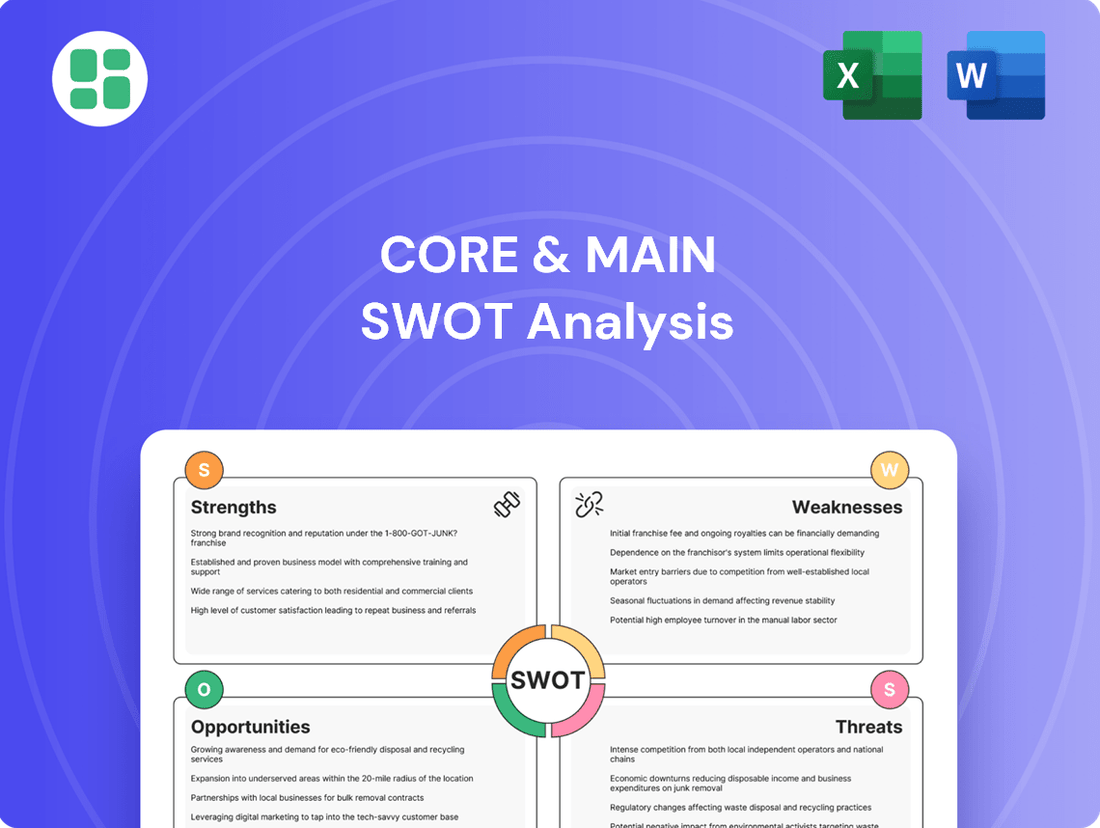

Core & Main SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core & Main Bundle

Core & Main possesses significant strengths in its established brand and loyal customer base, but faces challenges from intense market competition and evolving consumer preferences. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind Core & Main’s competitive edge, potential vulnerabilities, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and strategic initiatives.

Strengths

Core & Main stands as a dominant force in the U.S. waterworks industry, recognized for its extensive distribution of critical infrastructure components. Their comprehensive product line, encompassing pipes, valves, and fire protection systems, addresses the diverse needs of both public and private sector clients.

This market leadership is underpinned by a vast and varied product and service offering, making them a go-to supplier for essential water, wastewater, and storm drainage solutions. This breadth ensures they can cater to a wide array of project requirements, solidifying their competitive edge.

Core & Main's financial performance is remarkably consistent and shows a clear upward trend. For instance, in the first quarter of 2025, net sales jumped 9.8% compared to the previous year, reaching $1.91 billion. This builds on a solid foundation, as fiscal year 2024 marked the company's fifteenth consecutive year of positive sales growth, culminating in $7.4 billion in annual sales.

Core & Main's strategic acquisition approach is a significant strength, actively pursued to bolster its market standing and operational capacity. This disciplined M&A strategy is central to its growth.

The company's commitment to this strategy is evident in its recent performance. In 2024, Core & Main successfully integrated 9 acquisitions. This pace averages nearly 6 acquisitions annually over the past three years, demonstrating consistent execution.

These acquisitions are carefully chosen to expand geographic reach, incorporate valuable talent, and broaden product offerings. This consolidation of fragmented markets is a key driver for sustained, long-term expansion.

Strong Customer Relationships and Local Expertise

Core & Main cultivates robust relationships with a wide array of clients, encompassing municipalities, private water utilities, and specialized contractors. This deep customer engagement is a cornerstone of their success.

Their strategy of offering localized expertise across the nation is vital for navigating the intricacies of infrastructure projects and guaranteeing dependable service. This approach fosters trust and positions them as a go-to partner.

This strong local footprint and consultative sales model are key differentiators, enabling Core & Main to effectively leverage the anticipated growth in municipal infrastructure spending. For instance, in fiscal year 2024, the company reported a 6.6% increase in net sales, partly driven by strong demand from the municipal sector.

- Deep customer ties: Servicing municipalities, private water companies, and contractors.

- Local expertise nationwide: Essential for complex infrastructure projects.

- Trusted supplier status: Bolstered by a consultative sales approach.

- Capitalizing on municipal spending: Benefiting from increased infrastructure investment.

Robust Supply Chain and Operational Efficiency

Core & Main leverages a robust national supply chain, a critical asset supporting its vast network of over 370 U.S. locations and an extensive product catalog exceeding 225,000 items. This extensive reach ensures product availability and timely delivery to a wide customer base.

The company's commitment to operational excellence is evident in its strategic pricing discipline and focused initiatives on private label products and sourcing. These efforts have demonstrably driven sequential gross margin expansion, indicating effective cost management and value creation.

- Extensive Network: Over 370 U.S. locations.

- Product Breadth: Access to more than 225,000 products.

- Margin Improvement: Sequential gross margin expansion driven by operational strategies.

- Strategic Sourcing: Focus on private label and sourcing initiatives enhances profitability.

Core & Main's market dominance is built on a broad product portfolio and a strong, localized presence. Their ability to supply essential waterworks components, from pipes to fire protection systems, makes them indispensable to a wide range of clients.

The company's consistent financial growth, evidenced by a 9.8% rise in net sales to $1.91 billion in Q1 2025 and 15 consecutive years of positive sales growth through fiscal year 2024, highlights their stable performance and market penetration.

Core & Main's strategic acquisition strategy, averaging nearly 6 acquisitions annually over the past three years, effectively consolidates fragmented markets, expands their geographic footprint, and broadens their product and service offerings.

Their deep client relationships with municipalities and contractors, coupled with localized expertise, position them to capitalize on significant municipal infrastructure spending, as seen in their 6.6% net sales increase in FY2024 driven by municipal demand.

| Metric | FY 2024 | Q1 2025 |

|---|---|---|

| Total Net Sales | $7.4 billion | $1.91 billion |

| Net Sales Growth (YoY) | 6.6% | 9.8% |

| Acquisitions Completed | 9 | N/A |

| U.S. Locations | Over 370 | Over 370 |

| Product Catalog Size | Over 225,000 items | Over 225,000 items |

What is included in the product

Analyzes Core & Main’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential roadblocks into opportunities.

Weaknesses

Core & Main's financial performance is significantly tied to the health of the construction industry. For fiscal 2025, the company is projecting flat results in both residential and non-residential construction, indicating a potential headwind for sales growth outside its more stable municipal business.

This dependence exposes Core & Main to the volatility of broader economic conditions. Factors such as economic downturns, increased interest rates, or a slowdown in private sector development projects could directly impact their revenue streams, introducing an element of unpredictability into their financial outlook.

Core & Main faces significant headwinds from material cost volatility, a pervasive issue in the construction sector. For instance, the cost of key inputs like steel and lumber saw substantial increases throughout 2024 and into early 2025, driven by robust global demand and ongoing supply chain disruptions.

This inflationary pressure directly affected Core & Main's profitability. The company reported that its gross profit margin experienced a slight contraction in the first quarter of 2025, a direct consequence of absorbing higher average inventory costs compared to the previous year.

The ongoing unpredictability of these material prices poses a persistent threat, potentially leading to further margin compression and an elevated cost of goods sold for Core & Main.

Core & Main has experienced a notable uptick in its operating expenses, specifically in selling, general, and administrative (SG&A) costs. This trend was observed in both fiscal year 2024 and the first quarter of fiscal year 2025. These rising costs are largely a consequence of strategic acquisitions, investments aimed at fostering growth, and broader inflationary pressures impacting the economy.

The increase in SG&A expenses, while partly fueling expansion, presents a challenge to the company's profitability. For instance, SG&A as a percentage of revenue increased from 19.5% in fiscal 2023 to 20.1% in fiscal 2024. If these costs continue to outpace revenue growth, it could erode operating leverage and negatively impact the bottom line.

Reliance on Government and Municipal Spending Cycles

Core & Main's reliance on government and municipal spending cycles presents a notable weakness. A significant portion of its revenue stems from infrastructure projects, which are inherently tied to public budgets and political priorities. For instance, in fiscal year 2023, infrastructure spending, particularly in water and wastewater, remained a key driver, yet the company faces the risk of slowdowns if government funding priorities shift or budgets are constrained.

This dependency introduces a layer of economic and political uncertainty. While the Infrastructure Investment and Jobs Act (IIJA) has provided a tailwind, future funding levels are subject to legislative action and economic conditions. Any substantial reduction or delay in government outlays for water infrastructure, even with current positive momentum, could directly dampen demand for Core & Main's extensive product offerings.

- Government Funding Dependence: Revenue is significantly linked to public sector infrastructure investments, making it sensitive to budget allocations and political cycles.

- Project Delays Risk: Changes in government spending priorities or budgetary constraints can lead to delays or cancellations of key projects, impacting sales volume.

- Economic Sensitivity: The company's performance can be affected by broader economic downturns that may lead municipalities to cut back on capital expenditures.

Elevated Debt Levels from Acquisitions and Investments

Core & Main's financial position in fiscal 2024 shows elevated debt levels, with net debt reaching $2,275 million. This increase stems from borrowings used to finance organic growth initiatives, strategic acquisitions, and share repurchase programs.

While acquisitions can bolster market position, the heightened debt load directly impacts the company's financial flexibility. Higher interest expenses associated with this debt could potentially reduce profitability and limit the company's capacity for future investments or weathering economic downturns.

Further highlighting this concern, Core & Main's net cash provided by operating activities saw a decrease in fiscal 2024 compared to the prior year. This reduction suggests a greater portion of operating cash flow was allocated to working capital, potentially indicating increased inventory or receivables, which can tie up cash and further strain liquidity.

- Net Debt: $2,275 million in fiscal 2024.

- Drivers of Debt: Organic growth, acquisitions, and share repurchases.

- Impact of Debt: Increased interest expenses and reduced financial flexibility.

- Operating Cash Flow: Decrease in fiscal 2024, indicating higher investment in working capital.

Core & Main's significant reliance on the construction sector, particularly the projected flat growth in residential and non-residential construction for fiscal 2025, presents a notable weakness. This dependence makes the company susceptible to economic downturns and interest rate fluctuations, directly impacting revenue.

Material cost volatility, exemplified by substantial increases in steel and lumber prices throughout 2024 and early 2025, has already compressed gross profit margins. This ongoing unpredictability in input costs poses a persistent threat to profitability.

Rising selling, general, and administrative (SG&A) expenses, which increased to 20.1% of revenue in fiscal 2024 from 19.5% in fiscal 2023, challenge profitability. If these costs continue to outpace revenue, they could erode operating leverage.

The company's substantial net debt of $2,275 million in fiscal 2024, incurred for growth and acquisitions, increases interest expenses and reduces financial flexibility, potentially limiting future investment capacity.

| Weakness Category | Specific Issue | Financial Year/Period | Impact |

|---|---|---|---|

| Industry Dependence | Projected flat growth in residential/non-residential construction | Fiscal 2025 | Headwind for sales growth |

| Cost Pressures | Material cost volatility (steel, lumber) | 2024-Early 2025 | Gross profit margin contraction |

| Operational Costs | Increased SG&A expenses | FY2023-FY2024 | Erosion of operating leverage |

| Financial Structure | Elevated net debt | Fiscal 2024 | Reduced financial flexibility, higher interest expense |

What You See Is What You Get

Core & Main SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the real, structured content that will be yours to use immediately after checkout.

Opportunities

The Infrastructure Investment and Jobs Act (IIJA) is a game-changer, allocating a massive $69 billion specifically for water infrastructure improvements. This presents a golden opportunity for Core & Main, as it directly fuels demand for their core products and services.

This federal spending is expected to accelerate projects focused on critical areas like replacing aging lead service lines and addressing emerging contaminants such as PFAS. These are precisely the types of projects where Core & Main's expertise and product portfolio shine, creating a strong tailwind for growth.

The consistent flow of shovel-ready projects stemming from this substantial federal investment ensures a robust pipeline of new business. This ongoing demand translates into tangible revenue growth and market expansion opportunities for the company throughout 2024 and into 2025.

The United States is grappling with an aging water infrastructure crisis, with estimates suggesting a need for $625 billion in investment over the next two decades to bring systems to a good state of repair. This widespread deterioration, coupled with population increases and a history of underinvestment, translates into a consistent and significant demand for Core & Main's essential products and services.

This critical need for replacement and upgrades presents a durable, long-term revenue opportunity for Core & Main, as municipalities and utilities must continuously address these systemic issues to ensure public health and safety.

The water infrastructure sector is rapidly embracing digital solutions, with IoT sensors and advanced data analytics becoming standard for real-time monitoring and predictive maintenance. This technological wave presents a significant opportunity for Core & Main to broaden its offerings. By integrating smart water technologies and advanced metering infrastructure, the company can provide customers with tools to boost their operational efficiency.

This strategic move into smart water solutions could unlock substantial new revenue streams for Core & Main. For instance, the global smart water market was valued at approximately $12.8 billion in 2023 and is projected to reach $26.7 billion by 2028, growing at a CAGR of 15.7%. By capitalizing on this growth, Core & Main can solidify its market leadership and enhance its competitive edge.

Expansion into Green Infrastructure and Sustainability Solutions

The global market for green infrastructure is experiencing significant growth, driven by increased environmental awareness and regulatory pressures. For Core & Main, this translates into a substantial opportunity to expand its product and service portfolio. By offering solutions focused on sustainability, such as advanced water treatment technologies and stormwater management systems, the company can tap into a burgeoning sector. This strategic move can not only enhance its competitive edge but also attract a wider customer base committed to eco-friendly practices.

The demand for sustainable solutions is projected to continue its upward trajectory. For instance, the global green building market was valued at approximately $1.03 trillion in 2023 and is expected to reach $2.57 trillion by 2030, growing at a CAGR of 13.9% during the forecast period. Core & Main can capitalize on this trend by:

- Expanding its range of products for stormwater management and erosion control.

- Developing partnerships with manufacturers of energy-efficient water treatment equipment.

- Offering consulting services related to sustainable infrastructure development.

- Highlighting the environmental benefits of its existing and new product lines.

Continued Market Consolidation through Strategic Acquisitions

Core & Main's strategy of acquiring smaller, fragmented water infrastructure distributors presents a significant opportunity. The company has a history of successful, disciplined acquisitions, which allows it to expand its footprint and product offerings. For instance, in fiscal year 2024, Core & Main completed 14 acquisitions, adding approximately $700 million in annualized revenue. This inorganic growth is crucial for increasing market share in an industry still characterized by many independent operators.

This continued consolidation allows Core & Main to:

- Expand Geographic Reach: Enter new regional markets or deepen penetration in existing ones.

- Enhance Product Portfolio: Acquire companies with specialized or complementary product lines.

- Achieve Synergies: Realize cost savings and operational efficiencies through integration.

- Strengthen Market Position: Build a more robust competitive moat by increasing scale and influence.

The Infrastructure Investment and Jobs Act (IIJA) provides substantial funding, with $69 billion earmarked for water infrastructure, directly benefiting Core & Main's core business. This federal investment is accelerating projects like lead service line replacement and addressing emerging contaminants, areas where the company excels, ensuring a robust pipeline of business throughout 2024 and 2025.

The widespread need to repair aging U.S. water infrastructure, estimated at $625 billion over two decades, creates a consistent demand for Core & Main's essential products. This critical need for upgrades offers a durable, long-term revenue opportunity as municipalities must continually address these systemic issues for public health.

The increasing adoption of digital solutions in water infrastructure, such as IoT sensors and advanced analytics, presents an opportunity for Core & Main to expand its offerings into smart water technologies. The global smart water market, valued at approximately $12.8 billion in 2023 and projected to reach $26.7 billion by 2028, offers significant new revenue streams.

The growing green infrastructure market, driven by environmental awareness, allows Core & Main to expand its portfolio with sustainable solutions like advanced water treatment and stormwater management systems. The global green building market, valued at $1.03 trillion in 2023 and expected to reach $2.57 trillion by 2030, highlights this trend.

Core & Main's acquisition strategy continues to be a significant growth driver. In fiscal year 2024, the company completed 14 acquisitions, adding approximately $700 million in annualized revenue, thereby increasing market share in a fragmented industry.

| Opportunity Area | Description | Market Data/Impact |

|---|---|---|

| IIJA Funding | Government investment in water infrastructure. | $69 billion allocated; drives demand for products. |

| Aging Infrastructure | Need for widespread replacement and upgrades. | Estimated $625 billion investment needed over 20 years. |

| Smart Water Technology | Integration of digital solutions for water management. | Global market ~$12.8B (2023), projected $26.7B (2028). |

| Green Infrastructure | Demand for sustainable water solutions. | Global green building market ~$1.03T (2023), projected $2.57T (2030). |

| Acquisitions | Strategic purchase of smaller distributors. | 14 acquisitions in FY24 adding ~$700M annual revenue. |

Threats

Core & Main faces ongoing threats from persistent construction inflation, with key materials like steel, copper, and aluminum experiencing volatile price increases. These elevated input costs, exacerbated by global trade conflicts and supply chain disruptions, directly impact the company's cost of goods sold. For instance, the Producer Price Index for construction materials saw a significant jump in late 2023 and early 2024, though some easing has been observed, volatility remains a concern.

This inflationary environment poses a risk to Core & Main's profitability. If the company cannot fully pass these higher costs onto customers through increased selling prices, profit margins could be squeezed. Conversely, price hikes might dampen demand for its products, especially in price-sensitive segments of the construction market, potentially impacting sales volume.

Core & Main faces a challenging market, with formidable competitors like Ferguson Enterprises Inc., Trane Technologies Plc, and Builders Firstsource Inc. actively vying for market share. This intense rivalry often translates into significant pricing pressures, requiring substantial investment in marketing and sales to maintain visibility and customer loyalty.

The threat of new entrants or disruptive technologies looms large, potentially eroding Core & Main's competitive edge if the company fails to prioritize continuous innovation and adaptation. For instance, the building materials sector is seeing increased adoption of digital platforms and supply chain efficiencies, areas where agile new players can quickly gain traction.

Rising interest rates present a significant threat to Core & Main. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023 have made borrowing more expensive. This directly impacts municipal bond issuance, a key funding source for public water infrastructure. Higher borrowing costs can lead municipalities to postpone or scale back projects, directly reducing demand for Core & Main's essential products.

Furthermore, a general economic downturn, often exacerbated by higher interest rates, could stifle overall construction activity. A slowdown in residential and non-residential construction directly translates to lower sales volumes for Core & Main. For example, if housing starts, a key indicator of construction demand, were to decline significantly in 2024 or 2025, it would directly impact the company's top line.

Evolving Regulatory Landscape and Compliance Costs

The evolving regulatory landscape, particularly concerning lead service line replacement and PFAS remediation, presents significant compliance challenges for Core & Main. These new mandates necessitate substantial investment in product certifications and potentially require adjustments to inventory management, directly impacting operational expenses and profitability.

For instance, the Bipartisan Infrastructure Law's allocation of billions towards water infrastructure upgrades, while an opportunity, also means Core & Main must navigate complex compliance requirements for materials used in these projects. Failure to adapt to stricter environmental standards or updated building codes could lead to increased operational costs, affecting the company's bottom line in 2024 and beyond.

- Increased Compliance Burden: New regulations demand adherence to stringent standards for water quality and environmental impact.

- Investment in Certifications: Core & Main may need to invest in new product certifications to meet evolving regulatory requirements.

- Potential for Higher Operational Costs: Adapting inventory and operations to comply with new rules could increase overall expenses.

- Impact on Profitability: Unforeseen compliance costs can directly affect profit margins if not managed effectively.

Labor Shortages in the Construction Industry

The construction sector, a key market for Core & Main, continues to grapple with significant skilled labor shortages. This ongoing issue directly translates to higher labor costs for contractors, potentially impacting project budgets and profitability.

These labor constraints can also cause considerable project delays. For Core & Main, this means that the pace of new infrastructure development and essential maintenance work may slow down, which could indirectly dampen demand for their extensive product offerings.

- Skilled Labor Gap: The U.S. construction industry faced a shortage of approximately 546,000 workers in 2023, according to Associated Builders and Contractors (ABC) projections for 2024.

- Cost Implications: Increased wages to attract and retain workers contribute to higher overall project costs, which can influence purchasing decisions for construction materials.

- Project Timelines: Delays in project completion due to labor availability can lead to extended demand cycles for some products but may also reduce the overall volume of work available in shorter periods.

Persistent construction inflation, particularly for key materials like steel and copper, remains a significant threat, impacting Core & Main's cost of goods sold and potentially squeezing profit margins if these costs cannot be fully passed on. Intense competition from rivals such as Ferguson Enterprises and Trane Technologies necessitates ongoing investment in sales and marketing to maintain market share and customer loyalty.

Rising interest rates, exemplified by the Federal Reserve's actions in 2022-2023, increase municipal borrowing costs, potentially delaying or reducing public infrastructure projects that are crucial for Core & Main's demand. Furthermore, a general economic downturn, often linked to higher rates, could stifle overall construction activity, directly reducing sales volumes.

Evolving regulatory landscapes, including mandates for lead service line replacement and PFAS remediation, pose compliance challenges and necessitate investment in product certifications and inventory adjustments. Skilled labor shortages in the construction sector, projected to affect around 546,000 workers in 2024 according to ABC, can lead to project delays and higher labor costs for contractors, indirectly impacting demand for Core & Main's products.

SWOT Analysis Data Sources

This SWOT analysis is built on a robust foundation of data, including Core & Main's official financial reports, comprehensive market research studies, and insights from industry experts to ensure a thorough and accurate assessment.