Core & Main Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core & Main Bundle

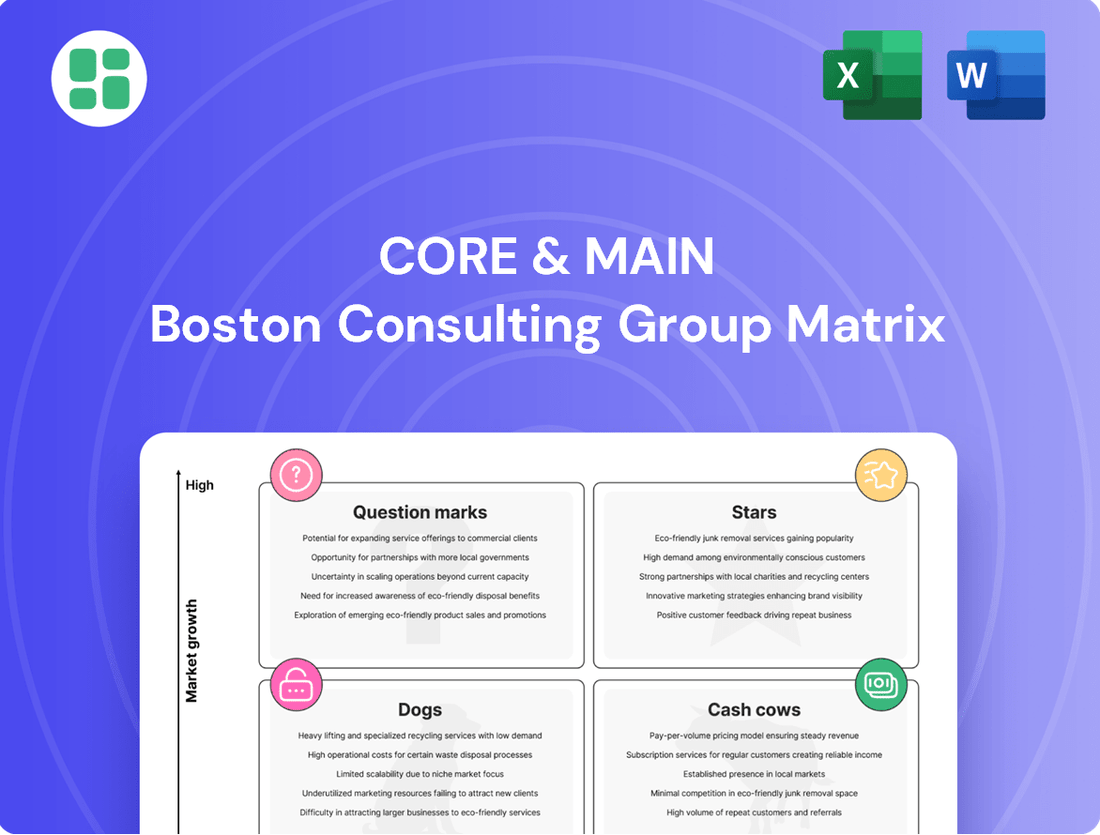

Uncover the strategic positioning of this company's product portfolio with our BCG Matrix analysis. See which products are generating significant cash, which require investment, and which may be underperforming. Ready to transform this insight into actionable strategy?

Purchase the full BCG Matrix for a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with data-driven recommendations to optimize your resource allocation and drive future growth.

Stars

Smart Water Technology Solutions represents a significant growth opportunity for Core & Main, fitting into the Stars quadrant of the BCG Matrix. The company is channeling investments into proprietary tech platforms, such as IoT sensors and advanced data analytics, to boost efficiency and customer satisfaction in water management. This strategic focus is particularly relevant in the water infrastructure sector, which is undergoing a digital transformation.

The market for digital water management solutions is experiencing rapid expansion. Core & Main's commitment to these technologies is enabling them to capture a larger share of this burgeoning market. For instance, the global smart water market was valued at approximately $18.5 billion in 2023 and is projected to reach over $45 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 13.5%.

Core & Main's advanced stormwater management systems are a key driver of growth, contributing to increased net sales in fiscal 2024. This segment is benefiting from a heightened emphasis on climate resilience and flood mitigation efforts across the nation.

The company's significant market penetration in this specialized area suggests a strong competitive advantage within a rapidly expanding sector of the infrastructure market.

Core & Main's strategic acquisitions, including Geothermal Supply Company Inc. in 2024, have significantly bolstered its position as a premier distributor and fabricator of High-Density Polyethylene (HDPE) pipes. This expansion into a high-growth product category underscores their commitment to modern infrastructure solutions.

HDPE pipes are experiencing robust demand due to their superior durability, flexibility, and exceptional resistance to corrosion. These qualities make them the material of choice for contemporary water and sewer systems, driving market growth for distributors like Core & Main.

PFAS Contamination Remediation Products

PFAS contamination remediation products represent a burgeoning market, especially following the finalized national drinking water standards in 2024. This regulatory shift has created a substantial demand for specialized solutions. Core & Main, a major distributor of water treatment products, is strategically positioned to serve this expanding sector.

Their extensive distribution network is a key asset, enabling swift market entry and widespread availability of essential remediation technologies. This allows Core & Main to efficiently supply the critical materials needed to address PFAS contamination across various regions.

- Market Growth: The global PFAS remediation market is projected to reach billions of dollars in the coming years, driven by increasing regulatory scrutiny and public awareness.

- Core & Main's Role: The company's established infrastructure facilitates the distribution of advanced filtration media, activated carbons, and ion exchange resins crucial for PFAS removal.

- Strategic Advantage: By leveraging their existing supply chains, Core & Main can offer timely and cost-effective solutions to municipalities and industrial clients facing PFAS challenges.

Water Reuse and Recycling System Components

The global emphasis on sustainability and the growing concern over water scarcity are fueling the adoption of water reuse and recycling systems. Core & Main's strategic focus on providing components for these advanced systems positions them to capitalize on this expanding market. The company's offerings directly support improved water management, a critical need driven by environmental regulations and resource conservation initiatives.

This sector represents a significant growth opportunity for Core & Main. For instance, the global water and wastewater treatment market was valued at approximately $650 billion in 2023 and is projected to grow substantially in the coming years, with water reuse technologies being a key driver. By supplying essential components for these systems, Core & Main is tapping into a market segment experiencing robust expansion due to increasing environmental mandates.

- Key Components: Advanced filtration membranes, specialized pumps, UV disinfection units, and smart monitoring sensors are crucial for effective water recycling.

- Market Drivers: Stricter environmental regulations, increasing water costs, and a heightened awareness of water resource depletion are propelling market growth.

- Core & Main's Role: Supplying reliable and efficient components that meet the stringent requirements of modern water reuse facilities.

Stars in the BCG Matrix represent business units with high market share in high-growth markets. Core & Main's smart water technology solutions, advanced stormwater management, and HDPE pipe distribution exemplify this category. These segments benefit from significant market expansion driven by digital transformation, climate resilience, and infrastructure upgrades.

The company's strategic investments and acquisitions in these areas, particularly in 2024, position them to capitalize on substantial growth projections. Core & Main's ability to capture a larger share of these burgeoning markets is a testament to their strong competitive positioning.

The demand for advanced water management and infrastructure materials is robust, supported by favorable market trends and regulatory drivers. Core & Main's focus on these high-potential areas solidifies their standing as a star performer within the industry.

| Segment | Market Growth Driver | Core & Main's Position |

|---|---|---|

| Smart Water Technology | Digital transformation in water management, IoT adoption | Investing in proprietary tech platforms, IoT sensors, data analytics |

| Stormwater Management | Climate resilience, flood mitigation efforts | Advanced systems contributing to increased net sales in fiscal 2024 |

| HDPE Pipes | Durability, flexibility, corrosion resistance in water/sewer systems | Bolstered position via strategic acquisitions in 2024 |

What is included in the product

Strategic guidance on investing, holding, or divesting product lines based on market growth and share.

It simplifies complex portfolio analysis, quickly identifying underperforming "Dogs" and resource-draining "Cash Cows" to inform strategic divestment or reallocation.

Cash Cows

Core & Main's traditional municipal pipes, valves, and fittings business is a bedrock of their operations, fitting squarely into the Cash Cows quadrant of the BCG Matrix. This segment benefits from a mature market characterized by steady, predictable demand. The ongoing need to maintain, repair, and replace aging water and wastewater infrastructure across the U.S. provides a consistent revenue stream.

With an established presence and strong ties to municipalities nationwide, Core & Main commands a significant market share in this essential sector. Their extensive product offerings further solidify this position, ensuring a reliable generation of stable cash flow. For instance, in fiscal year 2023, Core & Main reported net sales of $6.5 billion, with their Waterworks segment, which heavily features these products, being a substantial contributor.

Standard fire protection products, like pipes, valves, and hydrants, form a bedrock of Core & Main's business. This segment is a classic cash cow, characterized by steady, reliable demand driven by ongoing construction and maintenance needs.

The market for these essential components is mature but consistently robust. For instance, in 2023, Core & Main reported that its Fire Protection segment generated significant revenue, underscoring the stability of these product lines. This consistent performance, coupled with Core & Main's extensive distribution network, solidifies its dominant position.

Core & Main commands a significant market share in essential storm drainage components like corrugated pipes, culverts, and standard grates. These are the bedrock of urban planning and flood mitigation, experiencing steady, predictable demand. In 2023, the U.S. market for storm drainage systems was valued at approximately $5.5 billion, with basic products forming a substantial portion.

Routine Water Infrastructure Repair and Replacement Materials

Routine Water Infrastructure Repair and Replacement Materials represent a significant cash cow for Core & Main. The vast majority of the US water infrastructure is aging, with many systems exceeding their intended lifespan. This creates a consistent and substantial demand for essential materials used in repairs and replacements. For instance, the American Society of Civil Engineers (ASCE) 2021 Report Card for America's Infrastructure assigned a D grade to the drinking water system, highlighting the urgent need for investment and ongoing maintenance. This translates directly into a stable market for Core & Main's products.

This segment is defined by its predictable demand and the non-discretionary nature of water infrastructure maintenance. Core & Main consistently supplies fundamental materials such as repair clamps, couplings, and service line components. These are not optional purchases; they are necessities for municipalities and water utilities to ensure public health and safety. This reliability makes it a strong and steady revenue generator for the company. In 2023, Core & Main reported net sales of $7.4 billion, with a significant portion attributed to these essential product categories.

- Aging Infrastructure: Over 75% of US water mains are nearing or have exceeded their design life, creating a perpetual need for repairs.

- Essential Products: Core & Main supplies critical components like ductile iron pipe, PVC pipe, and fittings necessary for system upkeep.

- Predictable Demand: Unlike growth-oriented segments, this area benefits from consistent, non-cyclical demand driven by infrastructure necessity.

- Market Leadership: Core & Main's extensive distribution network and established relationships solidify its position as a reliable supplier in this mature market.

Non-Advanced Water Meter Products

Non-advanced water meter products represent a solid Cash Cow for Core & Main. This segment consistently generates reliable revenue, fulfilling the ongoing need for basic water volume measurement in residential and commercial settings.

The market for traditional water meters, while mature, benefits from consistent demand for both new installations and replacements. Core & Main's extensive distribution network ensures they maintain a significant share in this stable, foundational market.

- Steady Revenue: Traditional water meters provide a predictable income stream, acting as a reliable Cash Cow.

- Mature Market: The demand for standard water measurement devices is well-established, offering stability.

- Replacement Cycle: Ongoing need for meter replacements fuels consistent sales.

- Distribution Strength: Core & Main's broad reach solidifies its position in this segment.

Core & Main's established municipal and fire protection pipe and fittings business is a prime example of a Cash Cow. These products serve essential, ongoing needs for infrastructure maintenance and safety, ensuring a predictable revenue stream. The company's significant market share in this mature sector, supported by its vast distribution network, allows for consistent cash generation.

The demand for these foundational products remains robust due to the critical nature of water and fire safety systems. For instance, Core & Main's fiscal year 2023 net sales reached $7.4 billion, with these core segments being substantial contributors. This stability is further reinforced by the continuous requirement for repairs and upgrades to aging infrastructure across the nation.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Municipal Pipes & Fittings | Cash Cow | Mature market, steady demand, essential infrastructure | Significant portion of $7.4B net sales |

| Fire Protection Products | Cash Cow | Consistent demand for safety, established market | Significant portion of $7.4B net sales |

What You’re Viewing Is Included

Core & Main BCG Matrix

The preview you see is the exact Core & Main BCG Matrix document you will receive after purchase, offering a complete and unwatermarked strategic analysis tool. This means no hidden charges or incomplete data; you get the fully formatted, ready-to-implement report designed for insightful business planning. Once purchased, this comprehensive document will be instantly downloadable, allowing you to immediately leverage its market insights for strategic decision-making. You can confidently use this preview as a direct representation of the professional-grade BCG Matrix you'll acquire, ready for immediate application in your business strategy.

Dogs

Core & Main might still offer older water treatment chemical lines that are becoming less relevant. This is often due to tougher environmental rules or the availability of better, newer options. For instance, some older flocculants or disinfectants may be phased out as more eco-friendly or effective alternatives gain traction in the market.

These legacy products likely see falling demand and face stiff competition from innovative solutions, leading to a small market share and very little profit. Investing further in these declining segments would likely bring very little reward.

Within Core & Main's extensive product offerings, there exist highly specialized, low-volume niche items. These cater to extremely specific, limited market segments, resulting in a naturally low market share. For instance, a specialized pipe fitting for a unique industrial application might only sell a few units annually, contributing minimally to the company's overall revenue.

These niche products often represent a challenge in the BCG matrix, potentially falling into the 'Dog' category. Their narrow application means they don't capture significant market attention or demand. In 2024, it's estimated that such specialized items, while essential for certain customers, might account for less than 0.5% of Core & Main's total sales volume.

Furthermore, maintaining inventory for these low-turnover items can be costly. The capital tied up in stock that rarely moves, coupled with potential obsolescence, can lead to disproportionately high holding costs relative to the revenue generated. This financial strain further solidifies their position as potential 'Dogs' requiring careful management.

Core & Main's acquisition strategy, while largely successful, has encountered some legacy challenges. A few smaller, older acquisitions, particularly those involving specific product lines or regional operations, have struggled with effective integration. These units, operating in what are now considered low-growth markets, have failed to gain significant competitive traction, effectively becoming 'dogs' in the BCG matrix.

These underperforming segments may be draining valuable resources and management attention without contributing substantially to Core & Main's overall strategic objectives. For instance, in 2023, certain legacy product categories within these acquisitions saw a decline in sales, contributing to a marginal decrease in overall profitability for those specific business units.

Outdated Fire Suppression System Components

While Core & Main's fire protection segment generally performs well, specific legacy components for older fire suppression systems might be considered 'dogs' in a BCG matrix. These are likely products being replaced by newer, more efficient, or environmentally friendly options. For instance, certain older valve types or sprinkler heads that don't meet current performance standards could fall into this category.

Demand for these outdated components is expected to be low and declining as infrastructure is upgraded. Core & Main's 2024 financial reports indicate a continued focus on modernizing product lines, suggesting a strategic shift away from these less competitive offerings.

- Low Market Share: Components with declining demand and being phased out typically have a small and shrinking market share within the broader fire suppression market.

- Low Growth Rate: The market for outdated components is characterized by a negative or very low growth rate as newer technologies gain traction.

- Potential Obsolescence: These products face the risk of becoming completely obsolete as regulations and industry standards evolve.

- Strategic Divestment or Reduction: Companies often reduce investment in or consider divesting 'dog' products to focus resources on more promising segments.

Local, Low-Efficiency Distribution Hubs in Stagnant Markets

While Core & Main boasts a robust national network, some of its smaller distribution hubs might be situated in economically stagnant or declining areas. These locations could face challenges in capturing substantial market share or achieving meaningful growth.

These underperforming hubs can be categorized as ‘dogs’ within a BCG matrix framework. They likely generate low profits, especially when compared to their ongoing operational expenses, and may tie up valuable capital that could be reinvested elsewhere. For instance, a distribution center in a region experiencing a consistent population decline, such as parts of the Rust Belt, might see reduced demand for plumbing and HVAC supplies.

- Low Market Share: Hubs in stagnant markets may struggle to gain significant traction against established local competitors or larger, more efficient regional players.

- High Operational Costs: Maintaining smaller, less utilized facilities can lead to a disproportionately high cost per unit distributed.

- Limited Growth Potential: The overall economic environment in these areas restricts the potential for increased sales volume or market penetration.

- Capital Tie-up: Investment in inventory and infrastructure for these low-return locations represents capital that could be deployed in higher-growth areas or strategic initiatives.

Dogs in the BCG matrix represent products or business units with low market share in a low-growth industry. Core & Main likely has several such offerings, including older chemical lines, niche specialized items, and certain legacy components within their fire protection segment. These 'dogs' often require significant resources for maintenance but yield minimal returns, potentially draining capital and management focus.

For example, specialized pipe fittings for unique industrial applications, while essential for a select few, might only represent 0.5% of Core & Main's total sales volume in 2024. Similarly, older fire suppression system components face declining demand due to upgrades and evolving standards, further solidifying their 'dog' status. These products are often candidates for divestment or reduced investment to reallocate resources to more promising areas.

Question Marks

Core & Main's Advanced Metering Infrastructure (AMI) solutions align with the burgeoning digital transformation within water management. This sector is experiencing robust growth, projected to reach over $20 billion globally by 2027, fueled by demand for enhanced data analytics and operational efficiency. While Core & Main participates in this high-growth area, its market share in these advanced, integrated AMI systems is likely in a developing stage, requiring substantial investment to secure a dominant position.

Core & Main's acquisition of HM Pipe Products signifies a deliberate push into Canada, marking a strategic entry into new international markets. This expansion into Canada, a market with significant growth potential, positions these new ventures as potential Stars within the BCG framework, despite their initial low market share compared to Core & Main's established US presence.

These international market entries, while promising, necessitate considerable investment in building robust infrastructure and cultivating strong customer relationships. For example, establishing distribution networks and understanding local regulatory landscapes in Canada requires upfront capital, a characteristic of Stars that need funding to achieve their growth potential.

The market for specialized water quality monitoring and analytics services is experiencing robust growth, driven by escalating regulatory complexity and the increasing intricacy of water-related challenges. This presents a significant opportunity for companies like Core & Main.

While Core & Main has historically focused on product distribution, their entry into or expansion of specialized water quality monitoring and analytics services represents a strategic move into a high-potential area. This segment is projected to see substantial expansion as demand for comprehensive water management solutions rises.

Currently, Core & Main's market share in these specialized services might be nascent, but the sector's rapid growth trajectory indicates considerable upside. As municipalities and industrial clients increasingly require sophisticated data-driven insights for compliance and operational efficiency, Core & Main is well-positioned to capture a growing portion of this market.

Innovative Water Conservation Technologies

As water scarcity intensifies, the market for advanced water conservation technologies is expanding rapidly. Core & Main's strategic focus on sustainability positions them to capitalize on this trend, likely through the introduction of smart irrigation solutions, rainwater harvesting infrastructure, and sophisticated leak detection devices. These emerging product categories represent high-growth opportunities where Core & Main's market penetration is still developing.

- Smart Irrigation Systems: These technologies, which use sensors and weather data to optimize watering schedules, are projected to see significant adoption. For instance, the global smart irrigation market was valued at approximately $1.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030.

- Rainwater Harvesting Components: With increasing rainfall variability and a focus on sustainable water management, demand for efficient rainwater collection and storage systems is rising. The market for rainwater harvesting systems is anticipated to reach over $2.5 billion by 2028, driven by both residential and commercial applications.

- Advanced Leak Detection Systems: Water loss due to undetected leaks is a major concern. Innovations in acoustic sensors, AI-powered analytics, and smart meters are creating a robust market for these solutions, with the global water leak detection market expected to exceed $4 billion by 2027, growing at a CAGR of around 8%.

Solutions for Decentralized Water Systems

Decentralized water systems, a growing trend, represent a potential "question mark" for Core & Main in the BCG matrix. These systems, focusing on local treatment and reuse, are gaining traction due to efficiency and sustainability goals. For instance, the global decentralized water and wastewater treatment market was valued at approximately $18.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating significant growth potential.

Core & Main's strategy here would involve investing in niche products and technical expertise to serve this emerging sector. Their current market share in decentralized solutions is likely low, necessitating strategic development to capitalize on this high-growth, albeit less established, market segment. This investment is crucial for building a strong position before the market fully matures.

- Emerging Decentralized Systems: A notable trend is the move towards decentralized water and wastewater treatment, emphasizing local solutions and water reuse.

- Core & Main's Opportunity: This presents an opportunity for Core & Main to invest in specialized products and services tailored for these innovative, high-growth water infrastructure models.

- Market Position: Core & Main's market share in this nascent area is expected to be low, requiring strategic investment to foster growth and establish a stronger presence.

- Growth Projection: The decentralized water treatment market is anticipated to experience substantial growth, underscoring the strategic importance of developing capabilities in this space.

Decentralized water systems represent a potential "question mark" for Core & Main. These systems, focusing on local treatment and reuse, are gaining traction due to efficiency and sustainability goals. The global decentralized water and wastewater treatment market was valued at approximately $18.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating significant growth potential. Core & Main's current market share in these solutions is likely low, necessitating strategic development to capitalize on this high-growth, albeit less established, market segment.

| BCG Category | Market Growth | Core & Main's Market Share | Strategic Implication |

|---|---|---|---|

| Question Marks | High (Decentralized Water Treatment Market: $18.5B in 2023, projected $30B+ by 2030) | Low (Developing in specialized products/expertise) | Requires investment to build capabilities and gain traction in an emerging, high-potential segment. |

BCG Matrix Data Sources

Our Core & Main BCG Matrix is constructed using a blend of internal financial data, market research reports, and competitive analysis. This comprehensive approach ensures accurate representation of product performance and market share.