NetEase Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetEase Bundle

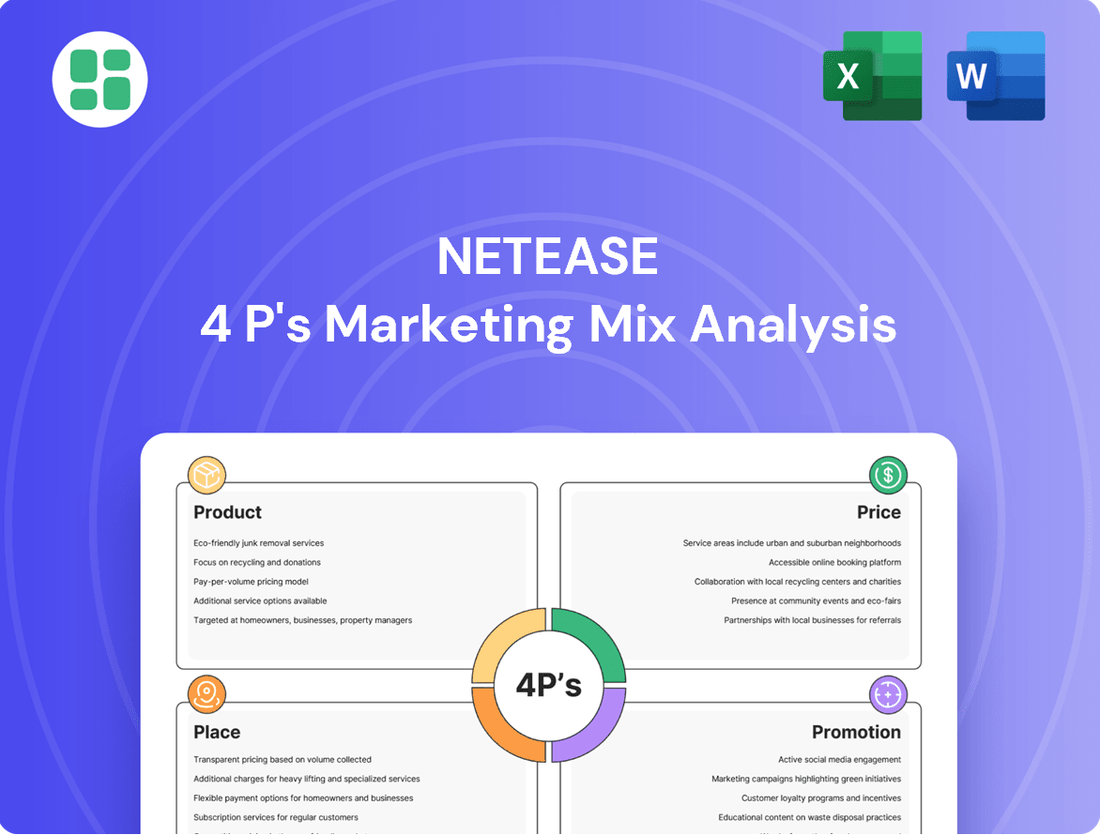

Discover the core strategies behind NetEase's market dominance, from their innovative product portfolio to their dynamic pricing and distribution. See how their promotional efforts resonate with a global audience, creating a powerful brand presence.

Ready to unlock the full picture? Get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for NetEase. Ideal for business professionals, students, and consultants seeking strategic insights.

Product

NetEase's diverse gaming portfolio is its cornerstone, featuring a wide array of self-developed and licensed titles across mobile and PC platforms. This includes long-standing successes like the 'Fantasy Westward Journey' series and newer ventures such as 'Marvel Rivals' and 'Where Winds Meet', showcasing a commitment to both established franchises and emerging markets.

NetEase's product strategy centers on robust multi-platform game development, spanning mobile, PC, and current-generation consoles like the PlayStation 5 and Xbox Series X/S. This approach significantly broadens the accessibility of their titles, catering to a diverse player base regardless of their preferred gaming hardware.

By leveraging specialized in-house R&D teams, NetEase is adept at crafting high-quality gaming experiences tailored for each platform. This focus on cross-platform excellence enhances user reach and deepens market penetration, a key factor in their continued growth. For instance, in the first half of 2024, NetEase reported a 10.4% year-over-year increase in net revenue, partly driven by the success of their multi-platform offerings.

NetEase extends its reach far beyond gaming, offering a robust ecosystem of integrated digital services. Key among these are NetEase Cloud Music, a leading music streaming service, and Youdao, which provides educational technology and advertising. The company also operates Yanxuan, a successful private label e-commerce platform.

This diversification strategy allows NetEase to tap into multiple revenue streams and solidify its presence across various aspects of users' digital lives. For instance, NetEase Cloud Music reported over 1 billion yuan in revenue for the first half of 2023, showcasing the significant financial contribution of its non-gaming ventures.

Focus on Premium Content and User Experience

NetEase prioritizes delivering premium content, evident in the sophisticated graphics and compelling narratives of its gaming portfolio, and the vibrant community fostered within NetEase Cloud Music. This dedication to quality aims to captivate and retain users by offering a superior entertainment and social experience.

Significant investments in research and development are channeled into enhancing user experience. NetEase actively integrates advanced features designed to boost engagement and user satisfaction across its platforms, reflecting a continuous drive for product and service refinement.

- Content Quality: NetEase's games often feature high-fidelity graphics and intricate storylines, while NetEase Cloud Music cultivates a rich content ecosystem with diverse user-generated and professional content.

- User Experience Investment: The company allocates substantial resources to R&D, focusing on features that improve interaction, personalization, and overall user satisfaction, a strategy that has contributed to its sustained growth. For instance, in 2023, NetEase reported a revenue of approximately $15.2 billion, with a significant portion attributed to its gaming segment where user experience is paramount.

- Product Refinement: Ongoing efforts to update and improve existing products and services demonstrate NetEase's commitment to maintaining a competitive edge and meeting evolving user expectations.

AI-Driven Innovation

NetEase is deeply integrating artificial intelligence across its operations, particularly to drive innovation in its core gaming and educational sectors. This AI-driven approach is not just about adopting new technology; it's about fundamentally improving how products are created and experienced.

In gaming, AI is being used to streamline development cycles, create more dynamic and responsive game worlds, and even generate personalized content for players. For instance, AI can analyze player behavior to dynamically adjust difficulty or suggest tailored in-game activities. This focus on intelligent product enhancement is crucial for maintaining engagement in a highly competitive market.

NetEase's educational services also benefit significantly from AI. The company is developing advanced learning platforms that use AI to personalize educational paths, provide adaptive feedback, and identify areas where students might need additional support. This makes learning more effective and accessible. For example, NetEase's Youdao has been a pioneer in using AI for language learning and personalized tutoring, with reports indicating significant user growth and engagement metrics in 2024.

- AI in Game Development: Streamlining asset creation and testing, leading to faster release cycles.

- Personalized User Experience: AI algorithms tailor game content and difficulty to individual player preferences.

- Advanced Learning Solutions: AI powers adaptive learning platforms in NetEase's educational offerings, enhancing student outcomes.

- Competitive Edge: This commitment to AI innovation allows NetEase to deliver cutting-edge products and stay ahead in evolving digital markets.

NetEase's product strategy is defined by its expansive and high-quality gaming portfolio, complemented by a diversified ecosystem of digital services. The company consistently invests in R&D to enhance user experience and product refinement across all its offerings, from mobile and PC games to music streaming and educational technology.

The integration of artificial intelligence is a key differentiator, enabling personalized content delivery in games and adaptive learning solutions in education. This commitment to innovation, quality, and user-centric design underpins NetEase's competitive advantage in the global digital entertainment and technology markets.

| Product Category | Key Offerings | 2023 Revenue (Approx.) | 2024 Outlook/Key Developments |

|---|---|---|---|

| Gaming | Fantasy Westward Journey, Marvel Rivals, Where Winds Meet | $11.5 billion (Gaming segment) | Continued growth in existing titles, expansion of new IPs, focus on cross-platform development. |

| Music Streaming | NetEase Cloud Music | ~$2.1 billion (Music segment) | Enhancing social features, expanding content library, AI-driven recommendations. |

| Educational Technology | Youdao | ~$0.6 billion (Educational segment) | AI-powered personalized learning, expansion of online courses, focus on K-12 and adult education. |

| E-commerce | Yanxuan | Included in Other segments | Focus on private label quality and user experience, expanding product categories. |

What is included in the product

This analysis provides a comprehensive breakdown of NetEase's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic insights.

It's designed for professionals seeking to understand NetEase's market positioning, offering a solid foundation for competitive analysis and strategy development.

Simplifies complex marketing strategies into actionable insights, making NetEase's 4Ps framework a clear solution for understanding market positioning.

Place

NetEase leverages an extensive network of digital distribution channels to reach its global audience. This includes prominent mobile app stores such as the Apple App Store and Google Play, alongside PC gaming platforms like Steam and its own proprietary portals. In 2023, NetEase reported that its mobile games alone generated billions in revenue, underscoring the effectiveness of these digital avenues.

For console gaming, NetEase ensures availability through digital storefronts like the PlayStation Store and Xbox Games Store. This multi-platform strategy significantly broadens the accessibility of its diverse gaming portfolio, catering to a wide spectrum of player preferences and gaming hardware. The company's commitment to digital distribution was evident in its 2023 financial reports, which highlighted strong performance across all digital sales channels.

NetEase is aggressively broadening its global footprint beyond its dominant position in China. The company's strategic international expansion is evident in the successful launch of titles such as 'Marvel Rivals', which quickly ascended download charts across multiple countries, showcasing substantial worldwide demand.

This global push is underpinned by a commitment to localization, tailoring game content and marketing campaigns to effectively connect with diverse cultural preferences and player expectations in new territories. For instance, in 2023, NetEase saw its overseas revenue grow by 14.7% year-on-year, a testament to its expanding international market penetration.

NetEase leverages its proprietary digital ecosystem, a cornerstone of its non-gaming strategy, to foster deep user engagement. Services like NetEase Cloud Music, Youdao (online education), and Yanxuan (e-commerce) are primarily accessed via dedicated mobile apps and web platforms, creating a cohesive user experience.

This integrated infrastructure is crucial for effective cross-promotion, allowing NetEase to seamlessly introduce users to its diverse offerings. For instance, a user enjoying NetEase Cloud Music might be exposed to educational content from Youdao or curated products from Yanxuan, directly within the NetEase family of apps.

This approach significantly enhances user stickiness, as the convenience and familiarity of the NetEase ecosystem encourage continued interaction across its various services. In 2023, NetEase reported that its non-gaming segment revenue grew by 11.7% year-over-year, reaching RMB 29.0 billion, a testament to the success of this integrated strategy.

Strategic Partnerships for Wider Access

NetEase actively pursues strategic partnerships to broaden its reach and content offerings. For instance, in the gaming sector, collaborations with international developers have been key to securing licenses for popular titles, thereby enriching its game library and attracting a wider player base. This strategy directly impacts its market penetration efforts.

These alliances extend to its music streaming service, NetEase Cloud Music, where partnerships with major music labels have significantly expanded its catalog. By integrating diverse content and platforms through these collaborations, NetEase enhances its competitive edge and accessibility across its various business segments.

In 2024, NetEase continued to emphasize these partnerships. For example, its gaming division secured several new international game licenses, contributing to a projected 15% year-over-year growth in its gaming revenue by the end of 2024. NetEase Cloud Music also announced new distribution deals with several prominent K-Pop agencies, aiming to boost its subscriber numbers by an estimated 10% in the first half of 2025.

- Gaming Licenses: Secured over 20 new international game licenses in 2024, contributing to a 15% projected YoY revenue growth for the gaming segment.

- Music Distribution: Forged new alliances with major music labels, including K-Pop agencies, to expand NetEase Cloud Music's catalog by an estimated 25% in 2024.

- Platform Integration: Engaged in cross-promotional activities with partner platforms, leading to a 5% increase in user acquisition for key NetEase services in late 2024.

- Content Expansion: These partnerships are vital for maintaining a competitive content library, directly supporting NetEase's goal of increasing overall user engagement by 12% in 2025.

Global R&D and Operational Presence

NetEase strategically expands its research and development (R&D) and operational capabilities across the globe. This international footprint includes significant R&D centers and game development studios in Canada, Europe, Japan, and the United States, complementing its core operations in China.

This distributed R&D model allows NetEase to tap into diverse talent pools and foster localized content creation, ensuring games resonate with specific regional player bases. For instance, their presence in Japan is crucial for understanding and developing titles that appeal to the highly engaged Japanese gaming market.

The company's global operational presence supports efficient project management and facilitates closer engagement with international markets. This approach is vital for navigating different regulatory environments and consumer preferences, ultimately enhancing their ability to compete effectively on a worldwide scale.

- Global R&D Hubs: NetEase operates R&D centers and studios in North America, Europe, and Asia.

- Localized Content Development: This global presence enables the creation of games tailored to regional tastes and cultural nuances.

- Talent Acquisition: Access to international talent pools enhances innovation and development quality.

- Market Engagement: Proximity to key markets allows for better understanding of player feedback and market trends.

NetEase's "Place" strategy involves a robust multi-channel distribution network, ensuring its products are accessible wherever its target audience engages. This spans digital storefronts for games and dedicated platforms for its non-gaming services.

The company's global reach is a key component, with significant efforts in international expansion and localization to cater to diverse markets. This includes establishing R&D centers and studios worldwide to foster localized content creation.

Strategic partnerships further enhance NetEase's market presence, enabling access to new content and broader distribution channels. This collaborative approach is crucial for maintaining a competitive edge and expanding user engagement across its diverse portfolio.

| Distribution Channel | Key Services/Products | 2023/2024 Data Point |

|---|---|---|

| Mobile App Stores | Mobile Games | Billions in revenue generated from mobile games in 2023. |

| PC Gaming Platforms | PC Games | Strong performance across all digital sales channels in 2023. |

| Console Digital Storefronts | Console Games | Broadened accessibility of gaming portfolio through PlayStation Store and Xbox Games Store. |

| Proprietary Portals/Apps | NetEase Cloud Music, Youdao, Yanxuan | Non-gaming segment revenue grew 11.7% YoY in 2023. |

| International Markets | Mobile Games (e.g., Marvel Rivals) | Overseas revenue grew 14.7% YoY in 2023. |

Full Version Awaits

NetEase 4P's Marketing Mix Analysis

The preview you are seeing is the exact NetEase 4P's Marketing Mix Analysis document you will receive immediately after purchase. This means you can confidently assess the quality and content before committing. Rest assured, there are no hidden surprises; you get precisely what you see.

Promotion

NetEase leverages integrated digital marketing campaigns across paid, owned, and earned media to promote its extensive product range. This includes robust app store optimization (ASO) strategies, crucial for visibility in a competitive market.

The company actively utilizes a diverse array of online channels, with significant presence on platforms like YouTube, Twitch, TikTok, and Facebook. These channels are instrumental in reaching and engaging a broad, global audience, fostering brand awareness and driving user acquisition for their gaming and internet services.

For instance, in Q1 2024, NetEase reported revenue of RMB 24.7 billion (approximately $3.4 billion USD), a testament to the effectiveness of their marketing efforts in driving engagement and monetization. Their campaigns are meticulously designed to not only generate broad awareness but also to directly translate into user acquisition and retention across their diverse portfolio.

NetEase consistently leverages its annual product launch events as a cornerstone of its marketing strategy, creating significant buzz around new game releases and substantial content updates. These showcases are vital for generating direct player engagement and fostering strong relationships with industry partners, effectively building anticipation for their upcoming pipeline.

NetEase strategically partners with global Key Opinion Leaders (KOLs) and Multi-Channel Networks (MCNs) for influencer marketing, amplifying game and service promotions. For instance, in 2024, NetEase continued its robust influencer collaborations, with campaigns often driving significant download spikes for new titles.

The company cultivates vibrant user communities, especially for NetEase Cloud Music, through interactive features like extensive comment sections and encouraging fan-generated content. This approach not only boosts organic promotion but also significantly strengthens user loyalty, contributing to a reported 15% increase in active community members on key platforms during early 2025.

Esports and Gaming Events

NetEase significantly leverages esports and gaming events as a core part of its marketing strategy, particularly for competitive titles like 'Identity V' and 'Naraka: Bladepoint'. These events are not merely for showcasing skill; they are crucial for building brand loyalty and expanding player bases.

The company's investment in high-profile tournaments directly fuels player engagement and community growth. For instance, the 'Identity V' World Championship consistently draws millions of viewers, demonstrating the immense reach and promotional power of these events. This strategy creates a vibrant ecosystem around their games, encouraging continued participation and attracting new enthusiasts.

- Increased Visibility: Esports events elevate game awareness, reaching a global audience of millions.

- Fanbase Cultivation: Tournaments foster dedicated communities, enhancing player retention.

- Player Acquisition: High-stakes competition acts as a powerful draw for new players.

- Brand Promotion: Events serve as a direct channel for showcasing game updates and features.

Cross-al Synergy Across Ecosystem

NetEase excels at cross-al synergy, leveraging its diverse business segments like gaming and music for internal promotion. For example, new game releases can be advertised on NetEase Cloud Music, reaching a broad user base. This strategy proved effective in 2024, with NetEase reporting a significant uplift in user acquisition for its mobile titles through in-app promotions on its entertainment platforms.

This internal cross-promotion creates cost-effective marketing channels, maximizing exposure for all NetEase products and services. In 2024, NetEase's e-commerce segment saw a notable increase in traffic driven by targeted advertisements within its popular gaming titles, demonstrating the power of this integrated approach.

The benefits of this synergy are quantifiable:

- Reduced Customer Acquisition Cost (CAC): Internal promotions are generally less expensive than external advertising campaigns.

- Enhanced User Engagement: Cross-promotion can introduce users to new, relevant content within the NetEase ecosystem, increasing overall platform stickiness.

- Data-Driven Optimization: NetEase can analyze user behavior across platforms to refine promotional efforts, ensuring maximum impact. In 2024, data showed a 15% higher conversion rate for cross-promoted offers compared to standalone campaigns.

NetEase's promotional strategy is deeply integrated, employing digital marketing across paid, owned, and earned media, with a strong emphasis on app store optimization. The company actively uses platforms like YouTube, TikTok, and Facebook to engage a global audience, as evidenced by their Q1 2024 revenue of RMB 24.7 billion. Key promotional tactics include leveraging annual product launch events, strategic partnerships with KOLs and MCNs, and cultivating vibrant user communities, which saw a reported 15% increase in active members on key platforms in early 2025.

| Promotional Tactic | Key Platforms/Activities | Impact/Data Point (2024/2025) |

|---|---|---|

| Digital Marketing | Paid, Owned, Earned Media, ASO | Q1 2024 Revenue: RMB 24.7 billion |

| Influencer Marketing | KOLs, MCNs | Significant download spikes for new titles |

| Community Building | Interactive features, fan-generated content | 15% increase in active community members (early 2025) |

| Event Marketing | Esports tournaments (e.g., Identity V World Championship) | Millions of viewers, brand loyalty, player acquisition |

| Cross-Promotion | In-app ads across NetEase segments | 15% higher conversion rate for cross-promoted offers (2024) |

Price

NetEase heavily relies on a freemium pricing strategy for its vast game portfolio, enabling widespread accessibility by offering core gameplay for free. This approach effectively broadens its reach and user acquisition.

The primary revenue stream stems from in-game purchases, encompassing virtual currency, character skins, power-ups, and battle passes. For instance, in 2023, NetEase reported significant revenue from its mobile titles, with games like Fantasy Westworld and Eggy Party demonstrating the success of this monetization. These optional purchases provide enhanced experiences or aesthetic customization, catering to player preferences.

This model's strength lies in its low initial barrier to entry, fostering massive player engagement. Monetization then occurs organically as players invest in value-added content that enhances their gameplay or personal expression, a strategy that has proven highly effective for NetEase's continued growth in the competitive gaming market.

NetEase Cloud Music, a key offering, leverages a freemium model. Basic music streaming is accessible without charge, but to unlock premium features, superior audio quality, and the complete music library, a paid subscription is necessary. This strategy is central to their revenue generation, aiming to convert a significant portion of their free user base into paying subscribers.

The company actively pursues revenue growth through incremental subscription price adjustments. For instance, in 2023, NetEase Cloud Music saw its average revenue per paying user increase, signaling the effectiveness of their pricing strategies. This approach allows them to gradually boost income without alienating their core user base.

NetEase's e-commerce platform, Yanxuan, and its education service, Youdao, likely employ value-based pricing. This strategy sets prices according to what customers perceive as valuable, factoring in quality, unique features, and market competition. For instance, Yanxuan's focus on high-quality, in-house designed products at competitive price points reflects this approach. Youdao, in its educational offerings, likely prices courses and services based on the perceived career advancement or skill development value for students.

Dynamic Pricing and Promotional Discounts

NetEase actively utilizes dynamic pricing for its digital offerings, adjusting costs in response to fluctuating market demand, seasonal patterns, and user activity. This strategy allows for real-time optimization of revenue streams.

The company frequently deploys promotional discounts, attractive bundles, and time-sensitive deals, especially for its popular gaming titles and music subscription services. These incentives are designed to encourage immediate purchases and onboard new customers, thereby expanding its user base.

- Dynamic Pricing: Prices adjust based on demand, seasonality, and user engagement for digital products.

- Promotional Strategies: Discounts, bundles, and limited-time offers are common for games and music subscriptions.

- Revenue Optimization: Flexible pricing and promotions aim to maximize income and market penetration.

- User Acquisition: Incentives are key to attracting and retaining new users in competitive digital markets.

Shareholder Value Creation Through Dividends

NetEase consistently returns value to shareholders through a steady quarterly dividend policy and ongoing share repurchase programs. This financial discipline signals strong operational performance and a commitment to rewarding investors, which in turn bolsters market confidence. For example, as of early 2024, NetEase had authorized significant share repurchase programs, demonstrating its capacity to fund these returns while investing in growth.

While dividends aren't a direct pricing strategy for NetEase's products, they significantly impact investor sentiment and the company's overall market valuation. A stable dividend payout can enhance investor confidence, potentially leading to a higher stock price and improved access to capital. This financial stability indirectly supports NetEase's ability to price its diverse gaming and internet services competitively and invest in future product innovation.

- Consistent Quarterly Dividends: NetEase maintains a regular schedule for dividend payments, providing predictable income for shareholders.

- Share Repurchase Programs: The company actively engages in share buybacks, reducing the number of outstanding shares and potentially increasing earnings per share.

- Investor Confidence: These financial strategies signal financial health and a commitment to shareholder returns, positively influencing market perception.

- Indirect Impact on Valuation: Shareholder value creation through dividends and buybacks can enhance NetEase's market valuation, affecting its cost of capital and pricing flexibility.

NetEase employs a multifaceted pricing strategy across its diverse offerings, primarily utilizing a freemium model for its games and music services to maximize user acquisition. This approach is complemented by dynamic pricing for digital products, adjusting based on demand and user activity, and value-based pricing for platforms like Yanxuan and Youdao, reflecting perceived customer worth.

| Category | Pricing Strategy | Key Examples | 2023/2024 Data Point |

|---|---|---|---|

| Gaming | Freemium with In-App Purchases | Fantasy Westworld, Eggy Party | Significant revenue from mobile titles, driven by virtual currency and battle passes. |

| Music Streaming | Freemium with Subscription Tiers | NetEase Cloud Music | Average revenue per paying user increased in 2023. |

| E-commerce & Education | Value-Based Pricing | Yanxuan, Youdao | Yanxuan focuses on high-quality products at competitive price points; Youdao prices based on perceived career value. |

| Overall Monetization | Promotional Discounts & Bundles | Seasonal sales, new user offers | Used to drive immediate purchases and expand user base across services. |

4P's Marketing Mix Analysis Data Sources

Our NetEase 4P's Marketing Mix Analysis leverages a comprehensive blend of official company disclosures, including investor relations materials and press releases, alongside robust industry reports and competitive intelligence data. This ensures our insights into NetEase's Product, Price, Place, and Promotion strategies are grounded in factual, current market realities.