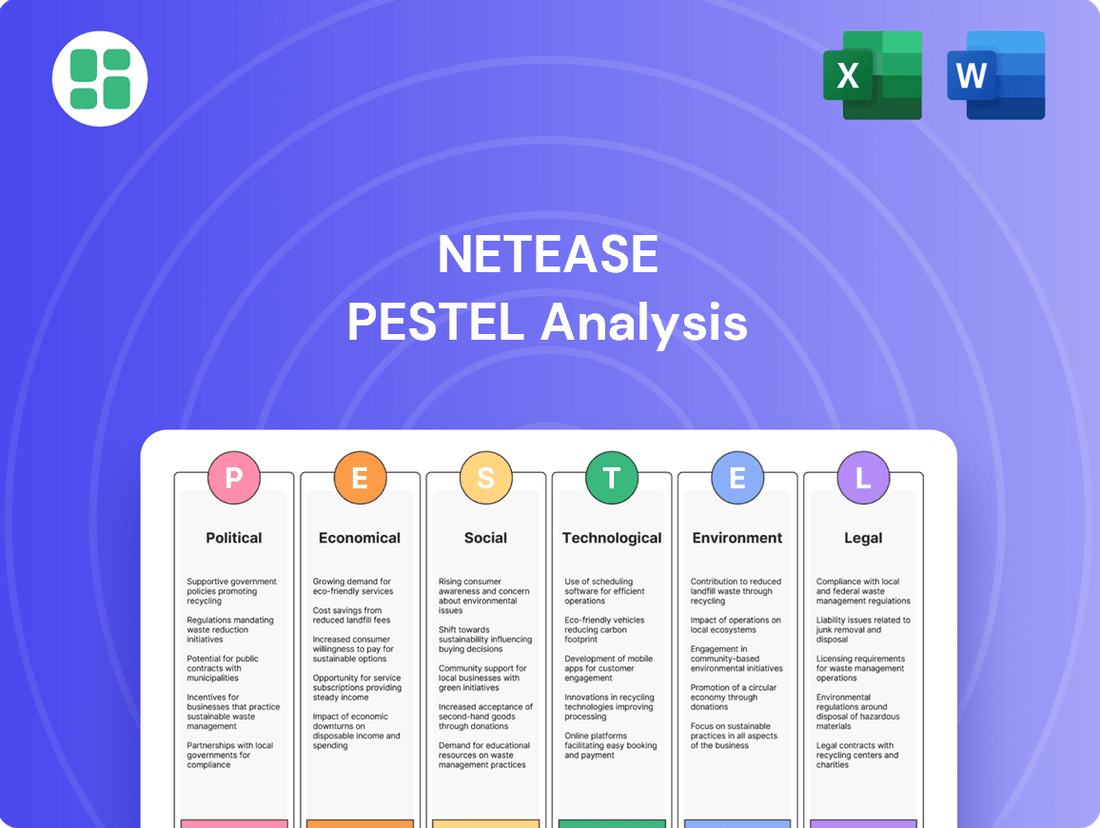

NetEase PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetEase Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping NetEase's future. This comprehensive PESTLE analysis provides actionable insights for strategic planning and investment decisions. Don't get left behind; gain a competitive edge by understanding the external landscape. Download the full version now for immediate access to expert-level intelligence.

Political factors

The Chinese government's stringent regulation of its online gaming sector, including content approval and playtime restrictions for minors, directly impacts NetEase's domestic operations. Recent measures, such as the Network Data Security Management Regulations effective January 1, 2025, underscore this ongoing oversight. These regulations, alongside continued scrutiny of in-game purchases and content, necessitate adaptive strategies for NetEase's game development and monetization models within China.

The Chinese government's stringent content regulations significantly impact online gaming. NetEase, like other publishers, must meticulously adhere to censorship guidelines, steering clear of politically sensitive themes, gambling, and content considered detrimental to public morality. This often translates to proactive content moderation within games, such as filtering specific phrases in chat functions, to ensure compliance and avert potential penalties.

New Network Data Security Management Regulations, effective January 1, 2025, will significantly alter how companies like NetEase manage user data. These regulations impose stricter guidelines on personal data protection and, crucially, cross-border data transfers, impacting operations that span international markets.

As a prominent internet platform, NetEase must meticulously ensure its data handling practices align with these evolving legal frameworks. The extra-territorial reach of these laws means that data pertaining to Chinese residents processed globally will also fall under these stringent rules, requiring a comprehensive review of all international data flows and storage practices.

Intellectual Property Protection Enforcement

China's commitment to strengthening intellectual property (IP) protection is a significant political factor for NetEase. While past enforcement has been inconsistent, recent years have seen a notable shift. For instance, China's Supreme People's Court has been increasingly active in hearing IP cases, signaling a more robust legal framework.

NetEase has directly benefited from these evolving trends, winning several high-profile copyright infringement lawsuits. These victories are critical for safeguarding its valuable game assets and preventing unauthorized replication, a core concern for its business model. The company's success in these legal battles underscores a more supportive environment for IP holders.

The ongoing efforts to enhance IP enforcement in China are crucial for NetEase's long-term strategy, particularly as it continues to invest heavily in game development and innovation. This trend is expected to continue, with further legislative and judicial reforms anticipated through 2025.

- Strengthening IP Laws: China has been actively revising its IP laws, with amendments aimed at increasing penalties for infringement and streamlining enforcement processes.

- Judicial Activism: Courts are showing greater willingness to award substantial damages in IP cases, providing a stronger deterrent against piracy.

- NetEase's Successes: NetEase reported winning multiple significant copyright infringement cases in 2023 and early 2024, protecting its intellectual property.

- Favorable Business Environment: The improved IP protection landscape is vital for NetEase's ability to monetize its creative content and attract international partnerships.

Government Support for Digital Economy and AI

The Chinese government's strong backing for its digital economy and advanced technologies, including Artificial Intelligence (AI) and cloud computing, creates a favorable landscape for companies like NetEase. This strategic focus is designed to drive national development and innovation, directly benefiting NetEase's investments in these cutting-edge sectors.

This political impetus translates into tangible support for NetEase's strategic initiatives. For instance, the government's emphasis on AI fuels the company's efforts in developing AI-enhanced gaming experiences and expanding its cloud service offerings, aligning with national technological ambitions.

- Government investment in AI research and development in China reached approximately $15.7 billion in 2023, signaling a significant commitment to the sector.

- China aims to become a global leader in AI by 2030, with policies encouraging domestic innovation and adoption across industries.

- The digital economy accounted for 39.2% of China's GDP in 2023, highlighting its critical role in economic growth and government priorities.

The Chinese government's regulatory stance on online gaming, including content approval and playtime limits for minors, significantly shapes NetEase's domestic operations. New data security regulations, effective January 1, 2025, further dictate data handling and cross-border transfers, impacting global operations.

China's strengthening of intellectual property (IP) protection is a key political factor, with courts increasingly awarding damages for infringement. NetEase has benefited from this trend, winning multiple copyright cases in 2023 and early 2024, securing its game assets.

| Factor | Description | Impact on NetEase | Data/Trend |

|---|---|---|---|

| Gaming Regulation | Government oversight on content and playtime. | Requires adaptive game development and monetization. | Network Data Security Management Regulations effective Jan 1, 2025. |

| IP Protection | Increased legal enforcement against infringement. | Safeguards game assets and revenue streams. | NetEase won multiple IP cases in 2023-2024. |

| Digital Economy Support | Government investment in AI and cloud tech. | Fuels innovation in AI-driven games and cloud services. | China's digital economy was 39.2% of GDP in 2023. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing NetEase across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable overview of external factors impacting NetEase, enabling proactive strategy adjustments and mitigating potential market disruptions.

Economic factors

China's economic trajectory is a critical driver for NetEase, as robust domestic growth directly fuels consumer spending, especially in digital entertainment. The gaming industry, a cornerstone for NetEase, has shown resilience, with forecasts pointing to continued expansion. For instance, China's GDP grew by an estimated 5.2% in 2023, supporting discretionary spending.

However, economic shifts and consumer sentiment can create volatility. Fluctuations in consumer confidence, potentially linked to factors like employment rates or inflation, can directly affect NetEase's revenue streams from its diverse offerings, including gaming, e-commerce platforms like Kaola, and music streaming services.

NetEase operates within a fiercely competitive digital entertainment landscape, contending with powerful domestic players like Tencent and a host of international game developers. This dynamic environment demands constant innovation and substantial marketing investment to capture and retain player attention.

The intense rivalry directly impacts NetEase's profitability, as significant resources are allocated to game development, user acquisition, and maintaining engagement. For instance, in 2023, the global gaming market was valued at approximately $184 billion, with China representing a substantial portion, underscoring the high stakes involved.

To navigate this competitive pressure, NetEase focuses on strategic partnerships and the continuous release of high-quality, engaging titles. This approach is crucial for maintaining market share and attracting new user bases in a sector where trends can shift rapidly.

NetEase is strategically expanding its global footprint, recognizing the critical need to diversify revenue beyond China. This push into overseas markets, particularly for its Game-as-a-Service (GaaS) offerings, is a key component of its long-term growth strategy.

The company faces significant hurdles in this expansion, including substantial upfront investment and navigating diverse cultural landscapes and regulatory environments. However, NetEase is committed to overcoming these challenges to tap into the vast global gaming market, which is projected to reach $256.7 billion in 2025, according to Newzoo.

NetEase's successful launch of titles like "Eggy Party" in Southeast Asia in 2023 demonstrates its growing capability in international markets. This expansion aims to capture a greater share of global gaming revenue, which saw significant growth in 2024, with mobile gaming continuing to be the dominant segment.

Impact of Regulatory Changes on Market Value

Sudden regulatory shifts in China, like proposed spending limits and content restrictions, can significantly impact investor confidence in gaming companies. For instance, in late 2023, news of potential new regulations caused a sharp decline in the stock prices of major Chinese gaming firms, with NetEase's stock falling by over 20% in a single trading day. This demonstrates the direct link between regulatory uncertainty and market value.

While some stringent proposals have been softened or withdrawn, the possibility of future regulatory adjustments continues to inject economic uncertainty into the sector. This creates a challenging environment for long-term financial planning and valuation for companies like NetEase. The unpredictability means investors must factor in potential policy changes when assessing future earnings and market capitalization.

- Regulatory Volatility: Proposed changes in 2023 led to significant stock price drops for Chinese gaming companies, highlighting investor sensitivity to policy shifts.

- Economic Uncertainty: The potential for future regulations creates an ongoing element of risk, impacting long-term investment strategies.

- Market Impact: Investor confidence is directly tied to the perceived stability of the regulatory landscape, influencing company valuations.

Diversification of Revenue Streams

NetEase's strategic diversification beyond its core gaming business significantly bolsters its economic resilience. The company's ventures into e-commerce, online music streaming via NetEase Cloud Music, and educational technology through Youdao create multiple avenues for revenue generation. This multi-pronged approach helps mitigate risks associated with over-reliance on any single market segment.

The financial performance of these non-gaming segments is crucial for NetEase's overall economic health. For instance, in Q1 2025, while gaming revenue continued to be the primary driver, contributions from other sectors demonstrated positive growth trends. This expansion into diverse digital services not only broadens the company's market reach but also enhances its ability to adapt to evolving consumer demands and economic shifts.

- NetEase Cloud Music: Continues to expand its user base and explore new monetization strategies, contributing to subscription and advertising revenues.

- Youdao: Leverages its online education platform to capture growth in the digital learning market, diversifying income streams with course fees and related services.

- E-commerce Initiatives: While smaller in scale, these ventures aim to capitalize on China's robust consumer spending, adding another layer to revenue diversification.

- Q1 2025 Financials: Highlighted the steady performance of these ancillary businesses, reinforcing their role in NetEase's economic stability.

China's economic growth directly impacts NetEase, with a projected GDP of 5.0% for 2024 supporting consumer spending in its key digital entertainment sectors. However, economic slowdowns or shifts in consumer confidence, influenced by factors like inflation, can affect revenue from gaming, e-commerce, and music streaming. NetEase's diversification into areas like NetEase Cloud Music and Youdao aims to create broader revenue streams, enhancing economic resilience.

| Metric | 2023 (Est.) | 2024 (Proj.) | 2025 (Proj.) |

|---|---|---|---|

| China GDP Growth | 5.2% | 5.0% | 4.8% |

| Global Gaming Market Value | $184 Billion | $200 Billion | $256.7 Billion |

| NetEase Revenue Diversification | Gaming Dominant | Growing Ancillary Revenue | Balanced Revenue Streams |

Same Document Delivered

NetEase PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive NetEase PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Chinese gamers' tastes are shifting, with a noticeable rise in demand for varied game genres. This includes a resurgence of interest in retro-style games, alongside a growing appetite for cross-media content and continued dominance of mobile gaming. NetEase needs to be nimble, adjusting its development and licensing approaches to align with these evolving preferences.

The demographic makeup of gamers is also broadening, with a significant and growing segment of female players and an average gamer age now around 35 years old. This demographic evolution presents both opportunities and challenges for NetEase, requiring a deeper understanding of diverse player motivations and gameplay expectations to maintain market relevance.

Societal concerns about gaming addiction, especially among younger players, have prompted governments to enact stringent rules on playtime and spending. For instance, China's regulations, implemented in 2021 and continuing into 2024, limit minors to three hours of online gaming per week, significantly impacting player engagement for companies like NetEase.

NetEase is therefore compelled to integrate advanced anti-addiction measures and real-name verification systems. This regulatory environment directly shapes game design, encouraging features that promote responsible play and influencing how user engagement is strategized to comply with these evolving societal expectations.

NetEase, like many Chinese gaming giants, is actively using its popular titles to facilitate cultural exchange. Games like Naraka: Bladepoint, which features historical Chinese figures, offer players worldwide a glimpse into Chinese culture, fostering understanding and connection. This approach is crucial for expanding their global reach beyond traditional markets.

By embedding culturally relevant narratives and gameplay mechanics, NetEase aims to create shared experiences that resonate across diverse player bases. This strategy not only enhances player engagement but also serves as a soft power tool, promoting cultural appreciation. For instance, in 2024, NetEase reported a significant increase in its international player base for its fantasy MMORPGs, indicating the success of its culturally inclusive content strategies.

Growth of Esports and Competitive Gaming

The rapid expansion of esports and competitive gaming is a major sociological shift, deeply embedding itself into modern culture. This trend offers substantial opportunities for NetEase, particularly in China where the market is booming. By investing in and nurturing esports titles, NetEase can significantly boost player engagement and attract a massive audience for spectating.

Globally, the esports market is experiencing explosive growth. For instance, the global esports market was projected to reach over $1.5 billion in 2023 and is expected to continue its upward trajectory, potentially exceeding $2.5 billion by 2027. This surge is fueled by increasing player participation and a growing viewership base. NetEase's strategic focus on developing and promoting its own esports titles, such as Identity V and Naraka: Bladepoint, directly taps into this powerful sociological phenomenon, creating avenues for revenue generation through in-game purchases, sponsorships, and broadcasting rights.

- Growing Esports Audience: The global esports audience reached approximately 530 million in 2023, with projections indicating further growth.

- Increased Investment: Sponsorships and media rights are key revenue streams, with significant investments from non-endemic brands entering the esports space.

- Mobile Gaming Dominance: Mobile esports, a strong area for NetEase, continues to be a dominant force, particularly in emerging markets.

- Content Creation Ecosystem: The rise of streamers and content creators further amplifies the reach and cultural impact of competitive gaming.

Influence of Social Media and Online Communities

NetEase Cloud Music's success is deeply intertwined with the social fabric of its platform. User-generated content, from song recommendations to fan discussions, fuels engagement. In 2023, the platform continued to see significant user interaction, with millions of daily active users contributing to playlists and comment sections, demonstrating the power of community in driving digital music consumption.

The influence of social media extends beyond the platform itself, with users actively sharing music and discussing artists on external networks. This social sharing amplifies NetEase's reach and contributes to the discovery of new talent. For instance, viral trends originating on platforms like Douyin often translate into increased listening on NetEase, highlighting the symbiotic relationship between social media and music streaming popularity.

- Community Engagement: NetEase Cloud Music fosters a strong sense of community through features like personalized recommendations and user-created playlists, encouraging active participation.

- Social Sharing Impact: External social media platforms significantly boost NetEase's content visibility and user acquisition through organic sharing of music and artist discussions.

- User-Generated Content Value: The platform's growth is substantially supported by user-generated content, including reviews, comments, and curated music lists, enriching the user experience.

Societal shifts are profoundly impacting NetEase's gaming and music ventures. The increasing demand for diverse game genres, including retro and cross-media content, alongside a broadening gamer demographic with a growing female player base and an average age nearing 35, necessitates adaptive strategies. Government regulations, such as playtime limits for minors implemented in 2021 and continuing through 2024, directly influence game design and user engagement models.

NetEase is leveraging its popular titles for cultural exchange, with games like Naraka: Bladepoint offering glimpses into Chinese culture, fostering global understanding and connection. This strategy is proving effective, as evidenced by a significant increase in NetEase's international player base for its fantasy MMORPGs in 2024. The burgeoning esports scene, with a global market projected to exceed $2.5 billion by 2027, presents substantial opportunities for NetEase to boost engagement and revenue through its esports titles.

NetEase Cloud Music thrives on community engagement, with millions of daily active users contributing to playlists and discussions, demonstrating the power of social interaction in driving music consumption. Viral trends on external social media platforms like Douyin significantly amplify NetEase's content visibility and user acquisition, highlighting a symbiotic relationship between social sharing and music streaming popularity.

| Sociological Factor | Impact on NetEase | Supporting Data/Trend (2023-2025) |

| Evolving Gamer Tastes | Demand for genre variety, retro games, cross-media content | Continued growth in mobile gaming; interest in diverse genres |

| Broadening Gamer Demographics | Increased female players, older average gamer age (approx. 35) | Need for inclusive game design and marketing |

| Gaming Regulations | Playtime limits for minors, anti-addiction measures | China's regulations (ongoing since 2021) impacting engagement |

| Cultural Exchange via Games | Soft power tool, global reach expansion | Increased international player base for titles like Naraka: Bladepoint (2024) |

| Esports Growth | Revenue generation, player engagement, viewership | Global esports market projected to exceed $2.5 billion by 2027; audience ~530 million (2023) |

| User-Generated Content (Music) | Community engagement, content discovery | Millions of daily active users on NetEase Cloud Music (2023) |

| Social Media Influence | Content amplification, user acquisition | Viral trends on platforms like Douyin driving music listening |

Technological factors

Artificial intelligence is becoming a cornerstone in game creation, influencing narrative design and character realism. NetEase is actively using AI to stand out technologically, enhancing player experiences through more dynamic and intelligent game worlds.

The company is also strategically positioned to capitalize on the burgeoning cloud gaming market, a significant focus within China's broader digital infrastructure expansion. In 2024, the global cloud gaming market was projected to reach $11.4 billion, with China being a major contributor to this growth.

Mobile gaming remains the undisputed king in China, consistently capturing a substantial majority of the gaming industry's revenue and user attention. This trend is expected to continue, with mobile platforms solidifying their dominance throughout 2024 and into 2025.

NetEase's strategic imperative to heavily invest in and refine its mobile game portfolio is paramount for sustaining its market-leading position. This focus directly addresses the pervasive smartphone penetration across China, ensuring the company remains relevant and competitive in a rapidly evolving digital landscape.

Virtual Reality (VR) technology is increasingly making its mark on China's entertainment landscape, particularly within the gaming industry. This trend presents a significant opportunity for NetEase as VR's integration into gaming experiences deepens.

Recognizing this potential, China's government has identified VR as a key industry in its Five-Year Plan, signaling strong support for its development. For NetEase, this translates into a clear pathway to explore innovative VR game development and actively contribute to building out the burgeoning metaverse ecosystem.

Data Center Infrastructure and Computing Power

NetEase's operations, spanning online gaming, music streaming, and e-commerce, are fundamentally dependent on a powerful and reliable data center infrastructure. This backbone supports the delivery of its vast array of digital services to millions of users.

The accelerating growth of China's data center capacity and computing power, significantly fueled by advancements in artificial intelligence (AI), presents a critical opportunity for NetEase. This expansion is vital for the company to effectively scale its services and continuously improve the user experience it offers.

- Data Center Growth: China's data center market is projected to see substantial growth, with investments in AI-driven infrastructure expected to reach hundreds of billions of dollars by 2025.

- Computing Power Demand: The demand for high-performance computing, essential for AI model training and deployment, is surging, with cloud providers significantly expanding their GPU capacities.

- NetEase's Infrastructure: NetEase operates its own data centers and leverages cloud services, requiring continuous investment to maintain and upgrade its computing resources to meet user demand and technological advancements.

Cybersecurity and Data Protection Technologies

NetEase faces escalating demands for advanced cybersecurity and data protection due to stringent regulations and the persistent threat of cyberattacks. The company must prioritize ongoing investment in technologies like robust encryption, multi-factor authentication, and sophisticated intrusion detection systems to shield user information and maintain regulatory adherence. For instance, China's Personal Information Protection Law (PIPL), fully effective in late 2021, imposes significant penalties for data breaches, underscoring the critical need for compliance.

The company's commitment to safeguarding user data is paramount, requiring comprehensive strategies that include regular security audits and the development of effective emergency response protocols. This proactive approach is essential for building and maintaining user trust in an era where data privacy is a significant concern. NetEase's continued success hinges on its ability to stay ahead of evolving cyber threats and adapt its technological defenses accordingly.

Key technological considerations for NetEase include:

- Enhanced Encryption: Implementing end-to-end encryption for sensitive user data across all platforms and services.

- Access Control Management: Utilizing granular access controls and zero-trust architecture principles to limit data exposure.

- Threat Intelligence: Investing in advanced threat intelligence platforms to proactively identify and neutralize emerging cyber threats.

- Incident Response: Developing and regularly testing comprehensive incident response plans to minimize damage from potential breaches.

NetEase is leveraging AI to enhance game development, focusing on realistic graphics and engaging narratives. The company's investment in AI is crucial for creating more immersive player experiences. Furthermore, NetEase is strategically positioned to benefit from China's expanding cloud gaming market, which saw significant growth in 2024.

Mobile gaming continues to dominate the Chinese market, with NetEase prioritizing its mobile game portfolio to maintain its leading position. The company's commitment to mobile gaming aligns with the high smartphone penetration in China. VR technology also presents a growing opportunity, with government support for its development in the gaming sector.

NetEase's operations rely heavily on robust data center infrastructure, which is being bolstered by China's AI-driven advancements. This expansion is vital for scaling services and improving user experience, with significant investments in AI infrastructure projected by 2025.

Cybersecurity is a critical concern, necessitating ongoing investment in advanced technologies to protect user data and comply with regulations like China's PIPL. NetEase must proactively manage cyber threats and implement strong data protection measures to maintain user trust.

Legal factors

NetEase must diligently adhere to China's National Press and Publication Administration (NPPA) regulations, which mandate licenses for all online game releases. This involves navigating complex approval procedures and complying with content restrictions, which are subject to ongoing updates, such as the evolving draft rules for online game management.

Laws like the Regulations on the Protection of Minors Online, effective October 1, 2024, impose strict playtime limits and real-name registration for minors, directly affecting NetEase's ability to engage younger players. This legislation requires NetEase to integrate robust anti-addiction systems and parental controls, which influences game design choices and how they approach acquiring younger users.

NetEase faces significant legal hurdles with the Network Data Security Management Regulations, effective January 1, 2025. These, along with existing laws like the Cybersecurity Law, Data Security Law, and PIPL, mandate stringent data handling practices, impacting how NetEase processes, stores, and transfers user information, especially across borders.

Anti-Monopoly and Unfair Competition Laws

China's commitment to fostering fair market competition is evident in its robust anti-monopoly and anti-unfair competition laws. These regulations actively shape how companies like NetEase conduct their business, aiming to prevent any single entity from dominating the market or engaging in predatory practices. NetEase, like all major players in the Chinese digital landscape, must navigate these legal boundaries diligently to maintain operational integrity and avoid potential sanctions.

The enforcement of these laws has significant implications for NetEase's strategic decisions. For instance, past regulatory actions against tech giants in China underscore the importance of adhering to fair competition principles. NetEase's business model, particularly its dominant position in areas like online gaming and its expansion into various digital services, means it is under scrutiny to ensure its practices do not stifle innovation or disadvantage smaller competitors. In 2023, the State Administration for Market Regulation (SAMR) continued its focus on platform economies, issuing fines and directives that set precedents for market behavior.

- Active Enforcement: China's anti-monopoly framework is actively applied, impacting market dynamics.

- Compliance Necessity: NetEase must comply with these laws to prevent legal repercussions and maintain market standing.

- Past Precedents: Regulatory actions against other tech firms highlight the seriousness of anti-monopoly enforcement.

- Market Fairness: The laws aim to ensure a level playing field, crucial for NetEase's continued growth and innovation.

Intellectual Property Rights and Copyright Enforcement

NetEase actively engages in legal battles concerning intellectual property (IP) rights, appearing as both a claimant and a potential respondent. This legal landscape underscores the critical role of IP in the competitive Chinese gaming market.

Recent successes in copyright infringement lawsuits demonstrate NetEase's commitment to safeguarding its creations. For instance, in 2023, NetEase secured significant damages in several high-profile cases, reinforcing the value of strong IP enforcement for game developers.

- NetEase's IP Litigation: The company is frequently involved in legal disputes, both initiating and defending against claims related to intellectual property.

- Copyright Enforcement Victories: Recent court rulings have favored NetEase in copyright infringement cases, underscoring the growing emphasis on IP protection within China's gaming sector.

- Industry Trend: These legal actions reflect a broader trend in the Chinese gaming industry where robust IP enforcement is becoming increasingly crucial for sustained growth and market position.

NetEase operates within a dynamic legal framework in China, with regulations significantly impacting its gaming and technology operations. The National Press and Publication Administration (NPPA) requires licenses for all online game releases, a process involving complex approvals and content restrictions that are subject to frequent updates, as seen with draft rules for online game management in 2024.

New legislation, like the Regulations on the Protection of Minors Online effective October 1, 2024, imposes strict playtime limits and real-name registration for minors. This directly influences NetEase's approach to younger demographics, necessitating robust anti-addiction systems and parental controls, which in turn shape game design and user acquisition strategies.

Furthermore, the Network Data Security Management Regulations, effective January 1, 2025, alongside existing laws such as the Cybersecurity Law and PIPL, mandate stringent data handling. These regulations affect how NetEase processes, stores, and transfers user information, particularly across international borders, requiring careful compliance to avoid penalties.

China's commitment to fair market competition, enforced through anti-monopoly laws, also shapes NetEase's business. The company must navigate these rules to prevent market dominance or unfair practices, a principle reinforced by past regulatory actions against tech giants. In 2023, the State Administration for Market Regulation (SAMR) continued its focus on platform economies, issuing directives that set precedents for market behavior.

NetEase is also actively involved in intellectual property (IP) litigation, highlighting the critical role of IP in the competitive gaming market. Recent successes in copyright infringement lawsuits in 2023, where NetEase secured significant damages, underscore the importance of strong IP enforcement for game developers.

Environmental factors

NetEase's vast online services necessitate a substantial network of data centers, making energy consumption a critical environmental consideration. These facilities are major users of electricity, directly impacting the company's carbon footprint.

The energy demands of data centers in China are on a sharp upward trajectory, with projections indicating a doubling of consumption by 2027. This trend places significant pressure on companies like NetEase to implement energy-efficient practices and align with China's ambitious green development goals.

China's commitment to environmental sustainability is significantly impacting the data center industry. By 2025, the government aims for data centers to achieve an average Power Usage Effectiveness (PUE) below 1.5, a substantial reduction from previous benchmarks. This push also includes a mandate to increase the use of renewable energy sources in powering these facilities.

NetEase, as a major player in the digital space, must actively integrate these green development targets into its infrastructure planning and daily operations. This means investing in energy-efficient cooling systems and exploring partnerships for renewable energy procurement to meet these evolving national environmental standards.

NetEase is increasingly weaving corporate social responsibility into its operations, particularly focusing on environmental sustainability. The company is using its popular gaming platforms to foster awareness and encourage player involvement in eco-friendly activities.

For instance, NetEase has supported afforestation projects, directly contributing to environmental restoration efforts. These initiatives are often amplified through in-game events and partnerships with environmental non-governmental organizations, broadening their reach and impact.

Resource Management and Waste Reduction

NetEase's environmental strategy extends beyond energy to encompass broader resource management. This includes scrutinizing water consumption, particularly within its data centers, and actively pursuing waste reduction initiatives across all operational facets. For instance, in 2023, China's data center water usage was estimated to be around 1.7 billion cubic meters, highlighting the significance of efficient water management for companies like NetEase.

The company is focused on meeting increasingly stringent efficiency standards for new projects. Furthermore, transforming existing infrastructure to align with these higher environmental benchmarks is a critical component of its sustainability roadmap. This commitment is crucial as global regulations on resource efficiency continue to tighten.

- Water Efficiency: Implementing advanced cooling systems and water recycling in data centers to minimize consumption.

- Waste Diversion: Targeting higher rates of recycling and reuse for electronic waste and operational byproducts.

- Circular Economy Principles: Exploring opportunities to integrate circular economy models into hardware lifecycle management.

- Supplier Engagement: Encouraging supply chain partners to adopt similar resource management and waste reduction practices.

Climate Change and Environmental Reporting

The growing global and domestic focus on climate change is driving a demand for clear and honest environmental reporting. Companies are increasingly expected to disclose their environmental impact and sustainability efforts.

NetEase has shown its understanding of these expectations by committing to releasing Environmental, Social, and Governance (ESG) reports. These reports often reference established international frameworks such as the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD).

This commitment signals NetEase's awareness of stakeholder concerns regarding its environmental footprint and its dedication to sustainable business practices. For instance, in its 2023 ESG report, NetEase highlighted efforts to reduce its carbon emissions intensity, aiming for a specific percentage reduction by 2025.

- NetEase's ESG Reporting: Commitment to transparency in environmental impact and sustainable practices.

- Adherence to Standards: Referencing SASB and TCFD frameworks to meet stakeholder expectations.

- Carbon Emission Goals: Specific targets for reducing carbon intensity, demonstrating proactive environmental management.

NetEase's environmental strategy is shaped by China's ambitious green development goals, particularly concerning data center efficiency and renewable energy adoption. The company is actively integrating these targets into its infrastructure planning, focusing on energy-efficient cooling and renewable energy procurement to meet evolving national standards.

The company's commitment to environmental sustainability is also evident in its CSR initiatives, leveraging gaming platforms to promote eco-friendly activities and supporting afforestation projects. This broader approach includes managing water consumption and waste reduction across all operations, aligning with national efforts to conserve resources.

NetEase demonstrates its dedication to transparency through ESG reporting, referencing frameworks like SASB and TCFD and setting specific carbon emission intensity reduction goals for 2025. This proactive environmental management addresses stakeholder concerns and reinforces its commitment to sustainable business practices.

| Environmental Focus | Key Initiatives/Targets | 2024/2025 Relevance |

|---|---|---|

| Data Center Efficiency | Achieve PUE below 1.5 (China mandate) | NetEase must invest in efficient cooling and infrastructure upgrades. |

| Renewable Energy | Increase renewable energy use in data centers | NetEase to explore partnerships for green energy procurement. |

| Carbon Emissions | Reduce carbon emission intensity | NetEase has set specific reduction targets for 2025. |

| Water Management | Efficient water usage in data centers | NetEase to implement advanced cooling and recycling systems. |

PESTLE Analysis Data Sources

Our NetEase PESTLE Analysis is meticulously constructed using a blend of publicly available financial reports, industry-specific market research, and official government publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing NetEase's operations.