Core Laboratories Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Laboratories Bundle

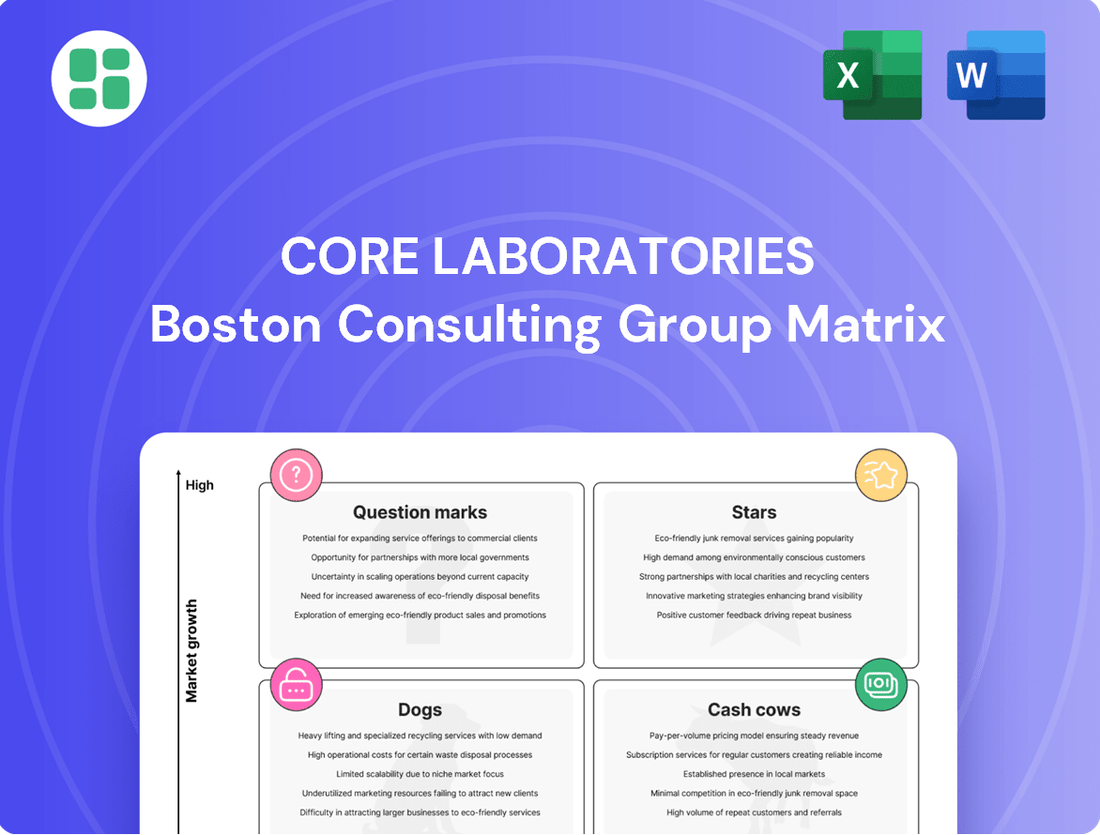

Unlock the strategic power of the BCG Matrix for Core Laboratories and pinpoint where its offerings truly shine. Understand if you have market-dominating Stars, reliable Cash Cows, underperforming Dogs, or promising Question Marks. Purchase the full report for a comprehensive analysis and actionable insights to optimize your portfolio.

Stars

Core Laboratories' advanced reservoir characterization technologies, including its proprietary PRISM™ workflow, are positioned as Stars in the BCG matrix. These services offer highly precise subsurface mapping and predictive capabilities for reservoir behavior, essential for optimizing recovery in complex, high-growth unconventional plays.

The company's commitment to this segment is further evidenced by its new Unconventional Core Analysis Laboratory in Dammam, Saudi Arabia. This strategic expansion caters to the rising demand for sophisticated reservoir analysis in the Middle East, a region actively developing its unconventional resources.

The integration of AI and ML into reservoir analysis and production optimization is a burgeoning high-growth area within the oil and gas sector. Core Laboratories' strategic focus on accelerating digital technology adoption and enhancing data delivery platforms like RAPID™ is designed to capture significant market share in this expanding, high-value segment.

The global AI in oil and gas market is anticipated to experience substantial growth, underscoring the critical importance of these digital capabilities for future performance. For instance, the market was valued at approximately USD 2.5 billion in 2023 and is projected to reach over USD 10 billion by 2028, demonstrating a compound annual growth rate (CAGR) exceeding 30%.

Core Laboratories' production enhancement segment, encompassing services and products for enhanced oil recovery (EOR) and water flood programs, is positioned in a robust growth market. Operators are increasingly focused on maximizing output from their existing oil fields, driving sustained demand for these specialized solutions.

The company's commitment to optimizing future completion strategies and improving overall hydrocarbon recovery directly addresses the industry's imperative to extract greater value from mature assets. This focus on advanced EOR techniques, such as chemical EOR and thermal EOR, is critical as conventional production declines.

In 2024, the global EOR market was valued at approximately $35 billion and is projected to grow significantly. Core Laboratories' expertise in areas like reservoir characterization and fluid analysis for EOR projects is essential for the successful implementation of these complex recovery methods.

Deepwater and International Project Support

Core Laboratories sees significant opportunity in supporting deepwater and international upstream projects, especially in regions like Asia, India, the Middle East, and Africa. These areas are expected to drive crude oil demand growth, making them key markets for the company's expertise.

The company's services for complex deepwater operations and large international projects are well-positioned. These ventures are often less impacted by short-term fluctuations in crude oil prices, offering a more stable growth trajectory. Core Lab's established global presence and market share in these demanding environments are key advantages.

- Market Focus: Core Laboratories is strategically targeting growth in non-OECD countries, where crude oil demand is projected to increase significantly.

- Service Strengths: The company excels in providing support for challenging deepwater operations and extensive international projects.

- Resilience: These project types demonstrate a lower sensitivity to immediate crude oil price volatility, offering a more robust revenue stream.

- Global Position: Core Lab holds a strong global standing and market share in the specialized services required for these complex operations.

Emerging Carbon Capture and Storage (CCS) Related Services

Emerging Carbon Capture and Storage (CCS) related services represent a promising future growth avenue for Core Laboratories. As the global imperative for emission reduction intensifies, the oil and gas sector is investing heavily in CCS technologies. Core Labs' established proficiency in reservoir characterization and fluid analysis is crucial for the successful and secure underground storage of captured carbon dioxide. This positions the company to capitalize on the burgeoning CCS market.

The demand for CCS solutions is projected to surge. For instance, the International Energy Agency (IEA) reported that global CCS capacity is expected to reach 230 million tonnes of CO2 per year by 2030, a significant increase from current levels. Core Labs' analytical services are fundamental to ensuring the geological suitability and integrity of storage sites, a critical component for the widespread adoption of CCS. Their existing infrastructure and technical expertise provide a strong foundation for expansion into this segment.

- Market Growth: The global CCS market is anticipated to grow substantially, driven by climate policy and corporate sustainability goals.

- Core Labs' Role: Expertise in reservoir characterization and fluid analysis directly supports the safe and effective geological sequestration of CO2.

- Technological Synergy: Core Labs' existing analytical capabilities are highly transferable to the specialized needs of CCS projects.

- Future Potential: This segment offers Core Laboratories a significant opportunity to diversify revenue streams and align with industry decarbonization efforts.

Core Laboratories' advanced reservoir characterization and digital technology integration, particularly its PRISM™ workflow and RAPID™ platform, are key drivers in the Stars category. These offerings cater to the high-growth demand for precise subsurface mapping and AI-driven production optimization in unconventional resource plays. The company's expansion into new markets, like its Dammam laboratory, underscores its commitment to capturing share in these lucrative segments.

The global AI in oil and gas market, valued around USD 2.5 billion in 2023 and projected to exceed USD 10 billion by 2028, highlights the significant growth potential Core Laboratories is targeting. Their focus on digital acceleration positions them to benefit from this trend.

Core Laboratories' production enhancement services, including EOR and water flood programs, are also strong contenders for the Stars category. The increasing industry focus on maximizing recovery from existing fields fuels demand for these solutions. The global EOR market, estimated at approximately $35 billion in 2024, presents a substantial opportunity for Core Lab's expertise in reservoir analysis for complex recovery methods.

Core Laboratories is strategically positioned to capitalize on the growing demand for Carbon Capture and Storage (CCS) services. Their established expertise in reservoir characterization and fluid analysis directly supports the safe and effective geological sequestration of CO2, a critical component for the widespread adoption of CCS. The International Energy Agency (IEA) projects global CCS capacity to reach 230 million tonnes of CO2 per year by 2030, indicating a substantial market for Core Lab's analytical capabilities.

What is included in the product

This analysis categorizes business units by market share and growth, guiding strategic decisions for investment and resource allocation.

Core Laboratories BCG Matrix simplifies complex portfolio analysis, relieving the pain of indecision by clearly visualizing strategic positioning.

Cash Cows

Routine core and fluid analysis services are Core Laboratories' foundational cash cows. These services, essential for reservoir management in mature basins, deliver consistent revenue with minimal reinvestment. This segment is the bedrock of their Reservoir Description business, generating stable cash flow.

Standard well completion and stimulation products and services are the bedrock of maintaining production in mature oil and gas fields. These are not the flashy, new technologies, but rather the reliable, proven methods that keep existing wells flowing. Think of them as the essential maintenance that ensures a steady output, rather than the exciting exploration for new reserves.

Core Laboratories' Production Enhancement segment likely benefits significantly from these cash cow offerings. Their long-standing presence and established customer relationships in the industry give them a strong market share for these essential products. This stability contributes to the overall reliable performance of the segment, providing a consistent revenue stream.

For instance, in 2024, the demand for these foundational services remained robust as operators focused on optimizing existing assets. While specific figures for this product category aren't always broken out, the broader Production Enhancement segment, which includes these standard offerings, demonstrated resilience. Core Laboratories reported that demand for their completion fluids and related services remained a consistent contributor to their revenue throughout the year.

Legacy Production Optimization Services are the bedrock of Core Laboratories' portfolio, acting as reliable cash cows within their BCG Matrix. These services focus on extracting maximum value from existing, mature oil and gas fields, employing proven techniques rather than cutting-edge, high-growth technologies. This stability provides consistent revenue streams, as clients continually seek to enhance output from their established infrastructure.

In 2024, Core Laboratories continued to see robust demand for these mature field services. While specific revenue figures for this segment are often bundled, the company's overall performance in its Production Enhancement segment, which heavily features these legacy optimizations, indicated strong, stable contributions. This segment’s consistent cash generation allows for reinvestment in other areas of the business, underscoring its cash cow status.

Established Laboratory Instrumentation Sales

Established Laboratory Instrumentation Sales within Core Laboratories are a prime example of a Cash Cow in the BCG Matrix. These instruments, honed by years of industry experience, are sold globally for standard laboratory setups. Their mature product lifecycle ensures consistent revenue streams and healthy profit margins, a testament to Core Laboratories' strong brand recognition and entrenched market position.

The stability of this segment is further underscored by its consistent performance. For instance, in 2023, Core Laboratories reported that its Laboratory Services segment, which heavily features instrumentation sales, contributed significantly to its overall revenue. Specific figures from their 2023 annual report indicated a robust demand for these reliable, high-quality tools across various petroleum industry applications.

- Mature Product Line: Sales of established laboratory instrumentation represent a stable, high-margin revenue source.

- Global Reach: Precision instruments are supplied to clients worldwide, particularly for standard laboratory configurations.

- Brand Reputation: Core Laboratories' established name and market presence drive consistent demand and profitability.

- Revenue Stability: This segment provides predictable income, supporting investment in other business areas.

Proprietary Data Delivery Systems (e.g., RAPID™)

Core Laboratories' proprietary data delivery systems, such as RAPID™, represent a significant cash cow. These systems are designed to offer enhanced data security and a streamlined process for accessing crucial petrophysical data, a niche where they have likely achieved substantial market penetration.

The core functionality of these established systems generates a consistent and recurring revenue stream. This reliability stems from subscription models or ongoing service agreements, making them a dependable source of cash for the company.

- High Market Penetration: RAPID™ and similar systems likely dominate their specific niche in petrophysical data delivery.

- Recurring Revenue: Subscription and service agreements provide a steady, predictable income flow.

- Established Technology: While continuously improved, the core technology is mature, reducing R&D intensity for this segment.

- Data Security Focus: Enhanced security features are a key selling point, justifying ongoing customer commitment.

Core Laboratories' established laboratory instrumentation sales serve as a prime example of a cash cow. These instruments, refined through years of industry expertise, are consistently sold for standard laboratory setups globally. Their mature product lifecycle translates into steady revenue and healthy profit margins, a direct result of Core Laboratories' strong brand recognition and established market standing.

In 2024, Core Laboratories reported that its Laboratory Services segment, which includes these instrumentation sales, continued to be a significant revenue contributor. The demand for these reliable, high-quality tools remained strong across various petroleum industry applications, showcasing the segment's consistent performance and its role as a stable income generator.

| Segment/Product | BCG Category | 2024 Performance Indicator | Key Characteristics |

| Established Laboratory Instrumentation | Cash Cow | Consistent revenue contributor to Laboratory Services segment | Mature product, global reach, strong brand reputation |

| Routine Core and Fluid Analysis | Cash Cow | Essential for reservoir management in mature basins | Foundational service, minimal reinvestment, stable cash flow |

| Legacy Production Optimization Services | Cash Cow | Strong, stable contributions to Production Enhancement segment | Focus on mature fields, proven techniques, consistent revenue |

Full Transparency, Always

Core Laboratories BCG Matrix

The BCG Matrix document you are previewing is the identical, fully completed file you will receive immediately after your purchase. This means you get the complete strategic analysis, ready for immediate application without any watermarks or placeholder content. The report is professionally formatted and designed to provide actionable insights into your business portfolio, just as you see it now.

Dogs

Outdated analytical techniques, such as manual data entry for financial modeling or reliance on purely historical trend analysis without incorporating forward-looking indicators, are becoming increasingly obsolete. These methods often lead to inefficiencies and a higher risk of human error. For instance, in 2023, companies still heavily reliant on legacy ERP systems without modern analytics integration reported an average of 15% higher operational costs compared to those leveraging cloud-based, AI-powered platforms.

Services highly dependent on declining US land activity would fall into the Dogs category of the BCG Matrix. These are segments that operate in slow-growing or shrinking markets with little competitive advantage for Core Laboratories.

For example, services tied to onshore US oil and gas exploration and production, particularly in basins with reduced drilling activity, exemplify this. In 2023, US land rig counts saw fluctuations, averaging around 620 rigs for the year, a decrease from previous periods, indicating a challenging environment for related services.

Core Laboratories' portfolio may include basic, undifferentiated commodity products. These offerings likely lack proprietary technology or significant competitive advantages, forcing them to compete primarily on price. In 2024, the market for such commodities, especially in the energy sector where CLB operates, generally exhibits low growth and intense price competition, leading to thin profit margins.

Services Adversely Impacted by Geopolitical Conflicts and Sanctions

Laboratory services closely linked to maritime crude oil and product trading have been significantly hampered by escalating geopolitical tensions and broader sanctions regimes. This situation has created a challenging environment, potentially pushing these services into a question mark category within the BCG matrix if the downturn proves persistent.

The impact is evident in reduced shipping volumes and altered trade routes. For instance, the International Maritime Organization (IMO) reported in late 2023 that while global maritime trade volume was projected to grow, specific segments tied to energy markets faced volatility due to geopolitical events. This volatility directly affects the demand for specialized laboratory testing services that verify cargo quality and quantity for these trades.

- Reduced Demand: Sanctions and conflicts disrupt established shipping lanes and trade partnerships, leading to fewer shipments of crude oil and refined products requiring laboratory analysis.

- Market Uncertainty: The unpredictable nature of geopolitical events creates significant uncertainty for businesses reliant on these specific maritime services, making long-term investment and service provision risky.

- Operational Challenges: Companies providing these laboratory services may face increased operational costs due to supply chain disruptions, insurance premiums, and the need to adapt to new or restricted market access.

Non-Core, Underperforming Niche Offerings

Non-core, underperforming niche offerings in Core Laboratories' BCG Matrix represent specialized services or minor product lines that consistently fail to gain traction or have become obsolete due to industry shifts. These segments often drain valuable resources without contributing significantly to the company's overall growth or cash flow. For instance, a niche testing service for a declining industrial sector might fall into this category, consuming operational capital without a clear path to profitability.

These "Dogs" are characterized by low market share and low market growth, making them unattractive investment opportunities. Core Laboratories, with its focus on high-return investments and free cash flow generation, would typically seek to divest or phase out such offerings. In 2024, companies across various sectors have been re-evaluating their portfolios, with many divesting non-core assets. For example, a report from S&P Global Market Intelligence indicated that divestitures of underperforming business units reached a notable volume in the first half of 2024, as companies prioritized core competencies.

- Low Market Share: These niche offerings typically hold a minimal percentage of their respective, often shrinking, markets.

- Low Market Growth: The industries or applications these services cater to are not expanding, limiting future potential.

- Resource Drain: They consume capital, personnel, and management attention that could be better allocated to stronger business segments.

- Lack of Competitive Advantage: Without a clear differentiator or path to market leadership, they struggle to compete effectively.

Dogs in Core Laboratories' BCG Matrix represent services or products in low-growth or declining markets with low market share. These segments typically offer minimal competitive advantage and are often price-sensitive, leading to low profitability. For example, services tied to declining onshore US oil and gas basins, where rig counts have seen a decrease, exemplify these "Dog" offerings.

Core Laboratories likely has offerings that are basic, undifferentiated commodities, competing primarily on price in slow-growth markets. In 2024, these segments are characterized by intense price competition and thin profit margins, making them unattractive for further investment. Companies are actively divesting such non-core assets to focus on more profitable ventures.

These "Dog" segments consume resources without generating significant returns, necessitating strategic divestment or phasing out. Their low market share and lack of growth potential make them a drain on capital and management attention, hindering the company's overall performance and strategic focus.

Core Laboratories would typically aim to divest or phase out these underperforming "Dog" offerings. In the first half of 2024, many companies, including those in the energy services sector, have been divesting non-core assets to improve efficiency and focus on core competencies.

| BCG Category | Market Growth | Market Share | Example for Core Laboratories | 2024 Outlook |

| Dogs | Low | Low | Services for declining onshore US oil basins | Continued pressure on margins due to price competition |

| Dogs | Low | Low | Basic, undifferentiated commodity products | Limited growth, high operational costs |

| Dogs | Low | Low | Obsolete niche testing services | Resource drain, no clear path to profitability |

Question Marks

Core Laboratories' new digital platform offerings, beyond their core RAPID™ system, represent potential Stars or Question Marks in the BCG matrix. These could include advanced AI-driven reservoir analysis or predictive maintenance software for oilfield equipment. The oil and gas sector's digital transformation creates a high-growth market, but Core Labs may still be in the early stages of capturing significant market share in these emerging digital services.

Significant investment in research and development, alongside targeted marketing efforts, will be crucial for these nascent digital platforms to achieve scalability and market dominance. For instance, if Core Labs is developing a new cloud-based data analytics platform for seismic interpretation, it would require substantial upfront capital and a robust go-to-market strategy to compete with established tech players entering the energy space.

As the energy sector pivots, Core Laboratories is likely cultivating specialized services for renewable energy integration, such as analyzing geothermal reservoirs or assessing hydrogen storage viability. This emerging market presents significant growth potential, but Core Lab's current footprint in these areas is probably minimal.

Significant investment will be necessary for Core Laboratories to establish a dominant position, transforming these nascent ventures into Stars within the BCG matrix. For instance, the global geothermal energy market was valued at approximately $6.5 billion in 2023 and is projected to grow substantially, offering a substantial opportunity for specialized analytical services.

Advanced predictive maintenance solutions, particularly those leveraging AI for the oil and gas sector, are a significant growth area. These technologies promise to drastically cut equipment downtime and operational expenses, a critical need in the industry. Core Laboratories' involvement in this space, if they have launched or are developing such offerings, positions them within a high-growth market segment.

As a potential star in the BCG matrix, these AI-powered solutions would require substantial investment to capture market share and fend off both established players and new entrants. The market for predictive maintenance in oil and gas was estimated to reach over $5 billion globally by 2023, with projections indicating continued robust expansion through 2030.

New Geographic Market Expansions for Specific Services

Core Laboratories is strategically expanding into new geographic markets, notably South America and emerging areas within the Middle East, to tap into growing demand for its services. This expansion is particularly focused on introducing new service lines where the company has yet to establish a substantial market presence, aiming to build market share from the ground up.

These new ventures represent potential Stars or Question Marks in the BCG matrix, depending on their initial market penetration and growth rates. For instance, introducing advanced reservoir characterization services in a nascent South American market where competitors have a strong foothold would likely place it as a Question Mark.

For example, Core Lab's recent push into offering specialized digital solutions for enhanced oil recovery in regions like Colombia, where adoption is still in early stages, would be classified as a Question Mark. In 2024, the global market for oilfield services, particularly in emerging regions, is projected to see significant growth, with some analysts estimating a compound annual growth rate (CAGR) of over 5% for specialized services in these developing markets.

- South America Expansion: Targeting regions with increasing exploration and production activity, potentially introducing new analytical techniques for unconventional reservoirs.

- Middle East Focus: Deepening presence in countries like Oman or Kuwait beyond existing hubs, offering integrated reservoir management solutions.

- New Service Introduction: Launching advanced geochemical analysis or digital well logging interpretation in these new territories where market share is minimal, classifying them as Question Marks.

- Market Growth Context: The global oil and gas services market was valued at approximately $150 billion in 2023 and is expected to grow, with emerging markets showing higher potential for new service adoption.

Innovative Tracer Technologies for New Applications

Core Laboratories' 3AB™ diagnostic tracer technology represents a significant innovation, speeding up well data analysis. This proprietary offering could be considered a 'Star' within its current, established use cases.

However, when Core Lab ventures into new applications or expands the use of 3AB™ into emerging, high-growth market segments where its market share is currently minimal, these new applications would be classified as Question Marks in the BCG matrix. This classification signifies that while the potential for growth is high, the market penetration is low, necessitating substantial investment to validate and capture market share.

- 3AB™ Technology: Accelerates well data analysis, a key innovation.

- Current Application: Likely a 'Star' in established markets.

- New Applications: Positioned as 'Question Marks' due to high growth potential but low current market share.

- Investment Need: Requires further investment to prove widespread adoption in new segments.

Question Marks in Core Laboratories' BCG matrix represent new ventures or services with high market growth potential but currently low market share. These are areas where the company is investing heavily but has not yet established a dominant position. Significant capital is required to nurture these offerings, aiming to convert them into Stars.

For example, Core Lab's expansion into specialized digital solutions for enhanced oil recovery in nascent markets, like Colombia, would fall into the Question Mark category. The global oilfield services market saw robust growth in emerging regions in 2024, with some estimates suggesting a CAGR exceeding 5% for specialized services in these developing territories.

The company's proprietary 3AB™ diagnostic tracer technology, when applied to new market segments with minimal existing penetration, also fits the Question Mark profile. These ventures require substantial investment to prove their value and capture market share against established competitors.

Core Laboratories' strategic focus on expanding its digital platform offerings, such as AI-driven reservoir analysis, places these as Question Marks. While the energy sector's digital transformation presents a high-growth landscape, Core Labs is still in the early stages of building significant market traction in these emerging digital services.

| BCG Category | Core Lab Example | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Question Mark | AI-driven reservoir analysis | High (Digital transformation in energy) | Low | High |

| Question Mark | 3AB™ tracer in new applications | High (Emerging market segments) | Low | High |

| Question Mark | Digital solutions in nascent markets (e.g., Colombia) | High (Emerging regions oilfield services) | Low | High |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, industry growth rates, and market share data, ensuring a robust and accurate strategic overview.