NetEase Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetEase Bundle

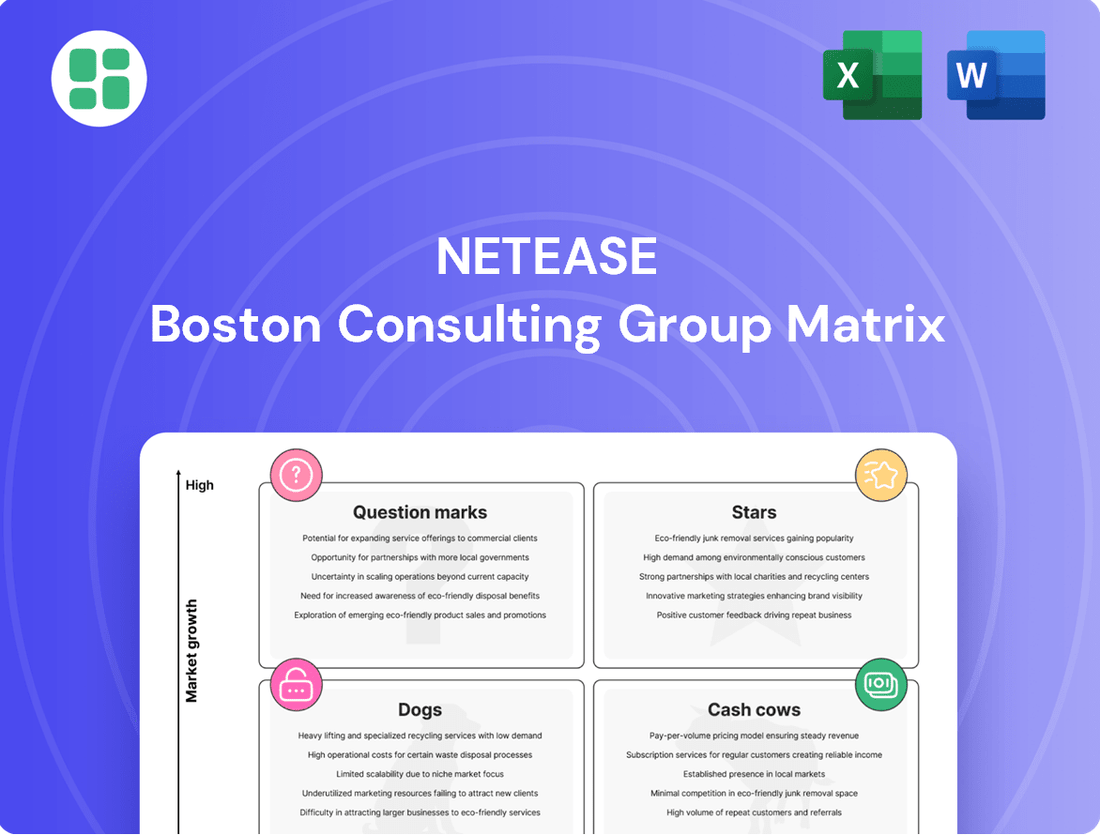

Curious about NetEase's strategic product positioning? This glimpse into their BCG Matrix reveals a dynamic mix of potential market leaders and established revenue generators. Understand which segments are poised for growth and which require careful management to optimize resource allocation.

Unlock the full NetEase BCG Matrix to gain a comprehensive understanding of their entire product portfolio. With detailed quadrant analysis and actionable insights, you'll be equipped to make informed decisions about investment, divestment, and future development strategies.

Don't miss out on the complete strategic blueprint. Purchase the full NetEase BCG Matrix report for a deep dive into each product's market share and growth potential, empowering you with the knowledge to navigate their competitive landscape effectively.

Stars

Marvel Rivals, a hero shooter released in December 2024, has made a significant impact, attracting over 40 million players by February 2025. This rapid user acquisition, coupled with its status as a global bestseller on Steam and a top performer on Twitch, highlights its strong market penetration and growth potential within the competitive gaming landscape.

The game's impressive player numbers and high engagement metrics position it as a star performer for NetEase, contributing substantially to the company's gaming revenue stream. Its success indicates a robust demand for high-quality, IP-driven multiplayer experiences.

Where Winds Meet, released in January 2025 for PC and mobile, is a martial arts action RPG that has quickly garnered over 15 million players. This impressive player base, coupled with its cross-platform synchronization, underscores its broad appeal and market penetration.

The game is projected to generate RMB 4 billion in revenue for 2025, a testament to its strong commercial performance and NetEase's successful product launch strategy. This financial outlook firmly places Where Winds Meet as a burgeoning star within NetEase's diverse gaming portfolio, demonstrating significant growth potential in the competitive gaming market.

NetEase's Blizzard licensed titles, including World of Warcraft and Overwatch 2, are positioned as Stars in the BCG Matrix. The company's strategic decision to re-establish its partnership with Blizzard Entertainment in late 2024 and early 2025 has demonstrably revitalized this segment, leading to sustained robust momentum among Chinese players.

These beloved games have rapidly recaptured significant market share within a highly competitive and in-demand segment of the gaming industry. This resurgence is a testament to the enduring appeal of Blizzard's intellectual property and NetEase's renewed operational capabilities in the Chinese market.

Eggy Party

Eggy Party, a standout title from NetEase, significantly boosted the company's mobile gaming revenue in the first quarter of 2024. This game demonstrates robust user engagement and a commanding presence in the casual and party game market.

Its sustained popularity highlights its position as a strong performer, likely categorizing it as a Star within NetEase's BCG Matrix.

- Market Dominance: Eggy Party has captured a significant share of the casual party game market.

- Revenue Driver: It was a key contributor to NetEase's Q1 2024 mobile gaming revenue growth.

- User Engagement: The game consistently maintains high user engagement, indicating strong player retention.

- Genre Strength: Its success solidifies its position as a leader within its specific gaming genre.

Justice Series (Mobile)

The Justice Series (Mobile) is a shining example of a star product within NetEase's portfolio. Its continued dominance in key Asian markets, including topping download and revenue charts in Hong Kong, Macau, and Taiwan in January 2025, underscores its significant market share and enduring appeal.

This mobile game’s strong performance is a testament to its robust gameplay and effective market penetration. In January 2025, it consistently held top positions on the App Store, indicating sustained player engagement and strong monetization.

- Market Leadership: Ranked number one in downloads and revenue in Hong Kong, Macau, and Taiwan as of January 2025.

- Sustained Popularity: Continues to attract a large player base, maintaining high engagement levels.

- Revenue Generation: Significant contributor to NetEase's mobile gaming revenue.

- Competitive Edge: Thrives in highly competitive Asian gaming markets, demonstrating strong brand loyalty.

Stars represent NetEase's most successful games with high growth and market share. Marvel Rivals, with over 40 million players by February 2025, and Where Winds Meet, attracting 15 million players by January 2025 and projecting RMB 4 billion in 2025 revenue, exemplify this category. Eggy Party's Q1 2024 revenue contribution and sustained engagement, alongside The Justice Series (Mobile)'s market leadership in key Asian markets in January 2025, further solidify their star status.

| Game Title | Release/Update Focus | Key Metrics (as of early 2025) | Market Position |

|---|---|---|---|

| Marvel Rivals | December 2024 | 40M+ players (Feb 2025), global bestseller on Steam | High growth, strong market penetration |

| Where Winds Meet | January 2025 | 15M+ players, projected RMB 4B revenue (2025) | High growth, significant revenue potential |

| Blizzard Titles (WoW, OW2) | Late 2024/Early 2025 Partnership Revitalization | Sustained robust momentum, recaptured market share | Strong existing IP, renewed engagement |

| Eggy Party | Q1 2024 Revenue Boost | Robust user engagement, leader in casual party games | High market share, consistent performer |

| The Justice Series (Mobile) | Ongoing Dominance | #1 downloads/revenue in HK, Macau, Taiwan (Jan 2025) | Market leadership, strong monetization |

What is included in the product

Strategic insights on NetEase's product portfolio, identifying units for investment, divestment, or maintenance based on market share and growth.

The NetEase BCG Matrix offers a clear, visual overview, relieving the pain of complex data analysis by placing each business unit in a quadrant.

Cash Cows

The Fantasy Westward Journey series stands as a prime example of a cash cow for NetEase. This franchise, a veteran in the gaming world, consistently delivers strong revenue streams. In fact, it achieved a new quarterly revenue record in the first quarter of 2024, underscoring its enduring financial power.

Despite operating in a mature market, the series maintains a dedicated player base, guaranteeing a stable and significant cash flow. This consistent performance means NetEase can rely on substantial income from Fantasy Westward Journey with minimal need for extensive new promotional investments.

The Westward Journey series is a significant revenue driver for NetEase, much like its other major titles. It benefits from ongoing content updates and a deeply engaged community, ensuring its continued profitability. This franchise operates in a stable, mature market where its strong brand recognition allows it to maintain a dominant position with relatively low investment needs.

Naraka: Bladepoint has been a significant driver of NetEase's PC revenue growth in 2024. This melee-focused battle royale has solidified its position in the PC gaming market, consistently bringing in substantial income. Its mature user base and stable growth prospects point to continued strong performance.

NetEase Cloud Music (Core Music Streaming)

NetEase Cloud Music's core online music streaming segment is a prime example of a Cash Cow within NetEase's business portfolio. In 2024, this segment experienced robust growth, with revenue climbing 23.1% year-on-year. This impressive performance was largely fueled by a steady increase in paid subscriptions, demonstrating the segment's ability to generate consistent cash flow.

As China's second-largest music streaming platform, NetEase Cloud Music benefits from a significant market share within a mature industry. This established position allows for efficient operations and strong cash generation through its well-entrenched subscription model. The company's focus on cost control further enhances the profitability of this segment.

- 2024 Revenue Growth: 23.1% year-on-year increase in core online music services.

- Key Revenue Driver: Growth attributed primarily to an expansion in paid subscriptions.

- Market Position: Second-largest music streaming provider in China, indicating a strong and stable market share.

- Profitability: Generates significant cash flow due to its subscription model and effective cost management.

Overall Mobile Games Portfolio (Established Titles)

NetEase's established mobile games are the backbone of its gaming empire, consistently generating substantial revenue. In 2024, this segment was responsible for a significant 72.7% of the company's total gaming revenue, underscoring its role as a primary cash cow.

These mature titles benefit from a large, loyal player base and well-honed monetization strategies. This consistent performance provides a stable and predictable income stream, essential for funding new ventures and research and development.

- Dominant Revenue Contributor: Established mobile games generated 72.7% of NetEase's gaming revenue in 2024.

- Mature Market Presence: These titles cater to a broad and consistent user base.

- Reliable Monetization: Proven strategies ensure steady income generation.

- Foundation for Growth: This segment provides financial stability for future investments.

Cash cows for NetEase are established businesses with a strong market presence that generate consistent, high profits with low investment. These ventures are crucial for funding other areas of the company, like question marks or stars. They benefit from a loyal customer base and mature market positioning, ensuring a steady cash flow.

| Business Segment | 2024 Revenue Contribution | Key Characteristics |

|---|---|---|

| Fantasy Westward Journey Series | Significant contributor to gaming revenue | Veteran franchise with a dedicated player base, achieved new quarterly revenue records in Q1 2024. |

| Established Mobile Games | 72.7% of total gaming revenue in 2024 | Mature titles with loyal players, providing stable income for new ventures. |

| NetEase Cloud Music (Core Online Music) | 23.1% year-on-year growth in 2024 | Second-largest music streaming platform in China, driven by paid subscriptions. |

Full Transparency, Always

NetEase BCG Matrix

The NetEase BCG Matrix preview you are viewing is the identical, fully polished document you will receive upon purchase. This means no watermarks, no placeholder text, and no alterations will be present in the final file, ensuring you get a complete and ready-to-use strategic analysis.

Dogs

Youdao's learning services segment, a key component of NetEase's business, faced significant revenue challenges. In the first quarter of 2025, this segment saw a revenue decrease of 16.1%, following a 9.5% drop in the fourth quarter of 2024.

This ongoing revenue contraction suggests Youdao is grappling with its position in the competitive edtech market. The company's focus on profitability and operational efficiency is evident, but the declining top-line performance in learning services points to difficulties in retaining or expanding its customer base amidst evolving industry demands.

NetEase Cloud Music's social entertainment services experienced a substantial revenue decline of 26.2% year-on-year in 2024. This downturn prompted NetEase to implement a more cautious operational strategy, redirecting its attention to its primary music streaming offerings.

The weak performance of this segment indicates a potentially low market share and limited growth prospects. Consequently, it presents as a potential candidate for divestiture or a significant reduction in operational focus to streamline resources.

Yanxuan, NetEase's private label consumer lifestyle brand, experienced a downturn in net revenues during the first quarter of 2025. This decline is particularly concerning given the highly competitive Chinese e-commerce landscape where larger players often dictate market trends.

With a seemingly low market share in this crowded sector, Yanxuan faces significant challenges in accelerating its growth trajectory. Its current performance suggests it may not be a top-tier strategic asset for NetEase, potentially positioning it as a question mark in the BCG matrix.

Advertising Services

NetEase's Advertising Services segment, while a part of its broader business, is positioned as a Question Mark in the BCG Matrix. This is due to a decline in net revenues observed in Q1 2025, signaling potential challenges. As a smaller segment within NetEase's diverse portfolio, it likely commands a low market share in the highly competitive digital advertising landscape.

Consequently, this segment's contribution to NetEase's overall growth and profitability is currently limited. The reduced revenue performance suggests that the advertising services may not be effectively capitalizing on market opportunities or facing significant competitive pressures.

- Decreased Net Revenues: Q1 2025 saw a dip in net revenues for the advertising services segment.

- Low Market Share: The segment likely holds a minor position within the overall digital advertising industry.

- Limited Growth Contribution: It does not significantly drive NetEase's expansion or financial success at present.

Legend of the Condor Heroes (Game)

Legend of the Condor Heroes (Game), developed by NetEase, was identified as facing significant challenges in January 2025. This suggests a decline in its market position and growth prospects.

The game's underperformance points to a low market share and limited growth potential, characteristic of a 'Dog' in the BCG Matrix. This classification implies that the title may not be generating substantial revenue or attracting a significant player base compared to its competitors.

- Market Share: Low, indicating it's not a dominant player in the MMORPG genre.

- Growth Rate: Minimal, suggesting limited appeal or increasing competition.

- January 2025 Challenges: Specific issues reported, likely impacting player retention and monetization efforts.

- Strategic Implication: May warrant a review of investment or a potential divestment strategy.

The Legend of the Condor Heroes (Game) is categorized as a 'Dog' within NetEase's BCG Matrix due to its challenging market position. This classification stems from its likely low market share and minimal growth prospects in the competitive gaming landscape.

The game's underperformance, highlighted by challenges reported in January 2025, suggests it is not a significant revenue generator or user acquisition driver for NetEase. This strategic position indicates a need for careful evaluation of continued investment or potential divestment.

The game's low market share and limited growth rate mean it contributes minimally to NetEase's overall portfolio performance. This situation often leads companies to consider reducing their focus on such assets to reallocate resources to more promising ventures.

This classification implies that the game may be facing intense competition or a decline in player engagement, making it a less attractive investment for future development or marketing efforts.

Question Marks

FragPunk, as a new entrant in the vibrant hero shooter market, embodies the Question Mark category within the NetEase BCG Matrix. This genre is experiencing robust growth, with the global gaming market projected to reach $321 billion by 2026, according to Statista. FragPunk’s positioning here signifies a high-potential but unproven product.

The game's current market share is minimal, reflecting its status as an upcoming title. Significant investment in marketing, content updates, and community building is crucial for FragPunk to differentiate itself in a competitive landscape and ascend to the Star category. For instance, major hero shooters often see substantial marketing budgets, with titles like Valorant reportedly having multi-million dollar launch campaigns.

Destiny: Rising, a mobile game developed by NetEase in collaboration with Bungie, is positioned as a potential star in the mobile gaming sector. Its target is the vast global market, aiming to capture a significant share of the rapidly growing mobile gaming industry.

While the Destiny intellectual property is strong, the game's market share is currently small. In 2024, the global mobile gaming market was valued at over $100 billion, and Destiny: Rising needs significant investment to capitalize on its high growth potential and establish a stronger foothold.

MARVEL Mystic Mayhem, a new tactical RPG for mobile, is poised to tap into the lucrative mobile RPG market by leveraging the immensely popular Marvel intellectual property. This segment is projected to reach $13.2 billion globally by the end of 2024, indicating substantial growth potential.

Despite the strong IP, MARVEL Mystic Mayhem is a nascent product with a currently low market share. This necessitates significant marketing and development investment to build brand awareness and capture a meaningful slice of this high-growth sector.

Once Human

Once Human, an ambitious supernatural open-world survival game, is positioned within a gaming genre experiencing significant player interest and rapid expansion. This suggests a high growth potential for the title.

However, as a relatively new entrant, Once Human requires substantial investment to build its player base and establish a strong market presence. This investment is crucial for overcoming initial market penetration challenges.

- Market Growth: The survival game genre has seen a steady increase in player engagement, with titles like Valheim and Rust demonstrating the genre's appeal. In 2024, the global gaming market is projected to reach over $200 billion, with PC gaming, where open-world survival often thrives, holding a significant share.

- Investment Needs: Developing and marketing a high-fidelity open-world game like Once Human demands considerable resources. Early-stage marketing, content updates, and community building are key to capturing market share in a competitive landscape.

- Early Stage Penetration: While the genre is popular, Once Human needs to differentiate itself to attract and retain players. This involves showcasing unique gameplay mechanics and a compelling narrative to carve out its niche.

New Single-Player Historical Game by 'Legend of the World' Team

Unveiled at the 2025 NetEase Games 520 press conference, this new single-player historical game from the 'Legend of the World' team signifies NetEase's strategic move into a potentially lucrative niche. The historical gaming segment, while not as dominant as some others, has shown consistent growth, with global revenue projected to reach $15.2 billion by the end of 2024.

As a new entrant, the game currently holds a minimal market share, reflecting its early stage of development and market penetration. NetEase's investment will be crucial for player acquisition and building a sustainable commercial footing in this competitive landscape.

- Market Position: New entrant, minimal current market share.

- Growth Potential: Targets the historically growing niche of single-player historical games.

- Strategic Imperative: Requires significant investment for player adoption and commercial viability.

- Industry Context: Historical gaming revenue expected to hit $15.2 billion globally in 2024.

Question Marks represent products with low market share in high-growth markets, demanding significant investment to increase their standing. These are often new ventures or products in emerging categories where NetEase is testing the waters.

The challenge for Question Marks is to convert their potential into market dominance, requiring strategic marketing and product development. Without this investment, they risk remaining in this category or becoming Dogs if the market growth slows.

The success of these ventures is crucial for NetEase's future portfolio, as they represent the potential Stars and Cash Cows of tomorrow.

| Product | Market Growth Rate | Current Market Share | Investment Strategy | Potential Outcome |

|---|---|---|---|---|

| FragPunk | High (Hero Shooter Genre) | Low | Aggressive Marketing, Content Updates | Star or Dog |

| Destiny: Rising | High (Mobile Gaming) | Low | Leverage IP, Targeted Marketing | Star or Dog |

| MARVEL Mystic Mayhem | High (Mobile RPG) | Low | IP Synergy, Aggressive User Acquisition | Star or Dog |

| Once Human | High (Survival Genre) | Low | Community Building, Gameplay Innovation | Star or Dog |

| 'Legend of the World' Historical Game | Moderate (Historical Niche) | Low | Niche Marketing, Content Depth | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide strategic insights.