Corning PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corning Bundle

Corning's future is intricately linked to global political shifts, economic fluctuations, and rapid technological advancements. Our PESTLE analysis dives deep into these external forces, revealing critical opportunities and potential challenges. Gain a strategic advantage by understanding the complete external landscape shaping Corning's operations and market position. Download the full analysis now for actionable intelligence.

Political factors

Government policies, including trade agreements and tariffs, significantly influence Corning's global operations and supply chain. For instance, the U.S. International Trade Commission (USITC) has been involved in intellectual property disputes, such as Corning's complaints against Chinese display glass and TV makers, underscoring the critical role of international trade laws and their enforcement in protecting innovation and market access.

Recent trade tensions, particularly between major economies like the U.S. and China, can directly impact the cost of raw materials and the competitiveness of Corning's advanced products, such as specialized glass and ceramics, in key international markets. These policy shifts necessitate agile supply chain management and strategic market positioning to mitigate potential disruptions and maintain profitability.

Geopolitical stability is a crucial element for Corning's global operations. Disruptions stemming from international conflicts or political instability in key manufacturing or sales regions can significantly impact supply chains and market access. For instance, ongoing tensions in Eastern Europe in early 2024 continued to pose challenges for global logistics and energy prices, indirectly affecting manufacturing costs for high-tech components.

Corning's extensive international presence, with operations in over 30 countries as of 2024, means that regional instability can have a ripple effect. The company must actively manage and mitigate these risks to ensure uninterrupted production and maintain its competitive edge in diverse markets.

Government industrial policies, such as the U.S. CHIPS and Science Act of 2022, which allocated $52 billion for semiconductor manufacturing and R&D, directly impact Corning. These policies, offering subsidies and incentives for domestic production of advanced technologies, create significant opportunities for Corning's optical communications and advanced optics segments.

Corning's strategic investments in the U.S., like its $1 billion expansion for optical fiber manufacturing announced in 2023, are directly influenced by such government support. These initiatives aim to bolster domestic supply chains for critical technologies, aligning with national security and economic growth objectives.

Furthermore, global trends in industrial policy, including subsidies for renewable energy components and electric vehicle battery production, can shape Corning's expansion decisions. For example, government support for solar manufacturing in Europe could encourage Corning to increase its presence and investment in those markets.

Regulatory Environment and Compliance

Corning navigates a stringent global regulatory landscape, encompassing product safety, environmental standards, and ethical business practices. For instance, in 2024, the company, like many in its sector, faced increased scrutiny regarding supply chain transparency and the environmental impact of its manufacturing processes, potentially requiring adjustments to operational procedures and reporting.

Evolving regulations, such as new mandates for extended producer responsibility or stricter emissions controls, demand ongoing investment in compliance infrastructure and strategic adaptation. Corning's past interactions with antitrust bodies, such as its 2023 settlement with EU regulators concerning exclusive agreements with mobile phone manufacturers, highlight the critical need for vigilance and proactive engagement with these frameworks to avoid disruptions and penalties.

- Product Safety: Adherence to evolving safety standards for optical fiber and display glass is paramount, with potential for increased testing and certification costs.

- Environmental Regulations: Compliance with stricter emissions targets and waste management protocols, particularly in regions like the EU and North America, impacts operational expenditures.

- Antitrust and Competition Law: Ongoing monitoring of global antitrust trends is essential to prevent investigations and ensure fair market practices, as demonstrated by past settlements.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws are paramount for Corning, a company heavily reliant on its innovative output. Strong IP protection, particularly in key markets, is essential to shield its proprietary technologies, like its renowned Gorilla Glass and advanced optical fiber, from unauthorized replication and market dilution.

Corning's commitment to safeguarding its inventions is evident in its active pursuit of legal remedies against alleged patent infringements. This proactive stance is crucial for preserving its competitive advantage and ensuring a return on its significant research and development investments. For instance, in 2023, Corning reported R&D expenses of approximately $1.1 billion, underscoring the importance of protecting these innovations.

- Global IP Landscape: Corning operates in a global market where IP protection varies significantly. Countries with strong patent laws and effective enforcement mechanisms are vital for Corning’s business strategy.

- Litigation and Enforcement: The company has a history of engaging in patent litigation to defend its technological leadership, which can involve substantial legal costs but is seen as a necessary investment to protect its market share and revenue streams.

- R&D Investment Protection: Robust IP protection directly influences Corning's ability to recoup its substantial R&D expenditures, which were over $1 billion in 2023, and to fund future innovation.

Government industrial policies, such as the U.S. CHIPS and Science Act of 2022, directly benefit Corning by incentivizing domestic production of advanced technologies, boosting its optical communications and advanced optics segments. Corning's strategic $1 billion expansion for optical fiber manufacturing in 2023 exemplifies alignment with these government initiatives aimed at strengthening national supply chains.

Trade agreements and tariffs significantly shape Corning's global operations, with intellectual property disputes, like those involving Chinese display glass makers in 2024, highlighting the critical role of international trade laws in protecting innovation. Geopolitical stability remains a concern, as evidenced by ongoing challenges in global logistics and energy prices in early 2024 impacting manufacturing costs.

Corning's global regulatory navigation includes strict adherence to product safety and environmental standards, with increased scrutiny on supply chain transparency in 2024. Past antitrust engagements, such as the 2023 EU settlement, underscore the need for proactive compliance with competition laws.

The strength of intellectual property (IP) laws is vital for Corning, which invested approximately $1.1 billion in R&D in 2023. Effective global IP protection is crucial for safeguarding its proprietary technologies and ensuring a return on its innovation investments.

What is included in the product

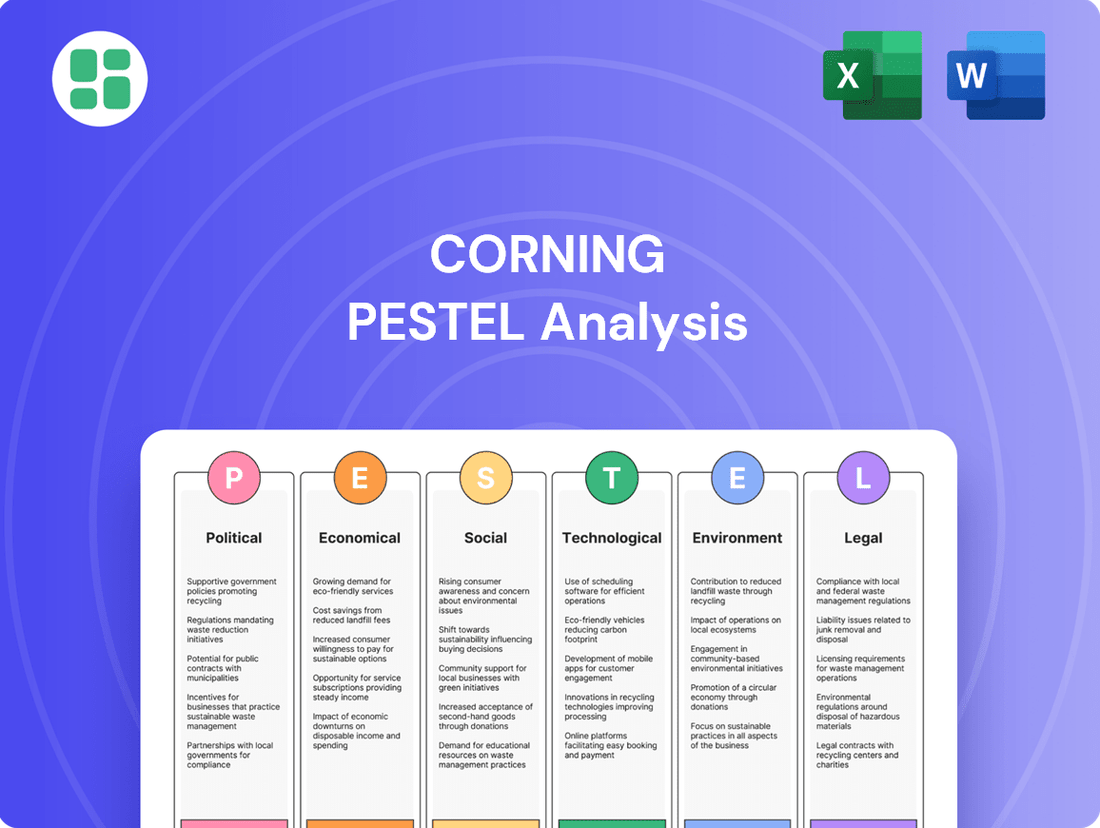

This PESTLE analysis examines the external macro-environmental forces impacting Corning, covering Political, Economic, Social, Technological, Environmental, and Legal factors to identify strategic opportunities and threats.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors into actionable insights.

Economic factors

Global economic growth is a significant factor influencing demand for Corning's advanced materials. As economies expand, so does consumer and business spending on high-technology products that rely on Corning's innovations, such as optical fiber for telecommunications and advanced glass for displays.

Consumer spending trends, especially in areas like smartphones and televisions, directly fuel Corning's Display Technologies and Specialty Materials segments. For instance, a strong consumer economy in 2024 and projected for 2025 typically translates to higher sales of these devices, benefiting Corning.

A healthy global economy also encourages investment in crucial infrastructure like 5G networks and data centers. This increased capital expenditure drives demand for Corning's optical communications products, with global telecom equipment spending expected to grow in the coming years.

Currency fluctuations, particularly the Japanese Yen's movement against the U.S. dollar, directly impact Corning's financial results. For instance, a stronger yen can reduce the dollar value of sales made in Japan, affecting profitability, especially within the Display Technologies segment which relies heavily on Asian markets. Corning actively employs currency hedging strategies to mitigate these effects and ensure more predictable U.S. dollar net income from its global operations.

Rising inflation presents a significant challenge for Corning, directly impacting its manufacturing expenses. For instance, the Producer Price Index for manufactured goods saw a notable increase throughout 2023 and into early 2024, signaling higher costs for raw materials and components essential to Corning's diverse product lines, from optical fiber to specialty glass.

Corning must strategically manage these escalating input costs, including energy and labor, to protect its profit margins. The company's ability to implement effective pricing strategies, potentially passed on to customers for products like Gorilla Glass used in smartphones and displays, will be crucial in offsetting these inflationary pressures.

To mitigate these effects, Corning is focused on optimizing its supply chains and driving operational efficiencies. This could involve diversifying suppliers, investing in automation to reduce labor dependence, and leveraging economies of scale across its global manufacturing footprint to maintain competitive pricing and profitability.

Interest Rates and Investment Climate

Interest rates significantly impact Corning's investment decisions. Higher rates increase the cost of borrowing for capital expenditures and research and development, which are vital for their innovation pipeline. For instance, the Federal Reserve's benchmark interest rate remained in the 5.25%-5.50% range through early 2024, a level that can make large-scale investments more expensive.

A supportive investment climate, characterized by readily available and affordable capital, is essential for Corning's growth. This environment allows them to fund manufacturing capacity expansions and the development of cutting-edge technologies. Corning's strategic 'Springboard' plan, aimed at capturing new sales opportunities, relies heavily on favorable access to funding.

- Cost of Capital: Elevated interest rates, such as those seen in the 2023-2024 period, directly increase the cost of debt financing for Corning's capital-intensive operations.

- Investment Climate: A robust economy with stable or declining interest rates typically fosters a more positive investment climate, encouraging R&D spending and capacity build-outs.

- Strategic Investments: Corning's 'Springboard' plan, targeting growth in areas like optical communications and automotive glass, necessitates substantial capital, making interest rate levels a critical consideration for its financial feasibility.

Supply Chain Dynamics and Disruptions

The intricate dance of global supply chains is a critical factor for Corning, a company heavily dependent on specialized materials and components. Disruptions, whether from geopolitical tensions, unexpected natural disasters, or widespread health crises, can significantly impact production timelines and inflate operational expenses. For instance, the semiconductor shortage experienced in 2021-2022, which affected numerous industries, underscored the vulnerability of complex supply networks.

Corning's strategic initiatives to bolster domestic supply chains are a direct response to these vulnerabilities. The company's investment in U.S.-based manufacturing for solar components, for example, aims to create more resilient and predictable sourcing. This move not only reduces reliance on international logistics but also aligns with broader trends toward onshoring critical manufacturing capabilities.

- Supply Chain Resilience: Corning's strategy to diversify sourcing and increase domestic production, particularly in areas like solar components, aims to buffer against global supply chain shocks.

- Impact of Disruptions: Events like the 2021-2022 semiconductor shortage highlight the tangible financial and operational consequences of supply chain interruptions for technology-reliant manufacturers.

- Geopolitical Influence: Trade policies and international relations can directly affect the cost and availability of raw materials and finished goods, influencing Corning's global operations.

- Logistical Costs: Fluctuations in shipping rates and fuel prices, exacerbated by supply chain congestion, directly impact Corning's cost of goods sold and overall profitability.

Global economic growth directly influences demand for Corning's products, from optical fiber for 5G infrastructure to advanced glass for electronics. A robust economy in 2024 and projected into 2025 generally means increased consumer and business spending, which benefits Corning's key markets like telecommunications and display technologies. For example, global GDP growth forecasts for 2024 and 2025 suggest continued expansion, supporting higher sales volumes for Corning.

Inflationary pressures, particularly rising costs for raw materials, energy, and labor, present a significant challenge for Corning's manufacturing operations. For instance, the Producer Price Index for manufactured goods saw increases throughout 2023 and into early 2024, indicating higher input costs. Corning must strategically manage these escalating expenses, potentially through pricing adjustments on products like Gorilla Glass, to protect profit margins.

Interest rates critically affect Corning's investment decisions and cost of capital. Higher rates, such as the Federal Reserve's benchmark rate remaining in the 5.25%-5.50% range through early 2024, increase the expense of borrowing for capital expenditures and R&D. This makes funding large-scale projects, like manufacturing capacity expansions, more costly, impacting the financial feasibility of growth initiatives.

Supply chain disruptions remain a key concern for Corning, given its reliance on specialized components. Events like the 2021-2022 semiconductor shortage highlighted the vulnerability of global networks. Corning's strategy to diversify sourcing and increase domestic production, such as in solar components, aims to build greater resilience against these shocks and mitigate logistical cost fluctuations.

| Economic Factor | Impact on Corning | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Global Economic Growth | Drives demand for optical fiber, display glass, and specialty materials. | Projected global GDP growth of approximately 2.7% for 2024 and 2.8% for 2025 (IMF estimates). |

| Inflation | Increases manufacturing costs (raw materials, energy, labor). | Producer Price Index for manufactured goods saw notable increases in 2023-early 2024. |

| Interest Rates | Affects cost of borrowing for capital expenditures and R&D. | Federal Reserve benchmark rate maintained at 5.25%-5.50% through early 2024. |

| Supply Chain Stability | Impacts production timelines and operational expenses. | Continued focus on supply chain resilience and onshoring initiatives by manufacturers. |

Preview the Actual Deliverable

Corning PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Corning PESTLE analysis covers all key external factors impacting the company's strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this detailed PESTLE analysis for Corning, providing actionable insights.

The content and structure shown in the preview is the same document you’ll download after payment. This Corning PESTLE analysis is meticulously researched and presented for your strategic advantage.

Sociological factors

Consumer preferences are shifting towards electronic devices that are not only smarter and more durable but also visually appealing, directly impacting the demand for Corning's advanced materials like Gorilla Glass. For instance, in 2024, consumer surveys indicated a 15% increase in willingness to pay a premium for devices with enhanced scratch resistance and improved optical clarity.

The rise of remote work and the growing importance of digital connectivity are fueling a demand for sophisticated display and optical solutions. By 2025, the global augmented reality (AR) and virtual reality (VR) market is projected to reach $100 billion, a trend that will necessitate advanced materials for immersive and high-performance devices, areas where Corning excels.

Global demographic shifts, particularly population growth in emerging markets and accelerating urbanization, are significant drivers for Corning's core businesses. By 2024, over 60% of the world's population resides in urban areas, a figure projected to reach 68% by 2050, according to UN data. This trend directly fuels demand for robust telecommunications infrastructure, where Corning's optical fiber solutions are essential for high-speed internet and 5G deployment.

The increasing concentration of people in cities also boosts the automotive sector. As urban populations grow, so does the need for vehicles, and consequently, advanced automotive glass components like heads-up displays and driver-assistance systems, areas where Corning holds a strong market position.

Societal expectations and regulatory emphasis on health and safety are paramount for Corning's manufacturing, influencing operational standards. The company actively strives to minimize workplace incidents, reporting a reduction in its Total Recordable Incident Rate (TRIR) to 0.26 in 2023, down from 0.31 in 2022, reflecting this commitment.

Maintaining robust safety protocols is not only vital for employee well-being but also directly impacts Corning's corporate reputation and operational continuity. High safety performance can lead to lower insurance premiums and fewer production disruptions, contributing to financial stability.

Education and Workforce Availability

Corning's success hinges on a skilled workforce, especially in science, engineering, and advanced manufacturing. The company actively invests in STEM education and collaborates with universities to cultivate a steady stream of qualified talent. This focus ensures they have the expertise needed for their cutting-edge research and production.

Corning's strategic partnerships directly address workforce development needs. For instance, their collaboration with the National Institute for Bioprocessing Research and Training (NIBRT) aims to speed up advancements in cell therapy, showcasing their commitment to building specialized skills within critical emerging fields. This proactive approach to talent acquisition and development is vital for maintaining their competitive edge.

- Skilled Workforce Demand: A significant portion of Corning's workforce is concentrated in roles requiring advanced scientific and technical expertise.

- STEM Education Investment: The company allocates resources towards programs designed to bolster STEM education at various levels, from K-12 to higher education.

- Academic Partnerships: Corning maintains collaborations with numerous universities globally to foster research and talent development in areas relevant to their material science innovations.

- Bioprocessing Talent: Their involvement with NIBRT specifically targets the growing need for professionals skilled in bioprocessing for advanced therapies.

Corporate Social Responsibility (CSR) and Brand Reputation

Societal expectations for corporate social responsibility are growing, directly influencing how consumers and investors perceive Corning. Companies demonstrating strong ethical practices and a commitment to sustainability often enjoy enhanced brand loyalty and investment appeal. Corning's efforts in this area are highlighted in its sustainability reports, showcasing its dedication to responsible operations.

Corning actively communicates its commitment to sustainability, community involvement, and ethical business conduct. For instance, its 2023 Global Impact Report detailed progress in areas like reducing greenhouse gas emissions and promoting diversity and inclusion. This proactive approach to CSR is crucial for maintaining a positive brand image in today's socially conscious market.

- Enhanced Brand Image: Corning's CSR initiatives, such as its focus on environmental stewardship, contribute to a stronger, more positive brand perception among stakeholders.

- Investor Attraction: A robust CSR strategy, evidenced by transparent reporting on environmental, social, and governance (ESG) metrics, makes Corning a more attractive investment for those prioritizing sustainable businesses.

- Consumer Loyalty: Consumers increasingly favor brands that align with their values; Corning's demonstrated commitment to ethical practices can foster deeper customer relationships and loyalty.

- Risk Mitigation: Proactive engagement with CSR principles helps Corning mitigate potential reputational risks associated with environmental or social missteps, ensuring long-term stability.

Societal expectations for corporate social responsibility are growing, directly influencing how consumers and investors perceive Corning. Companies demonstrating strong ethical practices and a commitment to sustainability often enjoy enhanced brand loyalty and investment appeal. Corning's efforts in this area are highlighted in its sustainability reports, showcasing its dedication to responsible operations.

Corning actively communicates its commitment to sustainability, community involvement, and ethical business conduct. For instance, its 2023 Global Impact Report detailed progress in areas like reducing greenhouse gas emissions and promoting diversity and inclusion. This proactive approach to CSR is crucial for maintaining a positive brand image in today's socially conscious market.

The demand for a highly skilled workforce, particularly in science and engineering, is a critical sociological factor for Corning. The company's investment in STEM education and university partnerships, such as its collaboration with NIBRT for bioprocessing talent, directly addresses this need, ensuring a pipeline of qualified professionals for its advanced material innovations.

| Sociological Factor | Impact on Corning | Supporting Data/Trend |

|---|---|---|

| Consumer Demand for Durability & Aesthetics | Drives demand for Gorilla Glass and advanced display materials. | 15% increase in willingness to pay a premium for enhanced scratch resistance in 2024 consumer surveys. |

| Remote Work & Digital Connectivity | Increases need for optical fiber and advanced display solutions. | Global AR/VR market projected to reach $100 billion by 2025. |

| Urbanization & Population Growth | Fuels demand for robust telecommunications infrastructure (optical fiber) and automotive components. | Over 60% of global population in urban areas in 2024, projected to reach 68% by 2050. |

| Workforce Skills Gap (STEM) | Necessitates investment in education and talent development. | Corning invests in STEM education and partners with universities; collaboration with NIBRT for bioprocessing skills. |

| Corporate Social Responsibility (CSR) Expectations | Enhances brand image, investor appeal, and consumer loyalty. | Corning's 2023 Global Impact Report detailed progress in reducing emissions and promoting diversity. |

Technological factors

Corning's foundation is built on its deep expertise in materials science, particularly in glass and ceramics. Ongoing breakthroughs in these formulations are critical for its sustained growth and market leadership.

Recent developments highlight this commitment, such as the creation of ultra-thin, flexible ceramic materials designed for advanced battery technologies and specialized engineered glass for enhanced solar module efficiency. These innovations are not just incremental improvements; they are opening doors to entirely new product lines and significantly boosting the performance of existing offerings.

For instance, Corning's Gorilla Glass, a testament to their materials innovation, has been a key component in over 8 billion devices globally as of early 2024, showcasing the commercial impact of their advancements. This continuous push in material science directly translates into competitive advantages and new revenue streams.

The continuous advancements in optical physics are a major catalyst for Corning's optical communications segment. This is particularly evident as the world embraces 5G, with global 5G infrastructure spending projected to reach hundreds of billions of dollars by 2025.

Corning's fiber optic solutions are essential for supporting the massive data demands of AI data centers and the broader digital economy. These technologies enable the high-speed, high-bandwidth connectivity required for these critical infrastructure build-outs, a trend that saw data center traffic grow by an estimated 25% year-over-year in 2024.

The relentless advancement in display technology, featuring innovations like OLED and sophisticated LCDs, alongside the burgeoning foldable device market, significantly shapes Corning's Display Technologies and Specialty Materials businesses. These shifts demand lighter, stronger, and more adaptable glass solutions.

Corning's commitment to developing premium glass substrates and robust cover glasses, such as their Gorilla Glass Ceramic 2, is crucial for facilitating the creation of thinner, more energy-efficient, and resilient displays. This directly supports the integration of advanced displays into a wider array of consumer electronics and automotive applications, where durability is paramount.

Automation and Advanced Manufacturing

Corning's strategic embrace of automation and advanced manufacturing is a significant technological driver. By integrating robotics and sophisticated production techniques, the company aims to boost operational efficiency, lower manufacturing expenses, and elevate the consistency and quality of its diverse product portfolio.

Corning's substantial investment in its U.S.-based advanced manufacturing capabilities is crucial. This footprint enables a faster and more agile production ramp-up for novel products, ensuring they can effectively meet escalating market demand. For instance, in 2024, Corning announced plans to expand its semiconductor materials manufacturing capacity in the U.S., a move directly linked to leveraging advanced manufacturing to meet projected growth in the semiconductor industry.

- Efficiency Gains: Automation reduces manual labor, minimizing errors and speeding up production cycles.

- Cost Reduction: Optimized processes and reduced waste contribute to lower overall manufacturing costs.

- Quality Enhancement: Precision in automated systems leads to more consistent and higher-quality output.

- Scalability: Advanced manufacturing infrastructure allows for quicker scaling to meet fluctuating market demands.

Research and Development (R&D) Investment

Corning's commitment to research and development is a cornerstone of its strategy, with significant and consistent investment fueling its competitive edge. The company's 'Springboard' plan, for instance, outlines an aggressive approach to R&D and the creation of new products designed to capitalize on emerging market trends. This dedication to ongoing innovation is what keeps Corning at the forefront of materials science and advanced technology components.

For the fiscal year ending December 31, 2023, Corning reported R&D expenses of $1.12 billion. This figure represents a substantial commitment to future growth and technological advancement. The company's innovation pipeline is robust, with a focus on areas like optical communications, automotive glass, and advanced display technologies, all of which require substantial upfront investment in R&D to maintain market leadership.

- R&D Investment: Corning invested $1.12 billion in research and development for the fiscal year 2023.

- Strategic Focus: The 'Springboard' plan highlights aggressive R&D spending to capture new market opportunities.

- Innovation Driver: Continuous investment ensures Corning's leadership in materials science and high-tech components.

- Key Sectors: R&D efforts are concentrated on optical communications, automotive glass, and display technologies.

Corning's technological prowess is evident in its continuous material science breakthroughs, such as ultra-thin, flexible ceramics for advanced batteries and improved glass for solar modules. Their Gorilla Glass, used in over 8 billion devices by early 2024, exemplifies the commercial success of these innovations.

The company's optical communications segment thrives on advancements in optical physics, crucial for the expanding 5G infrastructure, with global spending expected to reach hundreds of billions by 2025. This supports the massive data demands of AI data centers, where traffic grew an estimated 25% year-over-year in 2024.

Corning's investment in advanced manufacturing and automation, including U.S.-based facilities, boosts efficiency and quality. Their 2023 R&D spend of $1.12 billion fuels innovation in key areas like optical communications and display technologies, ensuring their market leadership.

Legal factors

Corning's core business thrives on its extensive intellectual property, particularly patents safeguarding its groundbreaking specialty glass and ceramic technologies. These legal protections are paramount, acting as a shield against unauthorized use and ensuring Corning's competitive edge in the market.

The company's commitment to defending its innovations is evident in its proactive legal stance. For instance, Corning has historically filed complaints with the US International Trade Commission (USITC) to address alleged patent infringements, demonstrating its resolve to protect its valuable proprietary technologies.

Corning must navigate a complex web of product liability and safety regulations globally. For instance, in 2024, automotive manufacturers faced increased scrutiny over Advanced Driver-Assistance Systems (ADAS) safety, directly impacting Corning's automotive glass solutions. Failure to meet these evolving standards, such as those set by the UNECE WP.29 for automated driving systems, could lead to costly recalls and reputational damage.

Ensuring the safety of its diverse product portfolio, from Gorilla Glass for electronics to specialized materials for the life sciences, is critical. In 2025, regulations surrounding medical device components are expected to tighten further, requiring Corning to maintain robust quality assurance and rigorous testing protocols to prevent litigation and maintain consumer confidence.

Corning must rigorously adhere to antitrust and competition laws to prevent significant penalties and uphold fair market operations. These regulations are crucial for fostering a competitive environment and preventing any single entity from dominating the market through unfair means.

The company's recent settlement with EU antitrust authorities, which involved ending exclusive agreements with mobile phone manufacturers, highlights how these legal frameworks directly influence Corning's strategic decisions and business relationships. This action underscores the importance of proactive compliance in navigating complex global markets.

Labor Laws and Employment Regulations

Corning's global operations necessitate strict adherence to a patchwork of labor laws and employment regulations across various jurisdictions. These laws govern everything from minimum wage requirements and working condition standards to employee rights and collective bargaining, impacting Corning's operational costs and human resource strategies. For instance, in 2024, many European countries continued to strengthen worker protections, with Germany's Works Constitution Act influencing employee representation and decision-making processes.

Navigating these diverse legal landscapes is crucial for Corning to foster a positive and compliant work environment, thereby mitigating the risk of costly litigation and reputational damage. Ensuring fair labor practices not only aids in talent acquisition and retention but also extends to upholding human rights throughout its extensive supply chain. By 2025, international pressure for supply chain transparency regarding labor practices is expected to intensify, potentially leading to new reporting mandates.

Key aspects of Corning's compliance efforts include:

- Adherence to minimum wage laws globally: Corning must track and comply with varying minimum wage rates, which saw adjustments in numerous countries throughout 2024, impacting labor costs.

- Ensuring safe and healthy working conditions: Compliance with occupational safety and health regulations, such as OSHA standards in the US and similar frameworks in other regions, is paramount.

- Upholding employee rights: This includes rights to freedom of association, protection against discrimination, and fair dismissal procedures, all governed by local laws.

- Supply chain labor standards: Monitoring and enforcing human rights and labor standards within its supply chain to prevent exploitation and ensure ethical sourcing.

Environmental Regulations and Compliance

Corning faces growing environmental regulations worldwide, impacting its manufacturing by requiring stricter controls on emissions, waste, and chemical usage. For instance, the European Union's Green Deal and similar initiatives in North America are pushing for reduced carbon footprints and circular economy principles, directly affecting material sourcing and production efficiency. Corning's commitment to sustainability is evident in its significant investments in upgrading reporting systems and pursuing certifications like ISO 14001, which demonstrates adherence to international environmental management standards.

Failure to comply with these evolving environmental mandates can result in substantial financial penalties and significant damage to Corning's brand reputation. In 2023, for example, companies across various industrial sectors faced millions in fines for environmental violations, underscoring the financial risks associated with non-compliance. Corning's proactive approach to environmental stewardship, including its 2023 sustainability report detailing progress in reducing greenhouse gas emissions by 15% compared to a 2019 baseline, aims to mitigate these risks.

- Stricter Emissions Standards: Regulations like the US EPA's National Ambient Air Quality Standards (NAAQS) necessitate advanced pollution control technologies in Corning's facilities.

- Waste Management Compliance: Adherence to regulations such as the Resource Conservation and Recovery Act (RCRA) in the US requires careful management and disposal of industrial waste.

- Chemical Use Restrictions: Global regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe impact the types of chemicals Corning can use in its manufacturing processes.

- Environmental Certifications: Achieving and maintaining ISO 14001 certification, as Corning has done, demonstrates a robust environmental management system and aids in regulatory compliance.

Corning's legal strategy heavily relies on robust patent protection for its proprietary glass and ceramic technologies, as seen in its proactive stance against alleged infringements. The company must also navigate evolving product liability and safety regulations, particularly in areas like automotive ADAS and medical devices, to avoid costly penalties and maintain consumer trust. Antitrust and competition laws are critical, with past EU settlements influencing Corning's business relationships and underscoring the need for ongoing compliance.

Environmental factors

Corning is actively addressing climate change by focusing on reducing its environmental impact, particularly its carbon footprint. The company has committed to ambitious science-based targets, aiming for a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2028, using 2021 as its baseline year.

Furthermore, Corning is targeting a 17.5% decrease in Scope 3 emissions within the same 2028 timeframe. These initiatives are vital for mitigating the effects of climate change and aligning with growing stakeholder demands for corporate environmental responsibility.

Corning's reliance on minerals and chemicals for its glass and ceramics manufacturing means that the availability and sustainable sourcing of these raw materials are paramount. The company actively seeks to mitigate resource scarcity by investigating alternative materials, improving material efficiency in its production processes, and expanding its recycling initiatives. For instance, in 2023, Corning reported a significant investment in research and development aimed at enhancing the recyclability of its Gorilla Glass, a key component in many electronic devices.

Corning's dedication to effective waste management and circular economy principles is a key environmental focus. The company actively works to minimize waste creation and boost landfill diversion rates, with several facilities achieving zero-waste-to-landfill status by 2024.

This commitment to reducing waste not only bolsters environmental sustainability but also enhances operational efficiency. For instance, by repurposing materials and optimizing production processes, Corning can lower disposal costs and potentially create new revenue streams from recycled content.

Energy Consumption and Renewable Energy Adoption

Corning's manufacturing operations are inherently energy-intensive, placing significant emphasis on energy consumption and the shift towards renewable energy sources as critical environmental considerations.

The company has set ambitious targets to reduce its energy footprint, aiming for a substantial 400% increase in renewable energy adoption by 2030, measured against a 2018 baseline.

Corning is actively pursuing this goal through strategic investments in green electricity and the execution of virtual power purchase agreements, demonstrating a commitment to sustainable energy practices.

- Energy-Intensive Manufacturing: Corning's core production processes, particularly in areas like glass and ceramic manufacturing, demand significant energy inputs.

- Renewable Energy Target: Aims for a 400% increase in renewable energy usage by 2030 compared to 2018 levels.

- Investment Strategy: Utilizes investments in green electricity and virtual power purchase agreements (VPPAs) to achieve its renewable energy goals.

Water Management and Conservation

Water usage in manufacturing is a key environmental consideration for Corning. The company is actively working to reduce its water withdrawal, particularly in areas facing water scarcity. For instance, by the end of 2023, Corning had achieved a 19% reduction in total water withdrawal compared to its 2019 baseline, with a specific focus on water-stressed sites.

Corning's commitment to responsible water management is evident in its global operations. They are implementing strategies to improve water efficiency and promote conservation throughout their manufacturing processes. This focus is crucial not only for environmental stewardship but also for ensuring the long-term operational resilience of their facilities.

- Water Withdrawal Reduction: Corning aims to decrease water usage, especially in regions with limited water resources.

- Efficiency Improvements: The company is investing in technologies and processes to make water use more efficient across its global sites.

- Operational Resilience: Effective water management is seen as vital for maintaining business continuity and mitigating risks associated with water availability.

Corning is actively tackling climate change, targeting a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2028 from a 2021 baseline, and a 17.5% cut in Scope 3 emissions within the same timeframe. The company is also prioritizing sustainability in its material sourcing and waste management, aiming for zero-waste-to-landfill at several facilities by 2024. A significant focus is placed on energy consumption, with a goal to increase renewable energy adoption by 400% by 2030 compared to 2018 levels, achieved through investments in green electricity and virtual power purchase agreements. Furthermore, Corning has reduced its total water withdrawal by 19% as of the end of 2023, relative to its 2019 baseline, with a particular emphasis on water-stressed locations.

| Environmental Focus | Target/Status | Baseline Year | Key Initiatives |

|---|---|---|---|

| Greenhouse Gas Emissions Reduction | Scope 1 & 2: 30% reduction by 2028 Scope 3: 17.5% reduction by 2028 |

2021 | Science-based targets |

| Renewable Energy Adoption | 400% increase by 2030 | 2018 | Green electricity investments, VPPAs |

| Water Withdrawal Reduction | 19% reduction by end of 2023 | 2019 | Water efficiency improvements, focus on water-stressed sites |

| Waste Management | Zero-waste-to-landfill at select facilities by 2024 | N/A | Waste minimization, recycling initiatives |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Corning is meticulously constructed using a blend of official government publications, reputable market research firms, and leading industry journals. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.