Corning Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corning Bundle

Unlock the core strategic components of Corning's innovative business model. This comprehensive Business Model Canvas details their unique value propositions, key partnerships, and revenue streams, offering a clear roadmap to their success.

Dive deeper into how Corning leverages its technological prowess and market insights to create and capture value. This full Business Model Canvas provides an in-depth look at their customer relationships, cost structures, and key resources, perfect for strategic analysis.

See exactly how Corning builds and scales its industry-leading operations. Download the complete Business Model Canvas to gain actionable insights into their customer segments, channels, and competitive advantages, empowering your own business strategy.

Partnerships

Corning actively collaborates with major technology firms and Original Equipment Manufacturers (OEMs) to embed its advanced materials into cutting-edge devices. This strategic approach ensures its specialized glass and ceramics are integral to product design from the outset.

A prime example is Corning's enduring partnership with Apple, where Gorilla Glass is a fundamental component of iPhones. This relationship highlights a deep co-development process, with Corning's innovations directly influencing Apple's product development timelines and specifications, a model critical for market success.

These collaborations are vital for driving market penetration and widespread product adoption. In 2024, the consumer electronics and automotive industries continue to be key beneficiaries, with Corning's materials enabling advancements in durability and functionality for a wide array of products.

Corning's commitment to pushing the boundaries of materials science and optical physics is significantly bolstered by its collaborations with universities, research institutions, and government-funded programs. These partnerships are crucial for staying ahead of the innovation curve.

These collaborations provide Corning with access to cutting-edge research, specialized equipment, and unique expertise that complements its internal capabilities. For instance, in 2023, Corning announced a significant expansion of its research and development efforts, including increased investment in university partnerships aimed at exploring next-generation display technologies and advanced optical materials.

By engaging with these external entities, Corning not only accelerates the development of new applications but also strengthens its intellectual property portfolio. This strategic approach ensures a steady pipeline of groundbreaking innovations, vital for maintaining its leadership position in highly competitive markets.

Corning's supply chain partners are crucial, providing everything from raw materials to specialized manufacturing equipment. These relationships are vital for maintaining the high quality and consistent supply needed for their advanced products. For instance, Corning's investment in a U.S.-integrated solar supply chain highlights their reliance on partners for critical components like polysilicon and wafer production, aiming for greater resilience and cost control.

Strategic Alliances for New Markets

Corning actively pursues strategic alliances to penetrate and expand within burgeoning markets such as GenAI infrastructure and the solar energy sector. These collaborations are crucial for navigating the complexities of new territories and meeting evolving market needs.

For example, in the U.S. solar energy landscape, Corning has forged partnerships with firms like Suniva and Heliene. These alliances are instrumental in building an integrated supply chain, enabling Corning to effectively address specific market demands and comply with relevant regulatory frameworks.

- Market Entry Acceleration: Partnerships shorten the time to market for new products and technologies in emerging sectors.

- Risk Mitigation: Sharing resources and expertise with partners helps distribute the financial and operational risks inherent in new market ventures.

- Supply Chain Integration: Alliances, like those in the U.S. solar industry, strengthen domestic supply chains to meet local content requirements and demand.

- Access to Expertise: Collaborations provide access to specialized knowledge and capabilities that Corning might not possess internally, fostering innovation and efficiency.

Distribution and Channel Partners

Corning leverages a robust network of distributors and channel partners to ensure its innovative products reach a wide array of customers across the globe. These partnerships are crucial for expanding market penetration, especially in regions or for product lines where a direct sales force is less efficient or cost-effective. For instance, in 2024, Corning's optical communications segment continued to rely on these partners to serve telecommunications providers and enterprise customers, facilitating complex logistics and providing essential local sales and technical support.

These collaborations are vital for navigating diverse market landscapes and catering to specific customer needs. By working with specialized distributors, Corning can effectively manage inventory, provide tailored solutions, and offer localized customer service, thereby enhancing the overall customer experience. This strategy is particularly impactful in emerging markets or for niche applications requiring specialized knowledge and infrastructure. In 2024, the success of their automotive glass solutions was also significantly bolstered by strong relationships with automotive manufacturers and their established supply chains, demonstrating the breadth of their channel strategy.

Key aspects of these partnerships include:

- Global Reach: Distributors extend Corning's sales and service capabilities into numerous international markets, overcoming geographical barriers.

- Logistics Management: Partners handle warehousing, transportation, and delivery, ensuring efficient product flow to end-users.

- Local Market Expertise: Channel partners provide invaluable on-the-ground knowledge, customer relationships, and tailored sales approaches.

- Specialized Support: In technical sectors, partners offer specialized pre-sales and post-sales support, crucial for complex product implementations.

Corning's key partnerships are foundational to its innovation and market reach, particularly with major technology firms and OEMs. These collaborations ensure Corning's advanced materials are integrated into leading products, exemplified by the long-standing relationship with Apple for Gorilla Glass, which directly influences product development cycles. In 2024, these partnerships continue to drive adoption across consumer electronics and automotive sectors, enabling advancements in device durability and functionality.

Further strengthening its innovation pipeline, Corning partners with universities and research institutions. These alliances grant access to cutting-edge research and specialized expertise, crucial for developing next-generation technologies. Corning's increased investment in university R&D in 2023, particularly for display and optical materials, underscores the strategic importance of these collaborations for maintaining its competitive edge.

Corning also relies on a robust network of supply chain partners for raw materials and manufacturing equipment, ensuring product quality and consistent supply. For instance, its investment in a U.S.-integrated solar supply chain highlights the critical role of partners in areas like polysilicon production for supply chain resilience.

To expand into new markets like GenAI infrastructure and solar energy, Corning forms strategic alliances. Partnerships with firms like Suniva and Heliene in the U.S. solar industry are vital for building integrated supply chains and meeting specific market demands and regulations.

Corning's distribution and channel partners are essential for extending its global reach and serving diverse customer needs. In 2024, the optical communications segment heavily relies on these partners to support telecommunications and enterprise clients with logistics and local support. These collaborations also bolster automotive glass solutions by leveraging established automotive manufacturer supply chains.

What is included in the product

A detailed, pre-written business model for Corning, outlining its innovation-driven approach to materials science and its diverse customer segments across various industries.

This canvas highlights Corning's core value propositions, such as advanced glass and ceramic technologies, and its key partnerships that drive product development and market access.

The Corning Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex strategies, making them easier to understand and adapt.

It alleviates the pain of scattered information and lengthy documentation, offering a clear, one-page snapshot of Corning's strategic pillars for efficient analysis and communication.

Activities

Corning's central activity revolves around substantial, ongoing investment in Research, Development, and Engineering (RD&E). This focus drives innovation across their core competencies in glass science, ceramic science, and optical physics.

These RD&E efforts translate into the creation of entirely new materials, the enhancement of existing product lines, and the exploration of groundbreaking applications for diverse industries.

Corning's dedication to innovation is underscored by its financial commitments, with R&D expenses reaching $1.089 billion in 2024 and $270 million in the first quarter of 2025.

Corning's core operations revolve around manufacturing high-technology products, particularly specialty glass, ceramics, and optical fiber. This is achieved through proprietary processes, notably their fusion technology, which is critical for producing their advanced materials.

The company operates a network of sophisticated manufacturing facilities across the globe. A significant recent investment in these capabilities includes $315 million allocated to upgrade their semiconductor glass manufacturing site in New York. This upgrade specifically aims to boost the production of High Purity Fused Silica (HPFS) and Ultra Low Expansion (ULE) glass, underscoring their commitment to advanced materials for the semiconductor industry.

Intellectual property management is core to Corning’s strategy, safeguarding its innovations and market position. The company actively protects its vast array of patents and proprietary technologies, which are fundamental to its competitive edge.

This includes the rigorous process of patenting new inventions, actively defending its existing intellectual property rights, and strategically exploring licensing opportunities for its technologies. By 2024, Corning maintained a robust portfolio of over 12,000 active global patents, underscoring its commitment to innovation and IP protection.

Customer Engagement and Co-Development

Corning's key activities heavily involve deep customer engagement. They work closely with global leaders, understanding specific needs to co-develop tailored solutions. This collaborative approach is crucial for ensuring their innovations align with market demands and support customers' future product development.

A prime example of this strategy is Corning's 'More Corning' content initiative. This strategy is particularly effective in driving engagement within the mobile consumer electronics and automotive sectors. For instance, in 2024, Corning continued to emphasize its role as a solutions provider, showcasing how its advanced materials, like Gorilla Glass, enable the design and durability of next-generation smartphones and automotive displays.

- Customer Collaboration: Corning actively partners with industry leaders to co-create customized material solutions.

- Innovation Alignment: This deep engagement ensures Corning's R&D efforts are directly tied to emerging market needs and customer product roadmaps.

- Market Penetration: Strategies like 'More Corning' content are used to foster relationships and highlight value, especially in high-growth areas like mobile and automotive.

- 2024 Focus: Continued emphasis on enabling advanced features in consumer electronics and automotive applications through material science partnerships.

Global Supply Chain Management

Corning's key activity involves meticulously managing its intricate global supply chain. This encompasses everything from securing essential raw materials, such as silica sand and specialty chemicals, to ensuring the timely delivery of finished products like optical fiber and advanced display glass to customers worldwide. In 2024, Corning continued to emphasize resilience and efficiency in its supply chain operations, a critical factor given the volatile global economic landscape and ongoing geopolitical shifts.

Optimizing logistics and fostering robust supplier relationships are paramount to meeting the diverse and often demanding needs of industries ranging from telecommunications and automotive to consumer electronics. Corning's commitment to supply chain reliability directly impacts its ability to fulfill orders and maintain market leadership. For instance, in the first quarter of 2024, the company reported strong demand for its optical communications products, underscoring the importance of an agile and responsive supply network.

- Raw Material Sourcing: Securing consistent access to high-purity raw materials is fundamental.

- Logistics Optimization: Efficiently managing transportation and warehousing to minimize costs and lead times.

- Supplier Relationship Management: Building and maintaining strong partnerships with key suppliers for critical components.

- Demand Fulfillment: Ensuring product availability to meet global customer demand across various industries.

Corning's key activities are deeply rooted in its advanced manufacturing capabilities, particularly its proprietary fusion technology. This allows for the precise creation of specialty glass, ceramics, and optical fiber, essential for high-tech applications. Recent investments, such as the $315 million upgrade to its New York semiconductor glass facility, highlight its commitment to producing materials like High Purity Fused Silica (HPFS) and Ultra Low Expansion (ULE) glass, crucial for the semiconductor industry.

| Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Manufacturing | Producing high-technology materials using proprietary processes like fusion technology. | $315 million invested in semiconductor glass manufacturing upgrade (2024). |

| Intellectual Property Management | Protecting innovations through patents and proprietary technologies. | Over 12,000 active global patents maintained by 2024. |

| Customer Engagement | Collaborating with industry leaders to co-develop tailored material solutions. | 'More Corning' content initiative focused on mobile and automotive sectors in 2024. |

| Supply Chain Management | Ensuring efficient sourcing of raw materials and timely delivery of finished products. | Strong demand for optical communications products in Q1 2024. |

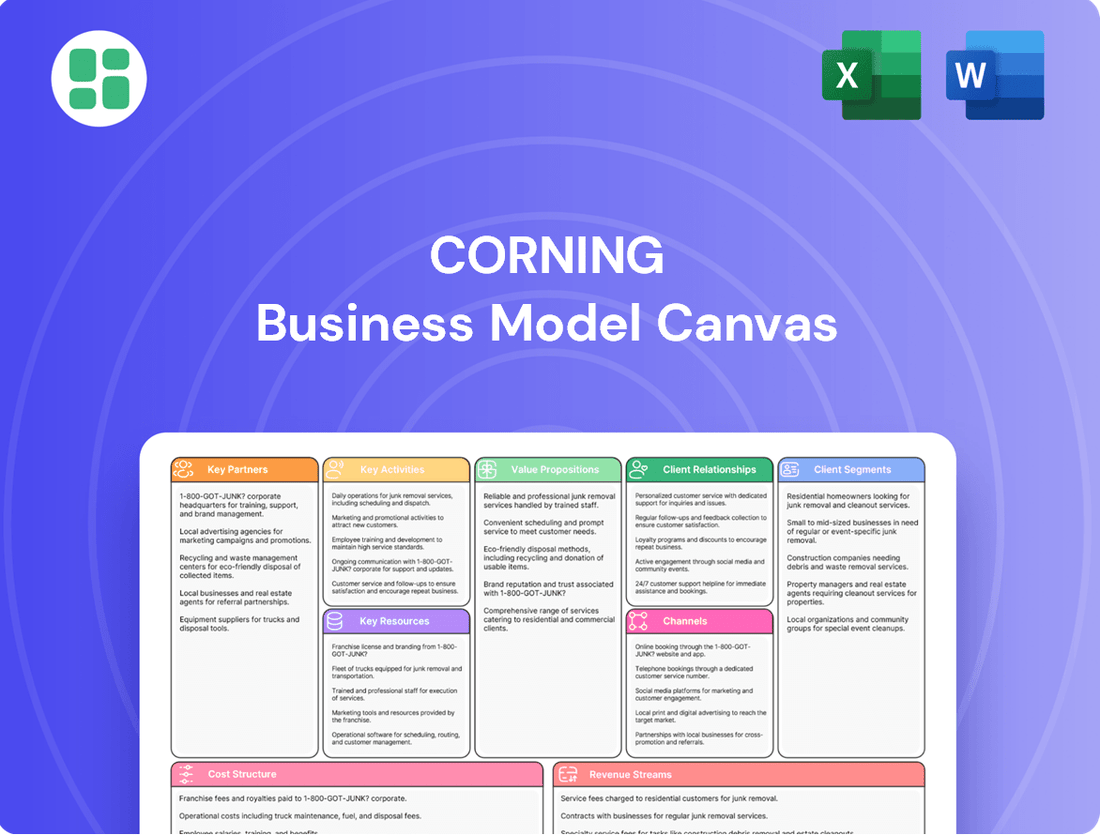

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you're viewing is the actual, complete document you will receive upon purchase. This isn't a sample or a stripped-down version; it's a direct representation of the full deliverable, ready for your immediate use. You'll get this exact file, allowing you to seamlessly continue your strategic planning without any discrepancies.

Resources

Corning's extensive intellectual property, boasting over 12,000 active global patents, is a cornerstone of its business model. These patents, spanning glass science, ceramic science, and optical physics, are not merely legal protections but tangible assets that shield its innovative technologies.

This robust patent portfolio acts as a formidable competitive moat, making it exceptionally difficult for rivals to replicate Corning's unique material science advancements. This exclusivity directly translates into its ability to set premium prices for its specialized products, reinforcing its market dominance.

Corning's specialized manufacturing facilities and unique production equipment are fundamental to its business model. These state-of-the-art plants, featuring proprietary technologies like fusion manufacturing for display glass, allow for the precise and high-volume creation of advanced materials that are essential for its customer segments.

These advanced capabilities are not static; Corning consistently invests in them. For instance, a significant $315 million upgrade at its Canton, New York facility, completed in 2024, underscores the company's commitment to maintaining and enhancing its manufacturing prowess, directly supporting its ability to deliver cutting-edge products.

Corning's highly skilled workforce, a cornerstone of its business model, includes world-class scientists, engineers, and manufacturing experts. Their deep knowledge in materials science, optical physics, and process engineering fuels the company's innovation and operational efficiency. This human capital is critical for developing and producing Corning's sophisticated products.

Proprietary Materials and Processes

Corning's competitive edge is deeply rooted in its proprietary materials and manufacturing processes. This includes exclusive access and control over unique raw materials and highly specialized production techniques, which are fundamental to their distinctive product portfolio.

These exclusive assets, such as the advanced glass compositions found in Gorilla Glass and the sophisticated chemistries used in their optical fibers, are not easily replicated by competitors. For instance, Corning's optical fiber segment, a significant revenue driver, relies on intricate manufacturing processes that ensure superior performance and durability.

- Proprietary Glass Compositions: Gorilla Glass, known for its scratch and drop resistance, is a prime example of Corning's material innovation.

- Advanced Optical Fiber Chemistries: Corning's leadership in optical fiber is built on unique material formulations and precise manufacturing, crucial for high-speed data transmission.

- Difficult Replication: The combination of specialized materials and intricate manufacturing processes creates a substantial barrier to entry for potential competitors.

Global Brand Reputation and Customer Relationships

Corning's brand is a cornerstone, built on over 170 years of innovation, quality, and reliability. This deep-rooted reputation acts as a powerful intangible asset, fostering trust with customers worldwide.

The company cultivates trust-based relationships with global industry leaders, reinforcing its esteemed brand. These strong customer ties are crucial for driving the adoption of new products and ensuring sustained business success.

- Brand Equity: Corning's reputation for innovation and quality, established over 170 years, is a significant intangible asset.

- Customer Relationships: Deep, trust-based relationships with global industry leaders reinforce this brand.

- Market Impact: This brand equity and strong customer ties facilitate new product adoption and sustained business.

- Financial Impact: While not directly quantifiable in a single metric, the value of this brand equity is reflected in Corning's premium pricing power and market share in its key segments, contributing to its robust financial performance. For instance, in 2023, Corning reported net sales of $13.2 billion, demonstrating the commercial success underpinned by its brand.

Corning's intellectual property, including over 12,000 active global patents, is a critical resource. These patents protect its innovations in areas like glass, ceramics, and optical physics, creating a significant competitive advantage and enabling premium pricing.

The company's specialized manufacturing facilities, featuring proprietary technologies such as fusion manufacturing, are essential for producing advanced materials at high volumes. Investments, like the $315 million upgrade at its Canton, New York facility in 2024, highlight the ongoing commitment to maintaining manufacturing excellence.

Corning's workforce, comprised of highly skilled scientists and engineers, is a key resource driving innovation and operational efficiency. This human capital is vital for developing and manufacturing its sophisticated product lines.

Proprietary materials and manufacturing processes, including unique glass compositions like Gorilla Glass and advanced optical fiber chemistries, are fundamental to Corning's competitive edge. These exclusive assets, coupled with intricate production techniques, create substantial barriers to entry for competitors.

Corning's strong brand equity, built over 170 years of innovation and reliability, fosters trust and facilitates new product adoption. This brand strength, combined with deep customer relationships with industry leaders, underpins its market position and pricing power, contributing to its financial success, as evidenced by $13.2 billion in net sales in 2023.

Value Propositions

Corning's superior performance and durability are key value propositions, especially evident in its Gorilla Glass for mobile devices. This material offers exceptional scratch resistance and toughness, directly benefiting manufacturers by allowing them to create more resilient products.

This enhanced durability translates into a better user experience and a longer product lifespan, reducing the need for frequent replacements. In 2024, the demand for durable smartphone displays continues to be a critical factor for consumers, driving the adoption of advanced materials like Gorilla Glass.

Corning's advanced materials are the bedrock for next-generation technologies, powering everything from the screens we use daily to the sophisticated infrastructure behind AI. For instance, their optical fiber is a key enabler for the massive data transfer demands of AI, a market projected for significant growth.

The company's innovations allow clients to achieve breakthroughs, such as enabling higher refresh rates and improved durability in displays, which are crucial for immersive computing experiences. This focus on foundational materials means Corning is integral to pushing technological frontiers in sectors like telecommunications and consumer electronics.

Corning excels by crafting material solutions precisely tailored to customer requirements, fostering a collaborative innovation environment. This means they don't just sell materials; they partner with clients to solve specific design and performance challenges.

Their co-development process ensures that the resulting materials are seamlessly integrated and optimized for each unique application. This deep customer engagement is a significant differentiator.

This close partnership creates a powerful, hard-to-replicate value proposition. For instance, in 2024, Corning continued to leverage this approach across its diverse markets, from advanced optics to specialized glass, solidifying customer loyalty and driving innovation that directly addresses evolving industry needs.

Reliability and Supply Security

Customers count on Corning for consistently high-quality products, thanks to their strong manufacturing and a dependable global supply chain. This is especially vital for industries needing large volumes and strict quality control.

Corning's commitment to reliability ensures that clients can maintain their production schedules without interruption. For instance, in the automotive sector, where just-in-time manufacturing is common, product consistency from suppliers like Corning is paramount to avoid costly downtime.

The development of a U.S.-integrated solar supply chain, a significant move in 2023 and continuing into 2024, directly addresses concerns about geopolitical stability and supply chain security. This strategic initiative aims to reduce reliance on overseas manufacturing, offering customers greater assurance of product availability.

- Consistent Product Quality: Corning's advanced manufacturing processes ensure that products meet rigorous specifications batch after batch.

- Resilient Global Supply Chain: A diversified network of suppliers and distribution centers minimizes risks associated with disruptions.

- Geopolitical Resilience: Investments in domestic supply chains, like the solar initiative, enhance security and reduce vulnerability to international trade disputes.

- High-Volume Production Support: Industries requiring substantial and continuous output rely on Corning's capacity and dependable delivery.

Sustainability and Efficiency Benefits

Corning's commitment to innovation directly translates into significant sustainability and efficiency benefits for its clientele. Their advanced optical fiber, for instance, is a cornerstone of energy-efficient data transmission, a critical factor as global data traffic continues its upward trajectory. In 2023, the demand for high-speed internet and cloud services continued to drive growth in the fiber optics market, underscoring the inherent efficiency of this technology.

Furthermore, Corning's specialized glass solutions contribute to lighter and more fuel-efficient automotive designs. As the automotive industry increasingly focuses on reducing emissions and improving mileage, these materials play a crucial role. The push towards electric vehicles and lighter combustion engine vehicles highlights the value of advanced glass in achieving these objectives.

- Energy Savings: Optical fiber's inherent efficiency in data transmission reduces the energy consumption of telecommunications networks.

- Reduced Emissions: Lightweight glass for automotive applications directly contributes to lower fuel consumption and, consequently, reduced greenhouse gas emissions.

- Resource Optimization: Corning's products enable customers to optimize their processes and resource utilization, aligning with broader sustainability goals.

- Circular Economy Contributions: While not always direct, Corning's durable products can contribute to longer product lifecycles, indirectly supporting circular economy principles.

Corning's value proposition is built on delivering differentiated, high-performance materials that enable customer innovation and solve complex challenges. Their expertise in glass, ceramics, and optical physics allows for breakthroughs in sectors like mobile devices, automotive, and telecommunications, driving tangible benefits for their clients.

This focus on advanced material science translates into superior product attributes such as enhanced durability, optical clarity, and thermal management. For instance, Corning's Gorilla Glass continues to set industry standards for scratch and impact resistance, a critical factor for consumer electronics manufacturers seeking to differentiate their products in a competitive market.

Corning's deep collaborative approach with customers ensures that their material solutions are precisely engineered for specific applications, fostering strong, long-term partnerships. This co-creation process allows clients to achieve performance targets that would otherwise be unattainable, cementing Corning's role as an indispensable innovation partner.

In 2024, Corning's optical communications segment continued to be a significant growth driver, fueled by the relentless demand for higher bandwidth and faster connectivity. The company reported substantial revenue growth in this segment, reflecting the critical role of its optical fiber and connectivity solutions in enabling 5G deployment and data center expansion.

| Segment | 2023 Revenue (USD Billions) | Year-over-Year Growth (%) | Key Value Proposition |

|---|---|---|---|

| Optical Communications | 4.2 | 10.5 | Enabling high-speed data transmission and network infrastructure growth. |

| Specialty Materials | 3.8 | 7.2 | Providing advanced glass and ceramics for consumer electronics, automotive, and other demanding applications. |

| Automotive Glass | 1.5 | -3.1 | Delivering lightweight and durable glass solutions for improved vehicle efficiency and safety. |

| Life Sciences | 1.1 | 5.0 | Supplying high-quality consumables and equipment for pharmaceutical and biotech research. |

Customer Relationships

Corning cultivates enduring strategic partnerships, often engaging in joint product and technology development with major clients. A prime example is their collaboration with Apple, where Corning's cutting-edge materials, like Ceramic Shield, are integral to next-generation iPhone designs, showcasing a deep commitment to shared innovation and R&D investment.

Corning offers dedicated technical support and consultation, a crucial element in their customer relationships. This support helps clients seamlessly integrate Corning's advanced materials, ensuring optimal performance and successful product development.

In 2024, Corning's commitment to technical expertise was evident in their ongoing collaborations across various industries. For instance, their work in optical communications involved extensive consultation to support the deployment of next-generation networks, a sector projected to see significant growth driven by 5G and AI infrastructure demands.

This proactive approach to problem-solving and integration not only addresses immediate technical hurdles but also fosters deep customer loyalty. By empowering clients with the knowledge to maximize material benefits, Corning solidifies its position as a trusted partner, contributing to repeat business and long-term value.

Corning employs direct sales teams and dedicated account managers for its most significant and strategic clients. This approach ensures tailored service, a profound grasp of client requirements, and streamlined communication channels.

This direct engagement model is fundamental for nurturing intricate, high-value business-to-business relationships. For instance, in 2023, Corning's Optical Communications segment, a key area for these relationships, reported net sales of $5.2 billion, highlighting the importance of these direct interactions in driving substantial revenue.

Industry Engagement and Thought Leadership

Corning actively participates in industry consortia, conferences, and standards bodies, positioning itself as a thought leader in areas like optical communications and advanced materials. This engagement is crucial for shaping industry trends and understanding future customer needs. For example, Corning's involvement in organizations like the Fiber Broadband Association helps define the future of connectivity, directly influencing product development and customer roadmaps.

This strategic participation not only demonstrates Corning's deep expertise but also builds significant credibility and strengthens relationships across the broader technology ecosystem. By contributing to standards and sharing insights, Corning fosters collaboration and ensures its innovations align with market demands. In 2023, Corning announced significant investments in its optical communications segment, underscoring the importance of these industry relationships in driving growth and innovation.

- Industry Leadership: Active participation in over 50 global standards bodies and consortia.

- Customer Insight: Direct feedback from industry events informs R&D and product strategy.

- Ecosystem Strengthening: Collaboration with peers and customers drives collective advancement.

- Market Influence: Shaping future technology roadmaps and customer expectations.

Customer Feedback Integration

Corning actively gathers customer feedback, integrating it directly into their product development to ensure offerings meet market needs. This commitment to customer input is vital for their continuous improvement strategy.

In 2024, Corning's focus on customer-centric innovation was evident in their ongoing dialogues with key partners across various sectors, from telecommunications to automotive. This iterative feedback loop allows them to refine existing products and conceptualize new solutions that address emerging technological challenges.

- Customer Feedback Channels: Corning utilizes a mix of direct customer engagement, surveys, and market analysis to capture feedback.

- Integration into R&D: Insights gathered are systematically fed into their research and development pipelines.

- Market Responsiveness: This process enables Corning to adapt quickly to shifting industry requirements and customer preferences.

Corning fosters deep, collaborative relationships, often co-developing products with major clients like Apple, integrating materials such as Ceramic Shield into their designs. This shared innovation approach is further supported by dedicated technical support and consultation, ensuring clients can effectively implement Corning's advanced materials. For instance, in 2024, their optical communications segment provided extensive consultation for 5G and AI network deployments.

Direct sales teams and account managers cater to key clients, ensuring tailored service and clear communication, which is vital for high-value B2B interactions. This direct engagement contributed significantly to their Optical Communications segment's $5.2 billion in net sales in 2023. Corning also actively participates in industry consortia and standards bodies, like the Fiber Broadband Association, to maintain thought leadership and align product development with future customer needs, reinforcing its role as a trusted partner.

Channels

Corning's direct sales force is instrumental in cultivating relationships with key clients across mobile consumer electronics, display technologies, and optical communications. This direct engagement facilitates tailored solutions and fosters robust partnerships, particularly for high-value, intricate sales processes.

Original Equipment Manufacturers (OEMs) represent a critical channel for Corning, as their advanced materials, like Gorilla Glass, are integrated into the final products of major technology and automotive players. This B2B relationship means Corning's innovations reach consumers indirectly, powering everything from the screens on our smartphones to the windows in our cars. In 2024, Corning continued to deepen these partnerships, with a significant portion of its revenue derived from supplying these key component materials.

Corning utilizes specialized distributors to reach niche markets and smaller customers, enhancing its market penetration. These partners are crucial for managing inventory and offering localized sales and technical assistance, especially in areas where a direct Corning presence is impractical.

In 2024, Corning's strategy to leverage these specialized channels continued to be vital for its optical communications segment, which saw significant demand driven by 5G infrastructure build-outs and data center expansion. For instance, distributors played a key role in ensuring timely delivery of fiber optic cables and connectivity solutions to a wider customer base across various regions.

Strategic Alliances and Joint Ventures

Corning leverages strategic alliances and joint ventures to unlock new market channels, particularly in emerging or expanding territories. These partnerships are crucial for establishing a foothold and effectively reaching customers.

A prime example is Corning's involvement in the U.S. solar supply chain. Through these collaborations, Corning has built a robust platform for introducing and selling its innovative wafer products, directly addressing market demand.

- Market Entry: Strategic alliances provide a cost-effective and rapid entry into new geographic or product markets.

- Risk Sharing: Joint ventures allow Corning to share the financial and operational risks associated with market expansion.

- Access to Expertise: Partnerships can grant access to complementary technologies, distribution networks, or local market knowledge, accelerating growth and market penetration.

Online and Digital Presence

Corning leverages its online and digital presence primarily through its corporate website and specialized product microsites. This digital infrastructure is crucial for disseminating technical specifications, product information, and company news to its business-to-business clientele. In 2024, Corning's website continued to be a primary hub for detailed product catalogs and research papers, supporting its global customer base.

Digital marketing efforts, including targeted online advertising and content marketing, further enhance Corning's reach. These initiatives aim to build brand awareness and generate qualified leads by providing valuable information and demonstrating technological leadership. Corning’s investment in digital channels in 2024 reflected a growing trend in B2B marketing to reach and engage key decision-makers efficiently.

This online and digital presence acts as a vital complement to its direct sales force. It facilitates initial customer engagement, provides essential resources for prospects, and supports ongoing customer relationships by offering accessible technical support and product updates. Corning’s digital strategy in 2024 focused on creating a seamless user experience that bridges the gap between online discovery and direct sales engagement.

- Corporate Website: Central repository for company information, investor relations, and product overviews.

- Product Microsites: Dedicated platforms for specific technologies like Gorilla Glass or optical fiber, offering in-depth details and applications.

- Digital Marketing Campaigns: Targeted online advertising and content creation to reach B2B audiences and generate leads.

- Technical Data Access: Online portals providing access to datasheets, white papers, and research for engineers and product developers.

Corning's channel strategy is multifaceted, encompassing direct sales, OEM partnerships, specialized distributors, strategic alliances, and a robust digital presence. This diversified approach ensures broad market reach and caters to various customer needs across its diverse product lines.

In 2024, Corning's direct sales team remained crucial for high-value engagements, while OEM integration, particularly for Gorilla Glass, continued to drive significant indirect consumer reach. Specialized distributors were key to penetrating niche markets, especially in the optical communications sector, supporting the demand from 5G and data center expansion.

Strategic alliances and joint ventures provided avenues for market entry and risk sharing, exemplified by their role in the U.S. solar supply chain. The company's digital channels, including its corporate website and targeted marketing, served as vital complements, facilitating information access and lead generation for its B2B clientele.

| Channel Type | Key Function | 2024 Focus/Impact |

|---|---|---|

| Direct Sales | Relationship building, high-value sales | Cultivating key client partnerships in mobile, display, optical |

| OEMs | Component integration into end products | Supplying advanced materials like Gorilla Glass to tech and auto |

| Specialized Distributors | Niche market access, localized support | Facilitating optical communications sales for 5G/data centers |

| Strategic Alliances/JVs | Market entry, risk sharing, expertise access | Expanding U.S. solar supply chain presence |

| Online/Digital | Information dissemination, lead generation | Enhancing B2B engagement via website, digital marketing |

Customer Segments

Mobile consumer electronics manufacturers, including major players like Samsung and Apple, represent a critical customer segment for Corning's specialty glass solutions. These companies rely on Corning's advanced glass technologies, such as Gorilla Glass, for their flagship smartphones, tablets, and wearables, valuing enhanced durability, superior optical clarity, and increasingly, thinner designs. For instance, Samsung's integration of Corning's Gorilla Armor 2 in its Galaxy S24 series in early 2024 highlights this ongoing partnership and demand for cutting-edge materials.

Display panel manufacturers, a crucial customer segment for Corning, produce the essential LCD and OLED screens found in everything from televisions to smartphones. These companies depend on Corning for their advanced display glass substrates, which must be large, exceptionally high in quality, and progressively thinner to meet evolving consumer electronics demands.

The purchasing decisions within this segment are heavily influenced by pricing strategies and the sheer volume of glass required. For instance, in 2024, the global display panel market continued its robust growth, with shipments of OLED panels for smartphones alone projected to reach hundreds of millions of units, underscoring the significant volume needs of these customers.

Optical Communications Providers are a crucial customer segment for Corning, encompassing telecommunication carriers, data center operators, and enterprise network providers. These entities rely on Corning's advanced optical fiber, cable, and connectivity solutions to build and maintain their networks.

The demand from this segment is significantly influenced by major global trends. These include the ongoing expansion of broadband internet access worldwide, the widespread deployment of 5G mobile technology, and the escalating requirement for high-density fiber infrastructure within artificial intelligence (AI) data centers. For instance, Corning's Enterprise business within Optical Communications experienced remarkable 81% year-over-year growth in the second quarter of 2025, largely fueled by the surging demand driven by Generative AI applications.

Automotive Industry

Automotive manufacturers represent a key customer segment for Corning, relying on its specialized glass for advanced vehicle displays, lighter glazing, and environmental control systems like gasoline particulate filters. This market is rapidly transforming due to the rise of electric vehicles and autonomous driving technology.

Corning has ambitious growth targets within this sector, projecting a threefold increase in its Automotive Glass Solutions business by the close of 2026. This expansion is driven by the increasing demand for sophisticated glass technologies that enhance vehicle safety, efficiency, and user experience.

- Key Customer Needs: Advanced displays, lightweight glazing, emission control solutions.

- Market Trends: Electrification, autonomous driving, enhanced in-car connectivity.

- Corning's Growth Projection: Expects to triple its Automotive Glass Solutions business by the end of 2026.

- Product Applications: Infotainment screens, heads-up displays, panoramic sunroofs, particulate filters.

Life Sciences and Pharmaceutical Companies

Life sciences and pharmaceutical companies are key customers for Corning, relying on their specialized glass and consumables for critical research and development. These entities, including major drug manufacturers and cutting-edge research labs, depend on Corning's high-purity materials for applications like cell culture and drug discovery. For instance, in 2024, the global biopharmaceutical market saw significant investment in R&D, directly impacting demand for these essential lab supplies.

These customers require products that meet stringent quality and reliability standards, as any deviation can compromise sensitive experiments and drug development pipelines. Corning's commitment to precision manufacturing ensures their glass products and consumables support the rigorous demands of these scientific endeavors. The pharmaceutical industry's growth, projected to reach trillions globally by 2025, underscores the increasing need for such dependable solutions.

- Drug Discovery & Development: Pharmaceutical firms utilize Corning's labware and specialty glass for everything from initial compound screening to advanced cell-based assays.

- Bioprocessing: Companies involved in manufacturing biologics and vaccines rely on Corning's high-quality consumables for cell culture and purification processes.

- Research Laboratories: Academic and private research institutions depend on Corning's diverse product portfolio for a wide array of life science investigations.

- Diagnostic Manufacturers: Companies producing diagnostic kits and equipment integrate Corning's glass components for accuracy and performance.

Specialty materials manufacturers, including those in the semiconductor and advanced manufacturing sectors, represent a vital customer base for Corning. These businesses require highly specialized glass and ceramic components for their complex production processes, valuing precision, purity, and advanced material properties.

The demand from this segment is directly tied to global technological advancements and manufacturing output. For example, the semiconductor industry's continued expansion in 2024, driven by AI and advanced computing, fuels the need for Corning's high-purity materials used in wafer processing and equipment components.

| Customer Segment | Key Needs | Market Drivers | Corning's Role |

|---|---|---|---|

| Specialty Materials Manufacturers | High-purity glass, precision components, advanced ceramics | Semiconductor demand, advanced manufacturing growth | Supplier of critical materials for fabrication and equipment |

Cost Structure

Corning's commitment to innovation is reflected in its substantial Research, Development, and Engineering (RD&E) expenses. These costs are fundamental to developing novel materials, refining manufacturing processes, and bringing cutting-edge products to market, ensuring the company maintains its competitive edge.

In 2024, Corning allocated $1.089 billion to its RD&E efforts. This significant investment underscores the company's strategy of continuous technological advancement and product pipeline development.

The first quarter of 2025 saw RD&E expenses total $270 million, indicating a sustained high level of investment in innovation as the company moves through the year.

Manufacturing and production costs are a significant component for Corning, stemming from the capital-intensive nature of specialty glass and ceramics production. These expenses encompass raw materials like sand and various chemicals, substantial energy consumption, skilled labor, and the depreciation of highly specialized manufacturing facilities and equipment.

Corning's commitment to innovation means these costs can fluctuate, as seen with higher production ramp costs for new GenAI and U.S.-made solar products reported in Q2 2025. This highlights the investment required to bring cutting-edge technologies to market.

Sales, General, and Administrative (SG&A) expenses at Corning encompass the costs of marketing, maintaining a sales force, running administrative functions, and managing corporate overhead. These are essential but controllable expenditures that directly impact profitability. For instance, in the first quarter of 2024, Corning reported SG&A expenses of $522 million, a slight decrease from the previous year, reflecting efforts to optimize these operational costs as they work towards their target of a 20% operating margin by 2026.

Intellectual Property Maintenance and Protection Costs

Corning incurs significant expenses for the global filing, maintenance, and defense of its extensive patent portfolio. These costs are crucial for safeguarding its technological advancements and market exclusivity.

In 2023, Corning reported research and development expenses of $1.2 billion, a portion of which directly supports the legal and administrative overhead associated with intellectual property protection. The sheer volume of patents Corning holds necessitates ongoing investment in legal counsel and administrative processes to maintain their validity and defend against infringement.

- Patent Filing and Registration Fees: Costs associated with applying for and obtaining patents in various jurisdictions worldwide.

- Maintenance Fees: Recurring payments required to keep patents in force.

- Legal Defense Costs: Expenses incurred for litigation, licensing negotiations, and enforcement actions to protect intellectual property rights.

Capital Expenditures (CapEx)

Corning's cost structure heavily relies on significant capital expenditures to maintain its competitive edge and drive innovation. These investments are crucial for upgrading and expanding manufacturing facilities, ensuring they can meet escalating demand and support the launch of new, advanced products. For instance, Corning has earmarked approximately $1.3 billion for capital expenditures in 2025, a substantial outlay reflecting its commitment to growth and technological advancement.

A prime example of this strategic investment is the planned $315 million upgrade for its semiconductor glass manufacturing facility. This specific investment underscores Corning's focus on high-growth sectors and its dedication to providing cutting-edge materials for the semiconductor industry. Such CapEx is fundamental to their ability to produce specialized glass components that are essential for next-generation electronics and advanced manufacturing processes.

- Capital Expenditures (CapEx): Significant investments in manufacturing capacity upgrades and expansions are essential for meeting demand and introducing new products.

- 2025 CapEx Projection: Corning plans to invest around $1.3 billion in capital expenditures in the upcoming year.

- Semiconductor Facility Investment: A notable allocation includes $315 million dedicated to upgrading its semiconductor glass manufacturing facility.

Corning's cost structure is characterized by significant investments in research and development, manufacturing, and intellectual property protection. These are crucial for maintaining its leadership in specialty materials and innovation.

The company's commitment to cutting-edge technology is evident in its substantial RD&E spending, with $1.089 billion allocated in 2024 and $270 million in Q1 2025. Manufacturing costs are also high due to the capital-intensive nature of its operations, including raw materials, energy, and specialized facilities. Sales, General, and Administrative (SG&A) expenses, though managed for efficiency, are necessary for market presence and operations, with $522 million reported in Q1 2024.

Corning also bears significant costs for its extensive patent portfolio, which is vital for safeguarding its technological advancements. Furthermore, capital expenditures are a major component, with approximately $1.3 billion earmarked for 2025 to enhance manufacturing capabilities, including a $315 million investment in its semiconductor glass facility.

| Cost Category | 2024 (Approx.) | Q1 2025 (Approx.) | Key Drivers |

| RD&E | $1.089 billion | $270 million | Innovation, new product development |

| SG&A | N/A (Q1 2024: $522 million) | N/A | Sales, marketing, administration |

| Capital Expenditures | N/A | N/A (2025 Projection: $1.3 billion) | Manufacturing upgrades, capacity expansion |

| Intellectual Property | N/A (2023 R&D included IP costs) | N/A | Patent filing, maintenance, defense |

Revenue Streams

Revenue generated from selling advanced specialty glasses, particularly Gorilla Glass for smartphones and other consumer electronics, forms a crucial part of Corning's business. This segment experienced a notable 8% growth in 2024, reaching $2.0 billion, driven by robust demand for high-quality glass in premium mobile devices.

Beyond mobile applications, this revenue stream also encompasses sales of semiconductor products. These materials are vital for the manufacturing processes within the semiconductor industry, contributing to the overall financial performance of this segment.

Corning's sales of optical communications products are a cornerstone of its business, generating significant revenue from essential components like optical fiber, optical cable, and various connectivity solutions. These products are critical for building and maintaining the infrastructure of telecommunications networks and the ever-expanding data centers that power our digital world.

This segment has demonstrated robust growth, with sales reaching $4.7 billion in 2024, marking a substantial 16% increase year-over-year. The momentum continued into 2025, with a remarkable 41% surge in sales during the second quarter, largely propelled by the insatiable demand generated by the advancements in Generative AI technologies.

Corning's Display Technologies segment is a significant revenue driver, primarily through the sale of specialized glass substrates. These high-quality glass materials are essential components for both LCD and OLED displays found in a wide array of consumer electronics, including televisions, laptops, and smartphones.

In 2024, this segment demonstrated robust performance, achieving a 10% growth rate. This expansion translated into $3.9 billion in revenue, a testament to increased sales volumes and the positive impact of strategic pricing adjustments implemented by the company.

Sales of Automotive and Environmental Technologies Products

Corning's revenue from selling automotive and environmental technologies is a key driver of its business. This includes specialized glass for vehicle interiors and lightweighting initiatives, as well as ceramic substrates crucial for environmental control systems like gasoline particulate filters.

The company anticipates substantial expansion in this area. Specifically, its Automotive Glass Solutions business is on track to triple its revenue by the close of 2026, underscoring strong market demand and Corning's strategic focus.

- Automotive Glass Solutions: Sales of specialized glass for vehicle interiors, displays, and lightweighting components.

- Environmental Technologies: Revenue from ceramic substrates used in emission control systems, such as gasoline particulate filters.

- Growth Projections: The Automotive Glass Solutions segment is projected to triple in sales by the end of 2026.

Sales of Life Sciences Products

Corning’s revenue from life sciences products is a significant contributor, encompassing a wide array of essential items for scientific advancement. These include laboratory consumables like specialized glassware and plasticware, crucial for experiments and diagnostics. Furthermore, the company supplies bioprocess solutions, vital for the large-scale manufacturing of biologics and pharmaceuticals.

This segment demonstrated resilience, with sales reaching $250 million in the fourth quarter of 2024. This performance represents a healthy 3% increase compared to the same period in the previous year, underscoring the consistent demand for Corning’s offerings in these critical industries.

- Laboratory Consumables: Products essential for research, testing, and development in scientific settings.

- Bioprocess Solutions: Equipment and supplies facilitating the production of biological drugs and therapies.

- Q4 2024 Revenue: $250 million, showing a 3% year-over-year growth.

- Industry Focus: Serving the life sciences and pharmaceutical sectors, including drug discovery and manufacturing.

Corning’s revenue streams are diverse, spanning advanced materials for consumer electronics, telecommunications infrastructure, displays, automotive applications, and life sciences. These segments collectively generated substantial revenue in 2024, reflecting broad market demand and Corning's technological leadership.

| Revenue Segment | 2024 Revenue (USD Billions) | Year-over-Year Growth |

|---|---|---|

| Optical Communications | 4.7 | 16% |

| Display Technologies | 3.9 | 10% |

| Specialty Materials (incl. Gorilla Glass) | 2.0 | 8% |

| Automotive & Environmental Technologies | N/A (projected to triple by 2026) | N/A |

| Life Sciences | N/A (Q4 2024: $0.25 Billion) | 3% (Q4 YoY) |

Business Model Canvas Data Sources

The Corning Business Model Canvas is built using a combination of internal financial reports, market intelligence from leading industry analysts, and strategic insights derived from R&D investments. These diverse data sources ensure a comprehensive and accurate representation of Corning's operations and strategic direction.