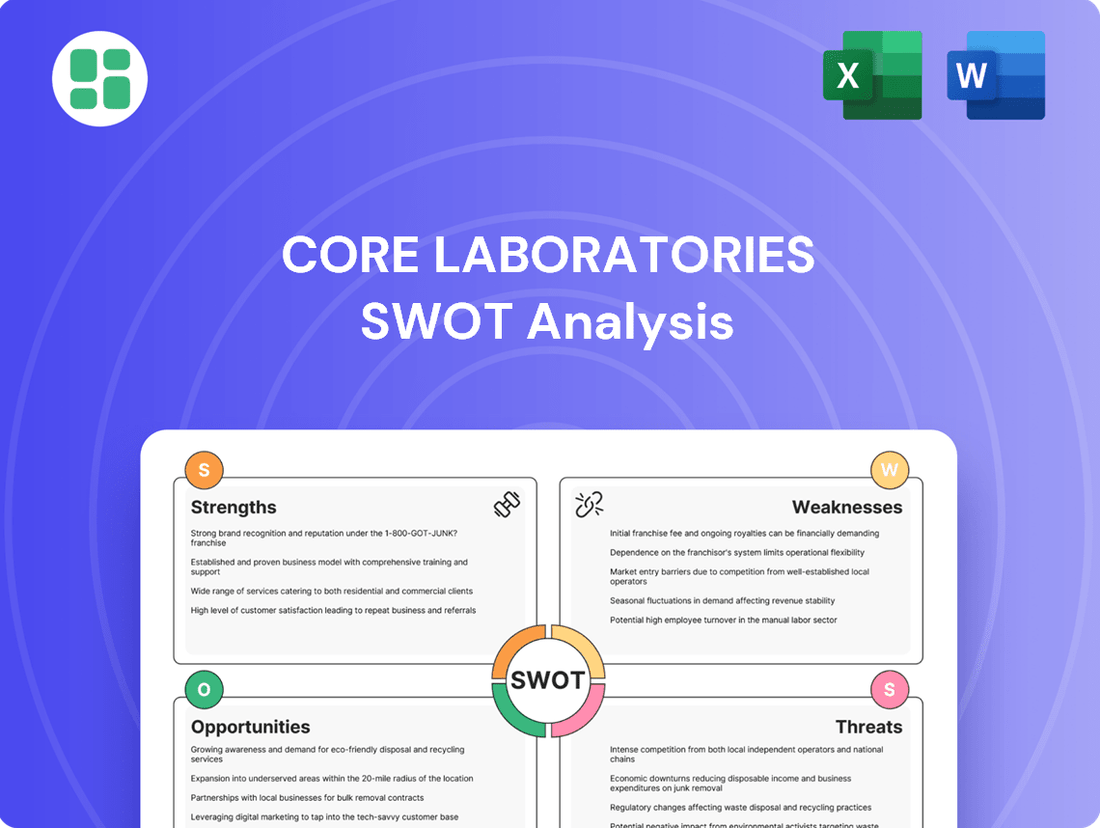

Core Laboratories SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Laboratories Bundle

Core Laboratories possesses strong technical expertise and a well-established client base, but faces challenges from evolving industry demands and potential regulatory shifts. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Core Laboratories' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Core Laboratories' strength lies in its proprietary and patented technologies for reservoir description and production enhancement. This unique intellectual property allows them to offer specialized solutions that competitors cannot easily replicate, giving them a distinct edge in optimizing oil and gas recovery.

These patented technologies are key to Core Labs' ability to provide differentiated services that directly impact client profitability by improving hydrocarbon recovery rates. For instance, their advanced logging and analytical tools, developed over years of research and development, are crucial for understanding complex reservoir characteristics, a service highly valued in the current energy market.

Core Laboratories boasts an impressive global presence, with over 70 offices strategically located in more than 50 countries. This extensive network allows them to operate in virtually every major oil-producing region across the globe, ensuring they can effectively serve a diverse international clientele.

This widespread reach is a significant advantage, enabling Core Laboratories to capitalize on demand for their specialized services wherever it arises. Their strategic expansions into key growth markets like the Middle East, Africa, and South America further solidify their market position and revenue potential.

Core Laboratories' strength lies in its diverse service segments, primarily Reservoir Description and Production Enhancement. This dual focus allows the company to cater to various stages of oil and gas reservoir management. For instance, in 2023, the Reservoir Description segment contributed significantly to revenue, showcasing the ongoing demand for detailed geological and fluid analysis.

Focus on Efficiency and Recovery Optimization

Core Laboratories' core strength lies in its ability to enhance efficiency and optimize recovery in oil and gas operations. Their specialized services are vital for reservoir management, directly impacting how much oil and gas can be extracted from existing fields. This focus on maximizing hydrocarbon recovery is a significant value proposition for clients aiming to boost the profitability of their assets.

The company's technological solutions and deep expertise are instrumental in improving reservoir performance. For instance, in 2023, Core Laboratories reported revenue of $543.7 million, with a significant portion attributed to its Production Optimization segment, highlighting the market demand for its recovery-focused services. This segment's performance underscores the critical role Core Labs plays in helping energy companies achieve better results from their investments.

- Reservoir Management Expertise: Core Labs provides critical services that enable operators to better understand and manage their oil and gas reservoirs.

- Production Optimization Technologies: Their advanced technologies are designed to increase the efficiency of hydrocarbon extraction, leading to higher recovery rates.

- Client Value Proposition: By improving reservoir performance, Core Laboratories helps clients maximize the economic return from their oil and gas assets.

Strong Financial Management and Free Cash Flow Generation

Core Laboratories has made significant strides in fortifying its financial health, notably through a concerted effort to reduce its net debt and consistently generate robust free cash flow. This disciplined approach to capital management underscores a commitment to shareholder value.

The company's performance in the second quarter of 2025 exemplifies this strength. Core Lab reported an increase in free cash flow, reaching $55 million, and a reduction in net debt to $650 million. These figures highlight effective operational management and a strategic focus on financial prudence.

- Increased Free Cash Flow: Q2 2025 free cash flow reached $55 million.

- Reduced Net Debt: Net debt decreased to $650 million in Q2 2025.

- Shareholder Returns: The company continues to return value through share repurchases and dividends.

- Financial Discipline: Demonstrated commitment to strong financial stewardship.

Core Laboratories' proprietary technologies are a significant strength, enabling specialized reservoir description and production enhancement services that are difficult for competitors to replicate. This intellectual property directly translates into improved hydrocarbon recovery for clients, a critical factor in today's energy landscape.

The company's global footprint, spanning over 70 offices in more than 50 countries, allows it to serve major oil-producing regions worldwide. This extensive network ensures Core Labs can capitalize on opportunities wherever they arise, reinforcing its market position.

Core Laboratories demonstrates strong financial management, evidenced by its consistent generation of free cash flow and strategic debt reduction. For example, in Q2 2025, the company reported $55 million in free cash flow and reduced its net debt to $650 million, showcasing its financial discipline and commitment to shareholder value.

What is included in the product

Analyzes Core Laboratories’s competitive position through key internal and external factors, highlighting its strengths in reservoir description and production enhancement while identifying threats from industry downturns and opportunities in emerging markets.

Provides a concise SWOT matrix for fast, visual strategy alignment, relieving the pain of complex analysis and enabling quick decision-making.

Weaknesses

Core Laboratories' financial performance is heavily dependent on the oil and gas sector. When oil and gas companies reduce their capital expenditures, demand for Core Lab's services naturally declines. For instance, in the first quarter of 2024, the company reported a revenue of $116.4 million, a decrease from the $122.7 million in the same period of 2023, reflecting the cyclical nature of its industry.

Core Laboratories faces significant headwinds from geopolitical instability and evolving regulatory landscapes. Ongoing conflicts and expanded sanctions, particularly those impacting the maritime transportation and trade of crude oil, directly threaten demand for their specialized laboratory services. For instance, in Q1 2025, the company noted that such external factors contributed to market volatility, disrupting client activity and impacting operational performance.

Core Laboratories' revenue is susceptible to seasonal dips, often seeing a sequential decline from the fourth to the first quarter due to reduced operational activity. This cyclical pattern can create predictable, albeit temporary, revenue headwinds.

Beyond seasonal factors, the company faces challenges from broader market volatility. A notable instance was the impact of declining U.S. land activity, which directly affected revenue stability in the near term, highlighting sensitivity to macro-economic shifts and specific industry trends.

Intensified Industry Competition

Core Laboratories operates in a highly competitive oil and gas services sector, facing significant pressure on both pricing and its ability to capture market share. This intensified competition is a persistent hurdle for the company.

Despite a general recovery trend observed in the broader oil and gas industry, Core Lab's revenue growth has not consistently mirrored this upswing. This suggests that competitive pressures are hindering its ability to fully capitalize on market demand.

- Pricing Pressure: Competitors often engage in aggressive pricing strategies, forcing Core Laboratories to make similar adjustments, which can impact profit margins.

- Market Share Erosion: Newer entrants and established rivals with broader service offerings can chip away at Core Lab's existing market share.

- Technological Advancements: Competitors investing heavily in new technologies can offer more efficient or cost-effective solutions, putting Core Laboratories at a disadvantage if it doesn't keep pace.

Potential for Project Delays or Cancellations

The oil and gas sector, which is Core Laboratories' primary market, is susceptible to project delays and outright cancellations. These disruptions can stem from volatile commodity prices, shifts in client capital expenditure plans, or evolving regulatory landscapes. For instance, a downturn in oil prices, like the significant drops seen in late 2023 and early 2024, often triggers clients to reassess and postpone or cancel exploration and production projects, directly impacting Core Lab's service demand and revenue forecasts.

These project uncertainties pose a significant challenge for Core Laboratories in terms of predictable revenue streams and efficient resource allocation. When projects are delayed or canceled, it can lead to underutilization of specialized equipment and personnel, thereby affecting profitability. The company's financial planning must account for this inherent volatility, which can manifest as a weakness if not adequately managed through diversification or robust contract structures.

- Industry Volatility: Oil and gas project timelines are highly sensitive to fluctuating crude oil prices, impacting Core Laboratories' revenue predictability.

- Client Strategy Shifts: Changes in client capital expenditure and project prioritization can lead to unexpected project delays or cancellations.

- Operational Impact: Project disruptions can result in underutilized assets and personnel, negatively affecting Core Laboratories' operational efficiency and profitability.

- Forecasting Challenges: The inherent uncertainty in project timelines makes accurate revenue forecasting and resource planning more difficult for Core Laboratories.

Core Laboratories faces intense competition, often leading to pricing pressures that erode profit margins. Market share erosion is also a concern, as rivals with broader service portfolios or technological advantages can capture business. If Core Lab fails to keep pace with competitors' investments in new technologies, it risks falling behind in offering efficient or cost-effective solutions.

| Metric | 2023 (Full Year) | Q1 2024 | Q1 2025 (Projected/Guidance) |

|---|---|---|---|

| Revenue ($M) | 499.3 | 116.4 | 115-120 |

| Operating Income ($M) | 59.1 | 10.3 | 8-12 |

| Net Income ($M) | 30.7 | 4.5 | 2-5 |

Same Document Delivered

Core Laboratories SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Core Laboratories is actively pursuing growth by establishing a stronger foothold in international arenas, with a specific focus on emerging markets in the Middle East, Africa, and South America. This strategic global expansion is designed to tap into regions experiencing significant upstream investment and evolving exploration activities.

The company's recent investment in new unconventional core analysis laboratories, exemplified by its facility in Saudi Arabia, directly addresses the opportunity to serve growing demand in these dynamic geographical areas. This move positions Core Laboratories to capitalize on the development of new reservoir plays and increased operational tempo in these key international territories.

Core Laboratories' deep understanding of reservoir characteristics offers a pathway into new energy arenas. This expertise is directly transferable to evaluating subsurface sites for carbon capture and sequestration (CCS) initiatives, a growing field critical for climate change mitigation.

Furthermore, the company's development of specialized high-temperature water tracers positions it well for the burgeoning geothermal energy sector. In 2024, the global geothermal market was valued at approximately $5.4 billion and is projected to reach over $11 billion by 2030, indicating substantial growth potential for Core Lab's innovative solutions.

Core Laboratories is well-positioned to capitalize on the increasing demand for digital and AI solutions within the energy sector. Integrating advanced technologies like AI and machine learning into reservoir analysis and production enhancement services presents a significant growth avenue.

By leveraging its proprietary databases and applying AI, Core Lab can offer clients enhanced efficiencies and reduced operating costs. This data-driven approach unlocks new insights, directly addressing the industry's need for smarter, more cost-effective production strategies, thereby driving future demand for their specialized services.

Increased Demand for Efficiency in Mature Fields

As oil and gas fields mature, the drive for efficiency intensifies, creating a consistent need for specialized services to optimize performance and extract the most from existing reserves. Core Laboratories' expertise in production enhancement, including well completion, stimulation, and diagnostic services, directly addresses this growing demand.

The company's ability to offer advanced solutions for maximizing hydrocarbon recovery from mature assets positions it favorably. For instance, in 2024, the global oil and gas industry continued to invest in enhanced oil recovery (EOR) techniques, with market reports indicating significant growth in this segment due to the need to sustain production from aging fields.

- Growing EOR Market: The global EOR market was projected to reach over $30 billion by 2025, driven by the need to boost output from mature reservoirs.

- Focus on Optimization: Operators are increasingly prioritizing operational efficiency and cost reduction, making Core Lab's diagnostic and stimulation services highly valuable.

- Technological Advancement: Continued innovation in reservoir characterization and production optimization technologies will further support demand for Core Lab's specialized offerings.

Strategic Acquisitions and Partnerships

Core Laboratories' strategy actively pursues acquisitions of complementary technologies, aiming to bolster its current service offerings and broaden its market footprint. This proactive growth model allows the company to enrich its technology base and extend its reach, responding effectively to evolving industry dynamics and solidifying its competitive standing.

In 2024, Core Laboratories continued to explore strategic partnerships and potential acquisitions, aligning with its stated objective of inorganic growth. For instance, the company’s 2023 annual report highlighted ongoing evaluations of opportunities that could enhance its data analytics and digital solutions capabilities, sectors experiencing significant investment and innovation.

- Acquisition of new digital platforms to enhance data processing.

- Partnerships with AI firms to integrate predictive analytics into service delivery.

- Expansion into new geographic markets through targeted M&A activities.

Core Laboratories is strategically expanding into emerging markets, particularly in the Middle East and Africa, to capitalize on increasing upstream investments and evolving exploration activities. The company's investment in new core analysis laboratories, such as its facility in Saudi Arabia, directly addresses the growing demand in these dynamic regions, positioning it to benefit from new reservoir plays and heightened operational tempo.

The company's expertise in reservoir characterization is transferable to the burgeoning carbon capture and sequestration (CCS) sector, a critical area for climate change mitigation. Additionally, Core Laboratories' development of specialized high-temperature water tracers positions it to serve the rapidly expanding geothermal energy market, which was valued at approximately $5.4 billion in 2024 and is projected to exceed $11 billion by 2030.

Core Laboratories is also poised to leverage the increasing demand for digital and AI solutions within the energy sector. By integrating advanced technologies like AI and machine learning into its reservoir analysis and production enhancement services, the company can offer clients improved efficiencies and reduced operating costs, tapping into the industry's need for smarter, more cost-effective production strategies.

The company's focus on production enhancement services for mature oil and gas fields aligns with the industry's intensified drive for efficiency and maximizing recovery from existing reserves. The global enhanced oil recovery (EOR) market was projected to exceed $30 billion by 2025, underscoring the significant demand for Core Lab's specialized diagnostic and stimulation services.

Core Laboratories is actively pursuing acquisitions of complementary technologies and strategic partnerships to enhance its service offerings and broaden its market reach. This inorganic growth strategy, including evaluations of opportunities in data analytics and digital solutions, aims to bolster its capabilities in sectors experiencing significant investment and innovation.

Threats

The accelerating global shift towards renewable energy sources and a broader decarbonization agenda presents a significant long-term threat to Core Laboratories. As nations and industries prioritize reduced fossil fuel consumption, demand for oil and gas, the bedrock of Core Lab's primary services, is expected to gradually decline over the coming decades.

This energy transition could directly impact Core Lab by leading to reduced capital expenditure within the oil and gas sector for new exploration and production activities. For instance, the International Energy Agency projected in its 2023 scenarios that global oil demand might peak before 2030, implying a potential slowdown in the very projects that drive Core Lab's reservoir characterization and production optimization services.

The oil and gas sector is notoriously sensitive to price swings, driven by everything from international politics to the basic balance of supply and demand. For Core Laboratories, this means that when oil prices fall significantly, exploration and production companies tend to cut back on their spending. This directly impacts Core Lab's ability to secure new projects and generate revenue, as their services are often tied to upstream investment cycles.

The oilfield services sector is a battlefield of innovation, with both seasoned giants and agile newcomers constantly pushing the envelope. This intense competition means Core Laboratories must stay ahead of the curve, as rivals are always looking for ways to offer better or cheaper solutions.

Core Lab faces a significant risk if competitors launch technologies that are not only more advanced but also more economical, potentially siphoning off market share. This could also devalue the company's own unique, patented technologies, impacting its competitive edge and profitability.

For instance, in 2024, the demand for advanced reservoir characterization services remained robust, but pricing pressures were evident across the industry. Companies that could offer integrated digital solutions, leveraging AI and machine learning for faster data analysis, gained traction, posing a direct threat to traditional service models.

Stringent Environmental Regulations and Policies

Increasingly stringent environmental regulations, particularly those targeting carbon emissions, present a significant challenge for Core Laboratories. For instance, the US Environmental Protection Agency (EPA) has been progressively tightening methane emission standards for oil and gas facilities. These evolving policies can translate into higher operational costs for Core Lab's clients in the oil and gas sector, potentially leading to reduced exploration and production activities, which in turn could dampen demand for Core Lab's specialized services.

These regulatory pressures may also necessitate significant investments in new technologies or operational adjustments for Core Laboratories itself, impacting profitability. For example, a shift towards greener energy sources, driven by government mandates, could directly affect the volume of traditional oil and gas projects requiring Core Lab's expertise. The International Energy Agency (IEA) has projected that global oil demand growth could slow significantly in the coming years due to climate policies, impacting the overall market size for services like those provided by Core Laboratories.

- Increased Compliance Costs: Clients in the oil and gas sector may face higher expenses for environmental compliance, potentially diverting funds from services like reservoir characterization and production optimization.

- Reduced Industry Activity: Stricter regulations could lead to a slowdown in exploration and production, directly impacting the demand for Core Lab's core analytical and testing services.

- Shift in Energy Landscape: A global transition towards renewable energy, accelerated by environmental policies, could diminish the long-term reliance on fossil fuels, affecting Core Lab's traditional customer base.

- Technological Adaptation Demands: Core Laboratories may need to invest in adapting its services to support emerging environmental monitoring or carbon capture technologies, adding to operational expenses.

Global Economic Slowdown and Capital Spending Cuts

A global economic slowdown presents a significant threat to Core Laboratories, as it directly impacts the capital expenditure budgets of its primary clients in the oil and gas sector. Reduced energy demand during economic downturns often translates into deferred or cancelled projects, which can severely curtail Core Lab's revenue streams and hinder its growth trajectory.

For instance, the International Monetary Fund (IMF) projected a global growth rate of 3.2% for 2024, a slight deceleration from previous estimates, signaling potential headwinds. This economic uncertainty can lead clients to postpone critical investments in exploration and production, directly affecting Core Lab's service demand.

- Economic Slowdown: Reduced global economic activity curtails energy demand, impacting oil and gas company revenues.

- Capital Spending Cuts: Lower client revenues force oil and gas companies to reduce their capital expenditure on new projects and services.

- Project Deferrals/Cancellations: Economic uncertainty leads clients to postpone or cancel projects, directly impacting Core Lab's order book and financial performance.

- Impact on Growth: These factors collectively threaten Core Laboratories' ability to achieve its projected revenue and profit targets for 2024 and beyond.

The accelerating global shift towards renewable energy sources and a broader decarbonization agenda presents a significant long-term threat to Core Laboratories. As nations and industries prioritize reduced fossil fuel consumption, demand for oil and gas, the bedrock of Core Lab's primary services, is expected to gradually decline over the coming decades. For instance, the International Energy Agency projected in its 2023 scenarios that global oil demand might peak before 2030, implying a potential slowdown in the very projects that drive Core Lab's reservoir characterization and production optimization services.

Intense competition within the oilfield services sector poses a constant threat, as rivals innovate to offer more advanced or cost-effective solutions. Core Laboratories must continually invest in its own technological edge to avoid losing market share. For example, in 2024, the industry saw increased demand for integrated digital solutions leveraging AI and machine learning, putting pressure on traditional service models.

Increasingly stringent environmental regulations, particularly concerning carbon emissions, can lead to higher operational costs for Core Lab's clients. This could result in reduced exploration and production activities, directly impacting the demand for Core Lab's specialized services. The US EPA's tightening methane emission standards are an example of policies that could affect client spending.

A global economic slowdown directly impacts the capital expenditure budgets of oil and gas companies, Core Lab's primary clients. Reduced energy demand during downturns often leads to deferred or cancelled projects, severely curtailing Core Lab's revenue streams. The International Monetary Fund projected a global growth rate of 3.2% for 2024, a slight deceleration, signaling potential headwinds for the sector.

SWOT Analysis Data Sources

This analysis leverages comprehensive data from Core Laboratories' official financial filings, detailed industry market research reports, and expert commentary from reputable energy sector analysts to provide a robust and accurate SWOT assessment.