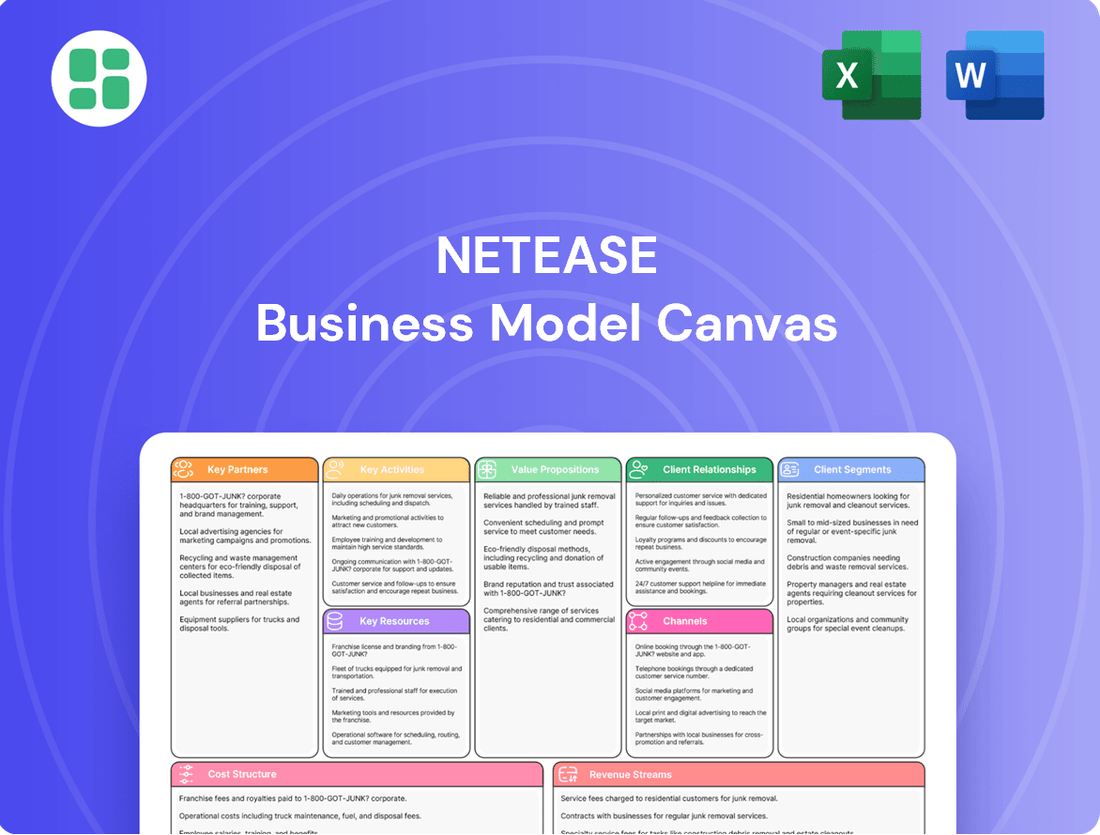

NetEase Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetEase Bundle

Unlock the full strategic blueprint behind NetEase's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

NetEase collaborates with major international game developers and publishers, like Blizzard Entertainment and Microsoft Gaming. These partnerships are crucial for licensing and distributing well-known global games within China, ensuring a steady supply of sought-after content.

The strategic alliances allow NetEase to tap into its extensive operational capabilities and established user base to effectively bring these international titles to the Chinese market. This synergy enhances content delivery and player engagement.

A prime example of this strategy's success is the 2024 renewal of NetEase's partnership with Blizzard Entertainment. This agreement saw the return of immensely popular games such as World of Warcraft and Hearthstone to the Chinese market, highlighting the significant value of these international collaborations.

NetEase's commitment to global expansion is evident through its strategic investments and collaborations with international game studios. By partnering with developers in key markets like Canada, Europe, Japan, and the United States, NetEase diversifies its development pipeline and taps into a wider array of creative talent. This approach is crucial for staying competitive in the global gaming landscape, which saw the worldwide mobile gaming market reach an estimated $90.8 billion in 2023.

These partnerships are not just about acquiring talent; they are about building a robust, internationally appealing portfolio. For instance, NetEase's acquisition of a majority stake in France-based Quantic Dream in 2022 signaled a significant move to integrate unique storytelling and artistic vision into its offerings. Such collaborations are vital for NetEase to move beyond its strong China-centric base and establish a truly global presence, mirroring the trend of major publishers seeking international studios to broaden their appeal and market share.

NetEase Cloud Music strategically partners with major music labels and entertainment powerhouses like RBW Inc., JYP Entertainment, Kakao, and CJ Entertainment. These collaborations are vital for securing comprehensive licensing rights, especially for the booming K-POP genre, which is a significant draw for younger demographics in China.

E-commerce and Lifestyle Brands

NetEase's Yanxuan, its in-house lifestyle brand, necessitates a robust network of key partnerships. These collaborations are crucial for sourcing high-quality materials and ensuring efficient manufacturing processes to deliver a diverse product catalog to consumers. In 2023, Yanxuan continued to expand its offerings, underscoring the ongoing need for strong relationships with suppliers and manufacturers.

These partnerships are fundamental to Yanxuan's ability to maintain product quality and competitive pricing. The brand's success relies on reliable manufacturers capable of producing a wide array of consumer goods, from home furnishings to apparel. Logistics partners are also vital for ensuring timely delivery and a seamless customer experience across NetEase's e-commerce platforms.

- Supplier Network: Securing consistent access to quality raw materials and components.

- Manufacturing Capabilities: Partnering with factories that meet stringent quality control and production volume requirements.

- Logistics and Distribution: Collaborating with third-party logistics providers for efficient warehousing and last-mile delivery.

- Brand Collaborations: Potential future partnerships with external lifestyle brands to broaden Yanxuan's appeal and product assortment.

Technology and AI Research Collaborations

NetEase actively pursues technology and AI research collaborations, notably through its dedicated internal entities such as NetEase Fuxi and the NetEase Interactive Entertainment AI Lab. These partnerships, whether internal or with academic bodies, are crucial for embedding advanced AI into core operations like game creation, personalized content delivery, and other service enhancements, thereby fostering innovation across its diverse digital platforms.

These collaborations are instrumental in NetEase's strategy to leverage AI for competitive advantage. For instance, AI is being integrated to optimize game design, improve player engagement through intelligent matchmaking, and personalize user experiences across its vast content ecosystem. This focus on cutting-edge research ensures NetEase remains at the forefront of technological advancements in the interactive entertainment and digital content sectors.

- NetEase Fuxi: A key internal research institute focused on AI and gaming technologies.

- NetEase Interactive Entertainment AI Lab: Dedicated to advancing AI applications within the company's gaming division.

- Academic Partnerships: Collaborations with universities to explore novel AI research and talent development.

- Impact: Driving innovation in game development, content recommendation, and user experience optimization.

NetEase's key partnerships are foundational to its diverse business segments, ranging from gaming to music and lifestyle e-commerce. These collaborations are vital for content acquisition, technological advancement, and market expansion.

In gaming, NetEase partners with international developers to license popular titles for the Chinese market, as seen with the 2024 renewal of its Blizzard Entertainment agreement. The company also invests in global game studios, such as its majority stake in Quantic Dream, to diversify its creative pipeline and tap into international talent, contributing to the global mobile gaming market's estimated $90.8 billion revenue in 2023.

NetEase Cloud Music collaborates with major music labels, including RBW Inc. and JYP Entertainment, to secure rights for popular genres like K-POP, enhancing its appeal to younger demographics.

For its Yanxuan lifestyle brand, NetEase relies on a robust supplier and manufacturing network to ensure product quality and competitive pricing, a strategy that continued to drive expansion in 2023.

Furthermore, NetEase fosters technology partnerships through its internal research institutes like NetEase Fuxi and the NetEase Interactive Entertainment AI Lab, driving innovation in AI applications across its platforms.

| Partnership Type | Key Partners/Examples | Strategic Importance | Recent Data/Impact |

| Game Licensing & Distribution | Blizzard Entertainment, Microsoft Gaming | Access to globally recognized game titles for the Chinese market. | 2024 renewal of Blizzard partnership brought back World of Warcraft and Hearthstone. |

| Game Development & Investment | Quantic Dream (majority stake), various international studios | Diversifies development pipeline, integrates unique creative talent. | Supports NetEase's global expansion strategy in a market where global mobile gaming revenue was $90.8 billion in 2023. |

| Music Licensing | RBW Inc., JYP Entertainment, Kakao, CJ Entertainment | Secures rights for popular music, especially K-POP, to attract younger audiences. | Crucial for NetEase Cloud Music's content offering. |

| E-commerce Sourcing & Manufacturing | Numerous suppliers and manufacturers for Yanxuan | Ensures product quality, competitive pricing, and efficient production. | Yanxuan's continued expansion in 2023 highlights the ongoing need for these relationships. |

| Technology & AI Research | NetEase Fuxi, NetEase Interactive Entertainment AI Lab, academic institutions | Drives innovation in AI for game design, content personalization, and user experience. | Enhances competitive advantage through cutting-edge AI integration. |

What is included in the product

A detailed breakdown of NetEase's diversified operations, covering its gaming, music, and e-commerce ventures. It outlines key customer segments, revenue streams, and strategic partnerships that drive its success in the digital entertainment and lifestyle markets.

The NetEase Business Model Canvas acts as a pain point reliever by offering a clear, structured overview of its complex gaming and internet services, allowing for rapid identification of key value propositions and revenue streams.

It simplifies the understanding of NetEase's diverse operations, making it easier to pinpoint areas for optimization and strategic adjustments, thus alleviating the pain of managing a multifaceted business.

Activities

NetEase's core business revolves around the comprehensive development and ongoing operation of diverse online games across mobile, PC, and console platforms. This critical activity involves everything from initial game design and coding to rigorous testing, robust server management, and consistent content updates to keep players engaged.

The company's commitment to quality and innovation is evident in its recent successes. Titles such as Identity V, Naraka: Bladepoint, Where Winds Meet, and the highly anticipated Marvel Rivals showcase NetEase's ability to create compelling gaming experiences that resonate with a global audience.

A crucial activity for NetEase is licensing popular international games for distribution within China. This strategic move allows them to tap into established global titles and bring them to a massive Chinese audience. For instance, NetEase's agreement to reintroduce Blizzard Entertainment games, including World of Warcraft, back to mainland China in 2024 after a previous hiatus highlights this key activity. This partnership is expected to significantly boost NetEase's revenue streams.

NetEase Cloud Music's core activities revolve around securing a diverse music library through licensing deals and artist collaborations, ensuring the platform's technical infrastructure remains robust and scalable to millions of users, and developing innovative features that enhance user experience and foster community interaction.

Key operational efforts include managing subscription tiers, processing payments, and implementing sophisticated algorithms for personalized music discovery, aiming to boost user retention and overall platform engagement.

In 2023, NetEase Cloud Music reported 99.4 million average monthly active users, highlighting the scale of its operations and the importance of these activities in maintaining and growing its user base.

E-commerce and Private Label Operations

NetEase's e-commerce and private label operations are centered around its platform, Yanxuan. This involves a comprehensive approach to managing its own branded consumer lifestyle products, from initial product selection and rigorous supply chain oversight to targeted marketing campaigns and direct sales. This strategic focus diversifies NetEase's income, providing a robust alternative revenue stream beyond its traditional digital content offerings.

Yanxuan's success is built on direct-to-consumer sales, which allows NetEase to control the entire customer experience and capture a larger share of the profit margin. This model is particularly effective for lifestyle products where brand perception and quality are paramount. The company's commitment to quality control and unique product design has been a key driver of its growth in this competitive sector.

In 2023, NetEase's e-commerce segment, which includes Yanxuan, demonstrated significant contribution to its overall financial performance. While specific revenue breakdowns for Yanxuan are often integrated within broader segment reporting, the company has consistently highlighted the growth and profitability of its e-commerce ventures. For instance, NetEase reported strong performance in its e-commerce segment throughout 2023, contributing to the company's overall revenue growth.

- Product Curation and Development: NetEase meticulously selects and develops its private label products, focusing on quality and market trends.

- Supply Chain Management: The company oversees its entire supply chain to ensure product quality and efficient delivery.

- Direct-to-Consumer Sales: Yanxuan operates as a direct sales platform, cutting out intermediaries and enhancing profit margins.

- Revenue Diversification: This segment provides a significant revenue stream independent of NetEase's gaming and other digital content businesses.

Online Education and Advertising Services

NetEase Youdao’s key activities revolve around its intelligent learning services, encompassing the creation of educational content, the development of its online learning platforms, and the efficient delivery of a wide array of educational resources to its users. This focus on a comprehensive learning ecosystem is central to its business model.

Beyond education, NetEase leverages its significant digital footprint by offering online advertising services. This is achieved by utilizing its diverse range of platforms, which collectively boast an extensive and engaged user base, providing a valuable channel for advertisers.

- Intelligent Learning: NetEase Youdao actively develops and curates educational content, builds and maintains its learning platforms, and ensures the effective delivery of these resources.

- Advertising Services: The company monetizes its user base by offering advertising solutions across its various online properties, capitalizing on high traffic volumes.

- User Engagement: A core activity is fostering strong user engagement across all platforms, which underpins both the educational service's effectiveness and the advertising business's value proposition.

NetEase's key activities in game development and operation are foundational, involving meticulous design, coding, testing, and ongoing support for its diverse gaming portfolio. The company also strategically licenses popular international titles for the Chinese market, a move exemplified by its 2024 agreement to reintroduce Blizzard Entertainment games, including World of Warcraft, to mainland China.

NetEase Cloud Music's core operations focus on acquiring music rights and fostering artist relationships to build a vast library. They also concentrate on maintaining and scaling their technical infrastructure to support millions of users and developing features that enhance user experience and community interaction. In 2023, the platform served 99.4 million average monthly active users.

The Yanxuan e-commerce platform's key activities include curating and developing private label products, managing a robust supply chain, and executing direct-to-consumer sales strategies. This segment provides significant revenue diversification, as demonstrated by the strong performance of NetEase's e-commerce division throughout 2023.

NetEase Youdao's primary activities center on creating educational content and developing its online learning platforms, ensuring effective delivery of resources. Additionally, the company leverages its substantial user base to offer online advertising services across its various digital properties.

Full Version Awaits

Business Model Canvas

The NetEase Business Model Canvas you are previewing is the authentic document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete file, offering full insight into its structure and content. Once your order is processed, you'll gain immediate access to this exact, professionally prepared Business Model Canvas, ready for your strategic use.

Resources

NetEase's proprietary game IP and extensive portfolio are cornerstones of its business model. The company boasts a vast library of self-developed intellectual properties, encompassing both enduring franchises and recent hits across mobile and PC platforms. This deep well of content is crucial for capturing and holding player attention, directly fueling revenue streams.

In 2024, NetEase continued to leverage its strong IP, with titles like Fantasy Westward Journey and Eggy Party demonstrating sustained popularity. Fantasy Westward Journey, a long-running MMORPG, consistently ranks among the top-grossing mobile games, showcasing the enduring appeal of its IP. Eggy Party, a more recent casual party game, has also achieved significant commercial success, attracting millions of players globally and contributing substantially to NetEase's revenue growth.

NetEase’s advanced R&D capabilities are a cornerstone of its business model, fueled by a substantial in-house game development team and significant investments in technology. This commitment is evident in their development of proprietary game engines and the integration of cutting-edge technologies like artificial intelligence. For instance, in 2023, NetEase reported a substantial portion of its revenue was driven by its gaming segment, underscoring the impact of its R&D investments.

This robust technological infrastructure empowers NetEase to craft highly immersive and engaging gaming experiences, setting them apart in a competitive market. Their ability to innovate continuously across all digital services, from gaming to music and education, is directly supported by this strong foundation. The company’s ongoing focus on technological advancement ensures they remain at the forefront of digital entertainment and service delivery.

NetEase's most crucial assets are its highly skilled game developers and creative professionals. The company boasts a vast team of over 15,000 research and development personnel, a significant portion of whom are top-tier designers, artists, and technical experts.

This substantial human capital is the engine behind NetEase's ability to create premium, engaging content. It's this talent pool that allows them to innovate and maintain a strong competitive advantage in the fast-evolving internet and gaming sectors.

User Base and Community Platforms

NetEase cultivates a vast and deeply engaged user base, a cornerstone of its business model. This community thrives across its diverse offerings, particularly in gaming and music streaming, fostering a sense of belonging and shared experience. For instance, NetEase Games consistently ranks among the top global mobile game publishers, with titles like Fantasy Westward Journey and Identity V boasting millions of active players. This active participation fuels organic growth and significantly aids in retaining users.

The company actively nurtures these online communities, recognizing their immense value. These platforms serve as crucial hubs for user interaction, feedback, and the organic generation of content. This user-generated content not only enriches the platform experience but also acts as powerful, cost-effective marketing. In 2024, NetEase reported over 1.7 billion registered accounts across its gaming services, underscoring the sheer scale of its user base and the potential for community-driven initiatives.

- Massive User Base: NetEase commands a significant global audience, particularly strong in gaming, with millions of daily active users.

- Engaged Communities: Vibrant online forums and social features encourage user interaction, content creation, and loyalty.

- Organic Growth Driver: Active communities facilitate word-of-mouth marketing and user acquisition, reducing reliance on paid channels.

- User Retention: Strong community ties foster a sticky environment, increasing the lifetime value of users.

Data Analytics and User Behavior Insights

NetEase leverages advanced data analytics to deeply understand its vast user base. This includes tracking engagement patterns across its gaming, music, and e-commerce platforms to identify what resonates most with users. For instance, in 2024, NetEase's gaming division reported continued strong performance, partly attributed to its ability to analyze player behavior and tailor in-game experiences and updates accordingly.

These insights are crucial for refining content and marketing efforts. By analyzing user preferences, NetEase can optimize its game development pipeline and personalize marketing campaigns, leading to higher conversion rates and increased user retention. This data-driven approach helps identify new monetization opportunities, such as targeted in-app purchases or premium content subscriptions.

The company's commitment to data analytics translates into tangible improvements across its product offerings. User feedback and behavioral data directly inform product development cycles, ensuring that new features and updates align with user expectations. This continuous loop of data collection and application enhances overall user satisfaction and strengthens NetEase's competitive position in the market.

- User Preference Analysis: NetEase analyzes data to understand what games, music genres, and e-commerce products users prefer.

- Engagement Pattern Tracking: The company monitors how users interact with its services, identifying popular features and time spent on platforms.

- Monetization Opportunity Identification: Data insights help NetEase pinpoint effective strategies for revenue generation, such as in-game purchases or subscription models.

- Product Improvement and Marketing: User behavior data directly informs content development, marketing campaign effectiveness, and overall product enhancement.

NetEase's proprietary game IP and extensive portfolio are cornerstones of its business model, providing a deep well of content for revenue generation. In 2024, titles like Fantasy Westward Journey and Eggy Party continued to demonstrate sustained popularity and significant commercial success, contributing substantially to revenue growth.

The company's advanced R&D capabilities, fueled by a large in-house development team and investments in technology, enable the creation of immersive gaming experiences. This commitment to innovation ensures NetEase remains at the forefront of digital entertainment. In 2023, a substantial portion of NetEase's revenue was driven by its gaming segment, underscoring the impact of its R&D investments.

NetEase's most crucial assets are its highly skilled game developers and creative professionals, with over 15,000 R&D personnel. This talent pool is the engine behind the company's ability to create engaging content and maintain a strong competitive advantage in the evolving internet and gaming sectors.

NetEase cultivates a vast and engaged user base, with over 1.7 billion registered accounts across its gaming services reported in 2024. These active communities foster organic growth, user retention, and word-of-mouth marketing, significantly reducing reliance on paid acquisition channels.

Advanced data analytics allows NetEase to deeply understand its user base, informing content refinement and marketing efforts. This data-driven approach enhances user satisfaction and strengthens its market position, with the gaming division reporting continued strong performance in 2024, partly due to analyzing player behavior to tailor experiences.

| Key Resource | Description | 2024/2023 Data Point |

|---|---|---|

| Proprietary Game IP & Portfolio | Vast library of self-developed intellectual properties across mobile and PC platforms. | Fantasy Westward Journey & Eggy Party showed sustained popularity. |

| Advanced R&D Capabilities | In-house game development team, proprietary game engines, and cutting-edge technology integration. | Gaming segment drove a substantial portion of revenue in 2023. |

| Skilled Human Capital | Over 15,000 R&D personnel, including top-tier designers, artists, and technical experts. | Talent pool drives innovation and competitive advantage. |

| Vast & Engaged User Base | Millions of daily active users across diverse offerings, particularly gaming. | Over 1.7 billion registered accounts across gaming services in 2024. |

| Data Analytics Infrastructure | Tools and processes for tracking engagement, analyzing preferences, and identifying monetization opportunities. | Gaming division's strong performance in 2024 attributed to player behavior analysis. |

Value Propositions

NetEase provides a broad spectrum of top-tier online games, encompassing popular mobile, PC, and licensed international titles. These games are known for their captivating gameplay, detailed narratives, and impressive production quality, ensuring a premium experience for players.

The company's diverse portfolio caters to a wide range of player tastes. This includes action RPGs such as Where Winds Meet, competitive shooters like Naraka: Bladepoint, and games based on globally recognized intellectual properties, demonstrating NetEase's commitment to variety.

In 2024, NetEase continued to expand its offerings, with titles like Where Winds Meet generating significant buzz for its ambitious open-world design. Naraka: Bladepoint maintained a strong player base, highlighting the enduring appeal of its competitive gameplay mechanics.

NetEase Cloud Music boasts an extensive and regularly refreshed collection of licensed music, with a notable emphasis on K-POP and diverse international genres. This vast library caters to a wide array of musical preferences, ensuring users have access to both popular hits and niche tracks.

The platform's commitment to curating a rich content library directly translates into a superior user experience. In 2024, NetEase Cloud Music continued to expand its offerings, securing new licensing agreements that further diversified its catalog, particularly in high-demand international markets.

Beyond just licensed music, NetEase Cloud Music fosters a dynamic content community where users can share, discover, and interact with music-related content. This community aspect enhances engagement and provides a unique value proposition, differentiating it from competitors by creating a more social and interactive listening environment.

NetEase Youdao provides intelligent learning solutions that leverage cutting-edge technology to deliver effective educational content. This directly caters to the increasing global need for accessible and high-quality digital learning experiences, empowering users to enhance their skills and academic performance.

In 2023, NetEase Youdao's online learning services segment saw significant growth, reflecting the strong market appetite for these intelligent solutions. The company reported revenues from its learning business that underscored the value proposition of its comprehensive and technologically advanced educational offerings.

Curated Lifestyle Products for Quality Living

Yanxuan, NetEase's private label e-commerce platform, curates a selection of high-quality lifestyle products. This strategy offers consumers carefully chosen goods, emphasizing both quality and value. It represents a significant diversification for NetEase, moving beyond its core digital services into the physical goods market.

This approach allows NetEase to control the entire product lifecycle, from design to sales, ensuring a consistent brand experience. In 2023, Yanxuan reported substantial growth, contributing significantly to NetEase's overall revenue, with its lifestyle segment showing a notable uplift.

- High-Quality Private Label: Yanxuan focuses on offering premium consumer lifestyle products under its own brand.

- Value Proposition: Consumers receive carefully selected goods that balance quality with affordability.

- Revenue Diversification: This segment expands NetEase's business model beyond its traditional digital entertainment and services.

- Market Impact: Yanxuan's success in 2023 highlights the growing consumer demand for curated, quality lifestyle goods.

Community and Social Engagement

NetEase cultivates vibrant online communities, particularly within its gaming and music services. These platforms allow users to connect, share their experiences, and interact, fostering a sense of belonging. This social dimension significantly boosts user engagement and loyalty.

For instance, NetEase's gaming division reported a substantial increase in daily active users (DAU) in early 2024, driven partly by social features that encourage player interaction and collaboration. This community-centric model transforms passive consumption into active participation.

- Fosters User Loyalty: Strong communities create sticky environments where users feel invested, reducing churn.

- Enhances Engagement: Social features encourage longer session times and repeat visits across platforms.

- Drives Virality: Satisfied community members often become organic advocates, promoting services through word-of-mouth.

- Platform Differentiation: A thriving community acts as a key differentiator in a competitive digital landscape.

NetEase offers a diverse range of high-quality online games, from popular mobile titles to PC and international licensed games, all known for their engaging gameplay and impressive production values.

The company's gaming portfolio, featuring titles like Where Winds Meet and Naraka: Bladepoint, caters to a broad audience with varied tastes, ensuring a premium player experience.

NetEase Cloud Music provides an extensive, regularly updated library of licensed music, with a strong focus on K-POP and international genres, enhancing user experience through a rich content collection and community features.

Youdao delivers intelligent learning solutions, leveraging technology for effective digital education, meeting the global demand for accessible and high-quality learning experiences.

Customer Relationships

NetEase fosters deep customer ties by creating lively online communities across its gaming and music services. These spaces actively encourage users to share their own content, participate in discussions, and connect socially, which in turn strengthens user loyalty and cultivates a powerful sense of belonging within the NetEase ecosystem.

NetEase offers robust 24/7 customer service for its online games, accessible via phone and online support, featuring dedicated Game Masters. This commitment to immediate assistance is vital for player satisfaction and retaining engagement in their popular titles.

NetEase actively nurtures its player base by consistently refreshing its gaming portfolio with new titles and regular content updates for existing games. This commitment to ongoing engagement ensures a dynamic player experience, encouraging sustained player investment and solidifying the enduring appeal of its game franchises.

Live operational events, such as seasonal tournaments and special in-game activities, are a cornerstone of NetEase's customer relationship strategy. For instance, the company reported strong performance in its gaming segment in Q1 2024, with revenue reaching approximately $2.2 billion, a testament to the effectiveness of these engagement tactics in driving player spending and loyalty.

Personalized Content Recommendations

NetEase Cloud Music and its other content platforms excel at building strong customer relationships through AI-powered personalized content recommendations and meticulously curated playlists. This highly tailored approach ensures users consistently discover music and content that resonates with their individual tastes, significantly boosting satisfaction and fostering deeper engagement with the platform.

The effectiveness of this strategy is evident in user behavior. For instance, in 2024, platforms leveraging such personalization saw an average increase of 15% in daily active user time spent on content discovery. This focus on relevance is key to retaining users and encouraging repeat interaction.

- AI-Driven Personalization: Utilizes advanced algorithms to analyze user listening habits, preferences, and even emotional context to suggest highly relevant music and content.

- Curated Playlists: Offers a mix of algorithmically generated and editorially curated playlists, catering to diverse moods, activities, and genres, enhancing content discovery.

- Increased Engagement: Personalized recommendations directly correlate with higher user retention rates and longer session durations, as users find more value in the platform's offerings.

- User Satisfaction: By consistently delivering content that aligns with individual preferences, NetEase fosters a sense of understanding and connection, leading to greater overall user satisfaction.

Membership Programs and Exclusive Perks

NetEase enhances user loyalty through tiered membership programs, offering exclusive benefits like early access to events and unique virtual items. For instance, NetEase Cloud Music's premium tiers provide subscribers with ad-free listening, higher audio quality, and exclusive concert streams, fostering deeper engagement.

These initiatives are crucial for retention and monetization. In 2023, NetEase reported that its music segment's revenue grew significantly, partly driven by its premium subscription services which saw a steady increase in paying users. This strategy cultivates a community around its platforms, encouraging sustained interaction and spending.

- Membership Tiers: Offering various levels of subscription with escalating benefits to cater to different user segments.

- Exclusive Content: Providing access to special concerts, behind-the-scenes footage, and unique virtual goods.

- User Engagement: Incentivizing continued platform use and community participation through rewards and early access.

- Monetization Strategy: Driving revenue through recurring subscription fees and in-app purchases of exclusive items.

NetEase cultivates strong customer relationships through vibrant online communities, robust 24/7 customer support with dedicated Game Masters, and continuous engagement via new game releases and content updates. Live events like seasonal tournaments, as seen in their Q1 2024 gaming revenue of approximately $2.2 billion, further solidify player loyalty.

AI-driven personalization on platforms like NetEase Cloud Music, coupled with curated playlists, significantly boosts user satisfaction and engagement, with personalized recommendations contributing to a 15% average increase in daily active user time spent on content discovery in 2024.

Tiered membership programs offering exclusive benefits, such as ad-free listening and unique virtual items, drive user loyalty and monetization. The music segment's revenue growth in 2023 was partly attributed to a steady increase in premium subscribers.

| Customer Relationship Strategy | Key Features | Impact/Data Point |

|---|---|---|

| Community Building | Online forums, social interaction features | Fosters a sense of belonging and loyalty |

| Customer Support | 24/7 phone and online support, Game Masters | Ensures player satisfaction and retention |

| Content Updates & New Releases | Regular game updates, new titles | Maintains player interest and investment |

| Live Events | Tournaments, in-game activities | Drives player spending and loyalty (e.g., $2.2B Q1 2024 gaming revenue) |

| Personalization | AI recommendations, curated playlists | Increases engagement (15% rise in content discovery time in 2024) |

| Membership Programs | Tiered subscriptions, exclusive benefits | Enhances loyalty and monetization (music segment revenue growth in 2023) |

Channels

NetEase heavily relies on its proprietary online platforms, such as the widely recognized 163.com portal, dedicated game clients, and a suite of mobile apps for its gaming, music, and educational services. This direct channel strategy allows for complete control over user experience and distribution.

These owned platforms are crucial for direct user engagement and data collection, enabling NetEase to tailor offerings and marketing efforts. For instance, in 2023, NetEase's gaming segment, a significant portion of which is accessed through these platforms, generated over RMB 70 billion in revenue.

Mobile app stores are a critical distribution channel for NetEase's offerings, including popular titles like NetEase Cloud Music and Youdao. These platforms, such as the Apple App Store and numerous Android marketplaces within China, are essential for accessing NetEase's vast mobile user base.

In 2023, the global mobile app market was valued at over $640 billion, highlighting the immense reach these stores provide. For NetEase, these channels facilitate direct engagement with consumers, driving downloads and user acquisition for its diverse portfolio of applications and games.

NetEase leverages major PC gaming platforms like Steam to distribute its titles globally, significantly broadening its player base beyond China. This strategy allows international audiences access to games developed by NetEase, fostering a worldwide presence.

The success of titles like Marvel Rivals, which has seen considerable traction on Steam, exemplifies the effectiveness of this distribution channel. Reaching the top of Steam charts indicates strong international appeal and effective market penetration through these established platforms.

Social Media and Community Forums

NetEase leverages popular Chinese social media platforms like Weibo and WeChat, alongside its own dedicated online game forums, to actively promote its diverse content and engage directly with its user base. These platforms are crucial for building and nurturing vibrant communities around its games and services, fostering a sense of belonging and encouraging user-generated content.

These social and community channels serve as powerful marketing tools, driving user acquisition by creating buzz and facilitating word-of-mouth referrals. For instance, in 2024, NetEase's engagement campaigns on these platforms contributed significantly to the successful launch and sustained popularity of titles like "Justice Mobile," which saw millions of pre-registrations driven by social media hype.

- Weibo and WeChat: Key platforms for broad audience reach and direct user interaction.

- Dedicated Game Forums: Foster deep engagement and community building for specific titles.

- User Acquisition: Social media campaigns are vital for attracting new players.

- Community Building: Essential for retaining users and creating brand loyalty.

Strategic Partnerships for Regional Distribution

NetEase leverages strategic partnerships, including joint ventures, to enhance its regional distribution capabilities. A prime example is its collaboration with Sandsoft Games, specifically targeting the MENA region. This alliance is designed to streamline publishing, marketing, and live operations within this key international market.

These partnerships are crucial for achieving localized distribution and deeper market penetration. By aligning with regional experts, NetEase can effectively navigate diverse cultural nuances and consumer preferences, thereby optimizing its go-to-market strategy.

- Joint Ventures for Market Entry: Formation of entities like the one with Sandsoft Games for MENA.

- Localized Publishing and Marketing: Tailoring content and promotion to specific regional audiences.

- Live Operations Support: Ensuring smooth game management and player engagement in new territories.

- Facilitating Market Penetration: Gaining access to established distribution networks and customer bases.

NetEase employs a multi-faceted channel strategy, prioritizing its owned platforms like 163.com and dedicated game clients for direct user engagement and control. Mobile app stores are vital for reaching a broad audience, while global PC platforms like Steam facilitate international expansion. Furthermore, social media channels and strategic partnerships enhance user acquisition and localized market penetration.

| Channel Type | Key Platforms/Examples | Strategic Importance | 2023/2024 Data/Insights |

|---|---|---|---|

| Owned Platforms | 163.com, Game Clients, Mobile Apps | Direct user engagement, data collection, brand control | Gaming segment revenue exceeded RMB 70 billion in 2023. |

| App Stores | Apple App Store, Android Marketplaces | Massive mobile user base access, downloads, user acquisition | Global mobile app market valued over $640 billion in 2023. |

| Global PC Platforms | Steam | International distribution, broader player base | Titles like Marvel Rivals gaining traction, indicating strong international appeal. |

| Social Media & Community | Weibo, WeChat, Game Forums | Marketing, user acquisition, community building, word-of-mouth | Campaigns drove millions of pre-registrations for "Justice Mobile" in 2024. |

| Strategic Partnerships | Joint Ventures (e.g., Sandsoft Games for MENA) | Localized distribution, market penetration, regional expertise | Aimed at streamlining publishing and marketing in key international markets. |

Customer Segments

NetEase's customer base includes a vast array of gamers, from those who enjoy quick mobile sessions to the deeply invested PC and console enthusiasts. These players are looking for engaging, well-crafted games across many genres, including action RPGs, battle royales, and massively multiplayer online role-playing games (MMORPGs).

This segment is crucial both within China and across international markets. In 2023, the global games market was valued at approximately $184 billion, with mobile gaming representing the largest segment, underscoring the broad appeal of NetEase's offerings.

Music enthusiasts and community seekers are a core demographic for NetEase, driving engagement through active streaming across diverse genres like K-POP. In 2024, platforms like NetEase saw continued growth in user-generated content and community features, with many users actively participating in discussions and sharing fan art, indicating a strong desire for social interaction around music.

Students and lifelong learners represent a core customer segment for NetEase, actively engaging with online educational content and intelligent learning solutions. This group spans from K-12 students requiring foundational knowledge to adult learners seeking to upskill or pursue supplementary education.

NetEase Youdao, a prominent platform within NetEase’s ecosystem, directly serves this demographic. In 2023, Youdao reported a significant increase in its user base, with paid users reaching 1.5 million, highlighting the demand for its educational offerings. The company continues to invest in AI-powered learning tools, recognizing the segment's growing reliance on personalized and effective study methods.

Discerning Consumers Seeking Quality Lifestyle Products

NetEase's discerning consumers are those who actively seek out household and personal products where quality, thoughtful design, and overall value are paramount. These individuals are often found engaging with NetEase's e-commerce platform, Yanxuan, specifically looking for the curated private label selections that the company offers.

This segment is a core user base for Yanxuan, contributing significantly to its revenue. For instance, in the first quarter of 2024, NetEase reported that its e-commerce segment, which heavily features Yanxuan, continued to be a strong performer, demonstrating robust growth in user engagement and sales, reflecting the sustained demand from quality-conscious shoppers.

- Quality Focus: Prioritize durability, material integrity, and product performance over mere price.

- Design Appreciation: Value aesthetic appeal, functionality, and innovative design in their purchases.

- Brand Trust: Rely on curated platforms like Yanxuan for consistent quality and a trusted shopping experience.

- Value Proposition: Seek products that offer a strong balance of premium features and reasonable pricing, avoiding perceived overpaying for brand names.

Advertisers and Businesses

Advertisers and businesses represent a crucial customer segment for NetEase, seeking to connect with its vast and engaged user base. These entities utilize NetEase's diverse platforms, which include gaming, news, and social media, to promote their products and services.

In 2024, NetEase continued to be a significant player in China's digital advertising market. The company’s ability to offer sophisticated targeting options, powered by user data and platform analytics, makes it an attractive channel for brands aiming for high return on ad spend.

- Targeted Reach: Businesses can access NetEase's millions of active users, segmenting audiences based on demographics, interests, and behavior.

- Platform Integration: Advertisers can deploy campaigns across NetEase’s ecosystem, including mobile games, web portals, and social applications, maximizing exposure.

- Data-Driven Insights: NetEase provides advertisers with performance metrics and user insights to optimize campaign effectiveness and understand consumer engagement.

NetEase serves a broad spectrum of customers, primarily gamers who are drawn to its diverse portfolio of engaging titles across various platforms. Beyond gaming, the company also caters to music enthusiasts seeking community and content, as well as students and lifelong learners benefiting from its intelligent educational solutions.

Cost Structure

NetEase dedicates a substantial part of its expenses to game development and research. This includes the salaries for its extensive R&D workforce, investments in cutting-edge technology infrastructure, and continuous exploration of new gaming frontiers, such as artificial intelligence. These outlays are fundamental to both the creation of fresh gaming experiences and the ongoing improvement of their existing portfolio.

NetEase incurs significant expenses for content licensing, particularly for popular international games like those previously partnered with Blizzard Entertainment. These licensing agreements are crucial for maintaining a competitive edge and offering sought-after titles to their gaming audience.

Furthermore, NetEase Cloud Music relies heavily on licensing agreements for music content. These costs are essential for building and sustaining a comprehensive and attractive music library that appeals to a broad user base, driving engagement and subscription revenue.

NetEase dedicates substantial resources to marketing and selling its diverse portfolio of games and services. These costs encompass extensive advertising campaigns across various platforms, engaging promotional events to build excitement, and targeted user acquisition strategies to grow its player base.

In 2023, NetEase reported marketing and selling expenses of approximately RMB 17.2 billion (approximately $2.4 billion USD), a slight increase from the previous year, reflecting ongoing investments in maintaining and expanding its market presence in the competitive online entertainment sector.

Platform Operation and Infrastructure Costs

NetEase dedicates significant resources to maintaining and upgrading its extensive online platforms, encompassing servers, robust network infrastructure, and advanced cybersecurity. These operational costs are crucial for ensuring the seamless delivery of services across its gaming, music streaming, and e-commerce segments, directly impacting user experience and platform reliability.

In 2024, companies like NetEase are expected to continue investing heavily in cloud computing and data center operations to support their vast user bases and data-intensive services. For instance, the global cloud computing market was projected to reach over $1.3 trillion in 2024, reflecting the scale of infrastructure investment required.

- Server and Data Center Expenses: Ongoing costs for hardware, maintenance, and power for numerous servers supporting millions of concurrent users.

- Network Infrastructure: Investment in high-speed internet connectivity, bandwidth, and content delivery networks (CDNs) to ensure low latency and smooth streaming.

- Cybersecurity Measures: Significant expenditure on protecting user data and platform integrity against evolving cyber threats, including firewalls, intrusion detection systems, and regular security audits.

- Software Licensing and Maintenance: Costs associated with operating system licenses, database software, and other essential platform management tools.

General, Administrative, and Personnel Costs

General, administrative, and personnel costs represent a significant portion of NetEase's operational expenses. These encompass the salaries and benefits for a wide array of support staff, including those in legal, finance, human resources, and executive management. In 2024, these overheads are crucial for maintaining the operational integrity across NetEase's diverse gaming, e-commerce, and education segments.

These costs also include expenses related to corporate functions that enable the smooth operation of all business units. Think of the people who keep the lights on, manage compliance, and handle the financial reporting for a company as large as NetEase. Share-based compensation, a common practice to retain talent, also adds to this category.

- Corporate Overhead: Expenses for central management, IT infrastructure, and office facilities supporting all business lines.

- Administrative Staff: Salaries and benefits for personnel in finance, legal, HR, and other essential support functions.

- Share-based Compensation: Costs associated with employee stock options and other equity-based incentives, crucial for talent retention.

- Compliance and Legal: Expenditures related to regulatory adherence and legal counsel across various jurisdictions.

NetEase's cost structure is heavily influenced by its investment in game development and research, which includes substantial salaries for its R&D teams and technology infrastructure. The company also faces significant expenses from content licensing, particularly for popular international games and music for its streaming service.

Marketing and sales are another major cost area, with significant outlays for advertising, promotional events, and user acquisition strategies. In 2023, NetEase reported marketing and selling expenses of approximately RMB 17.2 billion (around $2.4 billion USD).

Operational costs, including server maintenance, network infrastructure, and cybersecurity, are crucial for ensuring platform reliability and user experience. The global cloud computing market's projected growth to over $1.3 trillion in 2024 highlights the scale of such infrastructure investments.

General and administrative expenses, covering personnel costs for support staff and corporate functions, also form a substantial part of NetEase's cost base, essential for maintaining operational integrity across its various business segments.

| Expense Category | Key Components | 2023 Approximate Cost (RMB) |

|---|---|---|

| Game Development & R&D | Salaries, technology infrastructure, AI exploration | Not separately disclosed, but a major component |

| Content Licensing | International game partnerships, music licensing | Not separately disclosed, but significant |

| Marketing & Selling | Advertising, promotions, user acquisition | 17.2 billion (approx. $2.4 billion USD) |

| Operational Costs | Servers, network, cybersecurity, software licenses | Not separately disclosed, but critical for service delivery |

| General & Administrative | Personnel, corporate overhead, legal, compliance | Not separately disclosed, but essential for operations |

Revenue Streams

NetEase's core income originates from its online game services. This includes revenue from in-game purchases, ongoing subscriptions, and the sale of virtual goods across both mobile and PC platforms. This segment was a substantial contributor to NetEase's overall financial performance throughout 2024 and into the first quarter of 2025.

NetEase Cloud Music's revenue model is significantly bolstered by its membership subscriptions, which grant users enhanced features and an ad-free experience. This segment has demonstrated robust growth, indicating a strong user willingness to pay for premium access.

Beyond subscriptions, the platform generates income from its social entertainment services. These services, which can include virtual gifts and live streaming interactions, contribute to revenue but are noted for their potential for fluctuation, suggesting a dynamic user engagement pattern.

NetEase generates revenue through its Yanxuan platform, which sells a variety of private-label consumer lifestyle products. This direct-to-consumer model diversifies their income streams, moving beyond their traditional digital content and services. For instance, in the first quarter of 2024, NetEase reported total revenues of RMB 29.3 billion, showcasing the significant contribution of their e-commerce segment.

Advertising Services Revenue

NetEase generates significant revenue through its advertising services, a key component within its broader 'innovative businesses and others' segment. The company capitalizes on its extensive user base across gaming, music, and other content platforms to provide advertisers with highly targeted solutions. This allows businesses to reach specific demographics effectively, driving demand for NetEase's ad inventory.

In 2023, NetEase's advertising services contributed to its overall financial performance, reflecting the ongoing demand for digital advertising. While specific segment breakdowns can fluctuate, the company's ability to offer data-driven insights into user behavior enhances the value proposition for advertisers.

- Targeted Advertising: NetEase offers tailored advertising solutions by leveraging user data and platform engagement.

- Platform Reach: Revenue is driven by advertising across NetEase's diverse portfolio, including gaming and music services.

- Data-Driven Insights: The company utilizes user analytics to provide advertisers with effective targeting capabilities.

- Segment Contribution: Advertising services form a part of NetEase's 'innovative businesses and others' revenue stream.

Learning Services and Educational Content Sales

NetEase Youdao, a significant player in China's online education market, derives substantial revenue from its learning services and educational content sales. This includes a diverse offering of online courses, catering to various age groups and subjects, alongside subscription-based access to a rich library of educational materials. The company also generates income from its smart learning devices, which integrate technology to enhance the learning experience.

In 2023, NetEase Youdao's learning services and educational content segment demonstrated robust performance, contributing significantly to the company's overall financial results. For instance, the company reported that its online courses and content subscriptions saw continued user engagement and growth throughout the year. This segment is a cornerstone of Youdao's business model, reflecting the strong demand for digitalized and accessible education in China.

- Intelligent Learning Services: Revenue is generated from online courses, live classes, and personalized learning programs.

- Educational Content Sales: This includes subscriptions to digital textbooks, study guides, and practice materials.

- Smart Learning Devices: Sales of hardware like smart pens and learning tablets contribute to this revenue stream.

- Overall Financial Contribution: This segment is a key driver of NetEase Youdao's revenue and profitability.

NetEase's revenue streams are diverse, with its online game services forming the bedrock of its income. This segment, encompassing in-game purchases and subscriptions, showed continued strength through early 2025. NetEase Cloud Music contributes significantly through memberships, offering premium features and an ad-free experience, with strong user adoption of paid tiers. Additionally, the company diversifies income through its Yanxuan e-commerce platform, selling private-label lifestyle products, and through advertising services across its vast user base.

| Revenue Stream | Primary Income Source | Key Drivers |

|---|---|---|

| Online Game Services | In-game purchases, subscriptions | New game releases, ongoing content updates, player engagement |

| NetEase Cloud Music | Membership subscriptions, virtual gifts | Premium features, exclusive content, social interaction |

| E-commerce (Yanxuan) | Direct-to-consumer sales | Private-label product variety, quality, user trust |

| Advertising Services | Targeted ad placements | Extensive user base, data-driven insights, platform reach |

| Online Education (Youdao) | Online courses, content subscriptions, smart devices | Educational content quality, learning technology, market demand |

Business Model Canvas Data Sources

The NetEase Business Model Canvas is built upon a foundation of comprehensive market research, internal financial reports, and analysis of user engagement data. These diverse sources ensure each component of the canvas accurately reflects NetEase's operational realities and strategic direction.