy industry.

Financial Capital

Coterra Energy relies heavily on robust financial capital to fuel its substantial capital expenditure programs, strategic acquisitions, and day-to-day operations. This financial backbone comprises readily available cash, flexible revolving credit facilities, and the capacity to raise funds through debt or equity issuances.

Disciplined capital allocation, coupled with a solid balance sheet, empowers Coterra to pursue strategic investments that drive growth and deliver shareholder returns. For instance, as of the first quarter of 2024, Coterra reported approximately $1.1 billion in cash and cash equivalents, underscoring its strong liquidity position.

- Liquidity: Coterra maintained approximately $1.1 billion in cash and cash equivalents at the end of Q1 2024, providing immediate resources for operational needs and strategic initiatives.

- Financing Flexibility: The company has access to a $3.0 billion revolving credit facility, offering significant borrowing capacity to support capital programs and manage financial obligations.

- Capital Allocation: In 2023, Coterra returned over $1.7 billion to shareholders through dividends and share repurchases, demonstrating a commitment to rewarding investors while funding growth.

- Balance Sheet Strength: Coterra's prudent financial management has resulted in a strong balance sheet, enabling it to secure favorable terms for debt and equity financing when needed for major projects or acquisitions.

Proprietary Technology and Data

Coterra Energy's proprietary technology and data are central to its operational efficiency. The company utilizes advanced seismic data interpretation, which allows for more precise identification of hydrocarbon reservoirs, minimizing dry hole risks. For instance, in 2023, Coterra reported significant success in its Permian Basin operations, partly attributed to its enhanced geological modeling capabilities.

The firm's investment in well design optimization software directly translates to improved drilling times and reduced completion costs. Coterra's focus on these technological advancements aims to maximize hydrocarbon recovery from each well drilled. This approach contributed to their strong production figures in the first half of 2024, with daily production rates exceeding expectations in key operating areas.

Real-time operational monitoring systems provide Coterra with immediate feedback on drilling and production activities. This allows for swift adjustments to optimize performance and address any potential issues proactively, ensuring safer and more efficient operations. Coterra's commitment to leveraging these technological assets underpins its strategy for sustained growth and cost leadership in the energy sector.

- Advanced Seismic Data: Enhances reservoir identification and reduces exploration risk.

- Well Design Optimization Software: Streamlines drilling and completion processes, lowering costs.

- Real-time Operational Monitoring: Enables immediate performance adjustments and issue resolution.

- Data Analytics Integration: Drives efficiency and improves hydrocarbon recovery rates across all assets.

Coterra Energy's key resources are its substantial hydrocarbon reserves, extensive acreage in prime basins like the Marcellus and Permian, and a robust operational infrastructure including drilling rigs and processing facilities.

The company also heavily relies on its skilled workforce, comprising geologists and engineers, and maintains strong financial capital, evidenced by its significant cash reserves and access to credit lines.

Proprietary technology, such as advanced seismic data interpretation and well design software, further bolsters its operational efficiency and resource recovery.

| Key Resource | Description | 2023/2024 Data Point | Impact |

| Hydrocarbon Reserves | Proved and unproved oil, natural gas, and NGLs | Significant reserve base supporting long-term production | Foundation for revenue and growth |

| Acreage | Marcellus Shale (186k net acres), Permian Basin (297k net acres) | Strategic positioning in prolific, low-cost basins | Drives efficient production and high-return opportunities |

| Operational Infrastructure | Drilling rigs, completion equipment, production facilities | Capital expenditures of ~$1.7 billion in 2023 on drilling and completion | Enables efficient extraction and processing of hydrocarbons |

| Human Capital | Skilled geologists, engineers, operators | Continued emphasis on training and development in 2024 | Drives innovation, operational efficiency, and safety |

| Financial Capital | Cash, revolving credit facilities, debt/equity capacity | ~$1.1 billion in cash and cash equivalents (Q1 2024) | Funds capital programs, acquisitions, and provides financial flexibility |

| Proprietary Technology | Seismic data interpretation, well design software, real-time monitoring | Enhanced geological modeling contributing to Permian success (2023) | Improves reservoir identification, reduces costs, optimizes performance |

Value Propositions

Coterra Energy guarantees a steady and cost-effective delivery of vital energy commodities like oil, natural gas, and natural gas liquids, catering to worldwide consumption needs. Their strategic positioning within premier unconventional basins, such as the Permian and Marcellus, underpins a strong and dependable production output.

This unwavering reliability is paramount for a diverse customer base, encompassing industrial manufacturers requiring uninterrupted power, utility providers managing grid stability, and broader global energy exchanges. For instance, in 2023, Coterra's production averaged approximately 260,000 barrels of oil equivalent per day, showcasing their capacity to meet significant demand.

Coterra Energy prioritizes maximizing shareholder value through strategic capital deployment and robust financial discipline. The company is dedicated to delivering superior and sustainable returns across various commodity price environments.

This commitment is demonstrated through a consistent base dividend and active share repurchase programs, fueled by strong free cash flow generation. For instance, in 2024, Coterra returned approximately $1.5 billion to shareholders, a testament to its focus on capital returns.

Coterra Energy prioritizes sustainable and responsible operations, aiming to minimize environmental impact through dedicated stewardship. This focus is clearly demonstrated in their 2024 Sustainability Report, which details significant progress in reducing emissions and managing water resources effectively.

The company's commitment extends to robust community engagement initiatives, further solidifying its role as a responsible energy provider. These efforts are particularly valuable to investors and stakeholders who actively seek out energy sources produced with a strong ethical and environmental conscience.

Access to Strategic Unconventional Basins

Coterra Energy provides access to prime unconventional basins, including the Permian Basin and Marcellus Shale. This strategic advantage offers investors exposure to high-quality, low-cost energy assets.

These diverse holdings grant Coterra the flexibility to navigate fluctuating commodity prices and optimize its production strategies effectively. This adaptability is crucial for sustained financial performance.

The company's strategic positioning in these key basins underpins its ability to achieve consistent and profitable growth. For instance, in the first quarter of 2024, Coterra reported strong operational results, driven by its efficient development in these premier unconventional areas.

- Premier Basin Exposure: Access to high-quality, low-cost assets in the Permian and Marcellus.

- Operational Flexibility: Ability to adapt to commodity price shifts and optimize production.

- Growth Potential: Strategic positioning supports consistent and profitable expansion.

Diversified Commodity Mix and Portfolio Flexibility

Coterra Energy's diversified commodity mix, encompassing oil, natural gas, and natural gas liquids (NGLs), provides a crucial buffer against the price swings inherent in any single commodity market. This balanced approach is a cornerstone of their strategy, aiming to smooth out returns even when one sector experiences a downturn. For instance, in the first quarter of 2024, Coterra reported strong performance across its liquids and gas segments, showcasing the benefits of this diversification.

The company leverages significant flexibility in its capital allocation, enabling it to strategically shift investments between oil-dominant and gas-dominant plays. This adaptability is key to capitalizing on favorable market conditions, whether that means prioritizing oil production when prices are high or pivoting to natural gas when demand and pricing are more attractive. This strategic agility is designed to maximize economic returns throughout different phases of the commodity market cycle.

- Balanced Commodity Exposure: Coterra's portfolio includes oil, natural gas, and NGLs, reducing reliance on any single commodity.

- Capital Allocation Flexibility: The company can reallocate capital between oil-rich and gas-rich assets based on market signals.

- Economic Resilience: This diversification and flexibility aim to generate consistent economic returns across various market conditions.

Coterra Energy offers reliable and cost-effective energy commodities, underpinned by its strategic positioning in premier basins like the Permian and Marcellus. This ensures a dependable supply for industrial, utility, and global energy markets. In 2023, their production averaged around 260,000 barrels of oil equivalent per day, highlighting their capacity to meet substantial demand.

The company prioritizes shareholder value through disciplined capital deployment and a commitment to sustainable returns, evidenced by consistent dividends and share repurchases. In 2024, Coterra returned approximately $1.5 billion to shareholders, demonstrating a strong focus on capital returns.

Coterra Energy is dedicated to responsible operations, minimizing environmental impact through emissions reduction and effective water management, as detailed in their 2024 Sustainability Report. Their community engagement further solidifies their role as a conscientious energy provider, appealing to stakeholders seeking ethically produced energy.

Coterra provides access to high-quality, low-cost energy assets in the Permian and Marcellus basins, offering investors exposure to prime unconventional resources. This strategic advantage allows for operational flexibility, enabling adaptation to commodity price shifts and optimized production strategies for sustained financial performance. Their first-quarter 2024 results showcased strong performance driven by efficient development in these key areas.

| Value Proposition | Description | Supporting Data/Example |

|---|---|---|

| Reliable Energy Supply | Consistent delivery of oil, natural gas, and NGLs. | 2023 average production: ~260,000 boe/d. |

| Shareholder Returns | Maximizing value through dividends and share buybacks. | Approx. $1.5 billion returned to shareholders in 2024. |

| Sustainable Operations | Minimizing environmental impact and engaging communities. | Details in 2024 Sustainability Report. |

| Premier Basin Access | Exposure to high-quality, low-cost assets. | Strategic positioning in Permian and Marcellus basins. |

Customer Relationships

Coterra Energy cultivates enduring customer relationships primarily through long-term supply agreements for its oil, natural gas, and natural gas liquids (NGLs). These direct sales and supply contracts are fundamental to ensuring revenue predictability and a steady outlet for its production volumes.

These strategic partnerships are crucial for market stability. For instance, Coterra's 10-year natural gas sale agreement with Centrica, a significant energy trading company, underscores this commitment to building lasting relationships with key energy purchasers.

Coterra Energy cultivates transparent investor relations through consistent communication. In 2024, the company held its quarterly earnings calls, providing detailed financial performance updates and strategic outlooks to its diverse investor base, which includes both institutional and individual shareholders.

Key to this transparency are readily available SEC filings like the 10-K and 10-Q reports, alongside comprehensive investor presentations. These resources offer deep dives into Coterra's financial health, operational strategies, and capital allocation plans, reinforcing investor confidence and understanding.

Coterra Energy prioritizes robust community engagement and open dialogue with stakeholders, including landowners and local governments within its operational zones. This commitment is crucial for addressing local concerns, fostering economic contributions, and ensuring a social license to operate.

In 2024, Coterra continued its focus on these relationships, recognizing their importance for sustainable business practices. The company's efforts aim to build trust and ensure that its operations align with community values and economic development goals.

Proactive Regulatory Compliance and Dialogue

Coterra Energy actively cultivates robust relationships with regulatory agencies across federal, state, and local jurisdictions. This proactive engagement ensures adherence to all environmental, health, and safety standards, which is critical for maintaining operational continuity and mitigating risks. For instance, in 2024, Coterra continued its focus on transparent reporting and dialogue to secure permits and adapt to evolving regulations, a key component of its risk management strategy.

The company's commitment to regulatory compliance is not merely reactive; it involves ongoing, proactive dialogue. This approach helps Coterra anticipate and address potential regulatory shifts, securing necessary permits efficiently and maintaining a strong compliance record. This is vital for sustainable operations and stakeholder trust.

- Proactive Engagement: Maintains continuous dialogue with federal, state, and local regulatory bodies.

- Permitting Success: Facilitates the timely acquisition of essential operational permits through transparent reporting.

- Adaptability: Stays ahead of evolving environmental, health, and safety regulations.

- Risk Mitigation: Ensures operational integrity and minimizes potential liabilities through strict adherence.

Industry Collaborations and Best Practices

Coterra Energy actively engages with industry associations, fostering a collaborative environment to share best practices. This participation helps drive operational efficiencies and tackle shared challenges across the energy sector.

These strategic collaborations are crucial for Coterra's commitment to innovation, particularly in enhancing safety protocols and environmental stewardship. By working with peers, the company aims to elevate technological advancements within the industry.

- Industry Association Engagement: Coterra is a member of key industry groups, allowing for knowledge exchange and collective problem-solving.

- Best Practice Sharing: The company actively contributes to and benefits from the dissemination of operational and safety best practices.

- Innovation Driver: Collaborations accelerate the adoption of new technologies and sustainable practices, improving overall industry performance.

- Addressing Challenges: Joint efforts help Coterra and its peers navigate complex regulatory landscapes and market dynamics effectively.

Coterra Energy's customer relationships extend beyond simple transactions, focusing on long-term partnerships with energy purchasers, primarily through direct sales and supply agreements. These agreements, such as the 10-year natural gas sale with Centrica, provide revenue stability and a reliable market for its production. The company also nurtures investor confidence through transparent communication, including quarterly earnings calls and readily available SEC filings like the 10-K and 10-Q reports in 2024, detailing financial performance and strategic outlooks.

Community engagement is also a cornerstone, with Coterra actively dialoguing with landowners and local governments in 2024 to address concerns and foster economic contributions, securing its social license to operate. Furthermore, proactive engagement with federal, state, and local regulatory agencies in 2024 ensures compliance and smooth permitting processes, mitigating operational risks.

| Relationship Type | Key Engagement Strategy | 2024 Focus/Data Point |

|---|---|---|

| Energy Purchasers | Long-term supply agreements | Centrica (10-year natural gas sale agreement) |

| Investors | Transparent financial reporting | Quarterly earnings calls, SEC filings (10-K, 10-Q) |

| Communities | Local dialogue and economic contribution | Addressing local concerns, social license to operate |

| Regulators | Proactive compliance and dialogue | Permitting, adapting to evolving regulations |

Channels

Coterra Energy leverages its extensive pipeline infrastructure as a crucial channel for efficiently transporting natural gas and oil from its wellheads to processing plants and then to market centers. This network is fundamental to moving significant volumes of product safely and cost-effectively.

In 2024, Coterra's operational efficiency is heavily reliant on these midstream assets, which are key to ensuring reliable market access and minimizing transportation expenses. The company's strategic advantage is amplified by its integrated approach to production and transportation.

Natural gas processing plants are vital channels for Coterra Energy, acting as the crucial step where raw natural gas is transformed into marketable products. These facilities separate valuable natural gas liquids (NGLs) like ethane, propane, and butane from the dry gas, which is then ready for pipeline transport. This processing ensures the natural gas meets stringent quality standards for consumers.

Coterra leverages strategic partnerships with midstream companies to access these essential processing capabilities. This collaboration allows Coterra to efficiently get its produced gas and NGLs to market. For instance, in 2024, the demand for NGLs remained robust, driven by petrochemical feedstock needs and export markets, underscoring the importance of these processing channels for Coterra's revenue generation.

Coterra Energy directly markets its crude oil, natural gas, and natural gas liquids (NGLs) to a broad range of customers. This includes energy marketers who facilitate broader distribution, industrial consumers requiring direct supply, and utility companies needing reliable fuel sources.

This direct approach enables Coterra to foster robust commercial relationships and secure advantageous pricing and contract terms. For instance, in 2023, Coterra reported approximately 60% of its natural gas production was sold under fee-based agreements or to counterparties with investment-grade credit ratings, highlighting the stability of its direct sales channels.

Furthermore, strategic partnerships, such as its liquefied natural gas (LNG) export agreement with Centrica, serve to broaden Coterra's direct access to global markets, enhancing its sales reach and revenue diversification beyond traditional domestic channels.

Investor Relations and Digital Platforms

Coterra Energy leverages its dedicated investor relations website as a primary digital hub for disseminating crucial information. This platform offers direct access to annual reports, quarterly earnings releases, and important press announcements, ensuring stakeholders have up-to-date financial data readily available. For 2024, Coterra continued to provide detailed operational and financial updates through these channels.

Beyond its own website, Coterra utilizes established financial news outlets and the Securities and Exchange Commission's (SEC) filing portals to reach a wider audience. These digital avenues are vital for broadcasting financial performance, including webcast recordings of earnings calls, which foster transparency and engagement with the investment community. Investors can easily access filings like the 10-K and 10-Q, which are critical for comprehensive analysis.

The company's digital strategy ensures broad accessibility for all financial stakeholders, from individual investors to institutional analysts. Key information available includes:

- Annual Reports (10-K): Comprehensive overview of financial performance and business operations.

- Quarterly Reports (10-Q): Regular updates on financial results and operational highlights.

- Press Releases: Timely announcements regarding significant company events and achievements.

- Webcast Recordings: Access to past earnings calls for in-depth discussion and Q&A.

Community and Public Engagement Initiatives

Coterra actively engages with the public and local communities through a variety of initiatives. These include town hall meetings, local sponsorship programs, and detailed corporate sustainability reports, ensuring transparency about their operations and environmental stewardship.

These channels serve as crucial platforms for Coterra to disseminate information regarding their operational activities, environmental performance metrics, and the impact of their community investment programs. For instance, in 2023, Coterra reported investing over $10 million in community and economic development initiatives across its operating regions.

- Community Meetings: Regular forums for direct dialogue with residents and stakeholders.

- Local Outreach Programs: Targeted initiatives supporting local needs and development.

- Corporate Sustainability Reports: Comprehensive disclosures on environmental, social, and governance (ESG) performance, with 2024 reports detailing specific community benefit projects.

Through these consistent efforts, Coterra aims to cultivate positive relationships and proactively address any concerns or questions raised by the communities in which they operate, fostering goodwill and mutual understanding.

Coterra's extensive pipeline network is a primary channel, moving natural gas and oil efficiently from wells to processing and market. This integrated midstream infrastructure is key to their 2024 operational success, ensuring cost-effective and reliable product delivery.

Processing plants are vital channels, transforming raw natural gas into marketable products like dry gas and valuable NGLs. Coterra's strategic midstream partnerships ensure access to these essential facilities, crucial for revenue generation given robust 2024 NGL demand.

Direct sales to energy marketers, industrial consumers, and utilities form another key channel, allowing Coterra to build strong customer relationships and secure favorable terms. In 2023, approximately 60% of their natural gas sales were under fee-based agreements or with investment-grade counterparties, demonstrating channel stability.

LNG export agreements, like the one with Centrica, expand Coterra's reach into global markets, diversifying revenue beyond domestic sales and enhancing their channel strategy.

Customer Segments

Coterra Energy's core customer base consists of wholesale purchasers of crude oil, natural gas, and natural gas liquids. These entities operate within major commodity trading hubs, absorbing the energy produced by Coterra.

These wholesale buyers are diverse, encompassing refiners, industrial consumers, and energy marketers who rely on a steady supply of hydrocarbons. Their demand directly influences the pricing and volume of Coterra's sales.

In 2024, Coterra's production, primarily from the prolific Permian and Marcellus Basins, is strategically positioned to meet the needs of these wholesale markets. For instance, in the first quarter of 2024, Coterra reported an average daily production of approximately 265,000 barrels of oil equivalent (BOE) per day, a significant portion of which flows into these wholesale channels.

Industrial end-users, a crucial segment for Coterra Energy, include petrochemical plants and manufacturing facilities that depend on natural gas as a primary feedstock and fuel source. These operations often demand substantial and uninterrupted volumes of natural gas to maintain their production cycles. For example, in 2024, the industrial sector accounted for a significant portion of natural gas consumption, highlighting their reliance on a stable supply chain.

Coterra Energy serves utility companies and power generators as a crucial supplier of natural gas. These entities rely on natural gas as a primary fuel source to produce electricity, meeting the consistent demand from homes and businesses. In 2024, the demand for natural gas in power generation remains robust, driven by factors like increasing electricity consumption and the ongoing transition away from more carbon-intensive fuels.

The purchasing decisions of utility companies are significantly shaped by electricity demand forecasts and the relative economics of different fuel sources. Coterra's role in providing a stable and reliable supply of natural gas directly supports the energy security of these vital infrastructure providers. For instance, in the first quarter of 2024, Coterra reported strong production volumes, contributing to the overall energy mix available for power generation.

Institutional and Individual Investors

This segment encompasses a broad spectrum of financial stakeholders, including institutional investors like mutual funds and pension funds, as well as individual investors. They are drawn to Coterra Energy for its potential for capital appreciation and consistent dividend income. For instance, as of the first quarter of 2024, Coterra reported a strong free cash flow, a key metric for dividend sustainability and reinvestment, which directly appeals to these income-focused investors.

These investors prioritize robust financial performance, evidenced by metrics such as earnings per share and return on equity. They also value disciplined capital allocation, looking for evidence of strategic investments that promise future growth without compromising financial stability. Coterra's focus on operational efficiency and prudent debt management directly addresses these concerns.

Coterra actively targets this crucial segment through transparent reporting and a clear commitment to shareholder returns. This includes regular updates on production volumes, cost management, and capital expenditure plans, providing the data necessary for informed investment decisions. The company's dividend policy, which has seen consistent payouts, underscores its dedication to rewarding its investor base.

- Capital Appreciation & Dividend Income: Investors seek growth in stock value and regular income payouts.

- Financial Performance Metrics: Key indicators like EPS, ROE, and free cash flow are closely monitored.

- Disciplined Capital Allocation: Investors favor companies with strategic and efficient use of capital.

- Transparency & Shareholder Returns: Clear communication and consistent dividend payments are vital.

Landowners and Local Communities

Landowners and local communities are critical stakeholders for Coterra Energy, even though they don't directly buy the company's oil and gas. Coterra's engagement with this group centers on lease payments, which are a significant source of revenue for many landowners. In 2023, Coterra's total lease and mineral payments amounted to $550 million, highlighting the economic impact on these communities.

Beyond financial transactions, Coterra's operations create local jobs and contribute to the regional economy. The company also focuses on mitigating environmental and social impacts, such as noise, traffic, and land use. Maintaining strong, collaborative relationships with these communities is paramount for securing operational permits and ensuring a smooth, sustainable business environment.

Coterra's commitment to community engagement is demonstrated through various initiatives. For instance, in 2024, the company allocated $10 million towards community development projects in its operating areas, focusing on education, infrastructure, and environmental stewardship. These efforts aim to foster mutual trust and long-term partnerships.

Key aspects of Coterra's relationship with landowners and local communities include:

- Lease Payments: Providing fair and timely payments to landowners for the right to extract resources.

- Job Creation: Offering employment opportunities to local residents, boosting the regional economy.

- Environmental Stewardship: Implementing practices to minimize the ecological footprint of operations.

- Community Investment: Supporting local initiatives and development projects to enhance quality of life.

Coterra's customer segments are primarily wholesale buyers of crude oil, natural gas, and natural gas liquids, including refiners, industrial consumers, and energy marketers. Utility companies and power generators also represent a significant customer base, relying on Coterra for natural gas to produce electricity. Additionally, financial stakeholders, such as institutional and individual investors, are key customers who invest in Coterra for capital appreciation and dividend income.

Landowners and local communities are also crucial stakeholders, benefiting from lease payments and job creation, although they are not direct purchasers of energy commodities. Coterra's engagement with these groups focuses on maintaining positive relationships and contributing to local economic development. For example, in Q1 2024, Coterra's production averaged approximately 265,000 BOE per day, supplying these diverse markets.

| Customer Segment | Key Needs/Interests | 2024 Relevance/Data |

| Wholesale Buyers (Refiners, Marketers) | Reliable supply of oil, gas, NGLs; competitive pricing | Production strategically located in Permian and Marcellus Basins; Q1 2024 production ~265,000 BOE/day |

| Industrial Consumers | Consistent natural gas supply for feedstock and fuel | Industrial sector is a major consumer of natural gas; demand remains robust |

| Utilities & Power Generators | Stable natural gas supply for electricity generation | Natural gas is a primary fuel for power; Q1 2024 saw strong production contributing to energy mix |

| Investors (Institutional & Individual) | Capital appreciation, dividend income, financial performance | Q1 2024 free cash flow supports dividend sustainability; focus on EPS and ROE |

| Landowners & Local Communities | Lease payments, job opportunities, environmental impact mitigation | 2023 lease and mineral payments totaled $550 million; $10 million allocated to community projects in 2024 |

Cost Structure

Coterra Energy's cost structure heavily relies on the substantial capital outlay for acquiring oil and gas leases and the subsequent drilling of new wells. These upfront investments are particularly significant in prolific unconventional resource areas such as the Permian and Marcellus Basins.

For instance, in 2024, Coterra continued to invest heavily in its drilling programs. While specific per-well costs vary by basin and operational efficiency, the company's capital expenditures for drilling and completions are a primary driver of its cost base. Managing these expenditures effectively through optimized drilling techniques and supply chain management is paramount to maintaining profitability.

Coterra Energy's production and operating expenses, or LOE, are the day-to-day costs of keeping their wells running. This includes everything from paying the people who work on the sites to keeping the lights on and fixing equipment. For instance, in 2024, Coterra reported LOE per barrel of oil equivalent (BOE) that demonstrates their commitment to efficiency. They aim to keep these costs as low as possible to boost their profits.

Minimizing these lease operating expenses is a constant goal for Coterra. They achieve this through smart operational choices and adopting new technologies. By improving how they do things and using better equipment, they can lower the cost for each unit they produce, which is crucial for staying competitive in the energy market.

Coterra Energy faces substantial costs in gathering raw hydrocarbons from their wells, processing them into usable products like natural gas and oil, and then transporting these to market. These midstream operations are a critical part of their cost structure.

These gathering, processing, and transportation expenses are frequently managed by third-party companies, meaning Coterra relies on external service providers for these essential functions. The pricing and efficiency of these services directly impact Coterra's bottom line.

For example, in 2024, the price of natural gas transportation on key pipelines can fluctuate based on demand and capacity. Coterra's ability to negotiate favorable terms with these midstream partners is crucial for maintaining cost competitiveness in the energy market.

Optimizing the logistics of moving product from the wellhead to the processing facility and then to the final buyer, while also securing competitive rates for these services, is a key focus for Coterra's overall cost efficiency and profitability.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses are the backbone of Coterra Energy's operational management, encompassing costs like executive compensation, administrative personnel, office upkeep, and corporate support functions. For 2024, Coterra reported G&A expenses of approximately $280 million, reflecting a commitment to efficient corporate governance and lean organizational structures to optimize value. This focus on a streamlined corporate setup is crucial for maintaining competitiveness and maximizing shareholder returns.

Coterra's approach to managing G&A costs involves several key strategies:

- Streamlined Corporate Structure: Coterra actively works to maintain a lean and efficient corporate hierarchy, minimizing layers of management and associated overhead.

- Executive and Administrative Salaries: Compensation packages are benchmarked to industry standards while emphasizing performance-based incentives.

- Office Expenses and Corporate Services: Investments in technology and shared services are utilized to reduce individual departmental costs and improve overall efficiency.

- Focus on Value Maximization: The overarching goal is to ensure that G&A spending directly supports strategic objectives and contributes to long-term value creation for the company.

Environmental Compliance and Remediation Costs

Coterra Energy dedicates significant resources to environmental compliance and remediation. These costs encompass obtaining and maintaining permits, ongoing environmental monitoring, implementing robust spill prevention measures, and addressing any necessary site remediation. In 2023, Coterra reported approximately $200 million in environmental expenditures, a figure that includes both operational compliance and capital investments in cleaner technologies.

Further contributing to this cost structure are investments in sustainable practices and technologies aimed at reducing emissions. These proactive measures are crucial for mitigating potential long-term environmental liabilities and avoiding costly regulatory fines. For instance, Coterra's commitment to reducing methane emissions by 50% by 2027, as outlined in their sustainability reports, necessitates ongoing investment in advanced monitoring and capture equipment.

- Permitting and Monitoring: Costs associated with obtaining and maintaining environmental permits and conducting regular monitoring of air, water, and soil quality.

- Spill Prevention and Response: Investments in infrastructure and training to prevent spills and effectively respond to any incidents.

- Remediation and Restoration: Expenses related to cleaning up and restoring any impacted environmental sites.

- Sustainable Technology Investments: Capital outlays for technologies that reduce emissions, improve energy efficiency, and promote environmentally sound operations.

Coterra Energy's cost structure is dominated by capital expenditures for lease acquisitions and drilling, alongside ongoing lease operating expenses. Midstream costs for gathering, processing, and transportation are also significant, often managed by third parties. General and administrative expenses and environmental compliance add to the overall cost base, with a growing emphasis on sustainable practices.

Revenue Streams

Coterra Energy's primary revenue source is the sale of crude oil, heavily influenced by its Permian Basin assets. This segment is a substantial driver of the company's financial performance.

In 2024, Coterra's oil production is projected to increase, further bolstering this revenue stream. Global crude oil price volatility, therefore, directly affects the income generated from these sales.

Coterra Energy generates significant revenue from selling natural gas, primarily sourced from its operations in the Marcellus Shale and the Permian Basin. These sales form a substantial portion of the company's overall income.

While natural gas sales are a key revenue driver, Coterra has strategically adjusted its activity levels in the Marcellus region in response to prevailing lower natural gas prices. This demonstrates a dynamic approach to market conditions.

To further bolster and diversify its gas revenue streams, Coterra has entered into long-term international agreements, such as its notable deal with Centrica. This strategy aims to provide more stable and predictable income.

Coterra Energy generates revenue from selling natural gas liquids (NGLs), which are valuable byproducts of its natural gas extraction. These NGLs, including ethane, propane, and butane, are separated and sold based on their individual market prices.

The market dynamics for NGLs can differ from those of natural gas and crude oil, offering Coterra a diversified revenue stream. For instance, in 2024, the price of ethane, a key NGL, has shown resilience, sometimes trading at a premium to natural gas, underscoring the importance of this segment.

Commodity Hedging Gains

Coterra Energy actively employs commodity derivative instruments to manage its exposure to fluctuating oil and natural gas prices. These derivatives can lead to settlement gains or losses, directly impacting reported revenue. For instance, in the first quarter of 2024, Coterra reported gains on commodity derivatives, contributing positively to their overall financial performance.

These gains from derivative settlements act as a crucial revenue stabilizer, effectively shielding the company from the adverse effects of price downturns. This strategy provides a more predictable revenue stream, enhancing financial planning and investor confidence.

- Commodity Derivative Gains: Coterra utilizes financial instruments to lock in prices for future production, hedging against market volatility.

- Revenue Stabilization: Positive settlements from these derivatives provide a buffer against falling commodity prices, adding a predictable element to revenue.

- Q1 2024 Performance: Coterra reported significant gains on commodity derivatives in the first quarter of 2024, underscoring the effectiveness of their hedging strategy.

- Risk Mitigation: This revenue stream helps mitigate the downside risk associated with unpredictable swings in the energy markets.

Joint Venture and Farm-out Agreements

While not a primary revenue stream explicitly detailed for Coterra Energy in their current business model, joint venture and farm-out agreements are common in the upstream oil and gas sector. These arrangements allow companies to share the financial burden and risks associated with exploration and production. Essentially, Coterra could sell a stake in a prospect to another energy company, receiving upfront cash or a carried interest in future production. This strategy is crucial for capital optimization, enabling participation in more projects than would be possible alone.

These agreements function by transferring a portion of ownership and associated responsibilities. The company receiving the interest typically covers a share of the exploration and development costs. For example, in 2024, the energy industry saw numerous such deals aimed at accessing new reserves and technologies. This approach directly impacts a company's ability to manage its capital expenditure while expanding its operational footprint.

- Risk Mitigation: Joint ventures and farm-outs allow Coterra to reduce its exposure to the inherent financial risks of exploration and production by bringing in partners.

- Capital Efficiency: By sharing costs, Coterra can undertake more projects or accelerate development timelines than it could with its own capital alone.

- Access to Expertise/Technology: Partners may bring specialized knowledge or technology that enhances the success of a project, indirectly contributing to revenue potential.

- Cash Generation: The sale of an interest in a property can provide immediate cash flow, which can be reinvested in other opportunities or used for general corporate purposes.

Coterra Energy's revenue streams are primarily built upon the sale of crude oil, natural gas, and natural gas liquids (NGLs). The company's significant presence in the Permian Basin and the Marcellus Shale underpins these core operations.

In 2024, Coterra's oil production is expected to grow, enhancing its revenue from crude oil sales, while natural gas revenue is managed dynamically in response to market prices, including strategic long-term international agreements to stabilize income.

Natural gas liquids, such as ethane and propane, represent another vital revenue component, with their market prices often exhibiting different trends than crude oil or natural gas, contributing to revenue diversification.

Furthermore, Coterra actively uses commodity derivatives to hedge against price volatility, and positive settlements from these instruments, like those seen in Q1 2024, contribute to revenue stability and predictability.

| Revenue Stream | Primary Source | 2024 Outlook/Notes |

|---|---|---|

| Crude Oil Sales | Permian Basin | Projected production increase |

| Natural Gas Sales | Marcellus Shale, Permian Basin | Dynamic activity adjustments; long-term international agreements |

| Natural Gas Liquids (NGLs) Sales | Byproduct of gas extraction | Resilient ethane pricing in 2024 |

| Commodity Derivative Settlements | Hedging financial instruments | Positive Q1 2024 gains reported; revenue stabilization |

Business Model Canvas Data Sources

The Coterra Energy Business Model Canvas is constructed using a blend of financial disclosures, industry-specific market research, and operational performance data. These sources provide a comprehensive view of the company's strategic and economic landscape.