Corning Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corning Bundle

Unlock the strategic potential of this company's product portfolio with a clear understanding of its BCG Matrix. See which products are driving growth and which might be holding the business back. Purchase the full report for a comprehensive analysis and actionable insights to optimize your investments.

Stars

Corning's innovative optical connectivity solutions are fueling the generative AI revolution, leading to exceptional growth. The company's Enterprise business saw a remarkable 106% year-over-year sales increase in Q1 2025 and 81% in Q2 2025, directly attributed to the strong demand for these new AI-focused products.

This surge in demand has prompted an upgrade to Corning's Enterprise Network business growth forecast, now projecting a 30% compound annual growth rate (CAGR) from 2023 to 2027. These solutions are critical for building the high-speed, high-density networks required to link AI data centers effectively.

Corning's Enterprise Fiber Optic Network Solutions are a shining example of a Star in the BCG matrix. The Enterprise segment of their Optical Communications business experienced an impressive 93% sales increase in Q4 2024, capping off a full-year 2024 growth of 49% to reach a record $2 billion.

This remarkable expansion is directly linked to the escalating demand for Corning's optical connectivity products, driven by the widespread adoption of generative AI and the rapid build-out of data centers. The segment's consistent, strong performance and its leadership in supplying essential infrastructure for advanced networks highlight its Star status.

Continued strategic investment is crucial to sustain this high growth trajectory and capitalize on the ongoing technological shifts that favor advanced fiber optic solutions.

Corning's SMF-28® Contour fiber and Contour™ Flow Cable are revolutionary in high-density fiber optics, specifically targeting the burgeoning AI network market. These solutions are engineered to dramatically boost density, scalability, and overall performance, allowing operators to significantly enhance their existing duct capacity.

The primary benefit of these advanced cables is their ability to facilitate the construction of incredibly dense fiber infrastructure, crucial for the demanding requirements of hyperscale data centers. This innovation directly addresses the need for more bandwidth and faster data transmission as AI applications continue to expand.

Corning has seen an overwhelmingly positive customer reception, evidenced by a swift production ramp-up. This strong market demand, with initial orders for Contour Flow Cable exceeding expectations in early 2024, positions these products as Stars in the BCG matrix, reflecting both high growth and Corning's dominant market share in this segment.

Advanced Automotive Interior Glass (e.g., large curved displays)

Corning is actively pushing boundaries in automotive interior glass, particularly with large curved displays and integrated functionalities. This innovation directly addresses the growing consumer desire for sophisticated in-car digital experiences.

Their proprietary ColdForm™ Technology is a game-changer, allowing for intricate glass shaping at ambient temperatures. This not only facilitates complex design possibilities but also contributes to more environmentally conscious production methods.

The automotive industry's trajectory toward increased autonomy and connectivity is fueling demand for larger, more versatile displays. Corning's advanced glass solutions are strategically positioned to capitalize on these expanding market opportunities.

- Market Growth: The global automotive glass market is projected to reach over $25 billion by 2027, with advanced interior applications representing a significant growth segment.

- Technological Advantage: ColdForm™ Technology reduces energy consumption in manufacturing by up to 70% compared to traditional hot-forming methods.

- Demand Driver: The average number of displays in new vehicles is expected to increase from 3 in 2023 to over 5 by 2028, driving demand for specialized glass.

Specialty Materials for Emerging High-Performance Mobile Devices

Corning's Specialty Materials segment, particularly its premium glass innovations like advanced Gorilla Glass variants, is experiencing robust demand. This is a key driver for the company, with sales in this area rising 9% in Q4 2024.

This growth is fueled by the increasing need for materials in next-generation mobile devices. Think about the demand for glass that can handle folding screens or offers superior durability and optical performance for advanced features.

Even as the broader smartphone market matures, Corning's commitment to innovation in high-performance glass for these cutting-edge devices solidifies its leading position in a lucrative and expanding niche.

- Strong Demand for Premium Glass: Corning's advanced Gorilla Glass variants are highly sought after for their durability and performance.

- Growth in Next-Gen Devices: Demand is particularly strong for materials used in foldable phones and devices requiring enhanced optical capabilities.

- Market Leadership in a Niche: Despite a maturing core market, Corning maintains its leadership in the high-performance glass segment for innovative mobile technology.

- Q4 2024 Performance: The Specialty Materials segment saw a 9% increase in sales in the fourth quarter of 2024, underscoring the segment's strength.

Corning's optical connectivity solutions, particularly those supporting AI data centers, are exhibiting Star-like characteristics. The Enterprise Network business saw a remarkable 81% year-over-year sales increase in Q2 2025, and a projected 30% CAGR from 2023-2027. Products like SMF-28® Contour fiber and Contour™ Flow Cable are driving this, with initial orders exceeding expectations in early 2024, demonstrating high growth and market leadership.

| Corning Business Segment | 2024 Performance Highlight | Key Growth Driver | BCG Matrix Status |

| Optical Communications (Enterprise) | 93% sales increase in Q4 2024, $2 billion full-year 2024 revenue | Generative AI, data center build-out, high-density fiber needs | Star |

| Specialty Materials | 9% sales increase in Q4 2024 | Next-generation mobile devices, foldable screens, premium glass demand | Star |

| Automotive (Interior Glass) | Growing demand for large curved displays and integrated functionalities | Increased vehicle autonomy and connectivity, consumer desire for digital experiences | Potential Star / Question Mark (depending on market share capture) |

What is included in the product

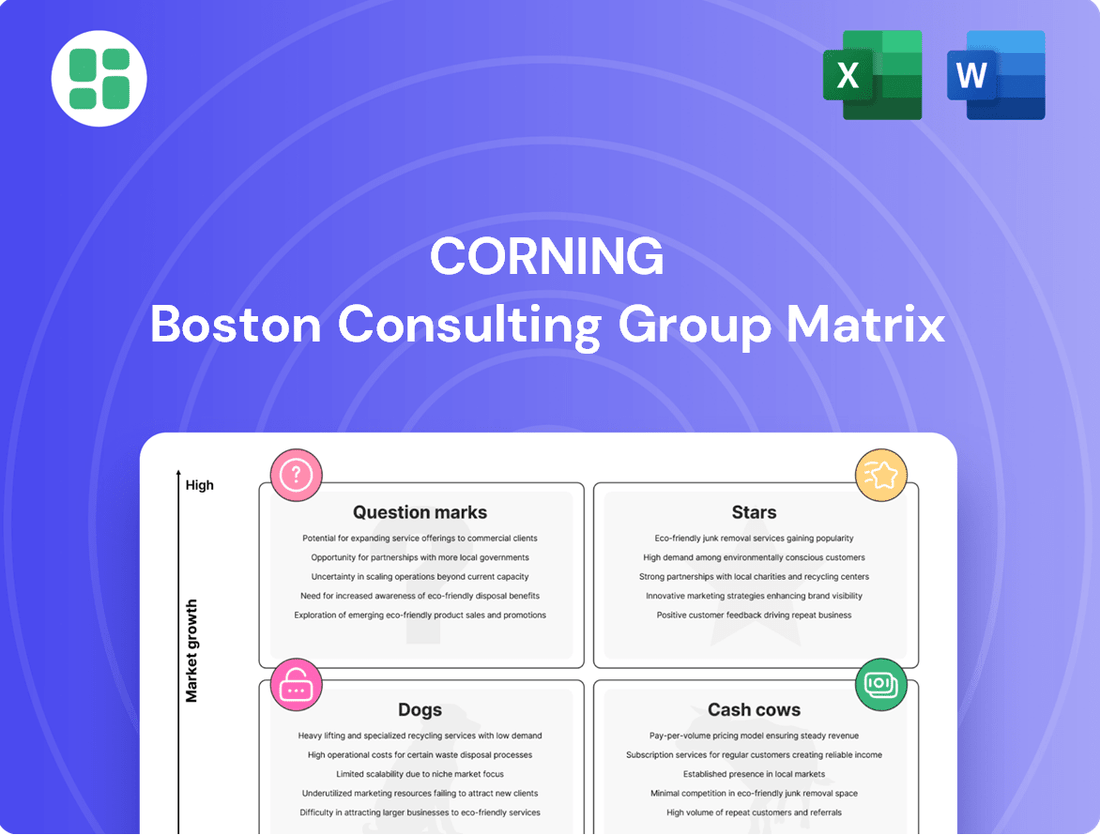

The BCG Matrix categorizes business units based on market share and growth, guiding strategic decisions for investment and resource allocation.

Quickly identify underperforming "Dogs" and reallocate resources from "Cash Cows" to promising "Stars" and "Question Marks."

Cash Cows

Corning's Display Technologies segment, primarily focused on glass for LCD TVs and monitors, operates as a mature market leader. In the fourth quarter of 2024, this segment achieved solid sales of $971 million, marking a 12% increase compared to the previous year.

Looking ahead to 2025, Corning anticipates a net income between $900 million and $950 million for this business. Despite the market experiencing modest single-digit growth, Corning has effectively managed to sustain stable U.S. dollar net income and a robust 25% net income margin through strategic price adjustments.

This segment consistently generates significant cash flow, a direct result of its commanding market share and highly efficient operational structure, solidifying its position as a cash cow for the company.

Corning Gorilla Glass is a prime example of a cash cow for Corning. It dominates the mobile consumer electronics market, celebrated for its exceptional durability and clear optics.

Although the smartphone market's growth is moderating, Gorilla Glass continues to be the go-to for high-end devices, ensuring steady revenue and profits. Corning's ability to leverage its strong brand and widespread adoption allows it to capitalize on this product, generating substantial cash flow with minimal marketing expenditure.

Corning's traditional Optical Communications carrier solutions are a prime example of a Cash Cow within the BCG Matrix. This segment consistently generates significant revenue by supplying essential fiber products to established telecommunications infrastructure providers. The ongoing demand for network maintenance and upgrades ensures a stable, predictable income stream for Corning.

While the growth rate in this segment may not match emerging technologies, its substantial market share, built on decades of strong customer relationships, provides a reliable foundation. In 2023, Corning's Optical Communications segment reported net sales of $5.2 billion, with a significant portion attributable to these carrier solutions, underscoring its role as a consistent cash generator.

Corning Life Sciences Labware and Consumables

Corning's Life Sciences division, encompassing labware and consumables, exhibits characteristics of a Cash Cow within the BCG Matrix. In Q3 2024, this segment saw its sales increase by a solid 6% compared to the previous year, reflecting its ongoing strength.

This business operates in a vital and inherently stable market, supplying fundamental products for scientific research, diagnostic testing, and the burgeoning bioprocessing industry. The consistent demand for these essential items translates into dependable cash flow for Corning.

- Stable Growth: Q3 2024 sales for Corning Life Sciences labware and consumables increased by 6% year-over-year.

- Essential Market: Serves critical and stable sectors like research, diagnostics, and bioprocessing.

- Predictable Cash Flow: Established market presence ensures reliable cash generation with minimal need for aggressive reinvestment.

Corning Pharmaceutical Technologies (e.g., Valor® Glass for vials)

Corning's Pharmaceutical Technologies, exemplified by innovations like Valor® Glass, directly addresses the pharmaceutical industry's stringent requirements for advanced packaging solutions. This segment thrives in a market characterized by stability and significant regulatory oversight, creating high barriers to entry for competitors. The emphasis on product integrity and dependable performance ensures a steady demand from major pharmaceutical manufacturers.

Valor® Glass, for instance, offers enhanced protection against particulate contamination and breakage, crucial for sterile drug containment. In 2023, the global pharmaceutical packaging market was valued at approximately $130 billion, with glass vials representing a significant portion. Corning's focus on this essential niche positions its Pharmaceutical Technologies as a strong Cash Cow, generating consistent revenue streams due to its established market presence and the critical nature of its products.

- Market Stability: Operates in a regulated, stable market with predictable demand.

- High Barriers to Entry: Significant R&D investment and regulatory compliance protect market share.

- Consistent Cash Flow: Reliable revenue generation from established pharmaceutical clients.

- Product Innovation: Valor® Glass exemplifies technological leadership in a critical sector.

Cash cows are business units or products that have a high market share in a slow-growing industry. They generate more cash than they consume, providing a stable income stream for the company. Corning's Display Technologies, Gorilla Glass, Optical Communications carrier solutions, Life Sciences labware and consumables, and Pharmaceutical Technologies all fit this description.

These segments benefit from established market positions, consistent demand, and efficient operations, allowing them to generate substantial cash flow with relatively low investment needs. For example, Corning's Display Technologies segment reported a 12% increase in sales in Q4 2024, reaching $971 million, and anticipates a net income between $900 million and $950 million for 2025.

Corning's Optical Communications segment, a key cash cow, generated $5.2 billion in net sales in 2023, demonstrating its significant contribution to the company's financial stability. The Life Sciences division also saw a 6% sales increase in Q3 2024, highlighting its reliable performance in essential markets.

These cash cows are crucial for funding research and development in newer, high-growth areas, ensuring Corning's long-term strategic advantage and profitability.

| Segment | Market Share | Growth Rate | Cash Flow Generation | Example Product/Service |

| Display Technologies | High | Slow | High | Glass for LCD TVs |

| Gorilla Glass | Dominant | Moderate | High | Durable smartphone glass |

| Optical Communications | Strong | Slow | High | Fiber optic cables |

| Life Sciences | Established | Steady | Consistent | Labware and consumables |

| Pharmaceutical Technologies | Niche Leader | Stable | Predictable | Valor® Glass vials |

Delivered as Shown

Corning BCG Matrix

The Corning BCG Matrix analysis you are previewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive, professionally formatted report ready for your strategic decision-making. You can trust that the insights and visualizations presented here are exactly what you'll be working with, ensuring a seamless transition from preview to practical application for your business planning.

Dogs

Corning's Diesel Particulate Filters (DPFs) within the Environmental Technologies segment are currently positioned as a Dog in the BCG Matrix. Sales in this area, especially for heavy-duty diesel applications, experienced a downturn, dropping 7% in the fourth quarter of 2024 and 6% for the entire year 2024. This decline is largely attributed to a softening global market and a notable downcycle in the Class 8 truck sector within North America.

While new prospects are emerging with gasoline particulate filters, the persistent weakness in the core diesel DPF business signals both low market growth and potential erosion of market share. This combination of factors firmly places DPFs in the Dog category, indicating a product with low growth prospects and potentially low relative market share.

Within Corning's Display Technologies segment, older or less advanced display glass products, especially those serving shrinking market segments, can be viewed as potential Dogs according to the BCG Matrix. These products are increasingly becoming commodities, experiencing reduced demand as the industry gravitates towards cutting-edge displays like OLED and larger screen formats.

For these legacy products, Corning's strategy often focuses on price adjustments rather than expanding sales volume to preserve profitability. For instance, while the overall Display Technologies segment reported net sales of $3.5 billion in 2023, a portion of this revenue is likely derived from these mature product lines facing significant competitive pressures and technological obsolescence.

Within Corning's vast Optical Communications segment, specific standard optical fiber products, particularly those without cutting-edge features or destined for low-margin, commoditized applications, can exhibit characteristics of a Dog in the BCG Matrix. These products often operate in mature, highly competitive markets where differentiation is minimal.

While Corning is a leader in high-growth areas like fiber for GenAI infrastructure, certain older fiber offerings might struggle with low growth rates and a diminished market share. This can result in very modest returns, making them less strategic assets for the company.

For instance, in 2024, the global optical fiber market, while growing, sees intense price competition in the standard single-mode fiber category. Products lacking specialized coatings or advanced performance metrics for niche applications are more susceptible to this commoditization, potentially impacting their profitability and market position.

Older Generation Specialty Materials (non-Gorilla Glass)

Within Corning's diverse portfolio, older generations of specialty materials, excluding flagship innovations like the latest Gorilla Glass iterations, often find themselves categorized as Dogs in the BCG Matrix. These products typically struggle with diminishing market relevance and face stiff competition from more advanced or cost-effective substitutes.

The market share for these legacy materials is often low, reflecting a declining demand. Growth prospects are minimal, as newer technologies and materials capture consumer and industry attention. For instance, while Corning's advanced display glass saw significant revenue growth, older, less specialized glass formulations might exhibit flat or negative sales trends.

- Low Market Share: Older specialty materials often hold a small percentage of their respective markets.

- Low Growth Prospects: These products typically experience little to no market expansion.

- Declining Demand: Consumer and industry preferences shift towards newer, more advanced alternatives.

- Intense Competition: Lower-cost or superior-performing products from competitors erode market position.

Basic Industrial Glass Products (less differentiated)

Corning's portfolio includes basic industrial glass products that are highly commoditized. These items, often lacking significant differentiation, typically compete in mature, low-growth markets. For example, while Corning is known for advanced materials, some of its glass offerings might fall into this category, facing intense competition and consequently, lower profit margins.

- Low Growth Markets: Many industrial glass segments, like certain types of flat glass for construction or basic automotive applications, experience growth rates often in the low single digits, mirroring overall economic expansion rather than technological advancement.

- High Competition: The market for basic industrial glass is often populated by numerous global and regional manufacturers, leading to price-sensitive competition and limited pricing power for individual companies.

- Minimal Profitability: Due to commoditization and intense competition, profit margins on these basic products are typically thin, often in the mid-to-high single digits, making them less attractive for significant investment compared to more specialized offerings.

- Strategic Divestment/Minimization: Companies like Corning may strategically choose to minimize investment or even divest from such segments to focus resources on higher-margin, innovation-driven businesses.

Corning's Diesel Particulate Filters (DPFs) are a prime example of a Dog in the BCG Matrix. Sales for these filters saw a 7% drop in Q4 2024 and a 6% decline for the full year 2024, largely due to a weaker global market and a downturn in the North American Class 8 truck sector. Despite new opportunities in gasoline particulate filters, the persistent weakness in the diesel DPF business indicates both low market growth and a potential loss of market share, firmly placing them in the Dog category.

Older, less advanced display glass products also fit the Dog profile. As the industry moves towards OLED and larger screens, these legacy products face reduced demand and increasing commoditization. Corning's strategy here often involves price adjustments to maintain profitability, as seen in the Display Technologies segment, which had $3.5 billion in net sales in 2023, with a portion likely from these mature, competitive product lines.

Certain standard optical fiber products within Corning's Optical Communications segment, particularly those lacking advanced features or targeting low-margin applications, can be considered Dogs. These products operate in mature, highly competitive markets with minimal differentiation. While Corning leads in areas like GenAI infrastructure fiber, older fiber offerings may struggle with low growth and diminished market share, resulting in modest returns.

Legacy specialty materials, excluding flagship innovations, often fall into the Dog category. These products face declining market relevance and strong competition from newer alternatives. Their market share is typically low, reflecting reduced demand and minimal growth prospects as newer technologies gain traction.

| Product Category | BCG Classification | Key Characteristics | Recent Performance Data |

|---|---|---|---|

| Diesel Particulate Filters (DPFs) | Dog | Low market growth, declining demand in heavy-duty diesel. | Q4 2024 sales down 7%; Full Year 2024 sales down 6%. |

| Legacy Display Glass | Dog | Mature market, commoditized, facing competition from newer technologies (OLED). | Part of $3.5 billion Display Technologies net sales (2023), but faces declining demand. |

| Standard Optical Fiber (less advanced) | Dog | Mature, highly competitive market, minimal differentiation. | Global optical fiber market sees intense price competition in standard single-mode fiber. |

| Older Specialty Materials | Dog | Diminishing market relevance, low market share, minimal growth prospects. | Flat or negative sales trends for older, less specialized glass formulations compared to advanced display glass. |

Question Marks

Corning is entering the solar wafer market with its new U.S.-made ingot and wafer products, aiming for this Solar Market-Access Platform to reach $2.5 billion in revenue by 2028. This positions Corning's solar wafer products as a Question Mark within the BCG matrix. The market itself is experiencing rapid growth, indicating significant future potential.

While Corning has secured strong customer commitments, the company is still in the early stages of scaling production and capturing market share. This ramp-up phase requires substantial capital investment to solidify its competitive standing. The high growth potential coupled with the current need for investment and market establishment firmly places these products in the Question Mark category, with the possibility of evolving into a Star if market penetration and profitability are achieved.

Corning's EXTREME ULE® Glass, launched in September 2024, is a pivotal material for advanced semiconductor fabrication, especially for EUV lithography essential for AI chips. This innovation directly addresses the surging demand for sophisticated and intelligent technologies, positioning Corning to capitalize on a high-growth market.

The semiconductor industry, particularly the segment focused on AI and advanced computing, is experiencing robust expansion. Industry analysts projected the global semiconductor market to reach approximately $600 billion in 2024, with the advanced lithography segment showing even higher growth rates due to the increasing complexity and performance demands of next-generation chips.

Given its recent introduction and the substantial investment required to establish market share in this specialized, high-growth area, EXTREME ULE® Glass fits the profile of a Question Mark in the BCG Matrix. Corning's strategy likely involves significant marketing and R&D to solidify its position and convert this into a future Star.

Corning's ultra-flat, high-index glass wafers are a key component for augmented and mixed reality devices, allowing for more streamlined headset designs and richer, more immersive user experiences. This positions Corning's AR/MR glass solutions as potential stars in the future, given the nascent but rapidly expanding nature of the AR market.

The AR/MR market is still in its infancy, exhibiting high growth potential but currently low market penetration. This suggests that while Corning has a promising product, it's still in the early phases of building significant market share. For instance, the global AR/MR market was valued at approximately $10.1 billion in 2023 and is projected to reach over $100 billion by 2028, demonstrating substantial growth.

These advanced glass solutions require ongoing investment to fully capitalize on the expanding AR market. Corning's commitment to innovation in this area is crucial for them to establish a dominant position as the technology matures and adoption rates increase.

Corning's Fusion5™ Glass for Automotive Exteriors

Corning's Fusion5™ Glass is designed for automotive exteriors, offering improved impact resistance and lighter weight, particularly beneficial for electric vehicles. This innovation directly addresses the automotive sector's growing need for more durable and efficient components. As a newer product in a rapidly changing market, Fusion5™ fits the Question Mark category in the BCG Matrix, signifying its potential for high growth as adoption increases.

The automotive glass market is dynamic, with projections indicating continued expansion driven by advancements in vehicle technology. For instance, the global automotive glass market was valued at approximately USD 22.5 billion in 2023 and is expected to grow at a CAGR of around 5.5% through 2030, according to industry reports. Fusion5™ is positioned to capitalize on this growth, especially within the electric vehicle segment, which is experiencing rapid development and demand for lightweight, robust materials. The company's focus on these evolving automotive needs suggests a strategic move to capture market share in a high-potential area.

- Product Innovation: Fusion5™ Glass enhances vehicle durability and reduces weight.

- Market Context: Addresses evolving automotive demands, especially for EVs.

- BCG Matrix Classification: Positioned as a Question Mark due to its newness and growth potential.

- Market Opportunity: Aligns with the expanding global automotive glass market, projected for significant growth.

Corning's 'Scale-Up' GenAI Data Center Connectivity

Corning is recognizing a significant shift in data center needs driven by Generative AI. Beyond the initial rapid expansion, known as 'scale-out', they see a future 'scale-up' phase. This involves upgrading and expanding existing infrastructure to handle the immense data demands of advanced AI workloads.

This 'scale-up' opportunity within hyperscale data centers is projected to be substantial, potentially 2 to 3 times the size of Corning's current $2 billion Enterprise Network business. This positions it as a high-growth area within the already expanding AI infrastructure market.

While Corning holds a strong position in optical communications, this specific 'scale-up' market is still in its nascent stages of development. Therefore, it's categorized as a Question Mark within the BCG framework, necessitating strategic investment to fully capitalize on its potential.

- Emerging Opportunity: Corning identifies a 'scale-up' phase in GenAI data centers as a new, high-growth frontier.

- Market Size Potential: This 'scale-up' market is estimated to be 2-3 times larger than Corning's current $2 billion Enterprise Network business.

- Strategic Importance: Capturing this opportunity requires strategic investment due to its developing nature.

- Corning's Position: As a leader in optical communications, Corning is well-positioned to address this evolving demand.

Question Marks represent new products or business areas with high growth potential but uncertain market share. Corning's solar wafer products, EXTREME ULE® Glass, Fusion5™ Glass, and the 'scale-up' phase in GenAI data centers all fit this description.

These ventures require significant investment to establish market presence and compete effectively. Their success hinges on Corning's ability to scale production, gain market acceptance, and fend off competitors in rapidly evolving industries.

The company's strategic focus on these areas indicates a calculated approach to future growth, aiming to transform these nascent opportunities into dominant market positions.

| Product/Area | Market Growth Potential | Current Market Share | Investment Needs | BCG Classification |

| Solar Wafers | High | Low (New Entry) | High | Question Mark |

| EXTREME ULE® Glass | Very High (AI Chips) | Low (New Product) | High | Question Mark |

| AR/MR Glass Solutions | High (Nascent Market) | Low | Medium to High | Question Mark |

| Fusion5™ Glass (Automotive) | Medium to High | Low (New Product) | Medium | Question Mark |

| GenAI Data Center 'Scale-Up' | Very High (2-3x Enterprise Network) | Very Low (Emerging) | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth projections to provide strategic insights.