Coterra Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

Coterra Energy operates within a dynamic energy landscape where buyer power, supplier leverage, and the threat of substitutes significantly shape its competitive environment. Understanding these forces is crucial for navigating industry challenges and identifying strategic opportunities.

The complete report reveals the real forces shaping Coterra Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and gas sector, including companies like Coterra Energy, depends on highly specialized services such as advanced drilling, hydraulic fracturing, and well completion. When a small number of firms control these critical offerings, their ability to dictate terms to energy producers increases significantly. For instance, in 2024, the market for specialized oilfield services saw consolidation, with major players acquiring smaller competitors, thereby concentrating expertise and market share among fewer entities.

This concentration of specialized service providers grants them substantial bargaining power. They can leverage their dominance to command higher prices for their services, directly impacting Coterra Energy's operational costs. This situation can also create potential bottlenecks, leading to delays in project execution and ultimately affecting the company's overall profitability and ability to bring production online efficiently.

Suppliers who possess patented technologies or highly specialized equipment, like advanced seismic imaging tools or unique drilling bits, wield significant bargaining power. Coterra Energy's operational success, particularly in challenging unconventional basins such as the Marcellus Shale and Permian Basin, is directly tied to its ability to access these innovative solutions. The distinctiveness of these proprietary offerings can restrict Coterra's available choices, thereby amplifying the suppliers' leverage in negotiations.

Switching suppliers in the oil and gas industry, particularly for Coterra Energy, can incur significant expenses. These costs often involve reconfiguring specialized equipment, retraining staff on new systems, and managing potential interruptions to ongoing operations. For instance, a new drilling fluid supplier might require specialized mixing equipment and extensive training for rig crews.

High switching costs create a substantial barrier for Coterra Energy when considering alternative suppliers for critical components or services under long-term agreements. This dynamic directly enhances the bargaining power of existing suppliers, as Coterra faces considerable financial and operational hurdles to transition. This can make it difficult for Coterra to negotiate lower prices or more favorable terms, even if market conditions would otherwise allow.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for Coterra Energy is a significant consideration within the bargaining power of suppliers. If suppliers, particularly those providing specialized equipment or services for exploration and production, possess the financial strength and strategic motivation to move into direct resource extraction, they could become competitors. This scenario would fundamentally alter the supplier-customer dynamic, placing Coterra in a position where its own suppliers could potentially control its upstream activities.

While direct forward integration by typical oilfield service providers is not a pervasive threat, it's a possibility that can't be ignored. For instance, a large, diversified energy services company might see an opportunity to acquire exploration rights or develop its own production assets if the market conditions are favorable and it has the necessary capital. This potential leverage allows suppliers to negotiate from a stronger position, knowing that Coterra would prefer to focus on its core competencies rather than face a direct competitor that also supplies critical services.

The financial health of potential integrating suppliers is a key indicator. For example, companies like Schlumberger or Halliburton, major players in the energy services sector, have substantial financial resources. While their primary focus remains on services, a strategic shift towards production is not out of the realm of possibility, especially during periods of high commodity prices or consolidation within the industry. Coterra Energy, like its peers, must monitor the financial strategies and market positions of its key suppliers to anticipate and mitigate this threat.

- Supplier Capability: Suppliers with significant capital reserves and operational expertise in exploration and production are better positioned to integrate forward.

- Market Incentives: High commodity prices or industry consolidation could incentivize suppliers to acquire exploration assets and engage in direct production.

- Negotiating Leverage: The potential for supplier forward integration strengthens their bargaining power, potentially increasing costs or reducing service availability for Coterra.

Labor and Talent Pool Availability

The availability of a skilled labor force, encompassing engineers, geologists, and field technicians, directly impacts Coterra Energy's operational efficiency. A tight labor market can significantly amplify the bargaining power of these specialized workers, potentially driving up wage demands and increasing recruitment expenses for the company.

The oil and gas sector, including companies like Coterra Energy, has historically grappled with attracting and retaining top talent, making the labor pool a critical consideration. For instance, in 2023, the U.S. Bureau of Labor Statistics reported a shortage of skilled trades workers across various industries, a trend that likely affects the energy sector as well.

- Skilled Workforce Dependency: Coterra Energy relies heavily on specialized professionals for exploration, drilling, and production.

- Talent Shortage Impact: A limited supply of qualified personnel can lead to increased labor costs and operational delays.

- Wage Pressures: In competitive labor markets, the bargaining power of skilled workers can push wages higher, impacting Coterra's cost structure.

- Retention Challenges: The industry's cyclical nature and the demand for specialized skills can make retaining experienced employees a significant challenge.

The bargaining power of suppliers for Coterra Energy is considerable, primarily due to the specialized nature of oilfield services and equipment essential for exploration and production. When a few dominant firms control these critical offerings, they can dictate terms, leading to higher costs for Coterra. For example, in 2024, consolidation in the specialized oilfield services market increased the leverage of major players.

Suppliers with proprietary technologies, such as advanced drilling bits or seismic imaging tools, hold significant sway, as Coterra's success in basins like the Permian Basin depends on accessing these innovations. High switching costs, involving retraining and operational adjustments, further entrench suppliers' positions, making it financially burdensome for Coterra to change providers.

The potential for forward integration by suppliers, where they might move into direct resource extraction, also strengthens their negotiating stance. While not a pervasive threat, large service companies with substantial capital, like Schlumberger, could strategically acquire exploration assets, creating a competitive dynamic that Coterra must monitor.

Furthermore, a tight labor market for skilled professionals, a persistent issue in the energy sector, enhances the bargaining power of workers. The U.S. Bureau of Labor Statistics noted skilled trades shortages in 2023, impacting Coterra through increased wage demands and recruitment expenses.

| Factor | Impact on Coterra Energy | Example/Data Point (2024) |

|---|---|---|

| Supplier Concentration | Increased leverage for fewer service providers | Consolidation in specialized oilfield services market |

| Proprietary Technology | Limited alternatives for critical solutions | Advanced drilling bits, seismic imaging tools |

| Switching Costs | Financial and operational barriers to changing suppliers | Equipment reconfiguration, staff retraining |

| Potential Forward Integration | Risk of suppliers becoming competitors | Large energy service firms' financial capacity |

| Labor Market Tightness | Higher wage demands and recruitment costs | Skilled trades shortages impacting energy sector talent |

What is included in the product

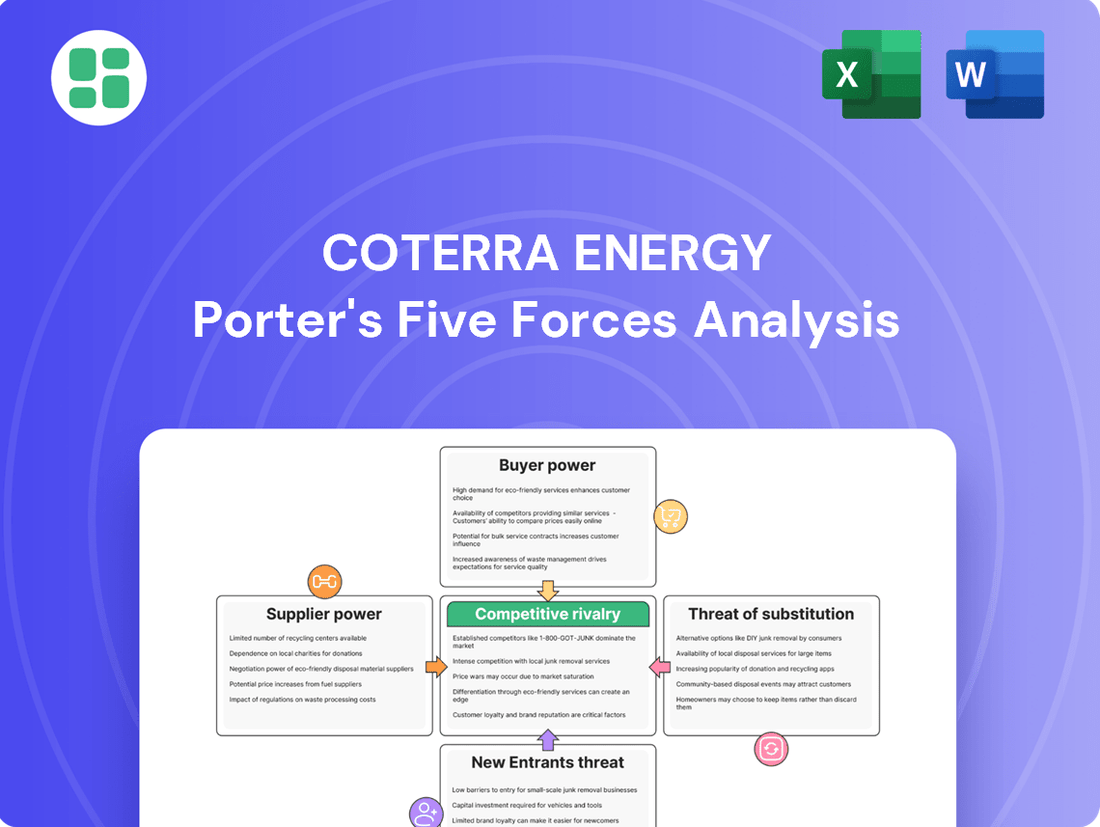

This analysis of Coterra Energy's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Visualize competitive intensity across all five forces with a dynamic, interactive dashboard, simplifying complex strategic pressures.

Customers Bargaining Power

The commodity nature of oil, natural gas, and natural gas liquids significantly enhances customer bargaining power. Because these products are largely undifferentiated, buyers often make decisions based almost exclusively on price. This lack of product differentiation means Coterra Energy has limited ability to charge premium prices, as customers can readily switch to competitors offering more favorable rates.

The market for these energy commodities is inherently volatile, driven by intricate supply and demand forces. For instance, in early 2024, fluctuations in global oil production and geopolitical events directly impacted pricing, giving buyers more leverage when negotiating purchase agreements. This price sensitivity underscores the reduced pricing power for producers like Coterra.

While Coterra Energy serves a broad customer base, including industrial users, local distribution companies, and power generators, the presence of a few very large buyers can significantly amplify their bargaining power. These major energy companies or substantial utility providers, by virtue of their immense purchase volumes, can negotiate for more advantageous pricing and contract terms. For instance, in 2023, Coterra's natural gas sales volumes averaged approximately 2.4 billion cubic feet equivalent per day, with a substantial portion likely coming from a limited number of key industrial and utility clients.

For many buyers of oil and natural gas, switching between suppliers is relatively straightforward once pipeline connections are established. This ease of transition means customers can readily compare prices and terms from different providers.

Unless Coterra Energy offers highly differentiated services or unique contractual benefits, customers face low switching costs. This lack of lock-in empowers buyers to seek the most competitive prices, directly impacting Coterra's pricing power and profit margins.

In 2024, the energy market saw continued volatility, with spot prices for natural gas fluctuating significantly. For instance, Henry Hub spot prices, a key benchmark, experienced periods of sharp decline and recovery throughout the year, driven by factors like weather patterns and storage levels. This environment further incentivizes buyers to switch suppliers for better deals.

Price Sensitivity and Market Transparency

The oil and gas sector, including Coterra Energy, operates with significant market transparency. Commodity prices for crude oil and natural gas are readily available, making it easy for buyers to compare. This accessibility directly translates into a high degree of price sensitivity among customers.

Because oil and gas are largely undifferentiated commodities, customers have little reason to pay a premium. They can easily switch suppliers if prices are not competitive. This dynamic means Coterra Energy must align its pricing with prevailing market rates.

- Price Transparency: Global benchmarks like West Texas Intermediate (WTI) and Henry Hub natural gas prices are widely published, offering clear visibility.

- Customer Price Sensitivity: In 2024, fluctuations in crude oil prices, for instance, impacting the cost of gasoline, directly influence consumer behavior and demand.

- Market Influence: Coterra Energy's revenue is heavily influenced by these transparent, globally traded commodity prices, which are subject to geopolitical events and supply-demand shifts.

Threat of Backward Integration by Customers

While direct consumers rarely possess the means, large industrial clients or energy utilities might explore backward integration by investing in their own oil and gas production assets. This is a significant capital undertaking, but the potential, however unlikely, grants substantial buyers negotiation leverage.

This threat compels Coterra Energy to maintain competitive pricing and service standards to retain its customer base.

- Threat of Backward Integration: Large industrial customers or utilities could theoretically invest in their own production facilities, a move requiring substantial capital.

- Customer Leverage: Even the remote possibility of backward integration grants significant buyers considerable negotiation power.

- Competitive Pressure: This threat necessitates Coterra Energy's commitment to competitive pricing and superior service delivery.

The bargaining power of Coterra Energy's customers is substantial, primarily due to the commodity nature of oil and natural gas. This means products are largely undifferentiated, leading buyers to focus almost exclusively on price. In 2024, volatile market conditions, such as fluctuating Henry Hub spot prices, further amplified this price sensitivity, compelling Coterra to maintain competitive pricing to retain its customer base.

Large industrial clients and utilities, by virtue of their significant purchase volumes, wield considerable negotiation leverage. The ease with which customers can switch suppliers, coupled with low switching costs for Coterra's products, means buyers can readily seek more favorable terms. For example, in 2023, Coterra's average daily sales of approximately 2.4 billion cubic feet equivalent per day likely included substantial volumes from a few key large buyers.

| Factor | Impact on Coterra's Customer Bargaining Power | 2024 Data/Context |

| Product Differentiation | Low (Commodity nature) | Oil and natural gas are largely undifferentiated, driving price-based decisions. |

| Switching Costs | Low | Relatively easy for customers to switch suppliers once pipeline infrastructure is in place. |

| Price Transparency | High | Benchmarks like WTI and Henry Hub prices are widely published, facilitating comparisons. |

| Customer Concentration | Moderate to High (for large buyers) | Large industrial and utility clients can negotiate based on volume. |

| Threat of Backward Integration | Low (but present for large buyers) | The theoretical possibility of customers investing in their own production grants negotiation leverage. |

Full Version Awaits

Coterra Energy Porter's Five Forces Analysis

This preview showcases the complete Coterra Energy Porter's Five Forces Analysis, providing a thorough examination of competitive pressures within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. This comprehensive analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing firms, all presented in the final version you are currently viewing.

Rivalry Among Competitors

The oil and gas sector, especially in prime areas like the Marcellus and Permian Basins, features a crowded field of independent and major energy firms. Coterra Energy competes with a mix of large publicly traded corporations and smaller, privately held businesses. This wide array of competitors fuels intense rivalry, as each seeks to capture market share, secure valuable resources, and attract skilled personnel.

While the Permian Basin continues to exhibit robust growth, the broader natural gas market, particularly in the Marcellus region, grappled with oversupply and subdued pricing throughout 2024. This dynamic creates intense rivalry as companies compete more fiercely for a limited pool of demand.

When growth slows or declines in certain segments, the competitive landscape intensifies. Companies are forced to adopt aggressive pricing and production strategies to secure market share, rather than focusing on expanding into new territories or developing innovative solutions.

The oil and natural gas industry, where Coterra Energy operates, is characterized by a high degree of product homogeneity. This means that the oil and gas produced by different companies are largely indistinguishable from one another. Consequently, price becomes the paramount factor in customer purchasing decisions, leading to fierce competition among producers.

This inherent interchangeability of products forces companies like Coterra Energy into intense price-based competition. To thrive in such an environment, Coterra must maintain exceptional operational efficiency and a lean cost structure. For instance, in the Permian Basin, a key operating area for Coterra, average drilling and completion costs for horizontal wells have seen fluctuations, but efficiency gains are critical. In 2024, many operators in the Permian reported continued focus on cost optimization, with some achieving well costs below $7 million for certain well types, a benchmark Coterra also strives to meet or beat.

High Fixed Costs and Exit Barriers

The upstream oil and gas industry, where Coterra Energy operates, is inherently capital-intensive. Companies must make massive investments in exploration, drilling, and the necessary infrastructure to extract and transport resources. These significant upfront expenditures create a high cost of doing business.

These substantial fixed costs, along with considerable sunk costs in existing exploration rights, wells, and pipelines, erect formidable exit barriers. Once a company has invested heavily, it is often more economical to continue operating, even in less favorable market conditions, rather than abandon these assets. This dynamic traps companies in the market, leading to intensified competition.

For instance, in 2024, the average cost to drill and complete a horizontal oil well in the Permian Basin, a key operating area for many, can range from $7 million to $10 million. These figures highlight the scale of investment required. Consequently, companies like Coterra are incentivized to maintain production and market share, contributing to a more aggressive competitive landscape.

- Capital Intensity: The oil and gas sector demands substantial capital for exploration, drilling, and infrastructure development.

- Sunk Costs: Significant investments in existing assets create high exit barriers, discouraging companies from leaving the market.

- Intensified Rivalry: High fixed costs and exit barriers compel firms to remain competitive even during industry downturns, intensifying rivalry among players.

Acquisition and Consolidation Activity

The oil and gas sector, especially U.S. shale, has been a hotbed for mergers and acquisitions. Companies are actively consolidating to achieve economies of scale and improve cost structures. This trend is reshaping the competitive landscape, as larger entities emerge.

Coterra Energy, for instance, has strategically pursued acquisitions to bolster its presence in the Permian Basin. This move is indicative of a broader industry strategy to gain market share and operational efficiencies. Such consolidation, while potentially reducing the sheer number of competitors, often results in the creation of more powerful, larger-scale rivals.

- Industry Consolidation: Significant M&A activity in U.S. shale oil and gas aims for scale and cost efficiencies.

- Coterra's Strategy: Coterra Energy has engaged in acquisitions to expand its Permian Basin operations.

- Impact on Competition: Consolidation reduces direct competitors but creates larger, more formidable rivals, altering the competitive dynamics.

The competitive rivalry within the oil and gas sector, where Coterra Energy operates, is notably intense due to a high degree of product homogeneity and significant capital requirements. This environment forces companies into price-driven competition, making operational efficiency and cost management paramount for survival and success.

In 2024, the natural gas market, particularly in regions like the Marcellus, experienced oversupply, intensifying rivalry as firms vied for limited demand. This pressure encourages aggressive pricing and production strategies, as seen with Permian Basin operators focusing on well costs below $7 million for efficiency gains.

Industry consolidation, driven by mergers and acquisitions, is creating larger, more formidable competitors. Coterra Energy's own strategic acquisitions in the Permian Basin exemplify this trend, aiming for market share and operational efficiencies, which in turn alters the competitive dynamics by producing stronger, larger-scale rivals.

| Factor | Description | Impact on Coterra Energy | 2024 Data/Trend |

|---|---|---|---|

| Product Homogeneity | Oil and gas products are largely indistinguishable. | Price becomes the primary differentiator, leading to intense competition. | Continued reliance on price as a key competitive lever. |

| Capital Intensity & Exit Barriers | High upfront investment in exploration, drilling, and infrastructure. | Companies are incentivized to maintain production and market share, fueling rivalry. | Average Permian Basin well costs ($7M-$10M) highlight ongoing capital demands. |

| Industry Consolidation | Mergers and acquisitions are common to achieve scale. | Creates larger, more powerful competitors, intensifying rivalry among major players. | Ongoing M&A activity reshaping the competitive landscape. |

SSubstitutes Threaten

The global push for decarbonization is a major threat from renewable energy sources. Solar and wind power, in particular, are becoming more cost-effective, supported by government incentives and ongoing technological improvements. For instance, in 2024, the International Energy Agency reported that renewable energy capacity additions reached record levels, further intensifying this competitive pressure.

The increasing adoption of electric vehicles (EVs) presents a significant threat by directly diminishing the demand for refined petroleum products, which are a core component of the energy market. By 2024, EV sales are projected to continue their upward trajectory, impacting the traditional gasoline and diesel markets that Coterra Energy serves.

Furthermore, advancements in energy efficiency across various sectors, from homes to factories, are steadily reducing the overall consumption of natural gas. This trend, coupled with the EV shift, creates a dual pressure on Coterra's long-term demand outlook for its primary products, oil and gas.

Emerging energy sources such as hydrogen fuel, advanced biofuels, and battery storage technologies are becoming increasingly viable substitutes for traditional oil and gas. While these alternatives are currently in their early stages, significant investment and rapid technological advancements are accelerating their market penetration.

For instance, global investment in clean energy reached a record $2 trillion in 2023, a substantial portion of which flowed into hydrogen and battery storage research and development. This trend suggests a growing potential for these substitutes to capture market share from hydrocarbon demand in the coming years.

Coterra Energy, like other players in the oil and gas sector, must closely track these evolving energy landscapes. A significant shift towards these substitutes could eventually impact demand for Coterra's core products, necessitating strategic adjustments to maintain competitiveness.

Policy and Regulatory Environment

Government policies, such as the Inflation Reduction Act of 2022, which offers significant tax credits for renewable energy projects, directly impact the competitiveness of substitutes for Coterra Energy's products. These policies can make clean energy alternatives more economically viable, thereby increasing their market penetration.

As regulatory frameworks increasingly favor a lower-carbon economy, they create a stronger incentive for the adoption of substitute energy sources. For example, the U.S. Environmental Protection Agency's proposed regulations on methane emissions from oil and natural gas facilities could increase operational costs for traditional energy producers, making alternatives more appealing.

The evolving policy landscape, including potential carbon taxes and stricter emissions standards, can accelerate the transition away from fossil fuels. This external pressure directly enhances the attractiveness and market share of substitute energy sources like solar, wind, and battery storage.

- Carbon Pricing: The potential for a federal carbon tax in the U.S., even if not yet enacted, serves as a significant threat, as it would directly increase the cost of fossil fuels relative to cleaner alternatives.

- Renewable Energy Incentives: Tax credits and subsidies for solar and wind power, like those extended by the Inflation Reduction Act, reduce the upfront cost and improve the return on investment for these substitutes.

- Emissions Regulations: Stricter regulations on methane and CO2 emissions from oil and gas operations can raise compliance costs for companies like Coterra, making it harder to compete with energy sources that have lower or no direct emissions.

- Corporate Sustainability Goals: Growing pressure from investors and consumers for companies to meet ESG (Environmental, Social, and Governance) targets encourages a shift towards renewable energy procurement, indirectly boosting substitutes.

Price-Performance Trade-off of Substitutes

The appeal of substitute energy sources hinges on their price-performance ratio relative to oil and natural gas. As renewable energy technologies mature, their costs are falling while their efficiency is rising, making them increasingly competitive. For instance, in 2023, the global average levelized cost of electricity from onshore wind and solar PV fell by 6% and 10% respectively, according to the International Renewable Energy Agency (IRENA).

This improving trade-off directly impacts Coterra Energy's profitability. If the company's oil and natural gas prices cannot effectively compete with the declining costs and enhancing capabilities of alternatives like solar, wind, or even advancements in battery storage, its market share and margins could face pressure. For example, the U.S. Energy Information Administration (EIA) reported that utility-scale solar PV generation increased by approximately 28% in 2023 compared to 2022.

The threat of substitutes is amplified by several factors:

- Technological Advancements: Continuous innovation in renewable energy technologies, such as more efficient solar panels and advanced battery storage solutions, improves their performance and reduces their cost.

- Government Policies and Incentives: Supportive government policies, including tax credits and subsidies for renewable energy, can further tilt the price-performance balance in favor of substitutes.

- Environmental Concerns: Growing societal and regulatory pressure to decarbonize the economy incentivizes the adoption of cleaner energy alternatives, making traditional fossil fuels less attractive.

The threat of substitutes for Coterra Energy primarily stems from the global energy transition, pushing for cleaner alternatives. Renewable energy sources, particularly solar and wind, are becoming increasingly cost-competitive, supported by government incentives and technological progress. For example, in 2024, renewable energy additions hit record highs globally, intensifying this competitive pressure.

The rise of electric vehicles (EVs) directly impacts demand for refined petroleum products, a core market for Coterra. By 2024, EV sales continue to grow, affecting traditional gasoline and diesel markets. Simultaneously, energy efficiency improvements across sectors reduce natural gas consumption, creating a dual threat to Coterra's core product demand.

Emerging energy technologies like hydrogen, advanced biofuels, and battery storage are becoming more viable. Global investment in clean energy reached $2 trillion in 2023, with significant portions directed towards hydrogen and battery R&D, indicating their growing potential to capture market share.

| Substitute Energy Source | Key Developments/Trends | Impact on Coterra Energy |

|---|---|---|

| Solar & Wind Power | Record capacity additions in 2024; falling levelized costs (e.g., 6-10% drop in 2023 for onshore wind/solar PV). | Direct competition for electricity generation, reducing demand for natural gas. |

| Electric Vehicles (EVs) | Continued upward trajectory in sales through 2024. | Decreased demand for refined petroleum products (gasoline, diesel). |

| Battery Storage | Significant investment in R&D; improved performance and cost-effectiveness. | Supports intermittent renewables, further displacing fossil fuels in power generation. |

| Hydrogen Fuel | Growing investment and technological advancements. | Potential long-term substitute for natural gas in industrial and transportation sectors. |

Entrants Threaten

The oil and gas exploration and production industry presents a formidable barrier to entry due to exceptionally high capital requirements. Companies like Coterra Energy, operating in prolific basins such as the Permian and Marcellus, necessitate substantial upfront investments. These investments cover everything from securing drilling rights and constructing essential infrastructure to meeting stringent environmental and safety regulations.

For instance, the cost of acquiring leases and drilling a single well can easily run into tens of millions of dollars, with extensive infrastructure development pushing these figures even higher. In 2023, the average capital expenditure per well for a major operator in the Permian Basin was reported to be upwards of $8 million, a figure that doesn't include midstream development or lease acquisition costs. This immense financial threshold effectively limits potential new entrants to only those with significant financial backing and access to substantial capital markets, thereby protecting established players like Coterra Energy.

New companies entering the oil and gas sector face significant hurdles in securing prime drilling locations. Established players like Coterra Energy often hold vast acreage in sought-after basins such as the Marcellus Shale and Permian Basin through leases and ownership. This control makes it difficult and expensive for newcomers to acquire commercially viable reserves or attractive drilling inventory, effectively limiting their ability to establish a competitive presence.

The oil and gas sector, including companies like Coterra Energy, faces significant regulatory hurdles. Stringent environmental regulations, complex permitting processes, and evolving safety standards are the norm, requiring substantial investment in compliance and expertise. For instance, in 2024, the U.S. Environmental Protection Agency continued to enforce regulations aimed at reducing methane emissions from oil and gas operations, a significant cost factor for any new player.

These compliance costs and the time required to navigate the regulatory landscape act as a substantial barrier to entry. New entrants must allocate considerable financial resources and expertise to meet these requirements, potentially facing lengthy delays in project development. This complexity discourages smaller or less capitalized companies from entering the market, thereby protecting established players like Coterra Energy.

Economies of Scale and Experience Curve

Established players in the energy sector, like Coterra Energy, leverage significant economies of scale. This translates to lower per-unit production costs due to bulk purchasing of materials and efficient utilization of existing infrastructure. For instance, in 2024, major oil and gas producers often reported lower operating expenses per barrel compared to smaller, newer operations.

The experience curve also acts as a formidable barrier. Coterra Energy, with years of operational history, possesses deep-seated knowledge in exploration, drilling, and production techniques. This accumulated expertise, often proprietary, allows for optimized efficiency and reduced risk, advantages that are difficult for new entrants to replicate quickly.

New entrants face a steep climb to match these cost and efficiency advantages. Without the benefit of scale or a mature experience curve, their initial operating costs are likely to be higher, making it challenging to compete effectively on price or profitability against established entities.

- Economies of Scale: Coterra Energy benefits from reduced per-unit costs in procurement and operations due to its size.

- Experience Curve: Years of operational knowledge and proprietary techniques provide Coterra Energy with efficiency advantages.

- New Entrant Disadvantage: Startups lack the scale and experience to match the cost-competitiveness of established firms.

Access to Distribution Channels and Infrastructure

Securing access to vital distribution channels and infrastructure presents a formidable barrier for new entrants in the oil and gas sector, directly impacting Coterra Energy's competitive landscape. The industry relies heavily on extensive pipeline networks, sophisticated processing facilities, and robust transportation infrastructure to move crude oil and natural gas from production sites to end markets. For instance, in 2024, the United States alone operated over 2.7 million miles of pipelines, a testament to the immense infrastructure investment required.

Existing, established players like Coterra Energy often possess significant advantages through their ownership or preferential access to these critical midstream assets. This established infrastructure grants them efficient and cost-effective means to transport their production, giving them a distinct edge. New companies entering the market would face substantial hurdles and considerable capital outlays to replicate or secure comparable access to the necessary infrastructure.

- Infrastructure Ownership: Established companies often own or have long-term leases on pipelines and processing plants, creating a significant cost barrier for new entrants.

- Transportation Costs: Without existing infrastructure access, new entrants face higher per-unit transportation costs, impacting their profitability and competitiveness.

- Regulatory Hurdles: Building new pipeline infrastructure involves complex permitting processes and regulatory approvals, which can cause significant delays and increase project costs.

- Market Access: Control over midstream assets can also dictate which producers gain access to premium markets, further disadvantaging new, unintegrated players.

The threat of new entrants for Coterra Energy is significantly low due to the immense capital required to enter the oil and gas exploration and production industry. Building out the necessary infrastructure, securing leases, and complying with regulations demand billions of dollars, a prohibitive cost for most potential newcomers. For example, in 2024, the average cost to drill and complete a horizontal well in the Permian Basin alone could exceed $10 million, not including the cost of acreage acquisition and midstream development.

Established players like Coterra Energy benefit from deep experience curves and economies of scale, which lower their per-unit production costs. New entrants would struggle to match these efficiencies, facing higher initial operating expenses. Furthermore, access to essential midstream infrastructure, such as pipelines and processing facilities, is often controlled by incumbents, creating a substantial barrier to market entry and efficient product delivery.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Coterra Energy is built upon a robust foundation of publicly available data, including SEC filings, annual reports, and investor presentations. We also incorporate insights from reputable industry research firms and financial news outlets to capture current market dynamics and competitive pressures.