Corning Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corning Bundle

Corning's industry landscape is shaped by intense competition, the bargaining power of buyers and suppliers, and the constant threat of substitutes and new entrants. Understanding these forces is crucial for navigating Corning's market.

The complete report reveals the real forces shaping Corning’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Corning's reliance on specialized raw materials for its advanced glass and ceramic products means that suppliers of these unique inputs can wield significant bargaining power. For instance, if a particular rare earth element or a proprietary chemical compound is essential and has few alternative sources, suppliers can influence pricing and availability. This is especially true for highly customized components crucial to Corning's innovative product lines.

However, Corning's substantial scale of operations and its established, long-term relationships with key suppliers often serve to temper this supplier leverage. By committing to large purchase volumes and fostering strong partnerships, Corning can negotiate more favorable terms, securing stable supply chains and more predictable costs. This proactive approach helps mitigate the inherent power of specialized material providers.

Corning's proprietary manufacturing processes and deep expertise in materials science are key to its competitive advantage. This internal capability allows Corning to develop alternative materials or refine existing ones, thereby reducing its reliance on specific suppliers. This innovation strengthens Corning's bargaining power against suppliers, mitigating the impact of potential price hikes or supply disruptions.

The concentration of suppliers for critical components can indeed amplify their leverage over Corning. If Corning faces substantial costs or disruptions when switching to alternative suppliers for specialized materials or technologies, these suppliers gain a stronger negotiating position. This is particularly true for proprietary or highly engineered inputs essential for Corning's advanced products.

However, Corning's sheer scale and the breadth of its procurement across various business units, from Gorilla Glass for smartphones to optical fiber for telecommunications, often position it as a highly valuable customer for its suppliers. For instance, in 2023, Corning's total revenue reached approximately $13.2 billion, signifying its substantial purchasing power across its supply chain. This significant demand can create a counterbalancing force, fostering a more equitable negotiation dynamic.

Backward Integration Potential

Corning's significant research and development investment, coupled with its advanced manufacturing capabilities, presents a theoretical avenue for backward integration into specific raw material production. This potential, though not a primary focus, acts as a subtle but effective deterrent against suppliers seeking to wield excessive pricing power or control. For instance, Corning's stated goal to build a domestic solar supply chain in 2024 highlights a strategic move towards securing and controlling critical inputs in a key sector.

This capability for backward integration is underscored by several factors:

- Corning's R&D Spending: In 2023, Corning reported $877 million in R&D expenses, demonstrating a commitment to innovation that could facilitate in-house production of specialized materials.

- Manufacturing Expertise: The company's mastery of complex manufacturing processes, such as glass melting and chemical strengthening, provides the foundational knowledge for potential upstream integration.

- Strategic Supply Chain Initiatives: The ongoing development of a domestic solar supply chain, supported by significant government incentives and Corning's own capital investments, illustrates a practical application of this backward integration potential in a targeted area.

Global Supply Chain Risks

Global supply chain disruptions, amplified by geopolitical tensions and currency fluctuations, directly influence the availability and cost of essential materials for companies like Corning. These external pressures can indirectly bolster the bargaining power of suppliers, as they may leverage these volatile conditions. For instance, in 2024, ongoing trade disputes and regional conflicts continued to create bottlenecks and price volatility for key components used in advanced manufacturing.

Corning's extensive global operations mean it is inherently exposed to these multifaceted risks. The company's reliance on a diverse range of raw materials and specialized components sourced from various international suppliers necessitates a proactive approach to managing these vulnerabilities. This exposure underscores the critical importance of robust supply chain management and strategic diversification to ensure operational continuity and cost stability.

To counter these challenges, Corning actively pursues strategic planning initiatives and leverages its global operational footprint. This includes building strong relationships with a broad supplier base and exploring alternative sourcing options to mitigate the impact of any single supplier or region. By diversifying its supply chain and maintaining flexibility, Corning aims to absorb and manage the effects of global disruptions, thereby preserving its competitive edge.

- Geopolitical Instability: Events such as the ongoing conflicts in Eastern Europe and the Middle East in 2024 have continued to disrupt shipping routes and increase transportation costs, impacting the supply of critical raw materials.

- Currency Volatility: Fluctuations in major currencies throughout 2024 have affected the cost of imported materials for Corning, potentially strengthening the negotiating position of suppliers in countries with appreciating currencies.

- Supplier Concentration Risk: In certain specialized material categories, Corning may face risks if a significant portion of its supply originates from a limited number of suppliers, increasing their bargaining power.

- Logistical Challenges: Port congestion and labor shortages, which persisted in various regions through 2024, have added to lead times and costs, indirectly enhancing supplier leverage by creating scarcity.

Corning's reliance on specialized inputs for its advanced materials means suppliers of these unique components can hold significant power, particularly if few alternatives exist. This leverage allows them to influence pricing and availability, especially for materials critical to Corning's innovative product lines. For example, suppliers of rare earth elements or proprietary chemicals essential for its optical fiber or advanced display glass can command higher prices.

However, Corning's substantial scale, as evidenced by its $13.2 billion in revenue in 2023, and its long-standing relationships with key suppliers help to mitigate this power. By committing to large purchase volumes and fostering strong partnerships, Corning can negotiate more favorable terms, securing stable supply chains and predictable costs. This proactive approach balances the inherent leverage of specialized material providers.

Corning's significant R&D investment, totaling $877 million in 2023, and its advanced manufacturing expertise allow it to develop alternative materials or improve existing ones, reducing dependence on specific suppliers. This innovation strengthens Corning's bargaining position against suppliers, mitigating the impact of potential price hikes or supply disruptions.

Global supply chain disruptions, including geopolitical tensions and currency fluctuations in 2024, can indirectly increase supplier bargaining power by creating volatility and bottlenecks. Corning's extensive global operations expose it to these risks, underscoring the need for robust supply chain management and diversification to maintain operational continuity and cost stability.

What is included in the product

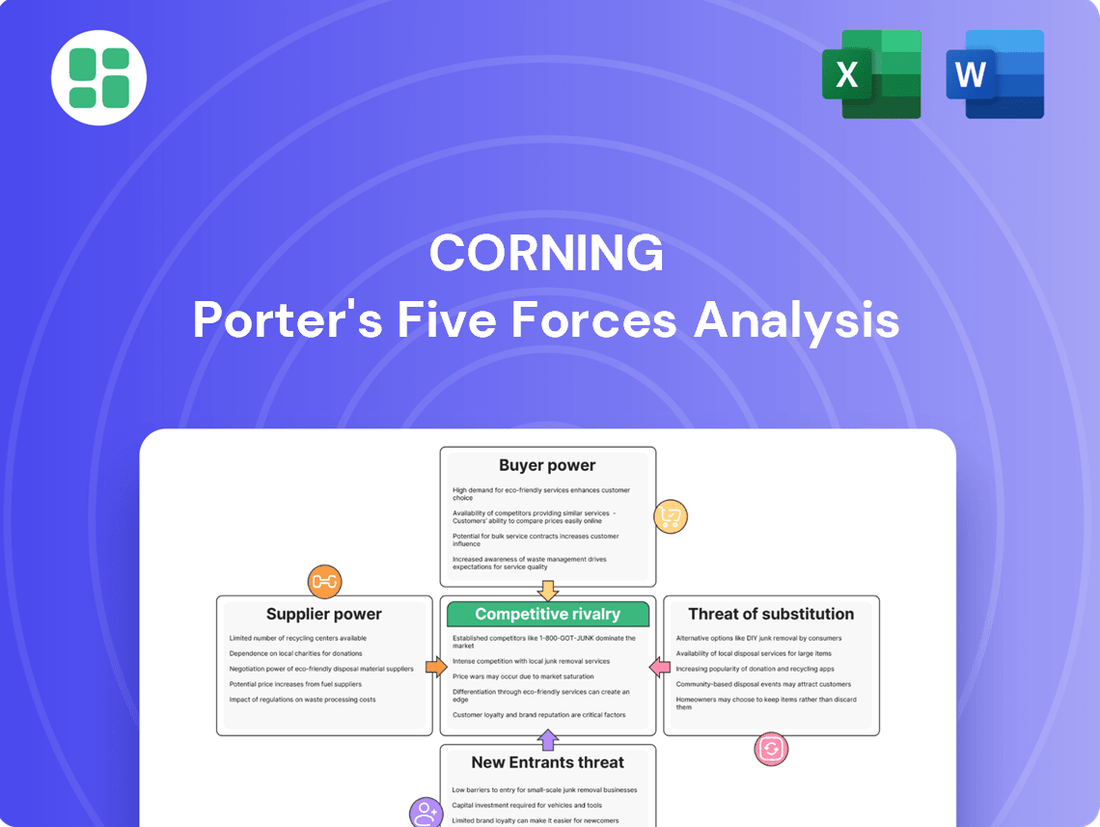

Corning's Porter's Five Forces analysis meticulously examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, providing a comprehensive understanding of its competitive environment.

Instantly identify and address competitive threats by visually mapping the intensity of each of Porter's five forces.

Customers Bargaining Power

Corning's diverse customer base significantly dilutes the bargaining power of any individual customer. The company supplies essential components across numerous sectors, including the booming optical communications market, mobile consumer electronics, advanced display technologies, the automotive industry, and the growing life sciences sector.

This broad market penetration means Corning is not overly reliant on any single industry segment or a few large buyers. For instance, in 2024, the optical communications segment continued to be a major driver for Corning, with strong demand fueled by 5G deployment and data center expansion. However, the company's presence in other resilient markets, such as life sciences, provides a crucial counterbalance, reducing the leverage any one customer group can exert.

For many of Corning's high-technology products, like Gorilla Glass used in smartphones or their advanced optical fiber, customers often encounter significant hurdles when considering a switch to another supplier. These switching costs arise from deep product integration, stringent performance demands, and the extensive qualification processes required for new materials in sensitive applications.

This inherent lock-in effect significantly diminishes a customer's flexibility to move to competitors, thereby strengthening Corning's bargaining position. For instance, Corning's continuous innovation, as seen with products like Gorilla® Armor 2, further entrenches these switching costs by offering enhanced capabilities that are difficult to replicate or replace without substantial investment and testing by the customer.

Corning's 'More Corning' content strategy aims to embed its advanced materials more deeply into customer products, thereby increasing their value and volume. This strategy directly tackles the bargaining power of customers by making Corning's components indispensable, thus limiting customers' ability to switch suppliers or demand lower prices. For example, in 2024, Corning's focus on optical components for 5G infrastructure and automotive displays significantly increased its integration into key customer supply chains.

Customer Price Sensitivity

Corning's position in markets with high-volume components, such as display glass, means customers can exhibit significant price sensitivity. This is particularly true when alternative suppliers exist, even if Corning's products offer superior quality or performance. The bargaining power of customers is thus influenced by the availability and cost of substitutes for these high-volume items.

Despite this, Corning has shown an ability to command premium pricing, indicating a degree of pricing power. For instance, in 2023, Corning reported successful double-digit price increases in its Display Technologies segment. This demonstrates that while customers can be price-sensitive, Corning's value proposition, including its technological innovation and market leadership, allows it to pass on costs and even increase prices in certain segments.

- Customer Price Sensitivity: High for high-volume components like display glass in competitive end-markets.

- Corning's Pricing Power: Demonstrated ability to implement price increases, evidenced by double-digit hikes in Display Technologies in 2023.

- Value Proposition Impact: Corning's specialized products and innovation can mitigate customer price sensitivity by justifying higher prices.

Strategic Partnerships and Innovation

Corning frequently establishes deep, trust-based relationships and engages in co-innovation with its key customers. This collaborative strategy cultivates a sense of mutual reliance, often resulting in extended supply agreements and a reduced ability for customers to exert price pressure.

For instance, Corning's strategic partnership with Lumen Technologies for optical fiber showcases this approach. By working closely on innovation and supply, Corning solidifies its position, making it harder for Lumen to switch suppliers or demand significantly lower prices due to the integrated nature of their collaboration.

- Strategic Partnerships: Corning's co-innovation model with major clients limits customer bargaining power.

- Customer Dependence: These collaborations foster mutual reliance, securing long-term supply commitments.

- Reduced Price Sensitivity: Strategic alignment makes customers less likely to seek alternative, potentially cheaper, suppliers.

- Innovation Collaboration: Joint development reduces the transactional nature of customer relationships, increasing switching costs.

Corning's diverse customer base and the specialized nature of its high-technology products significantly limit customer bargaining power. High switching costs, often involving deep product integration and rigorous qualification processes, further entrench Corning's position, making it difficult for customers to change suppliers. For example, the company's continuous innovation, such as with Gorilla® Armor 2, increases these switching costs by offering advanced capabilities that are hard to replicate.

| Customer Segment | Corning's Product Relevance | Customer Bargaining Power Factor | Impact on Corning |

|---|---|---|---|

| Optical Communications | Optical Fiber, Cable, Connectivity | High reliance on Corning's advanced technology for 5G/data centers | Low bargaining power due to switching costs and performance needs |

| Display Technologies | Specialty Glass (e.g., Gorilla Glass) | Price sensitivity for high-volume components, but tempered by performance | Moderate bargaining power, balanced by Corning's pricing power and innovation |

| Automotive | Advanced Displays, Optical Components | Increasing integration into vehicle systems | Low to moderate bargaining power, growing dependence on Corning's solutions |

| Life Sciences | Specialty Glassware, Consumables | Critical for research and diagnostics | Low bargaining power due to specialized needs and quality requirements |

Same Document Delivered

Corning Porter's Five Forces Analysis

This preview showcases the comprehensive Corning Porter's Five Forces Analysis, detailing the competitive landscape for the company. You're looking at the actual document, which includes in-depth analysis of threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. The document you see is your deliverable; it’s ready for immediate use, providing valuable strategic insights into Corning's market position.

Rivalry Among Competitors

Corning thrives in sectors where innovation is paramount. Its significant commitment to research, development, and engineering, often exceeding billions annually, is essential for staying ahead of competitors in areas like advanced optics and specialized glass. For instance, in 2023, Corning reported $1.1 billion in RD&E expenses, a testament to its dedication to technological advancement.

Corning operates in a highly competitive environment, facing formidable global rivals like AGC, Prysmian, and Schott. These diversified giants, along with numerous specialized companies within each of Corning's business segments, actively contest market share across a wide array of product offerings. This intense rivalry necessitates constant strategic agility and innovation to maintain a competitive edge.

Corning's competitive rivalry is significantly shaped by its product differentiation, which hinges on superior performance, quality, and unique features. For instance, the exceptional strength of its Gorilla Glass and the high bandwidth capabilities of its optical fiber are key differentiators.

This strategy effectively sidesteps intense price wars, enabling Corning to secure premium pricing in various market segments. In 2023, Corning reported net sales of $13.1 billion, with its Specialty Materials segment, which includes Gorilla Glass, contributing substantially, underscoring the market's willingness to pay for its differentiated offerings.

The company's consistent introduction of category-defining products further solidifies its competitive advantage, making it challenging for rivals to match its innovation and market position.

Market Share and Growth Initiatives

Corning is actively pursuing market share expansion through its 'Springboard' initiative, aiming for substantial annualized sales growth by capitalizing on major trends such as GenAI and solar energy. This forward-thinking strategy underscores a dynamic approach to competition.

The company’s ambitious growth targets, including an upgrade to add over $4 billion in annualized sales by 2026, demonstrate its commitment to outperforming rivals. This focus on leveraging secular trends is a key element in its competitive playbook.

- Corning's 'Springboard' plan targets significant annualized sales increases by leveraging secular trends like GenAI and solar.

- The plan was upgraded to add over $4 billion in annualized sales by 2026, showcasing aggressive growth ambitions.

- This proactive strategy indicates Corning's intent to gain a larger share of its served markets.

Intellectual Property and Patents

Corning's vast intellectual property portfolio, encompassing thousands of patents, acts as a formidable barrier to entry. This robust protection shields its innovative materials and processes, making it difficult for new players to compete. For instance, Corning's dominance in optical fiber technology is underpinned by patents that have historically deterred significant market entrants.

Maintaining this competitive advantage hinges on rigorous protection of its innovations. Corning actively monitors for and pursues legal action against any perceived infringement of its patents, safeguarding its market share and profitability. This vigilance is essential in industries where technological advancements are rapid.

The company acknowledges intellectual property risks as a key challenge. Protecting its innovations from theft or unauthorized use requires ongoing investment in legal resources and strategic patent management. This proactive approach is critical to sustaining its leadership position.

- Corning held over 100,000 patents globally as of early 2024, a testament to its commitment to innovation.

- The company invested approximately $1.1 billion in research and development in 2023, underscoring the importance of its IP pipeline.

- Corning's legal team actively manages and defends its patent portfolio, a crucial aspect of its competitive strategy.

Corning faces intense competition from established global players like AGC, Prysmian, and Schott, as well as numerous specialized firms within its various market segments. This rivalry is amplified by Corning's strategy of product differentiation, focusing on high-performance materials like Gorilla Glass and advanced optical fibers, which allows it to command premium pricing rather than engaging in price wars.

The company's proactive 'Springboard' initiative aims to capture significant market share by capitalizing on emerging trends, with an upgraded target to add over $4 billion in annualized sales by 2026. This aggressive growth strategy, supported by substantial R&D investment, including $1.1 billion in 2023, underscores Corning's commitment to outmaneuvering competitors through continuous innovation and strategic market positioning.

| Competitor | Key Business Areas | Corning's Competitive Edge |

|---|---|---|

| AGC | Glass, chemicals, ceramics, electronics | Specialty materials, optical fiber, display technologies |

| Prysmian | Energy and telecom cables | Optical fiber innovation, high-performance glass |

| Schott | Specialty glass and glass-ceramics | Advanced optics, durable glass solutions (e.g., Gorilla Glass) |

SSubstitutes Threaten

The threat of substitutes for Corning's specialty glass and ceramics is primarily driven by advancements in alternative materials and technologies. For example, new polymer composites and advanced plastics could potentially replace glass in certain applications, offering different performance characteristics and cost structures.

The market for advanced materials is dynamic, with ongoing research and development potentially yielding viable substitutes. For instance, in the automotive sector, lightweight composite materials are increasingly being explored as replacements for glass in certain structural components, aiming to improve fuel efficiency.

Corning must continuously monitor material science breakthroughs and evolving market needs to identify and adapt to potential substitute threats. This proactive approach ensures the company remains competitive by understanding where its core products might face pressure from alternative solutions across various industries.

Disruptive technologies in Corning's end markets represent a significant threat. For instance, a major shift away from glass substrates in display technology or the emergence of alternative connectivity solutions that bypass optical fiber could diminish demand for Corning's foundational products.

Corning's strategic investments in areas like Generative AI (GenAI) and solar energy products are designed to proactively address and capitalize on these evolving technological landscapes, aiming to mitigate the impact of disruption by participating in new growth waves.

Customers may choose less expensive alternatives if their performance needs aren't critical or if the cost savings from substitutes are more appealing than the benefits of Corning's advanced materials. For instance, in construction, while Corning's Gorilla Glass offers superior durability, less demanding applications might use standard tempered glass to reduce costs.

Corning needs to consistently prove the enhanced value and overall cost-effectiveness of its products. This means highlighting long-term benefits like reduced replacement frequency or improved efficiency, which can justify a higher initial investment. The company's pricing power, as seen in its ability to pass on cost increases, directly reflects how well it communicates this value proposition to its customer base.

Innovation as a Defense

Corning's relentless pursuit of innovation serves as its most potent shield against the threat of substitutes. By consistently investing in research and development, the company aims to create materials so advanced and integrated that their replacement becomes impractical.

This proactive strategy ensures Corning's products remain not just competitive, but often essential, thereby raising the barrier for potential substitutes. A prime example is the ongoing development and refinement of its specialty glass offerings, like the recently announced Gorilla® Armor 2, which demonstrates a commitment to staying ahead of evolving market needs and technological possibilities.

- Corning's R&D spending in 2023 reached $1.1 billion, highlighting its commitment to innovation as a defense against substitutes.

- The introduction of Gorilla® Glass Victus® 2 in late 2022, offering enhanced drop and scratch resistance, exemplifies Corning's strategy to make its products harder to replace.

- Corning's continuous improvement of its optical fiber technology, crucial for 5G infrastructure, makes it difficult for alternative communication mediums to gain traction.

Market-Specific Substitution Risks

The threat of substitutes for Corning's products isn't uniform across its diverse markets. For instance, while optical fiber used in high-bandwidth telecommunications might have limited direct substitutes, other glass or ceramic components in less critical applications could be more vulnerable to replacement by alternative materials. Corning's broad product range, serving industries from automotive to life sciences, helps mitigate this by diversifying its exposure to substitution risks. In 2023, Corning reported net sales of $10.9 billion, showcasing the breadth of its market presence.

Consider the automotive sector, where Corning's Gorilla Glass for displays faces competition from other strengthened glass manufacturers and even alternative display technologies. Conversely, its optical fiber, a critical component for 5G infrastructure, has fewer readily available substitutes that can match its performance and capacity. This highlights how market-specific dynamics significantly influence the intensity of substitution threats.

- Optical Fiber: Limited direct substitutes for high-bandwidth applications.

- Automotive Glass: Faces competition from other strengthened glass and display technologies.

- Ceramic Components: Potential substitution risk in less demanding applications.

- Diversified Portfolio: Corning's broad product range helps spread substitution risk across industries.

The threat of substitutes for Corning’s advanced materials is a constant consideration, with new technologies and materials emerging regularly. While Corning invests heavily in R&D, with $1.1 billion in 2023, to stay ahead, certain applications might still see a shift towards lower-cost or differently performing alternatives. For example, the automotive industry is exploring lightweight composites, which could reduce reliance on glass in some structural elements.

Corning’s strategy involves continuous innovation, like the development of Gorilla® Glass Victus® 2, to make its products indispensable and difficult to substitute. However, the intensity of this threat varies by market segment. Optical fiber, critical for 5G, faces fewer direct substitutes compared to some ceramic components used in less demanding applications.

Corning’s broad product portfolio, which generated $10.9 billion in net sales in 2023, helps to diversify its exposure to substitution risks across various industries, from telecommunications to automotive and life sciences. This diversification is key to mitigating the impact of potential substitutes in any single market.

| Corning Product Segment | Potential Substitute Threat Level | Examples of Substitutes/Threats |

|---|---|---|

| Optical Fiber | Low | Limited substitutes for high-bandwidth, long-distance communication. |

| Specialty Glass (e.g., Gorilla Glass) | Medium | Other strengthened glass manufacturers, advanced plastics, composite materials in automotive. |

| Ceramic Components | Medium to High | Alternative materials in less demanding applications, depending on specific performance requirements. |

Entrants Threaten

The specialty glass, ceramics, and optical physics sectors demand immense upfront investment in cutting-edge manufacturing plants and specialized machinery. This substantial capital requirement acts as a significant deterrent for potential new competitors seeking to enter these markets.

For instance, Corning itself anticipates capital expenditures around $1.3 billion in 2025, illustrating the scale of investment needed to establish and maintain a competitive presence in these industries. Such high entry barriers effectively limit the threat of new entrants.

Developing and launching cutting-edge materials, like those Corning specializes in, demands substantial and ongoing investment in research and development. This high barrier makes it difficult for new companies to enter the market and compete effectively.

Corning's deep-rooted commitment to innovation, evidenced by its extensive scientific expertise, creates a significant hurdle for potential entrants. Without similar R&D capabilities and a robust portfolio of intellectual property, new players struggle to match Corning's established position.

The company's dedication to research is quantified by its investment, which reached $546 million in the first half of 2025 alone. This considerable expenditure underscores the capital-intensive nature of staying at the forefront of materials science, further deterring new entrants.

Corning's formidable array of proprietary technologies, patents, and trade secrets in specialized fields like glass and ceramic science, alongside optical physics, acts as a significant barrier to entry. These intellectual property assets safeguard their innovations, making it exceptionally challenging for newcomers to replicate Corning's products or manufacturing processes without facing legal challenges related to patent infringement. For instance, Corning's Gorilla Glass, protected by numerous patents, has faced limited direct competition in its specific market segment for years.

Economies of Scale and Experience Curve

Established players like Corning leverage substantial economies of scale in their advanced manufacturing processes. For instance, Corning’s Gorilla Glass, a key product, benefits from massive production volumes, driving down per-unit costs significantly. This scale is difficult for newcomers to replicate, creating a substantial barrier.

Corning also benefits from a steep experience curve in specialty glass and ceramics production. Years of refining manufacturing techniques have led to enhanced efficiency, higher yields, and superior product quality. New entrants would face considerable challenges in matching this accumulated operational expertise and the associated cost advantages gained through learning-by-doing.

- Economies of Scale: Corning’s vast production capacity for products like Gorilla Glass allows for lower per-unit manufacturing costs, a hurdle for new entrants.

- Experience Curve: Decades of operational refinement have honed Corning’s manufacturing processes, leading to efficiency gains and quality improvements that are hard to match quickly.

- Cost Disadvantage for Newcomers: Without achieving similar scale and expertise, new entrants would face higher initial production costs, impacting their price competitiveness.

- Capital Investment: Reaching Corning’s level of operational efficiency requires immense upfront capital investment in specialized equipment and research, further deterring new market participants.

Strong Customer Relationships and Brand Reputation

Corning's formidable strength lies in its deeply ingrained, trust-based relationships with global industry titans, cultivated over decades. This, coupled with a stellar brand reputation for unwavering quality and reliability, presents a significant barrier to entry. Newcomers would face immense difficulty in supplanting these established connections and earning the crucial trust and credibility required by Corning's major clientele.

Corning's proactive customer engagement is not merely a byproduct of its success but a fundamental pillar of its strategic approach. This close collaboration often involves co-development and customization, making it exceptionally challenging for potential competitors to replicate the value proposition and lock-in effect Corning enjoys.

- Customer Loyalty: Corning's long-standing partnerships are characterized by high switching costs for customers due to integrated processes and shared intellectual property.

- Brand Equity: The company's brand is synonymous with innovation and performance in its key markets, such as specialty glass and ceramics.

- Strategic Alliances: Corning actively forms strategic alliances with industry leaders, further solidifying its market position and deterring new entrants.

The threat of new entrants for Corning is significantly low due to several formidable barriers. The immense capital required for advanced manufacturing facilities and cutting-edge research, coupled with a strong intellectual property portfolio, makes it exceptionally difficult for newcomers to compete. Established customer relationships and brand loyalty further solidify Corning's market position, presenting a substantial challenge for any potential disruptors.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in specialized manufacturing and R&D facilities. | Deters entry due to substantial upfront costs. |

| Intellectual Property | Extensive patents and proprietary technologies (e.g., Gorilla Glass). | Prevents replication of products and processes without legal issues. |

| Economies of Scale & Experience Curve | Large-scale production leads to lower costs; years of operational refinement. | New entrants face cost disadvantages and efficiency gaps. |

| Customer Relationships & Brand Loyalty | Deep, trust-based ties with industry leaders and strong brand reputation. | Difficult for newcomers to gain market access and customer trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports, company financial statements, and expert interviews. This multi-faceted approach ensures a comprehensive understanding of competitive intensity, supplier and buyer power, and the threat of new entrants and substitutes.