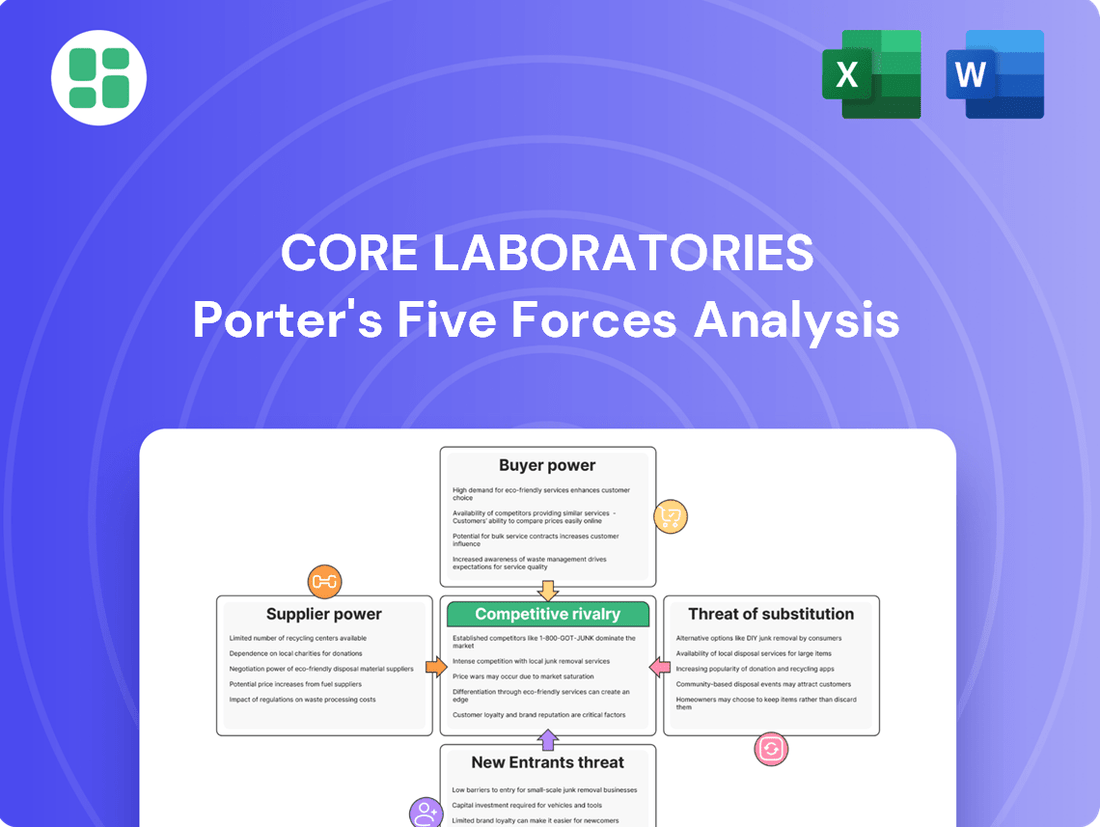

Core Laboratories Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Laboratories Bundle

Core Laboratories operates in a dynamic energy services sector, where understanding competitive pressures is paramount. Our Porter's Five Forces analysis unpacks the intricate web of industry rivalry, buyer and supplier power, the threat of new entrants, and the ever-present danger of substitutes. This foundational understanding is crucial for any strategic evaluation of Core Laboratories.

Ready to move beyond the basics? Get a full strategic breakdown of Core Laboratories’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Suppliers hold considerable sway when they offer specialized equipment, patented chemicals, or unique technologies vital to Core Laboratories' core offerings. The scarcity of alternative providers for these crucial inputs directly amplifies their bargaining strength.

This dynamic is especially pronounced in Core Labs' Reservoir Description segment, which is heavily dependent on sophisticated laboratory instruments and advanced analytical methodologies. For instance, in 2024, the market for advanced geological surveying equipment, a key input for this segment, was dominated by a handful of manufacturers, indicating a concentrated supplier base.

The cost and complexity associated with switching from one supplier to another significantly influence supplier power. If Core Laboratories has made substantial investments in integrating a particular supplier's specialized technology or relies on unique, supplier-specific training for its workforce, the process of changing providers can become both disruptive and costly. This increased switching friction inherently strengthens the supplier's bargaining position.

The uniqueness of inputs significantly bolsters supplier bargaining power. If Core Laboratories relies on highly differentiated or proprietary materials and data, suppliers gain leverage. For instance, patented chemicals or exclusive geological datasets crucial for Core Labs' production enhancement services are difficult to substitute, giving those suppliers more sway in pricing and terms.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a key consideration for Core Laboratories. If suppliers, such as those providing specialized laboratory equipment or chemicals, were to develop the capability and motivation to offer reservoir description or production enhancement services directly, they would become direct competitors. This scenario, while less common in highly specialized and capital-intensive industries like the oil and gas services sector where Core Labs operates, cannot be entirely discounted.

For instance, a major supplier of advanced seismic data acquisition technology might possess the technical expertise and client relationships to offer their own interpretation and analysis services. While this would require significant investment and a shift in business model, it represents a potential avenue for suppliers to capture more value within the industry chain. The actualization of this threat depends heavily on the specific supplier's strategic objectives and their ability to overcome the operational and market entry barriers that Core Laboratories has already navigated.

The bargaining power of suppliers, particularly concerning forward integration, is generally considered moderate for Core Laboratories. This is due to the highly specialized nature of the services Core Labs provides, which often require proprietary technologies and deep industry expertise. However, certain upstream suppliers of essential raw materials or components could potentially leverage their position. For example, if a key supplier of specialized chemicals used in core analysis were to integrate forward, it could impact Core Labs’ cost structure and service delivery.

- Suppliers may integrate forward by offering reservoir description or production enhancement services, directly competing with Core Laboratories.

- This threat is generally lower in highly specialized and capital-intensive segments like those Core Labs serves.

- The incentive for suppliers to integrate forward depends on their strategic goals and perceived market opportunities.

Importance of Core Labs to Suppliers

The bargaining power of suppliers to Core Laboratories is significantly shaped by how crucial Core Labs is as a customer. If Core Laboratories accounts for a substantial percentage of a supplier's overall sales, that supplier may have less leverage. For instance, if a key chemical supplier derives 15% of its revenue from Core Labs, it would likely be hesitant to impose unfavorable terms or price increases, fearing the loss of such a significant business relationship.

Conversely, if Core Laboratories is a minor client for a large, diversified supplier, its negotiating power is reduced. Imagine a broad-spectrum equipment manufacturer that serves thousands of clients; Core Labs' business might represent less than 1% of its total revenue. In such a scenario, the supplier has less incentive to accommodate Core Labs' demands, as the impact of losing this particular client would be minimal.

- Customer Dependence: Suppliers relying heavily on Core Labs for revenue may offer more favorable terms.

- Supplier Diversification: Suppliers with a broad customer base have less dependence on Core Labs, increasing their bargaining power.

- Market Share Impact: If Core Labs represents a large portion of a supplier's market share, the supplier's power is diminished.

- Switching Costs: High costs for Core Labs to switch suppliers also influence supplier power.

Suppliers of specialized equipment and proprietary chemicals hold significant bargaining power over Core Laboratories. This is particularly true when these inputs are critical for Core Labs' reservoir description services, and few alternative suppliers exist. For example, in 2024, the market for advanced geological surveying instruments remained highly concentrated, with a few key manufacturers dictating terms.

The bargaining power of these suppliers is further amplified by the high switching costs associated with integrating new technologies or retraining personnel. If Core Labs has heavily invested in a specific supplier's unique technology, moving to another provider becomes both disruptive and expensive, giving the original supplier more leverage in negotiations.

Core Laboratories' position as a customer also impacts supplier power. If Core Labs represents a substantial portion of a supplier's revenue, that supplier has less incentive to impose unfavorable terms. Conversely, if Core Labs is a small client for a diversified supplier, the supplier's bargaining power increases.

| Factor | Impact on Core Laboratories | Example (2024 Data) |

| Input Uniqueness/Specialization | High Supplier Power | Patented chemicals for core analysis; specialized geological data. |

| Switching Costs | High Supplier Power | Investment in proprietary equipment integration; workforce training. |

| Supplier Concentration | High Supplier Power | Dominance of a few manufacturers in advanced geological equipment market. |

| Customer Dependence (Core Labs as % of Supplier Revenue) | Low Supplier Power | Core Labs accounting for 15% of a key chemical supplier's revenue. |

| Supplier Diversification (Number of Clients) | High Supplier Power | Core Labs representing <1% of a broad-spectrum equipment manufacturer's revenue. |

What is included in the product

This analysis unpacks the competitive forces impacting Core Laboratories, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Quickly identify and mitigate competitive threats with a visual breakdown of each force, making strategic adjustments effortless.

Customers Bargaining Power

Core Laboratories' customer base is heavily concentrated among a few large players in the oil and gas industry. This means that a significant portion of their revenue comes from a small number of major clients.

When customers are concentrated, they gain substantial bargaining power. For Core Labs, this translates to the risk that losing even one of these large clients could have a considerable negative effect on their financial performance.

These oil and gas majors, due to their sheer size and the volume of services they procure, possess significant leverage. This leverage allows them to negotiate more favorable terms, potentially impacting Core Labs' pricing and profit margins.

Core Laboratories' customers, primarily major oil and gas companies, face varying switching costs. For highly specialized, patented services, the investment in integration and long-term contracts can create significant barriers to switching, thereby limiting customer bargaining power. For instance, a complex reservoir characterization study might involve proprietary software and data formats that are difficult and costly to replicate with a new provider.

Conversely, some of Core Labs' services may be more standardized or commoditized. In these instances, the effort and expense required to switch providers are considerably lower. This can empower customers, as they can more readily compare pricing and terms across different service providers, potentially driving down prices and increasing Core Labs' need to compete on cost for these offerings.

Customer price sensitivity is a significant factor for Core Laboratories, particularly given the inherent volatility in the oil and gas sector. When oil prices dip, such as the average Brent crude price which fluctuated significantly throughout 2023 and into early 2024, oil and gas companies face increased pressure to reduce their operational expenses. This directly translates into a stronger bargaining position for these customers, who will actively seek lower prices or more advantageous contract terms from service providers like Core Laboratories.

Availability of Substitute Services or In-house Capabilities

Customers can leverage alternative oilfield service providers or develop their own internal reservoir analysis capabilities, especially if these alternatives offer comparable, even if less specialized, results. This option significantly strengthens their negotiating position.

The feasibility of in-house development or switching to competitors directly impacts Core Laboratories' pricing power. For instance, if a major client like Shell or ExxonMobil finds it cost-effective to build out their own advanced reservoir simulation teams, their reliance on Core Labs diminishes.

- Customer Choice: The presence of numerous oilfield service companies offering reservoir characterization and data analytics means clients aren't locked into a single provider.

- In-house Development: Large energy companies often possess the financial and technical resources to build internal departments for reservoir analysis, reducing their need for external specialists.

- Cost-Benefit Analysis: Customers will weigh the cost and benefits of outsourcing versus developing in-house expertise or using a competitor.

Customer Information Asymmetry

Customer information asymmetry plays a crucial role in the bargaining power of customers. When customers possess more complete information about the market, including competitor offerings and Core Laboratories' cost structure, they are better positioned to negotiate favorable terms. This knowledge allows them to identify potential leverage points and demand better pricing or service levels.

Sophisticated clients, particularly large oil and gas companies, often have substantial technical expertise and market intelligence. This inherent advantage empowers them to effectively assess Core Laboratories' value proposition and negotiate more aggressively for concessions. For instance, in 2024, major energy producers continued to leverage their deep understanding of reservoir analysis and testing technologies to secure competitive service agreements.

- Information Advantage: Customers informed about market prices and Core Labs' operational costs can push for lower service fees.

- Technical Expertise: Oilfield service clients' deep understanding of geological data and testing methods enhances their negotiation leverage.

- Market Intelligence: Knowledge of alternative service providers and their pricing allows customers to demand competitive rates from Core Labs.

- Negotiation Power: Informed and technically adept customers can significantly influence the pricing and terms of service contracts.

Core Laboratories' customers, primarily large oil and gas companies, wield significant bargaining power. This strength stems from their concentrated nature, the potential for in-house development of services, and their access to market information. When these major clients negotiate, they can leverage their substantial purchasing volume and understanding of the market to secure more favorable pricing and contract terms, directly impacting Core Laboratories' profitability.

| Factor | Impact on Core Laboratories | Supporting Data/Context (as of early 2024) |

|---|---|---|

| Customer Concentration | High risk from losing major clients | A few large oil and gas majors account for a substantial portion of Core Labs' revenue. |

| Switching Costs | Varies by service; lower for commoditized offerings | Specialized reservoir studies have high switching costs, while standard testing may have lower barriers. |

| Price Sensitivity | Increased pressure during oil price downturns | In 2023 and early 2024, fluctuating oil prices (e.g., Brent crude) led clients to seek cost reductions. |

| Threat of In-house Development | Reduces reliance on external providers | Major energy firms possess the resources to develop internal reservoir analysis capabilities. |

| Information Asymmetry | Customers with more knowledge negotiate better | Clients with deep technical expertise and market intelligence can secure more advantageous agreements. |

Preview Before You Purchase

Core Laboratories Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for Core Laboratories, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning needs.

Rivalry Among Competitors

The oil and gas services sector, especially in specialized areas like reservoir description and production enhancement, is populated by both massive, diversified companies such as Schlumberger and Halliburton, and a host of smaller, focused firms. This dense competitive landscape, with many capable players, means rivalry is naturally high as everyone fights for their piece of the market.

Core Laboratories itself is a global entity, boasting over 70 offices strategically located in more than 50 countries, underscoring its significant international reach and the broad competitive arena it operates within. The sheer number of these strong competitors intensifies the battle for market share, pushing all involved to innovate and perform.

A slow or stagnant industry growth rate naturally heightens competition. When the overall pie isn't expanding, companies are forced to fight harder for a larger slice of the existing market. This means more aggressive pricing, increased marketing efforts, and a greater focus on differentiating products or services.

Core Laboratories experienced sequential revenue growth in the second quarter of 2025, a positive sign. However, the broader oil and gas services industry, where Core operates, faces headwinds. Volatile commodity prices, particularly for oil and natural gas, and ongoing geopolitical tensions can significantly dampen overall industry expansion. This slower growth environment compels companies like Core Laboratories to intensify their efforts to win contracts and secure market share from rivals.

Core Laboratories distinguishes itself through exclusive, patented technologies like its 3AB™ tracer portfolio and advanced unconventional core analysis facilities. This high degree of product and service differentiation helps mitigate direct price competition, as clients value these unique offerings. For instance, in 2023, the company highlighted its continued investment in R&D to maintain this edge.

Exit Barriers

High exit barriers in the oilfield services sector, like specialized equipment and long-term customer commitments, can trap companies in the market even when unprofitable. This situation often fuels intense price competition and contributes to market overcapacity, as firms struggle to recoup their investments.

The capital-intensive nature of many oilfield operations, requiring substantial upfront investment in technology and infrastructure, acts as a significant deterrent to exiting. For instance, companies heavily invested in seismic data acquisition or advanced drilling technologies face considerable losses if they try to divest these specialized assets quickly. This difficulty in exiting maintains a high level of competitive rivalry.

- Specialized Assets: Core Laboratories, like many in its field, relies on highly specialized equipment for its analytical services, making it difficult to repurpose or sell without significant depreciation.

- Long-Term Contracts: The company often enters into multi-year service agreements, creating obligations that are costly to break prematurely.

- Employee Severance Costs: Significant workforce reductions would incur substantial severance packages, adding to the financial burden of exiting the market.

- Capital Intensity: The oilfield services industry demands continuous investment in research, development, and physical assets, making it challenging to exit without substantial write-offs.

Market Concentration and Balance

The competitive landscape for Core Laboratories is shaped by the balance of power among its rivals. When a few large companies dominate the market, they often engage in intense competition, which can impact pricing and innovation. Core Laboratories' strategic push into international markets, such as the Middle East, highlights the importance of securing strong positions in these dynamic regions.

This global expansion is critical as it allows Core Laboratories to diversify its revenue streams and reduce reliance on any single market. For instance, in 2024, the oil and gas services sector, where Core operates, saw significant investment in emerging markets, presenting both opportunities and heightened competition. Companies are vying for contracts and technological leadership, making strategic partnerships and acquisitions key differentiators.

- Market Concentration: The oilfield services industry, a key sector for Core Laboratories, is moderately concentrated, with a few major players alongside numerous smaller, specialized firms.

- Rivalry Intensity: Intense rivalry exists, particularly for large, integrated projects, leading to price sensitivity and a focus on operational efficiency.

- International Focus: Core Laboratories' expansion into the Middle East, a region with substantial energy reserves, signifies a strategic move to capitalize on growth opportunities and counter competitive pressures in more mature markets.

- 2024 Market Trends: In 2024, the industry observed increased demand for advanced reservoir characterization services, an area where Core Laboratories has historically excelled, suggesting a competitive battle for technological superiority.

The competitive rivalry within the oil and gas services sector, where Core Laboratories operates, is significant due to the presence of both large, diversified players and numerous specialized firms. This dense landscape intensifies the fight for market share, especially in a market with moderate concentration and a focus on operational efficiency. The industry's capital-intensive nature and high exit barriers further contribute to this intense competition, as companies are compelled to remain and fight for existing contracts.

Core Laboratories actively mitigates this rivalry through its exclusive, patented technologies, such as its 3AB™ tracer portfolio, which differentiates its offerings and reduces direct price competition. The company's strategic international expansion, including a strong presence in the Middle East, aims to capitalize on growth opportunities and counter competitive pressures in mature markets. In 2024, the industry saw increased demand for advanced reservoir characterization services, a key area for Core, indicating a competitive drive for technological leadership.

| Competitor Type | Examples | Impact on Rivalry |

|---|---|---|

| Diversified Majors | Schlumberger, Halliburton | Intensify competition for large projects, drive innovation, and influence pricing. |

| Specialized Firms | Numerous smaller, focused companies | Fragment the market, compete on niche services, and can drive down prices in specific segments. |

| Core Laboratories' Strategy | Patented technologies, international expansion | Mitigates direct price competition, secures market share in growth regions, and focuses on technological differentiation. |

SSubstitutes Threaten

New technologies that offer similar reservoir optimization outcomes through different means represent a significant threat. Advanced computational modeling and AI/machine learning applied to seismic data can provide insights that previously required extensive laboratory analysis, potentially reducing demand for Core Laboratories' traditional services.

For instance, the increasing sophistication of real-time downhole measurements allows for more immediate data acquisition and analysis directly at the wellsite, bypassing the need for sample collection and subsequent laboratory testing. This shift towards in-situ analysis could erode Core Lab's market share in specific service areas.

While Core Laboratories is actively integrating AI and machine learning into its proprietary databases to enhance its offerings, the emergence of standalone AI-driven platforms or specialized software solutions that perform similar optimization tasks could still present a competitive challenge. The pace of technological advancement in this sector is rapid, with companies like Schlumberger and Halliburton also investing heavily in digital solutions and AI for reservoir management.

Large integrated oil and gas firms possess the financial muscle and technical expertise to develop their own reservoir characterization and production optimization services. This internal development can significantly reduce their dependence on third-party providers like Core Laboratories.

For instance, in 2024, major oil producers continued to invest heavily in advanced geological modeling and data analytics, aiming to internalize core competencies. This trend poses a threat as it directly captures market share that would otherwise go to specialized service companies.

By bringing these functions in-house, companies can achieve greater data security and potentially lower costs over the long term, making external service providers less attractive for these specific activities.

The global energy transition presents a significant, albeit indirect, threat to Core Laboratories. A sustained move away from fossil fuels towards renewable sources like solar and wind could diminish the long-term demand for the oil and gas reservoir services the company provides. This macro-level shift impacts the entire industry Core Labs operates within.

While the broader energy transition poses a long-term challenge, Core Laboratories is also exploring opportunities within this evolving landscape. The company recognizes innovations in geothermal technologies as a potential area for growth, suggesting a strategic pivot to leverage emerging energy sectors rather than solely relying on traditional oil and gas.

Cost-Effectiveness of Substitutes

The cost-effectiveness of substitute solutions poses a significant threat to Core Laboratories. If alternative methods can deliver comparable accuracy and value at a reduced price point, clients might shift their business, even if these substitutes aren't direct replacements for Core's highly specialized services. For instance, advancements in in-house laboratory capabilities or the rise of more affordable, albeit less comprehensive, third-party analysis providers could erode Core's market share.

Consider the trend in oil and gas exploration; while Core offers advanced reservoir characterization, simpler geological surveys or data interpretation software can serve as substitutes for less complex projects. The perceived value proposition of these alternatives, especially when cost savings are substantial, can be compelling. In 2024, many smaller exploration firms are prioritizing capital efficiency, making cost-conscious decisions about their analytical service providers.

- Cost-Benefit Analysis: Customers will weigh the total cost of Core's services against the benefits derived, comparing it to the cost and benefits of potential substitutes.

- Technological Advancements: Innovations in analytical technology could lower the cost of achieving similar results, making substitutes more attractive.

- Market Price Sensitivity: In a fluctuating commodity market, clients may become more sensitive to pricing, increasing the appeal of lower-cost alternatives.

- Scalability of Substitutes: The ability of substitute providers to scale their operations to meet demand can also influence customer choice, especially for larger projects.

Regulatory and Environmental Shifts

Changes in environmental regulations, such as stricter emissions standards or carbon pricing mechanisms, can directly impact the oil and gas industry. For instance, if governments implement policies that significantly increase the cost of hydrocarbon extraction, it could lead to reduced drilling activity. This, in turn, would decrease the demand for Core Laboratories' specialized services like reservoir characterization and production optimization.

The increasing global push towards cleaner energy sources, driven by climate change concerns, also presents a significant threat. As renewable energy technologies, such as solar and wind power, become more cost-competitive and widely adopted, they offer viable alternatives to fossil fuels. This shift can diminish the overall market size for oil and gas, indirectly affecting the demand for services supporting hydrocarbon exploration and production.

Consider the International Energy Agency's (IEA) projections. Their 2024 scenarios often highlight a plateauing or even declining demand for oil in certain sectors by the late 2020s and early 2030s, particularly in transportation. This trend, if it materializes as anticipated, would naturally reduce the need for the core services Core Laboratories provides.

- Regulatory Pressure: Policies like carbon taxes or cap-and-trade systems can increase operational costs for oil and gas companies, potentially reducing investment in new exploration.

- Energy Transition: The growth of renewable energy sources, projected to capture a larger share of global energy investment, directly competes with fossil fuels. In 2023, renewable energy capacity additions accounted for over 80% of new power capacity globally, according to the IEA.

- Demand Reduction: A decrease in hydrocarbon demand, driven by both regulation and substitution, directly translates to lower service requirements for companies like Core Laboratories.

New technologies and internal capabilities within large oil and gas firms represent significant substitutes for Core Laboratories' services. Advanced computational modeling, AI-driven analytics, and real-time downhole measurements offer alternative ways to achieve reservoir optimization, potentially bypassing traditional lab analysis. Furthermore, major energy companies increasingly develop these capabilities in-house, reducing their reliance on external providers.

The cost-effectiveness of these substitutes is a key driver. Clients, especially smaller exploration firms prioritizing capital efficiency in 2024, are likely to opt for lower-cost alternatives if they offer comparable value. This price sensitivity, coupled with the scalability of substitute providers, can shift market share away from specialized service companies.

The broader energy transition also acts as an indirect substitute threat. As the world moves towards renewable energy sources, the long-term demand for oil and gas exploration services diminishes. Projections, such as those from the IEA in 2024, suggest a plateauing or declining oil demand in certain sectors, directly impacting the market for Core Laboratories' core offerings.

Entrants Threaten

Entering the specialized oil and gas services market, particularly for reservoir description and production enhancement, demands significant upfront capital. This includes investments in state-of-the-art laboratories, sophisticated testing equipment, and ongoing research and development to stay competitive.

The high capital intensity inherently acts as a formidable barrier for potential new entrants. For instance, Core Laboratories anticipates capital expenditures between $14 million and $16 million for the entirety of 2025, illustrating the substantial financial commitment required in this sector.

Core Laboratories' significant investment in proprietary technology and patents presents a formidable barrier to new entrants. Their patented reservoir description and production enhancement services require substantial research and development, making it difficult for newcomers to replicate their effectiveness or create comparable innovations. For instance, in 2024, the company continued to emphasize its R&D spending, a key driver for maintaining its technological edge.

Core Laboratories' established relationships with major global oil and gas companies present a significant barrier to new entrants. Building the trust and credibility required to secure long-term contracts with these large clients, who often prioritize reliability, is a formidable challenge for newcomers. In 2023, Core Laboratories reported that over 80% of its revenue came from repeat customers, underscoring the strength of these existing client bonds.

Regulatory Hurdles and Compliance

The oil and gas sector faces significant regulatory burdens. Navigating stringent environmental protection laws, rigorous safety standards, and complex operational compliance across various jurisdictions presents a substantial challenge for any new player. For instance, in 2024, the International Energy Agency highlighted that meeting evolving emissions targets alone requires substantial upfront investment and ongoing monitoring, deterring many potential entrants.

These regulatory hurdles translate into considerable costs and extended timelines for new companies. Establishing the necessary infrastructure and processes to meet these requirements, such as obtaining permits and adhering to reporting mandates, can be prohibitively expensive. This complexity effectively acts as a significant barrier to entry, protecting established firms like Core Laboratories.

- High Compliance Costs: New entrants must invest heavily in meeting environmental, health, and safety (EHS) regulations, which are often country-specific.

- Extended Permitting Processes: Obtaining the necessary operating permits can take years, delaying market entry and increasing initial capital expenditure.

- Evolving Regulatory Landscape: Constant updates to regulations, particularly concerning climate change and emissions, necessitate continuous adaptation and investment.

- International Complexity: Operating in multiple countries means complying with a patchwork of different, often conflicting, regulatory frameworks.

Economies of Scale and Experience Curve

Existing players in the oilfield services sector, such as Core Laboratories, leverage significant economies of scale. This allows them to spread substantial fixed costs across a larger volume of operations, leading to lower per-unit costs in areas like technology development, manufacturing, and global logistics. For instance, in 2023, Core Laboratories reported revenues of $558.3 million, indicative of its established operational footprint.

New entrants face a considerable hurdle due to the experience curve. As companies gain more experience, they become more efficient in their processes, leading to reduced costs over time. A new competitor would need to invest heavily to reach a comparable level of efficiency and cost-effectiveness, making it challenging to compete with established firms that have decades of accumulated knowledge and optimized workflows.

- Economies of Scale: Core Laboratories benefits from cost advantages in R&D, manufacturing, and its extensive service network.

- Experience Curve: Established players have optimized processes and reduced costs through years of operational experience.

- Barriers to Entry: New entrants would require substantial capital investment to overcome initial cost disadvantages and achieve competitive efficiency.

The threat of new entrants in the specialized oil and gas services market, where Core Laboratories operates, is considerably low. This is primarily due to the substantial capital requirements for establishing state-of-the-art facilities and advanced technology, alongside the significant time and investment needed to build trust and secure contracts with major oil and gas clients.

Regulatory complexities and the need to achieve economies of scale further deter new players. Core Laboratories' established market position, built on proprietary technology and strong client relationships, creates a high barrier for any potential competitor seeking to enter this niche sector.

| Barrier Type | Description | Impact on New Entrants |

| Capital Intensity | High investment in labs, equipment, and R&D. | Significant financial hurdle. Core Labs' 2025 capex forecast is $14-16 million. |

| Proprietary Technology | Patented services requiring extensive R&D. | Difficult to replicate; requires substantial innovation investment. Core Labs emphasized R&D in 2024. |

| Customer Loyalty | Established relationships with major oil and gas firms. | New entrants struggle to gain trust and secure long-term contracts. Over 80% of Core Labs' 2023 revenue was from repeat customers. |

| Regulatory Environment | Stringent environmental, safety, and operational compliance. | Adds costs and time delays; complex international regulations. IEA noted 2024 emissions targets require significant investment. |

| Economies of Scale & Experience | Lower per-unit costs due to high volume and optimized processes. | New entrants face initial cost disadvantages. Core Labs' 2023 revenue was $558.3 million. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from company filings, industry association reports, and market research databases to provide a comprehensive view of competitive pressures.