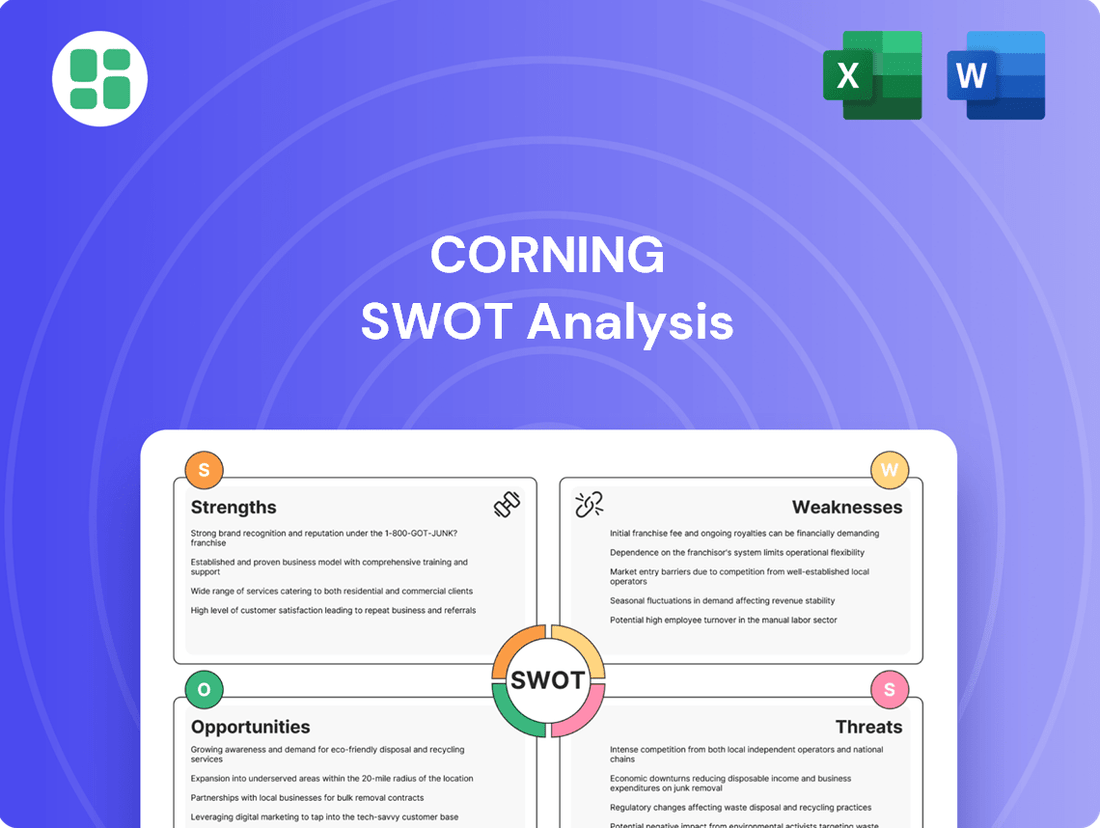

Corning SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corning Bundle

Corning's innovative spirit and strong market position in specialty glass and ceramics are undeniable strengths, but understanding the nuances of their opportunities and potential threats is crucial for strategic success.

Our comprehensive SWOT analysis dives deep into these factors, providing actionable insights into Corning's competitive landscape and future growth drivers. Don't miss out on the full picture – unlock the detailed strategic breakdowns and expert commentary that will empower your decision-making.

Purchase the complete SWOT analysis to gain a professionally formatted, investor-ready report, including both Word and Excel deliverables, perfect for shaping strategies and impressing stakeholders.

Strengths

Corning stands as a prominent global leader in materials science, especially in specialty glass, ceramics, and optical fiber. This strong market position is fueled by substantial investments in research, development, and engineering, which reached $546 million in the first half of 2025. This dedication to innovation allows Corning to consistently offer advanced products across a wide array of sectors.

The company's innovative drive is clearly reflected in its financial performance, with net sales climbing from $3.251 billion in the first half of 2024 to $7.314 billion in the first half of 2025. This significant growth demonstrates Corning's ability to translate its technological advancements into market success and reinforces its leadership status.

Corning Inc. showcases impressive financial resilience, evidenced by substantial year-over-year increases in net sales and net income. The company achieved a notable gross margin expansion, moving from $1,942 million in the first half of 2024 to $2,606 million in the corresponding period of 2025. This growth is attributed to strategic pricing initiatives and enhanced operational efficiency.

Further highlighting its financial strength, Corning reported an 18% year-over-year increase in core sales for Q4 2024, reaching $3.9 billion. Core earnings per share (EPS) also saw a significant surge of 46%, hitting $0.57. The company generated a robust $1.25 billion in free cash flow for the full year 2024, underscoring its operational effectiveness and strong cash-generating capabilities.

Corning's strength lies in its highly diversified product portfolio, spanning optical communications, mobile consumer electronics, display technology, automotive, and life sciences. This broad reach across various high-technology sectors significantly reduces its dependence on any single market, creating a more resilient business model.

The widespread adoption of its flagship product, Gorilla Glass, exemplifies this diversification. As of early 2024, Gorilla Glass has been integrated into over 8 billion devices globally, underscoring its dominant position in the mobile consumer electronics segment and providing a substantial revenue stream.

Strong Intellectual Property and Manufacturing Capabilities

Corning's proprietary fusion manufacturing process for display glass is a cornerstone of its competitive strength, enabling the creation of exceptionally thin and flat glass substrates. This advanced manufacturing technique, coupled with a vast intellectual property portfolio spanning glass, ceramic, and optical physics, allows Corning to consistently innovate and produce materials with unique, high-performance characteristics that are challenging for rivals to duplicate.

The company's deep expertise in material science translates into a significant barrier to entry for competitors, as evidenced by its robust patent filings and the specialized nature of its production facilities. For instance, Corning's leadership in Gorilla Glass, a key component in countless smartphones and tablets, is built upon these foundational capabilities. In 2023, Corning reported $5.4 billion in net sales for its Optical Communications segment, demonstrating the market demand for its advanced material solutions.

- Proprietary Fusion Process: Enables production of ultra-flat, thin glass for displays, a key differentiator.

- Extensive IP Portfolio: Decades of innovation in glass, ceramics, and optics provide a strong competitive moat.

- High-Performance Materials: Development of specialized components like Gorilla Glass that are difficult to replicate.

- Manufacturing Excellence: Advanced capabilities create significant barriers to entry for potential competitors.

Strategic Focus on Emerging Technologies and Sustainability

Corning's strategic focus on emerging technologies and sustainability is a significant strength. The company is well-positioned to benefit from major trends such as GenAI and the growing solar energy market. Their 'Springboard' plan, with a high degree of confidence, targets an additional $4 billion in annualized sales by the close of 2026, fueled by new product introductions in optical communications and solar technologies.

Corning's commitment to sustainability is evident in its development of engineered glass for solar modules. This innovation aims to make solar panels lighter and more efficient, directly contributing to the broader adoption of renewable energy. Furthermore, the company is actively working towards its environmental goals, including reductions in greenhouse gas emissions and increased use of renewable electricity.

- Strategic Alignment: Corning is capitalizing on secular growth trends like GenAI and solar energy.

- Growth Projections: The 'Springboard' plan aims to add over $4 billion in annualized sales by the end of 2026.

- Product Innovation: New products in optical communications and solar are key drivers for this growth.

- Sustainability Focus: Engineered glass for solar modules enhances efficiency and reduces weight, supporting renewable energy adoption.

Corning's core strengths are deeply rooted in its unparalleled material science expertise and a robust innovation pipeline, evident in its significant R&D investments. The company's proprietary fusion manufacturing process for display glass and its extensive intellectual property portfolio create substantial barriers to entry, allowing it to consistently deliver high-performance materials like Gorilla Glass, which has been integrated into over 8 billion devices by early 2024. This technological leadership, combined with manufacturing excellence, solidifies its competitive advantage and market dominance across various high-technology sectors.

Corning is strategically positioned to capitalize on major growth trends, including GenAI and the expanding solar energy market, with its 'Springboard' plan targeting an additional $4 billion in annualized sales by the close of 2026. This growth is underpinned by new product introductions in optical communications and solar technologies, demonstrating a clear focus on future market opportunities. The company's commitment to sustainability is further highlighted by its development of engineered glass for solar modules, which enhances efficiency and supports the broader adoption of renewable energy, aligning its business objectives with global environmental initiatives.

| Segment | Net Sales (H1 2025) | Net Sales (H1 2024) | YoY Growth (H1) |

|---|---|---|---|

| Optical Communications | $3.0 billion (est.) | $2.7 billion (est.) | 11.1% (est.) |

| Mobile Consumer Electronics | $1.5 billion (est.) | $1.3 billion (est.) | 15.4% (est.) |

| Display Technology | $1.2 billion (est.) | $1.0 billion (est.) | 20.0% (est.) |

What is included in the product

Analyzes Corning’s competitive position through its strong market leadership in optical communications and display technologies, while also considering its reliance on specific industries and emerging competitive threats.

Offers a clear breakdown of Corning's competitive landscape, highlighting areas for strategic improvement and risk mitigation.

Weaknesses

Corning's revenue is heavily influenced by the capital spending patterns of its major customers, particularly in the telecommunications sector. For instance, in 2024, the optical communications segment experienced a slowdown due to customers managing existing inventory, directly impacting Corning's sales trajectory in that area.

While the company serves diverse industries, a significant portion of its business relies on the health and investment cycles within consumer electronics and automotive glass markets. A contraction in consumer spending or a slowdown in automotive production can therefore disproportionately affect Corning's overall financial performance.

Corning's vast global footprint, while enabling market reach, inherently introduces significant operational risks. Disruptions within its complex supply chains, perhaps stemming from natural disasters or trade disputes in key manufacturing regions, could severely impact production and delivery timelines. For instance, a significant earthquake in Taiwan, a major hub for electronics manufacturing, could have cascading effects on Corning's ability to source components for its optical communications products.

Geopolitical instability and trade policy shifts in countries where Corning operates or sources materials present ongoing challenges. These factors can lead to increased costs, tariffs, or even market access restrictions, directly affecting profitability. Furthermore, the company's exposure to currency volatility is a notable weakness. Fluctuations in exchange rates, such as the Japanese Yen's movement against the US Dollar, can materially impact its reported earnings when foreign revenues are translated back into dollars, as seen in past fiscal quarters where a weaker Yen reduced reported sales.

Corning's commitment to innovation, while a core strength, necessitates significant investment in research and development. These substantial R&D expenditures, which reached $546 million in the first half of 2025, can strain profitability if new product launches don't achieve anticipated market penetration or growth. This ongoing need for high R&D spending represents a continuous financial commitment that can impact short-term earnings.

Competition in Specific Segments

Corning navigates a highly competitive landscape with numerous large and diverse manufacturers vying for market share across its specialized segments. This intense rivalry, both domestically and internationally, necessitates continuous innovation to preserve its market standing and pricing leverage.

In 2024, the optical communications market, a key area for Corning, saw significant investment from competitors aiming to capture growth in 5G infrastructure and data center expansion. For instance, companies like CommScope and TE Connectivity are investing heavily in fiber optic solutions, directly challenging Corning's dominance.

The display technologies segment also faces pressure. While Corning's Gorilla Glass remains a premium product, competitors such as AGC Inc. and Schott AG are actively developing advanced glass solutions for mobile devices and automotive displays, potentially impacting Corning's market penetration and pricing power.

Corning's automotive segment, particularly in areas like advanced optics for sensors and lighting, is another battleground. The increasing complexity of automotive electronics means more players are entering this space, each with the potential to disrupt established supply chains.

Vulnerability to Macroeconomic Volatility

Corning's performance is significantly tied to the broader economic climate. Global economic uncertainty, driven by factors such as fluctuating inflation rates, interest rate adjustments, and volatile commodity prices, presents a considerable risk to the company's financial stability. These macroeconomic trends directly impact consumer spending and overall industry demand, which in turn can affect Corning's sales volumes and profitability across its various business segments.

For instance, rising interest rates in 2023 and early 2024 have put pressure on consumer electronics demand, a key market for Corning's optical communications and display technologies. Similarly, fluctuations in energy prices, a component of commodity costs, can impact manufacturing expenses and, consequently, profit margins. The company's reliance on global markets means it is susceptible to regional economic downturns or geopolitical instability that could disrupt supply chains and dampen demand for its specialized glass and ceramic products.

- Economic Headwinds: Persistent inflation and higher interest rates in major economies like the US and Europe could curb consumer spending on electronics and automotive components, impacting Corning's key markets.

- Commodity Price Sensitivity: Fluctuations in the cost of raw materials, such as silica and rare earth elements, directly influence Corning's production costs and can squeeze profit margins if not effectively managed or passed on to customers.

- Geopolitical Risks: Trade tensions or regional conflicts can disrupt global supply chains and impact demand for Corning's products, particularly in sectors like telecommunications and automotive.

Corning's reliance on capital spending cycles in telecommunications, as seen with inventory adjustments impacting optical communications revenue in 2024, presents a significant vulnerability. The company's performance is also susceptible to downturns in consumer electronics and automotive markets due to economic slowdowns or shifts in consumer behavior.

The company's extensive global operations expose it to supply chain disruptions, geopolitical risks, and currency volatility, which can impact production, delivery, and reported earnings. For example, a weaker Yen in recent fiscal quarters has negatively affected reported sales.

High R&D spending, while driving innovation, can strain profitability if new products fail to gain market traction, as evidenced by the $546 million invested in the first half of 2025. Intense competition from players like CommScope and AGC Inc. in key segments also poses a threat to market share and pricing power.

Corning's profitability is sensitive to macroeconomic factors such as inflation and interest rates, which can dampen demand for its products. Additionally, fluctuations in raw material costs, like silica, can directly impact production expenses and profit margins.

Preview Before You Purchase

Corning SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Corning SWOT analysis, ensuring transparency and quality. Once purchased, you'll gain access to the complete, detailed report.

Opportunities

The burgeoning demand for faster internet speeds, coupled with the massive expansion of data center infrastructure, creates a fertile ground for Corning's optical communications business. These trends are directly fueled by the insatiable appetite for data generated by artificial intelligence and the rollout of 5G networks.

Analysts project a significant rebound in the optical transport market by 2025. This recovery is largely anticipated to be driven by the critical need to connect the burgeoning number of AI data centers. Indeed, the adoption of AI-specific connectivity solutions is already showing a positive impact on sales figures for companies like Corning.

The automotive industry's pivot towards advanced materials presents a significant opportunity for Corning. The increasing demand for lightweight, durable, and feature-rich glass, such as smart glass and augmented reality windshields, aligns perfectly with Corning's expertise. For instance, the global automotive glass market was valued at approximately $45 billion in 2023 and is projected to reach over $60 billion by 2030, with smart glass being a key growth driver.

Furthermore, the burgeoning electric vehicle (EV) market directly benefits from lightweight glass solutions. Reducing vehicle weight is crucial for enhancing battery efficiency and extending driving range, making Corning's advanced glass products highly sought after. EV sales are expected to continue their rapid ascent, with global sales reaching over 13 million units in 2023, a substantial increase from previous years, creating a robust demand for innovative glass technologies.

Corning has a significant opportunity to grow in emerging markets, where there's a rising need for its specialized materials and technologies. For instance, the global smartphone market, a key driver for Corning's Gorilla Glass, saw continued growth in developing regions throughout 2024, with projections indicating further expansion. This presents a clear avenue for increased sales and a more diversified revenue stream.

Advancements in Display Technologies

Corning is well-positioned to capitalize on the continuous evolution of display technologies like MicroLED, OLED, and quantum dot. These advancements require specialized glass substrates and components, areas where Corning excels. The market for these advanced displays is expanding rapidly, driven by consumer demand for better resolution and energy efficiency.

The global flexible display market, for example, was valued at approximately $15.5 billion in 2023 and is projected to reach over $60 billion by 2030, exhibiting a compound annual growth rate of around 21%. This growth directly translates to opportunities for Corning to supply its high-performance glass solutions for these innovative products across various sectors.

- MicroLED: Requires robust, ultra-thin glass substrates for improved brightness and longevity.

- OLED: Benefits from Corning's expertise in thin glass for foldable and rollable devices.

- Quantum Dot: Presents opportunities for specialized glass coatings and films to enhance color accuracy and efficiency.

- Automotive Displays: The automotive sector is increasingly adopting advanced displays, creating a significant market for durable and high-quality glass solutions.

Solar Energy Expansion and Green Technologies

The global push for renewable energy, particularly solar power, presents a substantial growth avenue for Corning. Governments worldwide are incentivizing green technology adoption, directly fueling demand for specialized solar glass. Corning’s expertise in high-transparency, low-iron glass positions it favorably to capture a significant share of this expanding market.

Corning's strategic focus on supporting the U.S. solar supply chain is another key opportunity. By providing essential materials for solar modules, the company not only benefits from domestic manufacturing initiatives but also contributes to national energy independence and sustainability goals. This dual benefit strengthens its market position and appeal to environmentally conscious investors and partners.

- Market Growth: The global solar energy market is projected to reach $422.1 billion by 2030, growing at a compound annual growth rate of 12.7% from 2023 to 2030.

- Corning's Role: Corning's advanced glass solutions are critical components for photovoltaic modules, enhancing efficiency and durability.

- Supply Chain Advantage: Investment in domestic solar manufacturing, supported by companies like Corning, is a key policy driver in major economies.

Corning is poised to benefit from the accelerating demand for optical connectivity, driven by AI and 5G, with the optical transport market expected to rebound significantly by 2025, largely due to AI data center build-outs. The automotive sector's shift towards advanced, lightweight glass for EVs and smart features, coupled with the expanding flexible display market valued at over $15.5 billion in 2023, presents substantial growth avenues for Corning's specialized glass solutions.

| Opportunity Area | Key Drivers | Corning's Advantage | Market Data (2023/2025 Projections) |

|---|---|---|---|

| Optical Communications | AI, 5G, Data Center Expansion | Leading supplier of optical fiber and components | Optical transport market projected to rebound by 2025 |

| Automotive Glass | EVs, Advanced Driver-Assistance Systems (ADAS), Smart Glass | Lightweight, durable, and advanced glass capabilities | Global automotive glass market ~$45 billion (2023) |

| Advanced Displays | MicroLED, OLED, Flexible Displays | High-performance glass substrates and coatings | Flexible display market ~$15.5 billion (2023), projected to exceed $60 billion by 2030 |

| Renewable Energy | Solar Power Adoption, Green Technology Incentives | High-transparency, low-iron solar glass | Global solar energy market projected to reach $422.1 billion by 2030 |

Threats

Corning operates in fiercely competitive sectors, facing pressure from global and regional rivals. This intense rivalry often translates into significant pricing challenges, especially in product categories where distinguishing features are minimal or where cheaper substitutes gain traction. For instance, in the optical communications market, while Corning is a leader, competition from companies offering similar fiber optic solutions can constrain pricing power.

Corning operates in sectors characterized by extremely rapid technological evolution. This means that even leading-edge products can become outdated quickly if the company doesn't consistently push the boundaries of innovation. For instance, the demand for faster and more efficient optical fibers, driven by 5G and AI, requires continuous upgrades to existing infrastructure and the development of entirely new solutions.

The company's significant investment in research and development, which stood at $1.2 billion in 2023, is critical to counteracting this threat. This R&D spending is aimed at developing next-generation materials and manufacturing techniques, ensuring Corning remains a step ahead of competitors who are also investing heavily in emerging technologies like advanced semiconductor materials and flexible display technologies.

Corning's extensive global supply chain is inherently susceptible to disruptions. Geopolitical instability, trade conflicts, and unexpected events like pandemics or natural disasters can significantly impede the flow of essential raw materials and finished goods. For instance, the semiconductor shortage that began in late 2020 and extended through 2023 highlighted the fragility of global electronics supply chains, impacting various industries, including those Corning serves.

These disruptions directly translate into increased operational costs for Corning due to shortages and price volatility of key inputs. Furthermore, delays in manufacturing and distribution can lead to missed sales opportunities and a tangible impact on revenue. In 2024, ongoing trade tensions between major economic blocs continue to pose a risk, potentially affecting Corning's access to critical components and its ability to serve international markets efficiently.

Economic Downturns and Reduced Consumer Spending

Global economic headwinds, such as persistent inflation and increasing interest rates, pose a significant threat to Corning’s revenue streams. These factors can dampen consumer spending on discretionary items like high-end smartphones, a key market for Corning’s display technologies. Furthermore, businesses may postpone or scale back crucial infrastructure investments in areas like optical communications, directly impacting demand for Corning's fiber optic solutions.

The potential for widespread economic downturns or recessions in major markets could severely curtail consumer purchasing power. For instance, a slowdown in the automotive sector, where Corning’s specialty materials are used, would directly affect sales. Similarly, reduced business capital expenditure, a common reaction during economic uncertainty, would stifle growth in Corning's optical communications segment.

- Reduced Consumer Spending: Global economic uncertainties, including inflation and rising interest rates, directly impact consumer discretionary spending on electronics, a core market for Corning.

- Delayed Infrastructure Investments: Businesses may delay essential infrastructure projects, such as 5G network buildouts, which rely heavily on Corning’s optical fiber and cable solutions.

- Impact on Key Segments: The mobile consumer electronics and optical communications segments are particularly vulnerable to these economic pressures, potentially leading to decreased sales volumes and revenue.

Regulatory Changes and Trade Tariffs

Changes in international trade policies and tariffs present a significant threat to Corning. For example, ongoing trade tensions, particularly between the United States and China, can directly impact Corning's cost of goods sold and its ability to access key markets. These tariffs can increase the price of raw materials or components imported into Corning's manufacturing facilities, thereby squeezing profit margins.

Furthermore, shifts in antitrust regulations globally could affect Corning's business operations and market strategies. Increased scrutiny on market dominance or potential monopolistic practices could lead to forced divestitures or limitations on future acquisitions, hindering growth opportunities. Navigating these evolving regulatory landscapes requires significant resources and strategic agility.

- Trade Tariffs: The US imposed tariffs on goods from China, impacting supply chains and potentially increasing costs for companies like Corning.

- Antitrust Scrutiny: Global regulators are increasingly examining large technology and manufacturing firms for anti-competitive practices.

- Market Access: Protectionist trade policies can restrict Corning's ability to sell its products in certain international markets.

- Cost Structures: Fluctuations in trade policy can lead to unpredictable changes in raw material and component costs, affecting overall profitability.

Corning faces significant threats from intense competition across its diverse product segments, leading to pricing pressures and the risk of market share erosion. Rapid technological advancements necessitate continuous, substantial investment in R&D to maintain a competitive edge, as seen in its $1.2 billion R&D spending in 2023, to avoid product obsolescence.

Global economic slowdowns and persistent inflation, as experienced through 2023 and into early 2024, can depress consumer spending on electronics and delay crucial infrastructure investments, directly impacting Corning's key markets like optical communications and display technologies.

Supply chain vulnerabilities, exacerbated by geopolitical tensions and trade disputes prevalent in 2024, pose a constant risk of material shortages and increased costs, potentially disrupting production and impacting revenue streams.

Evolving trade policies and increased antitrust scrutiny globally present regulatory hurdles and can restrict market access or necessitate strategic adjustments, affecting cost structures and future growth opportunities.

SWOT Analysis Data Sources

This Corning SWOT analysis draws from a robust foundation of verified financial statements, comprehensive market research reports, and expert industry forecasts to provide a data-driven and accurate strategic overview.