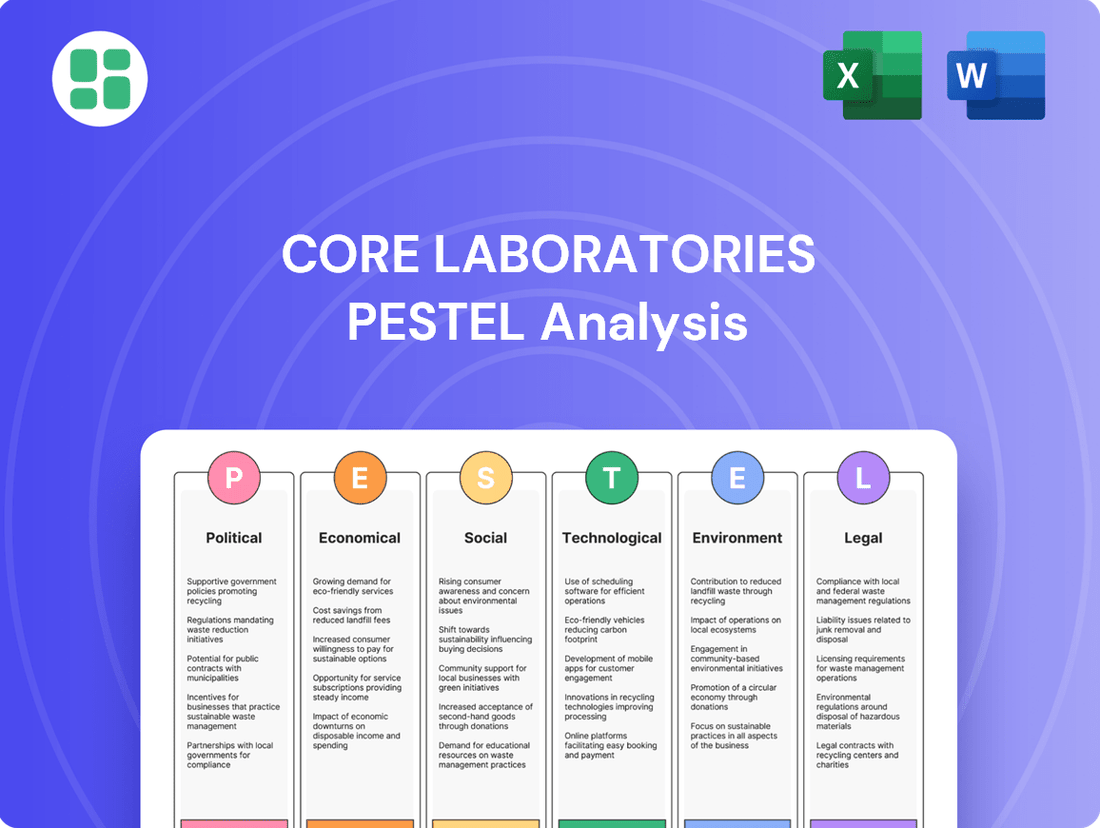

Core Laboratories PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Laboratories Bundle

Uncover the intricate web of external forces shaping Core Laboratories's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Gain a strategic advantage by understanding these critical dynamics. Download the full report now for actionable intelligence.

Political factors

Government policies, particularly those concerning energy security, resource extraction, and climate change, directly shape Core Laboratories' operational landscape. For instance, shifts in drilling permit approvals and exploration license renewals in major oil and gas hubs like the Permian Basin or the North Sea can significantly alter the demand for Core Lab's reservoir characterization and production optimization services.

The global energy transition presents a dual impact; supportive policies for fossil fuel development in certain nations, such as continued investment in offshore exploration, can boost demand for Core Lab's expertise. Conversely, aggressive climate change mitigation policies and mandates for renewable energy adoption in regions like the European Union might present challenges by potentially reducing upstream oil and gas activity, a core market for Core Laboratories.

Geopolitical instability in key oil-producing regions directly impacts crude oil prices and supply, which in turn influences the capital expenditure decisions of exploration and production (E&P) companies. This volatility creates uncertainty, affecting the demand for Core Laboratories' reservoir description and production optimization services. For instance, ongoing tensions in the Middle East in 2025 continue to be a significant factor, with the potential for disruptions to critical supply routes that could further exacerbate price swings in the global energy market.

International trade policies, including tariffs and sanctions, significantly influence the operational landscape for Core Laboratories by altering global energy trade flows. For instance, ongoing sanctions against Russian oil exports, which saw production levels impacted in 2023, are actively reshaping energy market dynamics, creating logistical hurdles and affecting price benchmarks.

These geopolitical measures can directly limit Core Laboratories' market access in certain regions or fundamentally shift the competitive environment for oilfield service providers. Such policy shifts necessitate adaptability in supply chain management and client engagement strategies to navigate the evolving global energy trade.

Government Incentives and Subsidies

Government support, including subsidies and tax incentives for oil and gas exploration and production, directly influences the demand for Core Laboratories' services. For instance, the U.S. government's Inflation Reduction Act of 2022 offers significant tax credits for carbon capture, utilization, and storage (CCUS) projects, which can boost the need for Core Lab's reservoir characterization and monitoring expertise. This creates opportunities for Core Labs to provide specialized services for these incentivized ventures.

These incentives can spur investment in advanced technologies and projects that align with Core Laboratories' core competencies. As of early 2024, many nations are exploring or expanding subsidies for energy transition technologies, including CCS and enhanced oil recovery (EOR). This policy direction is favorable for companies like Core Labs that offer critical data and analytical services for such complex operations.

Specifically, government initiatives aimed at decarbonization and energy security are likely to increase demand for services related to:

- Reservoir assessment for carbon sequestration projects.

- Advanced reservoir characterization for maximizing recovery from existing fields.

- Development and deployment of new energy technologies requiring specialized geological and engineering analysis.

Energy Transition Policies

Governments worldwide are increasingly implementing policies to drive the energy transition, focusing on decarbonization and the expansion of renewable energy sources. This global movement, while a long-term trend, directly impacts investment decisions within the traditional oil and gas sector, where Core Laboratories operates. For instance, the International Energy Agency (IEA) projected in its 2024 scenarios that while oil demand might plateau in the late 2020s, continued investment in existing infrastructure remains critical for meeting near-term energy needs.

Core Laboratories' business is sensitive to government commitments to net-zero emissions targets. Policies promoting clean energy technologies, such as tax credits for solar and wind power or mandates for electric vehicle adoption, can shape the long-term demand for services related to hydrocarbon exploration and production. The US Inflation Reduction Act of 2022, for example, allocates significant funding towards clean energy, signaling a sustained shift in capital allocation away from fossil fuels.

Despite the challenges posed by the energy transition, it also unlocks new avenues for Core Laboratories. The growing emphasis on carbon capture, utilization, and storage (CCUS) presents a significant opportunity. Furthermore, the development of geothermal energy projects, which require specialized subsurface analysis and reservoir management services similar to those provided for oil and gas, offers a diversification path. The global CCUS market is projected to grow substantially, with some estimates suggesting it could reach hundreds of billions of dollars by 2030, creating a new revenue stream for companies with relevant expertise.

- Global Shift: Increasing government mandates for renewable energy integration and emissions reduction are reshaping energy market dynamics.

- Investment Appetite: Policies favoring clean energy can temper long-term investment in traditional oil and gas extraction services.

- Net-Zero Commitments: National and international net-zero targets directly influence the future demand for hydrocarbon-related services.

- Emerging Opportunities: Core Laboratories can leverage its expertise in areas like carbon storage and geothermal energy development.

Government policies are a critical determinant for Core Laboratories, directly influencing the energy sector's investment climate. For example, the U.S. Inflation Reduction Act of 2022, with its substantial clean energy tax credits, signals a policy-driven shift that could impact demand for traditional oil and gas services while boosting opportunities in areas like carbon capture.

The global push towards net-zero emissions targets, as seen in numerous national climate strategies by 2024, necessitates a strategic adaptation for Core Laboratories. While this trend may reduce long-term investment in hydrocarbon exploration, it simultaneously creates new markets for services supporting carbon sequestration and geothermal energy development, areas where Core Labs' subsurface expertise is transferable.

Geopolitical factors, such as sanctions on energy-producing nations and regional instability, continue to create volatility in oil prices and supply chains as of early 2025. These dynamics directly affect the capital expenditure decisions of exploration and production companies, thereby influencing the demand for Core Laboratories' specialized reservoir characterization and production optimization services.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Core Laboratories, detailing their impact across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities derived from current market and regulatory dynamics.

Offers a clear, actionable summary of external factors impacting Core Laboratories, transforming complex data into easily digestible insights for strategic decision-making.

Economic factors

Global oil and gas prices are a huge factor for companies like Core Laboratories. When crude oil prices are low, exploration and production (E&P) companies often cut back on spending. This directly affects Core Laboratories, as it means less demand for their services that help describe reservoirs and boost production. For instance, during periods of price volatility in 2023 and early 2024, many E&P firms reassessed their capital budgets, which can lead to a slowdown in service requests.

Conversely, when oil and gas prices are stable or on the rise, it usually signals more investment in the sector. Higher prices incentivize E&P companies to drill more wells and optimize existing ones, increasing the need for Core Laboratories' specialized analytical and testing services. Looking ahead to 2024 and 2025, projections from organizations like the International Energy Agency (IEA) suggest that while prices may fluctuate, a general trend of sustained demand for oil and gas will likely support activity levels, benefiting service providers.

The capital expenditure plans of exploration and production (E&P) companies are a critical driver for Core Laboratories. When these companies invest more in exploring for and producing oil and gas, it directly translates to increased demand for the specialized services Core Labs provides.

Looking ahead, upstream capital expenditures are projected to surpass $40 billion in 2025. This figure represents the highest investment level seen in the past decade, signaling a cautiously optimistic sentiment within the E&P sector regarding future investments.

E&P operators are demonstrating a clear focus on projects offering high returns while adhering to strict capital discipline. Key investment areas include deepwater exploration, liquefied natural gas (LNG) projects, and initiatives aimed at decarbonizing existing brownfield operations.

Global economic growth is a primary driver of energy demand, directly impacting the oil and gas industry. As economies expand, so does the need for energy, which in turn fuels the demand for services that optimize petroleum reservoir performance. This correlation is fundamental to Core Laboratories' business model, as robust economic activity necessitates efficient hydrocarbon recovery.

In 2024, projections for global GDP growth, such as the IMF's estimate of 3.2%, suggest a sustained increase in energy consumption. This uptick in economic activity directly translates to higher demand for Core Laboratories' reservoir optimization and hydrocarbon recovery solutions, as oil and gas producers seek to maximize output from existing and new fields to meet this growing energy need.

Interest Rates and Access to Capital

Interest rates and the general availability of capital are critical for companies like Core Laboratories, which serves the energy sector. Fluctuations in borrowing costs directly affect the capacity of exploration and production (E&P) firms to finance new ventures or bolster existing ones. For instance, if interest rates climb, the cost of capital increases, making large-scale projects less attractive.

A tightening credit market, characterized by reduced lending or more stringent requirements, can significantly constrain investment. This directly impacts the demand for Core Laboratories' specialized services, which are often tied to the capital expenditure budgets of E&P companies. For example, the Federal Reserve's monetary policy decisions in 2024, including potential rate adjustments, will be closely watched by the energy sector for their influence on project financing.

The ability of E&P companies to secure financing is paramount. Higher borrowing costs or restricted access to credit can lead to scaled-back operations or project deferrals. This has a ripple effect on service providers. Consider the following:

- Impact on Project Funding: Rising interest rates can increase the hurdle rate for new projects, potentially leading to fewer wells being drilled or less investment in advanced reservoir analysis.

- Credit Market Conditions: A contraction in available credit, as seen during periods of economic uncertainty, can force companies to prioritize debt repayment over new capital expenditures.

- Core Laboratories' Revenue: Reduced E&P investment directly translates to lower demand for Core Laboratories' data acquisition, reservoir description, and production enhancement services.

- 2024/2025 Outlook: Analysts in late 2024 and early 2025 are observing how global economic conditions and central bank policies will shape interest rate environments, directly influencing E&P capital spending.

Currency Fluctuations

Currency fluctuations present a significant consideration for Core Laboratories, given its extensive global footprint spanning over 70 offices in more than 50 countries. As a company that conducts business internationally, shifts in exchange rates can directly affect the profitability of its contracts. For instance, if a contract is denominated in a currency that weakens against the US dollar, Core Laboratories would receive less in dollar terms upon settlement, impacting its reported earnings.

The cost of operations in various regions is also susceptible to currency volatility. When Core Laboratories incurs expenses in local currencies, a strengthening of those currencies relative to the US dollar would translate into higher operational costs when converted back for reporting purposes. This can erode profit margins, especially if pricing power in those markets cannot offset the increased expenses.

Furthermore, the translation of foreign earnings into the company's reporting currency, the US dollar, is directly influenced by exchange rate movements. A weaker foreign currency means that profits earned abroad will be worth less when converted to dollars, potentially dampening the overall financial performance reported by Core Laboratories. For example, in 2023, while specific figures for Core Laboratories' currency impact aren't publicly detailed in isolation, broader trends show the US dollar experiencing periods of strength against major currencies, which would generally put pressure on companies with substantial overseas earnings.

- Global Operations Exposure: Core Laboratories operates in over 50 countries, exposing it to a wide range of currency exchange rate risks.

- Contract Profitability Impact: Fluctuations can reduce the dollar value of international contract revenues if foreign currencies weaken.

- Operational Cost Volatility: Expenses incurred in foreign currencies become more expensive in dollar terms when those currencies appreciate.

- Earnings Translation Effects: Profits earned in foreign markets translate to lower dollar amounts when foreign currencies depreciate.

Global economic growth directly fuels energy demand, which is the bedrock for Core Laboratories' services. As economies expand, the need for efficient oil and gas extraction and production increases, directly benefiting companies like Core Labs that provide reservoir description and production enhancement solutions. Projections for 2024 and 2025 indicate continued global GDP growth, with the IMF forecasting 3.2% for 2024, suggesting a sustained demand for energy and, consequently, Core Laboratories' specialized offerings.

Interest rate policies significantly influence the capital expenditure budgets of exploration and production (E&P) companies, Core Laboratories' primary clientele. Higher interest rates increase the cost of capital, potentially leading E&P firms to scale back investments in new projects or advanced technologies. For example, central bank decisions in 2024 regarding monetary policy and potential rate adjustments are closely monitored by the energy sector for their impact on project financing and overall investment activity.

Currency fluctuations pose a risk for Core Laboratories due to its extensive international operations across over 50 countries. Changes in exchange rates can impact the profitability of contracts denominated in foreign currencies and affect the cost of operations abroad. In 2023, periods of US dollar strength generally put pressure on companies with substantial overseas earnings, a factor that continues to be relevant for Core Laboratories' financial reporting in 2024 and beyond.

| Economic Factor | Impact on Core Laboratories | 2024/2025 Relevance |

|---|---|---|

| Global GDP Growth | Drives energy demand, increasing need for reservoir optimization services. | IMF projects 3.2% global GDP growth in 2024, supporting sustained energy demand. |

| Interest Rates | Affects E&P capital expenditure by influencing the cost of borrowing. | Central bank policies in 2024/2025 will shape borrowing costs and investment decisions in the E&P sector. |

| Currency Exchange Rates | Impacts profitability of international contracts and operational costs. | Ongoing USD strength in 2023/2024 affects translation of foreign earnings and international expenses. |

Preview Before You Purchase

Core Laboratories PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Core Laboratories delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Public perception of the oil and gas sector is undergoing a significant shift, heavily influenced by growing environmental awareness and concerns about climate change. This evolving sentiment directly impacts the industry's social license to operate, a crucial element for business continuity.

Core Laboratories, as a key service provider, faces pressure to showcase robust corporate social responsibility and adopt sustainable practices. This commitment is vital for securing and maintaining acceptance from communities and stakeholders, especially as global ESG (Environmental, Social, and Governance) investment considerations gain traction, with ESG funds reaching an estimated $3.9 trillion globally by the end of 2024, according to Bloomberg Intelligence.

The availability of a skilled workforce, especially for specialized roles in reservoir engineering and production enhancement within the oil and gas sector, is a significant sociological consideration for Core Laboratories. A shortage of experienced professionals can directly hinder a company's ability to innovate and execute complex projects.

The oil and gas industry, including companies like Core Laboratories, is grappling with challenges in attracting and retaining new talent. For instance, a 2023 report indicated a projected deficit of over 400,000 skilled workers in the energy sector globally by 2025, which could impact operational capacity and future growth.

Societal expectations for robust Health, Safety, and Environmental (HSE) performance are increasingly shaping the oil and gas sector. This translates into significant regulatory pressures, compelling companies like Core Laboratories to operate under stringent standards to mitigate risks of reputational damage and operational shutdowns. For instance, in 2024, the International Energy Agency reported a continued focus on reducing methane emissions across the industry, a key environmental concern.

Core Laboratories' specialized services play a crucial role in enabling clients to meet these evolving HSE demands. By providing advanced reservoir characterization and production optimization solutions, the company helps its partners achieve safer operations and minimize their environmental footprint. This aligns with a global trend; by the end of 2025, it's projected that investments in green technologies within the energy sector will exceed $1 trillion annually, underscoring the market's shift towards sustainability.

Community Engagement and Local Impact

Core Laboratories' operations, particularly in the oil and gas sector, directly influence local communities. This includes land use for exploration and infrastructure development, as well as the potential for environmental impacts. Proactive engagement is essential to mitigate negative effects and ensure smooth project execution, influencing the company's ability to operate in various regions.

Maintaining strong community relationships is vital for securing project approvals and fostering ongoing operational stability. For instance, in 2024, several energy projects faced delays or increased scrutiny due to unresolved local concerns regarding water usage and land reclamation. Core Laboratories' success is therefore tied to its ability to address these sociopolitical factors effectively.

- Community Relations: Building trust and transparency with local stakeholders is paramount for project acceptance.

- Environmental Stewardship: Addressing concerns about land use and potential environmental impacts is critical for operational continuity.

- Infrastructure Impact: The development of infrastructure for oil and gas activities can strain local resources, requiring careful planning and community consultation.

- Social License to Operate: Demonstrating a commitment to local well-being is increasingly a prerequisite for long-term business success in the energy sector.

Demographic Shifts and Energy Consumption Patterns

Long-term demographic trends, including sustained population growth and increasing urbanization, are fundamentally reshaping global energy demand. By 2050, the United Nations projects the world population to reach nearly 10 billion people, with a significant portion of this growth concentrated in urban areas of developing nations. This demographic expansion directly correlates with higher energy consumption needs.

While the global imperative for cleaner energy sources continues to gain momentum, the reality in many developing economies is a concurrent rise in hydrocarbon demand to fuel industrialization and meet basic energy needs. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that while renewable energy is growing rapidly, fossil fuels still accounted for over half of global primary energy consumption in 2023, a figure expected to remain substantial in the medium term, particularly in emerging markets.

- Population Growth: World population projected to exceed 9.7 billion by 2050, increasing overall energy requirements.

- Urbanization: Over 65% of the world's population is expected to live in urban areas by 2050, concentrating energy demand.

- Developing Economies: Continued reliance on fossil fuels for economic development in these regions may sustain demand for oil and gas services.

- Energy Mix Transition: The pace of the shift to renewables versus the persistent demand for hydrocarbons will dictate the long-term market for Core Laboratories' services.

Societal expectations regarding corporate responsibility and ethical conduct significantly influence Core Laboratories' operational landscape. Public scrutiny of the oil and gas industry, particularly concerning environmental impact and labor practices, necessitates a strong commitment to transparency and sustainability. Failure to meet these evolving social standards can lead to reputational damage and affect investor confidence, a critical factor given that ESG-focused investments are projected to reach $50 trillion globally by 2025.

The availability of a skilled workforce is a critical sociological factor for Core Laboratories. The energy sector faces a growing talent gap, with projections indicating a shortfall of over 400,000 skilled workers globally by 2025. This shortage can impede innovation and operational efficiency, making talent acquisition and retention a key strategic imperative.

Core Laboratories must navigate the complex relationship between its operations and local communities. Effective community engagement, addressing concerns about land use, environmental stewardship, and infrastructure impact, is essential for maintaining a social license to operate. For instance, in 2024, several energy projects faced significant delays due to unresolved local opposition, highlighting the importance of proactive stakeholder management.

Demographic shifts, including population growth and urbanization, are driving long-term energy demand. As the global population approaches 10 billion by 2050, and urbanization accelerates, the need for energy services, including those provided by Core Laboratories, is likely to persist, even amidst the energy transition.

| Sociological Factor | Impact on Core Laboratories | Relevant Data/Trend |

|---|---|---|

| Public Perception & ESG | Influences social license to operate and investor attractiveness. | ESG investments projected to reach $50 trillion by 2025. |

| Skilled Workforce Availability | Affects operational capacity and innovation. | Projected global energy sector talent deficit of over 400,000 by 2025. |

| Community Relations | Crucial for project acceptance and operational continuity. | Energy project delays in 2024 due to local opposition. |

| Demographic Trends | Shapes long-term energy demand. | World population projected to exceed 9.7 billion by 2050. |

Technological factors

Continuous innovation in seismic imaging, core, and fluid analysis, coupled with the increasing application of AI and big data analytics, is fundamentally reshaping reservoir characterization. These advancements enable a more precise understanding of subsurface structures, directly impacting how oil and gas resources are identified and extracted.

For Core Laboratories, this translates into enhanced capabilities for optimizing resource allocation and boosting exploration success rates. For instance, advanced analytics can improve the accuracy of reserve estimations, a critical factor for companies relying on Core's services. The global market for AI in oil and gas is projected to reach over $5 billion by 2025, highlighting the significant financial implications of these technological shifts.

Technological advancements in Enhanced Oil Recovery (EOR) are pivotal for Core Laboratories. Techniques like polymer flooding and steam injection are increasingly vital for extracting more oil from older fields. For instance, the global EOR market was valued at approximately $25 billion in 2023 and is projected to grow, underscoring the demand for Core Laboratories' fluid analysis and production enhancement services.

The industry's embrace of digital oilfield technologies, incorporating sensors, IoT, and automation, is revolutionizing production through real-time monitoring and optimization. This digital transformation directly fuels demand for Core Laboratories' expertise in leveraging data analytics for enhanced well performance and operational efficiency, as seen in the increasing adoption of AI-driven reservoir management tools.

Carbon Capture, Utilization, and Storage (CCUS) Technologies

The global push for decarbonization is a significant technological driver, accelerating the development and adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies. This trend directly impacts Core Laboratories, as their core competencies in geological storage and reservoir analysis are crucial for the successful assessment and ongoing management of CO2 sequestration sites. This presents a substantial opportunity for service expansion and revenue growth within the energy transition landscape.

Core Laboratories' established proficiency in subsurface characterization and reservoir simulation is directly applicable to CCUS projects. For instance, their ability to analyze geological formations for CO2 containment and predict long-term storage integrity is paramount. The International Energy Agency (IEA) reported in its 2024 update that CCUS deployment is expected to grow significantly, with over 30 large-scale projects operational globally by early 2024, underscoring the increasing demand for specialized geological expertise.

- Geological Storage Assessment: Core Laboratories' expertise is vital for identifying and validating suitable geological formations for safe and permanent CO2 storage.

- Reservoir Management: Their skills in reservoir monitoring and performance prediction are essential for ensuring the long-term effectiveness and safety of CO2 injection operations.

- Growth Opportunity: The expanding CCUS market, driven by climate policy and corporate sustainability goals, represents a significant new revenue stream for the company.

- Technological Synergy: Core Laboratories' existing technological capabilities align well with the emerging needs of the CCUS sector, requiring minimal adaptation.

Drilling and Well Completion Innovations

Technological advancements in drilling and well completion are significantly reshaping hydrocarbon recovery. Innovations like autonomous drilling systems and sophisticated completion techniques are boosting operational efficiency and maximizing the amount of oil and gas extracted from reservoirs. For instance, the adoption of automated drilling technologies saw a notable increase in efficiency, with some projects reporting up to a 15% reduction in drilling time by late 2024.

Core Laboratories’ production enhancement segment is directly leveraging these technological shifts. The company offers services that enable clients to optimize their well completions and improve production volumes by integrating these cutting-edge innovations. This strategic alignment positions Core Laboratories to capitalize on the industry's drive for more efficient and cost-effective extraction methods.

Key innovations impacting the sector include:

- Advanced Hydraulic Fracturing Techniques: These methods are designed to improve reservoir connectivity and increase production rates.

- Smart Completions: Technologies that allow for real-time monitoring and control of individual reservoir zones, enhancing production management.

- Automated Drilling Systems: These systems reduce human intervention, leading to faster drilling times and improved safety.

- Managed Pressure Drilling (MPD): A technique that allows for drilling in challenging environments, expanding access to previously uneconomical reserves.

The increasing integration of Artificial Intelligence (AI) and advanced data analytics is revolutionizing reservoir characterization, enabling more precise subsurface understanding and impacting resource identification and extraction. The global market for AI in oil and gas was projected to exceed $5 billion by 2025, illustrating the significant financial implications of these technological advancements.

Technological progress in Enhanced Oil Recovery (EOR) techniques, such as polymer flooding and steam injection, is crucial for maximizing output from mature fields. The global EOR market was valued at approximately $25 billion in 2023, indicating sustained demand for Core Laboratories' specialized fluid analysis and production enhancement services.

Digital oilfield technologies, including sensors, IoT, and automation, are transforming production through real-time monitoring and optimization, directly boosting the need for Core Laboratories' data analytics expertise in improving well performance and operational efficiency.

The accelerating development of Carbon Capture, Utilization, and Storage (CCUS) technologies, driven by decarbonization efforts, presents a significant opportunity for Core Laboratories. Their core competencies in geological storage assessment and reservoir analysis are vital for evaluating and managing CO2 sequestration sites, with over 30 large-scale CCUS projects operational globally by early 2024.

Legal factors

Stringent environmental regulations, especially those focusing on methane and volatile organic compound (VOC) emissions from oil and gas activities, directly affect Core Laboratories' clientele. For instance, new Environmental Protection Agency (EPA) rules implemented in 2024 require advanced leak detection and repair technologies.

These evolving standards elevate compliance expenditures for energy companies, thereby fostering a demand for services that facilitate adherence to these stricter environmental mandates. Core Laboratories is positioned to offer solutions that help clients navigate these complex regulatory landscapes and meet emissions reduction targets.

Core Laboratories operates within a sector heavily influenced by stringent health and safety regulations. These rules, which differ significantly across various countries and regions, directly impact how the company conducts its operations and the types of equipment it must utilize. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) in the United States continued to enforce strict guidelines for hazardous material handling and workplace safety, with potential fines for non-compliance reaching up to $15,625 per violation.

Adherence to these mandates is not merely a legal obligation but a fundamental requirement for Core Laboratories and its clientele. Ensuring worker well-being and preventing operational accidents are paramount, as failures in these areas can lead to severe financial penalties, reputational damage, and operational disruptions. The company's commitment to safety directly influences its ability to secure and maintain contracts within the oil and gas industry.

Laws governing the permitting and licensing of exploration, drilling, and production activities are fundamental to the oil and gas industry. These regulations, which vary significantly by jurisdiction, dictate the operational scope and environmental compliance standards. For instance, in 2024, the U.S. Bureau of Land Management continued to streamline processes for oil and gas leases on federal lands, aiming to balance energy production with environmental stewardship, which directly influences the pace of new projects and thus the demand for Core Laboratories' analytical services.

International Laws and Treaties

Core Laboratories, as a global entity, must navigate a complex web of international laws and treaties. These legal frameworks significantly impact its operations, particularly in areas like offshore resource exploration and extraction. For instance, adherence to the United Nations Convention on the Law of the Sea (UNCLOS) is paramount for companies involved in maritime activities, dictating rights and responsibilities in international waters.

Bilateral investment treaties (BITs) also play a critical role, offering protections for foreign investments and outlining dispute resolution mechanisms. These treaties can influence Core Laboratories' decisions regarding capital deployment and operational strategies in various host countries. In 2024, the ongoing evolution of international trade law and environmental regulations continues to shape the landscape for companies operating across multiple jurisdictions, demanding constant vigilance and adaptation.

- UNCLOS Compliance: Essential for Core Laboratories' offshore service operations, defining territorial waters and economic zones.

- Bilateral Investment Treaties (BITs): Provide legal safeguards for Core's foreign direct investments and facilitate cross-border project execution.

- International Trade Regulations: Impact the import/export of specialized equipment and services, requiring careful compliance.

- Global Environmental Accords: Influence operational standards and sustainability practices, particularly in sensitive marine environments.

Intellectual Property Rights and Patent Protection

Core Laboratories' business model is intrinsically linked to its intellectual property, particularly its proprietary and patented services and products. The company's reliance on these assets means that robust legal frameworks protecting patents and trade secrets are crucial for maintaining its competitive edge and safeguarding its technological innovations.

In 2023, Core Laboratories continued to invest in research and development, a key driver for its intellectual property portfolio. While specific R&D spending figures for the full year 2024 and projections for 2025 are not yet fully released, the company's historical commitment suggests ongoing efforts to secure new patents and protect existing ones. For instance, in recent years, the company has actively pursued patent protection for advancements in areas like reservoir characterization and production optimization technologies.

- Patent Portfolio Strength: Core Laboratories holds a significant number of patents globally, covering its core technologies in reservoir description and production enhancement.

- Trade Secret Protection: Beyond patents, the company relies on trade secrets for proprietary methodologies and data analysis techniques, which are equally vital for its market position.

- Legal Enforcement: The ability to legally enforce these rights against infringement is paramount, directly impacting Core Laboratories' revenue streams and market share.

- R&D Investment: Continued investment in research and development is essential to expand and defend its intellectual property assets in the evolving energy sector.

Core Laboratories must navigate evolving environmental regulations, such as the EPA's 2024 rules on methane emissions, which increase compliance costs for its clients and drive demand for its emission-monitoring services.

Health and safety laws, like OSHA's stringent guidelines for hazardous material handling, are critical, with potential fines for violations underscoring the need for robust safety protocols.

Permitting and licensing laws, like the BLM's efforts to streamline oil and gas leases in 2024, directly influence project timelines and the demand for Core's analytical expertise.

The company's intellectual property, including patents and trade secrets, is vital for its competitive edge, necessitating strong legal protection against infringement.

| Legal Factor | Impact on Core Laboratories | 2024/2025 Relevance |

|---|---|---|

| Environmental Regulations | Increased compliance costs for clients, demand for emission solutions | New EPA rules (2024) on methane emissions drive need for advanced monitoring. |

| Health & Safety Laws | Operational standards, risk of penalties | OSHA enforcement (2024) on hazardous materials requires strict adherence. |

| Permitting & Licensing | Influences project pace and service demand | BLM lease streamlining (2024) impacts exploration activity. |

| Intellectual Property Law | Protection of proprietary technologies, competitive advantage | Ongoing R&D investment aims to secure new patents for innovations. |

Environmental factors

Global climate change policies, such as carbon pricing and emission reduction targets, are increasingly pressuring the oil and gas sector to decarbonize. For instance, the European Union's Emissions Trading System (EU ETS) saw carbon prices averaging around €80 per tonne in early 2024, directly impacting operational costs for energy companies.

These regulations, including net-zero commitments by many nations, are driving innovation and creating new market opportunities. Core Laboratories, with its expertise in reservoir optimization and production enhancement, is well-positioned to assist clients in improving efficiency for existing assets and supporting emerging sectors like carbon capture, utilization, and storage (CCUS).

Environmental regulations governing water usage, wastewater disposal, and contamination prevention are becoming more rigorous for oil and gas companies. Core Laboratories' expertise in optimizing drilling fluids and managing reservoir fluids directly aids clients in meeting these evolving compliance standards and minimizing their ecological footprint.

Growing concerns over the oil and gas industry's impact on biodiversity and land ecosystems are driving stricter environmental regulations and increased public scrutiny. For instance, the U.S. Fish and Wildlife Service reported in 2023 that over 1,300 species are currently listed as endangered or threatened, underscoring the sensitivity of ecosystems affected by industrial activities.

Core Laboratories, like its peers, faces pressure to showcase responsible land use and robust environmental protection measures. This directly influences their site selection processes and operational methodologies, particularly in ecologically sensitive regions, potentially increasing project costs and timelines.

Waste Management and Pollution Control

Environmental regulations are tightening globally, placing greater emphasis on waste management and pollution control. This means industries, including the oil and gas sector that Core Laboratories serves, are under increased pressure to minimize spills, control emissions, and properly handle hazardous waste. For instance, stricter methane emission standards, such as those being implemented or considered by the EPA in the US and similar bodies in Europe, directly impact operational practices.

Core Laboratories' expertise in optimizing operational efficiency and reducing environmental impact positions them to assist clients in navigating these challenges. By providing technologies and services that enhance production processes and minimize waste streams, Core Laboratories helps clients achieve compliance with evolving environmental standards. This can include advanced reservoir characterization that leads to more efficient extraction, thereby reducing the overall environmental footprint per barrel produced.

The company's offerings can directly address key environmental concerns:

- Spill Prevention and Response: Services that improve well integrity and provide advanced monitoring can mitigate the risk and impact of accidental releases.

- Emissions Reduction: Technologies that optimize combustion or capture fugitive emissions contribute to cleaner operations.

- Hazardous Waste Minimization: Solutions that enhance recovery rates and reduce the generation of byproducts lessen the burden of waste disposal.

Transition to Renewable Energy and Alternative Fuels

The global shift towards renewable energy and alternative fuels presents a significant long-term challenge to the traditional oil and gas sector. While Core Laboratories' core business is tied to hydrocarbons, its expertise in reservoir characterization and management is transferable. For instance, the company's technologies could be applied to the development of geothermal energy projects, a sector projected for substantial growth. The International Energy Agency (IEA) reported in its 2024 outlook that renewable energy capacity additions are expected to grow by over 50% by 2028 compared to 2023 levels, highlighting the scale of this transition.

This environmental trend necessitates strategic adaptation for companies like Core Laboratories. Opportunities exist in leveraging their existing skillsets for emerging energy solutions. Consider these potential applications:

- Geothermal Energy: Applying reservoir modeling and simulation expertise to identify and optimize geothermal resource extraction.

- Carbon Capture and Storage (CCS): Utilizing geological expertise to assess and manage suitable underground storage sites for captured CO2.

- Hydrogen Storage: Adapting reservoir engineering knowledge for the safe and efficient underground storage of hydrogen.

Increasingly stringent environmental regulations worldwide, particularly concerning emissions and waste management, directly impact the operational costs and strategies of oil and gas companies. For example, the European Union's Emissions Trading System (EU ETS) saw carbon prices averaging around €80 per tonne in early 2024, a significant factor for energy sector expenses. Furthermore, concerns over biodiversity and land use are leading to stricter oversight, influencing project planning and potentially increasing costs, especially in ecologically sensitive areas.

Core Laboratories' expertise in optimizing production processes and minimizing environmental footprints positions it to help clients navigate these complex regulatory landscapes. Their technologies can aid in spill prevention, emissions reduction, and hazardous waste minimization, aligning with evolving compliance standards. The company's ability to enhance operational efficiency also translates to a reduced environmental impact per unit of energy produced.

The global energy transition towards renewables presents both challenges and opportunities. While Core Laboratories' core business is linked to hydrocarbons, its reservoir characterization and management skills are transferable to emerging sectors like geothermal energy and carbon capture, utilization, and storage (CCUS). The International Energy Agency (IEA) projects substantial growth in renewable energy capacity, indicating a strategic imperative for companies like Core Laboratories to adapt and explore new applications for their core competencies.

| Environmental Factor | Impact on Core Laboratories | Example/Data Point (2024/2025) |

|---|---|---|

| Emissions Regulations | Increased operational costs, demand for emission reduction solutions | EU ETS carbon prices averaged ~€80/tonne in early 2024 |

| Waste Management | Need for services reducing hazardous waste and improving disposal | Stricter methane emission standards being implemented globally |

| Biodiversity & Land Use | Influences site selection, operational methods, potential cost increases | Over 1,300 US species listed as endangered/threatened (2023 data) |

| Energy Transition | Shift in client focus, opportunity in geothermal, CCUS, hydrogen storage | IEA projects >50% renewable capacity growth by 2028 vs. 2023 |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using data from reputable sources including government publications, international organizations like the IMF and World Bank, and leading market research firms. This ensures that every factor, from political stability to technological advancements, is grounded in current, verifiable information.