NetEase Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetEase Bundle

NetEase faces intense competition from rivals and the constant threat of new entrants disrupting the gaming and internet services landscape. Understanding the bargaining power of buyers and suppliers is crucial for navigating its market.

The full Porter's Five Forces Analysis reveals the real forces shaping NetEase’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

NetEase's gaming division heavily depends on specialized talent, including game designers, programmers, and artists. This reliance on a concentrated pool of skilled individuals means these human capital suppliers possess considerable bargaining power, especially given the competitive landscape for top-tier creative and technical expertise in the gaming industry.

The intellectual property (IP) behind successful game titles, whether developed internally or acquired, represents another critical supplier. The unique nature and popularity of these IPs give their owners significant leverage, as NetEase's revenue streams are directly tied to the appeal and performance of these games.

Furthermore, high switching costs associated with proprietary game development engines or essential specialized software tools can limit NetEase's ability to change suppliers easily, further strengthening the bargaining power of those providing these critical technological resources.

NetEase, like many tech companies, relies heavily on cloud infrastructure for its online games and digital services. While the cloud market has several players, switching providers for a company of NetEase's scale is a significant undertaking, often involving substantial costs and technical hurdles. This inherent switching cost grants major cloud providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, a degree of bargaining power.

This power is amplified when NetEase requires specialized cloud services or specific regional data center coverage, where options might be more limited. For instance, in 2024, the global cloud computing market was projected to reach over $1.3 trillion, with a few dominant players holding a significant market share, underscoring their leverage.

NetEase's reliance on licensing popular international games for the lucrative Chinese market significantly impacts its bargaining power with suppliers. These agreements, crucial for a substantial portion of NetEase's revenue, see terms like revenue splits and exclusivity periods heavily influenced by the global appeal and demand for the intellectual property. For instance, in 2023, NetEase reported significant revenue from games like Diablo Immortal, a testament to the value of licensed content. The strength of these international IP holders, especially for established franchises, often tips the negotiation scales in their favor, potentially leading to less favorable terms for NetEase.

Payment Gateway Providers

NetEase's reliance on payment gateway providers for its diverse online services, from gaming to music streaming, highlights a critical area of supplier power. The digital payment landscape in China, while not entirely consolidated, features dominant players with extensive user bases and deep integration into e-commerce and mobile platforms. This widespread adoption means NetEase, like many other digital companies, must often accept the terms offered by these major providers to ensure smooth transaction processing and maintain customer satisfaction, directly impacting revenue streams.

The bargaining power of these payment gateway providers stems from their essential role in facilitating NetEase's monetization efforts. For instance, in 2024, China's mobile payment market continued its robust growth, with platforms like Alipay and WeChat Pay processing trillions of yuan in transactions annually. This sheer volume and the critical nature of these services for consumer convenience give these providers considerable leverage. NetEase's need for reliable and widely accepted payment methods means it has limited alternatives when dealing with these established entities.

- Dominant Chinese Payment Platforms: Key players like Alipay and WeChat Pay hold significant sway due to their massive user penetration and integration across China's digital economy.

- Essential Transaction Facilitation: Payment gateways are indispensable for NetEase's revenue generation across gaming, e-commerce, and music streaming services.

- Limited Negotiation Power for NetEase: The widespread adoption and critical infrastructure of major payment providers often leave NetEase with less room to negotiate favorable terms.

- Impact on Revenue Flow: Secure and seamless payment processing is vital for customer experience and NetEase's financial performance, making it difficult to switch providers without significant disruption.

Content Creators for Music and Education

NetEase's expansion into music streaming and education means it relies heavily on content creators, from musicians to educators. While there are many creators, those producing popular or exclusive content hold significant leverage. This allows them to negotiate higher fees and more favorable terms, impacting NetEase's costs and content acquisition strategies.

The bargaining power of these suppliers is amplified when they can offer unique or in-demand content. For instance, a breakout musician or a highly sought-after educational course creator can significantly influence NetEase's platform appeal. This dynamic highlights the importance of NetEase cultivating strong partnerships to secure and retain valuable content, thereby maintaining user engagement and platform competitiveness.

- High-Value Content Creators: Popular musicians and exclusive educational content creators can demand premium compensation, increasing NetEase's content costs.

- Platform Dependence: While creators need platforms like NetEase, NetEase also needs these creators to attract and retain its user base.

- Contractual Leverage: Exclusive content deals or long-term contracts can shift bargaining power towards creators if their content proves highly successful.

NetEase faces considerable supplier power from dominant payment gateway providers in China, such as Alipay and WeChat Pay. These platforms are essential for NetEase's revenue generation across its diverse services, including gaming and music streaming.

The widespread adoption and critical infrastructure of these payment providers mean NetEase has limited negotiation leverage, often needing to accept offered terms to ensure seamless transactions and customer satisfaction. In 2024, China's mobile payment market continued its robust growth, with these platforms processing trillions of yuan annually, underscoring their significant influence.

| Supplier Type | Key Players | NetEase's Dependence | Supplier Bargaining Power Factors | Impact on NetEase |

|---|---|---|---|---|

| Payment Gateways | Alipay, WeChat Pay | Essential for revenue collection across all digital services | Massive user penetration, critical infrastructure, high transaction volumes | Limited negotiation power for NetEase, potential for less favorable terms |

What is included in the product

Tailored exclusively for NetEase, analyzing its position within its competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry.

Instantly visualize competitive intensity and identify strategic vulnerabilities with a dynamic, interactive Porter's Five Forces model.

Customers Bargaining Power

Customers in China's digital entertainment sector face an abundance of choices, significantly amplifying their bargaining power. They can readily shift their attention to rival online games from giants like Tencent and ByteDance, or explore numerous music streaming services and e-commerce platforms if NetEase's offerings fall short.

This intense competition means customers can easily switch providers, putting pressure on NetEase to maintain competitive pricing and quality. For example, the Chinese gaming market, a key sector for NetEase, is incredibly vast and fiercely contested, with numerous developers vying for player engagement.

For many of NetEase's offerings, such as its popular online games and music streaming services, the actual cost for a customer to switch to a competitor is surprisingly low. Think about it: if a new game or a different music app offers more appealing content or a better experience, it's usually just a quick download away. This ease of transition means customers can readily explore alternatives without significant financial hurdles.

While NetEase offers premium gaming and music subscriptions, a substantial segment of its Chinese digital consumer base remains price-sensitive. This is especially true for free-to-play games and ad-supported music streaming. For instance, in 2023, the average revenue per paying user (ARPPU) in the global mobile gaming market hovered around $10, but in segments focused on free-to-play, this metric can be significantly lower, indicating a greater reliance on volume and in-app purchases that are sensitive to price points.

Competitors employing aggressive pricing or promotional tactics can quickly divert these price-conscious customers. This forces NetEase to constantly evaluate its monetization strategies, seeking a delicate balance between generating revenue and maintaining competitive pricing to retain its user base. The broader Chinese e-commerce landscape also highlights this, with a strong emphasis on value creation and robust merchant support, further intensifying price competition.

Influence of User-Generated Content (UGC) and Community

NetEase's platforms, especially NetEase Cloud Music, benefit immensely from vibrant user communities and the content they create. This user-generated content (UGC) significantly shapes the platform's appeal and user retention.

Influential users and content creators wield considerable power. Their active participation and satisfaction can draw in more users, while their dissatisfaction or departure can deter others, directly impacting NetEase's user base and engagement metrics.

- Community as a Differentiator: A strong, active community is a critical competitive advantage for NetEase, setting its platforms apart from rivals.

- Impact of Disengagement: The disengagement of key community members or a decline in UGC quality can negatively affect user acquisition and overall platform health.

- User Influence on Platform Growth: For instance, in 2023, NetEase Cloud Music's community-driven features, like song recommendations and user-created playlists, contributed to its sustained growth in a competitive music streaming market.

Impact of Regulatory Changes on User Behavior

Chinese government regulations, such as the 2021 rules limiting online gaming time for minors to three hours per week, significantly shape user behavior and preferences. For instance, these restrictions directly influence how much time younger demographics can spend on NetEase's platforms, impacting overall engagement and spending patterns.

Customers, particularly parents concerned about compliance, may shift their engagement to platforms perceived as adhering strictly to these mandates. This can alter the competitive landscape, potentially increasing the bargaining power of users who have more choices or are less affected by these specific regulations.

NetEase's ability to adapt its offerings and policies to align with evolving regulatory frameworks, like content moderation or data privacy rules, is crucial. Failure to do so could alienate user segments, thereby amplifying customer bargaining power as they seek alternatives that meet governmental standards and their own expectations.

- Regulatory Impact: Chinese gaming regulations, like the 2021 minor playtime limits, directly affect user engagement and spending.

- User Shift: Customers may favor compliant platforms, influencing NetEase's user base and market position.

- Adaptation Necessity: NetEase must adjust to new rules to retain users and mitigate increased customer bargaining power.

The bargaining power of customers in China's digital entertainment sector is substantial due to abundant choices and low switching costs, forcing NetEase to compete on price and quality. For instance, the sheer volume of online games and music streaming services available means users can easily migrate to competitors like Tencent or ByteDance without significant financial or effort barriers.

Price sensitivity among a large user base, particularly for free-to-play games and ad-supported music, further empowers customers. This necessitates careful pricing strategies from NetEase to retain users. The global mobile gaming ARPPU in 2023 was around $10, but free-to-play segments often see much lower figures, highlighting the reliance on volume and price-sensitive in-app purchases.

User-generated content and influential community members also play a significant role, directly impacting platform appeal and retention. The disengagement of key creators can deter new users, as seen with NetEase Cloud Music's community features contributing to its 2023 growth through user-driven recommendations.

Government regulations, such as the 2021 limits on minor gaming time in China, directly influence user behavior and can shift bargaining power towards platforms perceived as compliant. NetEase's ability to adapt to these evolving rules is crucial for maintaining its user base and mitigating increased customer leverage.

| Factor | Impact on NetEase | Supporting Data/Example |

|---|---|---|

| Abundant Choices | High customer bargaining power | Numerous competitors in gaming (Tencent, ByteDance) and music streaming. |

| Low Switching Costs | Pressure on pricing and quality | Easy download of alternative games or music apps. |

| Price Sensitivity | Need for competitive pricing | Lower ARPPU in free-to-play segments compared to the 2023 global average of ~$10. |

| User-Generated Content (UGC) | Community influence on retention | NetEase Cloud Music's 2023 growth linked to user-created playlists and recommendations. |

| Regulatory Environment | Potential shift in user preference | 2021 Chinese gaming time limits for minors impact engagement and spending patterns. |

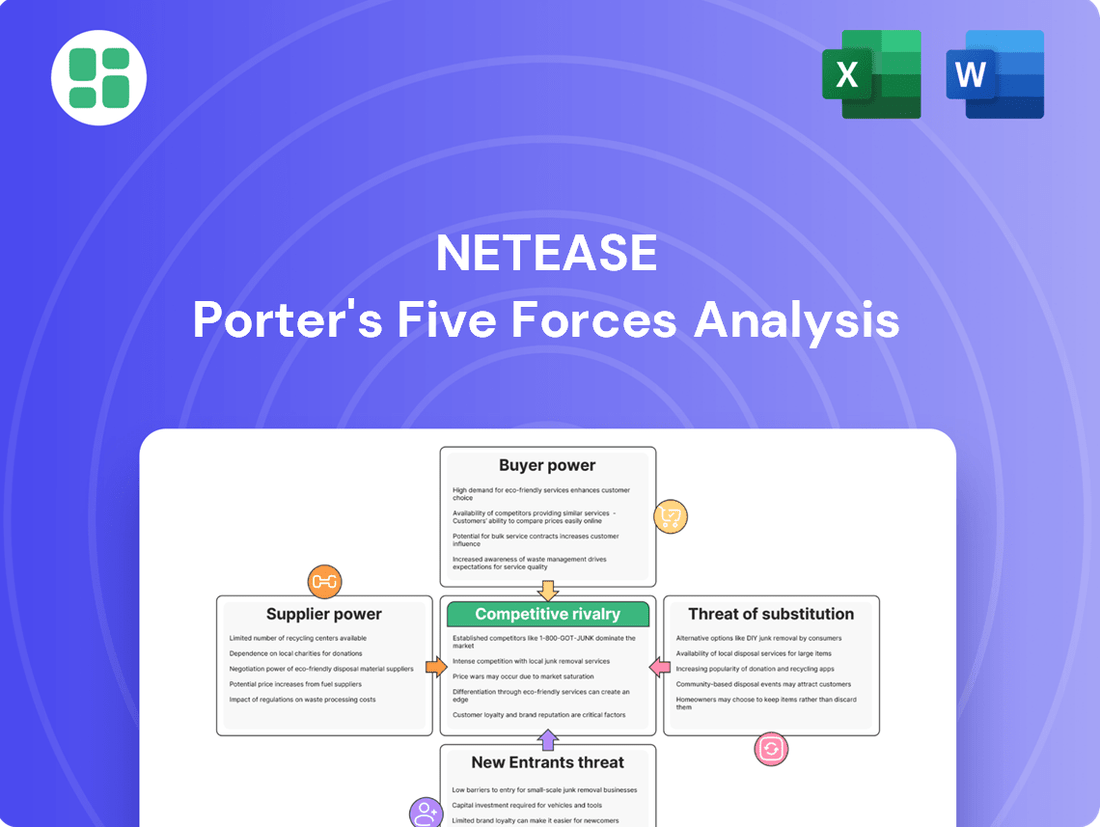

Preview the Actual Deliverable

NetEase Porter's Five Forces Analysis

The preview you see is the exact NetEase Porter's Five Forces Analysis document you will receive immediately after purchase. This comprehensive report details each force impacting NetEase, providing actionable insights without any placeholders or surprises. You're looking at the actual, professionally formatted analysis, ready for your immediate use upon completing your purchase.

Rivalry Among Competitors

The online gaming arena, NetEase's core business, is a battlefield of intense rivalry, with Tencent standing as a formidable competitor holding a substantial market share. This dynamic forces constant innovation, with both entities frequently releasing new games and updating existing ones. This continuous cycle fuels aggressive marketing campaigns and a fierce fight for user acquisition.

The Chinese gaming market, a key battleground for NetEase, was valued at an impressive USD 61.40 billion in 2024. Projections indicate continued growth in this sector, suggesting that the intense competition and the need for strategic differentiation will only intensify in the coming years.

NetEase's competitive rivalry extends far beyond its core gaming business. In e-commerce, it contends with giants like Alibaba and JD.com, while Tencent Music Entertainment poses a significant challenge in music streaming. The online education sector also presents a fragmented but competitive landscape with numerous specialized players.

This multi-segment competition demands substantial resource allocation across all of NetEase's ventures to defend and grow market share. The music streaming segment, for instance, is characterized by rapid growth and fierce competition, with companies vying for user attention and content exclusivity.

The digital entertainment landscape in China is a whirlwind of constant change, with new games and features popping up all the time. This means NetEase has to keep innovating to keep players hooked. Their Q1 2025 performance, showing growth, is a testament to this, largely driven by their latest game releases and a commitment to fresh content.

Aggressive Marketing and User Acquisition Strategies

NetEase and its competitors are locked in a fierce battle for China's vast and expanding internet user base. This intense rivalry fuels aggressive marketing and user acquisition campaigns, leading to significant investments in advertising, promotions, and special offers. For instance, in 2024, the digital advertising market in China saw substantial growth, with companies allocating considerable budgets to capture user attention.

This high spending on marketing directly impacts operational expenses and places considerable pressure on profit margins for all players. The competition isn't just about visibility; it also involves securing exclusive content and forging strategic partnerships. These efforts are crucial for attracting new users and, more importantly, for retaining existing ones in a market where switching costs can be relatively low.

- Aggressive Marketing Spend: Companies like NetEase often invest heavily in digital advertising and promotional activities to gain market share.

- User Acquisition Costs: The drive to acquire new users inflates operational expenses, impacting profitability.

- Content Exclusivity: Securing exclusive rights to popular games, media, or services is a key strategy to attract and retain users.

- Partnership Wars: Strategic alliances and collaborations are vital for expanding reach and offering compelling value propositions.

Regulatory Landscape and Market Consolidation

The Chinese government's regulatory stance, especially concerning gaming and online content, significantly impacts NetEase's competitive environment. For instance, in 2023, China's National Press and Publication Administration continued to issue new game licenses, a process that can favor established companies with proven compliance records. This evolving landscape can create hurdles for newcomers, thereby influencing market consolidation.

Regulatory shifts can also steer the strategic decisions of existing players. Companies might pivot towards areas less affected by stringent rules or focus on expanding their international presence to mitigate domestic regulatory risks. This strategic adaptation can lead to a more concentrated market, where larger, more adaptable firms like NetEase may gain an advantage.

- Regulatory Uncertainty: China's gaming and internet regulations are subject to change, impacting content approval and operational models.

- Market Consolidation Potential: Stricter regulations can act as barriers to entry, potentially leading to fewer, larger players in the market.

- Strategic Adaptation: Companies like NetEase must continually adapt their strategies to comply with and navigate these evolving rules.

- Impact on Business Models: New regulations can force changes in how games are developed, marketed, and monetized.

NetEase faces formidable competition, particularly from Tencent, in the highly dynamic online gaming sector, driving constant innovation and aggressive user acquisition strategies. The Chinese gaming market, valued at USD 61.40 billion in 2024, is expected to see intensified rivalry as companies vie for market share through new releases and content updates. This competitive pressure necessitates significant investment in marketing and user engagement, impacting profitability and demanding strategic differentiation across all business segments.

| Competitor | Primary Market | Key Strategy |

|---|---|---|

| Tencent | Online Gaming, Social Media | Dominant market share, extensive IP, ecosystem integration |

| Alibaba | E-commerce, Cloud Computing | Platform dominance, diverse service offerings |

| JD.com | E-commerce | Logistics efficiency, direct sales model |

| Tencent Music Entertainment | Music Streaming | Content licensing, social features |

SSubstitutes Threaten

Consumers have a vast array of alternative digital entertainment options that can substitute for NetEase's gaming and music services. Short-form video platforms like Douyin (TikTok) and Bilibili, along with traditional long-form video streaming services and social media apps, all vie for user attention and leisure time. This intense competition for screen time means users might opt for these alternatives instead of engaging with NetEase's offerings, impacting potential revenue and user retention.

Offline activities and traditional entertainment present a significant threat to NetEase. Options like attending cinemas, participating in live sports events, reading physical books, or simply socializing in person offer compelling alternatives to digital engagement. For instance, China's box office revenue reached approximately 54.9 billion yuan in 2023, indicating continued consumer spending on traditional entertainment.

As consumer preferences shift, particularly with a growing emphasis on healthier lifestyles and outdoor pursuits, there's a potential reduction in time and money allocated to online gaming and other digital services. This trend could directly impact NetEase's user base and revenue streams if these offline activities become more appealing.

Traditional education and offline learning centers represent a significant threat of substitutes for NetEase's Youdao. Many families still value the structure and in-person interaction offered by brick-and-mortar institutions and private tutors, especially for foundational learning. This preference means Youdao must continually innovate to demonstrate its added value beyond mere convenience.

The persistence of traditional learning methods is a key challenge. For instance, while online platforms like Youdao gained traction, the enduring appeal of physical classrooms and personalized, in-person tutoring means these remain viable alternatives. This dynamic is particularly relevant as Youdao navigates market shifts, with its net revenues experiencing a decrease in Q1 2025, highlighting the competitive pressure from these established substitute offerings.

Piracy and Unofficial Content Channels

Piracy and unofficial content channels represent a significant threat to NetEase, particularly in its gaming and music divisions. Users looking for free alternatives can bypass legitimate platforms, directly impacting revenue streams and subscriber numbers. For instance, in the gaming sector, the availability of cracked versions of popular titles or unauthorized access to in-game items can erode sales and discourage legitimate purchases.

The music industry faces similar challenges, where illegal downloading and unauthorized streaming services offer content without compensation to artists or platforms like NetEase Cloud Music. While efforts to combat piracy are ongoing, the ease of access to such content remains a persistent substitute. Industry-wide initiatives and robust intellectual property protection are vital to mitigate these losses.

The financial impact of piracy can be substantial. For example, a 2024 report indicated that the global digital music market loses billions annually due to piracy. Similarly, the video game industry has reported significant revenue shortfalls attributed to unauthorized distribution. This underscores the critical need for NetEase to invest in security measures and legal recourse.

Key considerations regarding this threat include:

- Ongoing battle against illegal downloads and unauthorized streaming services.

- Impact on revenue generation from game sales and music subscriptions.

- Importance of strong intellectual property enforcement and digital rights management.

- Need for user education on the value of legitimate content and artist support.

Shift to Different E-commerce Models and Physical Retail

NetEase's e-commerce ventures contend with a variety of substitutes. Traditional brick-and-mortar retail remains a viable alternative for consumers seeking immediate gratification or a tactile shopping experience. In 2024, physical retail sales in China continued to represent a significant portion of overall consumer spending, even as online channels grew.

Furthermore, established e-commerce behemoths like Alibaba and JD.com offer vast product selections and sophisticated logistics, presenting a formidable substitute. These platforms often benefit from economies of scale and brand loyalty, making it challenging for newer entrants or niche players to capture market share.

The rise of social commerce and live-streaming platforms also poses a significant threat. These models, which integrate entertainment and social interaction directly into the purchasing journey, have gained considerable traction. For instance, live-streaming e-commerce sales in China were projected to exceed $150 billion in 2024, demonstrating the growing consumer preference for these dynamic shopping formats.

- Traditional Retail: Physical stores offer immediate product access and a tactile shopping experience, remaining a persistent substitute.

- E-commerce Giants: Dominant players like Alibaba and JD.com leverage scale and established infrastructure, drawing consumers away from smaller platforms.

- Social & Live-streaming Commerce: Interactive and entertainment-driven shopping formats are increasingly popular, capturing consumer attention and spending.

The threat of substitutes for NetEase is substantial, stemming from both digital and traditional entertainment alternatives. Consumers can easily divert their attention and spending to platforms like Douyin, Bilibili, or even offline activities such as attending movies, which saw China's box office reach approximately 54.9 billion yuan in 2023. These substitutes directly compete for user engagement and leisure time, potentially impacting NetEase's revenue and user retention metrics.

Entrants Threaten

Entering China's online gaming and internet services sector demands immense capital. Developers need millions for cutting-edge game creation, robust server networks, widespread marketing campaigns, and attracting top talent. For instance, developing a AAA-quality online game can easily cost tens of millions of dollars, a significant hurdle for newcomers.

Incumbent tech giants like NetEase, Tencent, and Alibaba have built formidable brand loyalty and vast user ecosystems over years of operation. This makes it incredibly challenging for newcomers to gain traction, as consumers are already deeply integrated into existing platforms and their offerings. For instance, NetEase's enduring game franchises, such as Fantasy Westward Journey, continue to attract and retain millions of players through consistent content updates, demonstrating the power of established user bases.

China's stringent regulatory landscape presents a formidable barrier for new entrants in the online gaming and internet sectors. The government's oversight extends to critical areas like game licensing, content censorship, and data security, demanding significant compliance efforts. For instance, obtaining an Online Publication License for games, a prerequisite for operation, involves a lengthy and complex approval process, often taking months or even years, as evidenced by the fluctuating number of approvals granted annually.

These regulations effectively compel developers to align their offerings with government-defined market-influencing rules, adding another layer of difficulty. New players must not only possess innovative technology but also the capacity to navigate and adapt to these evolving compliance demands, making market entry a costly and uncertain endeavor.

Talent Acquisition and Retention Challenges

The threat of new entrants in the gaming and tech industry, particularly concerning talent, is significant. China's burgeoning digital economy fuels an insatiable demand for skilled professionals in game development, artificial intelligence, and internet technology. This intense competition for top talent presents a considerable hurdle for any new company aiming to break into the market.

New players must contend with established industry leaders like NetEase, which possess substantial resources to attract and retain specialized personnel. Securing highly skilled developers and AI experts is not only costly but also a protracted process, crucial for developing innovative and high-quality offerings that can compete effectively.

- Intense Demand: China's tech sector, particularly gaming, faces a critical shortage of experienced game developers, AI engineers, and internet technologists.

- Talent Acquisition Costs: New entrants must budget significantly for competitive salaries and benefits to attract talent away from established players.

- NetEase's Advantage: NetEase leverages its position as a major employer with one of the largest in-house R&D teams in China, making it a formidable competitor for talent.

- Innovation Barrier: The difficulty in acquiring specialized talent can directly impede a new entrant's ability to innovate and produce market-leading products.

Network Effects and Ecosystem Advantages

NetEase benefits significantly from network effects, particularly within its gaming communities and music streaming platforms. The more users engage with these services, the more valuable they become, creating a self-reinforcing growth loop. For instance, in games, a larger player base translates to more opponents, richer social interactions, and a more dynamic in-game economy, all of which are crucial for player retention and acquisition.

New entrants face a substantial hurdle in trying to replicate these established network effects. Without an existing, active user base, newcomers struggle to build the critical mass necessary to foster vibrant communities or offer compelling content diversity. This lack of an initial user base makes it exceedingly difficult for them to attract and retain users, as the core value proposition of many of NetEase's offerings is directly tied to the size and engagement of its user community.

This inherent ecosystem advantage acts as a powerful barrier to entry. Consider the gaming sector: in 2023, NetEase's mobile games, like Fantasy Westward Journey, continued to demonstrate strong user engagement and revenue, indicative of deep-seated network effects. A new game launching without a pre-existing community or a unique draw would find it challenging to compete against the established social dynamics and content libraries that NetEase has cultivated over years.

- Network Effects: NetEase's gaming and music platforms gain value as more users join, enhancing social interaction and content variety.

- Ecosystem Advantage: The established user base and interconnected services create a sticky environment that is difficult for new competitors to penetrate.

- Barrier to Entry: New entrants lack the critical mass needed to build comparable communities and content ecosystems, making it hard to gain market share.

The threat of new entrants into NetEase's core markets is moderate, primarily due to high capital requirements and strong brand loyalty. Developing high-quality online games or internet services demands significant investment in technology, marketing, and talent, often running into tens of millions of dollars. Established players like NetEase have cultivated deep user ecosystems and brand affinity, making it difficult for newcomers to attract and retain users. For instance, NetEase's flagship game, Fantasy Westward Journey, has maintained a robust player base for years, showcasing the power of brand and community.

Regulatory hurdles and intense competition for skilled labor further dampen the threat of new entrants. Navigating China's complex licensing and censorship requirements for online content is a costly and time-consuming process. Furthermore, the demand for experienced game developers and AI engineers is exceptionally high, with companies like NetEase leveraging their substantial resources to attract and retain top talent, making it a significant challenge for new companies to build competitive teams.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for game development, servers, and marketing. | Significant financial hurdle. |

| Brand Loyalty & Ecosystems | Established user bases and integrated services. | Difficult to attract users away from incumbents. |

| Regulatory Landscape | Strict licensing, content censorship, and data security rules. | Adds complexity, cost, and time to market entry. |

| Talent Acquisition | Intense competition for skilled developers and tech professionals. | Increases operational costs and hinders innovation. |

Porter's Five Forces Analysis Data Sources

Our NetEase Porter's Five Forces analysis is built upon a robust foundation of data, including NetEase's official financial statements, investor relations disclosures, and industry-specific market research reports. We also incorporate insights from reputable financial news outlets and competitor announcements to provide a comprehensive view of the competitive landscape.