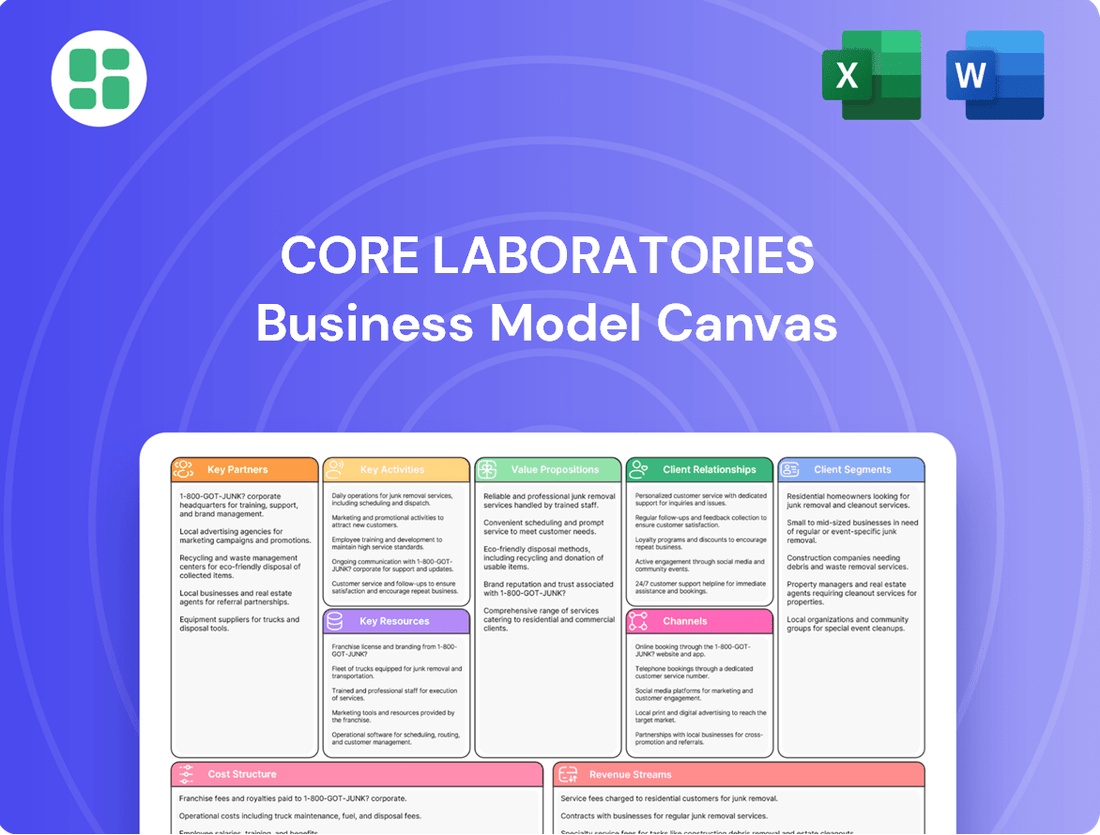

Core Laboratories Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Laboratories Bundle

Unlock the strategic blueprint behind Core Laboratories's success with our comprehensive Business Model Canvas. This detailed analysis breaks down how they deliver value, manage resources, and generate revenue in the energy sector. Discover their key partners, customer relationships, and cost structure.

Ready to gain a deeper understanding? Download the full Business Model Canvas for Core Laboratories to see their entire strategic framework, perfect for competitive analysis or strategic planning.

Partnerships

Core Laboratories' key partnerships are with major and independent oil and gas exploration and production (E&P) companies worldwide. These relationships are fundamental, as these operators represent the core customer base for Core's reservoir description and production enhancement services. For instance, in 2024, Core Labs continued to secure multi-year contracts with leading E&P firms focused on optimizing production from complex reservoirs.

These E&P companies rely on Core's expertise to maximize hydrocarbon recovery and improve asset performance. The collaborations often involve extensive reservoir characterization for both conventional and unconventional plays, as well as specialized support for exploration wells. This symbiotic relationship ensures that operators can make data-driven decisions to boost their output.

Core Laboratories' collaborations with National Oil Companies (NOCs) are crucial, especially in growth markets like the Middle East and Africa. These partnerships enable the evaluation of substantial national energy assets, contributing to major upstream projects and expanding Core Lab's international reach.

Core Laboratories' strategic alliances with technology and research institutions are crucial for maintaining its innovative edge. These collaborations focus on developing cutting-edge analytical methods, digital platforms, and the application of AI and machine learning to refine data analysis and operational processes. For instance, in 2024, Core Labs continued its investment in R&D, allocating a significant portion of its revenue to these partnerships, which directly fuels the creation of unique analytical tools and advanced instrumentation.

Equipment and Material Suppliers

Core Laboratories depends on a robust network of suppliers for specialized equipment, chemicals, and materials vital for its analytical and production enhancement services. Strong supplier relationships are critical for ensuring the consistent availability of high-quality components, especially for their advanced analytical programs and proprietary instrument manufacturing.

These partnerships are foundational to Core Laboratories' ability to deliver accurate and reliable data to its clients. For instance, in 2024, the company continued to invest in cutting-edge analytical instrumentation, necessitating secure supply chains for these sophisticated components.

- Specialized Equipment: Sourcing advanced analytical instruments and laboratory consumables.

- Chemicals and Reagents: Ensuring access to high-purity chemicals for sample analysis.

- Proprietary Materials: Securing components for the manufacturing of their unique production enhancement technologies.

Geothermal and Energy Transition Collaborators

Core Laboratories is actively forging alliances with geothermal developers and other energy transition organizations. This strategic move allows the company to adapt its deep understanding of subsurface conditions and reservoir optimization, honed in the oil and gas sector, to new and growing clean energy markets.

These collaborations are crucial for Core Laboratories to leverage its established expertise in data analysis and reservoir characterization for emerging sectors. For instance, in 2024, the company continued to explore how its advanced logging and analytical services can support the development of enhanced geothermal systems (EGS), a key area for decarbonization.

- Geothermal Energy Ventures: Partnering with companies focused on developing geothermal resources for power generation and direct heating applications.

- Carbon Capture and Storage (CCS) Projects: Collaborating on projects that utilize subsurface knowledge for safe and effective CO2 sequestration.

- Hydrogen Storage Solutions: Exploring opportunities to apply reservoir management principles to underground hydrogen storage initiatives.

- Advanced Materials for Energy: Engaging with partners developing novel materials and technologies for the broader energy transition.

Core Laboratories' key partnerships are primarily with major and independent oil and gas exploration and production (E&P) companies, including National Oil Companies (NOCs) in growth markets. These relationships are vital as they represent the core customer base for reservoir description and production enhancement services. In 2024, Core Labs continued to secure multi-year contracts with leading E&P firms, underscoring the ongoing demand for their specialized expertise in optimizing production from complex reservoirs.

Strategic alliances with technology and research institutions are crucial for maintaining Core's innovative edge, focusing on developing cutting-edge analytical methods and digital platforms. Furthermore, Core Laboratories is actively forging alliances with geothermal developers and other energy transition organizations, aiming to leverage its subsurface expertise in new clean energy markets, such as enhanced geothermal systems (EGS) and carbon capture and storage (CCS) projects, as seen in their 2024 initiatives.

| Partnership Type | Key Focus | 2024 Relevance |

| E&P Operators | Reservoir Description, Production Enhancement | Secured multi-year contracts, optimized complex reservoirs |

| National Oil Companies (NOCs) | Evaluation of National Energy Assets, Upstream Projects | Expansion in Middle East and Africa markets |

| Technology & Research Institutions | R&D, Advanced Analytical Methods, Digital Platforms | Investment in AI/ML for data analysis, development of unique tools |

| Energy Transition Organizations | Geothermal, CCS, Hydrogen Storage | Applying subsurface expertise to clean energy markets |

What is included in the product

A detailed breakdown of Core Laboratories' operations, outlining their customer segments, value propositions, and revenue streams in the oil and gas services sector.

Presents a strategic overview of Core Laboratories' business model, focusing on their core competencies in data analytics and reservoir management.

Saves hours of formatting and structuring your own business model, allowing for rapid identification of pain point relief strategies.

Condenses company strategy into a digestible format for quick review, making it easier to pinpoint and address key customer pains.

Activities

Core Laboratories' key activities heavily rely on its advanced laboratory analysis and testing services. This involves conducting specialized tests on reservoir rocks and fluids, such as reservoir condition testing and high-frequency Nuclear Magnetic Resonance (NMR). These sophisticated analyses are crucial for understanding the unique characteristics of oil and gas reservoirs.

A significant part of this involves the PRISM™ workflow, a proprietary method offering deep insights into fluid saturation profiles and hydrocarbon mobility within the reservoir. For example, in 2023, Core Laboratories reported revenue of $715.6 million, with a substantial portion attributed to these high-value technical services, demonstrating their market importance.

Core Laboratories' Production Enhancement Service Delivery is crucial for boosting oil and gas recovery, especially in challenging unconventional reservoirs. They focus on optimizing well completions and stimulation, providing integrated diagnostic services to track performance.

In 2024, the demand for enhanced oil recovery techniques remained strong, with Core Laboratories reporting significant contributions from this segment. Their expertise in complex completions and real-time monitoring helps clients maximize output, directly impacting their profitability.

Core Laboratories' commitment to research and development is central to its business. They consistently invest in R&D tailored to client needs, resulting in novel proprietary technologies, advanced instrumentation, and refined analytical processes. This dedication keeps Core Lab at the forefront of technological innovation, enabling them to provide sophisticated solutions for intricate reservoir issues.

This strategic R&D focus is evident in the creation of groundbreaking workflows like PRISM™ and diagnostic tracer technologies such as 3AB™. For instance, in 2024, Core Laboratories continued to refine its advanced analytical techniques, with a significant portion of their operational budget allocated to these forward-looking projects, aiming to enhance efficiency and accuracy in reservoir characterization.

Data Interpretation and Reservoir Modeling Support

Core Laboratories excels in interpreting intricate geological and fluid data, a crucial activity that directly informs client reservoir models. This expertise is foundational for understanding subsurface hydrocarbon potential.

The company's proprietary RAPID™ data management platform is central to this process. It provides secure storage and efficient delivery of analytical results, ensuring that engineers, geoscientists, and petrophysicists have timely access to the information they need.

- Data Interpretation: Core Lab analyzes core samples, cuttings, and fluid data to understand reservoir characteristics.

- Reservoir Modeling Support: The insights derived are fed into client reservoir simulation models, aiding in production optimization.

- RAPID™ Platform: This system facilitates secure data handling and rapid dissemination of analytical findings.

- Informed Decision-Making: By providing accurate data interpretation, Core Lab enables clients to develop more effective field development strategies.

Global Laboratory Network Management and Expansion

Core Laboratories actively manages and expands its extensive global laboratory network, which comprises over 70 offices strategically located in more than 50 countries. This robust presence is crucial for delivering localized services and supporting its international client base.

The company's expansion strategy involves establishing new, advanced facilities. A prime example is the Unconventional Core Analysis Laboratory opened in Saudi Arabia, designed to bolster local service capabilities and contribute to broader international growth objectives.

- Global Network: Over 70 offices across more than 50 countries.

- Strategic Expansion: Opening new, state-of-the-art facilities to enhance local service delivery.

- Key Investments: Development of specialized labs, like the Unconventional Core Analysis Laboratory in Saudi Arabia.

- Growth Support: Facilitating international growth initiatives and client support.

Core Laboratories' key activities revolve around providing specialized laboratory analysis and testing services for oil and gas reservoirs. This includes conducting sophisticated tests on reservoir rocks and fluids, such as reservoir condition testing and high-frequency Nuclear Magnetic Resonance (NMR), to understand reservoir characteristics. They also focus on production enhancement services, optimizing well completions and stimulation to maximize oil and gas recovery, particularly in unconventional reservoirs.

The company's commitment to research and development is a cornerstone, leading to proprietary technologies and advanced analytical processes. This R&D focus fuels the creation of innovative workflows and diagnostic tools, ensuring Core Lab remains at the forefront of technological advancements in reservoir characterization. Furthermore, Core Laboratories actively manages and expands its global laboratory network, comprising over 70 offices in more than 50 countries, to deliver localized services and support its international client base.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Laboratory Analysis & Testing | Specialized tests on reservoir rocks and fluids (e.g., NMR, reservoir condition testing). | Crucial for understanding reservoir characteristics; a significant revenue driver. |

| Production Enhancement | Optimizing well completions and stimulation for increased oil/gas recovery. | Strong demand in 2024 for unconventional reservoirs; directly impacts client profitability. |

| Research & Development | Investment in new technologies, instrumentation, and analytical processes. | Drives proprietary workflows like PRISM™ and diagnostic tracers; ongoing refinement in 2024. |

| Global Network Management | Operating and expanding a network of over 70 offices in 50+ countries. | Supports international client base and localized service delivery; exemplified by new facilities like the Saudi Arabia lab. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This is not a mockup or sample; it is a direct snapshot from the actual, fully editable file. You will gain immediate access to this professionally structured and formatted Business Model Canvas, ready for your strategic planning and analysis.

Resources

Core Laboratories' competitive edge is heavily reliant on its substantial collection of proprietary and patented technologies. These innovations, such as the PRISM™ analytical process and 3AB™ tracer technology, are central to its value proposition.

This intellectual property is not merely a collection of patents; it's a direct driver of Core Laboratories' ability to deliver specialized, high-value services. For instance, their advanced analytical processes allow for unparalleled reservoir characterization, a critical component in optimizing oil and gas production.

The company's commitment to R&D, evidenced by its continuous development of new technologies, ensures a sustained competitive advantage. In 2024, Core Laboratories continued to invest in these key resources, aiming to further solidify its position in the reservoir optimization market.

Core Laboratories operates a vital worldwide network of advanced laboratories, a cornerstone of its business model. These facilities are outfitted with precision instruments crucial for intricate geological and chemical analyses.

Strategically situated in key oil-producing regions, these state-of-the-art labs enable the company to offer specialized core and fluid analysis services. This global presence allows for efficient and accurate data collection, supporting production enhancement strategies for clients worldwide.

In 2024, Core Laboratories continued to leverage this extensive laboratory infrastructure. The company’s ability to conduct complex analyses globally underpins its value proposition in the energy sector, facilitating informed decision-making for exploration and production companies.

Highly skilled scientific and technical personnel are the bedrock of Core Laboratories' value proposition. The company employs a cadre of leading geoscientists, engineers, and petrophysicists whose specialized knowledge is crucial for delivering advanced analytical services to the energy sector.

In 2023, Core Laboratories' commitment to its technical workforce was evident in its ongoing investment in training and development programs. This focus ensures their experts remain at the forefront of industry advancements, enabling them to tackle complex reservoir characterization and production optimization challenges for clients.

The deep expertise resident within this talent pool directly translates into the company's ability to innovate and provide high-value consultative services. This human capital is fundamental to Core Laboratories' competitive advantage, driving the development of proprietary technologies and solutions that are essential for clients navigating the evolving energy landscape.

Proprietary Data and Digital Platforms

Core Laboratories’ proprietary data and digital platforms, notably the RAPID™ system, represent crucial assets. These extensive databases and sophisticated platforms are fundamental to their ability to analyze and integrate vast amounts of information, providing clients with actionable intelligence.

These digital infrastructures are designed for secure data storage and the efficient dissemination of critical insights. By leveraging these resources, Core Laboratories empowers client decision-making and drives significant improvements in operational efficiencies across the energy sector.

The company's investment in these technological assets underpins its competitive advantage. For instance, the ongoing development and maintenance of platforms like RAPID™ are essential for staying ahead in data-driven analysis and service delivery.

- Proprietary Databases: Extensive collections of specialized data, crucial for advanced analytics.

- Digital Platforms: Systems like RAPID™ enable data integration, analysis, and secure delivery.

- Enhanced Decision-Making: Facilitates informed choices for clients through timely and accurate insights.

- Operational Efficiency: Streamlines internal processes and client service delivery.

Strong Client Relationships and Industry Reputation

Core Laboratories cultivates enduring partnerships with leading oil companies, independent operators, and national oil companies (NOCs). This is a cornerstone of their business, built on a bedrock of independence, unwavering integrity, and a consistent track record of providing rapid, precise, and dependable data. These deeply entrenched relationships are not just valuable; they are critical resources that guarantee ongoing revenue streams and open doors to more complex, collaborative projects.

The company's sterling industry reputation acts as a powerful magnet, attracting and retaining clients. For instance, in 2024, Core Laboratories continued to be a trusted partner for many of the world's largest energy producers, underscoring the importance of their commitment to quality and reliability. This reputation translates directly into a significant competitive advantage.

- Long-standing client partnerships with major oil companies, independent operators, and NOCs.

- Reputation for independence and integrity in data provision.

- Consistent delivery of swift, accurate, and reliable data is a key differentiator.

- These relationships ensure **recurring business and foster collaborative project engagements**.

Core Laboratories' key resources are its extensive proprietary databases and sophisticated digital platforms, such as the RAPID™ system. These assets are vital for integrating and analyzing vast amounts of data, providing clients with actionable intelligence and improving operational efficiencies. The company's ongoing investment in these technological assets ensures its competitive edge in data-driven analysis and service delivery.

| Key Resource | Description | Impact |

|---|---|---|

| Proprietary Databases | Extensive collections of specialized data crucial for advanced analytics. | Enhances decision-making for clients through timely and accurate insights. |

| Digital Platforms (e.g., RAPID™) | Systems enabling data integration, analysis, and secure delivery. | Streamlines internal processes and client service delivery, improving operational efficiency. |

| Intellectual Property | Proprietary and patented technologies like PRISM™ and 3AB™. | Drives the ability to deliver specialized, high-value reservoir characterization services. |

| Global Laboratory Network | Worldwide network of advanced labs equipped for intricate geological and chemical analyses. | Facilitates efficient and accurate data collection in key oil-producing regions. |

| Skilled Personnel | Geoscientists, engineers, and petrophysicists with specialized knowledge. | Underpins innovation and the delivery of high-value consultative services. |

Value Propositions

Core Laboratories' core offering is to help clients unlock the full potential of their petroleum reservoirs, leading to significantly improved performance and higher hydrocarbon recovery rates. This is achieved through specialized services and advanced technologies designed to understand reservoir characteristics deeply. For instance, in 2024, the company's reservoir description services provided critical data that guided enhanced oil recovery (EOR) strategies for several major upstream operators.

Core Laboratories provides highly accurate and reliable data from complex reservoir core and fluid analyses. This data is crucial for understanding the subsurface, guiding decisions on how best to extract valuable resources.

Their proprietary digital platforms integrate this vital information, offering clients deep insights into reservoir rock and fluid characteristics. For instance, in 2024, Core Labs continued to be a key player in providing detailed reservoir characterization, essential for optimizing production strategies in a fluctuating energy market.

Core Laboratories significantly cuts client operational expenses and boosts efficiency through its advanced diagnostic services and optimized well completion strategies. For instance, in 2024, clients utilizing Core's integrated solutions reported an average reduction in drilling and completion costs by up to 15% due to improved resource allocation and reduced downtime.

By deploying cutting-edge technologies, Core Laboratories accelerates the analysis of crucial well data. This rapid assessment empowers operators to swiftly evaluate and refine stimulation techniques, leading to demonstrably better production outcomes. In the first half of 2024, Core’s proprietary data analytics platform enabled clients to identify and implement efficiency gains in stimulation treatments, resulting in an average 10% increase in initial production rates.

Mitigation of Reservoir Risks and Uncertainties

Core Laboratories' detailed reservoir description services are instrumental in helping clients gain a clearer understanding of subsurface conditions. This enhanced knowledge directly translates to a significant reduction in the risks and uncertainties inherent in oil and gas exploration and production activities.

By accurately delineating fluid saturation profiles and assessing mobility potential, Core Lab's data empowers clients to make more informed decisions. This precision minimizes the chances of costly operational errors, thereby boosting project success rates and optimizing resource recovery.

- Reduced Exploration Costs: In 2024, the average cost of exploring a new oil field continued to be a substantial investment, with many projects failing to yield commercially viable reserves. Core Lab's insights help de-risk these upfront expenditures.

- Improved Production Efficiency: Understanding reservoir heterogeneity through Core Lab's analysis allows for optimized well placement and stimulation, leading to higher ultimate recovery factors.

- Mitigated Operational Downtime: Accurate reservoir characterization helps prevent unexpected geological challenges during drilling and production, thereby minimizing costly downtime.

- Enhanced Reserve Estimation: Reliable data on fluid distribution and rock properties leads to more accurate reserve bookings, which is critical for financial reporting and investment decisions.

Access to Cutting-Edge Proprietary Technologies

Clients gain access to Core Laboratories' unique and patented technologies, including advanced laboratory instrumentation and analytical workflows not readily available elsewhere.

This exclusive access allows operators to leverage the latest innovations for complex reservoir challenges, enhancing their competitive edge.

- Proprietary Technologies: Core Laboratories holds numerous patents for its analytical methods and instrumentation, providing a distinct advantage.

- Advanced Analytical Workflows: These workflows are designed for high-precision analysis of complex geological samples, crucial for optimizing production.

- Competitive Edge: By utilizing these cutting-edge tools, clients can make more informed decisions, leading to improved recovery rates and reduced operational risks.

- Innovation Investment: In 2023, Core Laboratories continued to invest significantly in research and development, ensuring their technology portfolio remains at the forefront of the industry.

Core Laboratories' value proposition centers on delivering unparalleled insights into reservoir performance, driving enhanced hydrocarbon recovery and operational efficiency for its clients. Their specialized services and proprietary technologies provide the critical data needed to optimize extraction strategies, thereby reducing costs and mitigating risks in oil and gas operations. This focus on data accuracy and advanced analytics ensures clients can make more informed decisions, ultimately leading to improved production outcomes and a stronger competitive position in the market.

Customer Relationships

Core Laboratories cultivates deep consultative relationships, offering expert advisory services that leverage their analytical discoveries. This means actively working with client engineers, geoscientists, and petrophysicists to transform intricate data into practical strategies for reservoir management and optimization.

Core Laboratories cultivates enduring strategic alliances with major players in the oil and gas sector, including National Oil Companies. These collaborations are characterized by multi-well studies and sustained project engagements, underscoring a dedication to sustained cooperation and shared advancement in maximizing reservoir value over time.

Core Laboratories offers dedicated technical support, a crucial element in their customer relationships. This means clients aren't left to navigate complex challenges alone; they have a team ready to assist. In 2024, Core Labs continued to emphasize this, ensuring clients could leverage their expertise effectively for optimal project outcomes.

Their collaborative approach is key. Core Labs actively works with clients, fostering a partnership to understand unique needs and develop customized solutions. This hands-on engagement solidifies Core Labs' position not just as a service provider, but as a trusted technical ally, building long-term relationships based on shared success.

Performance-Based and Value-Driven Engagement

Customer relationships at Core Laboratories are fundamentally performance-based, emphasizing the tangible value delivered through improved reservoir performance and maximized hydrocarbon recovery. This focus ensures that client engagements are directly tied to measurable outcomes, fostering a strong sense of partnership.

Core Lab's data-driven approach directly strengthens these relationships by equipping clients with insights that enhance decision-making and accelerate development timelines. This commitment to tangible results is a cornerstone of their client engagement strategy.

- Performance Metrics: Core Lab's services directly impact client success, with engagements often structured around achieving specific production or recovery targets.

- Data-Driven Insights: Clients rely on Core Lab's advanced analytical capabilities to make informed decisions, reducing uncertainty and optimizing operational efficiency.

- Accelerated Development: By providing critical reservoir characterization data, Core Lab helps clients fast-track their field development plans, delivering value sooner.

- Long-Term Partnerships: The consistent delivery of value and performance fosters loyalty, leading to repeat business and enduring client relationships.

Global Client Engagement and Local Presence

Core Laboratories prioritizes maintaining strong connections with its diverse global clientele. This commitment is evident through consistent client engagement strategies, which include direct, face-to-face interactions. For instance, in 2024, the company continued its focus on personalized service to understand and meet specific client needs across various geographies.

The company strategically establishes local laboratories in key operational regions, such as the Middle East. This localized approach, exemplified by facilities like those in Saudi Arabia, allows for more immediate and responsive service delivery. By being physically present in these critical markets, Core Laboratories fosters deeper trust and builds more resilient, long-term partnerships with its clients.

- Global Reach, Local Touch: Core Laboratories balances its worldwide operations with a commitment to local presence, ensuring accessible and responsive client support.

- Face-to-Face Engagement: The company actively engages clients through direct meetings, reinforcing relationships and understanding unique project requirements.

- Strategic Local Facilities: Establishing laboratories in key regions, like the Middle East in 2024, demonstrates a dedication to serving clients effectively within their operational environments.

Core Laboratories fosters deep, consultative relationships, acting as a technical ally rather than just a service provider. Their approach is highly collaborative, working directly with client teams to translate complex data into actionable reservoir management strategies.

This partnership model is reinforced by performance-based engagements, where success is measured by tangible improvements in hydrocarbon recovery and operational efficiency. In 2024, Core Labs continued to emphasize this value-driven approach, solidifying long-term client loyalty through consistent delivery of measurable results.

The company’s commitment to client success is further demonstrated by its strategic global presence, including local laboratories in key regions like the Middle East. This localized support, coupled with direct, face-to-face engagement, allows Core Labs to deeply understand and respond to the unique needs of its diverse international clientele.

| Relationship Type | Key Engagement Driver | 2024 Focus |

|---|---|---|

| Consultative Partnerships | Expert advisory and data interpretation | Deepening collaboration with client geoscientists |

| Strategic Alliances | Multi-year, multi-well project engagements | Sustained cooperation with National Oil Companies |

| Performance-Based Support | Tangible improvements in reservoir performance | Ensuring clients leverage expertise for optimal outcomes |

Channels

Core Laboratories heavily relies on its direct sales force and technical experts to connect with customers. These skilled individuals are crucial for explaining the unique benefits of Core Lab's specialized services and products. They foster strong client relationships and offer in-depth technical advice.

In 2024, Core Laboratories continued to invest in its direct sales and technical teams, recognizing their pivotal role in driving revenue. These teams are instrumental in conveying the value proposition of Core Lab's advanced reservoir characterization and production optimization solutions directly to oil and gas operators.

Core Laboratories leverages its expansive global network, boasting over 70 laboratories and offices strategically positioned in more than 50 countries. This extensive reach is crucial for delivering its specialized services efficiently across the globe.

These facilities are deliberately situated within key oil-producing regions. This proximity ensures swift and convenient access to client samples, facilitating timely analysis and localized support, which is vital for the energy sector.

As of 2024, Core Laboratories' operational footprint demonstrates a significant commitment to global presence. This network is a primary channel for client engagement and the delivery of their data-driven solutions, underpinning their service model.

Core Laboratories actively participates in major industry conferences like the Society of Petroleum Engineers (SPE) Annual Technical Conference and Exhibition (ATCE) and the American Association of Petroleum Geologists (AAPG) Annual Convention. These events serve as crucial channels for demonstrating our advanced reservoir characterization technologies and analytical services. In 2024, ATCE attracted over 10,000 attendees, offering significant visibility.

Through technical presentations at these forums, Core Labs disseminates cutting-edge research and case studies, positioning our experts as thought leaders. This engagement directly supports lead generation by attracting potential clients seeking specialized solutions for complex reservoir challenges.

Workshops and technical sessions allow for deeper dives into our service offerings, fostering direct interaction with engineers and geoscientists. This hands-on approach strengthens our industry presence and facilitates the identification of new business opportunities within the oil and gas sector.

Proprietary Digital Data Management Platforms

Core Laboratories leverages proprietary digital data management platforms, such as RAPID™, as key channels to deliver analytical results and insights directly to its clients. These platforms are designed for secure access, ensuring the integrity of sensitive data while offering an efficient user experience for retrieving critical information.

These digital channels are instrumental in streamlining the communication of complex analytical findings, providing clients with a centralized and accessible hub for their data. This approach enhances client engagement and facilitates quicker decision-making based on the insights provided.

- Client Access: RAPID™ and similar platforms serve as the primary conduit for clients to view and interact with their analytical reports and data.

- Data Integrity: Robust security measures are embedded within these platforms to maintain the highest standards of data integrity and confidentiality.

- Efficiency: The user-friendly interface of these digital channels significantly improves the efficiency with which clients can access and utilize complex analytical outputs.

- Insight Delivery: These platforms are engineered to present data and insights in a clear, actionable format, supporting informed decision-making for clients.

Strategic Alliances and Joint Ventures

Strategic alliances and joint ventures represent key, albeit less explicit, channels for Core Laboratories. These collaborations can unlock new markets and expand service delivery by integrating complementary expertise with industry partners or technology firms. For instance, a joint venture could provide access to specialized geological data or advanced analytical techniques not currently within Core Lab's direct purview, thereby broadening their service portfolio.

These partnerships are crucial for enhancing market penetration and offering a more comprehensive suite of services. By joining forces, Core Laboratories can leverage the established presence and customer base of their partners, accelerating entry into new geographic regions or industry segments. This approach allows for shared risk and investment, making ambitious expansion projects more feasible.

- Market Access: Alliances can provide direct entry into markets where Core Laboratories might otherwise face significant barriers, leveraging partner networks.

- Service Expansion: Joint ventures allow for the co-development and offering of integrated services, combining Core Lab's core competencies with partner technologies.

- Risk Mitigation: Sharing the costs and risks associated with new market entries or technology development through partnerships can improve financial efficiency.

- Innovation Synergy: Collaborating with technology providers can accelerate the adoption and integration of cutting-edge analytical tools and methodologies.

Core Laboratories utilizes a multi-faceted approach to reach its clientele, blending direct engagement with digital solutions and strategic partnerships. This ensures comprehensive market coverage and effective delivery of its specialized services.

The company's direct sales force and technical experts are paramount, acting as the primary interface for client interaction and technical consultation. These teams are critical for conveying the value of Core Lab's advanced reservoir characterization and production optimization solutions, particularly in 2024, where continued investment underscored their importance in revenue generation.

Core Laboratories' extensive global network, comprising over 70 laboratories and offices in more than 50 countries as of 2024, serves as a vital channel for service delivery and client engagement. This strategic positioning within key oil-producing regions facilitates efficient sample analysis and localized support.

Industry conferences, such as the SPE ATCE which saw over 10,000 attendees in 2024, are key channels for showcasing technological advancements and fostering lead generation. Technical presentations and workshops at these events position Core Labs as a thought leader and identify new business opportunities.

Proprietary digital platforms like RAPID™ are essential for delivering analytical results and insights, offering secure, efficient, and centralized access to data for clients. These digital channels streamline communication and support informed decision-making.

Strategic alliances and joint ventures offer expanded market access and service capabilities by integrating complementary expertise. These collaborations, crucial for market penetration and risk mitigation, allow Core Laboratories to leverage partner networks and co-develop integrated services.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales & Technical Experts | Personalized client interaction, technical consultation, and relationship building. | Continued investment in teams to convey value of reservoir characterization and production optimization solutions. |

| Global Laboratory Network | Extensive physical presence for service delivery and localized support. | Over 70 labs in 50+ countries, strategically located in key oil-producing regions. |

| Industry Conferences & Events | Showcasing technology, thought leadership, and lead generation. | Participation in SPE ATCE (10,000+ attendees in 2024) and AAPG conventions. |

| Digital Data Platforms (e.g., RAPID™) | Secure, efficient delivery of analytical results and insights. | Centralized hub for client data, enhancing accessibility and decision-making. |

| Strategic Alliances & Joint Ventures | Market expansion, service enhancement, and risk sharing. | Leveraging partner networks for market access and co-developing integrated services. |

Customer Segments

Major International Oil Companies (IOCs) represent a critical customer segment. These global giants, such as ExxonMobil, Shell, and Chevron, operate in diverse and often challenging geological environments. They require sophisticated reservoir characterization and production optimization solutions to maximize recovery from their extensive, large-scale projects.

In 2024, IOCs continued to invest heavily in exploration and production, with global upstream capital expenditure projected to reach approximately $530 billion, according to industry analysis. Core Laboratories' advanced diagnostic and analytical services are vital for these companies to understand complex reservoir properties and implement effective enhanced oil recovery (EOR) techniques, thereby improving operational efficiency and profitability.

Independent Oil and Gas Exploration & Production (E&P) companies, spanning from smaller, agile operators to larger, established players, represent a crucial customer base for Core Laboratories. These companies are deeply invested in maximizing their asset value and operational efficiency.

These E&P firms depend on Core Laboratories’ specialized services to unlock greater production from their existing wells and to thoroughly assess the potential of new unconventional resource plays, such as those found in the prolific Permian Basin, including West Texas. Their focus is on improving the effectiveness of their drilling and completion operations.

For instance, in 2024, the U.S. rig count for oil-directed drilling averaged around 500-550 rigs, indicating robust activity among E&P companies. Core Laboratories' offerings directly support these operational efforts, helping clients optimize their hydrocarbon recovery and reduce costs, which is paramount in a dynamic commodity price environment.

National Oil Companies (NOCs) and government energy agencies, particularly in regions like the Middle East and Africa, are crucial clients for Core Laboratories. These organizations frequently seek Core Lab's advanced analytical services to conduct thorough evaluations of their national hydrocarbon reserves and to formulate long-term resource development strategies.

These entities rely on Core Lab's specialized knowledge to optimize the extraction and management of their valuable energy assets, aiming to maximize national resource utilization. For instance, in 2024, Core Lab continued to secure significant contracts with several NOCs for reservoir characterization and production enhancement studies, reflecting the ongoing demand for their expertise in mature and developing oil-producing nations.

Geothermal Energy Developers

Core Laboratories is actively engaging with companies focused on geothermal energy development, recognizing this as a significant emerging customer segment. This strategic move allows Core to leverage its deep subsurface knowledge and advanced diagnostic tools to assist in the unique challenges of geothermal projects.

This diversification aligns with the broader energy transition, where geothermal power is gaining traction. For instance, the global geothermal power market was valued at approximately $5.2 billion in 2023 and is projected to grow substantially in the coming years, presenting a clear opportunity for service providers like Core Laboratories.

- Geothermal Developers: Companies exploring and developing geothermal resources for power generation and direct-use applications.

- Subsurface Expertise: Core provides essential geological, reservoir engineering, and production optimization services tailored for geothermal environments.

- Diagnostic Technologies: Offering advanced analytical tools to assess reservoir potential, fluid properties, and operational efficiency in geothermal wells.

- Energy Transition Alignment: This segment represents Core's adaptation to evolving energy landscapes and its commitment to supporting sustainable energy solutions.

Research and Academic Institutions (for specialized projects)

Core Laboratories might partner with universities and research bodies on niche projects, even if these aren't major revenue sources. These collaborations foster industry-wide learning and help cultivate future talent.

Such engagements can also spark innovation, leading to the development of new technologies that benefit the broader energy sector. For instance, in 2024, many energy service companies are investing in R&D partnerships to explore advanced materials for extraction and carbon capture solutions.

- Specialized Project Funding: Core Labs could provide funding or resources for academic research aligned with its specific technological needs.

- Knowledge Exchange: Facilitating the sharing of expertise between industry professionals and academic researchers.

- Talent Pipeline Development: Identifying and nurturing promising students and researchers for future employment.

- Access to Advanced Research: Gaining insights into cutting-edge scientific discoveries and methodologies before they become widely adopted.

Core Laboratories serves a diverse clientele within the energy sector, including major international oil companies, independent exploration and production firms, and national oil companies. The company also actively targets emerging markets like geothermal energy development, showcasing its adaptability.

Cost Structure

Core Laboratories dedicates substantial resources to research and development, a critical component for innovation. These investments are crucial for developing and enhancing the company's proprietary technologies, advanced instrumentation, and sophisticated analytical methodologies that underpin its service offerings.

In 2023, Core Laboratories reported R&D expenses of approximately $37.5 million. This figure reflects the ongoing commitment to scientific personnel, the procurement of essential laboratory materials, and the significant costs associated with protecting its intellectual property, all vital for sustaining its competitive edge in the market.

Core Laboratories' cost structure is significantly shaped by its investment in a highly skilled workforce. This includes competitive salaries, comprehensive benefits packages, and ongoing training for its geoscientists, engineers, laboratory technicians, and field service personnel. These individuals are crucial for delivering the company's specialized services.

In 2024, personnel costs represent a substantial segment of Core Laboratories' operational expenses. For instance, in the first quarter of 2024, the company reported total operating expenses of approximately $116.3 million, with employee-related costs forming a significant portion of this figure, reflecting the specialized nature of their expertise.

Operating and maintaining a global network of specialized laboratories is a significant expense for Core Laboratories. These costs encompass facility leases, utilities, and the upkeep of highly specialized equipment, which is critical for their analytical services.

Consumables, such as chemicals and testing materials, along with stringent environmental compliance measures, also contribute substantially to these operational expenditures. For instance, in 2024, companies in the scientific research and development services sector reported average operating expenses that were a considerable portion of their revenue, reflecting the high cost of maintaining advanced lab infrastructure.

Equipment Acquisition and Depreciation

Core Laboratories invests significantly in acquiring new, advanced laboratory instruments and field equipment. This ongoing investment is crucial for maintaining their high-tech reservoir description and production enhancement services. For instance, in 2023, the company reported capital expenditures of $65.2 million, a substantial portion of which would be allocated to equipment.

The depreciation of existing assets is another key component of their cost structure. This reflects the capital-intensive nature of their operations, where high-value equipment loses value over time. In 2023, Core Laboratories’ depreciation and amortization expenses totaled $109.8 million, highlighting the ongoing cost associated with their asset base.

- Capital Expenditures: Core Laboratories allocated $65.2 million to capital expenditures in 2023, primarily for equipment.

- Depreciation and Amortization: The company recorded $109.8 million in depreciation and amortization expenses in 2023.

- Asset Intensity: These figures underscore the capital-intensive nature of providing specialized oil and gas services.

General, Administrative, and Sales & Marketing Expenses

General, Administrative, and Sales & Marketing Expenses are the backbone of Core Laboratories' operations, encompassing everything from executive leadership and back-office support to client outreach and market development. These costs are crucial for maintaining a global presence and fostering strong client relationships.

For instance, in 2023, Core Laboratories reported Selling, General, and Administrative (SG&A) expenses of $284.3 million. This figure reflects the investment in their corporate management, administrative functions, IT, legal, and essential sales and marketing efforts needed to support their diverse service offerings and international client base.

- Corporate Management and Administration: Costs associated with running the company's headquarters, including executive salaries, accounting, human resources, and legal departments.

- IT Infrastructure: Investments in technology systems and support necessary for global operations and data management.

- Sales and Marketing: Expenses incurred to promote Core Laboratories' services, engage with existing clients, and attract new business worldwide.

- Compliance and Regulatory: Costs related to adhering to industry regulations and maintaining ethical business practices across all operating regions.

Core Laboratories' cost structure is heavily influenced by its significant investments in research and development, aiming to innovate and improve its specialized services. Personnel costs, including salaries and benefits for a highly skilled workforce, represent a substantial operational expense. Maintaining a global network of laboratories and acquiring advanced equipment also contribute significantly to their expenditure.

| Cost Category | 2023 Data (Millions USD) | 2024 Data (Q1, Millions USD) |

|---|---|---|

| R&D Expenses | $37.5 | N/A |

| Total Operating Expenses | N/A | $116.3 |

| Capital Expenditures | $65.2 | N/A |

| Depreciation & Amortization | $109.8 | N/A |

| Selling, General & Administrative (SG&A) | $284.3 | N/A |

Revenue Streams

Core Laboratories generates revenue through fees for its specialized reservoir description services. These services involve in-depth laboratory analysis of core samples and reservoir fluids, providing critical data on rock and fluid characteristics essential for efficient hydrocarbon extraction.

This segment is a substantial contributor to the company's overall income. For instance, in 2023, the Reservoir Description segment reported revenue of $392.8 million, highlighting its importance to Core Laboratories' financial performance.

Core Laboratories generates revenue from Production Enhancement Services Fees, which are tied to helping clients optimize their oil and gas well operations. These fees come from services focused on well completion, stimulation, and overall production improvement. This includes specialized diagnostic services crucial for understanding and enhancing performance, especially in challenging unconventional reservoirs.

In 2024, the demand for these specialized services remained robust, driven by the ongoing need to maximize output from existing wells and develop new, more efficient extraction techniques. For instance, Core Laboratories reported that its Production Enhancement segment played a significant role in its overall financial performance, reflecting the value clients place on improving well efficiency and extending their productive lifespans.

Core Laboratories generates revenue by selling its unique, patented products, including specialized lab equipment and diagnostic tracers. These items are crucial for their service delivery and are purchased by clients for their own use in operations.

Licensing and Technology Transfer Agreements

While not a primary focus, Core Laboratories can generate revenue by licensing its proprietary technologies and intellectual property to other companies in the oil and gas sector. This strategy facilitates wider adoption of their innovations without the need for direct service delivery.

This approach allows Core Labs to monetize its research and development investments, expanding its market reach through partnerships. For instance, in 2024, the company continued to leverage its extensive patent portfolio, which underpins its advanced reservoir characterization and production optimization solutions.

- Technology Licensing: Core Laboratories may earn fees by allowing other companies to use its patented technologies, such as advanced core analysis techniques or digital solutions for reservoir management.

- Intellectual Property Royalties: Revenue can be generated through royalty payments based on the usage or commercialization of Core Labs' intellectual property by third parties.

- Joint Development Agreements: Partnerships for co-developing new technologies can also include licensing components, providing an upfront or ongoing revenue stream.

Consulting and Advisory Project Fees

Core Laboratories also earns revenue from specialized consulting and advisory projects. These engagements leverage their deep technical expertise to offer bespoke solutions and strategic direction, going beyond routine analytical services.

These fees are typically project-based, reflecting the scope and complexity of the tailored guidance provided to clients. This segment allows Core Lab to monetize its intellectual capital and problem-solving capabilities directly.

- Project-Based Fees: Revenue generated from specific, client-defined consulting engagements.

- Strategic Guidance: Income derived from providing expert advice on complex technical or operational challenges.

- Value-Added Services: Fees linked to proprietary methodologies or specialized analytical insights offered on a consultative basis.

Core Laboratories' revenue streams are multifaceted, encompassing fees from specialized laboratory services, production enhancement solutions, and the sale of proprietary products. The company also generates income through technology licensing and consulting engagements, all contributing to its financial performance.

| Revenue Stream | Description | 2023 Revenue (Millions USD) | 2024 Outlook/Notes |

|---|---|---|---|

| Reservoir Description Services | Laboratory analysis of core samples and reservoir fluids. | 392.8 | Continued demand for detailed reservoir characterization. |

| Production Enhancement Services | Services focused on well completion, stimulation, and production improvement. | N/A (Segmented within broader categories) | Robust demand driven by optimization needs in unconventional reservoirs. |

| Product Sales | Sale of patented lab equipment and diagnostic tracers. | N/A (Often bundled with services) | Supports service delivery and offers clients direct operational tools. |

| Technology Licensing & IP Royalties | Allowing third parties to use patented technologies. | N/A (Strategic, less direct revenue) | Leveraging extensive patent portfolio for market reach. |

| Consulting & Advisory | Bespoke solutions and strategic direction based on technical expertise. | N/A (Project-based) | Monetizing intellectual capital and problem-solving capabilities. |

Business Model Canvas Data Sources

The Core Laboratories Business Model Canvas is informed by a blend of internal financial reports, operational data, and detailed market research. This comprehensive approach ensures each component accurately reflects the company's current strategic position and market opportunities.